Composite coatings standards compliance for aerospace and industrial applications

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aerospace Composite Coating Evolution and Objectives

Composite coatings have evolved significantly over the past five decades in aerospace applications, transforming from basic protective layers to sophisticated multifunctional systems. The initial development phase in the 1970s focused primarily on corrosion protection and basic wear resistance for aluminum airframes. During this period, chromate-based primers dominated the industry due to their exceptional corrosion inhibition properties, despite their environmental concerns.

The 1980s marked a transition toward more durable coating systems as aircraft designs incorporated increasing amounts of composite materials. This period saw the emergence of polyurethane topcoats offering improved UV resistance and aesthetic durability, while epoxy-based intermediate coats provided enhanced adhesion between substrates and topcoats.

By the 1990s, environmental regulations began reshaping the industry, driving research toward chromate-free alternatives and lower volatile organic compound (VOC) formulations. This regulatory pressure coincided with the increasing use of carbon fiber reinforced polymers (CFRPs) in primary aircraft structures, necessitating coating systems specifically designed for these materials.

The early 2000s witnessed significant advancements in functional coatings, including the development of thermal barrier coatings for engine components, ice-phobic coatings for leading edges, and electrically conductive coatings for lightning strike protection on composite structures. These specialized coatings addressed specific operational challenges while meeting increasingly stringent performance requirements.

Current technological objectives focus on developing multi-functional coating systems that simultaneously address multiple performance requirements. These include self-healing capabilities to extend maintenance intervals, sensor-integrated coatings for structural health monitoring, and environmentally sustainable formulations that maintain or exceed performance standards while eliminating hazardous substances.

The aerospace industry now aims to develop coating systems that can withstand extreme temperature fluctuations (-65°C to +180°C), provide electromagnetic interference (EMI) shielding for sensitive avionics, and offer reduced radar signatures for military applications. Additionally, there is growing emphasis on coatings that can be applied and cured at ambient temperatures to reduce energy consumption and enable field repairs.

Future objectives include the development of nano-engineered coating systems with precisely controlled properties at the molecular level, integration with additive manufacturing processes, and coatings with adaptive properties that respond to environmental conditions. The ultimate goal is to create coating systems that not only protect composite structures but actively contribute to aircraft performance, safety, and sustainability throughout their operational lifecycle.

The 1980s marked a transition toward more durable coating systems as aircraft designs incorporated increasing amounts of composite materials. This period saw the emergence of polyurethane topcoats offering improved UV resistance and aesthetic durability, while epoxy-based intermediate coats provided enhanced adhesion between substrates and topcoats.

By the 1990s, environmental regulations began reshaping the industry, driving research toward chromate-free alternatives and lower volatile organic compound (VOC) formulations. This regulatory pressure coincided with the increasing use of carbon fiber reinforced polymers (CFRPs) in primary aircraft structures, necessitating coating systems specifically designed for these materials.

The early 2000s witnessed significant advancements in functional coatings, including the development of thermal barrier coatings for engine components, ice-phobic coatings for leading edges, and electrically conductive coatings for lightning strike protection on composite structures. These specialized coatings addressed specific operational challenges while meeting increasingly stringent performance requirements.

Current technological objectives focus on developing multi-functional coating systems that simultaneously address multiple performance requirements. These include self-healing capabilities to extend maintenance intervals, sensor-integrated coatings for structural health monitoring, and environmentally sustainable formulations that maintain or exceed performance standards while eliminating hazardous substances.

The aerospace industry now aims to develop coating systems that can withstand extreme temperature fluctuations (-65°C to +180°C), provide electromagnetic interference (EMI) shielding for sensitive avionics, and offer reduced radar signatures for military applications. Additionally, there is growing emphasis on coatings that can be applied and cured at ambient temperatures to reduce energy consumption and enable field repairs.

Future objectives include the development of nano-engineered coating systems with precisely controlled properties at the molecular level, integration with additive manufacturing processes, and coatings with adaptive properties that respond to environmental conditions. The ultimate goal is to create coating systems that not only protect composite structures but actively contribute to aircraft performance, safety, and sustainability throughout their operational lifecycle.

Market Analysis for High-Performance Composite Coatings

The global market for high-performance composite coatings has experienced significant growth in recent years, driven primarily by increasing demands in aerospace and industrial applications. The market size reached approximately $6.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2028, potentially reaching $8.7 billion by the end of the forecast period.

Aerospace applications currently represent the largest market segment, accounting for roughly 38% of the total market share. This dominance stems from the critical need for coatings that can withstand extreme temperatures, provide corrosion resistance, and maintain structural integrity under high-stress conditions. Commercial aviation's recovery post-pandemic has further accelerated demand in this sector.

Industrial applications follow closely behind, with particular growth observed in oil and gas, power generation, and automotive industries. These sectors collectively represent approximately 35% of the market share, with demand driven by the need for enhanced durability, chemical resistance, and performance optimization in harsh operating environments.

Regional analysis reveals North America as the leading market for high-performance composite coatings, holding approximately 32% of the global market share. This dominance is attributed to the region's robust aerospace industry and significant defense spending. Asia-Pacific represents the fastest-growing region with a CAGR of 7.2%, fueled by rapid industrialization in China and India, alongside expanding aerospace manufacturing capabilities.

Customer segmentation shows that OEMs constitute the largest end-user group (58%), followed by MRO (Maintenance, Repair, and Overhaul) services (27%) and aftermarket applications (15%). This distribution highlights the importance of establishing strong relationships with original equipment manufacturers for market penetration.

Key market drivers include increasingly stringent environmental regulations, growing emphasis on fuel efficiency, and rising demand for lightweight materials in transportation. The push toward sustainability has accelerated the development of water-based and powder coating technologies, which are projected to grow at above-market rates of 7.5% and 8.2% respectively.

Market challenges include volatile raw material prices, complex certification processes for aerospace applications, and increasing competition from emerging markets offering lower-cost alternatives. Additionally, the technical complexity of meeting multiple standards across different industries creates barriers to entry for new market participants.

Aerospace applications currently represent the largest market segment, accounting for roughly 38% of the total market share. This dominance stems from the critical need for coatings that can withstand extreme temperatures, provide corrosion resistance, and maintain structural integrity under high-stress conditions. Commercial aviation's recovery post-pandemic has further accelerated demand in this sector.

Industrial applications follow closely behind, with particular growth observed in oil and gas, power generation, and automotive industries. These sectors collectively represent approximately 35% of the market share, with demand driven by the need for enhanced durability, chemical resistance, and performance optimization in harsh operating environments.

Regional analysis reveals North America as the leading market for high-performance composite coatings, holding approximately 32% of the global market share. This dominance is attributed to the region's robust aerospace industry and significant defense spending. Asia-Pacific represents the fastest-growing region with a CAGR of 7.2%, fueled by rapid industrialization in China and India, alongside expanding aerospace manufacturing capabilities.

Customer segmentation shows that OEMs constitute the largest end-user group (58%), followed by MRO (Maintenance, Repair, and Overhaul) services (27%) and aftermarket applications (15%). This distribution highlights the importance of establishing strong relationships with original equipment manufacturers for market penetration.

Key market drivers include increasingly stringent environmental regulations, growing emphasis on fuel efficiency, and rising demand for lightweight materials in transportation. The push toward sustainability has accelerated the development of water-based and powder coating technologies, which are projected to grow at above-market rates of 7.5% and 8.2% respectively.

Market challenges include volatile raw material prices, complex certification processes for aerospace applications, and increasing competition from emerging markets offering lower-cost alternatives. Additionally, the technical complexity of meeting multiple standards across different industries creates barriers to entry for new market participants.

Global Standards Landscape and Technical Barriers

The global landscape for composite coatings standards in aerospace and industrial applications is characterized by a complex network of regulatory bodies and technical specifications. Organizations such as the International Organization for Standardization (ISO), ASTM International, and the Society of Automotive Engineers (SAE) have established comprehensive frameworks that govern the development, testing, and implementation of composite coating technologies. These standards vary significantly across regions, with North America, Europe, and Asia each maintaining distinct certification requirements that manufacturers must navigate.

In the aerospace sector, standards such as AS9100 and NADCAP certification represent critical barriers to market entry, requiring rigorous quality management systems and specialized process controls. The European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) impose additional layers of compliance that specifically address the performance characteristics of composite coatings under extreme environmental conditions. These include resistance to thermal cycling, chemical exposure, and mechanical stress that are unique to aerospace applications.

Technical barriers in composite coatings compliance often stem from the inherent complexity of testing methodologies. Standards such as ASTM D7136 for impact resistance and ISO 11507 for weathering performance demand sophisticated equipment and expertise that may be inaccessible to smaller manufacturers. The cost of certification can be prohibitive, with testing regimes often requiring multiple iterations and third-party validation before approval is granted.

Harmonization efforts between standards organizations have made progress in recent years, yet significant discrepancies remain. The European Union's REACH regulations impose stringent requirements on chemical components used in composite formulations, creating compliance challenges for global manufacturers seeking to serve multiple markets. Similarly, China's GB standards have evolved rapidly, introducing new technical specifications that often diverge from established international norms.

Emerging technologies in composite coatings face particularly steep barriers to standardization. Nano-enhanced coatings, self-healing formulations, and environmentally adaptive systems operate at the frontier of materials science, where existing standards may be inadequate or entirely absent. The development of new testing protocols for these advanced materials typically lags behind innovation, creating regulatory uncertainty that can impede commercialization.

Digital certification systems and blockchain-based compliance tracking represent promising approaches to streamlining the standards landscape. These technologies enable real-time verification of materials properties and processing parameters, potentially reducing the administrative burden of multi-jurisdictional compliance while enhancing traceability throughout the supply chain.

In the aerospace sector, standards such as AS9100 and NADCAP certification represent critical barriers to market entry, requiring rigorous quality management systems and specialized process controls. The European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) impose additional layers of compliance that specifically address the performance characteristics of composite coatings under extreme environmental conditions. These include resistance to thermal cycling, chemical exposure, and mechanical stress that are unique to aerospace applications.

Technical barriers in composite coatings compliance often stem from the inherent complexity of testing methodologies. Standards such as ASTM D7136 for impact resistance and ISO 11507 for weathering performance demand sophisticated equipment and expertise that may be inaccessible to smaller manufacturers. The cost of certification can be prohibitive, with testing regimes often requiring multiple iterations and third-party validation before approval is granted.

Harmonization efforts between standards organizations have made progress in recent years, yet significant discrepancies remain. The European Union's REACH regulations impose stringent requirements on chemical components used in composite formulations, creating compliance challenges for global manufacturers seeking to serve multiple markets. Similarly, China's GB standards have evolved rapidly, introducing new technical specifications that often diverge from established international norms.

Emerging technologies in composite coatings face particularly steep barriers to standardization. Nano-enhanced coatings, self-healing formulations, and environmentally adaptive systems operate at the frontier of materials science, where existing standards may be inadequate or entirely absent. The development of new testing protocols for these advanced materials typically lags behind innovation, creating regulatory uncertainty that can impede commercialization.

Digital certification systems and blockchain-based compliance tracking represent promising approaches to streamlining the standards landscape. These technologies enable real-time verification of materials properties and processing parameters, potentially reducing the administrative burden of multi-jurisdictional compliance while enhancing traceability throughout the supply chain.

Current Compliance Solutions and Testing Methodologies

01 Metal-based composite coatings

Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically incorporate metals like aluminum, zinc, or nickel with various additives to improve corrosion resistance, wear resistance, and durability. The metal components provide structural integrity while the additives contribute specific functional properties, resulting in coatings suitable for industrial applications requiring high performance under harsh conditions.- Metal-based composite coatings: Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically offer improved corrosion resistance, wear resistance, and durability. The metal components may include aluminum, zinc, nickel, or other metals, often combined with polymers or ceramic particles to create multi-functional protective surfaces for industrial applications.

- Polymer-ceramic composite coatings: Polymer-ceramic composite coatings combine organic polymers with ceramic particles to create protective layers with unique properties. These coatings offer benefits such as thermal insulation, chemical resistance, and mechanical durability. The ceramic components provide hardness and temperature resistance, while the polymer matrix offers flexibility and adhesion. These coatings are widely used in aerospace, automotive, and industrial applications where both thermal protection and mechanical strength are required.

- Environmental-friendly composite coatings: Environmental-friendly composite coatings are formulated to minimize ecological impact while maintaining high performance. These coatings typically use water-based systems, low-VOC formulations, or bio-derived components to reduce environmental harm. They may incorporate sustainable materials or renewable resources while still providing effective protection against corrosion, wear, or other degradation mechanisms. These coatings are increasingly important in industries facing stricter environmental regulations.

- Nanocomposite coating technologies: Nanocomposite coatings incorporate nanoscale particles or structures to achieve superior performance characteristics. These coatings utilize nanomaterials such as carbon nanotubes, graphene, nano-ceramics, or metal nanoparticles dispersed in various matrices. The nanoscale components provide exceptional properties including increased hardness, improved wear resistance, enhanced thermal conductivity, or special optical properties. These advanced coatings find applications in electronics, aerospace, medical devices, and other high-performance sectors.

- Multi-layer composite coating systems: Multi-layer composite coating systems consist of strategically designed layers of different materials to achieve complementary protective properties. These systems typically include primer layers for adhesion, intermediate layers for specific functional properties, and topcoats for environmental protection or aesthetic purposes. The layered approach allows for optimization of various properties such as corrosion resistance, thermal insulation, wear protection, and visual appearance. These systems are commonly used in automotive, aerospace, and architectural applications.

02 Polymer-based composite coatings

Polymer-based composite coatings combine organic polymers with various fillers, additives, or reinforcing materials to create versatile protective layers. These coatings offer advantages such as flexibility, chemical resistance, and ease of application. By incorporating different additives into the polymer matrix, properties like adhesion, weatherability, and impact resistance can be significantly enhanced. These coatings find applications in automotive, construction, and consumer goods industries where customizable protection is required.Expand Specific Solutions03 Ceramic and thermal barrier composite coatings

Ceramic and thermal barrier composite coatings are designed to provide protection against extreme temperatures and thermal cycling. These coatings typically consist of ceramic materials combined with binding agents to create layers that insulate substrates from heat transfer. The multi-layered structure often includes bond coats and top coats with different compositions to maximize adhesion and thermal resistance. These specialized coatings are critical in aerospace, power generation, and high-temperature industrial applications where thermal management is essential.Expand Specific Solutions04 Nanocomposite coating technologies

Nanocomposite coatings incorporate nanoscale particles or structures within a matrix material to achieve enhanced properties not possible with conventional materials. By dispersing nanoparticles throughout the coating matrix, properties such as hardness, scratch resistance, and antimicrobial activity can be significantly improved. The small size of these particles allows for unique interactions at the molecular level, resulting in coatings with superior performance characteristics. These advanced coatings are increasingly used in electronics, medical devices, and high-performance industrial applications.Expand Specific Solutions05 Environmentally friendly composite coating formulations

Environmentally friendly composite coating formulations focus on reducing or eliminating hazardous substances while maintaining high performance standards. These coatings typically use water-based systems, bio-derived materials, or low-VOC (volatile organic compound) formulations to minimize environmental impact. By incorporating sustainable raw materials and green chemistry principles, these coatings offer reduced toxicity and carbon footprint compared to conventional alternatives. These eco-friendly solutions are increasingly important in industries facing stricter environmental regulations and sustainability requirements.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings standards compliance landscape for aerospace and industrial applications is currently in a mature growth phase, with stringent regulatory requirements driving innovation. The market size is substantial, estimated at several billion dollars globally, with aerospace applications representing a significant segment. Technologically, industry leaders like Boeing, RTX Corp., and Airbus Operations have established advanced compliance frameworks, while specialized coating manufacturers such as PRC-DeSoto, PPG Industries, and DuPont de Nemours offer sophisticated solutions meeting rigorous standards. Research institutions including Harbin Institute of Technology and Battelle Memorial Institute are advancing next-generation coating technologies. The competitive landscape features both established aerospace giants and specialized coating technology providers collaborating to meet increasingly demanding performance and environmental requirements.

The Boeing Co.

Technical Solution: Boeing has developed advanced composite coating systems that meet stringent aerospace standards including AMS-C-83231A and ASTM D7091. Their proprietary BMS (Boeing Material Specification) series includes specialized formulations for different aircraft components with varying environmental exposure. Boeing's composite coating technology incorporates nano-ceramic particles dispersed in polymer matrices to enhance durability while maintaining compliance with FAA airworthiness requirements. Their multi-layer approach typically consists of a chromate-free primer, an intermediate coat with corrosion inhibitors, and a polyurethane topcoat with UV stabilizers. Boeing has also pioneered environmentally compliant water-based coating systems that reduce VOC emissions by approximately 70% compared to traditional solvent-based systems while maintaining equivalent performance in salt spray tests (ASTM B117) and adhesion tests (ASTM D3359).

Strengths: Extensive in-house testing capabilities for accelerated environmental simulation; proprietary formulations optimized specifically for commercial aircraft applications; strong integration with manufacturing processes. Weaknesses: Higher implementation costs compared to traditional coatings; longer curing times required for some specialized formulations; limited transferability to non-aerospace applications.

RTX Corp.

Technical Solution: RTX Corporation (formerly Raytheon Technologies) has developed advanced thermal spray coating technologies that comply with aerospace standards AMS 2447 and AMS 7003. Their HVOF (High Velocity Oxygen Fuel) coating systems create composite ceramic-metallic layers with exceptional wear resistance and thermal barrier properties. RTX's proprietary process involves precise particle size distribution control (5-45 μm) and computer-controlled spray parameters to ensure consistent coating thickness (typically 75-300 μm) and porosity levels below 2%. Their coatings undergo rigorous testing including adhesion strength (ASTM C633), thermal cycling (ASTM E2109), and erosion resistance (ASTM G76). For military applications, RTX has developed specialized radar-absorbing composite coatings that maintain compliance with MIL-STD-810 environmental conditions while providing electromagnetic interference protection according to MIL-STD-461 requirements.

Strengths: Superior thermal barrier properties suitable for extreme temperature applications; excellent wear resistance in high-friction components; comprehensive quality control systems integrated with aerospace manufacturing. Weaknesses: Higher application costs compared to conventional coatings; requires specialized equipment and trained personnel; limited color options for aesthetic applications.

Critical Patents and Technical Specifications Analysis

Syntactic foam compositions

PatentWO2024220960A1

Innovation

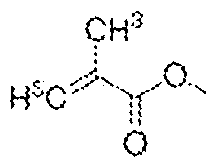

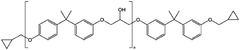

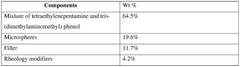

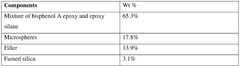

- A multi-component composition comprising an epoxy-functional compound, elastomeric particles, and a (meth)acrylic-functional compound, combined with an amine-functional curing agent, which forms a strong adhesive or sealant capable of curing at ambient conditions, providing enhanced compressive strength, lap shear strength, and density.

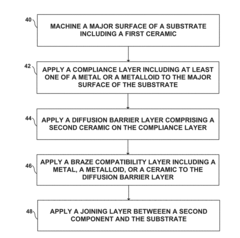

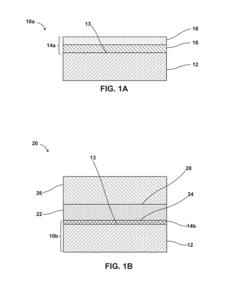

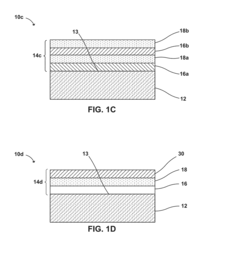

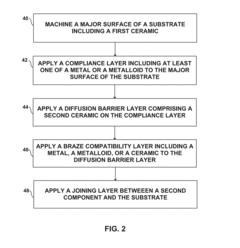

Joint surface coatings for ceramic components

PatentActiveUS20170368803A1

Innovation

- A joint surface coating comprising a diffusion barrier layer made of a second ceramic material and a compliance layer of metal or metalloid is applied between the substrate and the braze material, preventing unwanted diffusion and providing mechanical compliance to enhance braze wetting and adhesion, while reducing stress and ensuring a uniform joint.

Environmental Regulations Impact on Coating Formulations

Environmental regulations have significantly transformed the landscape of composite coating formulations for aerospace and industrial applications over the past decade. The introduction of stringent volatile organic compound (VOC) emission limits has forced manufacturers to reformulate traditional solvent-based coatings toward water-based and high-solids alternatives. The EU's REACH regulation and the U.S. EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) have been particularly influential, restricting the use of hexavalent chromium, cadmium, lead, and various solvents previously common in high-performance coatings.

These regulatory changes have catalyzed innovation in coating chemistry, with manufacturers developing novel formulations that maintain performance while reducing environmental impact. For instance, chromate-free corrosion inhibitors have emerged as viable alternatives for aerospace applications, though they often require more complex formulation strategies to achieve comparable protection levels. The transition has not been without challenges, as reformulated coatings must undergo extensive qualification testing to ensure they meet the rigorous performance standards of aerospace and industrial sectors.

Regional regulatory variations present additional complexity for global manufacturers. While the EU has implemented some of the most restrictive chemical regulations, North America, Asia, and other regions maintain different compliance requirements. This regulatory fragmentation necessitates either region-specific formulations or the development of universal coatings that meet the most stringent global standards, increasing R&D costs and complicating supply chain management.

The economic implications of environmental compliance are substantial. Initial reformulation costs can be high, but manufacturers who successfully navigate the transition often gain competitive advantages through access to restricted markets and alignment with sustainability initiatives. Many aerospace and industrial end-users now include environmental compliance in their supplier evaluation criteria, making regulatory adaptation a business imperative rather than merely a legal requirement.

Looking forward, the regulatory landscape continues to evolve. Substances of Very High Concern (SVHC) lists are regularly updated, potentially affecting current formulations. The industry trend toward circular economy principles is also influencing coating development, with increasing focus on recyclability, bio-based content, and end-of-life considerations. Manufacturers must maintain regulatory intelligence capabilities to anticipate changes and adapt formulations proactively rather than reactively.

These regulatory changes have catalyzed innovation in coating chemistry, with manufacturers developing novel formulations that maintain performance while reducing environmental impact. For instance, chromate-free corrosion inhibitors have emerged as viable alternatives for aerospace applications, though they often require more complex formulation strategies to achieve comparable protection levels. The transition has not been without challenges, as reformulated coatings must undergo extensive qualification testing to ensure they meet the rigorous performance standards of aerospace and industrial sectors.

Regional regulatory variations present additional complexity for global manufacturers. While the EU has implemented some of the most restrictive chemical regulations, North America, Asia, and other regions maintain different compliance requirements. This regulatory fragmentation necessitates either region-specific formulations or the development of universal coatings that meet the most stringent global standards, increasing R&D costs and complicating supply chain management.

The economic implications of environmental compliance are substantial. Initial reformulation costs can be high, but manufacturers who successfully navigate the transition often gain competitive advantages through access to restricted markets and alignment with sustainability initiatives. Many aerospace and industrial end-users now include environmental compliance in their supplier evaluation criteria, making regulatory adaptation a business imperative rather than merely a legal requirement.

Looking forward, the regulatory landscape continues to evolve. Substances of Very High Concern (SVHC) lists are regularly updated, potentially affecting current formulations. The industry trend toward circular economy principles is also influencing coating development, with increasing focus on recyclability, bio-based content, and end-of-life considerations. Manufacturers must maintain regulatory intelligence capabilities to anticipate changes and adapt formulations proactively rather than reactively.

Risk Management Strategies for Certification Processes

Effective risk management is essential for navigating the complex certification processes required for composite coatings in aerospace and industrial applications. Organizations must develop comprehensive strategies that address both predictable and unforeseen challenges throughout the certification lifecycle. A multi-layered approach begins with thorough risk identification, where potential compliance failures, testing inadequacies, and documentation gaps are systematically cataloged through cross-functional team assessments.

Risk prioritization frameworks should be implemented to categorize certification risks based on their potential impact on safety, project timelines, and financial outcomes. The aerospace industry typically employs quantitative risk assessment matrices that assign numerical values to both probability and consequence factors, enabling more objective decision-making when allocating resources to mitigation efforts.

Proactive mitigation strategies include establishing certification-specific quality management systems that incorporate regular internal audits against relevant standards such as AS9100D, NADCAP, and ISO 9001:2015. These systems should feature robust document control processes to ensure traceability and version control of all certification-related documentation, addressing a common point of failure in aerospace certification.

Contingency planning represents another critical component, with organizations developing alternative pathways for certification when primary approaches encounter obstacles. This may involve maintaining relationships with multiple testing facilities or developing modular coating systems that can be certified through different regulatory frameworks if necessary.

Continuous monitoring mechanisms must be established to track regulatory changes that may impact certification requirements. This includes subscribing to standards organization updates, participating in industry working groups, and maintaining open communication channels with certification bodies to anticipate evolving compliance expectations for composite coatings.

Knowledge management systems play a vital role in preserving institutional expertise regarding certification processes. Organizations should document lessons learned from previous certification efforts, creating searchable databases of common challenges and effective solutions that can inform future projects and reduce certification timelines.

Finally, certification risk transfer strategies may be appropriate in certain contexts, including contractual arrangements with coating suppliers that share certification responsibilities or insurance policies specifically designed to cover certification delays and failures. These approaches can help distribute risk across the supply chain while maintaining appropriate accountability for compliance outcomes.

Risk prioritization frameworks should be implemented to categorize certification risks based on their potential impact on safety, project timelines, and financial outcomes. The aerospace industry typically employs quantitative risk assessment matrices that assign numerical values to both probability and consequence factors, enabling more objective decision-making when allocating resources to mitigation efforts.

Proactive mitigation strategies include establishing certification-specific quality management systems that incorporate regular internal audits against relevant standards such as AS9100D, NADCAP, and ISO 9001:2015. These systems should feature robust document control processes to ensure traceability and version control of all certification-related documentation, addressing a common point of failure in aerospace certification.

Contingency planning represents another critical component, with organizations developing alternative pathways for certification when primary approaches encounter obstacles. This may involve maintaining relationships with multiple testing facilities or developing modular coating systems that can be certified through different regulatory frameworks if necessary.

Continuous monitoring mechanisms must be established to track regulatory changes that may impact certification requirements. This includes subscribing to standards organization updates, participating in industry working groups, and maintaining open communication channels with certification bodies to anticipate evolving compliance expectations for composite coatings.

Knowledge management systems play a vital role in preserving institutional expertise regarding certification processes. Organizations should document lessons learned from previous certification efforts, creating searchable databases of common challenges and effective solutions that can inform future projects and reduce certification timelines.

Finally, certification risk transfer strategies may be appropriate in certain contexts, including contractual arrangements with coating suppliers that share certification responsibilities or insurance policies specifically designed to cover certification delays and failures. These approaches can help distribute risk across the supply chain while maintaining appropriate accountability for compliance outcomes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!