What are the key regulatory requirements for Composite coatings in industrial deployment

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coatings Regulatory Landscape and Objectives

Composite coatings have emerged as critical materials in various industrial applications due to their enhanced properties including corrosion resistance, wear resistance, and thermal stability. The regulatory landscape governing these materials has evolved significantly over the past decade, reflecting growing concerns about environmental impact, worker safety, and sustainable manufacturing practices.

The global regulatory framework for composite coatings is characterized by regional variations but converging standards. In North America, the EPA's Toxic Substances Control Act (TSCA) and Canada's Chemicals Management Plan impose strict requirements on chemical components used in coating formulations. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation represents perhaps the most comprehensive approach, requiring thorough documentation of chemical properties and potential risks throughout the supply chain.

Recent regulatory developments have focused increasingly on volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) emissions. The EU's Industrial Emissions Directive (IED) and the US Clean Air Act amendments have progressively lowered permissible emission thresholds, driving innovation toward water-based and high-solids formulations with reduced environmental footprint.

Occupational safety regulations have similarly tightened, with OSHA in the United States and equivalent bodies worldwide implementing more stringent exposure limits for workers handling coating materials. These regulations specifically address respiratory protection, ventilation requirements, and monitoring protocols during application processes.

The trend toward circular economy principles is reshaping regulatory objectives for composite coatings. Extended Producer Responsibility (EPR) schemes in various jurisdictions now mandate considerations for end-of-life management, recyclability, and waste reduction. This represents a significant shift from traditional compliance models focused solely on production and application phases.

Industry-specific regulations add another layer of complexity. Aerospace applications must meet stringent fire resistance and outgassing requirements under FAA and EASA regulations. Marine coatings face International Maritime Organization (IMO) restrictions on biocides and antifouling compounds. Food contact applications must comply with FDA and European Food Safety Authority guidelines regarding migration and toxicity.

The technical objectives for composite coating development must therefore balance performance requirements with an increasingly complex regulatory landscape. Key objectives include developing formulations that maintain or enhance functional properties while eliminating restricted substances, reducing environmental impact throughout the product lifecycle, and ensuring compliance across multiple jurisdictions with divergent requirements.

The global regulatory framework for composite coatings is characterized by regional variations but converging standards. In North America, the EPA's Toxic Substances Control Act (TSCA) and Canada's Chemicals Management Plan impose strict requirements on chemical components used in coating formulations. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation represents perhaps the most comprehensive approach, requiring thorough documentation of chemical properties and potential risks throughout the supply chain.

Recent regulatory developments have focused increasingly on volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) emissions. The EU's Industrial Emissions Directive (IED) and the US Clean Air Act amendments have progressively lowered permissible emission thresholds, driving innovation toward water-based and high-solids formulations with reduced environmental footprint.

Occupational safety regulations have similarly tightened, with OSHA in the United States and equivalent bodies worldwide implementing more stringent exposure limits for workers handling coating materials. These regulations specifically address respiratory protection, ventilation requirements, and monitoring protocols during application processes.

The trend toward circular economy principles is reshaping regulatory objectives for composite coatings. Extended Producer Responsibility (EPR) schemes in various jurisdictions now mandate considerations for end-of-life management, recyclability, and waste reduction. This represents a significant shift from traditional compliance models focused solely on production and application phases.

Industry-specific regulations add another layer of complexity. Aerospace applications must meet stringent fire resistance and outgassing requirements under FAA and EASA regulations. Marine coatings face International Maritime Organization (IMO) restrictions on biocides and antifouling compounds. Food contact applications must comply with FDA and European Food Safety Authority guidelines regarding migration and toxicity.

The technical objectives for composite coating development must therefore balance performance requirements with an increasingly complex regulatory landscape. Key objectives include developing formulations that maintain or enhance functional properties while eliminating restricted substances, reducing environmental impact throughout the product lifecycle, and ensuring compliance across multiple jurisdictions with divergent requirements.

Market Demand Analysis for Industrial Composite Coatings

The global market for industrial composite coatings has been experiencing robust growth, driven by increasing demand across multiple sectors including aerospace, automotive, marine, construction, and general industrial applications. Current market valuations indicate that the industrial composite coatings sector is expanding at a compound annual growth rate of approximately 6.5% and is projected to reach significant market value by 2028.

Key market drivers include the growing need for corrosion-resistant coatings in harsh industrial environments, particularly in oil and gas, chemical processing, and marine applications. These industries require coatings that can withstand extreme conditions while maintaining structural integrity and performance characteristics over extended periods.

The automotive and aerospace sectors represent particularly strong growth segments, with manufacturers seeking lightweight, high-performance materials that can contribute to fuel efficiency while meeting stringent safety and durability requirements. Composite coatings offer an attractive solution by providing superior strength-to-weight ratios compared to traditional materials.

Environmental regulations are significantly shaping market demand patterns. Stringent VOC (Volatile Organic Compound) emission standards in North America, Europe, and increasingly in Asia-Pacific regions are driving the development and adoption of water-based and powder composite coating technologies. This regulatory pressure has accelerated innovation in environmentally friendly formulations that maintain or exceed performance characteristics of traditional solvent-based systems.

Regional analysis reveals that Asia-Pacific currently dominates the market share, fueled by rapid industrialization in China, India, and Southeast Asian countries. North America and Europe follow closely, with demand primarily driven by renovation activities and technological advancements in manufacturing processes.

Customer preferences are evolving toward multi-functional composite coatings that offer combinations of benefits such as corrosion resistance, chemical resistance, thermal stability, and aesthetic appeal in a single application system. This trend is particularly evident in high-value applications where performance requirements are most demanding.

Price sensitivity varies significantly by application segment. While commodity industrial applications remain highly price-sensitive, specialized sectors such as aerospace and medical equipment prioritize performance and regulatory compliance over initial cost considerations, creating premium market segments for advanced composite coating technologies.

The COVID-19 pandemic temporarily disrupted supply chains and manufacturing operations, but the market has shown resilience with recovery patterns indicating strong underlying demand fundamentals. Post-pandemic infrastructure development initiatives in many countries are expected to further boost demand for protective industrial coatings in the coming years.

Key market drivers include the growing need for corrosion-resistant coatings in harsh industrial environments, particularly in oil and gas, chemical processing, and marine applications. These industries require coatings that can withstand extreme conditions while maintaining structural integrity and performance characteristics over extended periods.

The automotive and aerospace sectors represent particularly strong growth segments, with manufacturers seeking lightweight, high-performance materials that can contribute to fuel efficiency while meeting stringent safety and durability requirements. Composite coatings offer an attractive solution by providing superior strength-to-weight ratios compared to traditional materials.

Environmental regulations are significantly shaping market demand patterns. Stringent VOC (Volatile Organic Compound) emission standards in North America, Europe, and increasingly in Asia-Pacific regions are driving the development and adoption of water-based and powder composite coating technologies. This regulatory pressure has accelerated innovation in environmentally friendly formulations that maintain or exceed performance characteristics of traditional solvent-based systems.

Regional analysis reveals that Asia-Pacific currently dominates the market share, fueled by rapid industrialization in China, India, and Southeast Asian countries. North America and Europe follow closely, with demand primarily driven by renovation activities and technological advancements in manufacturing processes.

Customer preferences are evolving toward multi-functional composite coatings that offer combinations of benefits such as corrosion resistance, chemical resistance, thermal stability, and aesthetic appeal in a single application system. This trend is particularly evident in high-value applications where performance requirements are most demanding.

Price sensitivity varies significantly by application segment. While commodity industrial applications remain highly price-sensitive, specialized sectors such as aerospace and medical equipment prioritize performance and regulatory compliance over initial cost considerations, creating premium market segments for advanced composite coating technologies.

The COVID-19 pandemic temporarily disrupted supply chains and manufacturing operations, but the market has shown resilience with recovery patterns indicating strong underlying demand fundamentals. Post-pandemic infrastructure development initiatives in many countries are expected to further boost demand for protective industrial coatings in the coming years.

Current Regulatory Challenges for Composite Coating Technologies

The regulatory landscape for composite coatings in industrial applications has become increasingly complex, with stringent requirements emerging across different jurisdictions. Environmental protection agencies worldwide have established comprehensive frameworks that govern the manufacturing, application, and disposal of composite coating materials. These regulations primarily focus on limiting volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and other potentially harmful substances that may be released during coating processes.

In the United States, the Environmental Protection Agency (EPA) enforces regulations through the Clean Air Act and the Toxic Substances Control Act (TSCA), which impose strict limitations on VOC emissions from industrial coating operations. Similarly, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation requires manufacturers and importers to register chemical substances and demonstrate their safe use throughout the supply chain.

The RoHS (Restriction of Hazardous Substances) directive further restricts the use of specific hazardous materials in manufacturing processes, including certain composite coating applications. This has forced coating manufacturers to reformulate their products and develop alternative solutions that maintain performance while complying with these restrictions.

Occupational safety regulations present another significant challenge for industrial deployment of composite coatings. Organizations such as OSHA in the United States and equivalent bodies in other regions mandate specific workplace safety protocols for handling coating materials, including proper ventilation systems, personal protective equipment, and employee training programs.

Product-specific regulations vary by industry sector, creating a complex matrix of compliance requirements. For instance, coatings used in food processing equipment must meet FDA or equivalent food safety standards, while those used in medical devices must comply with biocompatibility requirements established by ISO 10993 or similar standards.

Emerging regulations around nanomaterials present a particularly challenging frontier, as many advanced composite coatings incorporate nano-scale components. Regulatory frameworks for nanomaterials remain in development across many jurisdictions, creating uncertainty for manufacturers investing in these technologies.

Carbon footprint and lifecycle assessment requirements are becoming increasingly prominent, with some regions implementing carbon taxes or cap-and-trade systems that impact coating manufacturing processes. Companies must now document and minimize the environmental impact of their coating products throughout their entire lifecycle, from raw material extraction to end-of-life disposal.

Compliance documentation and certification processes have also grown more demanding, requiring extensive testing, validation, and reporting. This administrative burden represents a significant cost factor for coating developers and can substantially impact time-to-market for new coating technologies.

In the United States, the Environmental Protection Agency (EPA) enforces regulations through the Clean Air Act and the Toxic Substances Control Act (TSCA), which impose strict limitations on VOC emissions from industrial coating operations. Similarly, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation requires manufacturers and importers to register chemical substances and demonstrate their safe use throughout the supply chain.

The RoHS (Restriction of Hazardous Substances) directive further restricts the use of specific hazardous materials in manufacturing processes, including certain composite coating applications. This has forced coating manufacturers to reformulate their products and develop alternative solutions that maintain performance while complying with these restrictions.

Occupational safety regulations present another significant challenge for industrial deployment of composite coatings. Organizations such as OSHA in the United States and equivalent bodies in other regions mandate specific workplace safety protocols for handling coating materials, including proper ventilation systems, personal protective equipment, and employee training programs.

Product-specific regulations vary by industry sector, creating a complex matrix of compliance requirements. For instance, coatings used in food processing equipment must meet FDA or equivalent food safety standards, while those used in medical devices must comply with biocompatibility requirements established by ISO 10993 or similar standards.

Emerging regulations around nanomaterials present a particularly challenging frontier, as many advanced composite coatings incorporate nano-scale components. Regulatory frameworks for nanomaterials remain in development across many jurisdictions, creating uncertainty for manufacturers investing in these technologies.

Carbon footprint and lifecycle assessment requirements are becoming increasingly prominent, with some regions implementing carbon taxes or cap-and-trade systems that impact coating manufacturing processes. Companies must now document and minimize the environmental impact of their coating products throughout their entire lifecycle, from raw material extraction to end-of-life disposal.

Compliance documentation and certification processes have also grown more demanding, requiring extensive testing, validation, and reporting. This administrative burden represents a significant cost factor for coating developers and can substantially impact time-to-market for new coating technologies.

Current Compliance Frameworks for Composite Coatings

01 Metal-based composite coatings

Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically offer improved corrosion resistance, wear resistance, and durability. The metal components can include aluminum, zinc, nickel, or other metals, often combined with polymers or ceramic particles to create a composite structure that provides superior protection compared to single-component coatings.- Metal-based composite coatings: Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically incorporate metals such as aluminum, zinc, or copper with polymers or ceramics to improve corrosion resistance, wear resistance, and thermal stability. The metal components provide structural integrity and conductivity, while the additional materials contribute specific functional properties, resulting in coatings suitable for industrial applications in harsh environments.

- Polymer-based composite coatings: Polymer-based composite coatings utilize various polymeric materials as the matrix, reinforced with additives to enhance specific properties. These coatings combine organic polymers with inorganic fillers, fibers, or nanoparticles to achieve improved adhesion, flexibility, chemical resistance, and durability. The polymer matrix provides continuity and adhesion to substrates, while the reinforcing components enhance mechanical properties. These versatile coatings find applications in automotive, construction, and consumer goods industries where customizable performance characteristics are required.

- Ceramic and thermal barrier composite coatings: Ceramic and thermal barrier composite coatings are designed to provide protection against extreme temperatures and thermal cycling. These coatings typically consist of ceramic materials combined with other components to create layers that insulate substrates from heat transfer while maintaining structural integrity. The ceramic components provide temperature resistance, while additional materials improve adhesion and reduce thermal expansion mismatch. These specialized coatings are crucial in aerospace, power generation, and high-temperature industrial applications where thermal protection is essential.

- Environmentally friendly composite coatings: Environmentally friendly composite coatings are formulated to minimize ecological impact while maintaining high performance. These coatings utilize sustainable raw materials, water-based formulations, or low-VOC components to reduce environmental footprint. They often incorporate natural fibers, bio-based polymers, or recycled materials as reinforcing agents. The development of these coatings addresses increasing regulatory requirements and market demand for sustainable solutions while providing comparable or superior performance to conventional coating systems in various applications.

- Multi-functional composite coatings: Multi-functional composite coatings are engineered to provide multiple performance benefits simultaneously. These advanced coating systems combine various materials to deliver properties such as corrosion resistance, wear protection, self-healing capabilities, antimicrobial activity, or electrical conductivity in a single application. The synergistic interaction between different components creates coatings that can adapt to changing environmental conditions or operational requirements. These sophisticated coatings represent the cutting edge of surface engineering technology, offering solutions for complex protection needs across diverse industries.

02 Polymer-based composite coatings

Polymer-based composite coatings utilize various polymeric materials as the matrix, often reinforced with particles, fibers, or other additives to enhance specific properties. These coatings provide benefits such as chemical resistance, flexibility, and improved adhesion to substrates. The polymer matrix can be epoxy, polyurethane, acrylic, or other resins, with additives selected to enhance properties like UV resistance, thermal stability, or mechanical strength.Expand Specific Solutions03 Ceramic and thermal barrier composite coatings

Ceramic and thermal barrier composite coatings are designed to withstand extreme temperatures and harsh environments. These coatings typically consist of ceramic materials combined with other components to create layers that provide thermal insulation, oxidation resistance, and protection against thermal cycling. Applications include aerospace components, gas turbines, and industrial equipment operating at high temperatures.Expand Specific Solutions04 Nanocomposite coating technologies

Nanocomposite coatings incorporate nanoscale particles or structures within a matrix material to achieve enhanced properties not possible with conventional materials. These coatings exhibit superior hardness, wear resistance, and self-healing capabilities. The nanomaterials can include carbon nanotubes, graphene, nano-ceramics, or metal nanoparticles, which significantly improve the coating's performance while maintaining a thin profile.Expand Specific Solutions05 Environmentally friendly composite coating formulations

Environmentally friendly composite coating formulations focus on reducing or eliminating harmful substances while maintaining or improving coating performance. These coatings typically use water-based systems, bio-derived components, or low-VOC formulations. They are designed to provide effective protection while minimizing environmental impact during production, application, use, and disposal phases.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The composite coatings industry is currently in a growth phase, with increasing regulatory scrutiny as applications expand across industrial sectors. The market is projected to reach significant scale due to rising demand for corrosion-resistant and high-performance surface treatments. Leading players like PPG Industries and BASF have established mature technology portfolios, while companies such as RTX Corp. and Boeing are driving innovation in aerospace applications. Specialized firms including Castagra Products and Jiangsu Favored Nanotechnology are developing niche solutions for oil and gas and electronics sectors respectively. Academic-industry partnerships with institutions like the University of Leicester and University of Houston are accelerating technological advancement, particularly in environmentally compliant formulations that meet increasingly stringent global regulatory standards.

PPG Industries Ohio, Inc.

Technical Solution: PPG Industries has developed advanced composite coating systems that comply with stringent regulatory requirements across multiple industries. Their technology focuses on environmentally responsible formulations with reduced volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). PPG's aerospace composite coatings meet FAA requirements for flame resistance and smoke emission while providing protection against UV degradation and chemical exposure[1]. For industrial applications, they've engineered coatings that comply with FDA, EPA, and REACH regulations, particularly for food-contact surfaces and medical equipment. Their marine composite coatings adhere to IMO (International Maritime Organization) regulations regarding biocides and anti-fouling properties[3]. PPG has also pioneered water-based composite coating technologies that maintain performance while reducing environmental impact, meeting increasingly strict air quality regulations in manufacturing environments[5].

Strengths: Extensive regulatory compliance expertise across multiple industries; strong R&D capabilities for developing environmentally friendly formulations; global presence facilitating adaptation to regional regulatory requirements. Weaknesses: Higher cost compared to conventional coatings; some specialized formulations may require longer curing times; potential challenges with durability in extreme environments compared to traditional solvent-based systems.

BASF SE

Technical Solution: BASF SE has developed comprehensive regulatory-compliant composite coating solutions focusing on sustainability and performance. Their approach integrates REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) compliance across their product portfolio, with particular emphasis on eliminating substances of very high concern (SVHCs)[2]. BASF's water-based epoxy and polyurethane composite coating systems meet stringent VOC regulations in Europe, North America, and Asia while maintaining critical performance characteristics. Their Elastocoat® technology specifically addresses industrial requirements for chemical resistance and mechanical durability while complying with EU Construction Products Regulation (CPR) fire safety standards[4]. For food-contact applications, BASF has engineered composite coatings that comply with both FDA and European Food Safety Authority requirements. Their corrosion protection systems for industrial infrastructure meet ISO 12944 standards while incorporating regulatory-compliant raw materials[6]. BASF has also pioneered bio-based composite coating components that help manufacturers meet sustainability targets without compromising regulatory compliance.

Strengths: Global regulatory expertise with dedicated compliance teams for different regions; extensive R&D capabilities allowing rapid adaptation to changing regulations; vertical integration providing control over raw material supply chain and compliance. Weaknesses: Complex product portfolio can create challenges in maintaining consistent regulatory compliance across all offerings; premium pricing for fully compliant solutions may limit market penetration in cost-sensitive segments.

Critical Standards and Certification Requirements

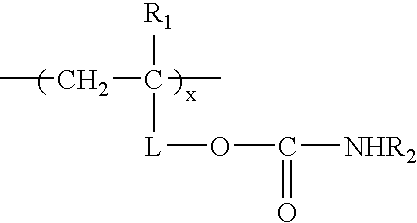

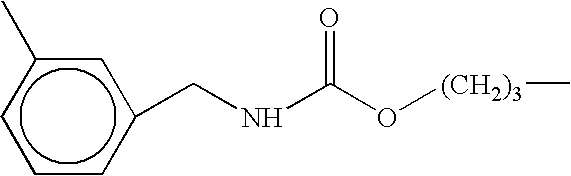

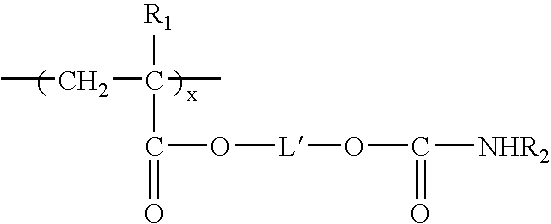

Curable coating compositions having improved compatibility and scratch and mar resistance, cured coated substrates made therewith and methods for obtaining the same

PatentInactiveUS20080050527A1

Innovation

- A thermally curable coating composition comprising a film-forming component, a strong acid catalyst, and a volatile tertiary amine catalyst carrier, which creates a crosslink density gradient in the cured film, enhancing scratch and mar resistance and compatibility with diverse basecoat types.

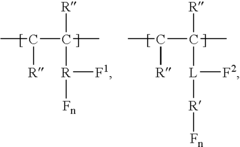

Method of preparing a macromolecule deterrent surface on a pharmaceutical package

PatentActiveUS20070187280A1

Innovation

- A method using plasma chemical vapor deposition to apply a coating directly onto pharmaceutical packages, utilizing ether and ester precursors like tetraethylene glycol dimethyl ether (TG) to create a surface that reduces macromolecule adsorption by more than 25%, with preferred coatings achieving over 50% reduction, thereby preventing protein denaturation and maintaining drug stability.

Environmental Impact Assessment Requirements

Environmental impact assessment for composite coatings in industrial applications has become increasingly stringent across global regulatory frameworks. These assessments typically require comprehensive evaluation of the entire lifecycle of coating materials, from raw material extraction to disposal or recycling. Manufacturers must document the environmental footprint of their composite coatings, including greenhouse gas emissions, energy consumption, and resource utilization during production processes.

Volatile Organic Compound (VOC) emissions represent a critical focus area in environmental assessments. Regulatory bodies worldwide have established maximum allowable VOC content in industrial coatings, with thresholds varying by jurisdiction. The European Union's VOC Solvents Emissions Directive and the U.S. EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) set particularly rigorous standards that manufacturers must meet through extensive testing and documentation.

Water pollution prevention measures constitute another essential component of environmental impact assessments. Regulatory frameworks require detailed analysis of potential leaching of toxic substances from composite coatings into groundwater or surface water. This includes evaluation of heavy metals, persistent organic pollutants, and other potentially harmful components that might be released during the coating's service life or disposal phase.

Waste management protocols for composite coating operations must be thoroughly documented in environmental assessments. This encompasses handling procedures for unused materials, contaminated containers, and application equipment. Many jurisdictions mandate specific disposal methods for coating waste classified as hazardous, requiring specialized treatment facilities and tracking systems to ensure regulatory compliance.

Ecological risk assessment has emerged as an increasingly important requirement, particularly for coatings used in sensitive environments. Manufacturers must evaluate potential impacts on local ecosystems, including effects on aquatic organisms, soil microbiota, and plant life. This often necessitates specialized toxicity testing and bioaccumulation studies to determine long-term environmental consequences.

Carbon footprint reporting has become mandatory in many regulatory frameworks, requiring manufacturers to calculate and disclose the total greenhouse gas emissions associated with their composite coating products. This includes not only direct emissions from manufacturing but also indirect emissions from raw material sourcing, transportation, and end-of-life scenarios. Many jurisdictions now require third-party verification of these calculations to ensure accuracy and prevent greenwashing.

Volatile Organic Compound (VOC) emissions represent a critical focus area in environmental assessments. Regulatory bodies worldwide have established maximum allowable VOC content in industrial coatings, with thresholds varying by jurisdiction. The European Union's VOC Solvents Emissions Directive and the U.S. EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) set particularly rigorous standards that manufacturers must meet through extensive testing and documentation.

Water pollution prevention measures constitute another essential component of environmental impact assessments. Regulatory frameworks require detailed analysis of potential leaching of toxic substances from composite coatings into groundwater or surface water. This includes evaluation of heavy metals, persistent organic pollutants, and other potentially harmful components that might be released during the coating's service life or disposal phase.

Waste management protocols for composite coating operations must be thoroughly documented in environmental assessments. This encompasses handling procedures for unused materials, contaminated containers, and application equipment. Many jurisdictions mandate specific disposal methods for coating waste classified as hazardous, requiring specialized treatment facilities and tracking systems to ensure regulatory compliance.

Ecological risk assessment has emerged as an increasingly important requirement, particularly for coatings used in sensitive environments. Manufacturers must evaluate potential impacts on local ecosystems, including effects on aquatic organisms, soil microbiota, and plant life. This often necessitates specialized toxicity testing and bioaccumulation studies to determine long-term environmental consequences.

Carbon footprint reporting has become mandatory in many regulatory frameworks, requiring manufacturers to calculate and disclose the total greenhouse gas emissions associated with their composite coating products. This includes not only direct emissions from manufacturing but also indirect emissions from raw material sourcing, transportation, and end-of-life scenarios. Many jurisdictions now require third-party verification of these calculations to ensure accuracy and prevent greenwashing.

Cross-Border Regulatory Harmonization Strategies

The harmonization of regulatory frameworks across international borders represents a critical challenge for the industrial deployment of composite coatings. Different countries maintain varying standards, testing protocols, and compliance requirements, creating significant barriers to global market entry and increasing compliance costs for manufacturers.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as a potential model for international harmonization, with its comprehensive approach to chemical safety assessment. Similarly, the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) provides a foundation for standardizing hazard communication across borders, though implementation varies significantly between jurisdictions.

Mutual Recognition Agreements (MRAs) between regulatory bodies offer a pragmatic pathway toward harmonization. These agreements enable regulatory authorities to accept conformity assessment results from partner countries, reducing duplicative testing requirements. The successful MRA between the EU and Canada for industrial products demonstrates how such arrangements can facilitate cross-border trade while maintaining safety standards.

International standards organizations, particularly ISO and ASTM International, play a pivotal role in developing globally recognized testing methodologies and performance criteria for composite coatings. Alignment with these standards can significantly reduce regulatory friction, though challenges remain in ensuring consistent interpretation and application across different regulatory regimes.

Industry consortia and public-private partnerships have emerged as effective mechanisms for advancing regulatory harmonization. The International Paint and Printing Ink Council (IPPIC) has successfully advocated for aligned approaches to VOC regulations and hazard classification systems across multiple jurisdictions, demonstrating the value of coordinated industry engagement with regulatory authorities.

Digital compliance management systems represent an emerging solution for navigating complex cross-border regulatory requirements. These platforms can track regulatory changes across multiple jurisdictions, manage compliance documentation, and facilitate electronic submission to different regulatory bodies, reducing administrative burden and improving compliance accuracy.

Developing countries present unique harmonization challenges, often lacking the technical infrastructure and expertise to implement sophisticated regulatory frameworks. Capacity-building initiatives and phased implementation approaches can help bridge this gap, allowing for progressive alignment with international standards while accounting for local economic and technical constraints.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as a potential model for international harmonization, with its comprehensive approach to chemical safety assessment. Similarly, the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) provides a foundation for standardizing hazard communication across borders, though implementation varies significantly between jurisdictions.

Mutual Recognition Agreements (MRAs) between regulatory bodies offer a pragmatic pathway toward harmonization. These agreements enable regulatory authorities to accept conformity assessment results from partner countries, reducing duplicative testing requirements. The successful MRA between the EU and Canada for industrial products demonstrates how such arrangements can facilitate cross-border trade while maintaining safety standards.

International standards organizations, particularly ISO and ASTM International, play a pivotal role in developing globally recognized testing methodologies and performance criteria for composite coatings. Alignment with these standards can significantly reduce regulatory friction, though challenges remain in ensuring consistent interpretation and application across different regulatory regimes.

Industry consortia and public-private partnerships have emerged as effective mechanisms for advancing regulatory harmonization. The International Paint and Printing Ink Council (IPPIC) has successfully advocated for aligned approaches to VOC regulations and hazard classification systems across multiple jurisdictions, demonstrating the value of coordinated industry engagement with regulatory authorities.

Digital compliance management systems represent an emerging solution for navigating complex cross-border regulatory requirements. These platforms can track regulatory changes across multiple jurisdictions, manage compliance documentation, and facilitate electronic submission to different regulatory bodies, reducing administrative burden and improving compliance accuracy.

Developing countries present unique harmonization challenges, often lacking the technical infrastructure and expertise to implement sophisticated regulatory frameworks. Capacity-building initiatives and phased implementation approaches can help bridge this gap, allowing for progressive alignment with international standards while accounting for local economic and technical constraints.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!