Compare Electrochemical Cell Technologies: Li-Ion vs Solid-State

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Evolution and Objectives

The evolution of battery technology has witnessed significant advancements since the commercialization of lithium-ion batteries in the early 1990s. These electrochemical cells have revolutionized portable electronics, electric vehicles, and energy storage systems. The trajectory of development has been characterized by incremental improvements in energy density, from approximately 100 Wh/kg in early commercial cells to over 250 Wh/kg in modern configurations, representing a compound annual growth rate of about 5% in performance metrics.

Lithium-ion technology, based on intercalation chemistry, has dominated the market for three decades due to its favorable combination of energy density, cycle life, and manufacturing scalability. However, this technology is approaching its theoretical limits, with diminishing returns on research investments. The fundamental architecture—utilizing liquid electrolytes—presents inherent safety concerns and density limitations that cannot be overcome without paradigm shifts in cell design.

Solid-state battery technology represents the next evolutionary step, promising to address the limitations of conventional lithium-ion cells. By replacing liquid electrolytes with solid conductors, these cells offer theoretical energy densities exceeding 400 Wh/kg, potentially doubling current capabilities. The historical development of solid electrolytes has progressed from polymer-based systems in the 1980s to advanced ceramic and glass-ceramic materials in recent years, with ionic conductivities now approaching those of liquid electrolytes.

The technical objectives for next-generation battery development focus on five key parameters: energy density, safety, charging speed, cycle life, and operating temperature range. Solid-state technology presents a pathway to simultaneously improve all these metrics, whereas conventional lithium-ion technology requires trade-offs between them. Specifically, the elimination of flammable organic electrolytes addresses the primary safety concerns while enabling the use of lithium metal anodes with ten times the capacity of graphite.

Market forces are accelerating this technological transition, with electric vehicle manufacturers demanding batteries that enable 500+ mile ranges, 10-minute charging times, and 15+ year lifespans. These requirements cannot be met by incremental improvements to existing lithium-ion chemistries. Consequently, research investment in solid-state technology has increased exponentially, with annual patent filings growing from fewer than 100 in 2010 to over 1,500 in 2022.

The technological evolution timeline suggests commercial viability of solid-state batteries at scale within the next 3-7 years, with pilot production already underway at several manufacturers. This represents a critical inflection point in energy storage technology, comparable to the transition from nickel-cadmium to lithium-ion cells in the 1990s, with profound implications for multiple industries and global energy systems.

Lithium-ion technology, based on intercalation chemistry, has dominated the market for three decades due to its favorable combination of energy density, cycle life, and manufacturing scalability. However, this technology is approaching its theoretical limits, with diminishing returns on research investments. The fundamental architecture—utilizing liquid electrolytes—presents inherent safety concerns and density limitations that cannot be overcome without paradigm shifts in cell design.

Solid-state battery technology represents the next evolutionary step, promising to address the limitations of conventional lithium-ion cells. By replacing liquid electrolytes with solid conductors, these cells offer theoretical energy densities exceeding 400 Wh/kg, potentially doubling current capabilities. The historical development of solid electrolytes has progressed from polymer-based systems in the 1980s to advanced ceramic and glass-ceramic materials in recent years, with ionic conductivities now approaching those of liquid electrolytes.

The technical objectives for next-generation battery development focus on five key parameters: energy density, safety, charging speed, cycle life, and operating temperature range. Solid-state technology presents a pathway to simultaneously improve all these metrics, whereas conventional lithium-ion technology requires trade-offs between them. Specifically, the elimination of flammable organic electrolytes addresses the primary safety concerns while enabling the use of lithium metal anodes with ten times the capacity of graphite.

Market forces are accelerating this technological transition, with electric vehicle manufacturers demanding batteries that enable 500+ mile ranges, 10-minute charging times, and 15+ year lifespans. These requirements cannot be met by incremental improvements to existing lithium-ion chemistries. Consequently, research investment in solid-state technology has increased exponentially, with annual patent filings growing from fewer than 100 in 2010 to over 1,500 in 2022.

The technological evolution timeline suggests commercial viability of solid-state batteries at scale within the next 3-7 years, with pilot production already underway at several manufacturers. This represents a critical inflection point in energy storage technology, comparable to the transition from nickel-cadmium to lithium-ion cells in the 1990s, with profound implications for multiple industries and global energy systems.

Market Analysis for Advanced Battery Solutions

The global advanced battery market is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current market valuations place the advanced battery sector at approximately $112 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 18.7% through 2030, potentially reaching $380 billion by decade's end.

Lithium-ion batteries currently dominate the market landscape, accounting for over 70% of the total advanced battery market share. This dominance stems from their established manufacturing infrastructure, relatively lower production costs, and continuous incremental improvements in energy density. Major markets include automotive (42%), consumer electronics (28%), and grid storage applications (15%).

Solid-state battery technology, while currently occupying less than 3% of the market, represents the fastest-growing segment with projected annual growth rates exceeding 35% over the next five years. This growth trajectory is supported by substantial venture capital investments, which reached $3.6 billion in 2022 alone - nearly triple the funding from 2020.

Regional analysis reveals interesting market dynamics. Asia-Pacific leads manufacturing capacity with China, Japan, and South Korea collectively controlling approximately 85% of lithium-ion production. However, solid-state battery research and development shows a more distributed pattern, with significant innovation clusters in North America (particularly in the United States), Europe (notably Germany and France), and Japan.

Consumer demand patterns indicate shifting priorities that favor solid-state technologies. Safety concerns rank as the primary consideration for 68% of potential EV buyers surveyed, while range anxiety remains the second most significant barrier to adoption at 57%. Solid-state batteries address both concerns directly, potentially accelerating market acceptance once commercialization reaches scale.

Corporate investment strategies further illuminate market trajectories. Traditional automotive manufacturers have committed over $300 billion to EV development through 2025, with approximately 22% of this investment specifically targeting advanced battery technologies. Meanwhile, technology companies not previously involved in transportation are entering the battery space, particularly focusing on solid-state solutions, indicating broader market confidence in this emerging technology.

Price sensitivity analysis suggests that solid-state batteries will need to achieve manufacturing costs below $100/kWh to achieve mass market penetration, compared to current lithium-ion costs hovering around $132/kWh. Industry forecasts suggest this price parity could be achieved between 2026-2028, potentially triggering rapid market realignment.

Lithium-ion batteries currently dominate the market landscape, accounting for over 70% of the total advanced battery market share. This dominance stems from their established manufacturing infrastructure, relatively lower production costs, and continuous incremental improvements in energy density. Major markets include automotive (42%), consumer electronics (28%), and grid storage applications (15%).

Solid-state battery technology, while currently occupying less than 3% of the market, represents the fastest-growing segment with projected annual growth rates exceeding 35% over the next five years. This growth trajectory is supported by substantial venture capital investments, which reached $3.6 billion in 2022 alone - nearly triple the funding from 2020.

Regional analysis reveals interesting market dynamics. Asia-Pacific leads manufacturing capacity with China, Japan, and South Korea collectively controlling approximately 85% of lithium-ion production. However, solid-state battery research and development shows a more distributed pattern, with significant innovation clusters in North America (particularly in the United States), Europe (notably Germany and France), and Japan.

Consumer demand patterns indicate shifting priorities that favor solid-state technologies. Safety concerns rank as the primary consideration for 68% of potential EV buyers surveyed, while range anxiety remains the second most significant barrier to adoption at 57%. Solid-state batteries address both concerns directly, potentially accelerating market acceptance once commercialization reaches scale.

Corporate investment strategies further illuminate market trajectories. Traditional automotive manufacturers have committed over $300 billion to EV development through 2025, with approximately 22% of this investment specifically targeting advanced battery technologies. Meanwhile, technology companies not previously involved in transportation are entering the battery space, particularly focusing on solid-state solutions, indicating broader market confidence in this emerging technology.

Price sensitivity analysis suggests that solid-state batteries will need to achieve manufacturing costs below $100/kWh to achieve mass market penetration, compared to current lithium-ion costs hovering around $132/kWh. Industry forecasts suggest this price parity could be achieved between 2026-2028, potentially triggering rapid market realignment.

Li-Ion vs Solid-State: Technical Challenges

Lithium-ion batteries have dominated the energy storage landscape for decades, but they face significant technical challenges that limit their further advancement. The primary issue is energy density limitation, with current commercial Li-ion cells reaching theoretical limits of 250-300 Wh/kg. This ceiling restricts applications requiring higher energy storage capabilities, particularly in electric vehicles where range anxiety remains a consumer concern.

Safety concerns represent another major challenge for Li-ion technology. The liquid electrolytes used in conventional Li-ion batteries are flammable and can lead to thermal runaway under certain conditions such as physical damage, overcharging, or manufacturing defects. Despite numerous engineering safeguards, high-profile battery fires continue to occur, damaging consumer confidence and necessitating complex thermal management systems.

Cycle life degradation presents ongoing difficulties, with Li-ion batteries typically maintaining only 80% of original capacity after 500-1000 charge cycles. This degradation occurs through multiple mechanisms including solid-electrolyte interphase (SEI) layer growth, lithium plating, and structural changes in electrode materials during cycling.

In contrast, solid-state battery technology promises to address many of these limitations but faces its own set of technical hurdles. The most significant challenge is the development of solid electrolytes with ionic conductivity comparable to liquid electrolytes at room temperature. Current solid electrolytes achieve only 1/10 to 1/100 the conductivity of liquid counterparts, severely limiting power density and charging rates.

Interface stability between solid electrolytes and electrodes represents another major obstacle. The solid-solid interfaces create high impedance and poor contact, leading to increased internal resistance and reduced performance. Additionally, these interfaces often experience chemical and mechanical degradation during cycling, further compromising battery performance and longevity.

Manufacturing scalability remains perhaps the greatest barrier to commercial adoption of solid-state technology. Current production methods are complex, expensive, and difficult to scale. Techniques for creating thin, defect-free solid electrolyte layers and ensuring consistent electrode-electrolyte interfaces across large-format cells have not been fully developed for mass production.

Temperature sensitivity also affects solid-state batteries, with many solid electrolytes showing significant performance drops at low temperatures due to reduced ionic mobility. This characteristic limits their practical application in regions with cold climates without additional heating systems.

While both technologies continue to advance, the technical challenges facing solid-state batteries are primarily developmental, whereas Li-ion faces fundamental physical limitations. The industry's focus has shifted toward overcoming solid-state manufacturing and interface challenges, as these represent solvable engineering problems rather than theoretical limits.

Safety concerns represent another major challenge for Li-ion technology. The liquid electrolytes used in conventional Li-ion batteries are flammable and can lead to thermal runaway under certain conditions such as physical damage, overcharging, or manufacturing defects. Despite numerous engineering safeguards, high-profile battery fires continue to occur, damaging consumer confidence and necessitating complex thermal management systems.

Cycle life degradation presents ongoing difficulties, with Li-ion batteries typically maintaining only 80% of original capacity after 500-1000 charge cycles. This degradation occurs through multiple mechanisms including solid-electrolyte interphase (SEI) layer growth, lithium plating, and structural changes in electrode materials during cycling.

In contrast, solid-state battery technology promises to address many of these limitations but faces its own set of technical hurdles. The most significant challenge is the development of solid electrolytes with ionic conductivity comparable to liquid electrolytes at room temperature. Current solid electrolytes achieve only 1/10 to 1/100 the conductivity of liquid counterparts, severely limiting power density and charging rates.

Interface stability between solid electrolytes and electrodes represents another major obstacle. The solid-solid interfaces create high impedance and poor contact, leading to increased internal resistance and reduced performance. Additionally, these interfaces often experience chemical and mechanical degradation during cycling, further compromising battery performance and longevity.

Manufacturing scalability remains perhaps the greatest barrier to commercial adoption of solid-state technology. Current production methods are complex, expensive, and difficult to scale. Techniques for creating thin, defect-free solid electrolyte layers and ensuring consistent electrode-electrolyte interfaces across large-format cells have not been fully developed for mass production.

Temperature sensitivity also affects solid-state batteries, with many solid electrolytes showing significant performance drops at low temperatures due to reduced ionic mobility. This characteristic limits their practical application in regions with cold climates without additional heating systems.

While both technologies continue to advance, the technical challenges facing solid-state batteries are primarily developmental, whereas Li-ion faces fundamental physical limitations. The industry's focus has shifted toward overcoming solid-state manufacturing and interface challenges, as these represent solvable engineering problems rather than theoretical limits.

Current Electrochemical Cell Architectures

01 Solid-state battery electrolyte compositions

Solid-state batteries utilize specialized electrolyte compositions to enhance performance characteristics. These electrolytes typically include ceramic, polymer, or composite materials that facilitate ion transport while maintaining structural integrity. Advanced solid electrolytes offer improved safety by eliminating flammable liquid components, enhanced thermal stability, and potentially higher energy density compared to conventional liquid electrolytes. These compositions are critical for enabling next-generation battery technologies with superior performance.- Solid-state battery electrolyte compositions: Solid-state batteries utilize specialized electrolyte compositions to enhance performance characteristics. These compositions include ceramic, polymer, and composite electrolytes that offer improved ionic conductivity while maintaining mechanical stability. The solid electrolytes eliminate the need for liquid components, reducing safety risks associated with leakage and flammability. Advanced formulations incorporate additives that enhance interfacial contact between electrodes and electrolytes, addressing a key challenge in solid-state battery technology.

- Lithium-ion battery electrode materials: Electrode materials significantly impact the performance characteristics of lithium-ion batteries. Advanced cathode materials such as lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) offer different balances of energy density, power capability, and cycle life. Anode innovations include silicon-carbon composites and lithium titanate that provide higher capacity or improved safety compared to traditional graphite. Surface modifications and nanostructuring of electrode materials enhance stability and rate capability by facilitating faster lithium-ion transport and reducing degradation mechanisms.

- Battery management systems for performance optimization: Battery management systems (BMS) play a crucial role in optimizing the performance of both lithium-ion and solid-state batteries. These systems monitor and control key parameters such as temperature, voltage, and current to ensure safe and efficient operation. Advanced BMS incorporate predictive algorithms that can estimate state of charge and state of health, enabling more precise energy management. Thermal management features prevent overheating and maintain optimal operating temperatures, which is particularly important for maximizing cycle life and maintaining consistent performance across varying conditions.

- Interface engineering for improved battery performance: Interface engineering addresses critical challenges at the electrode-electrolyte boundaries in both lithium-ion and solid-state batteries. Specialized coatings and interlayers minimize unwanted side reactions and reduce interfacial resistance, improving overall battery efficiency. In solid-state batteries, interface engineering is particularly crucial for maintaining good contact between solid components during cycling. Advanced techniques include atomic layer deposition of protective films and incorporation of functional additives that stabilize the solid-electrolyte interphase, leading to enhanced cycle life and rate capability.

- Fast-charging capabilities and safety features: Enhancing fast-charging capabilities while maintaining safety is a key focus in battery technology development. Advanced cell designs incorporate structural features that facilitate rapid ion transport without compromising stability. Specialized electrolyte formulations with high ionic conductivity and wide electrochemical stability windows enable faster charging rates. Safety features include pressure relief mechanisms, thermal fuses, and separator technologies that prevent internal short circuits. For solid-state batteries, the inherent non-flammability of solid electrolytes provides additional safety advantages while potentially supporting higher charging rates.

02 Lithium-ion battery electrode materials

Advanced electrode materials significantly impact the performance characteristics of lithium-ion batteries. These materials include novel cathode compositions (such as high-nickel NMC, LFP, or lithium-rich compounds) and anode materials (including silicon-carbon composites, lithium metal, and graphite derivatives). The selection and engineering of these materials directly influence energy density, power capability, cycle life, and thermal stability of the battery. Innovations in electrode material design focus on increasing capacity while maintaining structural stability during repeated charge-discharge cycles.Expand Specific Solutions03 Battery management and control systems

Sophisticated battery management systems (BMS) are essential for optimizing the performance and longevity of both Li-ion and solid-state batteries. These systems monitor and control critical parameters including temperature, voltage, current, and state of charge across individual cells and the entire battery pack. Advanced BMS technologies incorporate predictive algorithms to prevent thermal runaway, balance cell charging, and provide accurate state-of-health estimations. Effective battery management significantly improves safety, extends cycle life, and enhances overall system efficiency.Expand Specific Solutions04 Interface engineering for improved battery performance

Interface engineering focuses on optimizing the critical boundaries between electrodes and electrolytes in both Li-ion and solid-state batteries. This includes developing specialized coatings, interlayers, and surface treatments to reduce interfacial resistance, prevent unwanted side reactions, and enhance ion transport. Effective interface engineering mitigates dendrite formation in lithium metal batteries, improves cycling stability, and enables faster charging capabilities. These innovations are particularly important for solid-state batteries where solid-solid interfaces present unique challenges for efficient ion transfer.Expand Specific Solutions05 Fast-charging and high-power battery technologies

Advancements in fast-charging and high-power battery technologies address key performance limitations in electrochemical cells. These innovations include specialized electrode architectures that facilitate rapid ion diffusion, electrolyte formulations that maintain stability under high current conditions, and thermal management systems that dissipate heat during intensive charging. The technologies enable reduced charging times while preserving battery longevity and safety. Developments in this area are particularly important for electric vehicle applications where charging speed is a critical consumer concern.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium-ion vs solid-state battery technology landscape is currently in a transitional phase, with lithium-ion batteries dominating the market while solid-state technology emerges as a promising next-generation solution. The global battery market exceeds $100 billion, growing at 15% annually, with automotive applications driving demand. Technologically, traditional Li-ion is mature with established manufacturing infrastructure, while solid-state batteries remain in early commercialization stages. Leading players demonstrate varying development approaches: QuantumScape and Solid Power focus exclusively on solid-state technology; established manufacturers like Samsung and Toyota integrate solid-state R&D alongside existing Li-ion production; while academic institutions (MIT, University of Michigan) and specialized startups (Blue Current, Sakuu) drive fundamental innovation through novel materials and manufacturing processes.

GM Global Technology Operations LLC

Technical Solution: GM has developed a multi-faceted approach to next-generation battery technology, including significant investments in solid-state battery research. Their technology focuses on a silicon-dominant anode paired with a semi-solid electrolyte system that offers a practical transition path from current lithium-ion technology. GM's solid-state research utilizes a proprietary composite electrolyte that combines polymer and ceramic components to balance ionic conductivity with mechanical stability. This hybrid approach allows for improved energy density while maintaining manufacturability on modified existing production lines. GM's solid-state prototypes have demonstrated approximately 60% higher energy density than their current Ultium lithium-ion cells, with improved fast-charging capabilities and enhanced low-temperature performance. The company has established partnerships with multiple materials suppliers and research institutions to accelerate development, focusing particularly on reducing the cost of ceramic components and scaling production processes. GM's approach emphasizes practical implementation timelines, with plans to introduce semi-solid electrolyte technologies in specific vehicle applications before transitioning to fully solid-state designs.

Strengths: Extensive battery manufacturing experience and established supply chain; pragmatic approach to gradual technology implementation; strong integration with vehicle design teams ensures practical application focus; substantial R&D resources. Weaknesses: Hybrid approach may not deliver the full theoretical benefits of pure solid-state technology; conservative implementation timeline compared to some competitors; balancing performance improvements with cost constraints for mass-market vehicles.

Robert Bosch GmbH

Technical Solution: Bosch has developed a comprehensive solid-state battery technology platform focused on automotive applications, emphasizing manufacturability and system integration. Their approach utilizes oxide-based solid electrolytes combined with proprietary electrode formulations optimized for high power density applications. Bosch's solid-state cells feature a multi-layer design with ultrathin electrolyte layers (20-50μm) to minimize internal resistance while maintaining mechanical integrity during thermal cycling. The company has integrated advanced battery management systems specifically designed for solid-state chemistry, with algorithms that optimize performance based on the unique characteristics of solid electrolytes. Bosch's manufacturing approach leverages their extensive experience in precision manufacturing, applying techniques from semiconductor processing to achieve consistent electrolyte layer deposition. Their solid-state prototypes have demonstrated energy densities approaching 400 Wh/kg with fast-charging capabilities (10-80% in under 20 minutes) while maintaining thermal stability under extreme testing conditions.

Strengths: Strong manufacturing expertise and established automotive supply chain integration; comprehensive systems approach including battery management; extensive testing capabilities for automotive qualification; global production capacity. Weaknesses: More conservative approach may result in slower time-to-market compared to startups focused solely on solid-state technology; balancing cost constraints of automotive market with advanced materials may limit initial performance advantages.

Critical Patents in Battery Technology

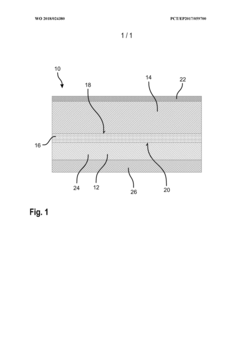

Method for producing an electrochemical cell comprising a lithium electrode, and electrochemical cell

PatentWO2018024380A1

Innovation

- A method for producing a solid-state electrochemical cell with a metallic lithium anode and solid electrolyte, where the lithium foil is heated to soften and improve contact with the electrolyte, reducing interfacial resistance and eliminating the need for a SEI layer formation during initial charging.

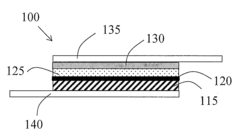

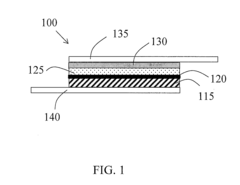

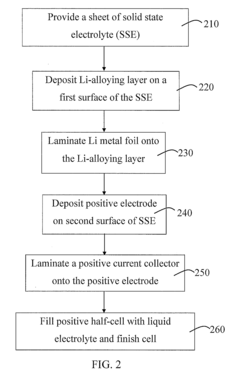

Electrochemical cell with solid and liquid electrolytes

PatentInactiveUS20160308243A1

Innovation

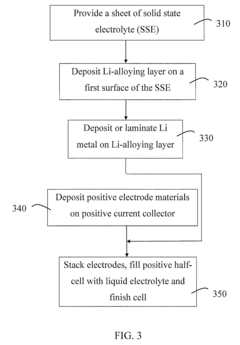

- A hybrid Li-ion battery design using a solid state electrolyte between the lithium metal or alloy negative electrode and a liquid or polymer electrolyte positive electrode, preventing dendrite formation and enhancing safety while maintaining high energy density.

Sustainability Impact Assessment

The sustainability impact of battery technologies extends far beyond their operational performance, encompassing their entire lifecycle from raw material extraction to disposal. When comparing lithium-ion and solid-state batteries, several critical environmental dimensions must be considered.

Lithium-ion batteries rely heavily on materials like lithium, cobalt, nickel, and graphite, whose extraction processes are energy-intensive and often environmentally damaging. Mining operations, particularly for cobalt in regions like the Democratic Republic of Congo, have been associated with significant ecological disruption, water pollution, and habitat destruction. Additionally, the manufacturing process for conventional Li-ion cells requires substantial energy inputs and involves potentially hazardous organic electrolytes.

In contrast, solid-state batteries offer promising sustainability advantages. Their potential for longer lifespans (potentially 2-3 times that of conventional Li-ion cells) means fewer replacement cycles and reduced waste generation over time. Many solid-state designs also eliminate the need for cobalt and nickel, instead utilizing more abundant materials like silicon and sulfur-based compounds, thereby reducing pressure on critical mineral supply chains.

Carbon footprint assessments reveal that solid-state technology could potentially reduce production-phase emissions by 15-30% compared to conventional lithium-ion batteries. This improvement stems from simplified manufacturing processes and reduced energy requirements during production. Furthermore, the elimination of flammable liquid electrolytes enhances safety profiles and diminishes the risk of environmental contamination from leakage or thermal events.

End-of-life considerations also favor solid-state technology. The absence of liquid components simplifies recycling processes, potentially increasing material recovery rates from 50-60% for conventional Li-ion to 70-85% for certain solid-state designs. This improvement in recyclability creates opportunities for more circular material flows within battery supply chains.

Water usage represents another significant sustainability factor. Lithium extraction, particularly from brine operations in water-stressed regions like South America's "Lithium Triangle," consumes vast quantities of water—approximately 500,000 gallons per ton of lithium. Solid-state technologies that reduce lithium content or utilize alternative materials could substantially decrease water footprints across the battery lifecycle.

Despite these advantages, solid-state batteries face their own sustainability challenges. Some designs require high-temperature manufacturing processes, potentially offsetting some environmental gains. Additionally, the novelty of these technologies means recycling infrastructure remains underdeveloped, creating potential barriers to achieving their full sustainability potential in the near term.

Lithium-ion batteries rely heavily on materials like lithium, cobalt, nickel, and graphite, whose extraction processes are energy-intensive and often environmentally damaging. Mining operations, particularly for cobalt in regions like the Democratic Republic of Congo, have been associated with significant ecological disruption, water pollution, and habitat destruction. Additionally, the manufacturing process for conventional Li-ion cells requires substantial energy inputs and involves potentially hazardous organic electrolytes.

In contrast, solid-state batteries offer promising sustainability advantages. Their potential for longer lifespans (potentially 2-3 times that of conventional Li-ion cells) means fewer replacement cycles and reduced waste generation over time. Many solid-state designs also eliminate the need for cobalt and nickel, instead utilizing more abundant materials like silicon and sulfur-based compounds, thereby reducing pressure on critical mineral supply chains.

Carbon footprint assessments reveal that solid-state technology could potentially reduce production-phase emissions by 15-30% compared to conventional lithium-ion batteries. This improvement stems from simplified manufacturing processes and reduced energy requirements during production. Furthermore, the elimination of flammable liquid electrolytes enhances safety profiles and diminishes the risk of environmental contamination from leakage or thermal events.

End-of-life considerations also favor solid-state technology. The absence of liquid components simplifies recycling processes, potentially increasing material recovery rates from 50-60% for conventional Li-ion to 70-85% for certain solid-state designs. This improvement in recyclability creates opportunities for more circular material flows within battery supply chains.

Water usage represents another significant sustainability factor. Lithium extraction, particularly from brine operations in water-stressed regions like South America's "Lithium Triangle," consumes vast quantities of water—approximately 500,000 gallons per ton of lithium. Solid-state technologies that reduce lithium content or utilize alternative materials could substantially decrease water footprints across the battery lifecycle.

Despite these advantages, solid-state batteries face their own sustainability challenges. Some designs require high-temperature manufacturing processes, potentially offsetting some environmental gains. Additionally, the novelty of these technologies means recycling infrastructure remains underdeveloped, creating potential barriers to achieving their full sustainability potential in the near term.

Manufacturing Scalability Analysis

The manufacturing scalability of lithium-ion and solid-state battery technologies represents a critical factor in their commercial viability and widespread adoption. Current lithium-ion battery manufacturing has achieved remarkable economies of scale, with global production capacity exceeding 500 GWh annually across established facilities in Asia, Europe, and North America. This mature manufacturing ecosystem benefits from decades of process optimization, resulting in production costs that have declined by approximately 85% since 2010, reaching below $100/kWh at the pack level in some cases.

In contrast, solid-state battery manufacturing remains predominantly at pilot scale, with total global capacity under 2 GWh. The transition from laboratory to mass production faces significant challenges, particularly in the handling and processing of solid electrolyte materials which often require specialized equipment and controlled environments. Current solid-state manufacturing processes typically demonstrate yields below 70%, compared to the 90%+ efficiency achieved in mature lithium-ion production lines.

The equipment requirements also differ substantially between technologies. Lithium-ion manufacturing leverages standardized coating, calendering, and assembly equipment, while solid-state production often necessitates custom-designed machinery for electrolyte synthesis, interface engineering, and novel cell assembly techniques. This specialization contributes to capital expenditure requirements approximately 2.5-3x higher per GWh of capacity for solid-state facilities compared to lithium-ion counterparts.

Material supply chains present another critical distinction. Lithium-ion batteries utilize established global supply networks for cathode materials, graphite anodes, and liquid electrolytes. Solid-state technologies frequently require specialized materials like lithium metal, ceramic electrolytes, and sulfide compounds that currently lack robust supply infrastructure, creating potential bottlenecks for large-scale deployment.

Production throughput metrics further highlight the scalability gap. Modern lithium-ion gigafactories can produce cells at rates exceeding 300 units per minute on high-speed assembly lines. Solid-state manufacturing processes currently achieve only 5-15% of this throughput, with significantly longer processing times for electrolyte formation and cell conditioning steps.

Despite these challenges, several technological developments are improving solid-state manufacturing scalability. Advances in dry film processing techniques, co-sintering methods, and roll-to-roll compatible electrolyte deposition are gradually reducing the complexity gap. Industry projections suggest solid-state manufacturing costs could approach lithium-ion parity by 2028-2030, contingent upon continued process innovation and increased production volumes driving economies of scale.

In contrast, solid-state battery manufacturing remains predominantly at pilot scale, with total global capacity under 2 GWh. The transition from laboratory to mass production faces significant challenges, particularly in the handling and processing of solid electrolyte materials which often require specialized equipment and controlled environments. Current solid-state manufacturing processes typically demonstrate yields below 70%, compared to the 90%+ efficiency achieved in mature lithium-ion production lines.

The equipment requirements also differ substantially between technologies. Lithium-ion manufacturing leverages standardized coating, calendering, and assembly equipment, while solid-state production often necessitates custom-designed machinery for electrolyte synthesis, interface engineering, and novel cell assembly techniques. This specialization contributes to capital expenditure requirements approximately 2.5-3x higher per GWh of capacity for solid-state facilities compared to lithium-ion counterparts.

Material supply chains present another critical distinction. Lithium-ion batteries utilize established global supply networks for cathode materials, graphite anodes, and liquid electrolytes. Solid-state technologies frequently require specialized materials like lithium metal, ceramic electrolytes, and sulfide compounds that currently lack robust supply infrastructure, creating potential bottlenecks for large-scale deployment.

Production throughput metrics further highlight the scalability gap. Modern lithium-ion gigafactories can produce cells at rates exceeding 300 units per minute on high-speed assembly lines. Solid-state manufacturing processes currently achieve only 5-15% of this throughput, with significantly longer processing times for electrolyte formation and cell conditioning steps.

Despite these challenges, several technological developments are improving solid-state manufacturing scalability. Advances in dry film processing techniques, co-sintering methods, and roll-to-roll compatible electrolyte deposition are gradually reducing the complexity gap. Industry projections suggest solid-state manufacturing costs could approach lithium-ion parity by 2028-2030, contingent upon continued process innovation and increased production volumes driving economies of scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!