Market Summary: Wastewater Nanofiltration Technology Opportunities

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nanofiltration Technology Evolution and Objectives

Nanofiltration technology has evolved significantly over the past four decades, emerging as a critical membrane separation process positioned between reverse osmosis and ultrafiltration in terms of selectivity and operating pressure. The technology was first conceptualized in the late 1970s, with commercial applications beginning to appear in the 1980s as researchers sought more energy-efficient alternatives to reverse osmosis systems while maintaining high separation efficiency.

The evolution of nanofiltration membranes has been characterized by three distinct generations. First-generation membranes, developed in the 1980s, were primarily thin-film composite structures with limited chemical stability and moderate rejection rates. Second-generation membranes (1990s-2000s) featured improved polymer chemistry and manufacturing techniques, resulting in enhanced flux rates and better selectivity for multivalent ions. Current third-generation membranes incorporate advanced materials such as nanocomposites, biomimetic elements, and surface-modified polymers that significantly improve performance parameters while reducing fouling tendencies.

A pivotal advancement in nanofiltration technology has been the development of chlorine-resistant membranes, addressing one of the major limitations of earlier generations. Additionally, the introduction of ceramic and graphene-based nanofiltration membranes has expanded application possibilities in harsh industrial environments where traditional polymeric membranes would degrade rapidly.

The primary objective of modern nanofiltration technology development is to achieve selective separation of contaminants from wastewater streams while minimizing energy consumption and maximizing membrane lifespan. Specific technical goals include enhancing rejection rates for micropollutants (particularly pharmaceutical compounds and personal care products), improving membrane antifouling properties, and developing self-cleaning membrane surfaces to reduce maintenance requirements.

Another critical objective is the scaling of nanofiltration technology for large municipal wastewater treatment facilities, which requires addressing challenges related to membrane module design, system integration, and process optimization. Researchers are also focusing on developing nanofiltration membranes specifically tailored for resource recovery applications, particularly for nutrients like phosphorus and nitrogen, as well as valuable metals from industrial wastewater streams.

The industry is increasingly prioritizing sustainability objectives, including the development of bio-based and biodegradable membrane materials, reduction of chemical usage in membrane cleaning processes, and minimizing the carbon footprint of nanofiltration systems through energy recovery and process optimization. These environmental considerations are becoming central to technology development roadmaps as regulatory frameworks worldwide increasingly emphasize sustainable water management practices.

The evolution of nanofiltration membranes has been characterized by three distinct generations. First-generation membranes, developed in the 1980s, were primarily thin-film composite structures with limited chemical stability and moderate rejection rates. Second-generation membranes (1990s-2000s) featured improved polymer chemistry and manufacturing techniques, resulting in enhanced flux rates and better selectivity for multivalent ions. Current third-generation membranes incorporate advanced materials such as nanocomposites, biomimetic elements, and surface-modified polymers that significantly improve performance parameters while reducing fouling tendencies.

A pivotal advancement in nanofiltration technology has been the development of chlorine-resistant membranes, addressing one of the major limitations of earlier generations. Additionally, the introduction of ceramic and graphene-based nanofiltration membranes has expanded application possibilities in harsh industrial environments where traditional polymeric membranes would degrade rapidly.

The primary objective of modern nanofiltration technology development is to achieve selective separation of contaminants from wastewater streams while minimizing energy consumption and maximizing membrane lifespan. Specific technical goals include enhancing rejection rates for micropollutants (particularly pharmaceutical compounds and personal care products), improving membrane antifouling properties, and developing self-cleaning membrane surfaces to reduce maintenance requirements.

Another critical objective is the scaling of nanofiltration technology for large municipal wastewater treatment facilities, which requires addressing challenges related to membrane module design, system integration, and process optimization. Researchers are also focusing on developing nanofiltration membranes specifically tailored for resource recovery applications, particularly for nutrients like phosphorus and nitrogen, as well as valuable metals from industrial wastewater streams.

The industry is increasingly prioritizing sustainability objectives, including the development of bio-based and biodegradable membrane materials, reduction of chemical usage in membrane cleaning processes, and minimizing the carbon footprint of nanofiltration systems through energy recovery and process optimization. These environmental considerations are becoming central to technology development roadmaps as regulatory frameworks worldwide increasingly emphasize sustainable water management practices.

Wastewater Treatment Market Demand Analysis

The global wastewater treatment market is experiencing significant growth, driven by increasing water scarcity, stringent environmental regulations, and growing industrialization. Current market valuations place the global wastewater treatment sector at approximately 250 billion USD in 2023, with projections indicating a compound annual growth rate of 7.1% through 2030, potentially reaching 400 billion USD by the end of the decade.

Nanofiltration technology specifically represents one of the fastest-growing segments within this market, currently valued at around 21 billion USD and expected to grow at 8.5% annually. This accelerated growth is attributed to nanofiltration's superior performance in removing specific contaminants while maintaining lower energy consumption compared to reverse osmosis systems.

Regional analysis reveals varying demand patterns. North America and Europe currently dominate the market with mature infrastructure and stringent regulatory frameworks. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth potential due to rapid industrialization, urbanization, and increasing government investments in water treatment infrastructure.

Industrial applications constitute approximately 60% of the nanofiltration market, with particular demand from pharmaceutical, food and beverage, textile, and chemical manufacturing sectors. Municipal applications account for the remaining 40%, though this segment is growing faster in developing economies where urbanization is accelerating.

Key market drivers include increasingly stringent discharge regulations worldwide, growing water reuse initiatives, and rising concerns about emerging contaminants such as pharmaceuticals, microplastics, and PFAS (per- and polyfluoroalkyl substances). The COVID-19 pandemic has further heightened awareness about water quality and safety, accelerating adoption of advanced filtration technologies.

Cost considerations remain a significant factor influencing market adoption. While operational costs for nanofiltration systems have decreased by approximately 30% over the past decade, initial capital investment requirements still present barriers to widespread implementation, particularly in smaller municipalities and developing regions.

Customer demand increasingly focuses on integrated solutions that combine nanofiltration with complementary technologies to address specific contaminant profiles. There is growing interest in modular, scalable systems that can be deployed rapidly and expanded as needed, particularly in industrial applications where production volumes may fluctuate.

Sustainability considerations are reshaping market demands, with customers increasingly valuing technologies that minimize chemical usage, reduce energy consumption, and enable water reuse. This trend is particularly pronounced in water-stressed regions where circular economy approaches to water management are gaining traction.

Nanofiltration technology specifically represents one of the fastest-growing segments within this market, currently valued at around 21 billion USD and expected to grow at 8.5% annually. This accelerated growth is attributed to nanofiltration's superior performance in removing specific contaminants while maintaining lower energy consumption compared to reverse osmosis systems.

Regional analysis reveals varying demand patterns. North America and Europe currently dominate the market with mature infrastructure and stringent regulatory frameworks. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth potential due to rapid industrialization, urbanization, and increasing government investments in water treatment infrastructure.

Industrial applications constitute approximately 60% of the nanofiltration market, with particular demand from pharmaceutical, food and beverage, textile, and chemical manufacturing sectors. Municipal applications account for the remaining 40%, though this segment is growing faster in developing economies where urbanization is accelerating.

Key market drivers include increasingly stringent discharge regulations worldwide, growing water reuse initiatives, and rising concerns about emerging contaminants such as pharmaceuticals, microplastics, and PFAS (per- and polyfluoroalkyl substances). The COVID-19 pandemic has further heightened awareness about water quality and safety, accelerating adoption of advanced filtration technologies.

Cost considerations remain a significant factor influencing market adoption. While operational costs for nanofiltration systems have decreased by approximately 30% over the past decade, initial capital investment requirements still present barriers to widespread implementation, particularly in smaller municipalities and developing regions.

Customer demand increasingly focuses on integrated solutions that combine nanofiltration with complementary technologies to address specific contaminant profiles. There is growing interest in modular, scalable systems that can be deployed rapidly and expanded as needed, particularly in industrial applications where production volumes may fluctuate.

Sustainability considerations are reshaping market demands, with customers increasingly valuing technologies that minimize chemical usage, reduce energy consumption, and enable water reuse. This trend is particularly pronounced in water-stressed regions where circular economy approaches to water management are gaining traction.

Global Nanofiltration Technology Landscape and Barriers

Nanofiltration technology has evolved significantly over the past two decades, establishing itself as a critical component in advanced wastewater treatment systems globally. Currently, North America and Europe lead in nanofiltration implementation, accounting for approximately 60% of the global market share, with Asia-Pacific regions demonstrating the fastest growth rate at 15-18% annually. The technology landscape is characterized by varying degrees of adoption across different regions, influenced by regulatory frameworks, water scarcity challenges, and industrial development levels.

Major technological barriers persist despite widespread adoption. Membrane fouling remains the primary challenge, reducing operational efficiency by 20-30% and increasing maintenance costs significantly. Current anti-fouling strategies have only partially addressed this issue, with complete solutions still elusive. Additionally, high energy consumption continues to limit widespread implementation, particularly in developing regions where energy costs represent 40-50% of operational expenses for nanofiltration systems.

Material limitations present another significant barrier. While polymeric membranes dominate the market (approximately 85% market share), they face durability issues when exposed to harsh chemical environments common in industrial wastewater. Ceramic and composite membranes offer superior chemical resistance but at 3-5 times higher production costs, limiting their commercial viability for many applications.

Standardization challenges further complicate the global landscape. The absence of unified performance metrics and testing protocols has created market fragmentation, with regional specifications varying significantly. This inconsistency impedes technology transfer across borders and complicates comparative performance assessment, particularly evident in the 30% variance in reported removal efficiencies for similar systems across different regions.

Scale-up difficulties represent another critical barrier. Laboratory-scale successes often fail to translate to industrial applications, with approximately 40% of promising technologies unable to maintain performance metrics at commercial scale. This gap is particularly pronounced in emerging economies where technical expertise and infrastructure support may be limited.

Intellectual property concentration presents both opportunities and challenges. Five major corporations control approximately 65% of core nanofiltration patents, creating potential bottlenecks for innovation. However, recent years have seen increasing patent activity from academic institutions and startups, particularly in novel membrane materials and process optimization, suggesting a gradually diversifying innovation landscape that may address some existing technological barriers in the coming years.

Major technological barriers persist despite widespread adoption. Membrane fouling remains the primary challenge, reducing operational efficiency by 20-30% and increasing maintenance costs significantly. Current anti-fouling strategies have only partially addressed this issue, with complete solutions still elusive. Additionally, high energy consumption continues to limit widespread implementation, particularly in developing regions where energy costs represent 40-50% of operational expenses for nanofiltration systems.

Material limitations present another significant barrier. While polymeric membranes dominate the market (approximately 85% market share), they face durability issues when exposed to harsh chemical environments common in industrial wastewater. Ceramic and composite membranes offer superior chemical resistance but at 3-5 times higher production costs, limiting their commercial viability for many applications.

Standardization challenges further complicate the global landscape. The absence of unified performance metrics and testing protocols has created market fragmentation, with regional specifications varying significantly. This inconsistency impedes technology transfer across borders and complicates comparative performance assessment, particularly evident in the 30% variance in reported removal efficiencies for similar systems across different regions.

Scale-up difficulties represent another critical barrier. Laboratory-scale successes often fail to translate to industrial applications, with approximately 40% of promising technologies unable to maintain performance metrics at commercial scale. This gap is particularly pronounced in emerging economies where technical expertise and infrastructure support may be limited.

Intellectual property concentration presents both opportunities and challenges. Five major corporations control approximately 65% of core nanofiltration patents, creating potential bottlenecks for innovation. However, recent years have seen increasing patent activity from academic institutions and startups, particularly in novel membrane materials and process optimization, suggesting a gradually diversifying innovation landscape that may address some existing technological barriers in the coming years.

Current Nanofiltration Solutions for Wastewater Treatment

01 Nanofiltration membrane materials and fabrication

Nanofiltration membranes can be fabricated using various materials and techniques to achieve specific separation properties. These membranes typically have pore sizes between ultrafiltration and reverse osmosis membranes, allowing for selective separation of molecules and ions. Advanced fabrication methods include interfacial polymerization, phase inversion, and surface modification to enhance performance characteristics such as flux, selectivity, and fouling resistance.- Nanofiltration membrane materials and fabrication: Various materials and fabrication techniques are used to develop nanofiltration membranes with enhanced properties. These include composite membranes, polymer-based membranes, and membranes with modified surface characteristics. Advanced fabrication methods help improve membrane performance metrics such as flux, selectivity, and fouling resistance. The development of novel membrane materials focuses on optimizing pore size, charge density, and mechanical stability for specific separation applications.

- Water treatment and purification applications: Nanofiltration technology is widely applied in water treatment and purification processes. It effectively removes contaminants such as heavy metals, organic pollutants, and dissolved salts from various water sources. The technology bridges the gap between ultrafiltration and reverse osmosis, offering advantages in terms of lower energy consumption while maintaining high separation efficiency. Nanofiltration systems are implemented in drinking water production, wastewater reclamation, and industrial water treatment.

- Industrial separation and concentration processes: Nanofiltration technology enables efficient separation and concentration processes in various industries. It is used for the recovery of valuable components, concentration of products, and removal of impurities in food processing, pharmaceutical manufacturing, and chemical industries. The selective separation capabilities of nanofiltration membranes allow for precise fractionation of mixtures based on molecular size and charge, making it suitable for high-value product purification and process intensification.

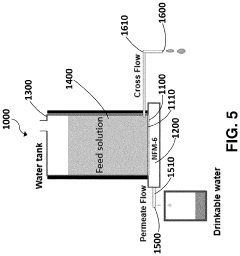

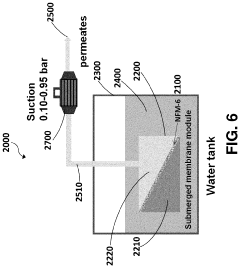

- Nanofiltration system design and optimization: The design and optimization of nanofiltration systems involve considerations of membrane module configuration, process parameters, and operational strategies. Various system designs, including spiral-wound, hollow fiber, and flat sheet configurations, are employed to maximize efficiency and minimize fouling. Process optimization techniques focus on controlling parameters such as pressure, temperature, cross-flow velocity, and recovery rate to achieve desired separation performance while reducing energy consumption and operational costs.

- Anti-fouling strategies and membrane cleaning: Membrane fouling is a significant challenge in nanofiltration operations that reduces efficiency and increases operational costs. Various anti-fouling strategies are developed, including surface modification of membranes, feed pretreatment, and optimized hydrodynamic conditions. Effective cleaning protocols, both chemical and physical, are essential for maintaining membrane performance and extending service life. Advanced monitoring techniques help detect fouling at early stages and implement timely cleaning interventions.

02 Water treatment and purification applications

Nanofiltration technology is widely applied in water treatment and purification processes. It effectively removes contaminants such as heavy metals, organic pollutants, and dissolved salts while maintaining essential minerals. The technology is particularly valuable for drinking water production, wastewater reclamation, and industrial water treatment where selective removal of specific contaminants is required while preserving beneficial components.Expand Specific Solutions03 Industrial separation and concentration processes

Nanofiltration systems are employed in various industrial separation and concentration processes. These include the concentration of valuable compounds in pharmaceutical manufacturing, food processing, and chemical industries. The technology enables efficient separation of components based on molecular size and charge, allowing for product purification, recovery of valuable materials, and waste stream treatment in industrial settings.Expand Specific Solutions04 Enhanced nanofiltration system designs

Advanced nanofiltration system designs incorporate innovations in module configuration, flow patterns, and operational parameters to optimize performance. These designs include spiral-wound modules, hollow fiber arrangements, and plate-and-frame systems with improved hydrodynamics. Enhanced systems may feature automated controls, energy recovery devices, and optimized cleaning protocols to increase efficiency, reduce fouling, and extend membrane life.Expand Specific Solutions05 Hybrid and integrated nanofiltration processes

Hybrid and integrated nanofiltration processes combine nanofiltration with other separation technologies to achieve superior performance. These integrated approaches may include pre-treatment steps such as coagulation or microfiltration, or post-treatment processes like reverse osmosis or adsorption. By combining multiple technologies, these hybrid systems can address complex separation challenges, improve overall efficiency, and provide more comprehensive treatment solutions for various applications.Expand Specific Solutions

Leading Companies in Wastewater Nanofiltration Industry

The wastewater nanofiltration technology market is currently in a growth phase, with increasing adoption driven by stringent environmental regulations and water scarcity concerns. The global market size is projected to expand significantly, reaching approximately $2.5 billion by 2027, with a CAGR of 5-7%. From a technical maturity perspective, established players like Siemens AG, Baker Hughes, and Aquatech International are leading commercial deployment with advanced membrane technologies, while academic institutions including Jiangnan University, National University of Singapore, and KU Leuven are driving fundamental research innovations. Chinese companies such as Zhejiang Jinmo Environment Technology are rapidly gaining market share through cost-effective solutions. The competitive landscape features a mix of multinational corporations, specialized water treatment firms, and emerging technology startups focusing on sustainability and efficiency improvements.

Siemens AG

Technical Solution: Siemens has developed the Memcor® NF nanofiltration technology platform specifically for industrial and municipal wastewater treatment applications. Their system utilizes advanced composite membranes with precisely engineered pore structures in the 1-10 nanometer range, allowing selective separation of contaminants based on size, charge, and chemical interactions. The technology incorporates proprietary low-fouling membrane chemistry with modified surface properties that maintain stable performance even with challenging wastewater streams. Siemens' approach integrates digital monitoring and control systems that optimize operational parameters in real-time, reducing energy consumption by up to 25% compared to conventional nanofiltration systems. Their modular skid-mounted design enables rapid deployment and scalability, while the automated cleaning and maintenance protocols extend membrane life by up to 30%. The system has demonstrated particular effectiveness in removing persistent organic pollutants, heavy metals, and pharmaceutical compounds from industrial wastewaters while allowing beneficial minerals to pass through.

Strengths: Advanced digital control systems optimize performance and reduce operational costs; robust design suitable for industrial environments; comprehensive global service network. Weaknesses: Higher initial investment compared to conventional treatment; requires specialized technical support; performance can be affected by extreme variations in influent quality.

Environmental Management Corp.

Technical Solution: Environmental Management Corporation (EMC) has developed the EcoFilter™ nanofiltration system specifically designed for decentralized wastewater treatment applications. Their technology utilizes thin-film composite nanofiltration membranes with specialized surface modifications that enhance resistance to organic fouling while maintaining high flux rates. The system features a unique tangential flow configuration that reduces membrane fouling by creating high shear forces at the membrane surface, extending operational cycles between cleanings by up to 40% compared to conventional designs. EMC's approach integrates nanofiltration with proprietary pre-treatment processes including advanced oxidation and electrocoagulation, creating a comprehensive solution for challenging wastewater streams. Their modular, containerized systems are particularly suited for remote locations and emergency deployment, with rapid installation times and minimal site preparation requirements. The technology has demonstrated exceptional performance in removing emerging contaminants of concern, including PFAS compounds, pharmaceutical residues, and endocrine disruptors, achieving removal rates exceeding 99% in field applications.

Strengths: Highly portable and modular design ideal for decentralized applications; lower capital costs compared to centralized systems; rapid deployment capabilities. Weaknesses: Limited economies of scale for larger applications; higher operational oversight requirements; more frequent membrane replacement cycles in challenging wastewater conditions.

Key Patents and Innovations in Nanofiltration Membranes

Super-high-permeance thin-film composite nanofiltration membrane incorporating silk nanofiber interlayer

PatentPendingUS20240058754A1

Innovation

- Development of nanofiltration membranes incorporating a silk layer, optionally with a porous substrate and selective layer, which significantly enhances water permeance and ion removal efficiency, utilizing silk nanomaterials like fibroin fibers with specific structural and chemical properties to improve mechanical stability and selectivity.

Environmental Impact and Sustainability Considerations

Nanofiltration technology represents a significant advancement in wastewater treatment with profound environmental implications. The implementation of nanofiltration systems substantially reduces the discharge of harmful contaminants into natural water bodies, protecting aquatic ecosystems and biodiversity. Studies indicate that nanofiltration can remove up to 98% of pharmaceutical residues, heavy metals, and persistent organic pollutants that conventional treatment methods often fail to address, thereby minimizing bioaccumulation risks in food chains.

From a sustainability perspective, nanofiltration enables water reclamation and reuse, addressing growing water scarcity challenges. By facilitating the closed-loop water cycle in industrial applications, this technology can reduce freshwater withdrawal by 30-60% in sectors such as textiles, food processing, and chemical manufacturing. This conservation aspect becomes increasingly critical as climate change exacerbates water stress in many regions globally.

Energy efficiency considerations represent both a challenge and opportunity for nanofiltration technologies. Current systems require 0.5-2.5 kWh per cubic meter of treated water, positioning them between reverse osmosis (more energy-intensive) and conventional filtration (less energy-intensive). Recent innovations in membrane materials, including biomimetic membranes and graphene-based composites, demonstrate potential for reducing energy requirements by up to 40%, enhancing the overall carbon footprint of treatment facilities.

The lifecycle assessment of nanofiltration systems reveals favorable environmental profiles compared to alternative advanced treatment technologies. Membrane manufacturing processes have become more sustainable, with reduced solvent usage and increased recycling of production materials. However, membrane disposal remains problematic, with most spent membranes currently directed to landfills. Emerging research into biodegradable membrane materials and effective recycling protocols represents a promising frontier for improving end-of-life sustainability.

Regulatory frameworks increasingly recognize nanofiltration's environmental benefits, with several countries implementing incentives for its adoption. The European Water Framework Directive specifically acknowledges membrane filtration as a preferred technology for meeting stringent effluent quality standards. Similarly, the United States EPA has included nanofiltration in its list of Best Available Technologies for removing contaminants of emerging concern, further legitimizing its environmental credentials.

The integration of nanofiltration with renewable energy sources presents perhaps the most promising sustainability pathway. Pilot projects utilizing solar-powered nanofiltration systems have demonstrated technical feasibility in remote locations and developing regions, potentially democratizing access to advanced water treatment technologies while minimizing carbon emissions associated with operation.

From a sustainability perspective, nanofiltration enables water reclamation and reuse, addressing growing water scarcity challenges. By facilitating the closed-loop water cycle in industrial applications, this technology can reduce freshwater withdrawal by 30-60% in sectors such as textiles, food processing, and chemical manufacturing. This conservation aspect becomes increasingly critical as climate change exacerbates water stress in many regions globally.

Energy efficiency considerations represent both a challenge and opportunity for nanofiltration technologies. Current systems require 0.5-2.5 kWh per cubic meter of treated water, positioning them between reverse osmosis (more energy-intensive) and conventional filtration (less energy-intensive). Recent innovations in membrane materials, including biomimetic membranes and graphene-based composites, demonstrate potential for reducing energy requirements by up to 40%, enhancing the overall carbon footprint of treatment facilities.

The lifecycle assessment of nanofiltration systems reveals favorable environmental profiles compared to alternative advanced treatment technologies. Membrane manufacturing processes have become more sustainable, with reduced solvent usage and increased recycling of production materials. However, membrane disposal remains problematic, with most spent membranes currently directed to landfills. Emerging research into biodegradable membrane materials and effective recycling protocols represents a promising frontier for improving end-of-life sustainability.

Regulatory frameworks increasingly recognize nanofiltration's environmental benefits, with several countries implementing incentives for its adoption. The European Water Framework Directive specifically acknowledges membrane filtration as a preferred technology for meeting stringent effluent quality standards. Similarly, the United States EPA has included nanofiltration in its list of Best Available Technologies for removing contaminants of emerging concern, further legitimizing its environmental credentials.

The integration of nanofiltration with renewable energy sources presents perhaps the most promising sustainability pathway. Pilot projects utilizing solar-powered nanofiltration systems have demonstrated technical feasibility in remote locations and developing regions, potentially democratizing access to advanced water treatment technologies while minimizing carbon emissions associated with operation.

Regulatory Framework for Water Purification Technologies

The regulatory landscape governing water purification technologies, particularly nanofiltration for wastewater treatment, has evolved significantly in response to growing water scarcity and contamination concerns. At the international level, organizations such as the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) have established guidelines that influence national regulatory frameworks, emphasizing the importance of advanced filtration technologies in meeting increasingly stringent water quality standards.

In the United States, the Environmental Protection Agency (EPA) regulates water purification technologies under the Clean Water Act and Safe Drinking Water Act, which establish maximum contaminant levels for various pollutants. Recent amendments have specifically addressed emerging contaminants such as PFAS (per- and polyfluoroalkyl substances), creating new opportunities for nanofiltration technologies that can effectively remove these persistent compounds. The EPA's National Pollutant Discharge Elimination System (NPDES) permit program further regulates wastewater discharges, driving industrial adoption of advanced treatment solutions.

The European Union's Water Framework Directive and Urban Waste Water Treatment Directive provide comprehensive regulatory frameworks that emphasize the "polluter pays" principle and establish progressive water quality objectives. The EU has recently strengthened regulations regarding micropollutants and pharmaceutical residues, areas where nanofiltration technologies demonstrate particular efficacy. These regulatory changes have accelerated market growth for advanced filtration solutions across European industrial and municipal sectors.

In Asia, China's Water Pollution Prevention and Control Action Plan (known as the "Water Ten Plan") has imposed strict discharge standards on industries, creating substantial market opportunities for wastewater treatment technologies. Similarly, Japan's stringent water quality regulations have fostered innovation in membrane filtration technologies, with particular emphasis on energy efficiency and membrane fouling reduction.

Compliance certification systems such as NSF International standards play a crucial role in market access for nanofiltration technologies. NSF/ANSI 61 certification for drinking water system components and NSF/ANSI 58 for reverse osmosis systems provide benchmarks that manufacturers must meet, influencing technology development pathways and commercial viability.

Emerging regulatory trends indicate increasing focus on resource recovery from wastewater, with several jurisdictions implementing frameworks that incentivize water reuse and nutrient recovery. This shift from "treatment for disposal" to "treatment for reuse" is creating new market opportunities for nanofiltration technologies that can produce high-quality effluent suitable for direct reuse applications.

Climate change adaptation policies are also reshaping the regulatory landscape, with many regions implementing water conservation mandates that favor advanced treatment technologies capable of enabling closed-loop water systems. These regulatory drivers are expected to accelerate adoption of nanofiltration solutions across multiple sectors in the coming decade.

In the United States, the Environmental Protection Agency (EPA) regulates water purification technologies under the Clean Water Act and Safe Drinking Water Act, which establish maximum contaminant levels for various pollutants. Recent amendments have specifically addressed emerging contaminants such as PFAS (per- and polyfluoroalkyl substances), creating new opportunities for nanofiltration technologies that can effectively remove these persistent compounds. The EPA's National Pollutant Discharge Elimination System (NPDES) permit program further regulates wastewater discharges, driving industrial adoption of advanced treatment solutions.

The European Union's Water Framework Directive and Urban Waste Water Treatment Directive provide comprehensive regulatory frameworks that emphasize the "polluter pays" principle and establish progressive water quality objectives. The EU has recently strengthened regulations regarding micropollutants and pharmaceutical residues, areas where nanofiltration technologies demonstrate particular efficacy. These regulatory changes have accelerated market growth for advanced filtration solutions across European industrial and municipal sectors.

In Asia, China's Water Pollution Prevention and Control Action Plan (known as the "Water Ten Plan") has imposed strict discharge standards on industries, creating substantial market opportunities for wastewater treatment technologies. Similarly, Japan's stringent water quality regulations have fostered innovation in membrane filtration technologies, with particular emphasis on energy efficiency and membrane fouling reduction.

Compliance certification systems such as NSF International standards play a crucial role in market access for nanofiltration technologies. NSF/ANSI 61 certification for drinking water system components and NSF/ANSI 58 for reverse osmosis systems provide benchmarks that manufacturers must meet, influencing technology development pathways and commercial viability.

Emerging regulatory trends indicate increasing focus on resource recovery from wastewater, with several jurisdictions implementing frameworks that incentivize water reuse and nutrient recovery. This shift from "treatment for disposal" to "treatment for reuse" is creating new market opportunities for nanofiltration technologies that can produce high-quality effluent suitable for direct reuse applications.

Climate change adaptation policies are also reshaping the regulatory landscape, with many regions implementing water conservation mandates that favor advanced treatment technologies capable of enabling closed-loop water systems. These regulatory drivers are expected to accelerate adoption of nanofiltration solutions across multiple sectors in the coming decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!