Compare Energy Density of Different Electrochemical Cells

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Evolution and Objectives

Electrochemical cells have undergone remarkable evolution since Alessandro Volta's pioneering work in 1800. The trajectory of battery technology development has been characterized by continuous improvements in energy density, which represents the amount of energy stored per unit volume or mass. This metric has become increasingly critical as portable electronics, electric vehicles, and renewable energy storage solutions demand more power in smaller, lighter packages.

The earliest commercial batteries, such as lead-acid cells developed in 1859, offered energy densities of merely 30-40 Wh/kg. The subsequent century witnessed gradual improvements with the introduction of nickel-cadmium (45-80 Wh/kg) and nickel-metal hydride batteries (60-120 Wh/kg). However, the transformative breakthrough came with lithium-ion technology in the early 1990s, which initially delivered 120-150 Wh/kg and has since advanced to 250-300 Wh/kg in modern implementations.

Current technological objectives center on pushing energy density boundaries while maintaining safety, cost-effectiveness, and environmental sustainability. The theoretical limit for lithium-ion technology is approximately 387 Wh/kg, suggesting we are approaching fundamental constraints of existing chemistries. This realization has catalyzed research into next-generation technologies such as lithium-sulfur (potential 500-600 Wh/kg), lithium-air (theoretical 3,458 Wh/kg), and solid-state batteries.

Beyond lithium-based technologies, alternative chemistries including sodium-ion, aluminum-ion, and magnesium-based cells are being explored to address resource constraints and geopolitical supply chain vulnerabilities. These alternatives may not necessarily offer higher energy densities but provide strategic advantages in terms of resource abundance and cost reduction.

The industry has established ambitious targets for energy density improvements: 350-400 Wh/kg by 2025 for consumer electronics, 400-500 Wh/kg by 2030 for electric vehicles, and cost-effective grid storage solutions reaching 200+ Wh/kg with 10,000+ cycle lifetimes. These objectives are driving unprecedented investment in battery research, with global funding exceeding $17 billion in 2022 alone.

Comparing energy densities across different electrochemical cells reveals not only technological progress but also application-specific optimization trends. While lithium-ion dominates portable applications, flow batteries with lower energy densities (20-70 Wh/kg) but superior cycle life are gaining traction for grid-scale storage. Similarly, emerging metal-air technologies promise extraordinary theoretical energy densities but face significant practical implementation challenges.

The evolution trajectory suggests that future advancements will likely come from multidisciplinary approaches combining materials science, nanotechnology, and computational modeling to overcome current limitations in electrode materials, electrolytes, and cell architectures.

The earliest commercial batteries, such as lead-acid cells developed in 1859, offered energy densities of merely 30-40 Wh/kg. The subsequent century witnessed gradual improvements with the introduction of nickel-cadmium (45-80 Wh/kg) and nickel-metal hydride batteries (60-120 Wh/kg). However, the transformative breakthrough came with lithium-ion technology in the early 1990s, which initially delivered 120-150 Wh/kg and has since advanced to 250-300 Wh/kg in modern implementations.

Current technological objectives center on pushing energy density boundaries while maintaining safety, cost-effectiveness, and environmental sustainability. The theoretical limit for lithium-ion technology is approximately 387 Wh/kg, suggesting we are approaching fundamental constraints of existing chemistries. This realization has catalyzed research into next-generation technologies such as lithium-sulfur (potential 500-600 Wh/kg), lithium-air (theoretical 3,458 Wh/kg), and solid-state batteries.

Beyond lithium-based technologies, alternative chemistries including sodium-ion, aluminum-ion, and magnesium-based cells are being explored to address resource constraints and geopolitical supply chain vulnerabilities. These alternatives may not necessarily offer higher energy densities but provide strategic advantages in terms of resource abundance and cost reduction.

The industry has established ambitious targets for energy density improvements: 350-400 Wh/kg by 2025 for consumer electronics, 400-500 Wh/kg by 2030 for electric vehicles, and cost-effective grid storage solutions reaching 200+ Wh/kg with 10,000+ cycle lifetimes. These objectives are driving unprecedented investment in battery research, with global funding exceeding $17 billion in 2022 alone.

Comparing energy densities across different electrochemical cells reveals not only technological progress but also application-specific optimization trends. While lithium-ion dominates portable applications, flow batteries with lower energy densities (20-70 Wh/kg) but superior cycle life are gaining traction for grid-scale storage. Similarly, emerging metal-air technologies promise extraordinary theoretical energy densities but face significant practical implementation challenges.

The evolution trajectory suggests that future advancements will likely come from multidisciplinary approaches combining materials science, nanotechnology, and computational modeling to overcome current limitations in electrode materials, electrolytes, and cell architectures.

Market Analysis of High Energy Density Batteries

The high energy density battery market is experiencing unprecedented growth, driven by the expanding electric vehicle (EV) sector, portable electronics, and renewable energy storage systems. Current market valuations indicate the global high energy density battery market reached approximately 45 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 18-20% through 2030, potentially reaching 180 billion USD by the end of the decade.

Lithium-ion batteries currently dominate the market with over 70% market share due to their relatively high energy density (250-300 Wh/kg) compared to traditional lead-acid batteries (30-50 Wh/kg). However, market segmentation reveals emerging demand for next-generation technologies that promise even higher energy densities, including solid-state batteries, lithium-sulfur, and lithium-air systems.

Regional analysis shows Asia-Pacific leading global production and consumption, with China controlling approximately 75% of the lithium-ion battery supply chain. North America and Europe are rapidly expanding their manufacturing capabilities through significant government investments, with the U.S. Inflation Reduction Act allocating over 35 billion USD to battery manufacturing and the European Battery Alliance mobilizing 120 billion EUR in investments.

Consumer electronics historically drove battery innovation, but electric vehicles now represent the largest and fastest-growing market segment. The automotive sector's demand for high energy density batteries is expected to grow at 25% annually as major manufacturers commit to electrification targets. Energy storage systems represent another high-growth segment, expanding at 30% annually as grid-scale applications increase.

Price sensitivity analysis reveals that battery costs have declined by approximately 85% over the past decade, from over 1,000 USD/kWh to approximately 135 USD/kWh in 2022. Industry projections suggest costs could fall below 100 USD/kWh by 2025, representing a critical threshold for EV price parity with internal combustion vehicles.

Market challenges include supply chain vulnerabilities for critical materials like lithium, cobalt, and nickel. Demand for these materials is projected to increase by 500% by 2030, creating potential bottlenecks. This has accelerated interest in alternative chemistries with reduced dependency on scarce materials, such as sodium-ion and lithium-iron-phosphate (LFP) batteries, despite their lower energy densities.

Consumer and regulatory trends increasingly emphasize sustainability, with battery recycling expected to grow into a 20 billion USD industry by 2030. Manufacturers achieving higher energy densities while reducing environmental impact are positioned to capture premium market segments and benefit from favorable regulatory frameworks.

Lithium-ion batteries currently dominate the market with over 70% market share due to their relatively high energy density (250-300 Wh/kg) compared to traditional lead-acid batteries (30-50 Wh/kg). However, market segmentation reveals emerging demand for next-generation technologies that promise even higher energy densities, including solid-state batteries, lithium-sulfur, and lithium-air systems.

Regional analysis shows Asia-Pacific leading global production and consumption, with China controlling approximately 75% of the lithium-ion battery supply chain. North America and Europe are rapidly expanding their manufacturing capabilities through significant government investments, with the U.S. Inflation Reduction Act allocating over 35 billion USD to battery manufacturing and the European Battery Alliance mobilizing 120 billion EUR in investments.

Consumer electronics historically drove battery innovation, but electric vehicles now represent the largest and fastest-growing market segment. The automotive sector's demand for high energy density batteries is expected to grow at 25% annually as major manufacturers commit to electrification targets. Energy storage systems represent another high-growth segment, expanding at 30% annually as grid-scale applications increase.

Price sensitivity analysis reveals that battery costs have declined by approximately 85% over the past decade, from over 1,000 USD/kWh to approximately 135 USD/kWh in 2022. Industry projections suggest costs could fall below 100 USD/kWh by 2025, representing a critical threshold for EV price parity with internal combustion vehicles.

Market challenges include supply chain vulnerabilities for critical materials like lithium, cobalt, and nickel. Demand for these materials is projected to increase by 500% by 2030, creating potential bottlenecks. This has accelerated interest in alternative chemistries with reduced dependency on scarce materials, such as sodium-ion and lithium-iron-phosphate (LFP) batteries, despite their lower energy densities.

Consumer and regulatory trends increasingly emphasize sustainability, with battery recycling expected to grow into a 20 billion USD industry by 2030. Manufacturers achieving higher energy densities while reducing environmental impact are positioned to capture premium market segments and benefit from favorable regulatory frameworks.

Current Limitations in Electrochemical Cell Technology

Despite significant advancements in electrochemical cell technology, several critical limitations continue to impede the development of high energy density power sources. The theoretical energy density limits of current battery chemistries represent a fundamental challenge. Lithium-ion batteries, while dominant in the market, typically achieve only 250-300 Wh/kg, far below their theoretical maximum of approximately 400-500 Wh/kg. This gap between theoretical and practical energy density stems from the necessity for inactive components such as current collectors, separators, and packaging materials that contribute to weight but not to energy storage capacity.

Material stability issues present another significant barrier, particularly in advanced battery systems. High-energy cathode materials often suffer from structural degradation during cycling, leading to capacity fade and shortened lifespan. Nickel-rich cathodes (NMC811, NCA), while offering higher energy density, demonstrate accelerated degradation compared to their lower-energy counterparts, creating a challenging trade-off between energy density and longevity.

Electrolyte limitations further constrain energy density improvements. Conventional liquid electrolytes are flammable and prone to decomposition at high voltages (>4.5V), restricting the operating voltage window of cells. This voltage limitation directly impacts achievable energy density, as energy scales with the square of voltage. Solid-state electrolytes, while promising for safety and voltage stability, currently suffer from poor ionic conductivity at room temperature and challenging manufacturing processes.

Thermal management represents another critical constraint. High-energy cells generate significant heat during fast charging and discharging, necessitating robust cooling systems that add weight and volume to battery packs. This thermal overhead effectively reduces system-level energy density, particularly in applications requiring high power output.

Interface stability between electrodes and electrolytes remains problematic, especially in next-generation chemistries. Lithium metal anodes, which could theoretically double energy density compared to graphite, suffer from dendrite formation and continuous SEI layer growth, leading to capacity loss and potential safety hazards. Similarly, sulfur cathodes face polysulfide shuttle effects that rapidly degrade performance despite their theoretical energy density advantage.

Manufacturing scalability presents additional challenges for emerging high-energy technologies. While laboratory demonstrations of silicon anodes, lithium metal, and conversion cathodes show promising energy densities exceeding 400 Wh/kg, translating these achievements to mass production with consistent quality and reasonable cost remains elusive. The precision required for manufacturing advanced electrochemical cells often conflicts with the high-throughput processes needed for commercial viability.

Material stability issues present another significant barrier, particularly in advanced battery systems. High-energy cathode materials often suffer from structural degradation during cycling, leading to capacity fade and shortened lifespan. Nickel-rich cathodes (NMC811, NCA), while offering higher energy density, demonstrate accelerated degradation compared to their lower-energy counterparts, creating a challenging trade-off between energy density and longevity.

Electrolyte limitations further constrain energy density improvements. Conventional liquid electrolytes are flammable and prone to decomposition at high voltages (>4.5V), restricting the operating voltage window of cells. This voltage limitation directly impacts achievable energy density, as energy scales with the square of voltage. Solid-state electrolytes, while promising for safety and voltage stability, currently suffer from poor ionic conductivity at room temperature and challenging manufacturing processes.

Thermal management represents another critical constraint. High-energy cells generate significant heat during fast charging and discharging, necessitating robust cooling systems that add weight and volume to battery packs. This thermal overhead effectively reduces system-level energy density, particularly in applications requiring high power output.

Interface stability between electrodes and electrolytes remains problematic, especially in next-generation chemistries. Lithium metal anodes, which could theoretically double energy density compared to graphite, suffer from dendrite formation and continuous SEI layer growth, leading to capacity loss and potential safety hazards. Similarly, sulfur cathodes face polysulfide shuttle effects that rapidly degrade performance despite their theoretical energy density advantage.

Manufacturing scalability presents additional challenges for emerging high-energy technologies. While laboratory demonstrations of silicon anodes, lithium metal, and conversion cathodes show promising energy densities exceeding 400 Wh/kg, translating these achievements to mass production with consistent quality and reasonable cost remains elusive. The precision required for manufacturing advanced electrochemical cells often conflicts with the high-throughput processes needed for commercial viability.

Comparative Analysis of Electrochemical Cell Architectures

01 Electrode materials for high energy density

Advanced electrode materials play a crucial role in enhancing the energy density of electrochemical cells. These materials include novel cathode compositions, anode materials with higher capacity, and composite structures that optimize ion storage and transfer. By selecting materials with higher specific capacity and operating voltage, the overall energy density of the cell can be significantly increased. Innovations in this area focus on materials that can store more energy per unit mass or volume while maintaining stability during charge-discharge cycles.- Electrode materials for high energy density: Advanced electrode materials play a crucial role in enhancing the energy density of electrochemical cells. These materials include novel cathode compositions, anode structures with increased capacity, and composite electrodes that optimize ion transport and electron conductivity. By selecting materials with higher specific capacity and operating voltage, the overall energy density of the cell can be significantly improved while maintaining stability during charge-discharge cycles.

- Electrolyte formulations for improved performance: Specialized electrolyte formulations can enhance energy density by enabling wider operating voltage windows and improving ion transport efficiency. These formulations may include novel liquid electrolytes, solid-state electrolytes, or hybrid systems that combine the advantages of both. Additives in the electrolyte can also stabilize electrode-electrolyte interfaces, reduce unwanted side reactions, and extend cycle life while allowing the cell to operate at higher energy densities.

- Cell design and architecture optimization: Innovative cell designs and architectures can maximize energy density by optimizing the spatial arrangement of components and reducing inactive material content. This includes thin-film configurations, bipolar designs, and three-dimensional structures that increase the active material loading while minimizing the volume occupied by current collectors, separators, and packaging. Advanced manufacturing techniques enable precise control over component dimensions and interfaces, further enhancing energy density.

- Thermal management systems for high-energy cells: Effective thermal management is essential for high-energy density cells to prevent thermal runaway and maintain performance. These systems include phase change materials, heat spreaders, active cooling mechanisms, and thermally conductive components that efficiently dissipate heat. By maintaining optimal operating temperatures, these systems allow cells to operate safely at higher energy densities while extending their useful life and preventing capacity degradation.

- Hybrid and dual-chemistry energy storage systems: Hybrid and dual-chemistry systems combine different electrochemical technologies to achieve higher overall energy density. These may include lithium-ion capacitors, battery-supercapacitor hybrids, or cells with multiple active materials in a single electrode. By leveraging the complementary properties of different energy storage mechanisms, these systems can deliver both high energy density and high power capability, addressing limitations of single-chemistry approaches.

02 Electrolyte formulations for improved performance

Specialized electrolyte formulations can enhance the energy density of electrochemical cells by improving ionic conductivity, expanding the electrochemical stability window, and enabling higher voltage operation. These formulations may include novel solvents, additives, and salt combinations that facilitate faster ion transport while preventing unwanted side reactions. Advanced electrolytes also contribute to better interfacial stability between electrodes and electrolyte, reducing capacity fade and extending cycle life while maintaining high energy density.Expand Specific Solutions03 Cell design and architecture optimization

Innovative cell designs and architectures can maximize the energy density of electrochemical cells by optimizing the spatial arrangement of components and reducing the volume of inactive materials. These approaches include novel cell geometries, improved packaging techniques, and strategic placement of current collectors and separators. By minimizing dead space within the cell and increasing the ratio of active to inactive materials, the volumetric energy density can be significantly enhanced while maintaining or improving safety characteristics.Expand Specific Solutions04 Hybrid and dual-chemistry systems

Hybrid and dual-chemistry electrochemical systems combine different electrochemical mechanisms or materials to achieve higher energy density than conventional single-chemistry cells. These systems may integrate characteristics of batteries with supercapacitors, or combine different types of battery chemistries to leverage the advantages of each. By strategically pairing materials with complementary properties, these hybrid approaches can achieve energy densities that exceed the limitations of individual technologies while potentially offering improved power capability and cycle life.Expand Specific Solutions05 Nanostructured materials and interfaces

Nanostructured materials and engineered interfaces can significantly enhance energy density in electrochemical cells by increasing active surface area, shortening ion diffusion paths, and improving reaction kinetics. These approaches include nanoparticles, nanowires, nanotubes, and hierarchical structures that maximize the utilization of active materials. By controlling the architecture at the nanoscale, these materials can accommodate volume changes during cycling, enhance electronic conductivity, and facilitate faster ion transport, all contributing to higher energy density while potentially improving cycle life and rate capability.Expand Specific Solutions

Leading Battery Manufacturers and Research Institutions

The electrochemical cell energy density market is currently in a growth phase, with increasing demand driven by electric vehicles and renewable energy storage applications. The market size is projected to reach significant expansion as battery technology advances. Leading academic institutions like MIT, University of California, and Northeastern University are conducting foundational research, while commercial players demonstrate varying levels of technological maturity. Companies like 24M Technologies, A123 Systems, and Sion Power are pioneering advanced lithium-based technologies with higher energy densities. Established manufacturers including Panasonic Energy, Samsung SDI, and Automotive Cells Company are scaling production capabilities, while Apple and Medtronic represent major end-users driving application-specific requirements. The competitive landscape shows a healthy ecosystem of research institutions, startups, and established manufacturers collaborating to overcome current energy density limitations.

24M Technologies, Inc.

Technical Solution: 24M Technologies开发了革命性的"半固态"电池制造平台,通过其专利的SemiSolid™技术显著简化了锂离子电池的生产流程。该技术使用高负载活性材料的粘稠电极浆料,消除了传统电池制造中的多个步骤,如涂布、干燥和日历加工。24M的电池设计实现了更厚的电极(>300μm,是传统电极的2-3倍),减少了非活性组件(如集流体、隔膜)的比例,从而提高了能量密度约20-30%。其最新的NCM正极配方结合半固态设计,实现了超过350 Wh/kg的实验室能量密度。公司还开发了适用于不同应用的多种化学体系,包括高能量NCM、长寿命LFP和高功率LTO配方。24M的技术特别适合大规模储能系统和电动汽车应用,其简化的制造流程可减少约50%的资本投入和约40%的生产成本。该技术已被多家全球合作伙伴许可,包括日本的京瓷和挪威的Freyr Battery。

优势:革命性的制造工艺显著降低了生产成本和资本支出;厚电极设计提高了活性材料比例和能量密度;生产过程更环保,减少了有机溶剂使用;技术平台适应性强,可应用于多种电池化学体系。劣势:厚电极设计可能限制高功率应用的性能;技术相对较新,长期可靠性数据有限;大规模商业化生产仍在进行中;在高倍率充放电条件下可能面临离子传输限制。

A123 Systems LLC

Technical Solution: A123 Systems专注于开发高功率和长寿命的锂离子磷酸铁(LFP)电池技术。其专利的纳米磷酸铁锂材料提供了卓越的功率性能和安全性,虽然质量能量密度(约100-140 Wh/kg)低于高镍电池,但在特定应用中具有明显优势。A123开发了独特的"超级磷酸铁锂"(Ultra LFP)技术,通过优化颗粒形貌和导电网络,提高了能量密度约15-20%,同时保持了LFP的固有安全性和长循环寿命。公司还研发了先进的双电极材料系统,结合LFP的安全性和高镍材料的高能量密度,创造了混合解决方案。A123的最新研究方向包括硅基负极材料和先进的电池管理系统,以进一步提高系统级能量密度。其电池技术主要应用于混合动力汽车、电网储能和工业应用,特别是在需要高功率输出和长循环寿命的场景。

优势:LFP技术提供卓越的安全性和循环寿命(>4000次循环);在高功率应用中表现出色;对关键原材料(如钴、镍)依赖较低,成本优势明显。劣势:能量密度低于高镍NCM/NCA电池;低温性能相对较差;在纯电动长续航应用中竞争力不足。

Key Patents in High Energy Density Battery Technology

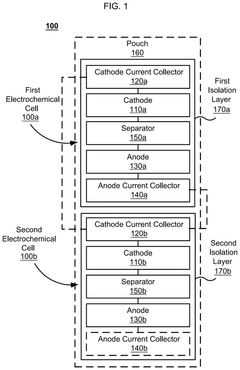

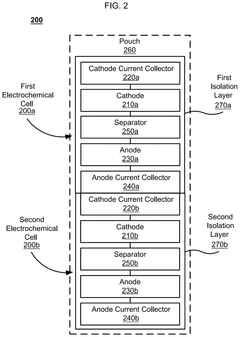

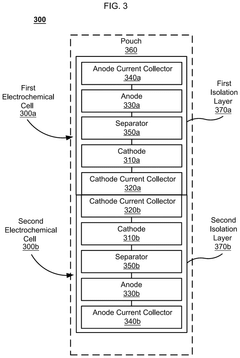

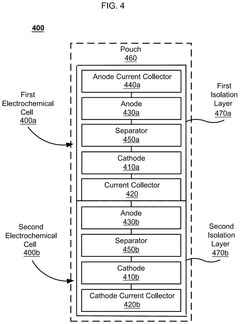

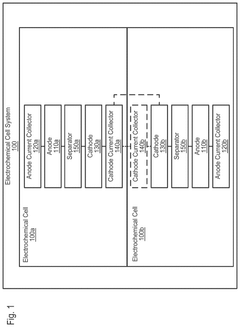

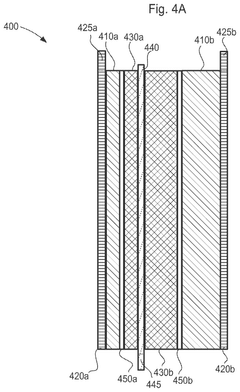

Electrochemical cell systems with divergent cell chemistries and methods of producing the same

PatentPendingUS20250141002A1

Innovation

- The development of electrochemical cell systems that integrate multiple electrochemical cells with dissimilar chemistries, such as lithium-ion and sodium-ion cells, within a single pouch or prismatic cell, allowing for fluidic isolation and connection in parallel or series configurations.

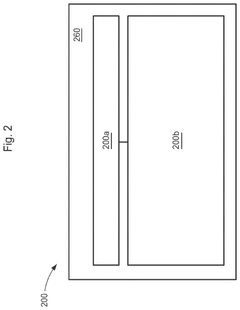

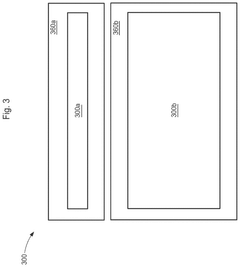

Divided energy electrochemical cell systems and methods of producing the same

PatentActiveUS12362398B2

Innovation

- The development of divided energy electrochemical cells systems comprising multiple electrochemical cells with different performance properties, such as high energy density and high power density, connected in parallel, utilizing semi-solid electrodes and selective permeable membranes to optimize individual cell properties.

Environmental Impact of Battery Technologies

The environmental footprint of battery technologies extends far beyond their operational phase, encompassing raw material extraction, manufacturing processes, and end-of-life management. When comparing the environmental impact of different electrochemical cells, lithium-ion batteries demonstrate significant advantages in energy density but present challenges in resource extraction. Lithium mining operations, particularly in South America's "Lithium Triangle," consume vast quantities of water—approximately 500,000 gallons per ton of lithium—potentially threatening local ecosystems and agricultural communities.

Lead-acid batteries, while featuring lower energy density, contain highly toxic materials that pose serious environmental risks if improperly disposed of. Their manufacturing process generates substantial greenhouse gas emissions—approximately 3.2 kg CO2 equivalent per kg of battery produced. However, these batteries boast the highest recycling rate among all battery types at over 99% in many developed nations, partially offsetting their environmental impact.

Nickel-metal hydride (NiMH) batteries present a moderate environmental profile with less toxic components than lead-acid alternatives but require energy-intensive manufacturing processes. The extraction of rare earth elements for NiMH batteries, particularly in regions with limited environmental regulations, has been linked to soil contamination and water pollution.

Emerging technologies such as sodium-ion and zinc-air batteries offer promising environmental advantages. Sodium-ion batteries utilize abundant, widely distributed resources, potentially reducing the geopolitical and environmental pressures associated with lithium extraction. Similarly, zinc-air batteries employ more readily available materials with established recycling infrastructures.

The carbon footprint across battery lifecycles varies significantly. High-energy-density lithium-ion batteries generate approximately 61-106 kg CO2 equivalent per kWh of capacity during production, while lower-density lead-acid batteries produce around 38-41 kg CO2 equivalent per kWh. This inverse relationship between energy density and production emissions highlights the complexity of environmental assessment.

Water consumption presents another critical environmental consideration. Battery manufacturing facilities typically consume between 50-400 liters of water per kWh of battery capacity produced, with higher-energy-density technologies generally requiring greater water inputs for purification processes and thermal management systems.

Recycling infrastructure development remains uneven across battery technologies, with established processes for lead-acid batteries contrasting sharply with the emerging recycling capabilities for newer high-energy-density systems. This disparity creates significant environmental implications as battery deployment accelerates globally.

Lead-acid batteries, while featuring lower energy density, contain highly toxic materials that pose serious environmental risks if improperly disposed of. Their manufacturing process generates substantial greenhouse gas emissions—approximately 3.2 kg CO2 equivalent per kg of battery produced. However, these batteries boast the highest recycling rate among all battery types at over 99% in many developed nations, partially offsetting their environmental impact.

Nickel-metal hydride (NiMH) batteries present a moderate environmental profile with less toxic components than lead-acid alternatives but require energy-intensive manufacturing processes. The extraction of rare earth elements for NiMH batteries, particularly in regions with limited environmental regulations, has been linked to soil contamination and water pollution.

Emerging technologies such as sodium-ion and zinc-air batteries offer promising environmental advantages. Sodium-ion batteries utilize abundant, widely distributed resources, potentially reducing the geopolitical and environmental pressures associated with lithium extraction. Similarly, zinc-air batteries employ more readily available materials with established recycling infrastructures.

The carbon footprint across battery lifecycles varies significantly. High-energy-density lithium-ion batteries generate approximately 61-106 kg CO2 equivalent per kWh of capacity during production, while lower-density lead-acid batteries produce around 38-41 kg CO2 equivalent per kWh. This inverse relationship between energy density and production emissions highlights the complexity of environmental assessment.

Water consumption presents another critical environmental consideration. Battery manufacturing facilities typically consume between 50-400 liters of water per kWh of battery capacity produced, with higher-energy-density technologies generally requiring greater water inputs for purification processes and thermal management systems.

Recycling infrastructure development remains uneven across battery technologies, with established processes for lead-acid batteries contrasting sharply with the emerging recycling capabilities for newer high-energy-density systems. This disparity creates significant environmental implications as battery deployment accelerates globally.

Supply Chain Considerations for Battery Materials

The global battery supply chain represents a complex network spanning multiple continents, with significant implications for the energy density capabilities of different electrochemical cells. Raw material availability directly impacts battery chemistry selection and performance characteristics, particularly energy density outcomes. Lithium, cobalt, nickel, and manganese—critical components for high-energy-density batteries—face varying degrees of supply constraints and geopolitical risks.

Lithium supply chains are concentrated in South America's "Lithium Triangle" (Chile, Argentina, Bolivia) and Australia, with China dominating processing operations. This concentration creates vulnerability in the supply chain for lithium-ion batteries, which currently offer the highest commercial energy densities. Recent price volatility in lithium markets has prompted manufacturers to explore alternative chemistries with reduced lithium content, potentially sacrificing optimal energy density for supply security.

Cobalt presents perhaps the most significant supply chain challenge, with over 70% of global production concentrated in the Democratic Republic of Congo, raising ethical and stability concerns. This has accelerated research into cobalt-reduced or cobalt-free cathode materials, such as LFP (lithium iron phosphate) batteries, which offer lower energy density but greater supply chain resilience compared to NMC (nickel manganese cobalt) formulations.

The processing and refining capacity for battery materials represents another critical bottleneck, with China controlling approximately 80% of global battery material processing. This concentration limits the ability of Western manufacturers to rapidly scale production of high-energy-density cells without dependence on Chinese supply chains, prompting recent initiatives to develop regional battery manufacturing ecosystems in North America and Europe.

Transportation logistics also significantly impact battery material availability and cost structures. The weight and hazardous classification of many battery materials increase shipping costs and complexity, affecting the economic viability of certain high-energy-density formulations. This has led to increasing co-location of battery material processing and cell manufacturing facilities to minimize logistical challenges.

Recycling infrastructure development represents a growing factor in battery supply chain considerations. Currently, less than 5% of lithium-ion batteries are recycled globally, representing a missed opportunity to recapture critical materials. Emerging recycling technologies promise to recover up to 95% of key metals from spent batteries, potentially alleviating supply constraints for high-energy-density chemistries while reducing environmental impact.

Lithium supply chains are concentrated in South America's "Lithium Triangle" (Chile, Argentina, Bolivia) and Australia, with China dominating processing operations. This concentration creates vulnerability in the supply chain for lithium-ion batteries, which currently offer the highest commercial energy densities. Recent price volatility in lithium markets has prompted manufacturers to explore alternative chemistries with reduced lithium content, potentially sacrificing optimal energy density for supply security.

Cobalt presents perhaps the most significant supply chain challenge, with over 70% of global production concentrated in the Democratic Republic of Congo, raising ethical and stability concerns. This has accelerated research into cobalt-reduced or cobalt-free cathode materials, such as LFP (lithium iron phosphate) batteries, which offer lower energy density but greater supply chain resilience compared to NMC (nickel manganese cobalt) formulations.

The processing and refining capacity for battery materials represents another critical bottleneck, with China controlling approximately 80% of global battery material processing. This concentration limits the ability of Western manufacturers to rapidly scale production of high-energy-density cells without dependence on Chinese supply chains, prompting recent initiatives to develop regional battery manufacturing ecosystems in North America and Europe.

Transportation logistics also significantly impact battery material availability and cost structures. The weight and hazardous classification of many battery materials increase shipping costs and complexity, affecting the economic viability of certain high-energy-density formulations. This has led to increasing co-location of battery material processing and cell manufacturing facilities to minimize logistical challenges.

Recycling infrastructure development represents a growing factor in battery supply chain considerations. Currently, less than 5% of lithium-ion batteries are recycled globally, representing a missed opportunity to recapture critical materials. Emerging recycling technologies promise to recover up to 95% of key metals from spent batteries, potentially alleviating supply constraints for high-energy-density chemistries while reducing environmental impact.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!