Composite coatings for high efficiency aerospace and automotive protection

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aerospace & Automotive Composite Coating Evolution

The evolution of composite coatings for aerospace and automotive applications has undergone significant transformation over the past several decades. Initially, protective coatings were primarily focused on basic corrosion resistance, with simple metallic layers such as chromium and zinc being the industry standard in the 1950s and 1960s. These early solutions provided adequate protection but lacked the multifunctional capabilities demanded by modern high-performance vehicles.

The 1970s marked a pivotal shift with the introduction of polymer-based composite coatings, which offered improved durability while reducing weight—a critical factor for fuel efficiency. This period saw the first integration of ceramic particles into polymer matrices, creating early hybrid coatings that demonstrated enhanced thermal stability and wear resistance compared to their predecessors.

By the 1990s, nanotechnology began influencing coating development, leading to the incorporation of nanoparticles that dramatically improved coating performance without significant weight penalties. Silicon carbide, aluminum oxide, and carbon nanotubes emerged as key reinforcement materials, enabling coatings to withstand increasingly extreme operating conditions in both aerospace and automotive applications.

The early 2000s witnessed the rise of self-healing coating technologies, incorporating microcapsules containing repair agents that could automatically address surface damage. This innovation represented a paradigm shift from passive protection to active response systems, significantly extending component lifespans and reducing maintenance requirements.

The 2010s brought sophisticated multi-layer composite coating systems designed to provide simultaneous protection against multiple threats—including corrosion, erosion, thermal cycling, and UV degradation. These integrated solutions often combined organic and inorganic components in carefully engineered structures to maximize performance across various environmental conditions.

Most recently, smart composite coatings have emerged, incorporating sensors and responsive elements that can adapt to changing conditions. These advanced systems can modify their properties based on environmental triggers such as temperature fluctuations, chemical exposure, or mechanical stress, providing dynamic protection that conventional static coatings cannot match.

The trajectory of development clearly points toward increasingly specialized, multifunctional coating systems that address the specific challenges of modern aerospace and automotive applications. As vehicles continue to push performance boundaries, coating technologies have evolved from simple protective barriers to sophisticated engineered systems that actively contribute to overall vehicle efficiency, safety, and sustainability.

The 1970s marked a pivotal shift with the introduction of polymer-based composite coatings, which offered improved durability while reducing weight—a critical factor for fuel efficiency. This period saw the first integration of ceramic particles into polymer matrices, creating early hybrid coatings that demonstrated enhanced thermal stability and wear resistance compared to their predecessors.

By the 1990s, nanotechnology began influencing coating development, leading to the incorporation of nanoparticles that dramatically improved coating performance without significant weight penalties. Silicon carbide, aluminum oxide, and carbon nanotubes emerged as key reinforcement materials, enabling coatings to withstand increasingly extreme operating conditions in both aerospace and automotive applications.

The early 2000s witnessed the rise of self-healing coating technologies, incorporating microcapsules containing repair agents that could automatically address surface damage. This innovation represented a paradigm shift from passive protection to active response systems, significantly extending component lifespans and reducing maintenance requirements.

The 2010s brought sophisticated multi-layer composite coating systems designed to provide simultaneous protection against multiple threats—including corrosion, erosion, thermal cycling, and UV degradation. These integrated solutions often combined organic and inorganic components in carefully engineered structures to maximize performance across various environmental conditions.

Most recently, smart composite coatings have emerged, incorporating sensors and responsive elements that can adapt to changing conditions. These advanced systems can modify their properties based on environmental triggers such as temperature fluctuations, chemical exposure, or mechanical stress, providing dynamic protection that conventional static coatings cannot match.

The trajectory of development clearly points toward increasingly specialized, multifunctional coating systems that address the specific challenges of modern aerospace and automotive applications. As vehicles continue to push performance boundaries, coating technologies have evolved from simple protective barriers to sophisticated engineered systems that actively contribute to overall vehicle efficiency, safety, and sustainability.

Market Analysis for High-Performance Protective Coatings

The global market for high-performance protective coatings continues to expand rapidly, driven by increasing demands in aerospace and automotive industries for materials that can withstand extreme conditions while improving operational efficiency. Current market valuations place the aerospace protective coatings segment at approximately 3.2 billion USD in 2023, with projections indicating growth to reach 4.7 billion USD by 2028, representing a compound annual growth rate of 8.1%.

The automotive protective coatings market demonstrates similar robust growth, currently valued at 5.8 billion USD and expected to reach 7.9 billion USD by 2028. This growth is primarily fueled by the automotive industry's shift toward lightweight materials requiring specialized protection and increasing consumer demand for longer-lasting vehicle finishes.

Regional analysis reveals that North America and Europe currently dominate the high-performance coatings market, collectively accounting for 58% of global market share. However, the Asia-Pacific region, particularly China and India, is experiencing the fastest growth rate at 9.7% annually, driven by rapid industrialization and expanding aerospace and automotive manufacturing bases.

Customer segmentation within these markets shows distinct requirements. The commercial aviation sector prioritizes coatings that reduce drag and fuel consumption, while military applications focus on stealth capabilities and extreme environment protection. The automotive industry increasingly demands coatings that provide both aesthetic appeal and functional benefits such as self-healing properties and enhanced durability.

Key market drivers include stringent environmental regulations pushing for low-VOC and chromium-free formulations, increasing fuel efficiency requirements in both industries, and rising consumer expectations for product longevity. The push toward electric vehicles is creating new demands for thermal management coatings and electromagnetic interference protection.

Market barriers include high development and certification costs for new coating technologies, lengthy approval processes particularly in aerospace applications, and supply chain vulnerabilities for rare earth elements and specialized additives used in advanced formulations.

Pricing trends indicate premium positioning for composite coatings, with customers demonstrating willingness to pay 30-40% more for solutions that offer measurable performance improvements and lifecycle cost reductions. The market increasingly values total cost of ownership over initial application costs, creating opportunities for innovative solutions that reduce maintenance frequency and extend service intervals.

The automotive protective coatings market demonstrates similar robust growth, currently valued at 5.8 billion USD and expected to reach 7.9 billion USD by 2028. This growth is primarily fueled by the automotive industry's shift toward lightweight materials requiring specialized protection and increasing consumer demand for longer-lasting vehicle finishes.

Regional analysis reveals that North America and Europe currently dominate the high-performance coatings market, collectively accounting for 58% of global market share. However, the Asia-Pacific region, particularly China and India, is experiencing the fastest growth rate at 9.7% annually, driven by rapid industrialization and expanding aerospace and automotive manufacturing bases.

Customer segmentation within these markets shows distinct requirements. The commercial aviation sector prioritizes coatings that reduce drag and fuel consumption, while military applications focus on stealth capabilities and extreme environment protection. The automotive industry increasingly demands coatings that provide both aesthetic appeal and functional benefits such as self-healing properties and enhanced durability.

Key market drivers include stringent environmental regulations pushing for low-VOC and chromium-free formulations, increasing fuel efficiency requirements in both industries, and rising consumer expectations for product longevity. The push toward electric vehicles is creating new demands for thermal management coatings and electromagnetic interference protection.

Market barriers include high development and certification costs for new coating technologies, lengthy approval processes particularly in aerospace applications, and supply chain vulnerabilities for rare earth elements and specialized additives used in advanced formulations.

Pricing trends indicate premium positioning for composite coatings, with customers demonstrating willingness to pay 30-40% more for solutions that offer measurable performance improvements and lifecycle cost reductions. The market increasingly values total cost of ownership over initial application costs, creating opportunities for innovative solutions that reduce maintenance frequency and extend service intervals.

Current Limitations in Composite Coating Technologies

Despite significant advancements in composite coating technologies for aerospace and automotive applications, several critical limitations continue to impede optimal performance and widespread adoption. Current composite coatings face substantial challenges in achieving consistent durability across varying environmental conditions. Extreme temperature fluctuations, particularly in aerospace applications where surfaces may experience temperatures ranging from -60°C at high altitudes to over 200°C near engine components, often lead to thermal expansion mismatches between coating layers, resulting in microcracking and delamination.

Adhesion stability represents another significant limitation, especially for components subjected to continuous vibration and mechanical stress. The interface between the substrate and coating remains vulnerable to degradation over time, with current bonding technologies struggling to maintain integrity throughout the entire service life of high-performance vehicles. This limitation becomes particularly evident in applications requiring frequent thermal cycling.

Weight considerations pose a persistent challenge, as many high-performance composite coatings add substantial mass to components, directly conflicting with the aerospace and automotive industries' push toward lightweight construction for improved fuel efficiency. Current coating systems often require thickness compromises that sacrifice either protective qualities or weight targets.

Manufacturing scalability presents significant barriers to widespread implementation. Many advanced composite coating technologies demonstrate excellent performance in laboratory settings but encounter substantial difficulties in scaling to industrial production volumes. Complex application processes, strict environmental controls, and lengthy curing times contribute to high production costs and limited throughput capabilities.

Environmental resistance limitations remain problematic, with many composite coatings exhibiting vulnerability to specific degradation mechanisms. UV radiation exposure, chemical contaminants (including de-icing fluids and aviation fuels), and erosion from particulate impacts progressively degrade coating performance. Current technologies rarely provide comprehensive protection against all environmental threats simultaneously.

Cost-effectiveness represents perhaps the most significant barrier to widespread adoption. Advanced composite coating systems often incorporate expensive materials like rare earth elements, specialized polymers, or precisely engineered nanoparticles. Combined with complex application processes requiring specialized equipment and highly trained personnel, these factors substantially increase implementation costs, limiting deployment to only the most critical or high-value applications.

Repair and maintenance challenges further complicate the practical application of composite coatings. Unlike traditional protective systems, many advanced coatings cannot be easily repaired in the field, requiring specialized facilities and techniques that increase vehicle downtime and operational costs.

Adhesion stability represents another significant limitation, especially for components subjected to continuous vibration and mechanical stress. The interface between the substrate and coating remains vulnerable to degradation over time, with current bonding technologies struggling to maintain integrity throughout the entire service life of high-performance vehicles. This limitation becomes particularly evident in applications requiring frequent thermal cycling.

Weight considerations pose a persistent challenge, as many high-performance composite coatings add substantial mass to components, directly conflicting with the aerospace and automotive industries' push toward lightweight construction for improved fuel efficiency. Current coating systems often require thickness compromises that sacrifice either protective qualities or weight targets.

Manufacturing scalability presents significant barriers to widespread implementation. Many advanced composite coating technologies demonstrate excellent performance in laboratory settings but encounter substantial difficulties in scaling to industrial production volumes. Complex application processes, strict environmental controls, and lengthy curing times contribute to high production costs and limited throughput capabilities.

Environmental resistance limitations remain problematic, with many composite coatings exhibiting vulnerability to specific degradation mechanisms. UV radiation exposure, chemical contaminants (including de-icing fluids and aviation fuels), and erosion from particulate impacts progressively degrade coating performance. Current technologies rarely provide comprehensive protection against all environmental threats simultaneously.

Cost-effectiveness represents perhaps the most significant barrier to widespread adoption. Advanced composite coating systems often incorporate expensive materials like rare earth elements, specialized polymers, or precisely engineered nanoparticles. Combined with complex application processes requiring specialized equipment and highly trained personnel, these factors substantially increase implementation costs, limiting deployment to only the most critical or high-value applications.

Repair and maintenance challenges further complicate the practical application of composite coatings. Unlike traditional protective systems, many advanced coatings cannot be easily repaired in the field, requiring specialized facilities and techniques that increase vehicle downtime and operational costs.

State-of-the-Art Composite Coating Solutions

01 Nanocomposite coatings for enhanced efficiency

Nanocomposite coatings incorporate nanoscale materials to significantly improve coating efficiency. These advanced formulations utilize nanoparticles to enhance properties such as durability, corrosion resistance, and thermal stability. The nanomaterials create a more uniform and dense coating structure, resulting in better performance with less material usage. These coatings can be applied to various substrates and offer improved protection while maintaining or reducing thickness compared to conventional coatings.- Nanocomposite coatings for enhanced efficiency: Nanocomposite coatings incorporate nanomaterials to significantly improve coating efficiency and performance. These advanced formulations utilize nanoparticles to enhance properties such as durability, corrosion resistance, and thermal stability. The nanoscale components create a more uniform structure with improved adhesion to substrates and reduced material consumption while maintaining or enhancing protective qualities.

- Energy-efficient coating technologies: Energy-efficient coating technologies focus on reducing energy consumption during application and curing processes. These innovations include low-temperature curing systems, rapid-drying formulations, and UV/LED curable coatings that minimize energy requirements. Such technologies not only reduce production costs but also decrease the environmental footprint of coating operations while maintaining high-quality surface protection.

- Self-healing composite coating systems: Self-healing composite coating systems incorporate active components that automatically repair damage without external intervention. These intelligent coatings contain microcapsules or other mechanisms that release healing agents when the coating is scratched or damaged. This technology extends coating lifespan, reduces maintenance requirements, and improves long-term efficiency by maintaining protective properties even after surface damage occurs.

- Multi-functional composite coatings: Multi-functional composite coatings combine several performance attributes in a single application, improving overall efficiency. These sophisticated formulations may simultaneously provide corrosion protection, thermal insulation, antimicrobial properties, and wear resistance. By consolidating multiple functions into one coating system, these technologies reduce the need for multiple coating layers, saving materials, application time, and maintenance costs.

- Environmentally sustainable coating formulations: Environmentally sustainable coating formulations focus on reducing environmental impact while maintaining high efficiency. These include water-based systems, powder coatings, high-solids formulations, and bio-based components that reduce or eliminate volatile organic compounds (VOCs). Such coatings not only comply with increasingly stringent environmental regulations but also offer improved application efficiency, reduced waste, and lower lifecycle costs.

02 Energy-efficient coating application methods

Various application techniques have been developed to improve the energy efficiency of composite coating processes. These methods include optimized spray systems, electrostatic application, and controlled deposition techniques that reduce material waste and energy consumption. Advanced application equipment allows for precise control of coating thickness and uniformity, minimizing the need for multiple coats or excessive material use. These energy-efficient methods also reduce curing times and temperatures, further enhancing overall process efficiency.Expand Specific Solutions03 Self-healing composite coatings

Self-healing composite coatings represent a significant advancement in coating efficiency by extending service life and reducing maintenance requirements. These innovative coatings contain encapsulated healing agents that are released when the coating is damaged, automatically repairing cracks or scratches. This self-repair mechanism prevents the progression of damage and maintains the protective properties of the coating over time. The technology significantly improves long-term efficiency by reducing the frequency of reapplication and repair.Expand Specific Solutions04 Environmentally friendly composite coating formulations

Eco-friendly composite coating formulations have been developed to improve efficiency while reducing environmental impact. These coatings utilize water-based systems, bio-derived materials, and low-VOC (volatile organic compound) formulations that maintain or exceed the performance of traditional solvent-based coatings. The environmentally conscious formulations provide excellent adhesion, durability, and protection while reducing hazardous emissions during application and curing. These coatings also often require less energy for curing and offer improved worker safety.Expand Specific Solutions05 Multi-functional composite coatings

Multi-functional composite coatings combine several protective properties in a single application, significantly improving overall efficiency. These advanced coatings simultaneously provide benefits such as corrosion resistance, thermal insulation, wear resistance, and antimicrobial properties. By integrating multiple functions into one coating system, these formulations eliminate the need for multiple coating layers or separate treatments. This approach reduces material usage, application time, and maintenance requirements while providing comprehensive protection for the substrate.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings market for aerospace and automotive protection is in a growth phase, driven by increasing demand for high-performance materials that enhance fuel efficiency and durability. The global market is expanding rapidly, with projections exceeding $1.5 billion by 2025. Technologically, the field is advancing from traditional protective coatings toward multi-functional composites with self-healing and smart properties. Key players demonstrate varying levels of technological maturity: established aerospace giants like Boeing, Honeywell, and GE lead with advanced solutions, while PPG Industries and Mankiewicz offer specialized coating expertise. Research institutions such as Harbin Institute of Technology and Lanzhou Institute collaborate with industry to develop next-generation solutions. Applied Materials and MTU Aero Engines are advancing material science applications, creating a competitive landscape balanced between established manufacturers and innovative research entities.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed advanced multi-layered composite coating systems specifically designed for aerospace applications. Their technology combines ceramic thermal barrier coatings (TBCs) with specialized metallic bond coats to create comprehensive protection systems. The company utilizes plasma spray deposition and electron beam physical vapor deposition (EB-PVD) techniques to create coatings with columnar microstructures that enhance strain tolerance during thermal cycling. Honeywell's composite coatings incorporate self-healing capabilities through the addition of aluminum-containing reservoirs that can replenish protective oxide scales when damaged. Their latest generation coatings also feature nanostructured compositions with improved erosion resistance and thermal insulation properties, extending component life by up to 30% compared to conventional coatings.

Strengths: Superior thermal cycling resistance due to engineered microstructures; excellent high-temperature oxidation protection; proven track record in aerospace applications. Weaknesses: Higher manufacturing costs compared to conventional coatings; complex application processes requiring specialized equipment; potential challenges in field repairs.

PPG Industries Ohio, Inc.

Technical Solution: PPG has pioneered electrocoat (e-coat) composite coating technologies for both aerospace and automotive applications. Their Aerocron™ e-coat primer system utilizes electrodeposition to create uniform, lightweight protective layers even on complex geometries. The technology combines epoxy resins with corrosion-inhibiting pigments and nanoparticle reinforcements to achieve superior adhesion and protection. For automotive applications, PPG has developed multi-functional composite coatings that integrate graphene nanoplatelets and ceramic particles to enhance scratch resistance while maintaining flexibility. Their coatings employ a unique self-stratifying technology that creates distinct functional layers from a single application, reducing manufacturing steps. PPG's latest innovations include hydrophobic top coats with ice-phobic properties for aerospace applications, reducing drag and preventing ice accumulation while providing UV protection.

Strengths: Excellent uniform coverage on complex parts; superior corrosion protection; environmentally friendly with reduced VOC emissions; efficient application process. Weaknesses: Requires specialized application equipment; higher initial investment costs; limited high-temperature performance compared to ceramic-based systems.

Key Patents and Breakthroughs in Coating Technology

Aerospace parts with protective coating and method of preparation thereof

PatentInactiveJP2023550727A

Innovation

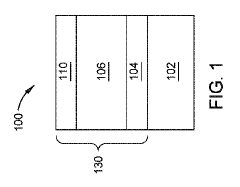

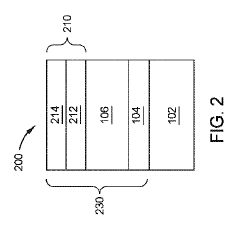

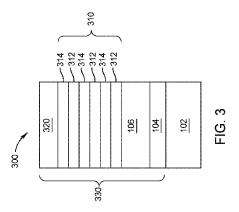

- A protective coating system for aerospace components comprising a nickel-based superalloy substrate with a bond coating containing chromium and aluminum, a thermal barrier coating of yttria-stabilized zirconia, and an oxide coating with multiple layers of different metal oxides, applied through vapor deposition processes like ALD to enhance resistance to CMAS and high-temperature oxidation.

Aerospace components having protective coatings and methods for preparing the same

PatentWO2022108740A1

Innovation

- A multi-layer protective coating system is applied to aerospace components, comprising a nickel-based superalloy substrate with a bond coating containing chromium and aluminum, a thermal barrier coating of yttria-stabilized zirconia, and an oxide coating with a film stack of different metal oxides, including a capping layer of aluminum, calcium, or magnesium oxides, deposited using vapor deposition processes like atomic layer deposition (ALD).

Environmental Compliance and Sustainability Factors

The aerospace and automotive industries are increasingly subject to stringent environmental regulations that significantly impact coating technologies. Current regulatory frameworks, including REACH in Europe and EPA standards in the United States, have established strict limitations on volatile organic compounds (VOCs), hexavalent chromium, and other hazardous substances traditionally used in protective coatings. These regulations have accelerated the development of environmentally compliant composite coating alternatives that maintain or exceed performance requirements.

Sustainability considerations have become central to coating development strategies, with lifecycle assessment (LCA) methodologies now routinely employed to evaluate environmental impacts from raw material extraction through disposal. Recent studies indicate that advanced composite coatings can reduce carbon footprints by 15-30% compared to conventional solutions, primarily through extended service life and reduced maintenance requirements.

Water-based and powder coating systems have emerged as environmentally preferable alternatives, eliminating up to 95% of solvent emissions while maintaining comparable protection properties. Bio-based components derived from renewable resources such as plant oils, cellulose, and lignin are increasingly incorporated into composite coating formulations, reducing dependence on petroleum-derived materials by up to 40% in some applications.

Energy efficiency considerations extend beyond the coating itself to application processes. Low-temperature curing technologies have reduced energy consumption in coating application by 25-35%, while simultaneously decreasing production cycle times. Additionally, self-healing and self-cleaning properties incorporated into modern composite coatings minimize the need for chemical cleaners and repair materials throughout the product lifecycle.

Waste reduction strategies have evolved significantly, with closed-loop manufacturing systems recovering and reusing up to 90% of overspray materials in some facilities. End-of-life considerations are increasingly addressed through the development of recyclable coating systems and delamination technologies that facilitate material separation during recycling processes.

The aerospace sector faces particularly complex sustainability challenges due to extreme operating conditions and safety requirements. Recent innovations include chromium-free corrosion inhibitors and flame-retardant systems that meet stringent safety standards without environmentally persistent chemicals. Similarly, the automotive industry has pioneered lightweight coating systems that contribute to vehicle weight reduction and subsequent fuel efficiency improvements of 1-3%.

International collaboration through initiatives like the Strategic Approach to International Chemicals Management (SAICM) is harmonizing environmental standards globally, creating more predictable regulatory landscapes for coating developers and manufacturers. This regulatory convergence is accelerating the adoption of sustainable coating technologies across global supply chains.

Sustainability considerations have become central to coating development strategies, with lifecycle assessment (LCA) methodologies now routinely employed to evaluate environmental impacts from raw material extraction through disposal. Recent studies indicate that advanced composite coatings can reduce carbon footprints by 15-30% compared to conventional solutions, primarily through extended service life and reduced maintenance requirements.

Water-based and powder coating systems have emerged as environmentally preferable alternatives, eliminating up to 95% of solvent emissions while maintaining comparable protection properties. Bio-based components derived from renewable resources such as plant oils, cellulose, and lignin are increasingly incorporated into composite coating formulations, reducing dependence on petroleum-derived materials by up to 40% in some applications.

Energy efficiency considerations extend beyond the coating itself to application processes. Low-temperature curing technologies have reduced energy consumption in coating application by 25-35%, while simultaneously decreasing production cycle times. Additionally, self-healing and self-cleaning properties incorporated into modern composite coatings minimize the need for chemical cleaners and repair materials throughout the product lifecycle.

Waste reduction strategies have evolved significantly, with closed-loop manufacturing systems recovering and reusing up to 90% of overspray materials in some facilities. End-of-life considerations are increasingly addressed through the development of recyclable coating systems and delamination technologies that facilitate material separation during recycling processes.

The aerospace sector faces particularly complex sustainability challenges due to extreme operating conditions and safety requirements. Recent innovations include chromium-free corrosion inhibitors and flame-retardant systems that meet stringent safety standards without environmentally persistent chemicals. Similarly, the automotive industry has pioneered lightweight coating systems that contribute to vehicle weight reduction and subsequent fuel efficiency improvements of 1-3%.

International collaboration through initiatives like the Strategic Approach to International Chemicals Management (SAICM) is harmonizing environmental standards globally, creating more predictable regulatory landscapes for coating developers and manufacturers. This regulatory convergence is accelerating the adoption of sustainable coating technologies across global supply chains.

Performance Testing Standards and Certification

Performance testing standards for composite coatings in aerospace and automotive applications are governed by rigorous international frameworks that ensure consistent quality and reliability. The American Society for Testing and Materials (ASTM) has developed specific standards such as ASTM D3359 for adhesion testing and ASTM B117 for salt spray resistance, which are widely adopted across industries. Similarly, the International Organization for Standardization (ISO) provides comprehensive guidelines through ISO 20340 for protective coating systems in offshore environments, applicable to high-performance aerospace coatings.

For aerospace applications, specialized standards like AMS-C-27725 (Aerospace Material Specification) define the performance requirements for high-temperature resistant coatings. These standards mandate specific testing protocols for thermal cycling, erosion resistance, and ultraviolet degradation that simulate extreme altitude conditions. The Federal Aviation Administration (FAA) further requires certification under 14 CFR Part 25 for materials used in commercial aircraft structures.

Automotive industry standards focus on different performance metrics, with particular emphasis on stone chip resistance (SAE J400), scratch resistance (ISO 20566), and weathering performance (SAE J2527). The German automotive industry has established VDA 621-415 as a benchmark for evaluating coating resistance to chemicals and environmental factors. These standards are continuously evolving to address emerging challenges in lightweight materials protection.

Certification processes typically involve third-party testing laboratories that provide independent verification of coating performance. Organizations such as Underwriters Laboratories (UL) and TÜV offer certification services that have become de facto requirements for market entry in many regions. The European Aviation Safety Agency (EASA) and its American counterpart FAA require extensive documentation of testing results before approving coatings for aerospace applications.

Recent developments in testing standards include the incorporation of accelerated aging protocols that can simulate decades of environmental exposure within weeks. These advanced testing methodologies employ combined stress factors such as UV radiation, temperature cycling, humidity, and chemical exposure simultaneously. Computational modeling is increasingly being integrated with physical testing to predict long-term performance more accurately.

Emerging standards are beginning to address sustainability concerns, with metrics for volatile organic compound (VOC) content, environmental impact assessment, and end-of-life recyclability becoming mandatory in certain markets. The aerospace industry, in particular, is moving toward harmonized global standards through the International Aerospace Environmental Group (IAEG) to streamline certification processes across different regulatory environments.

For aerospace applications, specialized standards like AMS-C-27725 (Aerospace Material Specification) define the performance requirements for high-temperature resistant coatings. These standards mandate specific testing protocols for thermal cycling, erosion resistance, and ultraviolet degradation that simulate extreme altitude conditions. The Federal Aviation Administration (FAA) further requires certification under 14 CFR Part 25 for materials used in commercial aircraft structures.

Automotive industry standards focus on different performance metrics, with particular emphasis on stone chip resistance (SAE J400), scratch resistance (ISO 20566), and weathering performance (SAE J2527). The German automotive industry has established VDA 621-415 as a benchmark for evaluating coating resistance to chemicals and environmental factors. These standards are continuously evolving to address emerging challenges in lightweight materials protection.

Certification processes typically involve third-party testing laboratories that provide independent verification of coating performance. Organizations such as Underwriters Laboratories (UL) and TÜV offer certification services that have become de facto requirements for market entry in many regions. The European Aviation Safety Agency (EASA) and its American counterpart FAA require extensive documentation of testing results before approving coatings for aerospace applications.

Recent developments in testing standards include the incorporation of accelerated aging protocols that can simulate decades of environmental exposure within weeks. These advanced testing methodologies employ combined stress factors such as UV radiation, temperature cycling, humidity, and chemical exposure simultaneously. Computational modeling is increasingly being integrated with physical testing to predict long-term performance more accurately.

Emerging standards are beginning to address sustainability concerns, with metrics for volatile organic compound (VOC) content, environmental impact assessment, and end-of-life recyclability becoming mandatory in certain markets. The aerospace industry, in particular, is moving toward harmonized global standards through the International Aerospace Environmental Group (IAEG) to streamline certification processes across different regulatory environments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!