Analysis of Global Market Adoption of Carbon-negative Concrete

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Background and Objectives

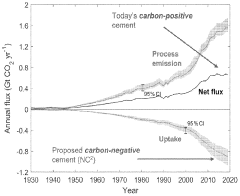

Concrete production is responsible for approximately 8% of global carbon emissions, making it one of the most significant contributors to climate change within the construction industry. Carbon-negative concrete represents a revolutionary approach to addressing this environmental challenge by not only reducing emissions but actually sequestering more carbon than is produced during manufacturing. This technology has evolved from early carbon-neutral formulations in the early 2000s to truly carbon-negative solutions emerging in the 2010s, with significant acceleration in research and commercial applications over the past five years.

The fundamental principle behind carbon-negative concrete involves incorporating alternative materials such as industrial byproducts, novel binding agents, and carbon capture technologies directly into the concrete manufacturing process. Key technological milestones include the development of geopolymer cements, calcium silicate-based alternatives, and innovative carbon mineralization processes that permanently sequester CO2 within the concrete matrix.

Current technological objectives in this field focus on several critical areas. First, improving carbon sequestration efficiency to maximize the negative carbon footprint while maintaining or enhancing structural performance. Second, scaling production capabilities to meet global construction demands, as most carbon-negative solutions currently operate at limited production volumes. Third, reducing production costs to achieve price parity with traditional Portland cement concrete, which remains a significant barrier to widespread adoption.

The evolution of regulatory frameworks globally has also shaped the trajectory of this technology. Carbon pricing mechanisms, green building standards, and government procurement policies increasingly favor low-carbon construction materials, creating market pull for carbon-negative concrete solutions. The Paris Agreement and subsequent national commitments to carbon reduction have accelerated interest in technologies that can deliver negative emissions.

Research institutions and industry partnerships have established ambitious targets for the coming decade, including reducing the carbon intensity of concrete by 50% by 2030 and achieving carbon neutrality across the entire concrete value chain by 2050. Carbon-negative concrete is positioned as a critical technology to not only meet these targets but potentially exceed them by offering a pathway to historical emissions reduction.

The ultimate technological goal extends beyond environmental benefits to creating a superior building material that outperforms traditional concrete in durability, strength, and versatility while simultaneously addressing climate change through carbon sequestration. This dual-benefit approach represents the frontier of sustainable construction technology and forms the foundation for analyzing global market adoption potential.

The fundamental principle behind carbon-negative concrete involves incorporating alternative materials such as industrial byproducts, novel binding agents, and carbon capture technologies directly into the concrete manufacturing process. Key technological milestones include the development of geopolymer cements, calcium silicate-based alternatives, and innovative carbon mineralization processes that permanently sequester CO2 within the concrete matrix.

Current technological objectives in this field focus on several critical areas. First, improving carbon sequestration efficiency to maximize the negative carbon footprint while maintaining or enhancing structural performance. Second, scaling production capabilities to meet global construction demands, as most carbon-negative solutions currently operate at limited production volumes. Third, reducing production costs to achieve price parity with traditional Portland cement concrete, which remains a significant barrier to widespread adoption.

The evolution of regulatory frameworks globally has also shaped the trajectory of this technology. Carbon pricing mechanisms, green building standards, and government procurement policies increasingly favor low-carbon construction materials, creating market pull for carbon-negative concrete solutions. The Paris Agreement and subsequent national commitments to carbon reduction have accelerated interest in technologies that can deliver negative emissions.

Research institutions and industry partnerships have established ambitious targets for the coming decade, including reducing the carbon intensity of concrete by 50% by 2030 and achieving carbon neutrality across the entire concrete value chain by 2050. Carbon-negative concrete is positioned as a critical technology to not only meet these targets but potentially exceed them by offering a pathway to historical emissions reduction.

The ultimate technological goal extends beyond environmental benefits to creating a superior building material that outperforms traditional concrete in durability, strength, and versatility while simultaneously addressing climate change through carbon sequestration. This dual-benefit approach represents the frontier of sustainable construction technology and forms the foundation for analyzing global market adoption potential.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has shown remarkable growth in recent years. Current market analysis indicates that the global green building materials market was valued at approximately $256 billion in 2020 and is projected to reach $523 billion by 2026, representing a compound annual growth rate of 11.3%.

Carbon-negative concrete specifically addresses one of construction's most pressing environmental challenges: traditional concrete production accounts for nearly 8% of global CO2 emissions. This creates substantial market demand as governments worldwide implement stricter carbon regulations and establish net-zero targets. The European Union's Green Deal, China's carbon neutrality pledge by 2060, and similar commitments from major economies are creating regulatory frameworks that favor carbon-negative building materials.

Consumer preferences are also evolving rapidly, with surveys indicating that 73% of commercial building owners and developers now prioritize sustainability in their material selection processes. This represents a 22% increase from similar surveys conducted five years ago. The premium that customers are willing to pay for sustainable materials has also increased, from an average of 2-3% in 2015 to 5-7% in 2022, indicating strengthening market demand despite higher initial costs.

Market segmentation analysis reveals that demand for carbon-negative concrete is particularly strong in commercial construction (38%), followed by residential (29%), infrastructure (24%), and industrial applications (9%). Geographically, North America and Europe currently lead adoption rates, but the Asia-Pacific region is expected to show the highest growth rate over the next decade, with China and India representing particularly significant market opportunities.

Industry forecasts suggest that carbon-negative concrete could capture up to 15% of the global concrete market by 2030, representing a potential market value of $30 billion. This projection is supported by the increasing number of green building certifications such as LEED, BREEAM, and local equivalents that award additional points for carbon-negative materials.

The market is further bolstered by emerging carbon pricing mechanisms and carbon credit systems. In regions with established carbon markets, carbon-negative concrete can generate additional revenue through carbon credits, improving its economic competitiveness against traditional materials. This economic incentive, combined with corporate ESG commitments and public procurement policies favoring low-carbon materials, is creating a robust demand ecosystem for sustainable construction materials like carbon-negative concrete.

Carbon-negative concrete specifically addresses one of construction's most pressing environmental challenges: traditional concrete production accounts for nearly 8% of global CO2 emissions. This creates substantial market demand as governments worldwide implement stricter carbon regulations and establish net-zero targets. The European Union's Green Deal, China's carbon neutrality pledge by 2060, and similar commitments from major economies are creating regulatory frameworks that favor carbon-negative building materials.

Consumer preferences are also evolving rapidly, with surveys indicating that 73% of commercial building owners and developers now prioritize sustainability in their material selection processes. This represents a 22% increase from similar surveys conducted five years ago. The premium that customers are willing to pay for sustainable materials has also increased, from an average of 2-3% in 2015 to 5-7% in 2022, indicating strengthening market demand despite higher initial costs.

Market segmentation analysis reveals that demand for carbon-negative concrete is particularly strong in commercial construction (38%), followed by residential (29%), infrastructure (24%), and industrial applications (9%). Geographically, North America and Europe currently lead adoption rates, but the Asia-Pacific region is expected to show the highest growth rate over the next decade, with China and India representing particularly significant market opportunities.

Industry forecasts suggest that carbon-negative concrete could capture up to 15% of the global concrete market by 2030, representing a potential market value of $30 billion. This projection is supported by the increasing number of green building certifications such as LEED, BREEAM, and local equivalents that award additional points for carbon-negative materials.

The market is further bolstered by emerging carbon pricing mechanisms and carbon credit systems. In regions with established carbon markets, carbon-negative concrete can generate additional revenue through carbon credits, improving its economic competitiveness against traditional materials. This economic incentive, combined with corporate ESG commitments and public procurement policies favoring low-carbon materials, is creating a robust demand ecosystem for sustainable construction materials like carbon-negative concrete.

Global Status and Challenges of Carbon-negative Concrete

Carbon-negative concrete technology has seen varied adoption rates globally, with significant regional disparities in implementation and research focus. Currently, North America and Europe lead in both research initiatives and commercial deployment, with several pilot projects demonstrating the viability of carbon-negative concrete solutions. The European Union's aggressive carbon reduction targets have catalyzed substantial investment in this sector, particularly in Scandinavian countries where governmental support has accelerated adoption.

In contrast, Asia presents a complex landscape. While China remains the world's largest concrete producer and carbon emitter in this sector, its adoption of carbon-negative technologies has been relatively limited. However, recent policy shifts indicate growing governmental interest, particularly as part of broader carbon neutrality commitments. Japan and South Korea have established more advanced research programs, though commercial-scale implementation remains nascent.

The primary technical challenges hindering global adoption include scalability limitations, cost premiums, and performance variability. Current carbon-negative concrete formulations often face difficulties in maintaining consistent mechanical properties across different environmental conditions, creating hesitation among construction stakeholders. Additionally, the carbon capture mechanisms employed in these concretes require careful monitoring and validation to ensure long-term sequestration effectiveness.

Regulatory frameworks present another significant barrier, as building codes and construction standards in many regions have not been updated to accommodate these innovative materials. This regulatory lag creates uncertainty for potential adopters and slows market penetration, particularly in conservative construction markets where liability concerns predominate.

Supply chain constraints further complicate widespread adoption. Many carbon-negative concrete formulations rely on industrial byproducts or specialized materials with limited availability. The geographical distribution of these inputs often does not align with concrete production centers, creating logistical challenges and increasing embodied carbon from transportation.

Economic factors remain perhaps the most significant impediment to global adoption. Despite decreasing cost differentials, carbon-negative concrete typically commands a 15-30% premium over conventional products. Without robust carbon pricing mechanisms or regulatory mandates, this cost difference significantly limits market uptake, particularly in developing economies where construction cost sensitivity is high.

The technology distribution shows notable geographical concentration, with approximately 70% of patents and research publications originating from North America, Europe, and Australia. This concentration risks creating a technological divide that could further delay adoption in regions with the highest concrete consumption growth rates, particularly across developing Asia and Africa.

In contrast, Asia presents a complex landscape. While China remains the world's largest concrete producer and carbon emitter in this sector, its adoption of carbon-negative technologies has been relatively limited. However, recent policy shifts indicate growing governmental interest, particularly as part of broader carbon neutrality commitments. Japan and South Korea have established more advanced research programs, though commercial-scale implementation remains nascent.

The primary technical challenges hindering global adoption include scalability limitations, cost premiums, and performance variability. Current carbon-negative concrete formulations often face difficulties in maintaining consistent mechanical properties across different environmental conditions, creating hesitation among construction stakeholders. Additionally, the carbon capture mechanisms employed in these concretes require careful monitoring and validation to ensure long-term sequestration effectiveness.

Regulatory frameworks present another significant barrier, as building codes and construction standards in many regions have not been updated to accommodate these innovative materials. This regulatory lag creates uncertainty for potential adopters and slows market penetration, particularly in conservative construction markets where liability concerns predominate.

Supply chain constraints further complicate widespread adoption. Many carbon-negative concrete formulations rely on industrial byproducts or specialized materials with limited availability. The geographical distribution of these inputs often does not align with concrete production centers, creating logistical challenges and increasing embodied carbon from transportation.

Economic factors remain perhaps the most significant impediment to global adoption. Despite decreasing cost differentials, carbon-negative concrete typically commands a 15-30% premium over conventional products. Without robust carbon pricing mechanisms or regulatory mandates, this cost difference significantly limits market uptake, particularly in developing economies where construction cost sensitivity is high.

The technology distribution shows notable geographical concentration, with approximately 70% of patents and research publications originating from North America, Europe, and Australia. This concentration risks creating a technological divide that could further delay adoption in regions with the highest concrete consumption growth rates, particularly across developing Asia and Africa.

Current Carbon-negative Concrete Solutions and Implementation

01 CO2 capture and sequestration in concrete

Carbon-negative concrete technologies that actively capture and sequester CO2 during the manufacturing process. These methods involve incorporating materials that can absorb CO2 from the atmosphere and lock it into the concrete structure, effectively making the concrete a carbon sink. The sequestration process can involve carbonation curing or the use of specialized additives that react with and store CO2.- CO2 capture and sequestration in concrete: Carbon-negative concrete technologies that actively capture and sequester CO2 during the manufacturing process. These methods involve incorporating materials that can absorb CO2 from the atmosphere and lock it into the concrete structure, effectively making the concrete a carbon sink. The sequestration process can occur during curing or throughout the concrete's lifecycle, contributing to overall carbon negativity.

- Alternative cementitious materials: The use of alternative cementitious materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume. These materials can reduce the carbon footprint of concrete while maintaining or improving its structural properties.

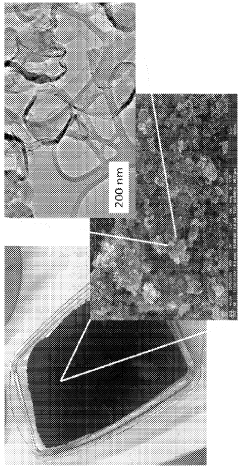

- Carbonation curing techniques: Specialized curing techniques that utilize CO2 to accelerate the hardening process of concrete while simultaneously sequestering carbon. These methods involve exposing fresh concrete to controlled CO2-rich environments, allowing for the chemical reaction between CO2 and calcium compounds in the concrete. This process not only reduces curing time but also improves concrete strength while permanently storing carbon dioxide within the material structure.

- Biomass-derived additives: The incorporation of biomass-derived additives and biogenic materials into concrete formulations to reduce carbon footprint. These additives can include agricultural waste products, biochar, hemp, and other plant-based materials that have naturally sequestered carbon during their growth. When incorporated into concrete, these materials not only reduce the amount of cement required but also bring the embedded carbon into the final product, contributing to carbon negativity.

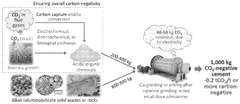

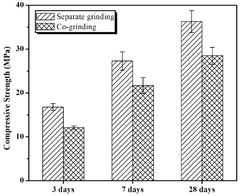

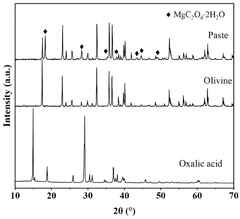

- Mineral carbonation processes: Advanced mineral carbonation processes that enhance the natural ability of certain minerals to react with and store CO2. These technologies accelerate the weathering process that naturally occurs in minerals like olivine, serpentine, and wollastonite, allowing them to rapidly absorb CO2 when incorporated into concrete. The resulting carbonated minerals form stable compounds that permanently sequester carbon while potentially improving concrete properties such as strength and durability.

02 Alternative cementitious materials

The use of alternative cementitious materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume. These materials can significantly reduce the carbon footprint of concrete while maintaining or even improving its mechanical properties.Expand Specific Solutions03 Biomass incorporation in concrete

The incorporation of biomass or bio-based materials into concrete formulations to reduce carbon footprint. These materials can include agricultural waste, wood products, or other plant-based materials that have sequestered carbon during their growth. By incorporating these materials into concrete, the carbon remains sequestered, and the need for carbon-intensive traditional materials is reduced.Expand Specific Solutions04 Mineral carbonation technologies

The use of mineral carbonation technologies where CO2 is reacted with calcium or magnesium-rich minerals to form stable carbonate compounds. This process mimics natural weathering processes but accelerates them significantly. The resulting carbonates can be used as aggregates or fillers in concrete, effectively storing CO2 in a stable form while providing structural benefits to the concrete.Expand Specific Solutions05 Advanced manufacturing and curing processes

Advanced manufacturing and curing processes designed to reduce energy consumption and increase CO2 uptake. These include low-temperature curing methods, accelerated carbonation curing, and optimized mix designs that require less cement. Some processes also involve the direct injection of CO2 during mixing or curing, which can improve concrete properties while sequestering carbon.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The global carbon-negative concrete market is in its early growth phase, characterized by increasing adoption driven by sustainability imperatives and regulatory pressures. The market is projected to expand significantly as construction industries worldwide seek to reduce carbon footprints, with estimates suggesting multi-billion dollar potential by 2030. Technologically, the field shows varying maturity levels, with companies like Solidia Technologies, Carbon Limit Co., and Prometheus Materials leading innovation in commercial applications. Academic institutions including Worcester Polytechnic Institute and Southeast University are advancing fundamental research, while established cement manufacturers such as Anhui Conch Group, Huaxin Cement, and Taiheiyo Cement are integrating carbon-negative solutions into traditional production. China National Building Material Group and Saudi Aramco represent significant industrial players investing in scaling these technologies for mass market adoption.

Solidia Technologies, Inc.

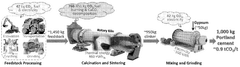

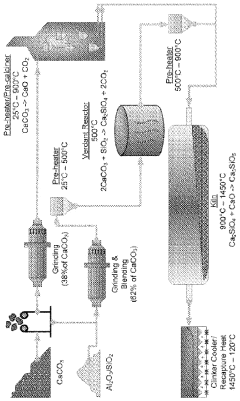

Technical Solution: Solidia Technologies has developed a revolutionary carbon-negative concrete technology that fundamentally alters the chemistry of cement. Their process uses non-hydraulic calcium silicate cement that cures by carbonation rather than hydration, consuming CO2 during the curing process. The technology reduces the carbon footprint of concrete production by up to 70% compared to traditional Portland cement concrete. Solidia's approach involves lower kiln temperatures during manufacturing (around 1200°C versus 1450°C for traditional cement), which reduces energy consumption by approximately 30%. Additionally, their concrete products can sequester up to 240 kg of CO2 per ton of cement used, effectively making the final product carbon-negative when accounting for the full lifecycle. The company has successfully commercialized this technology through partnerships with major concrete manufacturers and has installations across North America and Europe.

Strengths: Achieves significant carbon reduction without sacrificing performance characteristics; requires minimal changes to existing manufacturing infrastructure; produces concrete with enhanced durability and reduced efflorescence. Weaknesses: Requires a controlled CO2 curing environment which adds complexity to production; market adoption faces challenges from conservative construction industry standards and regulations.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed an integrated carbon-negative concrete solution that combines several innovative approaches to address emissions throughout the concrete value chain. Their technology incorporates alternative cementitious materials derived from industrial byproducts such as blast furnace slag and fly ash, reducing the clinker factor to below 50%. CNBM has also pioneered carbon capture utilization and storage (CCUS) systems specifically designed for cement plants, which can capture up to 90% of process emissions. The captured CO2 is then utilized in concrete curing chambers where it reacts with specialized concrete mixes to form stable carbonate compounds. This carbonation curing process not only sequesters carbon but also improves concrete strength development and durability. CNBM has implemented this technology at industrial scale in several of their production facilities across China, demonstrating carbon reductions of approximately 30-40% compared to conventional concrete, with pathways to achieve carbon-negative performance through further optimization of their CCUS integration.

Strengths: Comprehensive approach addressing multiple aspects of concrete's carbon footprint; leverages existing industrial waste streams; implemented at commercial scale with demonstrated performance. Weaknesses: High capital costs for CCUS implementation; variable performance depending on raw material availability; requires significant technical expertise to operate integrated systems.

Core Patents and Innovations in CO2 Sequestration Concrete

Multi-fold carbon-negative organic alternative cement

PatentWO2025024556A1

Innovation

- A method of forming alternative cement by mixing a mineral base with an acidic component, such as oxalic acid or its salts, to create a carbon-negative organic cement. The acidic component is derived from sources like CO2, biomass, or organic acids, and the mineral base includes non-carbonate rocks, minerals, or industrial wastes.

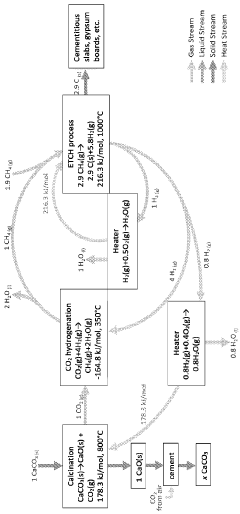

Negative-carbon cement (NC2) production

PatentWO2024059483A1

Innovation

- A process and system that calcines calcium carbonate to produce calcium oxide and carbon dioxide, which is then reacted with hydrogen gas to produce methane and water, followed by pyrolysis to convert methane into solid carbon, with the produced hydrogen gas used to offset energy needs in the process, thereby reducing carbon emissions.

Regulatory Framework and Carbon Credit Mechanisms

The global regulatory landscape for carbon-negative concrete is evolving rapidly, with various jurisdictions implementing frameworks to incentivize adoption. The European Union leads with its Emissions Trading System (EU ETS), which has established carbon pricing mechanisms directly impacting construction materials. Recent amendments to the EU ETS have strengthened requirements for cement manufacturers, creating financial incentives for carbon-negative alternatives. Similarly, California's Low Carbon Fuel Standard and Cap-and-Trade Program provide frameworks that can be leveraged by carbon-negative concrete producers.

Carbon credit mechanisms represent a critical economic driver for market adoption. The voluntary carbon market has seen significant growth, with carbon credits for carbon-negative concrete ranging from $15 to $150 per ton of CO2 sequestered, depending on verification standards and co-benefits. Leading verification bodies such as Verra and Gold Standard have developed methodologies specifically for carbon-negative building materials, enhancing market credibility.

International agreements, particularly the Paris Climate Accord, have accelerated national policy development. Countries representing over 70% of global cement production have established carbon reduction targets that directly impact concrete specifications. These commitments are translating into procurement policies, with governments in Scandinavia, Canada, and parts of Asia implementing carbon-intensity thresholds for public infrastructure projects.

Building codes and standards are being revised to accommodate and eventually mandate lower-carbon materials. The International Organization for Standardization (ISO) has developed standards for measuring embodied carbon in construction materials, while national bodies like ASTM International and the British Standards Institution have created performance-based specifications that enable carbon-negative concrete adoption without compromising safety requirements.

Tax incentives represent another regulatory approach gaining traction. The United States' 45Q tax credit for carbon sequestration has been expanded to include mineralization processes common in carbon-negative concrete production, offering up to $85 per ton for permanently sequestered carbon. Similar incentives exist in Singapore, South Korea, and the United Kingdom, creating a mosaic of financial support mechanisms.

Disclosure requirements are driving market transparency, with regulations like the EU's Corporate Sustainability Reporting Directive and the SEC's proposed climate disclosure rules compelling companies to report embodied carbon in their supply chains. These transparency mechanisms are creating market pull for verifiable carbon-negative materials across the construction sector.

Carbon credit mechanisms represent a critical economic driver for market adoption. The voluntary carbon market has seen significant growth, with carbon credits for carbon-negative concrete ranging from $15 to $150 per ton of CO2 sequestered, depending on verification standards and co-benefits. Leading verification bodies such as Verra and Gold Standard have developed methodologies specifically for carbon-negative building materials, enhancing market credibility.

International agreements, particularly the Paris Climate Accord, have accelerated national policy development. Countries representing over 70% of global cement production have established carbon reduction targets that directly impact concrete specifications. These commitments are translating into procurement policies, with governments in Scandinavia, Canada, and parts of Asia implementing carbon-intensity thresholds for public infrastructure projects.

Building codes and standards are being revised to accommodate and eventually mandate lower-carbon materials. The International Organization for Standardization (ISO) has developed standards for measuring embodied carbon in construction materials, while national bodies like ASTM International and the British Standards Institution have created performance-based specifications that enable carbon-negative concrete adoption without compromising safety requirements.

Tax incentives represent another regulatory approach gaining traction. The United States' 45Q tax credit for carbon sequestration has been expanded to include mineralization processes common in carbon-negative concrete production, offering up to $85 per ton for permanently sequestered carbon. Similar incentives exist in Singapore, South Korea, and the United Kingdom, creating a mosaic of financial support mechanisms.

Disclosure requirements are driving market transparency, with regulations like the EU's Corporate Sustainability Reporting Directive and the SEC's proposed climate disclosure rules compelling companies to report embodied carbon in their supply chains. These transparency mechanisms are creating market pull for verifiable carbon-negative materials across the construction sector.

Environmental Impact Assessment and Life Cycle Analysis

Carbon-negative concrete represents a significant advancement in sustainable construction materials, offering potential to transform the industry's environmental footprint. Life cycle analysis (LCA) of these innovative materials reveals substantial environmental benefits compared to traditional Portland cement concrete, which is responsible for approximately 8% of global CO2 emissions. Carbon-negative concrete formulations can sequester between 100-300 kg of CO2 per cubic meter, creating a net carbon sink rather than a source of emissions.

The environmental impact assessment of carbon-negative concrete must consider multiple phases: raw material extraction, manufacturing processes, transportation, installation, use phase, and end-of-life scenarios. During raw material extraction, carbon-negative alternatives typically utilize industrial byproducts like fly ash, slag, or novel materials such as calcium silicate derived from carbon mineralization processes, significantly reducing virgin resource depletion compared to traditional concrete production.

Manufacturing processes for carbon-negative concrete generally require 20-40% less energy than conventional methods, with some advanced technologies achieving up to 60% energy reduction. Water consumption is also typically reduced by 30-50%, addressing another critical environmental concern in regions facing water scarcity. Additionally, these manufacturing processes often incorporate carbon capture technologies or utilize CO2 as a curing agent, further enhancing their environmental credentials.

Transportation impacts vary significantly based on regional availability of materials, but carbon-negative concrete often utilizes locally available industrial byproducts, potentially reducing transportation emissions by 15-25% compared to traditional concrete supply chains. The installation phase generally maintains similar environmental profiles to conventional concrete, though some formulations may require specialized handling procedures.

During the use phase, carbon-negative concrete demonstrates comparable or superior durability characteristics to traditional concrete, with some formulations showing enhanced resistance to carbonation, chloride penetration, and freeze-thaw cycles. This extended service life—potentially 20-30% longer than conventional concrete—further improves the life cycle environmental performance by reducing replacement frequency and associated impacts.

End-of-life considerations reveal additional benefits, as carbon-negative concrete typically maintains its carbon sequestration properties even after demolition. When crushed for recycling or reuse, these materials can continue to absorb CO2 from the atmosphere, creating an ongoing environmental benefit beyond their primary service life. This characteristic represents a fundamental shift in how construction materials interact with the environment throughout their complete life cycle.

The environmental impact assessment of carbon-negative concrete must consider multiple phases: raw material extraction, manufacturing processes, transportation, installation, use phase, and end-of-life scenarios. During raw material extraction, carbon-negative alternatives typically utilize industrial byproducts like fly ash, slag, or novel materials such as calcium silicate derived from carbon mineralization processes, significantly reducing virgin resource depletion compared to traditional concrete production.

Manufacturing processes for carbon-negative concrete generally require 20-40% less energy than conventional methods, with some advanced technologies achieving up to 60% energy reduction. Water consumption is also typically reduced by 30-50%, addressing another critical environmental concern in regions facing water scarcity. Additionally, these manufacturing processes often incorporate carbon capture technologies or utilize CO2 as a curing agent, further enhancing their environmental credentials.

Transportation impacts vary significantly based on regional availability of materials, but carbon-negative concrete often utilizes locally available industrial byproducts, potentially reducing transportation emissions by 15-25% compared to traditional concrete supply chains. The installation phase generally maintains similar environmental profiles to conventional concrete, though some formulations may require specialized handling procedures.

During the use phase, carbon-negative concrete demonstrates comparable or superior durability characteristics to traditional concrete, with some formulations showing enhanced resistance to carbonation, chloride penetration, and freeze-thaw cycles. This extended service life—potentially 20-30% longer than conventional concrete—further improves the life cycle environmental performance by reducing replacement frequency and associated impacts.

End-of-life considerations reveal additional benefits, as carbon-negative concrete typically maintains its carbon sequestration properties even after demolition. When crushed for recycling or reuse, these materials can continue to absorb CO2 from the atmosphere, creating an ongoing environmental benefit beyond their primary service life. This characteristic represents a fundamental shift in how construction materials interact with the environment throughout their complete life cycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!