Application of Wastewater Nanofiltration in Industry Compliance

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nanofiltration Technology Background and Objectives

Nanofiltration technology emerged in the late 1980s as an intermediate membrane filtration process between reverse osmosis and ultrafiltration. This technology has evolved significantly over the past three decades, driven by increasing industrial wastewater challenges and stricter environmental regulations worldwide. The development trajectory shows a clear shift from simple filtration applications to sophisticated, industry-specific solutions designed to address complex wastewater compositions.

The fundamental principle of nanofiltration involves semi-permeable membranes with pore sizes typically ranging from 1-10 nanometers, allowing for selective separation of multivalent ions, organic molecules, and certain contaminants while permitting the passage of water and some monovalent ions. This selective permeability represents a critical advantage over other filtration technologies, particularly for industrial compliance applications where specific contaminants must be targeted.

Historical development of nanofiltration technology has progressed through several distinct phases: initial conceptualization and laboratory testing (1980s), early industrial applications (1990s), membrane material innovations (2000s), and current advanced system integration with process optimization (2010s onwards). Each phase has contributed to enhancing membrane performance, energy efficiency, and application versatility.

The primary technical objectives for nanofiltration in industrial wastewater compliance include achieving consistent contaminant removal rates exceeding 95% for targeted compounds, reducing energy consumption by 30-40% compared to reverse osmosis systems, extending membrane lifespan to 5+ years under industrial conditions, and developing fouling-resistant membrane materials capable of handling high-strength industrial effluents.

Current technological trends indicate movement toward composite nanofiltration membranes incorporating advanced materials such as graphene oxide, zeolites, and functionalized polymers. These innovations aim to address persistent challenges including membrane fouling, chlorine sensitivity, and selective ion rejection capabilities. Additionally, there is growing interest in developing modular, scalable nanofiltration systems that can be customized to specific industrial wastewater profiles.

The global research landscape shows concentrated efforts in developing nanofiltration applications for pharmaceuticals, textiles, mining, food processing, and chemical manufacturing industries – sectors facing increasingly stringent discharge regulations. Technological forecasting suggests that by 2030, nanofiltration will likely become the dominant membrane technology for industrial wastewater treatment due to its optimal balance of separation efficiency, energy requirements, and operational costs.

The ultimate technological goal remains the development of "intelligent" nanofiltration systems featuring real-time monitoring, self-cleaning capabilities, and adaptive operation parameters that respond to influent quality variations – representing the next frontier in industrial wastewater compliance technology.

The fundamental principle of nanofiltration involves semi-permeable membranes with pore sizes typically ranging from 1-10 nanometers, allowing for selective separation of multivalent ions, organic molecules, and certain contaminants while permitting the passage of water and some monovalent ions. This selective permeability represents a critical advantage over other filtration technologies, particularly for industrial compliance applications where specific contaminants must be targeted.

Historical development of nanofiltration technology has progressed through several distinct phases: initial conceptualization and laboratory testing (1980s), early industrial applications (1990s), membrane material innovations (2000s), and current advanced system integration with process optimization (2010s onwards). Each phase has contributed to enhancing membrane performance, energy efficiency, and application versatility.

The primary technical objectives for nanofiltration in industrial wastewater compliance include achieving consistent contaminant removal rates exceeding 95% for targeted compounds, reducing energy consumption by 30-40% compared to reverse osmosis systems, extending membrane lifespan to 5+ years under industrial conditions, and developing fouling-resistant membrane materials capable of handling high-strength industrial effluents.

Current technological trends indicate movement toward composite nanofiltration membranes incorporating advanced materials such as graphene oxide, zeolites, and functionalized polymers. These innovations aim to address persistent challenges including membrane fouling, chlorine sensitivity, and selective ion rejection capabilities. Additionally, there is growing interest in developing modular, scalable nanofiltration systems that can be customized to specific industrial wastewater profiles.

The global research landscape shows concentrated efforts in developing nanofiltration applications for pharmaceuticals, textiles, mining, food processing, and chemical manufacturing industries – sectors facing increasingly stringent discharge regulations. Technological forecasting suggests that by 2030, nanofiltration will likely become the dominant membrane technology for industrial wastewater treatment due to its optimal balance of separation efficiency, energy requirements, and operational costs.

The ultimate technological goal remains the development of "intelligent" nanofiltration systems featuring real-time monitoring, self-cleaning capabilities, and adaptive operation parameters that respond to influent quality variations – representing the next frontier in industrial wastewater compliance technology.

Industrial Wastewater Treatment Market Analysis

The global industrial wastewater treatment market is experiencing robust growth, valued at approximately $38.2 billion in 2023 and projected to reach $55.1 billion by 2028, representing a compound annual growth rate (CAGR) of 7.6%. This growth is primarily driven by increasingly stringent environmental regulations worldwide, particularly in developed economies where industrial discharge standards continue to tighten. The implementation of Zero Liquid Discharge (ZLD) policies in countries like China and India has significantly expanded market opportunities for advanced treatment technologies.

Nanofiltration specifically has emerged as a high-growth segment within this market, currently accounting for about 15% of the total industrial wastewater treatment technology share. This segment is growing at an accelerated rate of 9.3% annually, outpacing conventional treatment methods. The pharmaceutical, textile, and electronics manufacturing sectors represent the largest end-users of nanofiltration technology, collectively contributing to approximately 47% of the nanofiltration market revenue.

Regional analysis reveals that Asia-Pacific dominates the industrial wastewater treatment market with a 38% share, followed by North America (27%) and Europe (24%). China and India are experiencing the fastest growth rates due to rapid industrialization coupled with strengthening environmental compliance requirements. The Middle East region is showing particular interest in nanofiltration technologies due to water scarcity issues and the growing need for water reuse in industrial operations.

Key market drivers include the rising costs of freshwater resources, which have increased by an average of 5.7% annually over the past five years in industrial zones worldwide. Additionally, the recovery of valuable materials from wastewater streams has become economically viable through nanofiltration, creating a dual incentive of compliance and resource recovery. For instance, metal recovery from electronics manufacturing wastewater can offset treatment costs by up to 30%.

Market challenges include the relatively high initial capital expenditure for nanofiltration systems compared to conventional treatment methods, with installation costs typically 40-60% higher. However, total cost of ownership analyses demonstrate that operational savings often result in return on investment within 3-5 years. Another significant market constraint is the technical expertise required for system optimization and maintenance, creating barriers to adoption particularly among small and medium-sized enterprises.

The competitive landscape features both established water treatment corporations and specialized technology providers. Major players include Veolia, Suez, Evoqua Water Technologies, and DuPont Water Solutions, collectively holding approximately 45% market share in industrial nanofiltration applications. Recent market trends indicate increasing consolidation through strategic acquisitions, with 14 significant mergers recorded in the past two years as companies seek to offer comprehensive treatment solutions.

Nanofiltration specifically has emerged as a high-growth segment within this market, currently accounting for about 15% of the total industrial wastewater treatment technology share. This segment is growing at an accelerated rate of 9.3% annually, outpacing conventional treatment methods. The pharmaceutical, textile, and electronics manufacturing sectors represent the largest end-users of nanofiltration technology, collectively contributing to approximately 47% of the nanofiltration market revenue.

Regional analysis reveals that Asia-Pacific dominates the industrial wastewater treatment market with a 38% share, followed by North America (27%) and Europe (24%). China and India are experiencing the fastest growth rates due to rapid industrialization coupled with strengthening environmental compliance requirements. The Middle East region is showing particular interest in nanofiltration technologies due to water scarcity issues and the growing need for water reuse in industrial operations.

Key market drivers include the rising costs of freshwater resources, which have increased by an average of 5.7% annually over the past five years in industrial zones worldwide. Additionally, the recovery of valuable materials from wastewater streams has become economically viable through nanofiltration, creating a dual incentive of compliance and resource recovery. For instance, metal recovery from electronics manufacturing wastewater can offset treatment costs by up to 30%.

Market challenges include the relatively high initial capital expenditure for nanofiltration systems compared to conventional treatment methods, with installation costs typically 40-60% higher. However, total cost of ownership analyses demonstrate that operational savings often result in return on investment within 3-5 years. Another significant market constraint is the technical expertise required for system optimization and maintenance, creating barriers to adoption particularly among small and medium-sized enterprises.

The competitive landscape features both established water treatment corporations and specialized technology providers. Major players include Veolia, Suez, Evoqua Water Technologies, and DuPont Water Solutions, collectively holding approximately 45% market share in industrial nanofiltration applications. Recent market trends indicate increasing consolidation through strategic acquisitions, with 14 significant mergers recorded in the past two years as companies seek to offer comprehensive treatment solutions.

Current Nanofiltration Challenges in Industrial Applications

Despite significant advancements in nanofiltration technology for wastewater treatment, several critical challenges persist in industrial applications. Membrane fouling remains the most prevalent issue, significantly reducing operational efficiency and membrane lifespan. This phenomenon occurs when suspended solids, organic compounds, inorganic scale, and biological growth accumulate on membrane surfaces, creating a layer that restricts flow and increases energy consumption. In industrial settings with complex wastewater compositions, fouling can occur rapidly, necessitating frequent cleaning cycles that interrupt operations and increase maintenance costs.

Energy consumption presents another substantial challenge, as nanofiltration systems require considerable pressure to force water through semi-permeable membranes. This energy requirement directly impacts operational costs and carbon footprint, making the technology less economically viable for smaller industrial operations or facilities in regions with high energy costs. The pressure requirements increase proportionally with membrane fouling, creating a compounding economic challenge.

Selectivity limitations also hinder widespread adoption, as current nanofiltration membranes struggle to achieve optimal separation for specific industrial contaminants. While nanofiltration excels at removing divalent ions and larger molecules, it often demonstrates inconsistent performance with monovalent ions and certain organic compounds. This selectivity gap creates compliance risks for industries facing stringent discharge regulations for specific contaminants.

Membrane durability under harsh industrial conditions represents another significant challenge. Exposure to extreme pH levels, oxidizing agents, and high temperatures in industrial wastewater can degrade membrane materials, reducing their effective lifespan and separation efficiency. Chemical resistance varies widely among membrane types, creating application limitations for industries with particularly aggressive wastewater profiles.

Concentration polarization effects further complicate nanofiltration applications, as rejected solutes accumulate near membrane surfaces, increasing osmotic pressure and reducing effective driving force. This phenomenon is particularly problematic in high-recovery systems where concentrated waste streams must be managed effectively to maintain compliance with disposal regulations.

Scaling issues also persist, especially in applications treating water with high mineral content. Calcium, magnesium, and silica compounds frequently precipitate on membrane surfaces, forming hard deposits that resist conventional cleaning methods and permanently damage membrane structures. Pre-treatment requirements to address these challenges add complexity and cost to nanofiltration systems, creating implementation barriers for many industrial facilities.

Energy consumption presents another substantial challenge, as nanofiltration systems require considerable pressure to force water through semi-permeable membranes. This energy requirement directly impacts operational costs and carbon footprint, making the technology less economically viable for smaller industrial operations or facilities in regions with high energy costs. The pressure requirements increase proportionally with membrane fouling, creating a compounding economic challenge.

Selectivity limitations also hinder widespread adoption, as current nanofiltration membranes struggle to achieve optimal separation for specific industrial contaminants. While nanofiltration excels at removing divalent ions and larger molecules, it often demonstrates inconsistent performance with monovalent ions and certain organic compounds. This selectivity gap creates compliance risks for industries facing stringent discharge regulations for specific contaminants.

Membrane durability under harsh industrial conditions represents another significant challenge. Exposure to extreme pH levels, oxidizing agents, and high temperatures in industrial wastewater can degrade membrane materials, reducing their effective lifespan and separation efficiency. Chemical resistance varies widely among membrane types, creating application limitations for industries with particularly aggressive wastewater profiles.

Concentration polarization effects further complicate nanofiltration applications, as rejected solutes accumulate near membrane surfaces, increasing osmotic pressure and reducing effective driving force. This phenomenon is particularly problematic in high-recovery systems where concentrated waste streams must be managed effectively to maintain compliance with disposal regulations.

Scaling issues also persist, especially in applications treating water with high mineral content. Calcium, magnesium, and silica compounds frequently precipitate on membrane surfaces, forming hard deposits that resist conventional cleaning methods and permanently damage membrane structures. Pre-treatment requirements to address these challenges add complexity and cost to nanofiltration systems, creating implementation barriers for many industrial facilities.

Current Nanofiltration Implementation Strategies

01 Nanofiltration membrane materials and compositions

Various materials and compositions are used in nanofiltration membranes for wastewater treatment. These include advanced polymeric materials, composite structures, and novel nanomaterials that enhance filtration efficiency. The membrane composition significantly affects performance metrics such as flux rate, selectivity, and fouling resistance. Innovations in this area focus on developing membranes with improved durability, chemical resistance, and separation capabilities for specific contaminants in wastewater.- Nanofiltration membrane materials and structures: Various materials and structures are used in nanofiltration membranes for wastewater treatment. These include composite membranes, modified polymeric materials, and novel nanostructured materials that enhance filtration efficiency. The membrane structure can be optimized for specific contaminant removal, with features like controlled pore size, surface modifications, and multi-layer designs that improve selectivity and flux performance.

- Integrated wastewater treatment systems using nanofiltration: Nanofiltration is often integrated into comprehensive wastewater treatment systems. These systems combine nanofiltration with other treatment processes such as pre-filtration, biological treatment, or advanced oxidation to achieve optimal contaminant removal. The integration allows for targeted removal of specific pollutants while maximizing the efficiency of the overall treatment process.

- Industrial wastewater treatment applications: Nanofiltration technology is specifically adapted for various industrial wastewater streams, including those from textile, pharmaceutical, mining, and chemical manufacturing. These specialized applications address industry-specific contaminants such as dyes, heavy metals, pharmaceutical residues, and complex organic compounds that conventional treatment methods struggle to remove effectively.

- Fouling prevention and membrane cleaning methods: Techniques to prevent membrane fouling and extend operational lifetime are critical in nanofiltration systems. These include physical and chemical cleaning protocols, anti-fouling membrane modifications, hydrodynamic optimization, and real-time monitoring systems. Advanced approaches incorporate self-cleaning mechanisms, pulsed flow operations, and specialized chemical agents that target specific foulants common in wastewater treatment.

- Energy-efficient nanofiltration processes: Energy optimization in nanofiltration systems focuses on reducing the high energy demands typically associated with membrane processes. Innovations include low-pressure operation membranes, energy recovery devices, process optimization through computational modeling, and renewable energy integration. These approaches aim to make nanofiltration more economically viable for large-scale wastewater treatment while maintaining high contaminant removal efficiency.

02 Integrated wastewater treatment systems using nanofiltration

Nanofiltration is often integrated into comprehensive wastewater treatment systems that combine multiple purification technologies. These integrated systems may include pre-treatment processes, nanofiltration units, and post-treatment steps to achieve optimal water quality. The design of such systems considers factors like wastewater characteristics, treatment objectives, and operational efficiency. Integration allows for targeted removal of contaminants while optimizing energy consumption and operational costs.Expand Specific Solutions03 Industrial applications of nanofiltration for specific wastewater types

Nanofiltration technologies are adapted for specific industrial wastewater streams with unique characteristics and contaminant profiles. Applications include treatment of textile effluents, pharmaceutical waste, mining wastewater, and food processing wastewater. These specialized nanofiltration solutions address industry-specific challenges such as high organic content, heavy metals, or persistent chemicals. The technologies are optimized for the particular contaminant removal requirements while considering the economic feasibility for industrial implementation.Expand Specific Solutions04 Anti-fouling and membrane cleaning technologies

Membrane fouling is a significant challenge in nanofiltration systems for wastewater treatment. Innovations in this area include anti-fouling membrane surface modifications, novel cleaning protocols, and fouling prevention strategies. These technologies extend membrane lifespan, maintain filtration efficiency, and reduce operational downtime. Approaches include physical cleaning methods, chemical cleaning agents, and membrane surface treatments that minimize contaminant adhesion and biofilm formation.Expand Specific Solutions05 Energy-efficient nanofiltration systems and processes

Energy efficiency is a critical consideration in wastewater nanofiltration. Innovations focus on reducing energy consumption through improved system design, optimized operating conditions, and energy recovery mechanisms. These developments include low-pressure nanofiltration membranes, energy-efficient pumping systems, and process optimizations that minimize energy requirements while maintaining treatment effectiveness. Such systems aim to make nanofiltration more economically viable and environmentally sustainable for wastewater treatment applications.Expand Specific Solutions

Leading Companies in Industrial Nanofiltration Solutions

Industrial wastewater nanofiltration technology is currently in a growth phase, with increasing adoption driven by stringent environmental regulations and sustainability goals. The global market for this technology is expanding rapidly, projected to reach significant scale as industries seek cost-effective compliance solutions. From a technical maturity perspective, companies like Ecolab, Zhejiang Jinmo Environment Technology, and Aquatech International are leading commercial implementation with established membrane technologies, while Veolia Water Solutions offers integrated treatment systems. Academic institutions such as Tiangong University and Central South University of Forestry & Technology are advancing fundamental research. Industrial players like Baoshan Iron & Steel and Guangdong Power Grid are adopting these technologies to meet compliance requirements, while specialized firms like GreenTech Environmental and Rightleder Technology are developing next-generation nanofiltration solutions with improved efficiency and reduced fouling characteristics.

Korea Research Institute of Chemical Technology

Technical Solution: The Korea Research Institute of Chemical Technology (KRICT) has developed an innovative nanofiltration technology called HybriSol™ specifically designed for industrial wastewater compliance applications. Their approach combines ceramic-polymer hybrid membranes with tailored surface functionalization to achieve superior separation performance and chemical resistance. The technology utilizes a multi-layer composite structure with a ceramic support layer providing mechanical stability and a nanoporous polymer top layer with precisely controlled pore size distribution (average 1-5 nm). KRICT's membranes incorporate zwitterionic surface modifications that significantly reduce fouling by creating a hydration layer that repels both positively and negatively charged foulants. Their system operates effectively across a wide pH range (1-13) and can withstand temperatures up to 80°C, making it particularly suitable for harsh industrial environments. The technology has demonstrated exceptional performance in removing heavy metals (>99% removal), dyes (>98% removal), and persistent organic pollutants while maintaining high flux rates (20-25 LMH) at moderate pressures (5-10 bar). KRICT has successfully implemented this technology in textile, semiconductor, and petrochemical industries, where it has enabled facilities to meet increasingly stringent discharge regulations while reducing freshwater consumption through increased water recycling.

Strengths: Exceptional chemical and thermal stability allowing application in harsh industrial environments; lower fouling propensity compared to conventional polymeric membranes; long operational lifetime reducing replacement frequency and costs. Weaknesses: Higher manufacturing complexity leading to increased initial capital costs; requires specialized expertise for system optimization; limited commercial-scale implementation history compared to established technologies.

Aquatech International LLC

Technical Solution: Aquatech has developed advanced nanofiltration (NF) systems specifically designed for industrial wastewater treatment compliance. Their proprietary NanoTech™ membrane technology utilizes cross-flow filtration with specialized polymer membranes featuring pore sizes between 1-10 nanometers. This technology selectively removes multivalent ions, organic compounds, and color while allowing monovalent ions to pass through. The system incorporates anti-fouling mechanisms through automated cleaning cycles and pre-treatment processes to extend membrane life. Aquatech's approach integrates NF with complementary technologies like ultrafiltration pre-treatment and reverse osmosis post-treatment when necessary, creating customized treatment trains for specific industrial applications. Their systems achieve up to 98% removal of heavy metals and 95% reduction in total dissolved solids (TDS) while operating at lower pressures (7-14 bar) compared to reverse osmosis, resulting in energy savings of approximately 30%.

Strengths: Lower energy consumption compared to reverse osmosis; selective ion removal capability allowing valuable mineral recovery; modular design enabling scalability for various industrial applications. Weaknesses: Membrane fouling in high-organic wastewater requires extensive pre-treatment; higher initial capital investment compared to conventional filtration; limited effectiveness against monovalent ions like sodium and chloride.

Key Patents and Innovations in Nanofiltration Technology

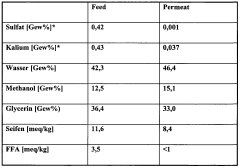

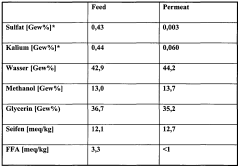

Method for purifying product mixtures from transesterification reactions

PatentInactiveEP2142286A1

Innovation

- The process employs nanofiltration to separate electrolytes from a polar, electrolyte-containing organic phase, using a pressure-driven membrane separation that retains particles in the nanometer range, reducing energy consumption and equipment complexity while maintaining high product quality.

Method for purifying product mixtures from transesterification reactions

PatentWO2008128652A1

Innovation

- A nanofiltration process is used to separate electrolytes from the polar organic phase in transesterification reactions, employing a membrane separation that operates at moderate pressures and temperatures, effectively removing electrolytes and reducing equipment complexity and energy consumption.

Regulatory Framework for Industrial Wastewater Treatment

The regulatory landscape for industrial wastewater treatment has become increasingly stringent worldwide, with nanofiltration technology emerging as a critical compliance solution. Current regulations are structured in a multi-tiered framework, encompassing international agreements, national legislation, regional directives, and industry-specific standards. The Clean Water Act in the United States and the Water Framework Directive in the European Union represent cornerstone legislation that establishes permissible discharge limits for various contaminants, including heavy metals, organic compounds, and emerging pollutants of concern.

Regulatory compliance requirements typically follow a hierarchical approach, with baseline standards set at national levels and more specific parameters defined by local environmental protection agencies. These standards are increasingly adopting a risk-based approach, where industries with higher pollution potential face more stringent requirements. For nanofiltration applications, regulations specifically address membrane performance criteria, rejection rates for priority pollutants, and operational parameters that ensure consistent treatment efficacy.

Enforcement mechanisms have evolved significantly in recent years, moving beyond traditional command-and-control approaches to incorporate economic instruments such as effluent charges, tradable permits, and compliance incentives. Penalties for non-compliance have increased substantially, with fines reaching millions of dollars for serious violations in many jurisdictions, alongside potential criminal liability for corporate executives in cases of willful negligence.

The regulatory framework also addresses monitoring and reporting requirements, mandating regular sampling, analysis, and documentation of treatment system performance. Advanced online monitoring systems are increasingly becoming mandatory for high-risk industries, with real-time data transmission to regulatory authorities. Nanofiltration systems must demonstrate consistent compliance through validated quality assurance protocols and third-party verification in many jurisdictions.

Recent regulatory trends indicate a shift toward more holistic approaches that consider the entire water cycle and promote circular economy principles. This includes incentives for water reuse, resource recovery from wastewater streams, and reduced freshwater withdrawal. Nanofiltration technology is particularly well-positioned to address these emerging regulatory priorities due to its selective separation capabilities and relatively low energy requirements compared to reverse osmosis.

Industry-specific regulations present unique challenges and opportunities for nanofiltration applications. The pharmaceutical sector faces stringent requirements for active pharmaceutical ingredient removal, while the textile industry must address complex dye compounds and the mining sector confronts strict limits on heavy metal discharges. Regulatory frameworks increasingly recognize technology-based standards, with nanofiltration acknowledged as Best Available Technology (BAT) for specific treatment scenarios in several jurisdictions.

Regulatory compliance requirements typically follow a hierarchical approach, with baseline standards set at national levels and more specific parameters defined by local environmental protection agencies. These standards are increasingly adopting a risk-based approach, where industries with higher pollution potential face more stringent requirements. For nanofiltration applications, regulations specifically address membrane performance criteria, rejection rates for priority pollutants, and operational parameters that ensure consistent treatment efficacy.

Enforcement mechanisms have evolved significantly in recent years, moving beyond traditional command-and-control approaches to incorporate economic instruments such as effluent charges, tradable permits, and compliance incentives. Penalties for non-compliance have increased substantially, with fines reaching millions of dollars for serious violations in many jurisdictions, alongside potential criminal liability for corporate executives in cases of willful negligence.

The regulatory framework also addresses monitoring and reporting requirements, mandating regular sampling, analysis, and documentation of treatment system performance. Advanced online monitoring systems are increasingly becoming mandatory for high-risk industries, with real-time data transmission to regulatory authorities. Nanofiltration systems must demonstrate consistent compliance through validated quality assurance protocols and third-party verification in many jurisdictions.

Recent regulatory trends indicate a shift toward more holistic approaches that consider the entire water cycle and promote circular economy principles. This includes incentives for water reuse, resource recovery from wastewater streams, and reduced freshwater withdrawal. Nanofiltration technology is particularly well-positioned to address these emerging regulatory priorities due to its selective separation capabilities and relatively low energy requirements compared to reverse osmosis.

Industry-specific regulations present unique challenges and opportunities for nanofiltration applications. The pharmaceutical sector faces stringent requirements for active pharmaceutical ingredient removal, while the textile industry must address complex dye compounds and the mining sector confronts strict limits on heavy metal discharges. Regulatory frameworks increasingly recognize technology-based standards, with nanofiltration acknowledged as Best Available Technology (BAT) for specific treatment scenarios in several jurisdictions.

Cost-Benefit Analysis of Nanofiltration Compliance Solutions

The implementation of nanofiltration technology for wastewater treatment in industrial settings requires careful economic evaluation to justify investment decisions. This cost-benefit analysis examines the financial implications of adopting nanofiltration solutions for regulatory compliance across various industrial sectors.

Initial capital expenditure for nanofiltration systems varies significantly based on treatment capacity, ranging from $150,000 for small-scale operations to over $2 million for large industrial facilities. These systems typically require specialized membrane modules ($20,000-$100,000), pressure vessels ($10,000-$50,000), high-pressure pumps ($15,000-$60,000), and control systems ($25,000-$150,000). Installation costs generally add 30-40% to equipment expenses.

Operational expenditures include energy consumption (0.5-2.5 kWh/m³), membrane replacement (every 2-5 years at $10,000-$50,000), chemical cleaning agents ($5,000-$20,000 annually), and maintenance labor (approximately 5-10% of capital costs annually). However, these costs must be weighed against substantial compliance benefits.

Non-compliance penalties under regulations like the Clean Water Act can reach $54,833 per day for serious violations, with cumulative fines potentially reaching millions for persistent offenders. Beyond direct penalties, non-compliance risks include production shutdowns, remediation costs, litigation expenses, and reputational damage that may impact market share and investor confidence.

Nanofiltration systems demonstrate positive return on investment in most industrial applications, with payback periods typically ranging from 2-5 years depending on industry type and discharge requirements. Chemical manufacturing facilities generally see the fastest returns (2-3 years), followed by textile processing (2.5-4 years) and food processing operations (3-5 years).

Additional economic benefits include reduced freshwater consumption through potential water reuse (savings of $3-$8 per cubic meter), recovery of valuable process chemicals and materials (5-15% reduction in raw material costs), and decreased sludge disposal expenses (30-50% reduction compared to conventional treatment methods).

Long-term financial modeling indicates that nanofiltration compliance solutions typically deliver 15-25% lower total cost of ownership over a 10-year operational period compared to conventional treatment technologies when accounting for all direct and indirect costs, including compliance assurance and risk mitigation factors.

Initial capital expenditure for nanofiltration systems varies significantly based on treatment capacity, ranging from $150,000 for small-scale operations to over $2 million for large industrial facilities. These systems typically require specialized membrane modules ($20,000-$100,000), pressure vessels ($10,000-$50,000), high-pressure pumps ($15,000-$60,000), and control systems ($25,000-$150,000). Installation costs generally add 30-40% to equipment expenses.

Operational expenditures include energy consumption (0.5-2.5 kWh/m³), membrane replacement (every 2-5 years at $10,000-$50,000), chemical cleaning agents ($5,000-$20,000 annually), and maintenance labor (approximately 5-10% of capital costs annually). However, these costs must be weighed against substantial compliance benefits.

Non-compliance penalties under regulations like the Clean Water Act can reach $54,833 per day for serious violations, with cumulative fines potentially reaching millions for persistent offenders. Beyond direct penalties, non-compliance risks include production shutdowns, remediation costs, litigation expenses, and reputational damage that may impact market share and investor confidence.

Nanofiltration systems demonstrate positive return on investment in most industrial applications, with payback periods typically ranging from 2-5 years depending on industry type and discharge requirements. Chemical manufacturing facilities generally see the fastest returns (2-3 years), followed by textile processing (2.5-4 years) and food processing operations (3-5 years).

Additional economic benefits include reduced freshwater consumption through potential water reuse (savings of $3-$8 per cubic meter), recovery of valuable process chemicals and materials (5-15% reduction in raw material costs), and decreased sludge disposal expenses (30-50% reduction compared to conventional treatment methods).

Long-term financial modeling indicates that nanofiltration compliance solutions typically deliver 15-25% lower total cost of ownership over a 10-year operational period compared to conventional treatment technologies when accounting for all direct and indirect costs, including compliance assurance and risk mitigation factors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!