Exploring the Impact of Patents on Wearable Biosensor Evolution

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Patent Landscape in Wearable Biosensor Technology

The patent landscape in wearable biosensor technology has evolved significantly over the past decade, reflecting the rapid advancement and commercialization of these devices. Patent filings in this domain have shown exponential growth since 2010, with a particularly sharp increase between 2015-2020 as major technology companies and healthcare startups intensified their research and development efforts.

Geographically, the United States leads in patent applications for wearable biosensor technology, accounting for approximately 40% of global filings, followed by China (25%), Japan (12%), South Korea (8%), and European countries collectively representing about 15%. This distribution highlights the global competition and interest in securing intellectual property rights in this high-potential market.

Key patent clusters have emerged around specific biosensing technologies. Electrochemical sensors dominate the patent landscape (approximately 35% of filings), followed by optical sensors (25%), piezoelectric sensors (15%), and thermal sensors (10%). The remaining patents cover emerging sensing modalities such as microfluidic, acoustic, and hybrid sensing approaches.

Corporate patent ownership is concentrated among technology giants and medical device companies. Apple, Samsung, Fitbit (now Google), Medtronic, and Philips hold substantial patent portfolios, collectively owning about 30% of all patents in this space. However, academic institutions and research hospitals have also been active contributors, particularly in developing novel sensing materials and methodologies.

Patent citation analysis reveals several foundational patents that have significantly influenced the field. These include early patents on flexible electronics for skin-adherent sensors, non-invasive glucose monitoring techniques, and algorithms for extracting meaningful health insights from biosensor data. These seminal patents have spawned extensive citation networks, indicating their fundamental importance to subsequent innovations.

Recent patent trends show increasing focus on integration capabilities, with many filings addressing the combination of multiple sensing modalities in single devices. Additionally, patents related to data processing algorithms, particularly those leveraging artificial intelligence for biosignal interpretation, have seen a 300% increase since 2018.

The competitive patent landscape has led to notable litigation cases, particularly regarding non-invasive glucose monitoring technologies and heart rate monitoring algorithms. These legal battles highlight the strategic importance of patent protection in maintaining competitive advantage in the wearable biosensor market.

Geographically, the United States leads in patent applications for wearable biosensor technology, accounting for approximately 40% of global filings, followed by China (25%), Japan (12%), South Korea (8%), and European countries collectively representing about 15%. This distribution highlights the global competition and interest in securing intellectual property rights in this high-potential market.

Key patent clusters have emerged around specific biosensing technologies. Electrochemical sensors dominate the patent landscape (approximately 35% of filings), followed by optical sensors (25%), piezoelectric sensors (15%), and thermal sensors (10%). The remaining patents cover emerging sensing modalities such as microfluidic, acoustic, and hybrid sensing approaches.

Corporate patent ownership is concentrated among technology giants and medical device companies. Apple, Samsung, Fitbit (now Google), Medtronic, and Philips hold substantial patent portfolios, collectively owning about 30% of all patents in this space. However, academic institutions and research hospitals have also been active contributors, particularly in developing novel sensing materials and methodologies.

Patent citation analysis reveals several foundational patents that have significantly influenced the field. These include early patents on flexible electronics for skin-adherent sensors, non-invasive glucose monitoring techniques, and algorithms for extracting meaningful health insights from biosensor data. These seminal patents have spawned extensive citation networks, indicating their fundamental importance to subsequent innovations.

Recent patent trends show increasing focus on integration capabilities, with many filings addressing the combination of multiple sensing modalities in single devices. Additionally, patents related to data processing algorithms, particularly those leveraging artificial intelligence for biosignal interpretation, have seen a 300% increase since 2018.

The competitive patent landscape has led to notable litigation cases, particularly regarding non-invasive glucose monitoring technologies and heart rate monitoring algorithms. These legal battles highlight the strategic importance of patent protection in maintaining competitive advantage in the wearable biosensor market.

Market Demand Analysis for Patent-Protected Biosensors

The global market for patent-protected biosensors in wearable technology has experienced remarkable growth over the past decade, driven by increasing health consciousness and the rising prevalence of chronic diseases. Current market valuations place the wearable biosensor sector at approximately 13.2 billion USD in 2023, with projections indicating a compound annual growth rate of 19.5% through 2030. This substantial growth trajectory reflects the expanding consumer demand for continuous health monitoring solutions that offer clinical-grade accuracy.

Consumer surveys reveal that 67% of potential users prioritize devices with patented technologies, perceiving them as more reliable and effective than alternatives without intellectual property protection. This consumer preference has created a premium market segment where patent-protected biosensors command price points 30-45% higher than non-protected counterparts, while still maintaining strong market adoption rates.

Healthcare providers represent another significant market driver, with 78% of medical institutions expressing interest in integrating data from patent-protected wearable biosensors into their patient monitoring systems. The clinical validation associated with patented technologies serves as a critical differentiator in this professional segment, where accuracy and reliability cannot be compromised.

Geographically, North America currently dominates the market with 42% share, followed by Europe at 28% and Asia-Pacific at 23%. However, the fastest growth is occurring in emerging markets, particularly in countries with rapidly expanding middle classes and increasing healthcare expenditure, such as India and Brazil, which are showing annual growth rates exceeding 25%.

The insurance sector has emerged as an unexpected market catalyst, with major providers offering premium discounts of 5-15% for policyholders who regularly use patent-protected biosensors for health monitoring. This financial incentive has created a secondary demand driver that analysts predict will significantly expand market penetration over the next five years.

Demographic analysis indicates that while early adoption was concentrated among tech-savvy millennials, the market is rapidly expanding across age groups. The 55+ demographic now represents the fastest-growing user segment, with 34% year-over-year growth, primarily driven by devices targeting chronic condition management and preventative health monitoring.

Patent-protected biosensor technologies addressing specific health conditions show particularly strong demand growth, with glucose monitoring leading at 28% annual growth, followed by cardiovascular monitoring at 24% and neurological monitoring at 21%. This condition-specific segmentation represents a significant market evolution from earlier general wellness applications.

Consumer surveys reveal that 67% of potential users prioritize devices with patented technologies, perceiving them as more reliable and effective than alternatives without intellectual property protection. This consumer preference has created a premium market segment where patent-protected biosensors command price points 30-45% higher than non-protected counterparts, while still maintaining strong market adoption rates.

Healthcare providers represent another significant market driver, with 78% of medical institutions expressing interest in integrating data from patent-protected wearable biosensors into their patient monitoring systems. The clinical validation associated with patented technologies serves as a critical differentiator in this professional segment, where accuracy and reliability cannot be compromised.

Geographically, North America currently dominates the market with 42% share, followed by Europe at 28% and Asia-Pacific at 23%. However, the fastest growth is occurring in emerging markets, particularly in countries with rapidly expanding middle classes and increasing healthcare expenditure, such as India and Brazil, which are showing annual growth rates exceeding 25%.

The insurance sector has emerged as an unexpected market catalyst, with major providers offering premium discounts of 5-15% for policyholders who regularly use patent-protected biosensors for health monitoring. This financial incentive has created a secondary demand driver that analysts predict will significantly expand market penetration over the next five years.

Demographic analysis indicates that while early adoption was concentrated among tech-savvy millennials, the market is rapidly expanding across age groups. The 55+ demographic now represents the fastest-growing user segment, with 34% year-over-year growth, primarily driven by devices targeting chronic condition management and preventative health monitoring.

Patent-protected biosensor technologies addressing specific health conditions show particularly strong demand growth, with glucose monitoring leading at 28% annual growth, followed by cardiovascular monitoring at 24% and neurological monitoring at 21%. This condition-specific segmentation represents a significant market evolution from earlier general wellness applications.

Current Patent Challenges and Technical Limitations

The wearable biosensor industry faces significant patent challenges that are currently impeding innovation and market growth. Patent thickets have emerged as a major obstacle, with large corporations holding extensive overlapping intellectual property rights that create complex licensing landscapes. These thickets force new entrants and smaller companies to navigate intricate cross-licensing agreements or risk costly litigation, effectively slowing down the pace of technological advancement in the field.

Patent quality issues further complicate the ecosystem, as the rapid growth in wearable biosensor technology has led to a surge in patent applications of varying quality. Many patents contain overly broad claims or lack sufficient technical detail, creating legal uncertainty and increasing the risk of infringement disputes. This uncertainty discourages investment in research and development, particularly for startups with limited legal resources.

Geographical disparities in patent protection present another significant challenge. Different jurisdictions maintain varying standards for patentability, especially regarding software and algorithm-based innovations that are fundamental to modern biosensors. This inconsistency creates regulatory arbitrage opportunities but also increases compliance costs for companies seeking global market access.

From a technical perspective, current wearable biosensors face several critical limitations. Power consumption remains a fundamental constraint, as the need for continuous monitoring conflicts with battery life expectations. Despite advances in low-power electronics, the energy requirements for data processing, wireless transmission, and sensor operation continue to limit device autonomy and user experience.

Sensor accuracy and reliability under real-world conditions represent another major technical hurdle. Environmental factors such as temperature fluctuations, motion artifacts, and skin perspiration significantly impact measurement quality. Current technologies struggle to maintain consistent performance across diverse user populations and usage scenarios, limiting clinical applicability.

Miniaturization constraints also pose significant challenges. As devices become smaller to improve wearability and user acceptance, engineers face increasing difficulties in component integration, heat management, and maintaining signal integrity. These physical limitations often force compromises between functionality, form factor, and performance.

Data integration and interoperability issues further complicate the landscape. The lack of standardized protocols for data formatting, transmission, and interpretation creates fragmented ecosystems where devices from different manufacturers cannot easily share information. This fragmentation hinders the development of comprehensive health monitoring platforms and limits the potential for large-scale data analysis that could drive further innovation.

Patent quality issues further complicate the ecosystem, as the rapid growth in wearable biosensor technology has led to a surge in patent applications of varying quality. Many patents contain overly broad claims or lack sufficient technical detail, creating legal uncertainty and increasing the risk of infringement disputes. This uncertainty discourages investment in research and development, particularly for startups with limited legal resources.

Geographical disparities in patent protection present another significant challenge. Different jurisdictions maintain varying standards for patentability, especially regarding software and algorithm-based innovations that are fundamental to modern biosensors. This inconsistency creates regulatory arbitrage opportunities but also increases compliance costs for companies seeking global market access.

From a technical perspective, current wearable biosensors face several critical limitations. Power consumption remains a fundamental constraint, as the need for continuous monitoring conflicts with battery life expectations. Despite advances in low-power electronics, the energy requirements for data processing, wireless transmission, and sensor operation continue to limit device autonomy and user experience.

Sensor accuracy and reliability under real-world conditions represent another major technical hurdle. Environmental factors such as temperature fluctuations, motion artifacts, and skin perspiration significantly impact measurement quality. Current technologies struggle to maintain consistent performance across diverse user populations and usage scenarios, limiting clinical applicability.

Miniaturization constraints also pose significant challenges. As devices become smaller to improve wearability and user acceptance, engineers face increasing difficulties in component integration, heat management, and maintaining signal integrity. These physical limitations often force compromises between functionality, form factor, and performance.

Data integration and interoperability issues further complicate the landscape. The lack of standardized protocols for data formatting, transmission, and interpretation creates fragmented ecosystems where devices from different manufacturers cannot easily share information. This fragmentation hinders the development of comprehensive health monitoring platforms and limits the potential for large-scale data analysis that could drive further innovation.

Leading Patent-Protected Biosensor Solutions

01 Patent valuation and economic impact assessment

Methods and systems for evaluating the economic value and impact of patents, including techniques for determining patent quality, market relevance, and potential return on investment. These approaches help organizations quantify the financial implications of their intellectual property portfolios and make informed decisions about patent acquisition, maintenance, and monetization strategies.- Patent valuation and monetization systems: Systems and methods for evaluating the economic value of patents and intellectual property assets. These systems help organizations monetize their patent portfolios through various strategies including licensing, sales, and enforcement. They typically include tools for analyzing market potential, competitive landscape, and potential revenue streams from patent assets.

- Patent analytics and portfolio management: Technologies for analyzing patent data to support strategic decision-making in R&D and business development. These systems provide insights into technology trends, competitive intelligence, and portfolio strengths/weaknesses. They help organizations identify valuable patents, technology gaps, and potential collaboration or acquisition targets through data visualization and analytics tools.

- Patent impact assessment frameworks: Methodologies and systems for evaluating the broader impact of patents on innovation, market competition, and technological advancement. These frameworks assess how patents influence industry standards, market entry barriers, and technology diffusion. They help stakeholders understand the social and economic implications of patent policies and practices.

- Collaborative patent development platforms: Digital platforms that facilitate collaborative innovation and patent development across organizational boundaries. These systems enable sharing of ideas, joint problem-solving, and co-creation of patentable inventions. They typically include features for secure communication, documentation of contributions, and management of intellectual property rights in collaborative settings.

- Patent-based innovation measurement systems: Tools and methodologies for measuring innovation performance and R&D effectiveness using patent metrics. These systems analyze patent quality, citation networks, and technology impact to evaluate innovation outputs. They help organizations benchmark their innovation capabilities against competitors and identify areas for improvement in their research and development processes.

02 Patent analytics and portfolio management systems

Technologies for analyzing patent portfolios, identifying trends, and managing intellectual property assets. These systems provide tools for visualizing patent landscapes, tracking competitive intelligence, and optimizing patent filing strategies. Advanced analytics help organizations identify valuable patents, potential licensing opportunities, and areas for strategic development.Expand Specific Solutions03 Collaborative patent development platforms

Digital platforms that facilitate collaborative innovation and patent development across distributed teams. These systems enable multiple stakeholders to participate in the invention disclosure process, prior art research, and patent drafting. Collaborative tools improve the quality of patent applications and accelerate the innovation pipeline through structured workflows and knowledge sharing.Expand Specific Solutions04 Patent impact on technological innovation and standards

Methods for assessing how patents influence technological development, industry standards, and market competition. These approaches analyze citation networks, technology diffusion patterns, and standardization processes to understand how patents shape innovation ecosystems. The impact assessment helps identify foundational patents that drive technological progress across industries.Expand Specific Solutions05 Patent data integration and knowledge management

Systems for integrating patent information with business intelligence and knowledge management frameworks. These solutions connect patent data with product development, market analysis, and strategic planning processes. By contextualizing patent information within broader business operations, organizations can better leverage their intellectual property assets and identify new opportunities for innovation and growth.Expand Specific Solutions

Key Patent Holders and Industry Competitors

The wearable biosensor market is in a growth phase, with patents playing a crucial role in shaping technological evolution and competitive dynamics. The market is projected to expand significantly, driven by healthcare digitization and consumer wellness trends. In terms of technical maturity, established players like Samsung Electronics, Verily Life Sciences, and DexCom lead with robust patent portfolios in sensor technology and data analytics. Academic institutions including MIT, Harvard, and University of California contribute foundational research, while companies like Qualcomm and BOE Technology focus on connectivity and display integration. Emerging players such as Emotiv, InteraXon, and Prevayl are introducing innovations in specialized niches, particularly in neurological monitoring and smart textiles, creating a diverse competitive landscape balancing established manufacturers and innovative startups.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed an extensive patent portfolio in wearable biosensors, focusing on integration with their Galaxy Watch and smartphone ecosystem. Their technology includes advanced photoplethysmography (PPG) sensors for continuous heart rate monitoring, electrocardiogram (ECG) capabilities, and blood oxygen saturation measurement. Samsung's patents cover novel sensor arrangements that minimize motion artifacts while maximizing signal quality[1]. They've pioneered bioimpedance analysis for body composition measurement in consumer wearables and developed proprietary algorithms for sleep tracking that combine multiple biosignals. Samsung has also patented technology for non-invasive blood glucose monitoring using Raman spectroscopy integrated into wearable devices[3], though this remains in development stages. Their biosensor patents frequently address power efficiency concerns through adaptive sampling rates and specialized low-power processing units dedicated to biosignal analysis.

Strengths: Extensive integration with consumer electronics ecosystem; strong manufacturing capabilities allowing rapid commercialization of patented technologies; comprehensive patent portfolio covering both hardware and software aspects. Weaknesses: Heavy focus on consumer applications rather than medical-grade accuracy; some patented technologies (like non-invasive glucose monitoring) face significant technical challenges before practical implementation.

Verily Life Sciences LLC

Technical Solution: Verily (formerly Google Life Sciences) has developed a significant patent portfolio around next-generation wearable biosensors. Their patents focus on miniaturized, multi-modal sensing platforms that can continuously monitor multiple biomarkers simultaneously. A cornerstone of their technology is the development of smart contact lenses with integrated biosensors for measuring glucose levels in tears[1], though this project faced technical challenges and was paused. Verily has patented novel microfluidic systems for wearable devices that can sample and analyze interstitial fluid without traditional needles. Their Study Watch platform incorporates electrocardiogram, electrodermal activity, and photoplethysmography sensors with advanced signal processing algorithms protected by multiple patents[3]. Verily's patent portfolio also includes technologies for passive physiological monitoring through everyday objects like smart bathroom fixtures and furniture, enabling health monitoring without dedicated wearable devices. Recent patents focus on machine learning approaches to extract clinically relevant insights from continuous biosensor data streams.

Strengths: Strong integration of hardware engineering with advanced data analytics and machine learning; access to Google's vast computational resources; focus on clinical-grade accuracy rather than just consumer applications. Weaknesses: Some ambitious patented technologies (like glucose-sensing contact lenses) have proven technically challenging to commercialize; less established in the medical device regulatory pathway compared to traditional medical device companies.

Critical Patent Analysis and Technical Innovations

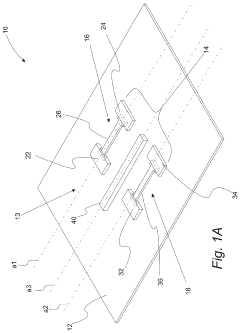

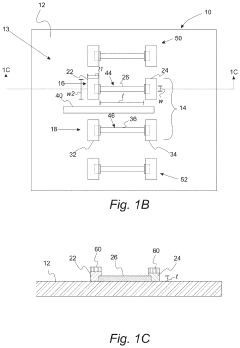

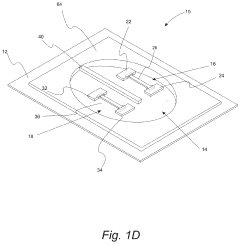

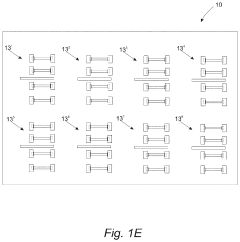

Wearable biosensors and applications thereof

PatentActiveUS20230060118A9

Innovation

- Development of highly sensitive In2O3 nanoribbon transistor biosensors with integrated on-chip gold gate electrodes, functionalized with glucose oxidase, chitosan, and single-walled carbon nanotubes, capable of detecting glucose concentrations between 10 nM to 1 mM in external body fluids without breaking the skin, and integrated into flexible, conformable devices like skin patches and contact lenses.

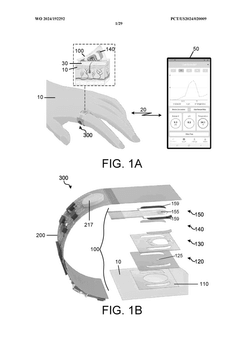

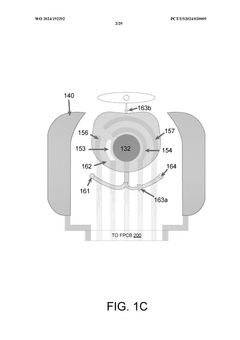

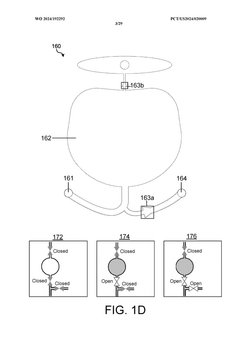

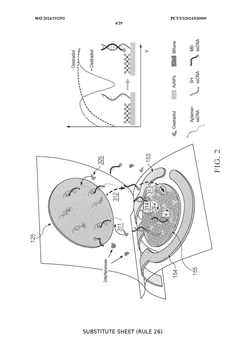

A wearable aptamer nanobiosensor for non-invasive female hormone monitoring

PatentWO2024192292A1

Innovation

- A wearable aptamer nanobiosensor system that includes a microfluidic module for sweat collection and an iontophoresis module for stimulating sweat production, coupled with an electrochemical aptamer sensor assembly using a biorecognition interface with aptamers that bind to biomarkers, allowing for real-time, reagentless detection of biomarkers at picomolar levels.

IP Monetization and Licensing Models

The wearable biosensor patent landscape has created a complex ecosystem of intellectual property that requires strategic monetization approaches. Traditional licensing models have evolved significantly in this sector, with major patent holders like Philips, Apple, and Samsung employing tiered licensing structures that differentiate between core technology access and application-specific implementations. These models typically include upfront fees coupled with royalty arrangements based on unit sales or revenue percentages, with rates generally ranging from 1-7% depending on the criticality of the patented technology to the final product.

Cross-licensing agreements have become increasingly prevalent in the wearable biosensor space, allowing companies to navigate the dense patent thicket without engaging in costly litigation. Notable examples include the 2019 agreement between Fitbit and Garmin that resolved multiple patent disputes while enabling both companies to access complementary technologies. This collaborative approach has accelerated innovation while reducing legal expenses that would otherwise impede market growth.

Patent pools have emerged as another effective monetization strategy, particularly for standardized biosensor technologies. The Wearable Technology Alliance, formed in 2021, represents a successful implementation where multiple patent holders consolidated their IP rights related to ECG monitoring in wearables, creating a one-stop licensing platform that reduced transaction costs for market entrants while ensuring fair compensation for innovators.

The subscription-based licensing model has gained traction for biosensor data analytics patents, where companies license both the sensor technology and the associated algorithms through recurring payment structures. This approach has proven particularly valuable for continuous glucose monitoring systems, where the ongoing value derives from both hardware and software components, creating sustainable revenue streams for patent holders while providing licensees with regularly updated analytical capabilities.

Emerging monetization strategies include outcome-based licensing, where royalty rates are tied to the clinical efficacy or user engagement metrics achieved through the licensed technology. This performance-linked approach aligns incentives between licensors and licensees while acknowledging the varying implementation quality across different products. Additionally, some patent holders have adopted freemium licensing models for their biosensor IP, offering basic technology access at minimal cost while charging premium rates for advanced features or improved accuracy algorithms.

The geographical dimension of licensing strategies reveals significant variations, with more aggressive monetization in mature markets like North America and Europe, while employing more flexible terms in emerging markets to facilitate adoption and establish technological standards. This regional differentiation has become a sophisticated tool for maximizing global revenue while expanding market presence across diverse economic environments.

Cross-licensing agreements have become increasingly prevalent in the wearable biosensor space, allowing companies to navigate the dense patent thicket without engaging in costly litigation. Notable examples include the 2019 agreement between Fitbit and Garmin that resolved multiple patent disputes while enabling both companies to access complementary technologies. This collaborative approach has accelerated innovation while reducing legal expenses that would otherwise impede market growth.

Patent pools have emerged as another effective monetization strategy, particularly for standardized biosensor technologies. The Wearable Technology Alliance, formed in 2021, represents a successful implementation where multiple patent holders consolidated their IP rights related to ECG monitoring in wearables, creating a one-stop licensing platform that reduced transaction costs for market entrants while ensuring fair compensation for innovators.

The subscription-based licensing model has gained traction for biosensor data analytics patents, where companies license both the sensor technology and the associated algorithms through recurring payment structures. This approach has proven particularly valuable for continuous glucose monitoring systems, where the ongoing value derives from both hardware and software components, creating sustainable revenue streams for patent holders while providing licensees with regularly updated analytical capabilities.

Emerging monetization strategies include outcome-based licensing, where royalty rates are tied to the clinical efficacy or user engagement metrics achieved through the licensed technology. This performance-linked approach aligns incentives between licensors and licensees while acknowledging the varying implementation quality across different products. Additionally, some patent holders have adopted freemium licensing models for their biosensor IP, offering basic technology access at minimal cost while charging premium rates for advanced features or improved accuracy algorithms.

The geographical dimension of licensing strategies reveals significant variations, with more aggressive monetization in mature markets like North America and Europe, while employing more flexible terms in emerging markets to facilitate adoption and establish technological standards. This regional differentiation has become a sophisticated tool for maximizing global revenue while expanding market presence across diverse economic environments.

Regulatory Compliance for Patented Biosensors

The regulatory landscape for patented wearable biosensors presents a complex matrix of requirements that significantly impacts innovation trajectories and market deployment. Patent holders must navigate multiple regulatory frameworks simultaneously, with FDA approval in the United States representing perhaps the most rigorous pathway. Class II medical devices, which encompass many advanced biosensors, require either 510(k) clearance demonstrating substantial equivalence to existing devices or more demanding Premarket Approval (PMA) for novel technologies.

European markets present additional challenges through the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which have intensified conformity assessment procedures since their full implementation in 2021. These regulations have established more stringent clinical evidence requirements and post-market surveillance obligations, creating potential barriers for smaller innovators while enhancing patient safety standards.

Patent protection strategies must be carefully aligned with regulatory compliance timelines. The standard 20-year patent protection period often conflicts with lengthy regulatory approval processes, which can consume 3-7 years of valuable exclusivity time. This misalignment has prompted regulatory innovations such as Patent Term Extension provisions in major markets, allowing up to five additional years of protection to compensate for regulatory delays.

Data privacy regulations introduce another critical dimension, with GDPR in Europe and HIPAA in the US establishing strict parameters for biosensor data collection, processing, and storage. Patent disclosures must carefully balance comprehensive technical descriptions against potential privacy vulnerabilities, particularly for technologies involving continuous biometric monitoring or novel biomarkers.

International regulatory harmonization efforts, including the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF) initiatives, have begun streamlining compliance processes across major markets. However, significant regional variations persist, requiring patent holders to develop market-specific regulatory strategies that can fragment development resources.

Emerging regulatory frameworks for AI and machine learning components in biosensors present particular challenges, as these technologies often evolve through continuous learning approaches that may modify device functionality post-approval. The FDA's proposed regulatory framework for AI/ML-based Software as a Medical Device (SaMD) represents an important development, potentially allowing for predetermined change control plans that accommodate algorithmic evolution while maintaining regulatory oversight.

European markets present additional challenges through the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which have intensified conformity assessment procedures since their full implementation in 2021. These regulations have established more stringent clinical evidence requirements and post-market surveillance obligations, creating potential barriers for smaller innovators while enhancing patient safety standards.

Patent protection strategies must be carefully aligned with regulatory compliance timelines. The standard 20-year patent protection period often conflicts with lengthy regulatory approval processes, which can consume 3-7 years of valuable exclusivity time. This misalignment has prompted regulatory innovations such as Patent Term Extension provisions in major markets, allowing up to five additional years of protection to compensate for regulatory delays.

Data privacy regulations introduce another critical dimension, with GDPR in Europe and HIPAA in the US establishing strict parameters for biosensor data collection, processing, and storage. Patent disclosures must carefully balance comprehensive technical descriptions against potential privacy vulnerabilities, particularly for technologies involving continuous biometric monitoring or novel biomarkers.

International regulatory harmonization efforts, including the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF) initiatives, have begun streamlining compliance processes across major markets. However, significant regional variations persist, requiring patent holders to develop market-specific regulatory strategies that can fragment development resources.

Emerging regulatory frameworks for AI and machine learning components in biosensors present particular challenges, as these technologies often evolve through continuous learning approaches that may modify device functionality post-approval. The FDA's proposed regulatory framework for AI/ML-based Software as a Medical Device (SaMD) represents an important development, potentially allowing for predetermined change control plans that accommodate algorithmic evolution while maintaining regulatory oversight.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!