Research Insights into Wearable Biosensor Application Sectors

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Wearable Biosensor Evolution and Research Objectives

Wearable biosensors have evolved significantly over the past two decades, transforming from simple fitness trackers to sophisticated medical-grade monitoring devices. The journey began with basic pedometers and heart rate monitors in the early 2000s, which primarily served fitness enthusiasts. By the mid-2010s, these devices incorporated more advanced sensors capable of tracking multiple physiological parameters simultaneously, marking a pivotal shift toward health monitoring applications.

The technological evolution has been driven by breakthroughs in materials science, miniaturization of electronics, and advances in data analytics. Flexible electronics and stretchable sensors have enabled more comfortable, unobtrusive designs that can be worn for extended periods. Concurrently, improvements in battery technology and power management systems have extended device longevity, addressing a critical limitation of early wearable biosensors.

Recent years have witnessed the integration of artificial intelligence and machine learning algorithms, enabling real-time data interpretation and personalized health insights. This progression has expanded the utility of wearable biosensors beyond consumer wellness into clinical applications, including remote patient monitoring, early disease detection, and therapeutic management.

The current research landscape focuses on enhancing sensor accuracy, biocompatibility, and multi-parameter monitoring capabilities. Significant attention is directed toward developing non-invasive glucose monitoring solutions, continuous blood pressure tracking, and biochemical analysis through sweat or interstitial fluid. These advancements aim to provide comprehensive health insights without the need for invasive procedures.

Our research objectives center on identifying and evaluating emerging application sectors for wearable biosensors across healthcare, sports performance, occupational safety, and preventive medicine. We seek to understand the technical requirements, market potential, and adoption barriers specific to each sector. Additionally, we aim to assess the regulatory landscape governing different applications and anticipate future compliance requirements.

A key research goal is to map the technological capabilities against unmet clinical needs, identifying high-impact opportunities where wearable biosensors could significantly improve health outcomes or reduce healthcare costs. This includes exploring applications in chronic disease management, post-operative recovery monitoring, and early warning systems for acute health events.

Furthermore, we intend to investigate the data integration challenges and interoperability requirements for incorporating wearable biosensor data into existing healthcare information systems. This encompasses data standardization, security protocols, and clinical validation methodologies necessary for widespread adoption in medical settings.

The technological evolution has been driven by breakthroughs in materials science, miniaturization of electronics, and advances in data analytics. Flexible electronics and stretchable sensors have enabled more comfortable, unobtrusive designs that can be worn for extended periods. Concurrently, improvements in battery technology and power management systems have extended device longevity, addressing a critical limitation of early wearable biosensors.

Recent years have witnessed the integration of artificial intelligence and machine learning algorithms, enabling real-time data interpretation and personalized health insights. This progression has expanded the utility of wearable biosensors beyond consumer wellness into clinical applications, including remote patient monitoring, early disease detection, and therapeutic management.

The current research landscape focuses on enhancing sensor accuracy, biocompatibility, and multi-parameter monitoring capabilities. Significant attention is directed toward developing non-invasive glucose monitoring solutions, continuous blood pressure tracking, and biochemical analysis through sweat or interstitial fluid. These advancements aim to provide comprehensive health insights without the need for invasive procedures.

Our research objectives center on identifying and evaluating emerging application sectors for wearable biosensors across healthcare, sports performance, occupational safety, and preventive medicine. We seek to understand the technical requirements, market potential, and adoption barriers specific to each sector. Additionally, we aim to assess the regulatory landscape governing different applications and anticipate future compliance requirements.

A key research goal is to map the technological capabilities against unmet clinical needs, identifying high-impact opportunities where wearable biosensors could significantly improve health outcomes or reduce healthcare costs. This includes exploring applications in chronic disease management, post-operative recovery monitoring, and early warning systems for acute health events.

Furthermore, we intend to investigate the data integration challenges and interoperability requirements for incorporating wearable biosensor data into existing healthcare information systems. This encompasses data standardization, security protocols, and clinical validation methodologies necessary for widespread adoption in medical settings.

Market Analysis of Biosensor Applications

The global wearable biosensor market has experienced remarkable growth, expanding from $12.1 billion in 2019 to an estimated $25.5 billion by 2024, representing a compound annual growth rate (CAGR) of 16.2%. This growth trajectory is primarily driven by increasing health consciousness among consumers, rising prevalence of chronic diseases, and technological advancements in sensor miniaturization and connectivity.

Healthcare applications currently dominate the market, accounting for approximately 65% of total revenue. Within this segment, continuous glucose monitoring devices lead with a 28% market share, followed by cardiac monitoring systems at 22%. The fitness and wellness sector represents the second-largest application area, contributing roughly 20% of market revenue, with activity trackers and sports performance monitors being the primary products.

Emerging application sectors showing significant growth potential include workplace safety monitoring, with a projected CAGR of 22.3% through 2025. These devices monitor environmental hazards and physiological parameters of workers in high-risk industries such as mining, construction, and manufacturing. Another rapidly expanding sector is agricultural biosensors, which are increasingly used for livestock health monitoring and have shown a 19.7% growth rate in the past two years.

Geographically, North America holds the largest market share at 42%, followed by Europe (28%) and Asia-Pacific (23%). However, the Asia-Pacific region is expected to witness the fastest growth at a CAGR of 19.8% due to increasing healthcare expenditure, growing awareness about preventive healthcare, and the presence of major manufacturing hubs in countries like China and South Korea.

Consumer adoption patterns reveal interesting trends across different demographics. Users aged 25-44 constitute the largest consumer segment (48%), while adoption among those over 65 has increased by 27% in the past three years, primarily for medical monitoring applications. The average consumer replacement cycle for wearable biosensors is approximately 18 months, though this varies significantly by application type.

Market challenges include concerns about data privacy and security, with 62% of potential users citing data protection as a major consideration in purchasing decisions. Additionally, reimbursement limitations in healthcare settings and accuracy issues in extreme environmental conditions remain significant barriers to wider adoption in certain sectors.

The competitive landscape is characterized by both established medical device manufacturers and technology companies entering the space. Strategic partnerships between technology providers and healthcare organizations have increased by 35% since 2020, indicating a trend toward integrated ecosystem development rather than standalone products.

Healthcare applications currently dominate the market, accounting for approximately 65% of total revenue. Within this segment, continuous glucose monitoring devices lead with a 28% market share, followed by cardiac monitoring systems at 22%. The fitness and wellness sector represents the second-largest application area, contributing roughly 20% of market revenue, with activity trackers and sports performance monitors being the primary products.

Emerging application sectors showing significant growth potential include workplace safety monitoring, with a projected CAGR of 22.3% through 2025. These devices monitor environmental hazards and physiological parameters of workers in high-risk industries such as mining, construction, and manufacturing. Another rapidly expanding sector is agricultural biosensors, which are increasingly used for livestock health monitoring and have shown a 19.7% growth rate in the past two years.

Geographically, North America holds the largest market share at 42%, followed by Europe (28%) and Asia-Pacific (23%). However, the Asia-Pacific region is expected to witness the fastest growth at a CAGR of 19.8% due to increasing healthcare expenditure, growing awareness about preventive healthcare, and the presence of major manufacturing hubs in countries like China and South Korea.

Consumer adoption patterns reveal interesting trends across different demographics. Users aged 25-44 constitute the largest consumer segment (48%), while adoption among those over 65 has increased by 27% in the past three years, primarily for medical monitoring applications. The average consumer replacement cycle for wearable biosensors is approximately 18 months, though this varies significantly by application type.

Market challenges include concerns about data privacy and security, with 62% of potential users citing data protection as a major consideration in purchasing decisions. Additionally, reimbursement limitations in healthcare settings and accuracy issues in extreme environmental conditions remain significant barriers to wider adoption in certain sectors.

The competitive landscape is characterized by both established medical device manufacturers and technology companies entering the space. Strategic partnerships between technology providers and healthcare organizations have increased by 35% since 2020, indicating a trend toward integrated ecosystem development rather than standalone products.

Technical Barriers and Global Development Status

Despite significant advancements in wearable biosensor technology, several technical barriers continue to impede widespread adoption across various application sectors. Power management remains a critical challenge, with current battery technologies struggling to support continuous monitoring capabilities while maintaining compact form factors. Most commercial wearable biosensors require daily charging, limiting their utility for long-term health monitoring applications, particularly for elderly care and chronic disease management.

Signal quality and reliability present another significant hurdle. Environmental factors such as motion artifacts, skin impedance variations, and electromagnetic interference frequently compromise data integrity. This is particularly problematic in real-world settings where controlled conditions cannot be maintained, resulting in false readings that undermine clinical confidence in these technologies.

Biocompatibility and user comfort issues persist across the industry. Extended skin contact can cause irritation, allergic reactions, or discomfort, leading to poor user compliance. The materials science challenge of developing flexible, breathable, yet durable sensor interfaces remains incompletely solved, especially for applications requiring weeks or months of continuous wear.

The global development landscape shows distinct regional specialization patterns. North American companies lead in consumer wellness applications and software integration, with firms like Apple and Fitbit dominating market share. European research institutions excel in clinical validation methodologies and regulatory framework development, particularly evident in Germany and Switzerland's contributions to medical-grade wearable certification standards.

Asian manufacturers, predominantly in China, Taiwan, and South Korea, have established dominance in component miniaturization and mass production capabilities. Japan maintains leadership in novel sensing materials and battery technologies. Meanwhile, emerging economies like India are rapidly developing expertise in frugal innovation approaches to wearable biosensors for resource-constrained healthcare settings.

Interoperability and standardization remain fragmented globally. Despite efforts from organizations like IEEE and ISO to establish common protocols, proprietary systems continue to dominate, creating data silos that hinder clinical adoption and comparative research. This technical fragmentation is particularly problematic for healthcare systems seeking to integrate wearable data into electronic health records.

Data security and privacy frameworks vary significantly across regions, creating compliance challenges for global deployment. The European GDPR establishes stringent requirements for biometric data handling, while regulatory frameworks in other regions remain less developed, creating uncertainty for manufacturers and limiting cross-border data sharing for research purposes.

Signal quality and reliability present another significant hurdle. Environmental factors such as motion artifacts, skin impedance variations, and electromagnetic interference frequently compromise data integrity. This is particularly problematic in real-world settings where controlled conditions cannot be maintained, resulting in false readings that undermine clinical confidence in these technologies.

Biocompatibility and user comfort issues persist across the industry. Extended skin contact can cause irritation, allergic reactions, or discomfort, leading to poor user compliance. The materials science challenge of developing flexible, breathable, yet durable sensor interfaces remains incompletely solved, especially for applications requiring weeks or months of continuous wear.

The global development landscape shows distinct regional specialization patterns. North American companies lead in consumer wellness applications and software integration, with firms like Apple and Fitbit dominating market share. European research institutions excel in clinical validation methodologies and regulatory framework development, particularly evident in Germany and Switzerland's contributions to medical-grade wearable certification standards.

Asian manufacturers, predominantly in China, Taiwan, and South Korea, have established dominance in component miniaturization and mass production capabilities. Japan maintains leadership in novel sensing materials and battery technologies. Meanwhile, emerging economies like India are rapidly developing expertise in frugal innovation approaches to wearable biosensors for resource-constrained healthcare settings.

Interoperability and standardization remain fragmented globally. Despite efforts from organizations like IEEE and ISO to establish common protocols, proprietary systems continue to dominate, creating data silos that hinder clinical adoption and comparative research. This technical fragmentation is particularly problematic for healthcare systems seeking to integrate wearable data into electronic health records.

Data security and privacy frameworks vary significantly across regions, creating compliance challenges for global deployment. The European GDPR establishes stringent requirements for biometric data handling, while regulatory frameworks in other regions remain less developed, creating uncertainty for manufacturers and limiting cross-border data sharing for research purposes.

Current Biosensor Implementation Approaches

01 Wearable biosensors for health monitoring

Wearable biosensors designed for continuous health monitoring can track various physiological parameters such as heart rate, blood pressure, body temperature, and oxygen saturation. These devices enable real-time health tracking and early detection of abnormalities, allowing for timely medical intervention. The sensors are typically integrated into comfortable wearable formats like patches, wristbands, or clothing to facilitate long-term use while maintaining accuracy in data collection.- Wearable biosensors for health monitoring: Wearable biosensors can be designed to continuously monitor various health parameters such as heart rate, blood pressure, and glucose levels. These devices typically use non-invasive or minimally invasive methods to collect physiological data from the user. The sensors can be integrated into everyday items like watches, patches, or clothing, allowing for real-time health monitoring without disrupting daily activities. These biosensors often include data processing capabilities and wireless connectivity to transmit health information to smartphones or healthcare providers.

- Electrochemical biosensors for analyte detection: Electrochemical biosensors utilize electrochemical reactions to detect specific analytes in bodily fluids such as sweat, tears, or interstitial fluid. These sensors typically consist of electrodes modified with biorecognition elements like enzymes, antibodies, or nucleic acids that selectively interact with target molecules. When the target analyte binds to the biorecognition element, it generates an electrical signal proportional to the analyte concentration. This technology enables continuous monitoring of various biomarkers without requiring blood samples, making it suitable for wearable applications.

- Flexible and stretchable biosensor materials: Advanced materials that are flexible, stretchable, and biocompatible are essential for creating comfortable and effective wearable biosensors. These materials include conductive polymers, carbon-based nanomaterials, and soft elastomers that can conform to the body's contours while maintaining sensing functionality. The development of these materials addresses challenges related to sensor durability, skin irritation, and signal stability during movement. Innovations in this area focus on creating sensors that can withstand repeated mechanical deformation while maintaining accurate sensing capabilities.

- Data processing and wireless communication systems: Wearable biosensors incorporate sophisticated data processing algorithms and wireless communication systems to analyze and transmit the collected physiological data. These systems often include microprocessors for signal processing, machine learning algorithms for pattern recognition, and various wireless protocols such as Bluetooth, NFC, or cellular connectivity. The integration of these technologies enables real-time data analysis, remote monitoring, and seamless integration with healthcare systems. Advanced power management solutions are also implemented to extend battery life while maintaining continuous monitoring capabilities.

- Biosensors for specific medical applications: Specialized wearable biosensors are being developed for specific medical conditions and therapeutic applications. These include sensors for continuous glucose monitoring in diabetes management, cardiac monitoring for heart patients, sweat analysis for hydration and electrolyte balance, and neurological monitoring for conditions like epilepsy. These application-specific biosensors often combine multiple sensing modalities and are designed to meet the unique requirements of particular medical conditions. They can provide early warning of health deterioration, assist in medication management, and enable personalized treatment approaches.

02 Sweat-based biosensing technologies

Sweat-based biosensors analyze biomarkers present in human sweat to provide non-invasive monitoring of various health indicators. These sensors can detect electrolytes, metabolites, hormones, and other biomolecules that correlate with health conditions. The technology typically involves microfluidic channels for sweat collection and electrochemical sensing elements that can detect specific analytes. These systems offer advantages in continuous monitoring without the need for blood sampling.Expand Specific Solutions03 Implantable and minimally invasive biosensors

Implantable and minimally invasive biosensors are designed to be placed under the skin or within body tissues for continuous monitoring of biomarkers. These sensors often utilize advanced materials that are biocompatible and can function reliably within the body for extended periods. They may incorporate wireless communication capabilities to transmit data to external devices without requiring physical connections. Applications include glucose monitoring for diabetes management, cardiac monitoring, and detection of specific disease markers.Expand Specific Solutions04 Flexible and stretchable biosensor platforms

Flexible and stretchable biosensor platforms are designed to conform to the contours of the human body, providing comfort and improved signal quality. These sensors utilize advanced materials such as conductive polymers, nanomaterials, and thin-film electronics that maintain functionality during bending, stretching, and twisting. The flexibility allows for better skin contact and reduced motion artifacts, resulting in more reliable data collection during physical activity or daily movements.Expand Specific Solutions05 Data processing and AI integration in biosensor systems

Advanced data processing techniques and artificial intelligence are integrated into wearable biosensor systems to enhance their capabilities. These technologies enable real-time analysis of complex biosensor data, pattern recognition for early disease detection, and personalized health insights. Machine learning algorithms can filter out noise, compensate for environmental factors, and improve the accuracy of measurements. Cloud connectivity allows for data storage, advanced analytics, and integration with healthcare systems for remote monitoring applications.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The wearable biosensor market is experiencing rapid growth, currently in its early maturity phase with significant innovation potential. The global market size is expanding substantially, driven by healthcare digitization and consumer wellness trends. Technologically, the field shows varying maturity levels across applications, with companies demonstrating different specialization areas. Samsung Electronics and Google lead in consumer-oriented biosensors with extensive R&D capabilities, while medical-focused players like Biosense Webster and Ascensia Diabetes Care offer specialized clinical solutions. Academic institutions including MIT, EPFL, and University of California contribute fundamental research advancements. The ecosystem is characterized by collaboration between technology giants, healthcare specialists, and research institutions, creating a competitive landscape that balances consumer accessibility with clinical precision.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed an advanced wearable biosensor ecosystem centered around their Galaxy Watch series and Samsung Health platform. Their technology integrates optical heart rate sensors, electrocardiogram (ECG) capabilities, bioelectrical impedance analysis for body composition measurements, and blood pressure monitoring through pulse wave analysis. Samsung's biosensors utilize proprietary algorithms that process multiple physiological signals simultaneously to provide comprehensive health insights. Their latest innovations include non-invasive blood glucose monitoring technology that uses Raman spectroscopy to detect glucose levels through the skin without needles. Samsung has also pioneered stress monitoring features that analyze heart rate variability patterns to determine stress levels and suggest appropriate interventions. Their biosensor technology is built on a foundation of miniaturized components that maximize battery efficiency while maintaining clinical-grade accuracy.

Strengths: Samsung's extensive manufacturing capabilities allow for vertical integration and cost-effective mass production of biosensors. Their established consumer electronics ecosystem provides immediate distribution channels and integration opportunities. Weaknesses: Their biosensor technology is primarily focused on consumer wellness applications rather than medical-grade diagnostics, limiting adoption in clinical settings. Regulatory approval processes for more advanced health monitoring features vary by region, creating inconsistent user experiences globally.

Google LLC

Technical Solution: Google has developed a comprehensive wearable biosensor strategy through its Fitbit acquisition and health-focused initiatives. Their technology incorporates photoplethysmography (PPG) sensors for continuous heart rate monitoring, accelerometers for activity tracking, and temperature sensors for detecting physiological changes. Google's biosensor approach emphasizes long-term data collection and analysis, with their devices capable of monitoring sleep patterns, stress levels, and activity metrics over extended periods. Their Advanced Health Metrics platform processes multiple biosensor inputs to generate health insights like respiratory rate and heart rate variability. Google has invested significantly in algorithm development that improves signal processing from noisy biosensor data, particularly for motion-tolerant heart rate monitoring during exercise. Their Fitbit ECG app received FDA clearance for atrial fibrillation detection, demonstrating their move toward medical-grade applications. Google's health AI initiatives leverage biosensor data from millions of users to develop predictive models for early disease detection and personalized health recommendations.

Strengths: Google's exceptional data analytics capabilities allow for sophisticated processing of biosensor information at scale. Their extensive user base provides vast amounts of real-world data for algorithm refinement and validation. Weaknesses: Privacy concerns regarding health data collection and usage may limit consumer adoption of their biosensor technologies. As primarily a software company, Google relies on hardware partners for physical sensor development, potentially limiting innovation in sensor design.

Key Patents and Scientific Breakthroughs

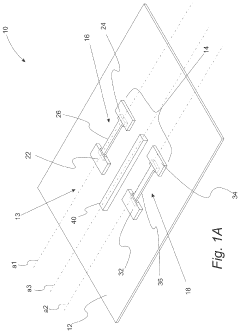

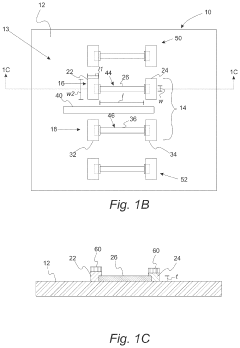

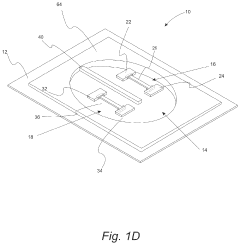

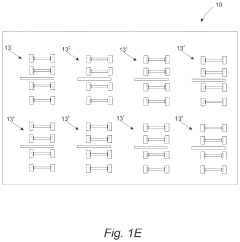

Wearable biosensors and applications thereof

PatentActiveUS11813057B2

Innovation

- Development of highly sensitive In2O3 nanoribbon transistor biosensors with integrated on-chip gold gate electrodes, deposited on flexible polyethylene terephthalate substrates, functionalized with glucose oxidase, chitosan, and single-walled carbon nanotubes, capable of detecting glucose concentrations between 10 nM to 1 mM in external body fluids without breaking the skin.

Regulatory Framework for Wearable Medical Devices

The regulatory landscape for wearable medical devices represents a complex and evolving framework that significantly impacts the development, approval, and market deployment of wearable biosensor technologies. Currently, regulatory bodies worldwide classify wearable biosensors based on their intended use, risk level, and functionality, with medical-grade devices facing more stringent requirements than consumer wellness products.

In the United States, the Food and Drug Administration (FDA) has established a three-tiered classification system for medical devices, with Class I devices subject to general controls, Class II requiring special controls and often 510(k) clearance, and Class III necessitating premarket approval (PMA). Wearable biosensors typically fall into Class I or II, though those with diagnostic capabilities may be classified as Class III. The FDA's Digital Health Innovation Action Plan has introduced more flexible regulatory pathways for software-driven medical technologies, including the Pre-Cert Program.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose more rigorous requirements for clinical evidence, post-market surveillance, and unique device identification. These regulations have significantly impacted wearable biosensor manufacturers by extending development timelines and increasing compliance costs.

Asian markets present varying regulatory approaches. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) maintains strict requirements similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently streamlined its approval process for innovative medical technologies, though still requiring local testing and validation.

Data privacy and security regulations intersect with medical device frameworks, creating additional compliance requirements. The General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the US, and similar regulations globally mandate specific data handling protocols for health information collected by wearable biosensors.

Regulatory harmonization efforts, including the International Medical Device Regulators Forum (IMDRF), aim to standardize requirements across jurisdictions, potentially reducing market entry barriers. However, significant regional differences persist, requiring manufacturers to develop market-specific regulatory strategies.

The COVID-19 pandemic has accelerated regulatory adaptations, with many authorities implementing emergency use authorizations and expedited review processes for remote monitoring technologies. This shift may establish precedents for more agile regulatory frameworks for wearable biosensors in the future, particularly those addressing public health priorities.

In the United States, the Food and Drug Administration (FDA) has established a three-tiered classification system for medical devices, with Class I devices subject to general controls, Class II requiring special controls and often 510(k) clearance, and Class III necessitating premarket approval (PMA). Wearable biosensors typically fall into Class I or II, though those with diagnostic capabilities may be classified as Class III. The FDA's Digital Health Innovation Action Plan has introduced more flexible regulatory pathways for software-driven medical technologies, including the Pre-Cert Program.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose more rigorous requirements for clinical evidence, post-market surveillance, and unique device identification. These regulations have significantly impacted wearable biosensor manufacturers by extending development timelines and increasing compliance costs.

Asian markets present varying regulatory approaches. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) maintains strict requirements similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently streamlined its approval process for innovative medical technologies, though still requiring local testing and validation.

Data privacy and security regulations intersect with medical device frameworks, creating additional compliance requirements. The General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the US, and similar regulations globally mandate specific data handling protocols for health information collected by wearable biosensors.

Regulatory harmonization efforts, including the International Medical Device Regulators Forum (IMDRF), aim to standardize requirements across jurisdictions, potentially reducing market entry barriers. However, significant regional differences persist, requiring manufacturers to develop market-specific regulatory strategies.

The COVID-19 pandemic has accelerated regulatory adaptations, with many authorities implementing emergency use authorizations and expedited review processes for remote monitoring technologies. This shift may establish precedents for more agile regulatory frameworks for wearable biosensors in the future, particularly those addressing public health priorities.

User Experience and Adoption Challenges

The adoption of wearable biosensors faces significant challenges despite their technological advancement. User experience remains a critical barrier, with many devices still struggling to balance functionality with comfort and aesthetics. Current-generation wearables often present a trade-off between continuous monitoring capabilities and design elements that users find acceptable for daily wear. This dichotomy creates adoption resistance, particularly among non-medical consumers who prioritize form alongside function.

Device comfort represents a fundamental challenge, as sensors must maintain consistent skin contact while avoiding irritation during prolonged wear. Studies indicate that approximately 30% of users discontinue wearable usage within six months, citing physical discomfort as a primary reason. The weight, material properties, and form factor significantly impact user willingness to incorporate these devices into daily routines.

Data interpretation complexity further complicates user experience. Many consumers lack the technical literacy to meaningfully interpret the physiological data collected by biosensors. Without intuitive visualization tools and actionable insights, users experience "data fatigue" - overwhelmed by information without clear pathways to behavioral change. This disconnect between data collection and practical application diminishes perceived value and sustained engagement.

Privacy concerns represent another substantial adoption barrier. Wearable biosensors collect intimate health data, raising questions about data ownership, security protocols, and potential vulnerabilities. Research indicates that 67% of potential users express significant concerns about how their biometric data might be used by manufacturers or third parties. These concerns intensify when devices integrate with broader digital ecosystems, creating uncertainty about data boundaries.

Battery life limitations continue to frustrate users across device categories. The power requirements for continuous monitoring, data processing, and wireless transmission create practical usage constraints. Users report significant dissatisfaction when required to remove devices for frequent charging, as this interrupts the continuous monitoring that provides the core value proposition of many biosensor applications.

Integration challenges with existing technology ecosystems also impede adoption. Users increasingly expect seamless connectivity between wearable biosensors and their smartphones, electronic health records, and other digital health platforms. Fragmented ecosystems and proprietary data formats create friction points that diminish the perceived utility of individual devices, regardless of their technical capabilities.

Human-centered design approaches that prioritize user needs alongside technical requirements represent the most promising path forward. Successful adoption strategies must address both the functional and emotional aspects of wearable technology integration into daily life, recognizing that even the most advanced biosensing capabilities provide limited value if users are unwilling to incorporate the devices into their routines.

Device comfort represents a fundamental challenge, as sensors must maintain consistent skin contact while avoiding irritation during prolonged wear. Studies indicate that approximately 30% of users discontinue wearable usage within six months, citing physical discomfort as a primary reason. The weight, material properties, and form factor significantly impact user willingness to incorporate these devices into daily routines.

Data interpretation complexity further complicates user experience. Many consumers lack the technical literacy to meaningfully interpret the physiological data collected by biosensors. Without intuitive visualization tools and actionable insights, users experience "data fatigue" - overwhelmed by information without clear pathways to behavioral change. This disconnect between data collection and practical application diminishes perceived value and sustained engagement.

Privacy concerns represent another substantial adoption barrier. Wearable biosensors collect intimate health data, raising questions about data ownership, security protocols, and potential vulnerabilities. Research indicates that 67% of potential users express significant concerns about how their biometric data might be used by manufacturers or third parties. These concerns intensify when devices integrate with broader digital ecosystems, creating uncertainty about data boundaries.

Battery life limitations continue to frustrate users across device categories. The power requirements for continuous monitoring, data processing, and wireless transmission create practical usage constraints. Users report significant dissatisfaction when required to remove devices for frequent charging, as this interrupts the continuous monitoring that provides the core value proposition of many biosensor applications.

Integration challenges with existing technology ecosystems also impede adoption. Users increasingly expect seamless connectivity between wearable biosensors and their smartphones, electronic health records, and other digital health platforms. Fragmented ecosystems and proprietary data formats create friction points that diminish the perceived utility of individual devices, regardless of their technical capabilities.

Human-centered design approaches that prioritize user needs alongside technical requirements represent the most promising path forward. Successful adoption strategies must address both the functional and emotional aspects of wearable technology integration into daily life, recognizing that even the most advanced biosensing capabilities provide limited value if users are unwilling to incorporate the devices into their routines.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!