Study of Regulatory Standards in Wastewater Nanofiltration

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nanofiltration Regulatory Background and Objectives

Nanofiltration technology has evolved significantly over the past three decades, emerging as a critical membrane separation process positioned between reverse osmosis and ultrafiltration in terms of selectivity and operating pressure. Initially developed in the 1970s, nanofiltration gained substantial commercial traction in the 1990s as environmental regulations became more stringent and water scarcity issues intensified globally.

The regulatory landscape governing wastewater nanofiltration has been shaped by several key international frameworks, including the Clean Water Act in the United States, the Water Framework Directive in the European Union, and similar regulatory structures in Asia-Pacific regions. These frameworks have progressively lowered permissible discharge limits for various contaminants, driving innovation in treatment technologies.

Current regulatory trends indicate a shift toward more comprehensive control of emerging contaminants, including pharmaceuticals, personal care products, and industrial chemicals that traditional treatment methods struggle to remove. Nanofiltration has emerged as a promising solution due to its ability to target these specific contaminant classes while maintaining operational efficiency.

The primary technical objectives in the nanofiltration regulatory space include developing standardized testing protocols for membrane performance evaluation, establishing uniform quality criteria for treated effluent across different applications, and creating regulatory frameworks that balance technological feasibility with environmental protection goals.

Industry stakeholders have identified several critical gaps in the current regulatory framework, particularly regarding the lack of harmonized standards for nanofiltration membrane classification, inconsistent requirements across jurisdictions, and insufficient guidance on the management of concentrate streams generated during the filtration process.

Recent technological advancements have enabled nanofiltration systems to achieve higher selectivity and lower energy consumption, creating opportunities for regulatory frameworks to incorporate these improvements into updated standards. The trend toward digitalization and real-time monitoring also presents new possibilities for regulatory compliance verification and reporting.

The evolution of nanofiltration technology is closely intertwined with regulatory developments, with each driving innovation in the other. As regulations become more stringent, technology providers respond with enhanced solutions; as technology capabilities expand, regulators can establish more ambitious environmental protection goals.

Looking forward, the regulatory landscape for wastewater nanofiltration is expected to continue evolving toward a more holistic approach that considers the entire water treatment cycle, energy consumption, and resource recovery potential, rather than focusing solely on contaminant removal efficiency.

The regulatory landscape governing wastewater nanofiltration has been shaped by several key international frameworks, including the Clean Water Act in the United States, the Water Framework Directive in the European Union, and similar regulatory structures in Asia-Pacific regions. These frameworks have progressively lowered permissible discharge limits for various contaminants, driving innovation in treatment technologies.

Current regulatory trends indicate a shift toward more comprehensive control of emerging contaminants, including pharmaceuticals, personal care products, and industrial chemicals that traditional treatment methods struggle to remove. Nanofiltration has emerged as a promising solution due to its ability to target these specific contaminant classes while maintaining operational efficiency.

The primary technical objectives in the nanofiltration regulatory space include developing standardized testing protocols for membrane performance evaluation, establishing uniform quality criteria for treated effluent across different applications, and creating regulatory frameworks that balance technological feasibility with environmental protection goals.

Industry stakeholders have identified several critical gaps in the current regulatory framework, particularly regarding the lack of harmonized standards for nanofiltration membrane classification, inconsistent requirements across jurisdictions, and insufficient guidance on the management of concentrate streams generated during the filtration process.

Recent technological advancements have enabled nanofiltration systems to achieve higher selectivity and lower energy consumption, creating opportunities for regulatory frameworks to incorporate these improvements into updated standards. The trend toward digitalization and real-time monitoring also presents new possibilities for regulatory compliance verification and reporting.

The evolution of nanofiltration technology is closely intertwined with regulatory developments, with each driving innovation in the other. As regulations become more stringent, technology providers respond with enhanced solutions; as technology capabilities expand, regulators can establish more ambitious environmental protection goals.

Looking forward, the regulatory landscape for wastewater nanofiltration is expected to continue evolving toward a more holistic approach that considers the entire water treatment cycle, energy consumption, and resource recovery potential, rather than focusing solely on contaminant removal efficiency.

Market Analysis of Wastewater Nanofiltration Solutions

The global market for wastewater nanofiltration solutions has experienced significant growth in recent years, driven by increasing water scarcity concerns and stricter environmental regulations. The market was valued at approximately USD 750 million in 2022 and is projected to reach USD 1.2 billion by 2028, representing a compound annual growth rate (CAGR) of 8.2% during the forecast period.

Industrial applications currently dominate the market, accounting for nearly 45% of the total market share. This is primarily due to the increasing adoption of nanofiltration technologies in industries such as textiles, pharmaceuticals, and food processing, where regulatory compliance for wastewater discharge is becoming increasingly stringent. The municipal sector follows closely, representing about 35% of the market, with growing implementation in urban wastewater treatment facilities.

Geographically, North America and Europe lead the market with combined market shares of approximately 60%. This dominance can be attributed to advanced regulatory frameworks and higher investment capabilities in these regions. However, the Asia-Pacific region is emerging as the fastest-growing market, with a projected CAGR of 10.5% through 2028, driven by rapid industrialization, urbanization, and increasing regulatory pressure in countries like China and India.

The market is characterized by a growing demand for cost-effective and energy-efficient nanofiltration solutions that can meet increasingly stringent regulatory standards. End-users are particularly interested in systems that can effectively remove emerging contaminants such as pharmaceuticals, personal care products, and microplastics, which are becoming subjects of new regulations worldwide.

A notable trend is the increasing integration of nanofiltration with other treatment technologies to create comprehensive water treatment solutions. This integration is creating new market opportunities for technology providers who can offer holistic approaches to wastewater treatment that address multiple regulatory requirements simultaneously.

Customer segments are increasingly differentiated by their regulatory compliance needs rather than just by industry type. This shift is creating specialized market niches for nanofiltration solutions tailored to specific regulatory frameworks, such as those focused on heavy metal removal, pharmaceutical residue elimination, or nutrient recovery to meet circular economy regulations.

The competitive landscape is moderately fragmented, with several large water treatment companies and specialized membrane manufacturers competing for market share. Recent market consolidation through mergers and acquisitions suggests that companies are strategically positioning themselves to offer more comprehensive regulatory compliance solutions rather than standalone nanofiltration products.

Industrial applications currently dominate the market, accounting for nearly 45% of the total market share. This is primarily due to the increasing adoption of nanofiltration technologies in industries such as textiles, pharmaceuticals, and food processing, where regulatory compliance for wastewater discharge is becoming increasingly stringent. The municipal sector follows closely, representing about 35% of the market, with growing implementation in urban wastewater treatment facilities.

Geographically, North America and Europe lead the market with combined market shares of approximately 60%. This dominance can be attributed to advanced regulatory frameworks and higher investment capabilities in these regions. However, the Asia-Pacific region is emerging as the fastest-growing market, with a projected CAGR of 10.5% through 2028, driven by rapid industrialization, urbanization, and increasing regulatory pressure in countries like China and India.

The market is characterized by a growing demand for cost-effective and energy-efficient nanofiltration solutions that can meet increasingly stringent regulatory standards. End-users are particularly interested in systems that can effectively remove emerging contaminants such as pharmaceuticals, personal care products, and microplastics, which are becoming subjects of new regulations worldwide.

A notable trend is the increasing integration of nanofiltration with other treatment technologies to create comprehensive water treatment solutions. This integration is creating new market opportunities for technology providers who can offer holistic approaches to wastewater treatment that address multiple regulatory requirements simultaneously.

Customer segments are increasingly differentiated by their regulatory compliance needs rather than just by industry type. This shift is creating specialized market niches for nanofiltration solutions tailored to specific regulatory frameworks, such as those focused on heavy metal removal, pharmaceutical residue elimination, or nutrient recovery to meet circular economy regulations.

The competitive landscape is moderately fragmented, with several large water treatment companies and specialized membrane manufacturers competing for market share. Recent market consolidation through mergers and acquisitions suggests that companies are strategically positioning themselves to offer more comprehensive regulatory compliance solutions rather than standalone nanofiltration products.

Global Regulatory Standards and Technical Challenges

The global regulatory landscape for wastewater nanofiltration exhibits significant variation across different regions, reflecting diverse environmental priorities, economic development stages, and governance structures. In the European Union, the Water Framework Directive (2000/60/EC) establishes comprehensive guidelines for water quality management, while the Urban Waste Water Treatment Directive (91/271/EEC) specifically addresses treatment standards. These regulations have progressively incorporated nanofiltration technologies as acceptable treatment methods, particularly for removing micropollutants and emerging contaminants.

The United States implements a decentralized regulatory approach through the Clean Water Act and Safe Drinking Water Act, administered by the Environmental Protection Agency (EPA). Recent amendments to these frameworks have begun to address advanced filtration technologies, though specific nanofiltration standards remain less prescriptive than their European counterparts. The EPA's Effluent Guidelines Program continues to evolve to incorporate emerging treatment technologies, creating both opportunities and compliance challenges for technology developers.

In Asia, regulatory frameworks demonstrate significant heterogeneity. Japan maintains stringent wastewater treatment standards comparable to European regulations, with explicit provisions for membrane filtration technologies in its Water Pollution Control Law. China has rapidly strengthened its environmental regulations through the Water Pollution Prevention and Control Law, with the 2018 amendments specifically addressing advanced treatment technologies including nanofiltration for industrial effluents.

A critical technical challenge in regulatory compliance involves the standardization of nanofiltration performance metrics. Current regulations often specify outcome-based requirements (contaminant concentration limits) rather than technology-specific parameters, creating uncertainty in compliance verification. The absence of universally accepted testing protocols for nanofiltration membrane performance represents a significant barrier to global technology adoption and regulatory harmonization.

Energy consumption requirements present another regulatory challenge, as different jurisdictions impose varying efficiency standards. The European Union's Energy Efficiency Directive increasingly influences wastewater treatment technology selection, while developing nations often prioritize treatment effectiveness over energy efficiency in their regulatory frameworks, creating divergent market requirements for technology providers.

Emerging contaminants regulation represents perhaps the most dynamic regulatory challenge. Pharmaceuticals, personal care products, and microplastics are increasingly targeted by regulatory frameworks, with nanofiltration positioned as a potential solution. However, the rapid evolution of these regulations creates compliance uncertainty, as detection limits and acceptable thresholds continue to shift across jurisdictions.

Cross-border harmonization efforts through organizations like ISO (particularly ISO 16075 for treated wastewater reuse) and the World Health Organization provide frameworks for regulatory convergence, though implementation remains fragmented. This regulatory heterogeneity necessitates adaptable nanofiltration technology designs capable of meeting diverse and evolving compliance requirements across global markets.

The United States implements a decentralized regulatory approach through the Clean Water Act and Safe Drinking Water Act, administered by the Environmental Protection Agency (EPA). Recent amendments to these frameworks have begun to address advanced filtration technologies, though specific nanofiltration standards remain less prescriptive than their European counterparts. The EPA's Effluent Guidelines Program continues to evolve to incorporate emerging treatment technologies, creating both opportunities and compliance challenges for technology developers.

In Asia, regulatory frameworks demonstrate significant heterogeneity. Japan maintains stringent wastewater treatment standards comparable to European regulations, with explicit provisions for membrane filtration technologies in its Water Pollution Control Law. China has rapidly strengthened its environmental regulations through the Water Pollution Prevention and Control Law, with the 2018 amendments specifically addressing advanced treatment technologies including nanofiltration for industrial effluents.

A critical technical challenge in regulatory compliance involves the standardization of nanofiltration performance metrics. Current regulations often specify outcome-based requirements (contaminant concentration limits) rather than technology-specific parameters, creating uncertainty in compliance verification. The absence of universally accepted testing protocols for nanofiltration membrane performance represents a significant barrier to global technology adoption and regulatory harmonization.

Energy consumption requirements present another regulatory challenge, as different jurisdictions impose varying efficiency standards. The European Union's Energy Efficiency Directive increasingly influences wastewater treatment technology selection, while developing nations often prioritize treatment effectiveness over energy efficiency in their regulatory frameworks, creating divergent market requirements for technology providers.

Emerging contaminants regulation represents perhaps the most dynamic regulatory challenge. Pharmaceuticals, personal care products, and microplastics are increasingly targeted by regulatory frameworks, with nanofiltration positioned as a potential solution. However, the rapid evolution of these regulations creates compliance uncertainty, as detection limits and acceptable thresholds continue to shift across jurisdictions.

Cross-border harmonization efforts through organizations like ISO (particularly ISO 16075 for treated wastewater reuse) and the World Health Organization provide frameworks for regulatory convergence, though implementation remains fragmented. This regulatory heterogeneity necessitates adaptable nanofiltration technology designs capable of meeting diverse and evolving compliance requirements across global markets.

Current Compliance Solutions for Nanofiltration Systems

01 Regulatory compliance for nanofiltration systems

Nanofiltration systems must comply with various regulatory standards to ensure safety and effectiveness. These regulations govern the design, manufacturing, and operation of nanofiltration equipment used in water treatment, pharmaceutical production, and food processing. Compliance with these standards ensures that nanofiltration systems meet quality requirements and operate within acceptable parameters for their intended applications.- Regulatory compliance frameworks for nanofiltration systems: Regulatory standards for nanofiltration systems require compliance with specific frameworks that govern their implementation and operation. These frameworks include guidelines for quality control, performance validation, and safety assessments. Companies implementing nanofiltration technologies must adhere to these regulatory requirements to ensure their systems meet established standards for various applications including water treatment, pharmaceutical processing, and food safety.

- Environmental protection standards for nanofiltration processes: Environmental protection standards for nanofiltration processes establish requirements for minimizing ecological impact while maintaining filtration efficiency. These standards address discharge limits, waste management protocols, and sustainability metrics for nanofiltration operations. Regulatory bodies have developed specific guidelines to ensure that nanofiltration technologies are implemented in an environmentally responsible manner, with particular focus on reducing chemical usage and managing concentrate disposal.

- Quality assurance protocols for nanofiltration in water treatment: Quality assurance protocols for nanofiltration in water treatment establish testing methodologies and performance criteria to ensure consistent filtration results. These protocols define acceptable contaminant removal rates, membrane integrity testing procedures, and operational parameters that must be maintained. Regulatory standards in this area focus on ensuring that nanofiltration systems reliably produce water that meets safety and quality requirements for various applications including drinking water, industrial processes, and wastewater treatment.

- Certification requirements for nanofiltration equipment and materials: Certification requirements for nanofiltration equipment and materials establish standards for manufacturing, material composition, and performance validation. These requirements ensure that nanofiltration membranes and associated components meet specific criteria for durability, chemical resistance, and filtration efficiency. Regulatory frameworks mandate testing protocols and documentation procedures that manufacturers must follow to obtain certification for their nanofiltration products before market entry.

- Monitoring and compliance verification systems for nanofiltration: Monitoring and compliance verification systems for nanofiltration establish protocols for ongoing assessment of operational parameters and filtration performance. These systems include requirements for data collection, record keeping, and periodic testing to ensure continued compliance with regulatory standards. Automated monitoring technologies and verification methodologies help operators maintain regulatory compliance while optimizing nanofiltration system performance across various industrial and municipal applications.

02 Environmental protection standards for nanofiltration

Environmental protection standards for nanofiltration focus on minimizing ecological impact while maximizing filtration efficiency. These regulations address discharge limits, waste management, and sustainability requirements for nanofiltration processes. The standards ensure that nanofiltration technologies contribute to environmental conservation through proper treatment of effluents and reduction of harmful discharges into natural water bodies.Expand Specific Solutions03 Quality control and certification requirements

Quality control and certification requirements for nanofiltration technologies establish protocols for testing, validation, and ongoing monitoring of filtration systems. These standards ensure consistent performance and reliability of nanofiltration membranes and equipment. Certification processes verify that nanofiltration systems meet industry-specific requirements for applications in drinking water treatment, pharmaceutical manufacturing, and other sensitive applications.Expand Specific Solutions04 International standards harmonization for nanofiltration

International standards harmonization efforts aim to create consistent regulatory frameworks for nanofiltration technologies across different countries and regions. These initiatives facilitate global trade of nanofiltration equipment and technology transfer while maintaining safety and quality standards. Harmonized standards address technical specifications, testing methodologies, and performance criteria to ensure interoperability and compliance across international markets.Expand Specific Solutions05 Digital compliance and monitoring systems

Digital compliance and monitoring systems leverage advanced technologies to ensure nanofiltration processes meet regulatory standards in real-time. These systems incorporate sensors, data analytics, and automated reporting to track performance metrics and regulatory compliance. Digital solutions enable more efficient regulatory oversight, predictive maintenance, and continuous verification that nanofiltration operations remain within approved parameters.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The regulatory landscape for wastewater nanofiltration is evolving rapidly as the technology matures from emerging to growth phase. The market is expanding at approximately 15% annually, driven by increasing water scarcity and stricter environmental regulations. Major industrial players like Evoqua Water Technologies, Veolia Water Technologies, and LG Chem are leading commercial applications, while academic institutions such as Tongji University, Tianjin University, and USC are advancing fundamental research. Chinese companies including Midea Group and GreenTech Environmental are gaining market share through cost-effective solutions. The technology has reached moderate maturity in industrial applications but continues to evolve with innovations in membrane materials and process optimization, creating a competitive environment where regulatory compliance capabilities increasingly differentiate market leaders.

Evoqua Water Technologies LLC

Technical Solution: Evoqua Water Technologies has developed advanced nanofiltration systems specifically designed to meet stringent regulatory standards for wastewater treatment. Their technology employs thin-film composite membranes with optimized pore sizes (typically 1-5 nm) that effectively remove dissolved contaminants while allowing beneficial minerals to pass through. The company's regulatory compliance approach integrates real-time monitoring systems that continuously track key parameters such as total dissolved solids, conductivity, and specific contaminant levels to ensure adherence to local and international standards. Evoqua's systems are designed with modular configurations that can be customized to address specific regulatory requirements across different industries and geographical regions, allowing for scalability and adaptability as standards evolve. Their technology also incorporates automated backwashing and cleaning protocols that maintain membrane performance while minimizing chemical usage, addressing both operational efficiency and environmental compliance concerns.

Strengths: Industry-leading expertise in regulatory compliance across multiple jurisdictions; extensive installed base providing real-world performance data; comprehensive service network supporting implementation and maintenance. Weaknesses: Higher initial capital investment compared to conventional filtration; requires specialized technical expertise for optimal operation; membrane fouling can still occur in challenging wastewater streams requiring additional pretreatment.

LG Chem Ltd.

Technical Solution: LG Chem has developed NanoH2O™ nanofiltration membrane technology specifically engineered to address stringent regulatory requirements for wastewater treatment across multiple industries. Their proprietary thin-film nanocomposite (TFN) membranes incorporate zeolite nanoparticles that create precisely controlled water channels at the molecular level, enabling selective filtration of contaminants while maintaining high flux rates. The technology achieves removal efficiencies exceeding 99% for regulated organic compounds and heavy metals while operating at pressures 20-30% lower than conventional nanofiltration membranes. LG Chem's regulatory compliance approach includes comprehensive material safety documentation and certification against international standards including NSF/ANSI 61 and EU REACH regulations. Their membranes feature a proprietary anti-fouling surface modification that extends operational life in challenging wastewater applications while maintaining consistent performance against regulatory parameters. The company has also developed specialized membrane formulations for specific regulatory challenges, such as enhanced PFAS removal capabilities to address emerging contaminant regulations in various jurisdictions.

Strengths: Industry-leading energy efficiency reducing operational costs; extensive material safety documentation facilitating regulatory approval; specialized formulations addressing emerging contaminants of concern. Weaknesses: Limited track record in certain industrial applications compared to established competitors; higher replacement costs for specialized membrane formulations; requires precise pretreatment to maintain optimal performance in challenging wastewater streams.

Critical Standards and Technical Specifications Analysis

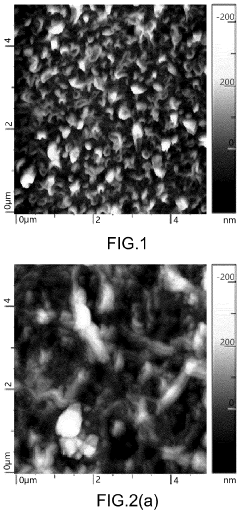

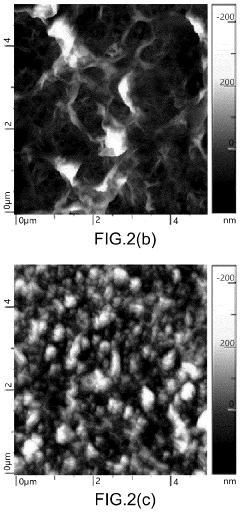

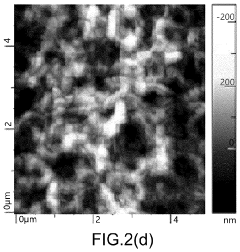

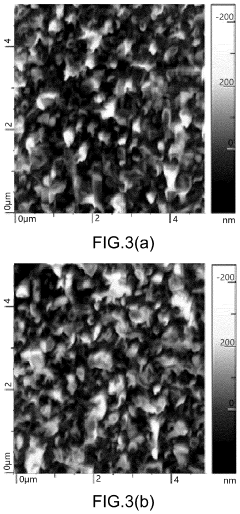

Nanofiltration membrane for treating printing and dyeing wastewater and its preparation method

PatentActiveUS11878921B2

Innovation

- A nanofiltration membrane is prepared using a polysulfone ultrafiltration membrane as a base, with m-phenylenediamine and trimesoyl chloride polymerized to form a polyamide active layer, aided by camphorsulfonic acid as a phase transfer catalyst and triethylamine to control reaction conditions, and interfacial auxiliary polymerization agents like acetone and acetic ester to enhance compatibility and structure, resulting in a membrane with improved water flux and rejection rates at reduced filtration pressure.

Cross-Border Regulatory Harmonization Opportunities

The global nature of water scarcity and pollution challenges necessitates international cooperation in regulatory approaches to wastewater nanofiltration technologies. Currently, significant disparities exist between regulatory frameworks across different regions, creating barriers to technology transfer and implementation of advanced nanofiltration solutions. These disparities stem from varying environmental priorities, economic development stages, and scientific assessment methodologies.

Harmonization of regulatory standards presents substantial opportunities for accelerating the adoption of nanofiltration technologies worldwide. The European Union's Water Framework Directive could serve as a potential model for standardization, as it provides comprehensive guidelines for water quality parameters while allowing flexibility for regional implementation. Similarly, the WHO's Guidelines for Drinking-water Quality offers internationally recognized benchmarks that could be extended to treated wastewater applications.

Key areas for cross-border harmonization include standardized testing protocols for nanofiltration membrane performance, unified classification systems for contaminants of emerging concern, and consistent methodologies for risk assessment of nanoparticle release from filtration systems. The development of these shared standards would significantly reduce compliance costs for technology developers and accelerate market entry across multiple jurisdictions.

International organizations such as ISO and OECD are already facilitating dialogue on harmonized approaches to nanotechnology regulation, which could be leveraged specifically for nanofiltration applications. The ISO/TC 229 committee on nanotechnologies has established working groups focused on terminology and nomenclature, measurement and characterization, and environmental health and safety—all critical components for regulatory alignment.

Bilateral and multilateral trade agreements represent another avenue for regulatory harmonization, particularly through mutual recognition arrangements for testing and certification. The recent USMCA (United States-Mexico-Canada Agreement) includes provisions for regulatory cooperation that could be expanded to include water treatment technologies, creating a North American framework for nanofiltration standards.

Developing nations stand to benefit significantly from harmonized regulations, as they could adopt proven regulatory frameworks rather than developing systems from scratch. Technical assistance programs through organizations like UNEP and the World Bank could support capacity building for regulatory implementation in these regions, ensuring that harmonization efforts are truly global in scope.

Harmonization of regulatory standards presents substantial opportunities for accelerating the adoption of nanofiltration technologies worldwide. The European Union's Water Framework Directive could serve as a potential model for standardization, as it provides comprehensive guidelines for water quality parameters while allowing flexibility for regional implementation. Similarly, the WHO's Guidelines for Drinking-water Quality offers internationally recognized benchmarks that could be extended to treated wastewater applications.

Key areas for cross-border harmonization include standardized testing protocols for nanofiltration membrane performance, unified classification systems for contaminants of emerging concern, and consistent methodologies for risk assessment of nanoparticle release from filtration systems. The development of these shared standards would significantly reduce compliance costs for technology developers and accelerate market entry across multiple jurisdictions.

International organizations such as ISO and OECD are already facilitating dialogue on harmonized approaches to nanotechnology regulation, which could be leveraged specifically for nanofiltration applications. The ISO/TC 229 committee on nanotechnologies has established working groups focused on terminology and nomenclature, measurement and characterization, and environmental health and safety—all critical components for regulatory alignment.

Bilateral and multilateral trade agreements represent another avenue for regulatory harmonization, particularly through mutual recognition arrangements for testing and certification. The recent USMCA (United States-Mexico-Canada Agreement) includes provisions for regulatory cooperation that could be expanded to include water treatment technologies, creating a North American framework for nanofiltration standards.

Developing nations stand to benefit significantly from harmonized regulations, as they could adopt proven regulatory frameworks rather than developing systems from scratch. Technical assistance programs through organizations like UNEP and the World Bank could support capacity building for regulatory implementation in these regions, ensuring that harmonization efforts are truly global in scope.

Environmental Impact Assessment Frameworks

Environmental impact assessment frameworks for wastewater nanofiltration technologies have evolved significantly over the past decade, reflecting growing concerns about water quality and ecosystem health. These frameworks provide structured methodologies to evaluate the environmental consequences of implementing nanofiltration systems in wastewater treatment facilities.

The primary components of these assessment frameworks typically include life cycle assessment (LCA), environmental risk assessment (ERA), and sustainability metrics. LCA examines the environmental impacts throughout the entire lifecycle of nanofiltration membranes, from raw material extraction to disposal or recycling. This approach helps quantify energy consumption, carbon footprint, and resource depletion associated with nanofiltration technologies.

Regulatory bodies worldwide have developed specific protocols for assessing the environmental impacts of nanofiltration. The European Union's Water Framework Directive incorporates comprehensive guidelines for evaluating treatment technologies, while the U.S. Environmental Protection Agency employs the National Environmental Policy Act (NEPA) framework to assess potential environmental effects of wastewater treatment innovations.

Recent advancements in environmental impact assessment methodologies have introduced more sophisticated tools for quantifying ecosystem services affected by wastewater treatment processes. These include habitat equivalency analysis and resource equivalency analysis, which help translate environmental impacts into measurable ecological and economic terms.

The integration of nanomaterial risk assessment into these frameworks represents a critical development. As nanofiltration employs engineered nanomaterials, specialized protocols have been established to evaluate potential nanoparticle release and subsequent ecological impacts. The Organization for Economic Cooperation and Development (OECD) has published specific guidelines for testing the environmental behavior and ecotoxicity of manufactured nanomaterials used in filtration systems.

Water quality impact matrices form another essential component of these frameworks, allowing for systematic evaluation of how nanofiltration affects receiving water bodies. These matrices track changes in parameters such as biological oxygen demand, total dissolved solids, heavy metals, and emerging contaminants before and after treatment.

Cumulative impact assessment methodologies have also been incorporated to evaluate how nanofiltration systems interact with existing environmental stressors. This approach recognizes that environmental impacts rarely occur in isolation and must be considered within the broader context of watershed management and regional environmental conditions.

The development of standardized environmental performance indicators specifically for membrane filtration technologies has enhanced the comparability of different nanofiltration systems. These indicators typically address membrane fouling rates, chemical cleaning requirements, concentrate disposal impacts, and energy efficiency metrics.

The primary components of these assessment frameworks typically include life cycle assessment (LCA), environmental risk assessment (ERA), and sustainability metrics. LCA examines the environmental impacts throughout the entire lifecycle of nanofiltration membranes, from raw material extraction to disposal or recycling. This approach helps quantify energy consumption, carbon footprint, and resource depletion associated with nanofiltration technologies.

Regulatory bodies worldwide have developed specific protocols for assessing the environmental impacts of nanofiltration. The European Union's Water Framework Directive incorporates comprehensive guidelines for evaluating treatment technologies, while the U.S. Environmental Protection Agency employs the National Environmental Policy Act (NEPA) framework to assess potential environmental effects of wastewater treatment innovations.

Recent advancements in environmental impact assessment methodologies have introduced more sophisticated tools for quantifying ecosystem services affected by wastewater treatment processes. These include habitat equivalency analysis and resource equivalency analysis, which help translate environmental impacts into measurable ecological and economic terms.

The integration of nanomaterial risk assessment into these frameworks represents a critical development. As nanofiltration employs engineered nanomaterials, specialized protocols have been established to evaluate potential nanoparticle release and subsequent ecological impacts. The Organization for Economic Cooperation and Development (OECD) has published specific guidelines for testing the environmental behavior and ecotoxicity of manufactured nanomaterials used in filtration systems.

Water quality impact matrices form another essential component of these frameworks, allowing for systematic evaluation of how nanofiltration affects receiving water bodies. These matrices track changes in parameters such as biological oxygen demand, total dissolved solids, heavy metals, and emerging contaminants before and after treatment.

Cumulative impact assessment methodologies have also been incorporated to evaluate how nanofiltration systems interact with existing environmental stressors. This approach recognizes that environmental impacts rarely occur in isolation and must be considered within the broader context of watershed management and regional environmental conditions.

The development of standardized environmental performance indicators specifically for membrane filtration technologies has enhanced the comparability of different nanofiltration systems. These indicators typically address membrane fouling rates, chemical cleaning requirements, concentrate disposal impacts, and energy efficiency metrics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!