Compare Iron-Air and High-Temperature Batteries: Efficiency

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Iron-Air and HT Battery Technology Background and Objectives

Energy storage technologies have evolved significantly over the past decades, with various battery chemistries emerging to address different application needs. Iron-Air and High-Temperature (HT) batteries represent two distinct approaches to large-scale energy storage that have gained attention for their unique characteristics and potential applications in renewable energy integration and grid stabilization.

Iron-Air batteries have roots dating back to the 1970s, but have seen renewed interest in recent years due to advancements in materials science and electrochemistry. These batteries utilize the oxidation of iron and reduction of oxygen from the air to store and release energy. The fundamental chemistry leverages abundant, low-cost materials, positioning Iron-Air technology as a potentially sustainable solution for long-duration energy storage applications.

High-Temperature batteries, including sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) systems, operate at elevated temperatures typically between 270-350°C. Their development began in the 1960s with Ford Motor Company's work on sodium-sulfur technology, followed by subsequent refinements. These systems have been commercially deployed since the 1990s, primarily for grid-scale applications in Japan and increasingly worldwide.

The technological evolution trajectory for both systems has been driven by the growing need for efficient, cost-effective energy storage solutions that can support renewable energy integration and provide grid resilience. As intermittent renewable sources like solar and wind power increase their market share, the demand for storage technologies that can balance supply and demand has intensified.

The primary technical objectives for both Iron-Air and HT batteries center on efficiency improvements, cost reduction, and operational longevity. For Iron-Air systems, key goals include enhancing round-trip efficiency beyond current 50-60% levels, extending cycle life, and developing scalable manufacturing processes. HT batteries face objectives related to thermal management optimization, reducing operating temperatures to improve safety and reduce energy parasitic losses, and extending service life beyond the current 15-20 year range.

Current research and development efforts are focused on addressing these challenges through materials innovation, cell design optimization, and system-level engineering. Both technologies are positioned as potential alternatives to lithium-ion batteries for applications requiring longer discharge durations (4+ hours), where the emphasis shifts from power density to energy capacity and cost-effectiveness.

The comparative efficiency analysis between these technologies must consider not only electrical conversion efficiency but also factors such as energy density, response time, self-discharge rates, and thermal management requirements, which collectively determine their suitability for specific applications in the evolving energy landscape.

Iron-Air batteries have roots dating back to the 1970s, but have seen renewed interest in recent years due to advancements in materials science and electrochemistry. These batteries utilize the oxidation of iron and reduction of oxygen from the air to store and release energy. The fundamental chemistry leverages abundant, low-cost materials, positioning Iron-Air technology as a potentially sustainable solution for long-duration energy storage applications.

High-Temperature batteries, including sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) systems, operate at elevated temperatures typically between 270-350°C. Their development began in the 1960s with Ford Motor Company's work on sodium-sulfur technology, followed by subsequent refinements. These systems have been commercially deployed since the 1990s, primarily for grid-scale applications in Japan and increasingly worldwide.

The technological evolution trajectory for both systems has been driven by the growing need for efficient, cost-effective energy storage solutions that can support renewable energy integration and provide grid resilience. As intermittent renewable sources like solar and wind power increase their market share, the demand for storage technologies that can balance supply and demand has intensified.

The primary technical objectives for both Iron-Air and HT batteries center on efficiency improvements, cost reduction, and operational longevity. For Iron-Air systems, key goals include enhancing round-trip efficiency beyond current 50-60% levels, extending cycle life, and developing scalable manufacturing processes. HT batteries face objectives related to thermal management optimization, reducing operating temperatures to improve safety and reduce energy parasitic losses, and extending service life beyond the current 15-20 year range.

Current research and development efforts are focused on addressing these challenges through materials innovation, cell design optimization, and system-level engineering. Both technologies are positioned as potential alternatives to lithium-ion batteries for applications requiring longer discharge durations (4+ hours), where the emphasis shifts from power density to energy capacity and cost-effectiveness.

The comparative efficiency analysis between these technologies must consider not only electrical conversion efficiency but also factors such as energy density, response time, self-discharge rates, and thermal management requirements, which collectively determine their suitability for specific applications in the evolving energy landscape.

Market Demand Analysis for Advanced Energy Storage Solutions

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the push for grid stability. Advanced energy storage solutions, particularly Iron-Air and High-Temperature batteries, are positioned to capture significant market share due to their potential for high efficiency and cost-effectiveness. Current market projections indicate the global energy storage market will reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2035.

Industrial sectors, including manufacturing and heavy industry, are demonstrating strong demand for high-temperature batteries due to their ability to operate efficiently in extreme environments. These batteries address critical needs in sectors where operational temperatures exceed the capabilities of conventional lithium-ion systems. Market research indicates that industrial applications for high-temperature batteries could represent a $89 billion opportunity by 2030.

Simultaneously, the utility-scale storage segment is increasingly interested in Iron-Air battery technology due to its long-duration storage capabilities and use of abundant, low-cost materials. Grid operators and renewable energy developers are seeking storage solutions that can provide 10+ hours of discharge time, a requirement that Iron-Air batteries can potentially fulfill at a fraction of the cost of lithium-ion alternatives. This market segment is projected to grow at 25% annually through 2030.

Commercial and residential sectors are also emerging as significant demand drivers for both technologies. Building energy management systems increasingly incorporate storage solutions to optimize energy consumption patterns and reduce peak demand charges. The commercial building energy storage market is expected to grow by 30% annually over the next five years, representing a substantial opportunity for efficient battery technologies.

Geographic demand patterns reveal interesting trends, with developed economies in North America and Europe focusing on grid modernization and renewable integration, creating immediate demand for Iron-Air batteries. Meanwhile, rapidly industrializing economies in Asia and parts of Africa show stronger interest in high-temperature batteries for industrial applications and microgrids.

Consumer preferences are evolving toward solutions with lower environmental impacts and reduced lifecycle costs. Both Iron-Air and High-Temperature batteries offer advantages in these areas compared to conventional lithium-ion technology, with Iron-Air batteries particularly appealing due to their use of earth-abundant materials and minimal environmental footprint.

Regulatory frameworks are increasingly favorable for advanced energy storage deployment, with many jurisdictions implementing policies that incentivize or mandate storage capacity additions. These regulatory tailwinds are expected to accelerate market adoption of both technologies, particularly in regions with aggressive decarbonization targets.

Industrial sectors, including manufacturing and heavy industry, are demonstrating strong demand for high-temperature batteries due to their ability to operate efficiently in extreme environments. These batteries address critical needs in sectors where operational temperatures exceed the capabilities of conventional lithium-ion systems. Market research indicates that industrial applications for high-temperature batteries could represent a $89 billion opportunity by 2030.

Simultaneously, the utility-scale storage segment is increasingly interested in Iron-Air battery technology due to its long-duration storage capabilities and use of abundant, low-cost materials. Grid operators and renewable energy developers are seeking storage solutions that can provide 10+ hours of discharge time, a requirement that Iron-Air batteries can potentially fulfill at a fraction of the cost of lithium-ion alternatives. This market segment is projected to grow at 25% annually through 2030.

Commercial and residential sectors are also emerging as significant demand drivers for both technologies. Building energy management systems increasingly incorporate storage solutions to optimize energy consumption patterns and reduce peak demand charges. The commercial building energy storage market is expected to grow by 30% annually over the next five years, representing a substantial opportunity for efficient battery technologies.

Geographic demand patterns reveal interesting trends, with developed economies in North America and Europe focusing on grid modernization and renewable integration, creating immediate demand for Iron-Air batteries. Meanwhile, rapidly industrializing economies in Asia and parts of Africa show stronger interest in high-temperature batteries for industrial applications and microgrids.

Consumer preferences are evolving toward solutions with lower environmental impacts and reduced lifecycle costs. Both Iron-Air and High-Temperature batteries offer advantages in these areas compared to conventional lithium-ion technology, with Iron-Air batteries particularly appealing due to their use of earth-abundant materials and minimal environmental footprint.

Regulatory frameworks are increasingly favorable for advanced energy storage deployment, with many jurisdictions implementing policies that incentivize or mandate storage capacity additions. These regulatory tailwinds are expected to accelerate market adoption of both technologies, particularly in regions with aggressive decarbonization targets.

Current State and Technical Challenges in Battery Technologies

The global battery technology landscape is experiencing rapid evolution, with iron-air and high-temperature batteries emerging as significant contenders in the energy storage market. Currently, lithium-ion batteries dominate commercial applications, but their limitations in terms of resource scarcity, cost, and energy density have accelerated research into alternative technologies.

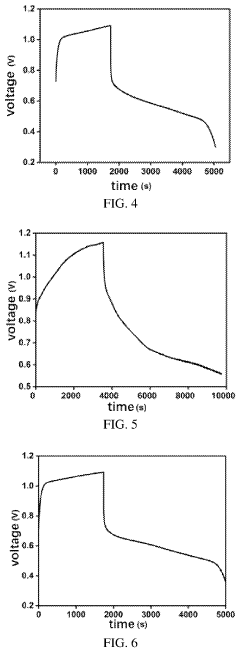

Iron-air batteries have reached a promising developmental stage, with several companies demonstrating functional prototypes achieving energy densities of 150-200 Wh/kg. These systems utilize the oxidation of iron in ambient air to store energy, offering theoretical energy densities up to 300 Wh/kg. However, they currently face efficiency challenges with round-trip efficiencies typically ranging from 40-60%, significantly lower than the 85-95% achieved by lithium-ion systems.

High-temperature batteries, particularly sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) variants, have progressed beyond research stages into commercial deployment for grid applications. These systems operate at temperatures between 270-350°C and demonstrate energy densities of 100-200 Wh/kg with round-trip efficiencies of 75-85%. Their thermal management requirements, however, present significant engineering challenges.

The primary technical hurdles for iron-air technology include addressing the parasitic hydrogen evolution reaction during charging, preventing electrode degradation over multiple cycles, and improving oxygen reduction reaction kinetics. Current research indicates cycle life limitations of 1,000-2,000 cycles, compared to 3,000-5,000 for commercial lithium-ion batteries.

High-temperature batteries face distinct challenges related to thermal insulation, seal integrity at elevated temperatures, and safety concerns associated with high operating temperatures. The energy required to maintain operating temperature can consume 10-15% of stored energy, reducing overall system efficiency. Additionally, these systems typically require 12-24 hours to reach operating temperature from a cold state.

Manufacturing scalability presents different obstacles for each technology. Iron-air batteries benefit from abundant, low-cost materials but require precise control of iron particle morphology and electrolyte composition. High-temperature batteries involve complex ceramic components and specialized sealing technologies that currently limit mass production capabilities.

Recent advancements in electrocatalysts for iron-air batteries and solid-state electrolytes for high-temperature systems show promise for addressing efficiency gaps. Research institutions and companies across North America, Europe, and Asia are actively developing proprietary solutions, with particular concentration of iron-air research in the United States and high-temperature battery development in Japan, Germany, and South Korea.

Iron-air batteries have reached a promising developmental stage, with several companies demonstrating functional prototypes achieving energy densities of 150-200 Wh/kg. These systems utilize the oxidation of iron in ambient air to store energy, offering theoretical energy densities up to 300 Wh/kg. However, they currently face efficiency challenges with round-trip efficiencies typically ranging from 40-60%, significantly lower than the 85-95% achieved by lithium-ion systems.

High-temperature batteries, particularly sodium-sulfur (NaS) and sodium-nickel chloride (ZEBRA) variants, have progressed beyond research stages into commercial deployment for grid applications. These systems operate at temperatures between 270-350°C and demonstrate energy densities of 100-200 Wh/kg with round-trip efficiencies of 75-85%. Their thermal management requirements, however, present significant engineering challenges.

The primary technical hurdles for iron-air technology include addressing the parasitic hydrogen evolution reaction during charging, preventing electrode degradation over multiple cycles, and improving oxygen reduction reaction kinetics. Current research indicates cycle life limitations of 1,000-2,000 cycles, compared to 3,000-5,000 for commercial lithium-ion batteries.

High-temperature batteries face distinct challenges related to thermal insulation, seal integrity at elevated temperatures, and safety concerns associated with high operating temperatures. The energy required to maintain operating temperature can consume 10-15% of stored energy, reducing overall system efficiency. Additionally, these systems typically require 12-24 hours to reach operating temperature from a cold state.

Manufacturing scalability presents different obstacles for each technology. Iron-air batteries benefit from abundant, low-cost materials but require precise control of iron particle morphology and electrolyte composition. High-temperature batteries involve complex ceramic components and specialized sealing technologies that currently limit mass production capabilities.

Recent advancements in electrocatalysts for iron-air batteries and solid-state electrolytes for high-temperature systems show promise for addressing efficiency gaps. Research institutions and companies across North America, Europe, and Asia are actively developing proprietary solutions, with particular concentration of iron-air research in the United States and high-temperature battery development in Japan, Germany, and South Korea.

Technical Comparison of Current Iron-Air and HT Battery Solutions

01 Iron-Air Battery Electrode Materials and Structures

Advanced electrode materials and structures are crucial for improving the efficiency of iron-air batteries. These innovations include specialized iron-based anodes, air cathodes with optimized catalysts, and novel structural designs that enhance electron transfer and oxygen reduction reactions. The electrode configurations often incorporate nanomaterials and composite structures to increase active surface area and improve reaction kinetics, resulting in higher energy density and better overall battery performance.- Iron-Air Battery Electrode Materials and Structures: Advanced electrode materials and structures are crucial for improving iron-air battery efficiency. These innovations include specialized iron-based anodes with optimized morphology, enhanced air cathodes with catalytic properties, and novel structural designs that facilitate better ion transport. These materials and structures help overcome traditional limitations of iron-air batteries such as capacity fade and charging inefficiency, resulting in higher energy density and improved cycle life.

- High-Temperature Battery Thermal Management Systems: Thermal management systems are essential for maintaining optimal operating conditions in high-temperature batteries. These systems include advanced cooling mechanisms, heat-resistant materials, and thermal insulation designs that prevent overheating while allowing batteries to operate efficiently at elevated temperatures. Effective thermal management extends battery lifespan, improves safety, and maintains consistent performance across varying environmental conditions.

- Electrolyte Compositions for Enhanced Ionic Conductivity: Specialized electrolyte compositions significantly impact battery efficiency, particularly in high-temperature applications. These formulations include heat-stable electrolytes, additives that prevent degradation, and ionic liquids with high conductivity at elevated temperatures. Advanced electrolytes reduce internal resistance, improve ion transport between electrodes, and enhance overall electrochemical performance while maintaining stability under demanding thermal conditions.

- Catalyst Technologies for Oxygen Reduction and Evolution: Catalyst technologies play a critical role in improving the efficiency of iron-air batteries by enhancing oxygen reduction and evolution reactions. These catalysts include bifunctional materials, noble metal alternatives, and nanostructured designs that accelerate electrochemical reactions while reducing energy barriers. Effective catalysts minimize overpotential, increase energy efficiency, and improve the reversibility of oxygen-related reactions that are fundamental to air battery operation.

- Battery Management Systems for Efficiency Optimization: Advanced battery management systems optimize the performance of both iron-air and high-temperature batteries through intelligent monitoring and control. These systems incorporate real-time diagnostics, adaptive charging algorithms, and predictive maintenance capabilities that maximize energy efficiency while preventing degradation. Sophisticated management systems balance cell performance, regulate operating parameters, and extend battery lifespan by maintaining optimal conditions throughout charge-discharge cycles.

02 High-Temperature Battery Thermal Management Systems

Thermal management systems are essential for maintaining optimal operating conditions in high-temperature batteries. These systems include heat-resistant materials, thermal insulation layers, and cooling mechanisms that prevent overheating and thermal runaway. Advanced thermal management approaches enable batteries to operate efficiently at elevated temperatures while extending cycle life and preventing degradation of battery components. These innovations help maintain consistent performance across varying temperature conditions.Expand Specific Solutions03 Electrolyte Compositions for Enhanced Ionic Conductivity

Specialized electrolyte compositions are developed to improve ionic conductivity in both iron-air and high-temperature batteries. These formulations include heat-stable electrolytes, additives that prevent electrode passivation, and compounds that enhance oxygen solubility and transport. The electrolyte innovations focus on maintaining stability at high temperatures while facilitating efficient ion movement between electrodes, which directly impacts charging efficiency, discharge rates, and overall battery performance.Expand Specific Solutions04 Battery System Integration and Control Algorithms

Advanced system integration approaches and control algorithms optimize the efficiency of iron-air and high-temperature batteries. These include smart battery management systems that monitor and adjust operating parameters in real-time, predictive models for performance optimization, and integrated cooling systems. The control strategies help balance charging and discharging cycles, prevent capacity degradation, and maximize energy conversion efficiency while extending battery lifespan under demanding operating conditions.Expand Specific Solutions05 Novel Catalysts for Oxygen Evolution and Reduction Reactions

Innovative catalysts significantly improve the efficiency of oxygen evolution and reduction reactions in iron-air batteries. These catalysts include bifunctional materials, noble metal-free alternatives, and nanostructured composites that lower activation energy barriers and accelerate reaction kinetics. By enhancing the oxygen reactions that are often rate-limiting in metal-air batteries, these catalytic materials increase energy efficiency, power density, and overall battery performance while potentially reducing manufacturing costs.Expand Specific Solutions

Key Industry Players and Competitive Landscape Analysis

The Iron-Air and High-Temperature Battery market is currently in an early growth phase, with significant technological advancements driving expansion in grid-scale energy storage applications. The global market for these technologies is projected to reach $15-20 billion by 2030, fueled by increasing renewable energy integration demands. Form Energy leads innovation in iron-air technology with their multi-day storage solutions, while companies like Siemens AG, BYD, and LG Chem are advancing high-temperature battery technologies. Research institutions including MIT, Caltech, and Chinese Academy of Sciences are contributing fundamental breakthroughs. Technical maturity varies significantly: high-temperature batteries are more established with commercial deployments by Siemens and Tesla, while iron-air technology is emerging with Form Energy's pilot projects demonstrating promising efficiency-to-cost ratios for long-duration applications.

Form Energy, Inc.

Technical Solution: Form Energy has developed an innovative iron-air battery technology that leverages the principle of reversible rusting. Their batteries utilize iron pellets that are exposed to air, causing them to rust (oxidize) during discharge and revert to iron when charged. This technology stores energy at approximately 1/10th the cost of lithium-ion systems, with a target price of less than $20/kWh. Form Energy's iron-air batteries are designed specifically for long-duration energy storage (100+ hours), making them ideal for grid-scale applications. The company's first commercial product, the Form Energy Iron-Air 100™ system, can deliver 100 hours of continuous power at system costs competitive with conventional power plants. The technology uses earth-abundant materials (iron, water, and air), making it sustainable and scalable for widespread deployment.

Strengths: Extremely low cost compared to lithium-ion batteries; uses abundant, non-toxic materials; capable of multi-day storage (100+ hours); environmentally sustainable; scalable for grid applications. Weaknesses: Lower energy density than lithium-ion batteries; primarily suited for stationary applications rather than mobile uses; relatively new technology with limited field deployment history; slower response time compared to some other battery technologies.

BYD Co., Ltd.

Technical Solution: BYD has pioneered the development and commercialization of high-temperature sodium-ion batteries, particularly their Blade Battery technology. These batteries operate at elevated temperatures (typically 270-350°C) and utilize molten sodium as the anode and various cathode materials. BYD's high-temperature battery systems employ beta-alumina solid electrolytes that enable sodium ion conduction at operating temperatures. The company has focused on enhancing energy density, which now reaches approximately 160-200 Wh/kg, while maintaining thermal management systems that maintain optimal operating temperatures. BYD's high-temperature batteries demonstrate exceptional cycle life (4,000+ cycles) and safety performance, with virtually zero risk of thermal runaway. The company has integrated these batteries into both grid storage solutions and electric vehicles, leveraging their high energy efficiency (89-92%) and ability to operate effectively in extreme climate conditions.

Strengths: High energy efficiency; excellent thermal stability; long cycle life; good performance in extreme temperatures; lower raw material costs than lithium-ion batteries; minimal self-discharge when maintained at operating temperature. Weaknesses: Energy required to maintain operating temperature reduces overall efficiency; complex thermal management systems add weight and cost; slower startup from cold conditions; higher manufacturing complexity compared to ambient temperature batteries.

Core Efficiency Mechanisms and Performance Metrics Analysis

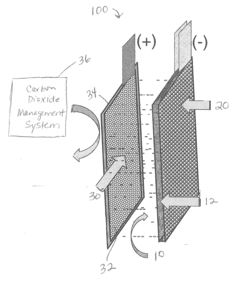

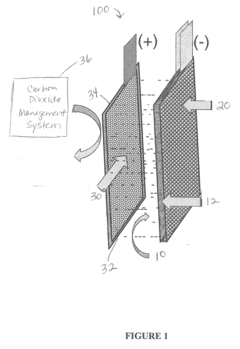

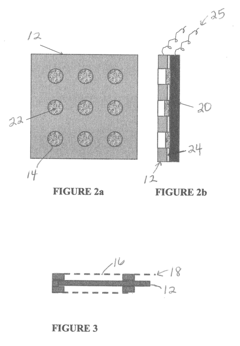

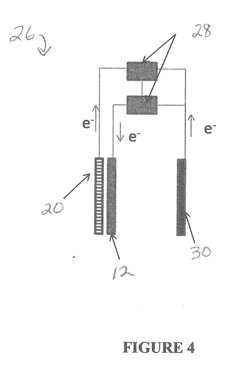

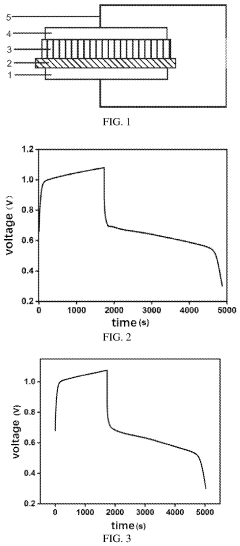

Iron-air rechargeable battery

PatentActiveUS20120187918A1

Innovation

- Incorporating self-assembling organic sulfur-based additives to inhibit hydrogen evolution, using non-toxic bismuth additives to suppress parasitic reactions, integrating a bilayer composite electrode for hydrogen utilization, employing nano-structured corrosion-resistant substrates for the air electrode, and implementing a carbon dioxide management system to enhance efficiency and durability.

All-solid-state iron-air battery

PatentPendingUS20230275212A1

Innovation

- An all-solid-state iron-air battery design featuring a ferrate-based negative electrode, a redox-active positive electrode, an oxygen-ion conducting solid electrolyte, and an electronically insulating separator to prevent electric leakage, with the negative electrode doped with alkali metals and mixed with yttria stabilized zirconia to enhance conductivity and stability.

Environmental Impact and Sustainability Assessment

The environmental impact of energy storage technologies has become a critical consideration in the transition to sustainable energy systems. Iron-Air batteries demonstrate significant environmental advantages compared to High-Temperature Batteries (HTBs), primarily due to their material composition. Iron-Air batteries utilize abundant, non-toxic materials such as iron, which is the fourth most common element in the Earth's crust. This abundance translates to lower environmental degradation from mining activities and reduced supply chain vulnerabilities.

In contrast, many HTBs rely on rare earth elements and specialized materials that require energy-intensive extraction processes. For instance, sodium-sulfur and sodium-nickel chloride batteries operate at temperatures between 300-350°C, necessitating continuous heating that increases their overall energy consumption and carbon footprint during operation.

Life cycle assessment (LCA) studies indicate that Iron-Air batteries have a substantially lower carbon footprint throughout their production, use, and disposal phases. The manufacturing process for Iron-Air batteries generates approximately 30-40% fewer greenhouse gas emissions compared to HTBs, primarily due to lower processing temperatures and simpler manufacturing requirements.

Water usage represents another critical environmental metric. Iron-Air battery production typically consumes 25-35% less water than HTB manufacturing processes. This reduced water footprint becomes increasingly important in regions facing water scarcity challenges, where industrial water consumption competes with agricultural and residential needs.

End-of-life considerations further differentiate these technologies. Iron-Air batteries offer superior recyclability, with up to 90% of materials potentially recoverable through established recycling processes. The iron components can be readily reintegrated into new batteries or repurposed for other industrial applications. HTBs present more complex recycling challenges due to their specialized materials and the safety concerns associated with handling components that have operated at extreme temperatures.

Land use efficiency also favors Iron-Air technology. These systems typically require 15-20% less physical space per kWh of storage capacity compared to most HTB installations, reducing habitat disruption and allowing for more flexible deployment options in space-constrained environments.

When evaluating sustainability through the lens of the United Nations Sustainable Development Goals (SDGs), Iron-Air batteries align more closely with multiple objectives, including SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action), due to their lower resource intensity and reduced emissions profile throughout their lifecycle.

In contrast, many HTBs rely on rare earth elements and specialized materials that require energy-intensive extraction processes. For instance, sodium-sulfur and sodium-nickel chloride batteries operate at temperatures between 300-350°C, necessitating continuous heating that increases their overall energy consumption and carbon footprint during operation.

Life cycle assessment (LCA) studies indicate that Iron-Air batteries have a substantially lower carbon footprint throughout their production, use, and disposal phases. The manufacturing process for Iron-Air batteries generates approximately 30-40% fewer greenhouse gas emissions compared to HTBs, primarily due to lower processing temperatures and simpler manufacturing requirements.

Water usage represents another critical environmental metric. Iron-Air battery production typically consumes 25-35% less water than HTB manufacturing processes. This reduced water footprint becomes increasingly important in regions facing water scarcity challenges, where industrial water consumption competes with agricultural and residential needs.

End-of-life considerations further differentiate these technologies. Iron-Air batteries offer superior recyclability, with up to 90% of materials potentially recoverable through established recycling processes. The iron components can be readily reintegrated into new batteries or repurposed for other industrial applications. HTBs present more complex recycling challenges due to their specialized materials and the safety concerns associated with handling components that have operated at extreme temperatures.

Land use efficiency also favors Iron-Air technology. These systems typically require 15-20% less physical space per kWh of storage capacity compared to most HTB installations, reducing habitat disruption and allowing for more flexible deployment options in space-constrained environments.

When evaluating sustainability through the lens of the United Nations Sustainable Development Goals (SDGs), Iron-Air batteries align more closely with multiple objectives, including SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action), due to their lower resource intensity and reduced emissions profile throughout their lifecycle.

Cost-Benefit Analysis and Commercial Viability

The economic viability of energy storage technologies is paramount for their widespread adoption. When comparing Iron-Air and High-Temperature Batteries, cost structures reveal significant differences that impact their commercial potential. Iron-Air batteries leverage abundant, low-cost materials with iron oxide as the primary component, resulting in estimated costs between $20-$40 per kWh at scale—substantially lower than lithium-ion alternatives currently dominating the market.

High-Temperature Batteries, including sodium-sulfur and sodium-nickel chloride systems, present higher initial capital expenditures ranging from $400-$600 per kWh due to specialized materials and complex thermal management requirements. However, their extended cycle life (often exceeding 4,500 cycles) improves lifetime economics when properly maintained.

Operational expenditures further differentiate these technologies. Iron-Air systems require minimal thermal management but incur efficiency losses of 30-40% during charge-discharge cycles. This inefficiency translates to higher operational costs over time, particularly in regions with expensive electricity. Conversely, High-Temperature Batteries maintain higher round-trip efficiencies (75-85%) but demand continuous heating to maintain optimal operating temperatures (typically 270-350°C), consuming 5-15% of stored energy.

Levelized cost of storage (LCOS) analysis indicates Iron-Air technology may achieve $0.05-$0.08 per kWh-cycle for long-duration applications, while High-Temperature Batteries range from $0.12-$0.20 per kWh-cycle but excel in high-power applications where frequent cycling occurs.

Market adoption trajectories differ significantly. Iron-Air technology, championed by companies like Form Energy, targets grid-scale applications with 100+ hour duration capabilities, addressing renewable integration challenges. Their commercial deployment timeline projects significant market penetration by 2025-2027. High-Temperature Battery systems have established commercial presence in grid stabilization and industrial applications, with companies like NGK Insulators demonstrating proven field reliability.

Regulatory incentives increasingly favor long-duration storage solutions, potentially accelerating Iron-Air adoption through investment tax credits and capacity payments. Meanwhile, High-Temperature Batteries benefit from established safety standards and grid integration protocols, reducing deployment barriers in regulated markets.

The investment landscape reflects these differences, with Iron-Air attracting significant venture capital for scaling manufacturing, while High-Temperature Battery development focuses on incremental improvements to existing commercial platforms, primarily funded through corporate R&D channels.

High-Temperature Batteries, including sodium-sulfur and sodium-nickel chloride systems, present higher initial capital expenditures ranging from $400-$600 per kWh due to specialized materials and complex thermal management requirements. However, their extended cycle life (often exceeding 4,500 cycles) improves lifetime economics when properly maintained.

Operational expenditures further differentiate these technologies. Iron-Air systems require minimal thermal management but incur efficiency losses of 30-40% during charge-discharge cycles. This inefficiency translates to higher operational costs over time, particularly in regions with expensive electricity. Conversely, High-Temperature Batteries maintain higher round-trip efficiencies (75-85%) but demand continuous heating to maintain optimal operating temperatures (typically 270-350°C), consuming 5-15% of stored energy.

Levelized cost of storage (LCOS) analysis indicates Iron-Air technology may achieve $0.05-$0.08 per kWh-cycle for long-duration applications, while High-Temperature Batteries range from $0.12-$0.20 per kWh-cycle but excel in high-power applications where frequent cycling occurs.

Market adoption trajectories differ significantly. Iron-Air technology, championed by companies like Form Energy, targets grid-scale applications with 100+ hour duration capabilities, addressing renewable integration challenges. Their commercial deployment timeline projects significant market penetration by 2025-2027. High-Temperature Battery systems have established commercial presence in grid stabilization and industrial applications, with companies like NGK Insulators demonstrating proven field reliability.

Regulatory incentives increasingly favor long-duration storage solutions, potentially accelerating Iron-Air adoption through investment tax credits and capacity payments. Meanwhile, High-Temperature Batteries benefit from established safety standards and grid integration protocols, reducing deployment barriers in regulated markets.

The investment landscape reflects these differences, with Iron-Air attracting significant venture capital for scaling manufacturing, while High-Temperature Battery development focuses on incremental improvements to existing commercial platforms, primarily funded through corporate R&D channels.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!