Current Regulatory Framework for Wastewater Nanofiltration

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nanofiltration Technology Evolution and Objectives

Nanofiltration technology has evolved significantly since its inception in the late 1970s, emerging as a specialized membrane filtration process positioned between reverse osmosis and ultrafiltration in terms of selectivity. The initial development focused primarily on water softening applications, with early membranes demonstrating limited selectivity and operational efficiency. By the 1990s, advancements in polymer chemistry and membrane manufacturing techniques led to the creation of more robust nanofiltration membranes with enhanced separation capabilities and reduced energy consumption.

The evolution of nanofiltration technology has been characterized by several key milestones. The transition from cellulose acetate membranes to thin-film composite membranes marked a significant improvement in performance and durability. Subsequently, the development of charged nanofiltration membranes in the early 2000s expanded the technology's application scope by enabling more selective ion separation based on both size and charge interactions.

Recent technological advancements have focused on addressing persistent challenges such as membrane fouling, chlorine tolerance, and energy efficiency. The integration of nanomaterials, including graphene oxide, carbon nanotubes, and metal-organic frameworks, has opened new possibilities for creating next-generation nanofiltration membranes with superior performance characteristics. These innovations have significantly expanded the potential applications of nanofiltration beyond traditional water treatment to include pharmaceutical separation, food processing, and resource recovery from wastewater.

The primary technical objectives for nanofiltration in wastewater treatment include developing membranes with enhanced selectivity for specific contaminants of concern, particularly emerging pollutants such as pharmaceuticals, personal care products, and microplastics. Improving membrane resistance to fouling remains a critical goal, as fouling significantly impacts operational efficiency and membrane lifespan in wastewater applications.

Energy optimization represents another key objective, with research focused on reducing the energy footprint of nanofiltration systems through improved membrane permeability, module design, and operational strategies. The development of chlorine-resistant membranes is particularly important for wastewater applications, where disinfection is often necessary but can damage conventional membrane materials.

Looking forward, the integration of nanofiltration with complementary technologies, such as advanced oxidation processes and biological treatment, presents promising opportunities for creating more effective and sustainable wastewater treatment solutions. The trend toward modular, decentralized treatment systems is also driving innovation in nanofiltration technology, with a focus on developing compact, energy-efficient systems suitable for distributed applications.

The ultimate goal is to establish nanofiltration as a core technology in advanced wastewater treatment, capable of addressing increasingly stringent regulatory requirements while supporting water reuse initiatives and resource recovery objectives.

The evolution of nanofiltration technology has been characterized by several key milestones. The transition from cellulose acetate membranes to thin-film composite membranes marked a significant improvement in performance and durability. Subsequently, the development of charged nanofiltration membranes in the early 2000s expanded the technology's application scope by enabling more selective ion separation based on both size and charge interactions.

Recent technological advancements have focused on addressing persistent challenges such as membrane fouling, chlorine tolerance, and energy efficiency. The integration of nanomaterials, including graphene oxide, carbon nanotubes, and metal-organic frameworks, has opened new possibilities for creating next-generation nanofiltration membranes with superior performance characteristics. These innovations have significantly expanded the potential applications of nanofiltration beyond traditional water treatment to include pharmaceutical separation, food processing, and resource recovery from wastewater.

The primary technical objectives for nanofiltration in wastewater treatment include developing membranes with enhanced selectivity for specific contaminants of concern, particularly emerging pollutants such as pharmaceuticals, personal care products, and microplastics. Improving membrane resistance to fouling remains a critical goal, as fouling significantly impacts operational efficiency and membrane lifespan in wastewater applications.

Energy optimization represents another key objective, with research focused on reducing the energy footprint of nanofiltration systems through improved membrane permeability, module design, and operational strategies. The development of chlorine-resistant membranes is particularly important for wastewater applications, where disinfection is often necessary but can damage conventional membrane materials.

Looking forward, the integration of nanofiltration with complementary technologies, such as advanced oxidation processes and biological treatment, presents promising opportunities for creating more effective and sustainable wastewater treatment solutions. The trend toward modular, decentralized treatment systems is also driving innovation in nanofiltration technology, with a focus on developing compact, energy-efficient systems suitable for distributed applications.

The ultimate goal is to establish nanofiltration as a core technology in advanced wastewater treatment, capable of addressing increasingly stringent regulatory requirements while supporting water reuse initiatives and resource recovery objectives.

Wastewater Treatment Market Analysis

The global wastewater treatment market has experienced significant growth in recent years, driven by increasing water scarcity, stringent environmental regulations, and growing awareness of water quality issues. As of 2023, the market was valued at approximately $250 billion, with projections indicating a compound annual growth rate (CAGR) of 6.5% through 2030, potentially reaching $380 billion by the end of the decade.

Nanofiltration technology represents one of the fastest-growing segments within this market, currently accounting for about 15% of the total wastewater treatment technology share. This segment is expected to grow at a CAGR of 8.7% through 2028, outpacing the overall market growth due to its effectiveness in removing specific contaminants while maintaining essential minerals.

Regional analysis reveals that North America and Europe currently dominate the wastewater nanofiltration market, collectively holding approximately 60% market share. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization, urbanization, and increasingly stringent environmental policies.

By application segment, industrial wastewater treatment represents the largest market for nanofiltration technologies (45%), followed by municipal treatment (35%) and commercial applications (20%). Within industrial applications, the pharmaceutical, textile, and food & beverage sectors are the primary adopters of nanofiltration solutions due to their specific effluent characteristics and regulatory requirements.

Market demand is increasingly being shaped by regulatory frameworks, with regions implementing stricter discharge standards showing accelerated adoption of advanced filtration technologies. The European Union's Water Framework Directive and the United States EPA's Clean Water Act amendments have been particularly influential in driving market growth in their respective regions.

Customer preferences are evolving toward integrated water management solutions that combine nanofiltration with complementary technologies. This trend is reflected in the growing market for packaged or turnkey solutions, which has expanded by approximately 12% annually over the past five years.

Cost considerations remain a significant factor influencing market dynamics. While the initial capital expenditure for nanofiltration systems remains higher than conventional treatments, the total cost of ownership analysis increasingly favors nanofiltration when accounting for operational efficiency, maintenance requirements, and compliance with tightening regulations. The average return on investment period for industrial nanofiltration systems has decreased from 7-8 years a decade ago to 4-5 years currently.

Nanofiltration technology represents one of the fastest-growing segments within this market, currently accounting for about 15% of the total wastewater treatment technology share. This segment is expected to grow at a CAGR of 8.7% through 2028, outpacing the overall market growth due to its effectiveness in removing specific contaminants while maintaining essential minerals.

Regional analysis reveals that North America and Europe currently dominate the wastewater nanofiltration market, collectively holding approximately 60% market share. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization, urbanization, and increasingly stringent environmental policies.

By application segment, industrial wastewater treatment represents the largest market for nanofiltration technologies (45%), followed by municipal treatment (35%) and commercial applications (20%). Within industrial applications, the pharmaceutical, textile, and food & beverage sectors are the primary adopters of nanofiltration solutions due to their specific effluent characteristics and regulatory requirements.

Market demand is increasingly being shaped by regulatory frameworks, with regions implementing stricter discharge standards showing accelerated adoption of advanced filtration technologies. The European Union's Water Framework Directive and the United States EPA's Clean Water Act amendments have been particularly influential in driving market growth in their respective regions.

Customer preferences are evolving toward integrated water management solutions that combine nanofiltration with complementary technologies. This trend is reflected in the growing market for packaged or turnkey solutions, which has expanded by approximately 12% annually over the past five years.

Cost considerations remain a significant factor influencing market dynamics. While the initial capital expenditure for nanofiltration systems remains higher than conventional treatments, the total cost of ownership analysis increasingly favors nanofiltration when accounting for operational efficiency, maintenance requirements, and compliance with tightening regulations. The average return on investment period for industrial nanofiltration systems has decreased from 7-8 years a decade ago to 4-5 years currently.

Global Nanofiltration Challenges and Status

Nanofiltration technology has emerged as a critical solution for wastewater treatment globally, yet faces significant implementation challenges across different regions. Currently, approximately 80% of wastewater worldwide is discharged without adequate treatment, creating an urgent need for advanced filtration technologies. Nanofiltration represents a middle ground between reverse osmosis and ultrafiltration, offering selective removal of multivalent ions and organic compounds while operating at lower pressures than reverse osmosis systems.

The global landscape of nanofiltration implementation reveals stark regional disparities. In North America and Western Europe, nanofiltration has achieved moderate market penetration with established regulatory frameworks governing its application in municipal and industrial settings. These regions have developed specific discharge standards for treated wastewater and protocols for membrane technology implementation. In contrast, developing regions in Asia, Africa, and parts of Latin America face significant barriers to adoption, including limited infrastructure, insufficient technical expertise, and inadequate regulatory oversight.

Technical challenges persist across all markets, primarily centered on membrane fouling, which reduces efficiency and increases operational costs. Current data indicates that membrane fouling can decrease flux rates by 30-50% within operational cycles, necessitating frequent cleaning or replacement. Energy consumption remains another critical concern, with nanofiltration systems typically requiring 3-10 kWh per cubic meter of treated water, though this represents an improvement over reverse osmosis systems.

Regulatory frameworks governing nanofiltration vary substantially worldwide, creating a fragmented landscape for technology developers and implementers. The European Union has established the Water Framework Directive and Urban Waste Water Treatment Directive, which provide comprehensive guidelines for water quality standards and treatment methodologies. The United States relies on the Clean Water Act and Safe Drinking Water Act, administered by the Environmental Protection Agency, which set enforceable standards for wastewater discharge and treatment technologies.

Emerging economies present a more complex regulatory environment. China has recently strengthened its water pollution control regulations through the Water Pollution Prevention and Control Law, though enforcement remains inconsistent across provinces. India's National Green Tribunal has established guidelines for industrial wastewater treatment, but implementation faces significant challenges due to limited monitoring capacity and enforcement mechanisms.

The global nanofiltration market is projected to grow at a CAGR of 5.8% through 2027, driven by increasing water scarcity concerns and stricter environmental regulations. However, this growth remains constrained by the high capital costs associated with installation, which average $0.5-1.5 million for medium-scale municipal applications, and operational expenses ranging from $0.20-0.60 per cubic meter of treated water, creating significant barriers to adoption in resource-constrained regions.

The global landscape of nanofiltration implementation reveals stark regional disparities. In North America and Western Europe, nanofiltration has achieved moderate market penetration with established regulatory frameworks governing its application in municipal and industrial settings. These regions have developed specific discharge standards for treated wastewater and protocols for membrane technology implementation. In contrast, developing regions in Asia, Africa, and parts of Latin America face significant barriers to adoption, including limited infrastructure, insufficient technical expertise, and inadequate regulatory oversight.

Technical challenges persist across all markets, primarily centered on membrane fouling, which reduces efficiency and increases operational costs. Current data indicates that membrane fouling can decrease flux rates by 30-50% within operational cycles, necessitating frequent cleaning or replacement. Energy consumption remains another critical concern, with nanofiltration systems typically requiring 3-10 kWh per cubic meter of treated water, though this represents an improvement over reverse osmosis systems.

Regulatory frameworks governing nanofiltration vary substantially worldwide, creating a fragmented landscape for technology developers and implementers. The European Union has established the Water Framework Directive and Urban Waste Water Treatment Directive, which provide comprehensive guidelines for water quality standards and treatment methodologies. The United States relies on the Clean Water Act and Safe Drinking Water Act, administered by the Environmental Protection Agency, which set enforceable standards for wastewater discharge and treatment technologies.

Emerging economies present a more complex regulatory environment. China has recently strengthened its water pollution control regulations through the Water Pollution Prevention and Control Law, though enforcement remains inconsistent across provinces. India's National Green Tribunal has established guidelines for industrial wastewater treatment, but implementation faces significant challenges due to limited monitoring capacity and enforcement mechanisms.

The global nanofiltration market is projected to grow at a CAGR of 5.8% through 2027, driven by increasing water scarcity concerns and stricter environmental regulations. However, this growth remains constrained by the high capital costs associated with installation, which average $0.5-1.5 million for medium-scale municipal applications, and operational expenses ranging from $0.20-0.60 per cubic meter of treated water, creating significant barriers to adoption in resource-constrained regions.

Current Nanofiltration Regulatory Compliance Solutions

01 Regulatory compliance for nanofiltration systems

Nanofiltration systems must comply with various regulatory frameworks established by governmental bodies. These regulations typically cover aspects such as water quality standards, permissible contaminant levels, and operational requirements. Compliance with these regulations is essential for the implementation and operation of nanofiltration systems in water treatment facilities, ensuring that treated water meets safety standards for human consumption and environmental discharge.- Regulatory compliance for nanofiltration in water treatment: Nanofiltration systems used in water treatment must comply with specific regulatory frameworks that govern water quality standards, safety protocols, and environmental impact assessments. These regulations typically include requirements for monitoring contaminant removal efficiency, membrane performance validation, and certification processes. Compliance with these frameworks ensures that nanofiltration technologies meet public health standards while minimizing environmental impacts.

- International standards for nanofiltration membrane manufacturing: Manufacturing of nanofiltration membranes is subject to international standards that regulate material composition, production processes, and quality control measures. These standards ensure consistency in membrane performance, durability, and safety across different applications. Manufacturers must adhere to specific guidelines regarding polymer composition, pore size distribution, and chemical resistance to ensure their products meet global regulatory requirements.

- Certification requirements for nanofiltration in pharmaceutical applications: Nanofiltration systems used in pharmaceutical processing must meet stringent certification requirements to ensure product purity and safety. Regulatory frameworks in this sector focus on validation protocols, documentation standards, and quality assurance systems. These regulations typically include requirements for material compatibility testing, process validation, and contamination control strategies to ensure that nanofiltration processes maintain pharmaceutical grade standards.

- Environmental regulations for nanofiltration waste management: Disposal of waste products from nanofiltration processes is subject to environmental regulations that govern concentrate management, membrane disposal, and chemical handling. These frameworks aim to minimize ecological impacts while promoting sustainable practices in nanofiltration applications. Regulations typically address issues such as concentrate discharge limits, membrane recycling requirements, and protocols for handling potentially hazardous cleaning chemicals used in membrane maintenance.

- Emerging regulatory frameworks for novel nanofiltration technologies: As nanofiltration technologies evolve, new regulatory frameworks are being developed to address emerging applications and potential risks. These include regulations for nanofiltration in food processing, biotechnology, and specialized industrial applications. Regulatory bodies are working to establish appropriate standards for risk assessment, performance evaluation, and safety monitoring of novel nanofiltration systems while balancing innovation with consumer and environmental protection.

02 Environmental protection standards for nanofiltration processes

Nanofiltration processes are subject to environmental protection standards that govern their impact on ecosystems. These standards regulate aspects such as waste discharge, energy consumption, and chemical usage in nanofiltration operations. The regulatory framework aims to minimize the environmental footprint of nanofiltration technologies while maximizing their efficiency in removing contaminants from water sources.Expand Specific Solutions03 Quality control and certification requirements

Nanofiltration technologies must meet specific quality control and certification requirements before they can be commercially deployed. These requirements include performance testing, material safety assessments, and operational reliability verification. Certification processes often involve third-party testing and validation to ensure that nanofiltration systems consistently deliver the expected filtration performance while maintaining safety standards throughout their operational lifecycle.Expand Specific Solutions04 International standards harmonization for nanofiltration

The regulatory framework for nanofiltration includes efforts to harmonize international standards to facilitate global trade and technology transfer. These harmonization initiatives aim to establish common testing methodologies, performance metrics, and safety requirements across different jurisdictions. By aligning regulatory approaches, manufacturers can design nanofiltration systems that comply with multiple regional requirements, reducing barriers to market entry and accelerating the adoption of advanced filtration technologies worldwide.Expand Specific Solutions05 Emerging regulations for novel nanofiltration applications

As nanofiltration technology evolves and finds applications in new sectors, regulatory frameworks are being developed to address these emerging uses. These regulations focus on specialized applications such as pharmaceutical manufacturing, food processing, and advanced industrial separations. The regulatory approach typically involves risk assessment methodologies specific to each application domain, considering factors such as membrane material compatibility, cross-contamination risks, and product quality implications.Expand Specific Solutions

Leading Companies in Wastewater Nanofiltration

The wastewater nanofiltration regulatory landscape is evolving as the technology matures, with the market currently in a growth phase. The global market is expanding rapidly due to increasing water scarcity concerns and stricter discharge regulations. Major industrial players like DuPont, BASF, LG Chem, and Evoqua Water Technologies are driving technological innovation, while specialized companies such as KX Technologies and BL Technology focus on niche applications. Chinese entities including Baowu Water Technology and GreenTech Environmental are gaining market share through government-backed initiatives. Academic institutions like the University of Hong Kong and National University of Singapore are contributing significant research advancements, creating a competitive ecosystem where regulatory compliance is becoming increasingly important for market participants.

BASF Corp.

Technical Solution: BASF has developed innovative nanofiltration solutions that align with current regulatory frameworks through their inge® ultrafiltration technology combined with specialized nanofiltration membrane chemistry. Their approach integrates multifunctional polymeric membranes with precisely controlled surface properties that enable selective removal of contaminants while maintaining compliance with discharge regulations. BASF's technology features proprietary membrane formulations that achieve 90-98% removal of organic micropollutants, heavy metals, and other regulated substances from industrial wastewater streams. Their systems incorporate advanced fouling-resistant materials that maintain consistent performance under varying influent conditions, ensuring reliable regulatory compliance over extended operational periods. BASF has also developed specialized membrane coating technologies that enhance selectivity for specific contaminants of regulatory concern, such as PFAS compounds and pharmaceutical residues. Their solutions include comprehensive monitoring systems that track key performance indicators related to regulatory compliance, with automated alerts when parameters approach compliance thresholds.

Strengths: Exceptional chemical resistance suitable for challenging industrial wastewaters; customizable membrane chemistry for specific regulatory targets; extensive global technical support network. Weaknesses: Higher energy consumption compared to some competing technologies; complex implementation requiring specialized engineering expertise; more challenging to retrofit into existing treatment systems.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed the FilmTec™ nanofiltration membrane technology specifically engineered to address current regulatory requirements for wastewater treatment across various industries. Their NF270 and NF90 membrane series feature proprietary thin-film composite structures with precisely controlled pore sizes that enable selective filtration of contaminants while optimizing flow rates and energy efficiency. DuPont's technology achieves 85-95% removal of divalent ions and organic compounds with molecular weights above 200-400 Daltons, aligning with increasingly stringent regulatory standards for effluent quality. Their membranes incorporate fouling-resistant surface modifications that extend operational lifespans in challenging wastewater environments while maintaining consistent regulatory compliance. DuPont has also developed specialized membrane configurations for specific regulatory challenges, such as their FilmTec Fortilife™ series designed for high-recovery applications where discharge volume limitations are regulatory concerns. The company provides comprehensive regulatory compliance documentation and testing protocols to support end-users in meeting discharge permit requirements across different jurisdictions.

Strengths: Industry-leading membrane durability and longevity; extensive performance data to support regulatory submissions; modular systems that can be configured to meet specific compliance requirements. Weaknesses: Requires precise pretreatment to maintain optimal performance; higher initial investment compared to conventional filtration; specialized expertise needed for system optimization.

Key Patents and Research in Nanofiltration Compliance

Nanofiltration membrane for treating printing and dyeing wastewater and its preparation method

PatentActiveUS11878921B2

Innovation

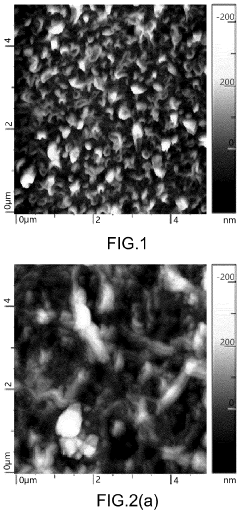

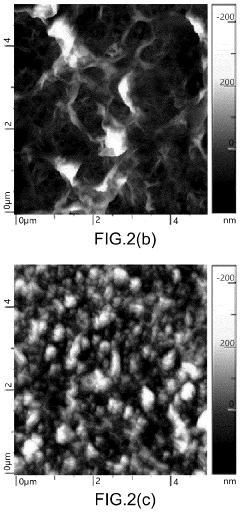

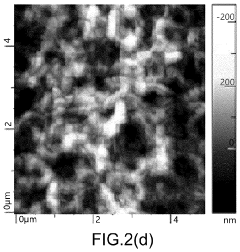

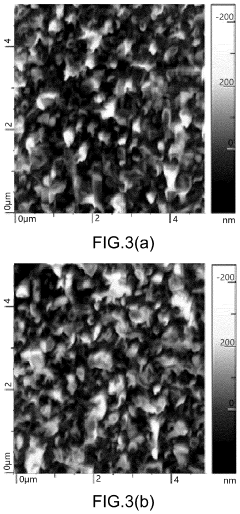

- A nanofiltration membrane is prepared using a polysulfone ultrafiltration membrane as a base, with m-phenylenediamine and trimesoyl chloride polymerized to form a polyamide active layer, aided by camphorsulfonic acid as a phase transfer catalyst and triethylamine to control reaction conditions, and interfacial auxiliary polymerization agents like acetone and acetic ester to enhance compatibility and structure, resulting in a membrane with improved water flux and rejection rates at reduced filtration pressure.

Novel NANO graphene based composite for water treatment application and method of synthesis thereof

PatentActiveIN1819DEL2015A

Innovation

- Development of novel surface fluorinated graphene-lanthanide orthovanadate (G-LnVO4) nanohybrids, prepared through a microwave-assisted hydrothermal process, which enhances photocatalytic degradation by reducing electron-hole pair recombination and promoting the formation of active radical species.

Environmental Impact Assessment

Nanofiltration technology for wastewater treatment presents significant environmental implications that must be thoroughly assessed. The implementation of nanofiltration systems generally results in reduced environmental footprints compared to conventional treatment methods. These systems require less chemical usage for disinfection and treatment, as the membrane filtration process physically removes contaminants rather than chemically treating them. This reduction in chemical dependency translates to fewer harmful byproducts being released into ecosystems and reduced chemical manufacturing impacts.

Energy consumption represents a critical environmental consideration for nanofiltration operations. While these systems require energy for pressure-driven filtration, technological advancements have progressively improved energy efficiency. Modern nanofiltration membranes operate at lower pressures than reverse osmosis systems, resulting in reduced energy demands. However, the environmental impact of this energy usage varies significantly depending on regional energy sources, with renewable-powered systems offering substantially lower carbon footprints.

Waste stream management constitutes another essential environmental factor. Nanofiltration processes generate concentrate streams containing rejected contaminants that require proper disposal or further treatment. The environmental impact of these concentrate streams depends on their composition, volume, and management approach. Advanced systems increasingly incorporate concentrate recovery technologies that extract valuable resources from waste streams, transforming potential environmental liabilities into recoverable assets.

The lifecycle assessment of nanofiltration systems reveals favorable environmental outcomes regarding membrane manufacturing, operational lifespan, and disposal considerations. Modern membranes demonstrate extended operational lifespans, reducing replacement frequency and associated manufacturing impacts. End-of-life management has also improved with emerging recycling technologies for spent membrane materials, though this remains an area requiring further development.

Water conservation represents perhaps the most significant environmental benefit of nanofiltration technology. By enabling water reuse and reclamation, these systems substantially reduce freshwater withdrawal requirements. This conservation effect is particularly valuable in water-stressed regions where ecosystem protection depends on maintaining adequate environmental flows. The ability to treat and reuse wastewater reduces discharge volumes into natural water bodies, minimizing habitat disruption and pollution impacts on aquatic ecosystems.

Climate resilience considerations further enhance the environmental case for nanofiltration. As climate change intensifies water scarcity in many regions, technologies enabling efficient water reuse become increasingly critical for environmental sustainability. Nanofiltration systems provide adaptable treatment solutions that can help communities maintain water security while reducing environmental pressures on natural water sources.

Energy consumption represents a critical environmental consideration for nanofiltration operations. While these systems require energy for pressure-driven filtration, technological advancements have progressively improved energy efficiency. Modern nanofiltration membranes operate at lower pressures than reverse osmosis systems, resulting in reduced energy demands. However, the environmental impact of this energy usage varies significantly depending on regional energy sources, with renewable-powered systems offering substantially lower carbon footprints.

Waste stream management constitutes another essential environmental factor. Nanofiltration processes generate concentrate streams containing rejected contaminants that require proper disposal or further treatment. The environmental impact of these concentrate streams depends on their composition, volume, and management approach. Advanced systems increasingly incorporate concentrate recovery technologies that extract valuable resources from waste streams, transforming potential environmental liabilities into recoverable assets.

The lifecycle assessment of nanofiltration systems reveals favorable environmental outcomes regarding membrane manufacturing, operational lifespan, and disposal considerations. Modern membranes demonstrate extended operational lifespans, reducing replacement frequency and associated manufacturing impacts. End-of-life management has also improved with emerging recycling technologies for spent membrane materials, though this remains an area requiring further development.

Water conservation represents perhaps the most significant environmental benefit of nanofiltration technology. By enabling water reuse and reclamation, these systems substantially reduce freshwater withdrawal requirements. This conservation effect is particularly valuable in water-stressed regions where ecosystem protection depends on maintaining adequate environmental flows. The ability to treat and reuse wastewater reduces discharge volumes into natural water bodies, minimizing habitat disruption and pollution impacts on aquatic ecosystems.

Climate resilience considerations further enhance the environmental case for nanofiltration. As climate change intensifies water scarcity in many regions, technologies enabling efficient water reuse become increasingly critical for environmental sustainability. Nanofiltration systems provide adaptable treatment solutions that can help communities maintain water security while reducing environmental pressures on natural water sources.

Cross-Border Regulatory Harmonization

The harmonization of regulatory frameworks across national boundaries represents a critical challenge in advancing wastewater nanofiltration technologies globally. Currently, significant disparities exist between regulatory approaches in different regions, creating barriers to technology transfer and implementation. The European Union has established the Water Framework Directive which provides comprehensive guidelines for water quality standards, while incorporating specific provisions for nanofiltration technologies in wastewater treatment. These regulations emphasize performance metrics and environmental safety considerations that differ substantially from those in North America and Asia.

The United States Environmental Protection Agency (EPA) maintains separate regulatory frameworks focused primarily on effluent quality standards rather than specific treatment technologies, creating a performance-based approach that contrasts with the more prescriptive European model. Meanwhile, countries like Singapore and Australia have developed advanced regulatory frameworks specifically addressing water recycling technologies including nanofiltration, establishing themselves as regulatory innovators in this space.

These regulatory divergences create significant challenges for technology developers and implementers operating across multiple jurisdictions. Companies must navigate complex compliance requirements that often necessitate redesigning systems or conducting redundant testing to satisfy different regional authorities. This regulatory fragmentation increases costs, delays implementation, and ultimately impedes the global adoption of advanced nanofiltration solutions for wastewater treatment.

Several international initiatives are currently underway to address these challenges through regulatory harmonization efforts. The International Organization for Standardization (ISO) has established technical committees focused on developing unified standards for membrane filtration technologies, including nanofiltration applications in wastewater treatment. These efforts aim to create globally recognized testing protocols and performance metrics that could be incorporated into national regulatory frameworks.

The World Health Organization has also published guidelines for water reuse that incorporate nanofiltration technologies, providing a foundation for international regulatory alignment. These guidelines emphasize risk-based approaches that could potentially bridge differences between prescriptive and performance-based regulatory systems. Additionally, bilateral agreements between major economic regions like the EU-US Mutual Recognition Agreement provide mechanisms for regulatory cooperation that could extend to wastewater treatment technologies.

Achieving meaningful cross-border regulatory harmonization will require continued multilateral engagement, with particular emphasis on establishing common technical standards, shared risk assessment methodologies, and mutual recognition frameworks. Success in this area would significantly accelerate the global implementation of advanced nanofiltration technologies for wastewater treatment, ultimately contributing to more sustainable water management practices worldwide.

The United States Environmental Protection Agency (EPA) maintains separate regulatory frameworks focused primarily on effluent quality standards rather than specific treatment technologies, creating a performance-based approach that contrasts with the more prescriptive European model. Meanwhile, countries like Singapore and Australia have developed advanced regulatory frameworks specifically addressing water recycling technologies including nanofiltration, establishing themselves as regulatory innovators in this space.

These regulatory divergences create significant challenges for technology developers and implementers operating across multiple jurisdictions. Companies must navigate complex compliance requirements that often necessitate redesigning systems or conducting redundant testing to satisfy different regional authorities. This regulatory fragmentation increases costs, delays implementation, and ultimately impedes the global adoption of advanced nanofiltration solutions for wastewater treatment.

Several international initiatives are currently underway to address these challenges through regulatory harmonization efforts. The International Organization for Standardization (ISO) has established technical committees focused on developing unified standards for membrane filtration technologies, including nanofiltration applications in wastewater treatment. These efforts aim to create globally recognized testing protocols and performance metrics that could be incorporated into national regulatory frameworks.

The World Health Organization has also published guidelines for water reuse that incorporate nanofiltration technologies, providing a foundation for international regulatory alignment. These guidelines emphasize risk-based approaches that could potentially bridge differences between prescriptive and performance-based regulatory systems. Additionally, bilateral agreements between major economic regions like the EU-US Mutual Recognition Agreement provide mechanisms for regulatory cooperation that could extend to wastewater treatment technologies.

Achieving meaningful cross-border regulatory harmonization will require continued multilateral engagement, with particular emphasis on establishing common technical standards, shared risk assessment methodologies, and mutual recognition frameworks. Success in this area would significantly accelerate the global implementation of advanced nanofiltration technologies for wastewater treatment, ultimately contributing to more sustainable water management practices worldwide.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!