Analysis of Market Strategies for Wearable Biosensors

OCT 24, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Wearable Biosensor Technology Evolution and Objectives

Wearable biosensor technology has evolved significantly over the past two decades, transitioning from simple fitness trackers to sophisticated multi-parameter monitoring devices. The journey began in the early 2000s with basic step counters and heart rate monitors, primarily targeting fitness enthusiasts. By 2010, these devices incorporated more advanced sensors capable of tracking sleep patterns and caloric expenditure, broadening their appeal to health-conscious consumers.

The technological breakthrough came between 2015-2018 when continuous glucose monitoring (CGM) systems and electrochemical sensors became miniaturized enough for comfortable wearable integration. This period marked a pivotal shift from wellness-focused devices to medical-grade biosensors capable of providing actionable health insights, expanding the market beyond fitness to healthcare applications.

Recent advancements have focused on improving sensor accuracy, extending battery life, and developing non-invasive monitoring techniques. The integration of artificial intelligence for data interpretation has transformed these devices from mere data collectors to predictive health tools. Notably, the COVID-19 pandemic accelerated development of respiratory and temperature monitoring capabilities, highlighting the adaptability of biosensor technology to emerging health concerns.

The current technological frontier includes sweat-based biochemical analysis, optical sensors for blood composition measurement, and flexible, skin-adherent "electronic tattoos" that can monitor multiple physiological parameters simultaneously. These innovations are pushing wearables beyond the wrist to various body locations, enabling more comprehensive health monitoring.

The primary objective of wearable biosensor technology development is to create unobtrusive, accurate, and continuous health monitoring systems that bridge the gap between periodic clinical assessments. Specific goals include enhancing early disease detection capabilities, improving chronic condition management, and providing personalized health insights through longitudinal data collection.

Future technological objectives focus on addressing current limitations such as sensor drift, biocompatibility issues, and power constraints. Research aims to develop self-calibrating sensors, biodegradable components, and energy harvesting capabilities. Additionally, there is significant interest in expanding the range of biomarkers that can be reliably detected through non-invasive means, particularly for conditions requiring frequent monitoring like diabetes and cardiovascular diseases.

The ultimate vision is to establish wearable biosensors as integral components of preventative healthcare systems, enabling continuous health surveillance that can detect physiological changes before they manifest as clinical symptoms, thereby facilitating earlier interventions and potentially reducing healthcare costs.

The technological breakthrough came between 2015-2018 when continuous glucose monitoring (CGM) systems and electrochemical sensors became miniaturized enough for comfortable wearable integration. This period marked a pivotal shift from wellness-focused devices to medical-grade biosensors capable of providing actionable health insights, expanding the market beyond fitness to healthcare applications.

Recent advancements have focused on improving sensor accuracy, extending battery life, and developing non-invasive monitoring techniques. The integration of artificial intelligence for data interpretation has transformed these devices from mere data collectors to predictive health tools. Notably, the COVID-19 pandemic accelerated development of respiratory and temperature monitoring capabilities, highlighting the adaptability of biosensor technology to emerging health concerns.

The current technological frontier includes sweat-based biochemical analysis, optical sensors for blood composition measurement, and flexible, skin-adherent "electronic tattoos" that can monitor multiple physiological parameters simultaneously. These innovations are pushing wearables beyond the wrist to various body locations, enabling more comprehensive health monitoring.

The primary objective of wearable biosensor technology development is to create unobtrusive, accurate, and continuous health monitoring systems that bridge the gap between periodic clinical assessments. Specific goals include enhancing early disease detection capabilities, improving chronic condition management, and providing personalized health insights through longitudinal data collection.

Future technological objectives focus on addressing current limitations such as sensor drift, biocompatibility issues, and power constraints. Research aims to develop self-calibrating sensors, biodegradable components, and energy harvesting capabilities. Additionally, there is significant interest in expanding the range of biomarkers that can be reliably detected through non-invasive means, particularly for conditions requiring frequent monitoring like diabetes and cardiovascular diseases.

The ultimate vision is to establish wearable biosensors as integral components of preventative healthcare systems, enabling continuous health surveillance that can detect physiological changes before they manifest as clinical symptoms, thereby facilitating earlier interventions and potentially reducing healthcare costs.

Market Demand Analysis for Wearable Biosensors

The wearable biosensor market is experiencing unprecedented growth, driven by increasing health consciousness and the rising prevalence of chronic diseases globally. Market research indicates that the global wearable biosensor market was valued at approximately 12 billion USD in 2022 and is projected to reach 33 billion USD by 2027, representing a compound annual growth rate (CAGR) of 22.4%. This remarkable growth trajectory underscores the expanding consumer demand for continuous health monitoring solutions.

Consumer demand for wearable biosensors is primarily fueled by the growing aging population and the increasing incidence of lifestyle-related diseases such as diabetes, cardiovascular conditions, and obesity. According to the World Health Organization, cardiovascular diseases account for 17.9 million deaths annually, while diabetes affects over 422 million people worldwide. These statistics highlight the critical need for continuous monitoring solutions that can provide early warning signs and facilitate preventive healthcare approaches.

The COVID-19 pandemic has significantly accelerated market demand, creating a paradigm shift in healthcare delivery models toward remote patient monitoring and telehealth services. This shift has expanded the application scope of wearable biosensors beyond fitness tracking to include vital signs monitoring, disease management, and early detection of health anomalies. Market surveys indicate that 67% of healthcare providers now view remote patient monitoring as essential to their practice, compared to just 28% in pre-pandemic assessments.

Consumer preferences are evolving toward more sophisticated, multi-parameter monitoring devices with enhanced accuracy and reliability. The demand for non-invasive, comfortable, and aesthetically pleasing wearable devices with extended battery life and seamless connectivity features continues to grow. Market segmentation reveals distinct consumer groups: health enthusiasts seeking fitness optimization, patients managing chronic conditions, elderly individuals requiring continuous monitoring, and healthcare professionals utilizing these devices for clinical decision support.

Geographically, North America currently dominates the market with approximately 42% share, followed by Europe at 28% and Asia-Pacific at 22%. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to increasing healthcare expenditure, growing awareness about preventive healthcare, and the rapid adoption of digital health technologies in countries like China, Japan, and India.

Industry analysis reveals several emerging market trends, including the integration of artificial intelligence for predictive analytics, the development of textile-integrated biosensors, and the rise of subscription-based business models offering comprehensive health monitoring services. The consumer wearables segment currently holds the largest market share at 58%, while the medical-grade wearable biosensor segment is projected to grow at the highest CAGR of 26.8% through 2027.

Consumer demand for wearable biosensors is primarily fueled by the growing aging population and the increasing incidence of lifestyle-related diseases such as diabetes, cardiovascular conditions, and obesity. According to the World Health Organization, cardiovascular diseases account for 17.9 million deaths annually, while diabetes affects over 422 million people worldwide. These statistics highlight the critical need for continuous monitoring solutions that can provide early warning signs and facilitate preventive healthcare approaches.

The COVID-19 pandemic has significantly accelerated market demand, creating a paradigm shift in healthcare delivery models toward remote patient monitoring and telehealth services. This shift has expanded the application scope of wearable biosensors beyond fitness tracking to include vital signs monitoring, disease management, and early detection of health anomalies. Market surveys indicate that 67% of healthcare providers now view remote patient monitoring as essential to their practice, compared to just 28% in pre-pandemic assessments.

Consumer preferences are evolving toward more sophisticated, multi-parameter monitoring devices with enhanced accuracy and reliability. The demand for non-invasive, comfortable, and aesthetically pleasing wearable devices with extended battery life and seamless connectivity features continues to grow. Market segmentation reveals distinct consumer groups: health enthusiasts seeking fitness optimization, patients managing chronic conditions, elderly individuals requiring continuous monitoring, and healthcare professionals utilizing these devices for clinical decision support.

Geographically, North America currently dominates the market with approximately 42% share, followed by Europe at 28% and Asia-Pacific at 22%. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to increasing healthcare expenditure, growing awareness about preventive healthcare, and the rapid adoption of digital health technologies in countries like China, Japan, and India.

Industry analysis reveals several emerging market trends, including the integration of artificial intelligence for predictive analytics, the development of textile-integrated biosensors, and the rise of subscription-based business models offering comprehensive health monitoring services. The consumer wearables segment currently holds the largest market share at 58%, while the medical-grade wearable biosensor segment is projected to grow at the highest CAGR of 26.8% through 2027.

Technical Challenges and Global Development Status

The wearable biosensor market faces significant technical challenges despite its rapid growth. Miniaturization remains a primary hurdle as manufacturers strive to create increasingly smaller devices without compromising functionality. Current sensors struggle to maintain accuracy while achieving the form factors demanded by consumers who expect unobtrusive, lightweight devices that can be worn continuously.

Power management presents another critical challenge. Most wearable biosensors require frequent recharging, typically every 1-3 days, creating user friction and limiting continuous monitoring capabilities. Energy harvesting technologies and ultra-low-power circuits show promise but remain insufficient for power-intensive applications like continuous glucose monitoring or comprehensive vital sign tracking.

Data accuracy and reliability under various real-world conditions constitute persistent challenges. Environmental factors such as temperature fluctuations, moisture, and movement artifacts significantly impact sensor performance. Clinical-grade accuracy remains elusive for many consumer wearables, particularly when users are engaged in physical activity or experiencing physiological stress.

Globally, North America leads wearable biosensor development, with approximately 45% of patents and commercial products originating from this region. Major innovation hubs include Silicon Valley, Boston, and the Research Triangle Park. The Asia-Pacific region, particularly China, Japan, and South Korea, has shown the fastest growth rate (23% annually) in biosensor technology development over the past five years, focusing primarily on manufacturing scalability and cost reduction.

European contributions center on medical-grade applications, with Germany, Switzerland, and the Netherlands leading in regulatory-compliant biosensor technologies. The region accounts for approximately 30% of clinical validation studies for wearable biosensors, emphasizing precision and reliability over consumer convenience features.

Regulatory frameworks vary significantly across regions, creating complex compliance challenges for global market entry. The FDA's Digital Health Innovation Action Plan in the US contrasts with Europe's more stringent MDR requirements, while China's NMPA has recently accelerated approval pathways specifically for wearable health technologies.

Interoperability and standardization remain underdeveloped, with competing data formats and communication protocols limiting ecosystem development. The IEEE's P1752 standard for mobile health data and Bluetooth SIG's Medical Device Profile represent attempts to address these challenges, but adoption remains fragmented across the industry.

Material science limitations also constrain advancement, as biocompatible materials that maintain sensor performance while ensuring skin compatibility and durability remain difficult to develop at scale. Recent innovations in flexible electronics and stretchable conductive materials show promise but face manufacturing scalability challenges.

Power management presents another critical challenge. Most wearable biosensors require frequent recharging, typically every 1-3 days, creating user friction and limiting continuous monitoring capabilities. Energy harvesting technologies and ultra-low-power circuits show promise but remain insufficient for power-intensive applications like continuous glucose monitoring or comprehensive vital sign tracking.

Data accuracy and reliability under various real-world conditions constitute persistent challenges. Environmental factors such as temperature fluctuations, moisture, and movement artifacts significantly impact sensor performance. Clinical-grade accuracy remains elusive for many consumer wearables, particularly when users are engaged in physical activity or experiencing physiological stress.

Globally, North America leads wearable biosensor development, with approximately 45% of patents and commercial products originating from this region. Major innovation hubs include Silicon Valley, Boston, and the Research Triangle Park. The Asia-Pacific region, particularly China, Japan, and South Korea, has shown the fastest growth rate (23% annually) in biosensor technology development over the past five years, focusing primarily on manufacturing scalability and cost reduction.

European contributions center on medical-grade applications, with Germany, Switzerland, and the Netherlands leading in regulatory-compliant biosensor technologies. The region accounts for approximately 30% of clinical validation studies for wearable biosensors, emphasizing precision and reliability over consumer convenience features.

Regulatory frameworks vary significantly across regions, creating complex compliance challenges for global market entry. The FDA's Digital Health Innovation Action Plan in the US contrasts with Europe's more stringent MDR requirements, while China's NMPA has recently accelerated approval pathways specifically for wearable health technologies.

Interoperability and standardization remain underdeveloped, with competing data formats and communication protocols limiting ecosystem development. The IEEE's P1752 standard for mobile health data and Bluetooth SIG's Medical Device Profile represent attempts to address these challenges, but adoption remains fragmented across the industry.

Material science limitations also constrain advancement, as biocompatible materials that maintain sensor performance while ensuring skin compatibility and durability remain difficult to develop at scale. Recent innovations in flexible electronics and stretchable conductive materials show promise but face manufacturing scalability challenges.

Current Market Strategy Solutions for Biosensor Products

01 Wearable biosensors for health monitoring

Wearable biosensors designed for continuous health monitoring can track various physiological parameters such as heart rate, blood pressure, body temperature, and blood glucose levels. These devices enable real-time health tracking and early detection of abnormalities, allowing for timely medical intervention. The sensors are typically integrated into comfortable wearable formats like patches, wristbands, or clothing to facilitate long-term use while maintaining accuracy in data collection.- Wearable biosensors for health monitoring: Wearable biosensors designed for continuous health monitoring can track various physiological parameters such as heart rate, blood pressure, body temperature, and glucose levels. These devices enable real-time health tracking and early detection of abnormalities, allowing for timely medical intervention. The sensors can be integrated into everyday wearable items like watches, patches, or clothing for non-invasive monitoring of the user's health status.

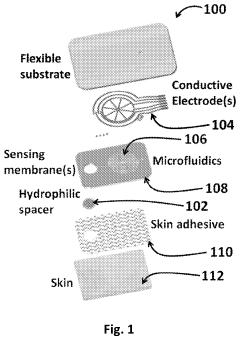

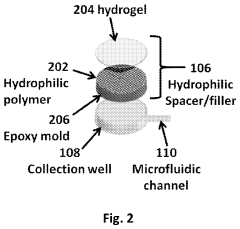

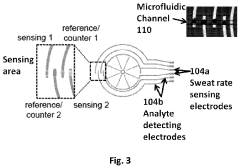

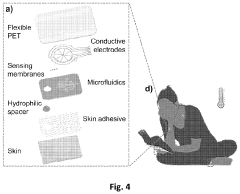

- Sweat-based biosensing technologies: Biosensors that analyze sweat composition can provide valuable insights into a person's health status without invasive procedures. These sensors detect various biomarkers in sweat, including electrolytes, metabolites, and hormones, which can indicate hydration levels, stress, and potential health issues. The technology typically involves flexible materials that conform to the skin and microfluidic channels that collect and analyze sweat in real-time.

- Implantable and minimally invasive biosensors: Advanced biosensing technologies that can be implanted under the skin or inserted into the body with minimal invasion provide continuous monitoring of internal physiological parameters. These sensors can measure glucose levels, detect specific biomarkers, or monitor organ function. They often incorporate biocompatible materials to reduce rejection and inflammation, and may include wireless communication capabilities for data transmission to external devices.

- Smart textile integrated biosensors: Biosensors integrated into textiles and fabrics create smart garments capable of monitoring physiological parameters during daily activities. These textiles incorporate conductive fibers, flexible electronics, and sensing elements that can detect heart rate, respiratory patterns, muscle activity, and body temperature. The integration of biosensors into everyday clothing provides a comfortable and unobtrusive way to monitor health metrics continuously.

- Data processing and AI for wearable biosensors: Advanced data processing techniques and artificial intelligence algorithms enhance the functionality of wearable biosensors by analyzing complex biosignal patterns. These technologies enable accurate interpretation of sensor data, personalized health insights, and predictive analytics for early disease detection. Machine learning models can identify subtle changes in physiological parameters that might indicate developing health issues, allowing for preventive interventions before symptoms become apparent.

02 Sweat-based wearable biosensors

Biosensors that analyze sweat composition can non-invasively monitor various biomarkers including electrolytes, metabolites, and hormones. These sensors typically use electrochemical detection methods to measure analytes in sweat, providing insights into hydration status, stress levels, and metabolic health. The technology enables continuous monitoring without the need for blood sampling, making it particularly suitable for athletes, patients with chronic conditions, and general wellness applications.Expand Specific Solutions03 Implantable and minimally invasive biosensors

Advanced biosensing technologies that can be implanted under the skin or inserted minimally invasively to monitor internal physiological parameters. These sensors often utilize biocompatible materials and wireless communication to transmit data continuously to external devices. Applications include continuous glucose monitoring, cardiac function assessment, and detection of specific biomarkers for disease management. The sensors are designed to remain functional for extended periods while minimizing tissue reaction and infection risks.Expand Specific Solutions04 Flexible and stretchable biosensor platforms

Innovative biosensor designs incorporating flexible and stretchable materials that conform to body contours for improved comfort and signal quality. These platforms typically use conductive polymers, nanomaterials, or thin-film electronics that maintain functionality during body movement and deformation. The flexibility allows for better skin contact and reduced motion artifacts, enhancing data reliability while providing a more comfortable user experience for long-term monitoring applications.Expand Specific Solutions05 Data processing and AI integration in biosensor systems

Advanced data processing techniques and artificial intelligence algorithms integrated with wearable biosensors to enhance data interpretation and clinical utility. These systems can filter noise, identify patterns, predict health events, and provide personalized insights based on collected physiological data. The integration of machine learning enables adaptive monitoring that becomes more accurate over time as it learns individual baseline patterns and variations, allowing for more precise health assessments and personalized recommendations.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The wearable biosensor market is currently in a growth phase, characterized by increasing adoption and technological advancements. The market size is expanding rapidly, projected to reach significant valuation as healthcare monitoring shifts toward personalized and continuous solutions. In terms of technical maturity, the field shows varied development levels with established players like Samsung Electronics leading commercial applications through their extensive R&D capabilities, while academic institutions such as University of California, California Institute of Technology, and Washington University in St. Louis drive fundamental innovations. Companies like Biosense Webster and Emotiv are advancing specialized applications, while Nitto Denko and Imagis focus on material and component development. This competitive landscape reflects a dynamic ecosystem where collaboration between academic research and commercial entities is accelerating technological progress toward more sophisticated, accurate, and user-friendly wearable biosensing solutions.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed an advanced wearable biosensor ecosystem centered around their Galaxy Watch series and Samsung Health platform. Their technology integrates optical heart rate sensors, electrocardiogram (ECG) capabilities, bioelectrical impedance analysis for body composition measurements, and blood pressure monitoring through pulse wave analysis. Samsung's biosensors utilize proprietary algorithms that process multiple physiological signals simultaneously to provide comprehensive health insights. Their latest sensors incorporate reflective photoplethysmography (PPG) technology with multiple wavelengths to improve accuracy across different skin tones and environmental conditions. Samsung has also pioneered the integration of these sensors with their broader ecosystem, allowing data to flow seamlessly between devices and healthcare providers through secure HIPAA-compliant channels. Their market strategy focuses on consumer accessibility while maintaining medical-grade accuracy for certain measurements.

Strengths: Extensive global distribution network, strong brand recognition, and seamless integration with their smartphone ecosystem. Their biosensors benefit from vertical integration of hardware and software development. Weaknesses: Higher price point compared to specialized fitness trackers, and some advanced health features are only available in select markets due to varying regulatory approvals.

The Georgia Tech Research Corp.

Technical Solution: Georgia Tech Research Corporation has developed a comprehensive wearable biosensor platform focused on non-invasive, continuous monitoring of multiple physiological parameters. Their technology utilizes flexible, stretchable electronics that conform to body contours while maintaining sensor accuracy during movement. Georgia Tech's biosensors incorporate advanced microelectromechanical systems (MEMS) with specialized signal processing algorithms that can isolate biological signals from motion artifacts and environmental noise. Their platform features multimodal sensing capabilities including electrochemical, optical, and impedance-based measurements that can simultaneously track vital signs, sweat composition, and muscle activity. Georgia Tech has pioneered low-power wireless communication protocols specifically optimized for biosensor networks, enabling extended battery life while maintaining data integrity. Their market strategy emphasizes technology transfer and industry partnerships, particularly in healthcare, military, and athletic performance sectors. Georgia Tech's biosensor technology has been validated through extensive human subject testing in both laboratory and field conditions, with particular focus on reliability in high-movement scenarios where traditional sensors fail.

Strengths: Exceptional durability and accuracy during physical activity; comprehensive multimodal sensing capabilities; and strong scientific validation across diverse use cases and populations. Weaknesses: Less consumer-oriented approach compared to commercial entities; more complex integration requirements with existing health systems; and typically higher initial costs due to advanced materials and manufacturing processes.

Critical Patents and Technical Literature Review

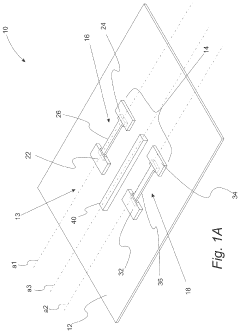

A wearable patch for continuous analysis of sweat at a naturally secreting rate

PatentPendingUS20230157587A1

Innovation

- A microfluidic patch with a hydrophilic filler and integrated electrical and electrochemical sensors that can detect sweat rate and composition, such as pH and levodopa, allowing for continuous analysis of natural sweat without artificial induction, even at low secretion sites like the wrist.

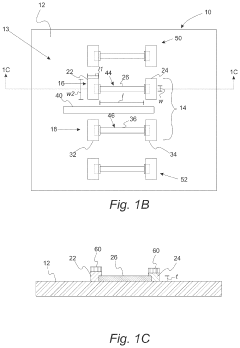

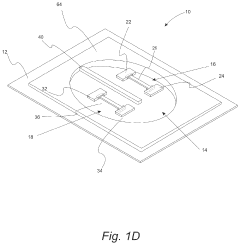

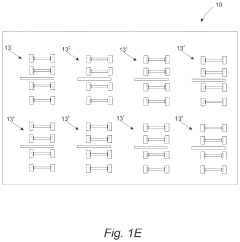

Wearable biosensors and applications thereof

PatentActiveUS11813057B2

Innovation

- Development of highly sensitive In2O3 nanoribbon transistor biosensors with integrated on-chip gold gate electrodes, deposited on flexible polyethylene terephthalate substrates, functionalized with glucose oxidase, chitosan, and single-walled carbon nanotubes, capable of detecting glucose concentrations between 10 nM to 1 mM in external body fluids without breaking the skin.

Regulatory Framework for Wearable Health Devices

The regulatory landscape for wearable health devices is complex and evolving rapidly as these technologies become increasingly integrated into healthcare systems worldwide. In the United States, the Food and Drug Administration (FDA) has established a risk-based framework that classifies wearable biosensors based on their intended use and potential risk to users. Class I devices, which include simple fitness trackers, face minimal regulatory requirements, while Class II devices that make specific health claims require premarket notification (510(k)) clearance. Class III devices, which may include implantable biosensors, undergo the most rigorous premarket approval process.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which came into full effect in 2021 and 2022 respectively. These regulations have significantly increased requirements for clinical evidence, post-market surveillance, and technical documentation for wearable health technologies. Notably, the MDR has reclassified many wearable biosensors into higher risk categories, necessitating more comprehensive conformity assessment procedures.

In Asia, regulatory approaches vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for software as a medical device (SaMD), which applies to many wearable biosensor systems. China has recently reformed its regulatory framework through the National Medical Products Administration (NMPA), implementing a classification system similar to that of the FDA but with unique requirements for local testing and clinical evaluation.

Data privacy regulations present another critical dimension of the regulatory framework. The General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the US, and similar regulations globally impose strict requirements on the collection, storage, and processing of health data generated by wearable biosensors. These regulations mandate robust data security measures, user consent mechanisms, and limitations on data sharing.

Reimbursement policies also significantly impact market strategies for wearable biosensors. In the US, the Centers for Medicare & Medicaid Services (CMS) has begun recognizing certain wearable health technologies for reimbursement, particularly those with demonstrated clinical benefits. Similarly, health insurance systems in Europe and Asia are gradually developing frameworks for covering wearable health monitoring devices, though approaches vary widely by country.

Interoperability standards represent another regulatory consideration, with organizations like the International Organization for Standardization (ISO) and Health Level Seven International (HL7) developing frameworks to ensure wearable biosensors can seamlessly integrate with electronic health records and other healthcare information systems. Compliance with these standards is increasingly becoming a prerequisite for market entry in many regions.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which came into full effect in 2021 and 2022 respectively. These regulations have significantly increased requirements for clinical evidence, post-market surveillance, and technical documentation for wearable health technologies. Notably, the MDR has reclassified many wearable biosensors into higher risk categories, necessitating more comprehensive conformity assessment procedures.

In Asia, regulatory approaches vary significantly. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established specific pathways for software as a medical device (SaMD), which applies to many wearable biosensor systems. China has recently reformed its regulatory framework through the National Medical Products Administration (NMPA), implementing a classification system similar to that of the FDA but with unique requirements for local testing and clinical evaluation.

Data privacy regulations present another critical dimension of the regulatory framework. The General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the US, and similar regulations globally impose strict requirements on the collection, storage, and processing of health data generated by wearable biosensors. These regulations mandate robust data security measures, user consent mechanisms, and limitations on data sharing.

Reimbursement policies also significantly impact market strategies for wearable biosensors. In the US, the Centers for Medicare & Medicaid Services (CMS) has begun recognizing certain wearable health technologies for reimbursement, particularly those with demonstrated clinical benefits. Similarly, health insurance systems in Europe and Asia are gradually developing frameworks for covering wearable health monitoring devices, though approaches vary widely by country.

Interoperability standards represent another regulatory consideration, with organizations like the International Organization for Standardization (ISO) and Health Level Seven International (HL7) developing frameworks to ensure wearable biosensors can seamlessly integrate with electronic health records and other healthcare information systems. Compliance with these standards is increasingly becoming a prerequisite for market entry in many regions.

Consumer Adoption Barriers and Solutions

Despite the promising potential of wearable biosensors, several significant barriers impede widespread consumer adoption. Privacy and data security concerns rank among the most pressing issues, as these devices continuously collect sensitive health information. Consumers express hesitation about who can access their data, how it's stored, and whether it might be vulnerable to breaches or unauthorized commercial use. Companies must implement robust encryption protocols, transparent data policies, and user-controlled sharing options to address these concerns.

Cost remains another substantial barrier, with many advanced biosensor devices priced beyond the reach of average consumers. The initial investment, coupled with potential subscription fees for advanced analytics or replacement costs, creates financial obstacles. Market strategies should include tiered pricing models, insurance reimbursement partnerships, and demonstrating clear return on investment through preventative health benefits.

Technical limitations present ongoing challenges, particularly regarding accuracy and reliability. Consumers report frustration with inconsistent readings, false alarms, and discrepancies between different devices. Manufacturers must prioritize clinical validation studies and transparent communication about device limitations while continuously improving sensor technology and algorithms.

User experience issues significantly impact adoption rates, with many consumers abandoning devices due to comfort problems, complex interfaces, or battery limitations. Successful market strategies incorporate human-centered design principles, emphasizing comfort for continuous wear, intuitive interfaces for all age groups, and extended battery life or convenient charging solutions.

Integration challenges with existing healthcare systems create another adoption hurdle. Consumers desire seamless connectivity between their wearable data and healthcare providers, but interoperability issues and lack of physician engagement limit this potential. Forward-thinking companies are developing standardized data formats, EHR integration capabilities, and clinician-friendly dashboards to bridge this gap.

Cultural and behavioral barriers also influence adoption patterns. Many consumers struggle with maintaining long-term device use or interpreting complex health data. Effective solutions include gamification elements, personalized insights rather than raw data, and building supportive user communities. Additionally, addressing diverse needs across demographic groups through inclusive design and culturally sensitive health recommendations can expand market reach.

Regulatory uncertainty creates hesitation among both consumers and manufacturers. Clear communication about regulatory compliance, transparent quality standards, and participation in developing industry best practices can build consumer confidence in this rapidly evolving market segment.

Cost remains another substantial barrier, with many advanced biosensor devices priced beyond the reach of average consumers. The initial investment, coupled with potential subscription fees for advanced analytics or replacement costs, creates financial obstacles. Market strategies should include tiered pricing models, insurance reimbursement partnerships, and demonstrating clear return on investment through preventative health benefits.

Technical limitations present ongoing challenges, particularly regarding accuracy and reliability. Consumers report frustration with inconsistent readings, false alarms, and discrepancies between different devices. Manufacturers must prioritize clinical validation studies and transparent communication about device limitations while continuously improving sensor technology and algorithms.

User experience issues significantly impact adoption rates, with many consumers abandoning devices due to comfort problems, complex interfaces, or battery limitations. Successful market strategies incorporate human-centered design principles, emphasizing comfort for continuous wear, intuitive interfaces for all age groups, and extended battery life or convenient charging solutions.

Integration challenges with existing healthcare systems create another adoption hurdle. Consumers desire seamless connectivity between their wearable data and healthcare providers, but interoperability issues and lack of physician engagement limit this potential. Forward-thinking companies are developing standardized data formats, EHR integration capabilities, and clinician-friendly dashboards to bridge this gap.

Cultural and behavioral barriers also influence adoption patterns. Many consumers struggle with maintaining long-term device use or interpreting complex health data. Effective solutions include gamification elements, personalized insights rather than raw data, and building supportive user communities. Additionally, addressing diverse needs across demographic groups through inclusive design and culturally sensitive health recommendations can expand market reach.

Regulatory uncertainty creates hesitation among both consumers and manufacturers. Clear communication about regulatory compliance, transparent quality standards, and participation in developing industry best practices can build consumer confidence in this rapidly evolving market segment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!