Wearable Biosensors: Balancing Innovation with Regulation

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Wearable Biosensor Evolution and Objectives

Wearable biosensors have undergone a remarkable evolution over the past two decades, transforming from rudimentary step counters to sophisticated multi-parameter monitoring systems capable of continuous health assessment. The journey began in the early 2000s with basic fitness trackers that primarily measured steps and estimated calorie expenditure. By 2010, these devices had incorporated heart rate monitoring capabilities, marking a significant advancement in non-invasive physiological measurement.

The mid-2010s witnessed the integration of more complex biosensing technologies, including electrocardiogram (ECG), blood oxygen saturation (SpO2), and skin temperature sensors. This period also saw the miniaturization of components and improvements in battery efficiency, enabling longer wear times and more comfortable form factors. The development of flexible electronics and stretchable materials further enhanced wearability and user acceptance.

Recent technological breakthroughs have pushed wearable biosensors into the realm of clinical relevance. Advanced sensors now enable continuous glucose monitoring without blood sampling, sweat analysis for electrolyte balance, and even preliminary biomarker detection for conditions like inflammation and stress. Machine learning algorithms have simultaneously evolved to interpret these complex physiological signals, transforming raw data into actionable health insights.

The primary objective of contemporary wearable biosensor development is to achieve a balance between technological innovation and regulatory compliance. Developers aim to create devices that provide clinically relevant data while meeting stringent regulatory requirements for medical devices. This includes ensuring measurement accuracy comparable to clinical gold standards, maintaining data privacy and security, and demonstrating clinical utility through robust validation studies.

Another critical objective is to bridge the gap between consumer wellness devices and medical-grade diagnostic tools. This involves developing technologies that can reliably detect early warning signs of health deterioration while minimizing false alarms. The goal is to create systems that can seamlessly integrate into healthcare workflows, providing physicians with reliable data for clinical decision-making while empowering users with meaningful health information.

Looking forward, the field is trending toward non-invasive continuous monitoring of biomarkers previously accessible only through laboratory testing. Research efforts are focused on developing sensors for continuous monitoring of glucose, lactate, cortisol, and various disease-specific biomarkers. The ultimate vision is to create comprehensive health monitoring platforms that can detect subtle physiological changes before they manifest as symptoms, potentially revolutionizing preventive healthcare and chronic disease management.

The mid-2010s witnessed the integration of more complex biosensing technologies, including electrocardiogram (ECG), blood oxygen saturation (SpO2), and skin temperature sensors. This period also saw the miniaturization of components and improvements in battery efficiency, enabling longer wear times and more comfortable form factors. The development of flexible electronics and stretchable materials further enhanced wearability and user acceptance.

Recent technological breakthroughs have pushed wearable biosensors into the realm of clinical relevance. Advanced sensors now enable continuous glucose monitoring without blood sampling, sweat analysis for electrolyte balance, and even preliminary biomarker detection for conditions like inflammation and stress. Machine learning algorithms have simultaneously evolved to interpret these complex physiological signals, transforming raw data into actionable health insights.

The primary objective of contemporary wearable biosensor development is to achieve a balance between technological innovation and regulatory compliance. Developers aim to create devices that provide clinically relevant data while meeting stringent regulatory requirements for medical devices. This includes ensuring measurement accuracy comparable to clinical gold standards, maintaining data privacy and security, and demonstrating clinical utility through robust validation studies.

Another critical objective is to bridge the gap between consumer wellness devices and medical-grade diagnostic tools. This involves developing technologies that can reliably detect early warning signs of health deterioration while minimizing false alarms. The goal is to create systems that can seamlessly integrate into healthcare workflows, providing physicians with reliable data for clinical decision-making while empowering users with meaningful health information.

Looking forward, the field is trending toward non-invasive continuous monitoring of biomarkers previously accessible only through laboratory testing. Research efforts are focused on developing sensors for continuous monitoring of glucose, lactate, cortisol, and various disease-specific biomarkers. The ultimate vision is to create comprehensive health monitoring platforms that can detect subtle physiological changes before they manifest as symptoms, potentially revolutionizing preventive healthcare and chronic disease management.

Market Analysis for Wearable Health Monitoring

The wearable health monitoring market has experienced exponential growth over the past decade, evolving from simple fitness trackers to sophisticated medical-grade biosensors. The global market for wearable health devices was valued at approximately $18.4 billion in 2020 and is projected to reach $46.6 billion by 2025, representing a compound annual growth rate (CAGR) of 20.5%. This remarkable growth is driven by increasing health consciousness among consumers, rising prevalence of chronic diseases, and technological advancements in sensor technology and data analytics.

Consumer demand for wearable biosensors spans across various demographic segments. While early adoption was primarily among fitness enthusiasts and tech-savvy millennials, the market has expanded to include older adults managing chronic conditions and healthcare providers seeking remote patient monitoring solutions. A 2021 survey indicated that 56% of consumers are interested in using wearable technology to monitor their health metrics, with heart rate, sleep patterns, and blood oxygen levels being the most sought-after parameters.

The COVID-19 pandemic has significantly accelerated market growth, creating unprecedented demand for remote health monitoring solutions. Many healthcare systems have embraced telehealth and remote patient monitoring to reduce hospital visits while maintaining quality care. This shift has positioned wearable biosensors as essential tools in the evolving healthcare ecosystem, with 72% of healthcare providers reporting increased utilization of wearable data in patient care decisions since 2020.

Market segmentation reveals distinct categories within the wearable biosensor landscape. Consumer-grade devices dominate in volume, comprising approximately 78% of units sold, while medical-grade devices, though smaller in volume, generate higher revenue per unit. The prescription wearable segment is growing at 32% annually, outpacing the consumer segment as insurance reimbursement policies become more favorable for these devices.

Regional analysis shows North America leading the market with 42% share, followed by Europe (28%) and Asia-Pacific (22%). However, the Asia-Pacific region is expected to witness the highest growth rate of 24.7% through 2025, driven by increasing healthcare expenditure, growing awareness, and improving reimbursement scenarios in countries like China and India.

Key market challenges include regulatory hurdles, data privacy concerns, and interoperability issues. The balance between innovation and regulation remains delicate, with 63% of industry executives citing regulatory compliance as their top challenge. Additionally, consumer trust regarding data security represents a significant market barrier, with 58% of potential users expressing concerns about how their health data might be used.

Consumer demand for wearable biosensors spans across various demographic segments. While early adoption was primarily among fitness enthusiasts and tech-savvy millennials, the market has expanded to include older adults managing chronic conditions and healthcare providers seeking remote patient monitoring solutions. A 2021 survey indicated that 56% of consumers are interested in using wearable technology to monitor their health metrics, with heart rate, sleep patterns, and blood oxygen levels being the most sought-after parameters.

The COVID-19 pandemic has significantly accelerated market growth, creating unprecedented demand for remote health monitoring solutions. Many healthcare systems have embraced telehealth and remote patient monitoring to reduce hospital visits while maintaining quality care. This shift has positioned wearable biosensors as essential tools in the evolving healthcare ecosystem, with 72% of healthcare providers reporting increased utilization of wearable data in patient care decisions since 2020.

Market segmentation reveals distinct categories within the wearable biosensor landscape. Consumer-grade devices dominate in volume, comprising approximately 78% of units sold, while medical-grade devices, though smaller in volume, generate higher revenue per unit. The prescription wearable segment is growing at 32% annually, outpacing the consumer segment as insurance reimbursement policies become more favorable for these devices.

Regional analysis shows North America leading the market with 42% share, followed by Europe (28%) and Asia-Pacific (22%). However, the Asia-Pacific region is expected to witness the highest growth rate of 24.7% through 2025, driven by increasing healthcare expenditure, growing awareness, and improving reimbursement scenarios in countries like China and India.

Key market challenges include regulatory hurdles, data privacy concerns, and interoperability issues. The balance between innovation and regulation remains delicate, with 63% of industry executives citing regulatory compliance as their top challenge. Additionally, consumer trust regarding data security represents a significant market barrier, with 58% of potential users expressing concerns about how their health data might be used.

Technical Barriers and Global Development Status

Wearable biosensors face significant technical barriers despite their rapid advancement in recent years. The miniaturization of sensors while maintaining accuracy presents a fundamental challenge, as developers must balance size reduction with performance reliability. Power management remains a critical obstacle, with current battery technologies limiting continuous monitoring capabilities and necessitating frequent recharging, which diminishes user experience and adoption rates.

Data integrity and signal processing pose substantial challenges in real-world environments where motion artifacts, electromagnetic interference, and environmental factors can compromise measurement accuracy. The development of robust algorithms for noise filtering and signal enhancement requires significant computational resources, which conflicts with size and power constraints.

Biocompatibility and skin interface issues persist, as prolonged contact between sensors and skin can cause irritation, allergic reactions, or discomfort. Materials science innovations are needed to develop flexible, breathable substrates that maintain sensor functionality while ensuring user comfort during extended wear periods.

Globally, wearable biosensor development exhibits distinct regional characteristics. North America leads in innovation and commercialization, with the United States hosting major players like Apple, Fitbit (Google), and numerous startups backed by substantial venture capital. The FDA has established regulatory frameworks specifically for digital health technologies, providing a structured pathway for market entry despite rigorous requirements.

The European market emphasizes medical-grade accuracy and compliance with the Medical Device Regulation (MDR), which has created higher barriers to entry but ensures greater reliability for clinical applications. European research institutions maintain strong collaboration networks with industry partners, focusing on validation studies and clinical trials.

Asia-Pacific represents the fastest-growing market, with China emerging as a manufacturing powerhouse and innovation hub. Chinese companies like Huawei and Xiaomi have rapidly expanded their wearable portfolios, while Japan excels in miniaturization technologies and novel materials development. South Korea leverages its semiconductor expertise to advance integrated circuit solutions for biosensors.

Regulatory approaches vary significantly across regions, creating a fragmented global landscape that complicates international market entry. While the FDA's Digital Health Innovation Action Plan provides clear pathways in the US, and Europe's MDR establishes stringent requirements, many emerging markets lack comprehensive regulatory frameworks, creating uncertainty for developers and potentially compromising user safety.

Interoperability and standardization remain underdeveloped globally, with proprietary systems limiting data sharing and integration capabilities across different platforms and healthcare systems. This fragmentation hinders the realization of wearable biosensors' full potential in comprehensive health monitoring and preventive care applications.

Data integrity and signal processing pose substantial challenges in real-world environments where motion artifacts, electromagnetic interference, and environmental factors can compromise measurement accuracy. The development of robust algorithms for noise filtering and signal enhancement requires significant computational resources, which conflicts with size and power constraints.

Biocompatibility and skin interface issues persist, as prolonged contact between sensors and skin can cause irritation, allergic reactions, or discomfort. Materials science innovations are needed to develop flexible, breathable substrates that maintain sensor functionality while ensuring user comfort during extended wear periods.

Globally, wearable biosensor development exhibits distinct regional characteristics. North America leads in innovation and commercialization, with the United States hosting major players like Apple, Fitbit (Google), and numerous startups backed by substantial venture capital. The FDA has established regulatory frameworks specifically for digital health technologies, providing a structured pathway for market entry despite rigorous requirements.

The European market emphasizes medical-grade accuracy and compliance with the Medical Device Regulation (MDR), which has created higher barriers to entry but ensures greater reliability for clinical applications. European research institutions maintain strong collaboration networks with industry partners, focusing on validation studies and clinical trials.

Asia-Pacific represents the fastest-growing market, with China emerging as a manufacturing powerhouse and innovation hub. Chinese companies like Huawei and Xiaomi have rapidly expanded their wearable portfolios, while Japan excels in miniaturization technologies and novel materials development. South Korea leverages its semiconductor expertise to advance integrated circuit solutions for biosensors.

Regulatory approaches vary significantly across regions, creating a fragmented global landscape that complicates international market entry. While the FDA's Digital Health Innovation Action Plan provides clear pathways in the US, and Europe's MDR establishes stringent requirements, many emerging markets lack comprehensive regulatory frameworks, creating uncertainty for developers and potentially compromising user safety.

Interoperability and standardization remain underdeveloped globally, with proprietary systems limiting data sharing and integration capabilities across different platforms and healthcare systems. This fragmentation hinders the realization of wearable biosensors' full potential in comprehensive health monitoring and preventive care applications.

Current Biosensor Implementation Approaches

01 Wearable biosensors for health monitoring

Wearable biosensors designed for continuous health monitoring can track various physiological parameters such as heart rate, blood pressure, body temperature, and glucose levels. These devices enable real-time health tracking and early detection of abnormalities, allowing for timely medical intervention. The sensors are typically integrated into comfortable, non-invasive wearable formats that can be used for extended periods in daily life.- Wearable biosensors for health monitoring: Wearable biosensors designed for continuous health monitoring can track various physiological parameters such as heart rate, blood pressure, body temperature, and glucose levels. These devices enable real-time health tracking and early detection of abnormalities, allowing for timely medical intervention. The sensors are typically integrated into comfortable wearable formats like patches, wristbands, or clothing to facilitate long-term use while maintaining accuracy in data collection.

- Sweat-based biosensing technologies: Biosensors that analyze sweat composition can non-invasively monitor biomarkers including electrolytes, metabolites, and hormones. These sensors utilize electrochemical, optical, or colorimetric detection methods to measure analytes in sweat. The technology enables continuous monitoring without blood sampling, making it particularly valuable for athletes, patients with chronic conditions, and individuals requiring regular health assessment without the discomfort of invasive procedures.

- Implantable and minimally invasive biosensors: Advanced biosensing technologies that can be implanted under the skin or inserted minimally invasively into the body provide continuous monitoring of internal biomarkers. These sensors often utilize biocompatible materials and wireless communication to transmit data to external devices. Applications include continuous glucose monitoring for diabetes management, cardiac monitoring, and detection of specific biomarkers associated with various health conditions, offering improved accuracy compared to external sensors.

- Flexible and stretchable biosensor platforms: Flexible and stretchable biosensor platforms conform to the contours of the human body, improving comfort and sensor-skin contact. These platforms utilize advanced materials such as conductive polymers, nanomaterials, and stretchable electronics to maintain functionality during movement and deformation. The enhanced skin contact improves signal quality and reduces motion artifacts, making these sensors particularly suitable for continuous monitoring during physical activity or for long-term health assessment.

- Data processing and AI integration in biosensor systems: Modern wearable biosensors incorporate sophisticated data processing algorithms and artificial intelligence to enhance the accuracy and utility of collected data. These systems can filter noise, identify patterns, detect anomalies, and provide predictive insights based on historical and real-time data. The integration of AI enables personalized health recommendations, early warning systems for potential health issues, and improved diagnostic capabilities, transforming raw sensor data into actionable health information.

02 Sweat-based biosensing technologies

Biosensors that analyze sweat composition can detect various biomarkers without invasive procedures. These sensors measure electrolytes, metabolites, hormones, and other biomolecules present in sweat to provide insights into the wearer's health status. The technology incorporates microfluidic channels and electrochemical sensing elements to capture, transport, and analyze sweat in real-time, making them particularly useful for athletic performance monitoring and disease management.Expand Specific Solutions03 Flexible and stretchable biosensor materials

Advanced materials that combine flexibility, stretchability, and biocompatibility enable biosensors to conform to the body's contours while maintaining sensing accuracy. These materials include conductive polymers, carbon-based nanomaterials, and hybrid composites that can withstand repeated mechanical deformation. The development of such materials addresses key challenges in wearable technology by improving comfort, durability, and signal quality while reducing motion artifacts.Expand Specific Solutions04 Implantable and minimally invasive biosensors

Biosensors designed for subcutaneous or intravascular placement offer continuous monitoring of internal biomarkers that cannot be reliably measured through non-invasive means. These devices incorporate biocompatible materials to minimize foreign body response and may include wireless power and data transmission capabilities. Applications include continuous glucose monitoring, cardiac function assessment, and detection of specific disease markers, providing more accurate and timely health data than external sensors alone.Expand Specific Solutions05 Data processing and AI integration in biosensor systems

Advanced algorithms and artificial intelligence systems process the vast amounts of data generated by wearable biosensors to extract meaningful health insights. These systems can identify patterns, predict health events, and provide personalized recommendations based on continuous monitoring data. The integration of edge computing capabilities within the wearable devices themselves allows for real-time analysis and reduces dependency on constant connectivity to external systems, enhancing privacy and extending battery life.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The wearable biosensor market is in a growth phase, characterized by rapid technological innovation and expanding applications across healthcare and consumer sectors. With an estimated market size of $20 billion by 2025, this sector represents a significant opportunity despite regulatory challenges. Leading players include established technology giants like Samsung Electronics, Qualcomm, and Sony Group, who leverage their consumer electronics expertise, alongside healthcare specialists such as Medtronic and DexCom focusing on medical-grade biosensors. Academic institutions like MIT and Caltech drive fundamental research, while companies like Polar Electro and Affectiva pioneer specialized applications. The competitive landscape is evolving as regulatory frameworks mature, with companies balancing innovation speed against compliance requirements in different markets.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed a comprehensive wearable biosensor ecosystem centered around their Samsung Health platform and Galaxy Watch series. Their BioActive Sensor technology combines optical heart rate monitoring (PPG), electrical heart signal measurement (ECG), and bioelectrical impedance analysis (BIA) into a single compact chip[1]. This integration enables multiple health metrics from a single sensor array, including heart rate, blood oxygen levels, stress levels, and body composition analysis. Samsung's approach to regulatory compliance involves a tiered strategy: offering basic health monitoring features globally while gradually securing region-specific approvals for medical-grade features like ECG and blood pressure monitoring. Their Health Monitor app received FDA clearance for ECG functionality in 2020, demonstrating their ability to navigate regulatory pathways[2]. Samsung has also pioneered non-invasive blood pressure monitoring technology through pulse wave analysis algorithms that correlate with traditional cuff measurements, addressing a significant gap in continuous cardiovascular monitoring while working through the complex regulatory landscape for such innovations.

Strengths: Extensive consumer electronics distribution network; integrated ecosystem approach connecting wearables with smartphones and health platforms; strong manufacturing capabilities for miniaturization. Weaknesses: Regulatory approvals vary significantly by region creating fragmented user experiences; consumer electronics focus sometimes prioritizes feature addition over clinical validation; battery life limitations when multiple biosensors operate simultaneously.

Massachusetts Institute of Technology

Technical Solution: MIT has developed groundbreaking wearable biosensor technologies through its Media Lab and Research Laboratory of Electronics. Their "second skin" electronic tattoo platform utilizes ultrathin, stretchable electronics that conform to skin contours while measuring multiple physiological parameters simultaneously[1]. These devices incorporate novel materials science innovations including gold nanomesh conductors and silicone-based substrates that maintain electrical performance during natural skin movement and stretching. MIT researchers have pioneered chemical sensing approaches through microfluidic channels integrated with colorimetric and electrochemical sensors that can detect biomarkers in sweat, addressing the challenge of non-invasive molecular monitoring[2]. Their regulatory approach emphasizes open-source hardware designs and transparent validation protocols that accelerate technology transfer while establishing standards for emerging biosensor categories. MIT's Conformable Decoders research group has developed biosensors that can detect muscle signals with sufficient precision to control prosthetic devices, incorporating machine learning algorithms that improve signal processing while maintaining low power consumption suitable for wearable applications. Additionally, their ingestible biosensor platform enables internal physiological monitoring through devices that can safely pass through the digestive system while transmitting data wirelessly, creating new regulatory considerations for this hybrid category between wearables and ingestibles[3].

Strengths: Cutting-edge materials science innovations enable novel form factors; interdisciplinary approach combines engineering with biological insights; strong academic validation protocols. Weaknesses: Technology transfer timelines from research to commercial products can be lengthy; academic focus sometimes prioritizes technical innovation over regulatory pathway development; funding constraints can limit clinical validation studies compared to commercial entities.

Key Patents and Technical Breakthroughs

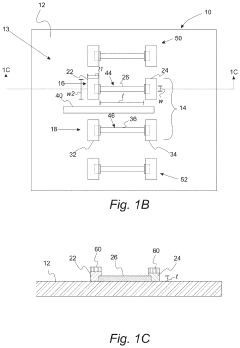

Wearable biosensors for semi-invasive, real-time monitoring of analytes, and related methods and apparatus

PatentWO2023003983A1

Innovation

- Development of integrated photonic systems with sensor photonic integrated circuits (PICs) functionalized with binding ligands, capable of real-time monitoring using refractive index-based biosensing, absorption spectroscopy, and fluorescence spectroscopy, integrated into wearable devices with microneedles for semi-invasive sampling and optical analyte sensors configured to detect multiple analytes simultaneously.

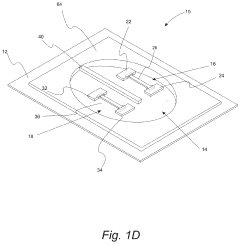

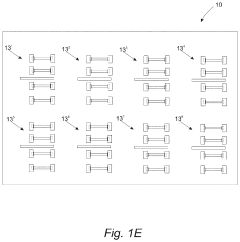

Wearable biosensors and applications thereof

PatentActiveUS20230060118A9

Innovation

- Development of highly sensitive In2O3 nanoribbon transistor biosensors with integrated on-chip gold gate electrodes, functionalized with glucose oxidase, chitosan, and single-walled carbon nanotubes, capable of detecting glucose concentrations between 10 nM to 1 mM in external body fluids without breaking the skin, and integrated into flexible, conformable devices like skin patches and contact lenses.

Regulatory Framework and Compliance Strategies

The regulatory landscape for wearable biosensors presents a complex matrix of requirements that vary significantly across global markets. In the United States, the FDA has established a risk-based classification system for medical devices, with wearable biosensors typically falling under Class I or Class II depending on their intended use and risk profile. Devices claiming diagnostic capabilities face more stringent regulatory scrutiny than those marketed for general wellness or fitness tracking. The FDA's Digital Health Innovation Action Plan has created pathways for expedited review of certain digital health technologies, offering opportunities for innovative biosensor developers.

The European Union's regulatory framework centers around the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose comprehensive requirements for clinical evidence, post-market surveillance, and technical documentation. The EU's GDPR adds another layer of compliance requirements specifically addressing data protection and privacy concerns, which are particularly relevant for biosensors collecting sensitive health data.

Asian markets present varying regulatory approaches, with Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implementing a system similar to the FDA, while China's National Medical Products Administration (NMPA) has recently streamlined its approval process for innovative medical technologies while maintaining strict control over data security.

Successful compliance strategies for wearable biosensor developers include early regulatory engagement through pre-submission consultations with relevant authorities. This proactive approach helps identify potential regulatory hurdles before significant resources are invested in development. Implementing quality management systems that align with ISO 13485 standards has proven essential for meeting regulatory requirements across multiple jurisdictions.

Risk classification determination represents a critical strategic decision point, as it significantly impacts the regulatory pathway and associated costs. Companies must carefully evaluate their product's intended use claims, as marketing materials and product descriptions directly influence regulatory classification.

Data privacy compliance frameworks have become increasingly important, with successful strategies incorporating privacy-by-design principles from early development stages. This includes implementing robust data encryption, transparent user consent mechanisms, and clear data retention policies.

Regulatory intelligence monitoring has emerged as a competitive advantage for leading biosensor companies, allowing them to anticipate regulatory changes and adapt their development roadmaps accordingly. Organizations maintaining dedicated regulatory affairs teams with specialized expertise in digital health regulations demonstrate higher success rates in navigating the complex approval processes.

The European Union's regulatory framework centers around the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose comprehensive requirements for clinical evidence, post-market surveillance, and technical documentation. The EU's GDPR adds another layer of compliance requirements specifically addressing data protection and privacy concerns, which are particularly relevant for biosensors collecting sensitive health data.

Asian markets present varying regulatory approaches, with Japan's Pharmaceuticals and Medical Devices Agency (PMDA) implementing a system similar to the FDA, while China's National Medical Products Administration (NMPA) has recently streamlined its approval process for innovative medical technologies while maintaining strict control over data security.

Successful compliance strategies for wearable biosensor developers include early regulatory engagement through pre-submission consultations with relevant authorities. This proactive approach helps identify potential regulatory hurdles before significant resources are invested in development. Implementing quality management systems that align with ISO 13485 standards has proven essential for meeting regulatory requirements across multiple jurisdictions.

Risk classification determination represents a critical strategic decision point, as it significantly impacts the regulatory pathway and associated costs. Companies must carefully evaluate their product's intended use claims, as marketing materials and product descriptions directly influence regulatory classification.

Data privacy compliance frameworks have become increasingly important, with successful strategies incorporating privacy-by-design principles from early development stages. This includes implementing robust data encryption, transparent user consent mechanisms, and clear data retention policies.

Regulatory intelligence monitoring has emerged as a competitive advantage for leading biosensor companies, allowing them to anticipate regulatory changes and adapt their development roadmaps accordingly. Organizations maintaining dedicated regulatory affairs teams with specialized expertise in digital health regulations demonstrate higher success rates in navigating the complex approval processes.

Data Privacy and Security Considerations

Wearable biosensors present significant data privacy and security challenges that must be addressed to ensure user trust and regulatory compliance. These devices continuously collect sensitive health data, creating an unprecedented volume of personal information that requires robust protection mechanisms. The intimate nature of biometric data - including heart rate, blood glucose levels, sleep patterns, and physical activity - makes it particularly valuable to malicious actors and raises the stakes for adequate security measures.

Current security vulnerabilities in wearable biosensors include insufficient encryption protocols, insecure data transmission channels, and inadequate authentication mechanisms. Many devices utilize Bluetooth Low Energy (BLE) for data transmission, which has documented security weaknesses when not properly implemented. Additionally, the resource constraints of wearable devices often limit the implementation of comprehensive security features, creating a tension between functionality and protection.

Data ownership and consent management represent critical concerns in the wearable biosensor ecosystem. Users often have limited visibility into how their health data is stored, processed, and shared with third parties. The complex data flow between devices, smartphone applications, cloud services, and potentially healthcare providers creates multiple points of vulnerability and complicates the implementation of consistent security practices across the entire data lifecycle.

Regulatory frameworks addressing these concerns vary significantly across regions. The European Union's General Data Protection Regulation (GDPR) imposes strict requirements for health data processing, while the Health Insurance Portability and Accountability Act (HIPAA) in the United States applies only to certain entities and data types. This regulatory fragmentation creates compliance challenges for global manufacturers and may leave significant gaps in protection for consumers.

Industry best practices are emerging to address these challenges, including privacy-by-design approaches, data minimization strategies, and enhanced user control mechanisms. Advanced encryption techniques such as homomorphic encryption show promise for allowing data analysis while maintaining privacy. Federated learning approaches enable algorithm improvement without centralizing sensitive data, potentially offering a path forward for balancing innovation with privacy protection.

The integration of wearable biosensors with healthcare systems introduces additional security considerations related to medical record systems and clinical decision support. As these devices increasingly influence medical decisions, ensuring data integrity becomes paramount, requiring sophisticated authentication and verification protocols that can function within the constraints of wearable form factors.

Current security vulnerabilities in wearable biosensors include insufficient encryption protocols, insecure data transmission channels, and inadequate authentication mechanisms. Many devices utilize Bluetooth Low Energy (BLE) for data transmission, which has documented security weaknesses when not properly implemented. Additionally, the resource constraints of wearable devices often limit the implementation of comprehensive security features, creating a tension between functionality and protection.

Data ownership and consent management represent critical concerns in the wearable biosensor ecosystem. Users often have limited visibility into how their health data is stored, processed, and shared with third parties. The complex data flow between devices, smartphone applications, cloud services, and potentially healthcare providers creates multiple points of vulnerability and complicates the implementation of consistent security practices across the entire data lifecycle.

Regulatory frameworks addressing these concerns vary significantly across regions. The European Union's General Data Protection Regulation (GDPR) imposes strict requirements for health data processing, while the Health Insurance Portability and Accountability Act (HIPAA) in the United States applies only to certain entities and data types. This regulatory fragmentation creates compliance challenges for global manufacturers and may leave significant gaps in protection for consumers.

Industry best practices are emerging to address these challenges, including privacy-by-design approaches, data minimization strategies, and enhanced user control mechanisms. Advanced encryption techniques such as homomorphic encryption show promise for allowing data analysis while maintaining privacy. Federated learning approaches enable algorithm improvement without centralizing sensitive data, potentially offering a path forward for balancing innovation with privacy protection.

The integration of wearable biosensors with healthcare systems introduces additional security considerations related to medical record systems and clinical decision support. As these devices increasingly influence medical decisions, ensuring data integrity becomes paramount, requiring sophisticated authentication and verification protocols that can function within the constraints of wearable form factors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!