Comparative Study of Boron Nitride Nanosheets and Boron Carbide

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BN Nanosheets and B4C Background and Research Objectives

Boron nitride nanosheets (BNNS) and boron carbide (B4C) represent two significant advanced materials that have garnered substantial research interest over the past few decades. The evolution of these materials traces back to the mid-20th century, with boron carbide first synthesized in 1934, while hexagonal boron nitride (h-BN), the precursor to BNNS, was studied extensively since the 1950s. The isolation of two-dimensional BNNS, however, gained momentum only after the groundbreaking discovery of graphene in 2004, which catalyzed research into other 2D materials.

The technological trajectory of these materials has been shaped by increasing demands for high-performance materials in extreme environments. BNNS, often referred to as "white graphene," exhibits remarkable thermal conductivity, electrical insulation properties, and mechanical strength, making it an ideal candidate for next-generation electronic devices and thermal management systems. Meanwhile, B4C has established itself as one of the hardest materials known, third only to diamond and cubic boron nitride, with exceptional wear resistance and neutron absorption capabilities.

Recent advancements in synthesis techniques have significantly improved the quality and scalability of both materials. For BNNS, methods such as chemical vapor deposition (CVD), liquid-phase exfoliation, and chemical exfoliation have enabled the production of large-area, high-quality nanosheets. Similarly, B4C manufacturing has evolved from traditional hot-pressing methods to more sophisticated techniques including spark plasma sintering and reactive hot pressing, enhancing its performance characteristics.

The primary objective of this comparative study is to establish a comprehensive understanding of the fundamental properties, synthesis methodologies, and application potentials of BNNS and B4C. By juxtaposing these materials, we aim to identify their respective advantages and limitations across various technological domains, including electronics, aerospace, nuclear industry, and advanced manufacturing.

Furthermore, this research seeks to explore potential synergistic effects when these materials are combined in composite structures. Preliminary studies suggest that BNNS-reinforced B4C composites may exhibit enhanced mechanical properties and thermal stability compared to pure B4C, opening new avenues for material design in extreme environments.

The technological goals of this investigation include mapping the performance boundaries of both materials under diverse operational conditions, identifying optimal synthesis parameters for tailored applications, and developing predictive models for material behavior in complex systems. Additionally, we aim to establish design principles for next-generation composites that leverage the complementary properties of these remarkable materials, potentially revolutionizing industries ranging from electronics to defense.

The technological trajectory of these materials has been shaped by increasing demands for high-performance materials in extreme environments. BNNS, often referred to as "white graphene," exhibits remarkable thermal conductivity, electrical insulation properties, and mechanical strength, making it an ideal candidate for next-generation electronic devices and thermal management systems. Meanwhile, B4C has established itself as one of the hardest materials known, third only to diamond and cubic boron nitride, with exceptional wear resistance and neutron absorption capabilities.

Recent advancements in synthesis techniques have significantly improved the quality and scalability of both materials. For BNNS, methods such as chemical vapor deposition (CVD), liquid-phase exfoliation, and chemical exfoliation have enabled the production of large-area, high-quality nanosheets. Similarly, B4C manufacturing has evolved from traditional hot-pressing methods to more sophisticated techniques including spark plasma sintering and reactive hot pressing, enhancing its performance characteristics.

The primary objective of this comparative study is to establish a comprehensive understanding of the fundamental properties, synthesis methodologies, and application potentials of BNNS and B4C. By juxtaposing these materials, we aim to identify their respective advantages and limitations across various technological domains, including electronics, aerospace, nuclear industry, and advanced manufacturing.

Furthermore, this research seeks to explore potential synergistic effects when these materials are combined in composite structures. Preliminary studies suggest that BNNS-reinforced B4C composites may exhibit enhanced mechanical properties and thermal stability compared to pure B4C, opening new avenues for material design in extreme environments.

The technological goals of this investigation include mapping the performance boundaries of both materials under diverse operational conditions, identifying optimal synthesis parameters for tailored applications, and developing predictive models for material behavior in complex systems. Additionally, we aim to establish design principles for next-generation composites that leverage the complementary properties of these remarkable materials, potentially revolutionizing industries ranging from electronics to defense.

Market Applications and Demand Analysis for BN and B4C Materials

The global market for both boron nitride nanosheets (BN) and boron carbide (B4C) materials has been experiencing significant growth, driven by their exceptional properties and expanding applications across multiple industries. The market for BN nanosheets is projected to grow at a CAGR of 5.8% through 2028, while the boron carbide market is expected to reach $158 million by 2026.

In the electronics sector, BN nanosheets have gained substantial traction due to their excellent thermal conductivity and electrical insulation properties. The increasing miniaturization of electronic components and the growing demand for efficient thermal management solutions have positioned BN nanosheets as a critical material for next-generation electronic devices. Major electronics manufacturers are incorporating BN-based thermal interface materials to enhance device performance and reliability.

The aerospace and defense industries represent significant markets for both materials, with boron carbide being particularly valued for its exceptional hardness and lightweight properties. The global military body armor market, where B4C is extensively used, is expanding at approximately 5.4% annually. Additionally, the aerospace sector's demand for lightweight, high-temperature resistant materials continues to drive adoption of both BN and B4C in specialized components.

Energy storage applications represent an emerging market for BN nanosheets, particularly in lithium-ion batteries where they can enhance thermal stability and cycling performance. Research indicates that BN-enhanced battery separators can improve battery safety and longevity, addressing critical concerns in electric vehicle and portable electronics markets.

The industrial sector remains the largest consumer of boron carbide, particularly for abrasive applications, where its extreme hardness makes it ideal for precision grinding and cutting tools. The global abrasives market, valued at over $40 billion, continues to drive steady demand for B4C materials.

Regional analysis reveals that Asia-Pacific dominates the market for both materials, accounting for approximately 45% of global consumption. This is primarily due to the region's robust electronics manufacturing base and growing industrial sector. North America and Europe follow, with significant demand coming from aerospace, defense, and advanced manufacturing applications.

Customer requirements are increasingly focused on material purity, consistency, and customization capabilities. End-users in high-tech industries demand materials with precisely controlled properties, driving manufacturers to invest in advanced production and purification technologies. Additionally, there is growing interest in environmentally sustainable production methods, particularly for BN nanosheets, as environmental regulations become more stringent globally.

In the electronics sector, BN nanosheets have gained substantial traction due to their excellent thermal conductivity and electrical insulation properties. The increasing miniaturization of electronic components and the growing demand for efficient thermal management solutions have positioned BN nanosheets as a critical material for next-generation electronic devices. Major electronics manufacturers are incorporating BN-based thermal interface materials to enhance device performance and reliability.

The aerospace and defense industries represent significant markets for both materials, with boron carbide being particularly valued for its exceptional hardness and lightweight properties. The global military body armor market, where B4C is extensively used, is expanding at approximately 5.4% annually. Additionally, the aerospace sector's demand for lightweight, high-temperature resistant materials continues to drive adoption of both BN and B4C in specialized components.

Energy storage applications represent an emerging market for BN nanosheets, particularly in lithium-ion batteries where they can enhance thermal stability and cycling performance. Research indicates that BN-enhanced battery separators can improve battery safety and longevity, addressing critical concerns in electric vehicle and portable electronics markets.

The industrial sector remains the largest consumer of boron carbide, particularly for abrasive applications, where its extreme hardness makes it ideal for precision grinding and cutting tools. The global abrasives market, valued at over $40 billion, continues to drive steady demand for B4C materials.

Regional analysis reveals that Asia-Pacific dominates the market for both materials, accounting for approximately 45% of global consumption. This is primarily due to the region's robust electronics manufacturing base and growing industrial sector. North America and Europe follow, with significant demand coming from aerospace, defense, and advanced manufacturing applications.

Customer requirements are increasingly focused on material purity, consistency, and customization capabilities. End-users in high-tech industries demand materials with precisely controlled properties, driving manufacturers to invest in advanced production and purification technologies. Additionally, there is growing interest in environmentally sustainable production methods, particularly for BN nanosheets, as environmental regulations become more stringent globally.

Current Development Status and Technical Barriers

Boron nitride nanosheets (BNNS) and boron carbide (B4C) represent two significant advanced materials with unique properties and applications. Currently, BNNS production has achieved considerable progress through various synthesis methods including chemical vapor deposition (CVD), mechanical exfoliation, and liquid-phase exfoliation. CVD methods yield high-quality BNNS with controlled thickness and crystallinity, while liquid-phase exfoliation offers scalability advantages despite producing smaller flakes with more defects. Recent advancements have enabled production of few-layer BNNS with lateral dimensions exceeding 100 μm.

Boron carbide development has focused on improving synthesis techniques and enhancing material properties. Traditional methods include carbothermal reduction and direct elemental synthesis, with recent innovations in spark plasma sintering (SPS) and reactive hot pressing significantly improving densification and mechanical properties. Commercial production has reached multi-ton annual capacity, primarily serving defense, nuclear, and abrasive applications.

Despite these advances, both materials face substantial technical barriers. For BNNS, large-scale production of defect-free, uniform sheets remains challenging. Current synthesis methods struggle with trade-offs between quality, yield, and cost-effectiveness. Controlling layer thickness and achieving consistent lateral dimensions present significant hurdles for industrial applications. Additionally, the transfer process of BNNS from growth substrates to target substrates often introduces contamination and structural damage.

Boron carbide faces different challenges, primarily related to its inherent brittleness and low fracture toughness, which limit its application in high-impact environments. The material exhibits amorphization under high pressure, leading to degraded mechanical properties. Processing difficulties arise from its high melting point (>2400°C) and hardness, making machining and shaping extremely challenging and costly. Furthermore, achieving full densification without grain growth requires precise control of sintering parameters.

Integration challenges exist for both materials in composite systems. For BNNS, achieving uniform dispersion and strong interfacial bonding with matrix materials remains problematic. For boron carbide, compatibility issues with certain metals and polymers limit composite development options. Additionally, both materials face economic barriers—BNNS production costs remain prohibitively high for many potential applications, while boron carbide's complex processing requirements drive up manufacturing expenses.

Research gaps include the need for improved understanding of structure-property relationships, particularly how defects and grain boundaries affect thermal and mechanical properties. Standardization of characterization methods is also lacking, making cross-study comparisons difficult. Environmental and health impact assessments for production processes and material handling remain incomplete, potentially creating regulatory hurdles for widespread adoption.

Boron carbide development has focused on improving synthesis techniques and enhancing material properties. Traditional methods include carbothermal reduction and direct elemental synthesis, with recent innovations in spark plasma sintering (SPS) and reactive hot pressing significantly improving densification and mechanical properties. Commercial production has reached multi-ton annual capacity, primarily serving defense, nuclear, and abrasive applications.

Despite these advances, both materials face substantial technical barriers. For BNNS, large-scale production of defect-free, uniform sheets remains challenging. Current synthesis methods struggle with trade-offs between quality, yield, and cost-effectiveness. Controlling layer thickness and achieving consistent lateral dimensions present significant hurdles for industrial applications. Additionally, the transfer process of BNNS from growth substrates to target substrates often introduces contamination and structural damage.

Boron carbide faces different challenges, primarily related to its inherent brittleness and low fracture toughness, which limit its application in high-impact environments. The material exhibits amorphization under high pressure, leading to degraded mechanical properties. Processing difficulties arise from its high melting point (>2400°C) and hardness, making machining and shaping extremely challenging and costly. Furthermore, achieving full densification without grain growth requires precise control of sintering parameters.

Integration challenges exist for both materials in composite systems. For BNNS, achieving uniform dispersion and strong interfacial bonding with matrix materials remains problematic. For boron carbide, compatibility issues with certain metals and polymers limit composite development options. Additionally, both materials face economic barriers—BNNS production costs remain prohibitively high for many potential applications, while boron carbide's complex processing requirements drive up manufacturing expenses.

Research gaps include the need for improved understanding of structure-property relationships, particularly how defects and grain boundaries affect thermal and mechanical properties. Standardization of characterization methods is also lacking, making cross-study comparisons difficult. Environmental and health impact assessments for production processes and material handling remain incomplete, potentially creating regulatory hurdles for widespread adoption.

Synthesis Methods and Characterization Techniques

01 Synthesis methods for boron nitride nanosheets

Various methods have been developed for synthesizing boron nitride nanosheets, including chemical vapor deposition, exfoliation techniques, and thermal treatments. These processes can control the thickness, size, and quality of the nanosheets. The synthesis often involves precursors like boron and nitrogen sources under specific temperature and pressure conditions to achieve desired crystalline structures and properties.- Synthesis methods for boron nitride nanosheets: Various methods have been developed for synthesizing boron nitride nanosheets, including chemical vapor deposition, exfoliation techniques, and thermal treatments. These processes can produce nanosheets with controlled thickness, crystallinity, and surface properties. The synthesis methods often involve precursors such as boron trioxide, ammonia, or other nitrogen-containing compounds under specific temperature and pressure conditions to achieve the desired hexagonal boron nitride structure.

- Boron carbide synthesis and processing techniques: Boron carbide can be synthesized through various methods including carbothermal reduction, direct reaction of elements, and chemical vapor deposition. Processing techniques involve sintering, hot pressing, and spark plasma sintering to create dense materials. These methods control the microstructure, grain size, and porosity of the final product, which directly affects its mechanical and physical properties. Advanced processing techniques have been developed to overcome challenges related to the high melting point and covalent bonding nature of boron carbide.

- Composite materials combining boron nitride nanosheets and boron carbide: Composite materials that incorporate both boron nitride nanosheets and boron carbide exhibit enhanced properties compared to the individual components. These composites benefit from the high thermal conductivity and electrical insulation of boron nitride nanosheets combined with the hardness and wear resistance of boron carbide. The synergistic effects result in materials with improved mechanical strength, thermal stability, and chemical resistance, making them suitable for extreme environment applications.

- Applications in armor and protective materials: Boron nitride nanosheets and boron carbide are extensively used in armor and protective materials due to their exceptional hardness, low density, and high strength. These materials can absorb and dissipate impact energy effectively, making them ideal for ballistic protection. The combination of boron nitride's thermal properties with boron carbide's mechanical strength creates lightweight yet highly protective materials for military, law enforcement, and civilian applications where protection against high-velocity projectiles is required.

- Functionalization and surface modification techniques: Functionalization and surface modification of boron nitride nanosheets and boron carbide enhance their compatibility with various matrices and expand their application range. These techniques include chemical treatments, plasma processing, and grafting of functional groups to alter surface properties. Modified materials show improved dispersion in polymers, metals, and ceramics, leading to better mechanical properties, thermal conductivity, and chemical stability in the resulting composites. Surface modifications also enable these materials to be used in specialized applications such as catalysis, sensors, and biomedical devices.

02 Boron carbide synthesis and processing

Boron carbide materials can be synthesized through various methods including carbothermal reduction, direct reaction of elements, and chemical vapor deposition. Processing techniques involve sintering, hot pressing, and spark plasma sintering to achieve desired density and mechanical properties. The processing parameters significantly affect the microstructure, hardness, and wear resistance of the final boron carbide products.Expand Specific Solutions03 Composite materials combining boron nitride and boron carbide

Composite materials that incorporate both boron nitride nanosheets and boron carbide exhibit enhanced mechanical, thermal, and electrical properties. These composites benefit from the high thermal conductivity and electrical insulation of boron nitride combined with the hardness and wear resistance of boron carbide. Applications include armor systems, cutting tools, and high-temperature structural components where both materials' properties are advantageous.Expand Specific Solutions04 Surface functionalization and modification techniques

Surface functionalization of boron nitride nanosheets and boron carbide can improve their compatibility with various matrices and enhance specific properties. Modification techniques include chemical treatments, plasma processing, and grafting of functional groups. These modifications can improve dispersion in composites, increase chemical reactivity, and tailor the interface properties for specific applications.Expand Specific Solutions05 Applications in thermal management and electronics

Boron nitride nanosheets and boron carbide materials are increasingly used in thermal management solutions and electronic applications. Their high thermal conductivity, electrical insulation properties, and stability at high temperatures make them ideal for heat dissipation in electronic devices, thermal interface materials, and substrates for electronic components. These materials can significantly improve device performance and reliability in high-power electronics.Expand Specific Solutions

Leading Research Institutions and Industrial Manufacturers

The boron nitride nanosheets and boron carbide market is currently in a growth phase, with increasing applications in advanced materials science. The global market size for these materials is expanding, driven by their exceptional thermal, mechanical, and electronic properties. Technologically, boron nitride nanosheets are more mature in research settings, while boron carbide has established industrial applications. Leading academic institutions (Shandong University, Northwestern University, McGill University) are advancing fundamental research, while commercial entities (IBM, Texas Instruments, Teijin Ltd.) are developing practical applications. National laboratories (Naval Research Laboratory, National Institute for Materials Science) bridge fundamental research with industrial applications. White Graphene Ltd. and Li-S Energy are emerging specialized players focusing on commercialization pathways for these materials in energy storage and electronic applications.

White Graphene Ltd.

Technical Solution: White Graphene Ltd. specializes in boron nitride nanosheets (BNNS) production and applications. Their proprietary technology enables large-scale synthesis of high-quality hexagonal boron nitride nanosheets with controlled thickness (from few-layer to monolayer) and lateral dimensions. The company employs a liquid-phase exfoliation method that combines ultrasonication with specialized solvents to achieve high yield and purity. Their BNNS products feature exceptional thermal conductivity (up to 2000 W/mK in-plane), electrical insulation properties (bandgap ~5.9 eV), and mechanical strength. White Graphene's materials are specifically engineered for thermal management applications in electronics, with demonstrated heat dissipation improvements of 30-45% compared to conventional materials. The company has also developed surface functionalization techniques to enhance BNNS compatibility with various polymer matrices for composite applications.

Strengths: Specialized expertise in BNNS production with scalable manufacturing capabilities; high-quality products with exceptional thermal and electrical properties; established applications in thermal management. Weaknesses: Limited comparative research on boron carbide materials; primarily focused on BNNS rather than offering comprehensive solutions across both material systems; relatively new market entrant compared to established materials science corporations.

National Institute for Materials Science IAI

Technical Solution: The National Institute for Materials Science (NIMS) has developed advanced synthesis methods for both boron nitride nanosheets (BNNS) and boron carbide (B4C) materials. Their comparative research demonstrates that BNNS exhibits superior thermal conductivity (up to 2000 W/mK in-plane) compared to boron carbide (~30-35 W/mK), while boron carbide offers significantly higher hardness (Vickers hardness ~30-35 GPa vs. ~10-15 GPa for BNNS). NIMS researchers have pioneered chemical vapor deposition (CVD) techniques for large-area, high-quality BNNS growth on various substrates with precise control over layer numbers. For boron carbide, they've developed innovative sintering processes that achieve near-theoretical density (>99%) while maintaining nanoscale grain structures. Their comparative studies have mapped the distinct performance boundaries of both materials across thermal, mechanical, and chemical resistance applications, providing crucial guidance for industry-specific implementations. NIMS has also explored hybrid structures combining both materials to create composites with tailored property profiles.

Strengths: Comprehensive research capabilities across both material systems; world-class characterization facilities enabling detailed comparative analyses; established synthesis methods for high-quality materials. Weaknesses: Primary focus on fundamental research rather than commercial applications; technology transfer pathways to industry may be less developed than commercial entities; research priorities may shift based on funding rather than market demands.

Key Properties and Performance Comparison

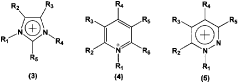

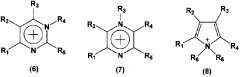

Boron nitride nanosheet-containing fluid dispersion and production method thereof, and boron nitride nanosheet composite and production method thereof

PatentActiveJP2015196632A

Innovation

- The use of superacids to disperse boron nitride nanosheets, allowing for the exfoliation and adsorption of the nanosheets, resulting in a highly dispersed state with improved stability and dispersibility.

Boron nitride nanosheet-containing fluid dispersion, boron nitride nanosheet composite and production method thereof

PatentActiveJP2015187057A

Innovation

- The use of ionic liquids to disperse and peel boron nitride nanosheets, utilizing cation-π and anion-π interactions to enhance dispersibility, with methods including sonication, stirring, and grinding treatments to achieve high dispersion stability and efficiency.

Environmental Impact and Sustainability Considerations

The environmental impact assessment of boron nitride nanosheets (BNNS) and boron carbide (B4C) reveals significant differences in their sustainability profiles. BNNS production typically involves chemical vapor deposition or exfoliation methods that consume less energy compared to the high-temperature carbothermal reduction required for B4C synthesis, which operates at temperatures exceeding 2000°C. This substantial energy requirement for B4C manufacturing translates to a larger carbon footprint, particularly when powered by non-renewable energy sources.

Waste generation patterns also differ markedly between these materials. BNNS production generates primarily chemical wastes from solvents and reagents used in exfoliation processes, while B4C manufacturing produces particulate emissions and solid waste residues containing potentially harmful boron compounds. The environmental persistence of these materials presents another consideration, with BNNS demonstrating higher stability in environmental conditions and lower degradation rates than certain forms of B4C.

Water usage represents a critical sustainability factor, with BNNS wet chemical processes requiring significant water volumes for synthesis and purification. In contrast, B4C production is less water-intensive but generates more problematic wastewater containing abrasive particles and dissolved boron compounds that require specialized treatment before discharge.

Life cycle assessment (LCA) studies indicate that BNNS may offer superior environmental performance in applications where its unique properties enable material efficiency gains. For instance, BNNS-enhanced thermal management systems can reduce overall energy consumption in electronics, potentially offsetting initial production impacts. B4C's durability in extreme environments, however, provides sustainability advantages through extended service life in applications like nuclear shielding and ballistic protection.

Recycling capabilities present distinct challenges for both materials. BNNS, particularly when incorporated into polymer composites, faces separation difficulties that currently limit end-of-life recovery. B4C components, while theoretically recyclable, often require energy-intensive processing to reclaim, with limited commercial recycling infrastructure currently available.

Recent regulatory developments increasingly impact both materials, with nanomaterial regulations affecting BNNS commercialization pathways and hazardous substance directives potentially restricting certain B4C applications. Forward-looking manufacturers are responding by developing greener synthesis routes, including biomass-derived precursors for BNNS and lower-temperature synthesis methods for B4C, demonstrating the industry's movement toward more sustainable production paradigms.

Waste generation patterns also differ markedly between these materials. BNNS production generates primarily chemical wastes from solvents and reagents used in exfoliation processes, while B4C manufacturing produces particulate emissions and solid waste residues containing potentially harmful boron compounds. The environmental persistence of these materials presents another consideration, with BNNS demonstrating higher stability in environmental conditions and lower degradation rates than certain forms of B4C.

Water usage represents a critical sustainability factor, with BNNS wet chemical processes requiring significant water volumes for synthesis and purification. In contrast, B4C production is less water-intensive but generates more problematic wastewater containing abrasive particles and dissolved boron compounds that require specialized treatment before discharge.

Life cycle assessment (LCA) studies indicate that BNNS may offer superior environmental performance in applications where its unique properties enable material efficiency gains. For instance, BNNS-enhanced thermal management systems can reduce overall energy consumption in electronics, potentially offsetting initial production impacts. B4C's durability in extreme environments, however, provides sustainability advantages through extended service life in applications like nuclear shielding and ballistic protection.

Recycling capabilities present distinct challenges for both materials. BNNS, particularly when incorporated into polymer composites, faces separation difficulties that currently limit end-of-life recovery. B4C components, while theoretically recyclable, often require energy-intensive processing to reclaim, with limited commercial recycling infrastructure currently available.

Recent regulatory developments increasingly impact both materials, with nanomaterial regulations affecting BNNS commercialization pathways and hazardous substance directives potentially restricting certain B4C applications. Forward-looking manufacturers are responding by developing greener synthesis routes, including biomass-derived precursors for BNNS and lower-temperature synthesis methods for B4C, demonstrating the industry's movement toward more sustainable production paradigms.

Cost-Benefit Analysis and Commercialization Potential

The economic viability of both boron nitride nanosheets (BNNS) and boron carbide (B4C) represents a critical factor in their industrial adoption. Current production costs for high-quality BNNS remain significantly higher than those for boron carbide, primarily due to the complex exfoliation and synthesis processes required for nanosheets. While BNNS production costs range from $200-500 per gram for research-grade materials, boron carbide can be manufactured at approximately $30-80 per kilogram in industrial quantities, representing a substantial cost differential.

However, this cost analysis must be balanced against performance benefits. BNNS offers exceptional thermal conductivity (up to 2000 W/mK), superior electrical insulation properties, and unique two-dimensional characteristics that enable applications impossible with traditional boron carbide. These performance advantages can justify the higher costs in high-value applications such as next-generation electronics, where thermal management is critical.

The commercialization pathway for BNNS appears most promising in specialized, high-margin sectors including advanced electronics cooling, aerospace components, and high-performance composites. Market analysis indicates that the thermal interface materials segment alone is projected to reach $4.3 billion by 2026, with BNNS potentially capturing premium segments of this market.

For boron carbide, established commercialization channels exist in traditional applications such as armor systems, abrasives, and nuclear shielding. The global boron carbide market is expected to reach $175 million by 2025, with steady growth driven by defense and industrial applications. Its cost-effectiveness and established manufacturing infrastructure provide significant advantages for large-scale deployment.

Scaling considerations reveal divergent trajectories: boron carbide benefits from decades of manufacturing optimization and established supply chains, while BNNS production faces challenges in scaling beyond laboratory quantities. Recent advancements in liquid-phase exfoliation and chemical vapor deposition methods show promise for reducing BNNS production costs by 40-60% over the next five years, potentially expanding its commercial viability.

Return on investment calculations suggest that while boron carbide offers predictable returns in established markets, BNNS presents higher risk but potentially greater rewards in emerging high-tech applications. Companies investing in BNNS technology may achieve competitive advantages through intellectual property development and positioning in nascent markets with significant growth potential.

However, this cost analysis must be balanced against performance benefits. BNNS offers exceptional thermal conductivity (up to 2000 W/mK), superior electrical insulation properties, and unique two-dimensional characteristics that enable applications impossible with traditional boron carbide. These performance advantages can justify the higher costs in high-value applications such as next-generation electronics, where thermal management is critical.

The commercialization pathway for BNNS appears most promising in specialized, high-margin sectors including advanced electronics cooling, aerospace components, and high-performance composites. Market analysis indicates that the thermal interface materials segment alone is projected to reach $4.3 billion by 2026, with BNNS potentially capturing premium segments of this market.

For boron carbide, established commercialization channels exist in traditional applications such as armor systems, abrasives, and nuclear shielding. The global boron carbide market is expected to reach $175 million by 2025, with steady growth driven by defense and industrial applications. Its cost-effectiveness and established manufacturing infrastructure provide significant advantages for large-scale deployment.

Scaling considerations reveal divergent trajectories: boron carbide benefits from decades of manufacturing optimization and established supply chains, while BNNS production faces challenges in scaling beyond laboratory quantities. Recent advancements in liquid-phase exfoliation and chemical vapor deposition methods show promise for reducing BNNS production costs by 40-60% over the next five years, potentially expanding its commercial viability.

Return on investment calculations suggest that while boron carbide offers predictable returns in established markets, BNNS presents higher risk but potentially greater rewards in emerging high-tech applications. Companies investing in BNNS technology may achieve competitive advantages through intellectual property development and positioning in nascent markets with significant growth potential.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!