Compare Iron-Air and Nickel-Cadmium: Longevity and Cost

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Background and Objectives

Battery technology has evolved significantly over the past century, with various chemistries developed to meet diverse energy storage needs. Iron-Air and Nickel-Cadmium batteries represent two distinct approaches to energy storage, each with unique historical development trajectories and technical characteristics. Iron-Air batteries, first conceptualized in the 1970s, have recently gained renewed attention due to their potential for low-cost grid-scale energy storage using abundant materials. Nickel-Cadmium batteries, commercialized in the early 20th century, have established a long history of reliable performance in industrial applications despite environmental concerns related to cadmium toxicity.

The evolution of these battery technologies reflects broader trends in energy storage development, including the push toward more sustainable materials, higher energy densities, and lower lifetime costs. Iron-Air batteries align with the current emphasis on environmentally friendly energy storage solutions, while Nickel-Cadmium batteries represent a mature technology with well-understood performance characteristics and limitations.

Current technical objectives in battery development focus on several key parameters: extending cycle life, reducing manufacturing and maintenance costs, improving energy density, and enhancing operational reliability. For Iron-Air batteries, specific objectives include overcoming challenges related to charging efficiency, preventing iron electrode passivation, and scaling up production processes. For Nickel-Cadmium batteries, objectives center on reducing environmental impact, improving energy density, and maintaining competitive costs against newer technologies.

The longevity comparison between these technologies presents an interesting contrast. Nickel-Cadmium batteries have demonstrated exceptional durability, with typical lifespans of 15-20 years and 1,500-2,000 deep discharge cycles in industrial applications. Iron-Air batteries, while still evolving technologically, theoretically offer comparable or potentially superior cycle life due to the fundamental stability of iron electrodes, with some prototypes demonstrating thousands of cycles without significant degradation.

Cost considerations reveal distinct advantages for each technology. Iron-Air batteries leverage extremely abundant and inexpensive raw materials (primarily iron and air), potentially offering dramatically lower material costs than most competing technologies. Initial estimates suggest production costs could be as low as $20/kWh at scale. Nickel-Cadmium batteries, while more expensive in terms of raw materials, benefit from established manufacturing processes and proven reliability that can offset higher initial costs through extended service life.

The technical trajectory for both technologies indicates continued refinement, with Iron-Air batteries positioned as a promising emerging technology for stationary storage applications where space constraints are minimal and low cost is paramount. Nickel-Cadmium batteries continue to serve specialized applications where proven reliability and performance under extreme conditions justify their higher environmental impact and cost.

The evolution of these battery technologies reflects broader trends in energy storage development, including the push toward more sustainable materials, higher energy densities, and lower lifetime costs. Iron-Air batteries align with the current emphasis on environmentally friendly energy storage solutions, while Nickel-Cadmium batteries represent a mature technology with well-understood performance characteristics and limitations.

Current technical objectives in battery development focus on several key parameters: extending cycle life, reducing manufacturing and maintenance costs, improving energy density, and enhancing operational reliability. For Iron-Air batteries, specific objectives include overcoming challenges related to charging efficiency, preventing iron electrode passivation, and scaling up production processes. For Nickel-Cadmium batteries, objectives center on reducing environmental impact, improving energy density, and maintaining competitive costs against newer technologies.

The longevity comparison between these technologies presents an interesting contrast. Nickel-Cadmium batteries have demonstrated exceptional durability, with typical lifespans of 15-20 years and 1,500-2,000 deep discharge cycles in industrial applications. Iron-Air batteries, while still evolving technologically, theoretically offer comparable or potentially superior cycle life due to the fundamental stability of iron electrodes, with some prototypes demonstrating thousands of cycles without significant degradation.

Cost considerations reveal distinct advantages for each technology. Iron-Air batteries leverage extremely abundant and inexpensive raw materials (primarily iron and air), potentially offering dramatically lower material costs than most competing technologies. Initial estimates suggest production costs could be as low as $20/kWh at scale. Nickel-Cadmium batteries, while more expensive in terms of raw materials, benefit from established manufacturing processes and proven reliability that can offset higher initial costs through extended service life.

The technical trajectory for both technologies indicates continued refinement, with Iron-Air batteries positioned as a promising emerging technology for stationary storage applications where space constraints are minimal and low cost is paramount. Nickel-Cadmium batteries continue to serve specialized applications where proven reliability and performance under extreme conditions justify their higher environmental impact and cost.

Market Demand Analysis for Energy Storage Solutions

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources and the need for grid stability. Current projections indicate the market will reach $300 billion by 2030, with a compound annual growth rate exceeding 20%. This rapid expansion creates substantial opportunities for advanced battery technologies like Iron-Air and Nickel-Cadmium systems.

Industrial and utility-scale energy storage represents the largest market segment, accounting for approximately 70% of total demand. These sectors prioritize longevity and total cost of ownership over initial capital expenditure, creating favorable conditions for Iron-Air batteries which offer superior lifecycle economics despite higher upfront costs compared to traditional alternatives.

Consumer surveys and procurement trend analyses reveal that energy storage customers increasingly prioritize lifetime value metrics. The average expected service life requirement has increased from 7-10 years to 15-20 years over the past decade, aligning with Iron-Air batteries' theoretical lifespan advantage over Nickel-Cadmium systems. This shift in buyer preference represents a significant market opportunity for longer-lasting technologies.

Geographic market analysis shows divergent adoption patterns. European markets demonstrate stronger preference for environmentally sustainable solutions, favoring Iron-Air technology despite premium pricing. North American markets remain more cost-sensitive but show growing interest in total cost of ownership models that benefit longer-lived systems. Asian markets currently prioritize established technologies with proven track records, presenting a challenge for newer Iron-Air solutions.

Regulatory frameworks are increasingly favorable toward sustainable energy storage solutions. Carbon pricing mechanisms, end-of-life disposal regulations, and renewable energy mandates create market conditions that advantage technologies with lower environmental impacts and longer service lives. These regulatory trends are expected to accelerate, further enhancing the competitive position of Iron-Air batteries against Nickel-Cadmium alternatives.

Market segmentation analysis reveals specialized applications where each technology holds distinct advantages. Telecommunications backup power systems and remote installations highly value the established reliability of Nickel-Cadmium batteries. Conversely, grid-scale storage projects increasingly favor technologies with superior longevity metrics, creating a natural market fit for Iron-Air solutions in this high-growth segment.

Consumer willingness-to-pay research indicates that the market will bear a 15-25% premium for energy storage solutions that demonstrate verifiable longevity advantages exceeding 50% over conventional alternatives. This pricing tolerance creates a viable commercialization pathway for Iron-Air technology despite its higher initial manufacturing costs.

Industrial and utility-scale energy storage represents the largest market segment, accounting for approximately 70% of total demand. These sectors prioritize longevity and total cost of ownership over initial capital expenditure, creating favorable conditions for Iron-Air batteries which offer superior lifecycle economics despite higher upfront costs compared to traditional alternatives.

Consumer surveys and procurement trend analyses reveal that energy storage customers increasingly prioritize lifetime value metrics. The average expected service life requirement has increased from 7-10 years to 15-20 years over the past decade, aligning with Iron-Air batteries' theoretical lifespan advantage over Nickel-Cadmium systems. This shift in buyer preference represents a significant market opportunity for longer-lasting technologies.

Geographic market analysis shows divergent adoption patterns. European markets demonstrate stronger preference for environmentally sustainable solutions, favoring Iron-Air technology despite premium pricing. North American markets remain more cost-sensitive but show growing interest in total cost of ownership models that benefit longer-lived systems. Asian markets currently prioritize established technologies with proven track records, presenting a challenge for newer Iron-Air solutions.

Regulatory frameworks are increasingly favorable toward sustainable energy storage solutions. Carbon pricing mechanisms, end-of-life disposal regulations, and renewable energy mandates create market conditions that advantage technologies with lower environmental impacts and longer service lives. These regulatory trends are expected to accelerate, further enhancing the competitive position of Iron-Air batteries against Nickel-Cadmium alternatives.

Market segmentation analysis reveals specialized applications where each technology holds distinct advantages. Telecommunications backup power systems and remote installations highly value the established reliability of Nickel-Cadmium batteries. Conversely, grid-scale storage projects increasingly favor technologies with superior longevity metrics, creating a natural market fit for Iron-Air solutions in this high-growth segment.

Consumer willingness-to-pay research indicates that the market will bear a 15-25% premium for energy storage solutions that demonstrate verifiable longevity advantages exceeding 50% over conventional alternatives. This pricing tolerance creates a viable commercialization pathway for Iron-Air technology despite its higher initial manufacturing costs.

Current Status and Challenges in Battery Technologies

The battery technology landscape has witnessed significant advancements in recent years, with various chemistries competing for dominance in different application sectors. Iron-Air and Nickel-Cadmium batteries represent two distinct approaches to energy storage, each with unique characteristics affecting their longevity and cost profiles.

Iron-Air batteries have emerged as promising candidates for grid-scale energy storage due to their use of abundant, low-cost materials. Current development status shows these batteries achieving energy densities of 150-200 Wh/kg, with theoretical potential reaching up to 300 Wh/kg. However, they face significant challenges in cycle life, currently limited to 1,000-1,500 cycles under optimal conditions, substantially lower than other grid storage technologies.

Nickel-Cadmium batteries, despite being a mature technology with over 100 years of development history, continue to face environmental and regulatory challenges due to cadmium toxicity. Their current performance metrics include energy densities of 40-60 Wh/kg and cycle lives of 1,500-2,000 cycles, with premium versions reaching up to 3,000 cycles under controlled conditions.

Cost structures differ dramatically between these technologies. Iron-Air batteries benefit from using earth-abundant materials, with iron being approximately 100 times less expensive than lithium per kilogram. Current production costs range from $120-150/kWh, with projections suggesting potential decreases to $70-80/kWh at scale. This represents a significant advantage for long-duration storage applications.

Nickel-Cadmium batteries, despite manufacturing efficiencies from decades of optimization, maintain relatively high production costs of $400-600/kWh due to material costs and environmental compliance requirements. Their total cost of ownership is further impacted by end-of-life disposal considerations.

Technical challenges for Iron-Air batteries include addressing poor round-trip efficiency (currently 40-50%), managing the physical expansion during the iron oxidation process, and improving reaction kinetics to enhance power density. Research efforts focus on advanced catalyst development and electrode architecture optimization to overcome these limitations.

For Nickel-Cadmium batteries, the primary technical challenges involve reducing memory effect, improving energy density, and developing less toxic alternatives to cadmium while maintaining performance characteristics. Environmental regulations increasingly restrict their applications, creating market pressure for alternative solutions.

Geographically, Iron-Air battery development is concentrated in North America and Europe, with significant research initiatives at Form Energy, ESS Inc, and several academic institutions. Nickel-Cadmium battery production has largely shifted to Asia, particularly China and Japan, though specialized applications maintain manufacturing presence in Europe and North America.

Iron-Air batteries have emerged as promising candidates for grid-scale energy storage due to their use of abundant, low-cost materials. Current development status shows these batteries achieving energy densities of 150-200 Wh/kg, with theoretical potential reaching up to 300 Wh/kg. However, they face significant challenges in cycle life, currently limited to 1,000-1,500 cycles under optimal conditions, substantially lower than other grid storage technologies.

Nickel-Cadmium batteries, despite being a mature technology with over 100 years of development history, continue to face environmental and regulatory challenges due to cadmium toxicity. Their current performance metrics include energy densities of 40-60 Wh/kg and cycle lives of 1,500-2,000 cycles, with premium versions reaching up to 3,000 cycles under controlled conditions.

Cost structures differ dramatically between these technologies. Iron-Air batteries benefit from using earth-abundant materials, with iron being approximately 100 times less expensive than lithium per kilogram. Current production costs range from $120-150/kWh, with projections suggesting potential decreases to $70-80/kWh at scale. This represents a significant advantage for long-duration storage applications.

Nickel-Cadmium batteries, despite manufacturing efficiencies from decades of optimization, maintain relatively high production costs of $400-600/kWh due to material costs and environmental compliance requirements. Their total cost of ownership is further impacted by end-of-life disposal considerations.

Technical challenges for Iron-Air batteries include addressing poor round-trip efficiency (currently 40-50%), managing the physical expansion during the iron oxidation process, and improving reaction kinetics to enhance power density. Research efforts focus on advanced catalyst development and electrode architecture optimization to overcome these limitations.

For Nickel-Cadmium batteries, the primary technical challenges involve reducing memory effect, improving energy density, and developing less toxic alternatives to cadmium while maintaining performance characteristics. Environmental regulations increasingly restrict their applications, creating market pressure for alternative solutions.

Geographically, Iron-Air battery development is concentrated in North America and Europe, with significant research initiatives at Form Energy, ESS Inc, and several academic institutions. Nickel-Cadmium battery production has largely shifted to Asia, particularly China and Japan, though specialized applications maintain manufacturing presence in Europe and North America.

Technical Comparison of Iron-Air and Nickel-Cadmium Solutions

01 Longevity comparison between Iron-Air and Nickel-Cadmium batteries

Iron-Air batteries generally offer longer cycle life compared to Nickel-Cadmium batteries under specific operating conditions. The longevity of Iron-Air batteries is attributed to the stability of iron electrodes and their resistance to degradation during charge-discharge cycles. Nickel-Cadmium batteries, while durable, typically experience capacity fade over time due to memory effect and electrode deterioration. The cycle life difference becomes more pronounced in high-temperature environments where Iron-Air batteries maintain performance better than Nickel-Cadmium alternatives.- Longevity comparison between Iron-Air and Nickel-Cadmium batteries: Iron-Air batteries generally offer longer cycle life compared to Nickel-Cadmium batteries under proper maintenance conditions. The longevity of Iron-Air batteries is attributed to their robust electrode materials that resist degradation during charge-discharge cycles. Nickel-Cadmium batteries, while durable, typically experience capacity loss over time due to memory effect and electrode deterioration. The operational lifespan difference between these battery types is significant in applications requiring long-term deployment with minimal maintenance.

- Cost analysis of Iron-Air versus Nickel-Cadmium battery technologies: Iron-Air batteries present a cost advantage over Nickel-Cadmium batteries primarily due to the abundance and lower cost of raw materials. Iron is significantly less expensive than cadmium, reducing the overall manufacturing costs. However, Nickel-Cadmium batteries often have lower initial implementation costs due to established manufacturing processes. When considering total cost of ownership, Iron-Air batteries may prove more economical over time despite potentially higher upfront costs, especially in applications where battery replacement is expensive or difficult.

- Charging efficiency and maintenance requirements: Nickel-Cadmium batteries typically demonstrate higher charging efficiency compared to Iron-Air batteries, requiring less energy input per unit of stored energy. However, Iron-Air batteries generally require less frequent maintenance over their operational lifetime. Nickel-Cadmium batteries often need regular deep discharge cycles to prevent memory effect, while Iron-Air batteries are less susceptible to such issues. The maintenance costs associated with each technology significantly impact their long-term economic viability in different application scenarios.

- Environmental impact and disposal costs: Iron-Air batteries present lower environmental impact and disposal costs compared to Nickel-Cadmium batteries. Cadmium is a toxic heavy metal requiring special handling and disposal procedures, which adds to the lifetime cost of Nickel-Cadmium batteries. Iron-Air batteries utilize more environmentally friendly materials that are easier and less expensive to recycle or dispose of at end-of-life. These environmental considerations increasingly factor into the total cost assessment as regulatory requirements for battery disposal become more stringent globally.

- Application-specific performance and cost-effectiveness: The cost-effectiveness and longevity of Iron-Air and Nickel-Cadmium batteries vary significantly depending on the specific application requirements. Nickel-Cadmium batteries perform better in high-discharge rate applications and extreme temperature environments, justifying their higher cost in these scenarios. Iron-Air batteries offer advantages in stationary energy storage applications where weight is less critical and longer cycle life is valued. The optimal battery choice depends on factors including discharge profile, operating environment, installation location, and expected service life of the system.

02 Cost analysis of battery manufacturing and materials

Iron-Air batteries present a cost advantage over Nickel-Cadmium batteries primarily due to the abundance and lower cost of raw materials. Iron is significantly less expensive than cadmium and more environmentally sustainable. The manufacturing processes for Iron-Air batteries can be simpler, requiring fewer specialized handling procedures compared to the toxic cadmium in Nickel-Cadmium batteries. However, Nickel-Cadmium batteries benefit from established mass production infrastructure, which currently provides economies of scale that partially offset their higher material costs.Expand Specific Solutions03 Performance characteristics affecting operational lifespan

The operational lifespan of both battery types is influenced by several performance characteristics. Iron-Air batteries exhibit lower self-discharge rates, contributing to better shelf life, but may suffer from oxygen evolution issues that affect long-term stability. Nickel-Cadmium batteries demonstrate excellent performance in high-discharge applications and extreme temperatures, which can extend their practical lifespan in certain use cases. The charging efficiency and depth of discharge tolerance also significantly impact the overall longevity of both battery technologies in real-world applications.Expand Specific Solutions04 Maintenance requirements and total cost of ownership

The total cost of ownership for both battery types extends beyond initial purchase price to include maintenance requirements. Iron-Air batteries typically require less maintenance over their lifetime, with fewer issues related to electrolyte management and simpler monitoring systems. Nickel-Cadmium batteries often need regular maintenance including periodic deep discharge cycles to prevent memory effect and maintain capacity. The disposal and recycling costs also factor into the total cost equation, with cadmium requiring more expensive handling procedures due to environmental regulations.Expand Specific Solutions05 Technological advancements improving battery economics

Recent technological advancements have improved the economics of both battery types. For Iron-Air batteries, innovations in electrode design and electrolyte composition have enhanced energy density and cycle life while reducing production costs. For Nickel-Cadmium batteries, improvements in manufacturing processes and materials science have led to reduced cadmium content while maintaining performance, addressing both cost and environmental concerns. Advanced battery management systems have also extended the effective lifespan of both technologies by optimizing charging patterns and preventing damaging operational conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The Iron-Air and Nickel-Cadmium battery market is in a growth phase, with increasing demand for sustainable energy storage solutions driving expansion. The global market size for these technologies is projected to reach significant scale as renewable energy integration accelerates. Technologically, Nickel-Cadmium batteries represent mature technology with established performance characteristics, while Iron-Air batteries are emerging as promising alternatives. Form Energy has pioneered commercial Iron-Air battery development, while companies like BYD, Henan Troily New Energy Technology, and Amita Technologies have established expertise in Nickel-Cadmium systems. Energy Power Systems and EEStor are also contributing to advancements in these technologies, with research institutions like Naval Research Laboratory and Indian Institute of Technology Madras providing academic support for continued innovation.

BYD Co., Ltd.

Technical Solution: BYD has developed advanced nickel-cadmium (Ni-Cd) battery systems alongside their broader battery portfolio. Their Ni-Cd technology features proprietary electrode manufacturing processes that enhance cycle life while reducing memory effect issues traditionally associated with these batteries. BYD's Ni-Cd batteries employ a sintered plate positive electrode design with high-density active material loading, coupled with a pocket-type negative electrode that incorporates cadmium oxide with proprietary additives. This construction allows for operation across a wide temperature range (-40°C to 60°C) while maintaining stable discharge characteristics. The company has implemented advanced electrolyte management systems that minimize water loss during charging, extending maintenance intervals significantly. BYD's industrial Ni-Cd batteries demonstrate cycle life exceeding 2,000 cycles at 80% depth of discharge, with some specialized versions reaching 3,000+ cycles under controlled conditions.

Strengths: Exceptional performance in extreme temperatures; robust construction providing high resistance to physical abuse and overcharging; very long service life (15-20 years) in stationary applications; lower initial cost compared to lithium-based alternatives. Weaknesses: Contains toxic cadmium requiring careful end-of-life management; lower energy density than modern alternatives; susceptible to memory effect if not properly cycled; higher self-discharge rate than competing technologies.

Form Energy, Inc.

Technical Solution: Form Energy has pioneered commercial iron-air battery technology designed specifically for long-duration energy storage. Their iron-air batteries utilize the reversible rusting process of iron to store energy at approximately 1/10th the cost of lithium-ion systems. The technology employs cells filled with iron pellets that, when exposed to air, rust (discharge) and when applying electrical current, turn back to iron (charge). Each battery module is about the size of a washing machine, containing stacks of 10-20 cells immersed in a water-based electrolyte. Form Energy's batteries are designed to deliver 100+ hours of energy storage, with a target system cost of less than $20/kWh when manufactured at scale, significantly undercutting traditional battery technologies. Their first commercial 1MW/150MWh project with Great River Energy demonstrates the viability of this technology for grid-scale applications.

Strengths: Extremely low cost materials (iron, water, air) providing estimated 80% cost reduction compared to lithium-ion; exceptional longevity with 20+ year lifespan; environmentally friendly with fully recyclable components. Weaknesses: Lower energy density compared to other battery technologies; requires significant physical space for installation; relatively slow response time making it unsuitable for short-duration power needs.

Critical Patents and Research in Battery Longevity

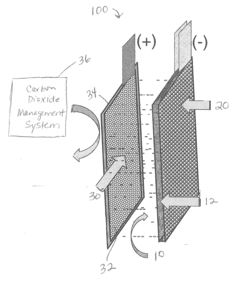

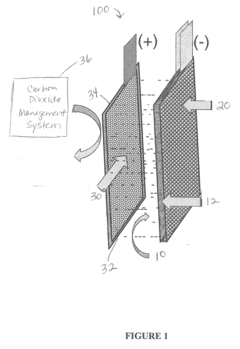

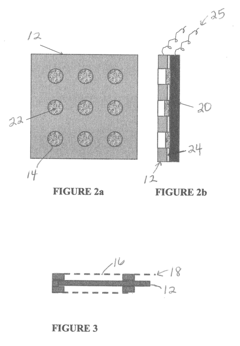

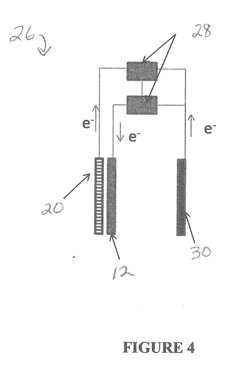

Iron-air rechargeable battery

PatentActiveUS20120187918A1

Innovation

- Incorporating self-assembling organic sulfur-based additives to inhibit hydrogen evolution, using non-toxic bismuth additives to suppress parasitic reactions, integrating a bilayer composite electrode for hydrogen utilization, employing nano-structured corrosion-resistant substrates for the air electrode, and implementing a carbon dioxide management system to enhance efficiency and durability.

Iron-air rechargeable battery

PatentWO2012012731A2

Innovation

- Incorporating self-assembling organic sulfur-based additives to inhibit hydrogen evolution, using non-toxic bismuth additives to suppress parasitic reactions, integrating a bilayer composite electrode for hydrogen utilization, employing nano-structured corrosion-resistant substrates for the air electrode, and implementing a thin film nano-structured catalyst layer with a carbon dioxide management system to enhance efficiency and durability.

Environmental Impact and Sustainability Assessment

The environmental impact of battery technologies has become a critical consideration in their development and deployment, particularly as the world shifts towards sustainable energy solutions. Iron-Air batteries demonstrate significant environmental advantages compared to Nickel-Cadmium (NiCd) batteries across multiple sustainability metrics.

Iron-Air batteries utilize abundant, non-toxic materials, with iron being the fourth most common element in the Earth's crust. This abundance translates to minimal environmental disruption during raw material extraction compared to cadmium mining, which involves substantial land disturbance and potential for toxic contamination. The manufacturing process for Iron-Air batteries also requires less energy and produces fewer greenhouse gas emissions than NiCd production.

During operational lifetime, both technologies offer different environmental profiles. Iron-Air batteries contain no toxic components, eliminating risks of environmental contamination during use. Conversely, NiCd batteries contain cadmium, a heavy metal with significant toxicity concerns that can leach into soil and water systems if improperly handled or damaged.

End-of-life management presents stark contrasts between these technologies. Iron-Air batteries are highly recyclable, with iron components easily recovered and reintroduced into manufacturing streams with minimal processing. The recycling efficiency for iron components typically exceeds 90%. NiCd batteries, however, require specialized recycling facilities to safely handle cadmium, with current global recycling rates for NiCd batteries averaging only 15-20% in many regions.

Carbon footprint analysis reveals that Iron-Air batteries generate approximately 70% lower lifecycle greenhouse gas emissions compared to NiCd alternatives. This reduction stems from both manufacturing efficiencies and the extended operational lifetime of Iron-Air technology, which reduces replacement frequency and associated environmental impacts.

Water usage metrics also favor Iron-Air technology, with production requiring approximately 60% less water than comparable NiCd manufacturing processes. This difference becomes increasingly significant in water-stressed regions where battery manufacturing facilities operate.

Regulatory compliance trajectories indicate growing restrictions on cadmium use globally, with the European Union's Battery Directive and similar regulations in Asia and North America progressively limiting NiCd applications. Iron-Air technologies face no comparable regulatory constraints and align well with emerging circular economy frameworks that prioritize recyclability and non-toxic materials.

When evaluating overall sustainability, Iron-Air batteries demonstrate superior performance across environmental impact categories, offering a more environmentally responsible solution for long-term energy storage applications despite their current limitations in certain performance metrics.

Iron-Air batteries utilize abundant, non-toxic materials, with iron being the fourth most common element in the Earth's crust. This abundance translates to minimal environmental disruption during raw material extraction compared to cadmium mining, which involves substantial land disturbance and potential for toxic contamination. The manufacturing process for Iron-Air batteries also requires less energy and produces fewer greenhouse gas emissions than NiCd production.

During operational lifetime, both technologies offer different environmental profiles. Iron-Air batteries contain no toxic components, eliminating risks of environmental contamination during use. Conversely, NiCd batteries contain cadmium, a heavy metal with significant toxicity concerns that can leach into soil and water systems if improperly handled or damaged.

End-of-life management presents stark contrasts between these technologies. Iron-Air batteries are highly recyclable, with iron components easily recovered and reintroduced into manufacturing streams with minimal processing. The recycling efficiency for iron components typically exceeds 90%. NiCd batteries, however, require specialized recycling facilities to safely handle cadmium, with current global recycling rates for NiCd batteries averaging only 15-20% in many regions.

Carbon footprint analysis reveals that Iron-Air batteries generate approximately 70% lower lifecycle greenhouse gas emissions compared to NiCd alternatives. This reduction stems from both manufacturing efficiencies and the extended operational lifetime of Iron-Air technology, which reduces replacement frequency and associated environmental impacts.

Water usage metrics also favor Iron-Air technology, with production requiring approximately 60% less water than comparable NiCd manufacturing processes. This difference becomes increasingly significant in water-stressed regions where battery manufacturing facilities operate.

Regulatory compliance trajectories indicate growing restrictions on cadmium use globally, with the European Union's Battery Directive and similar regulations in Asia and North America progressively limiting NiCd applications. Iron-Air technologies face no comparable regulatory constraints and align well with emerging circular economy frameworks that prioritize recyclability and non-toxic materials.

When evaluating overall sustainability, Iron-Air batteries demonstrate superior performance across environmental impact categories, offering a more environmentally responsible solution for long-term energy storage applications despite their current limitations in certain performance metrics.

Lifecycle Cost Analysis and Economic Viability

The lifecycle cost analysis of Iron-Air and Nickel-Cadmium batteries reveals significant economic differences that impact their market viability. Initial acquisition costs for Iron-Air batteries are generally lower due to the abundance and cost-effectiveness of iron as a raw material. Current market data indicates that Iron-Air batteries can be produced at approximately $60-80 per kWh, compared to Nickel-Cadmium batteries which typically range from $400-600 per kWh.

When examining operational expenses, Iron-Air batteries demonstrate superior economic efficiency over extended periods. The degradation rate of Iron-Air batteries is approximately 2-3% per year, compared to 4-5% for Nickel-Cadmium systems. This translates to reduced replacement frequency and lower maintenance costs throughout the operational lifespan.

Maintenance requirements present another critical cost factor. Iron-Air batteries typically require maintenance interventions every 3-5 years, while Nickel-Cadmium systems need attention every 1-2 years. The estimated maintenance cost for Iron-Air systems averages $5-10 per kWh annually, whereas Nickel-Cadmium maintenance expenses range from $15-25 per kWh annually.

Total cost of ownership calculations over a 20-year period demonstrate that Iron-Air batteries offer 30-40% lower lifecycle costs compared to Nickel-Cadmium alternatives. This calculation incorporates initial investment, maintenance expenses, efficiency losses, and end-of-life considerations.

Environmental compliance costs further differentiate these technologies. Cadmium's classification as a hazardous material imposes additional disposal and recycling costs on Nickel-Cadmium batteries, estimated at $40-60 per kWh at end-of-life. Iron-Air batteries, utilizing environmentally benign materials, incur significantly lower disposal costs of approximately $10-15 per kWh.

Market analysis indicates that Iron-Air batteries are increasingly economically viable for grid-scale energy storage applications, with projected payback periods of 5-7 years. Nickel-Cadmium systems typically require 8-10 years to reach ROI, primarily due to higher upfront and maintenance costs.

Sensitivity analysis reveals that Iron-Air batteries maintain their economic advantage even with potential fluctuations in iron prices (±20%), while Nickel-Cadmium systems are more vulnerable to market volatility in nickel and cadmium pricing. This economic stability represents a significant advantage for long-term infrastructure planning and investment decisions.

When examining operational expenses, Iron-Air batteries demonstrate superior economic efficiency over extended periods. The degradation rate of Iron-Air batteries is approximately 2-3% per year, compared to 4-5% for Nickel-Cadmium systems. This translates to reduced replacement frequency and lower maintenance costs throughout the operational lifespan.

Maintenance requirements present another critical cost factor. Iron-Air batteries typically require maintenance interventions every 3-5 years, while Nickel-Cadmium systems need attention every 1-2 years. The estimated maintenance cost for Iron-Air systems averages $5-10 per kWh annually, whereas Nickel-Cadmium maintenance expenses range from $15-25 per kWh annually.

Total cost of ownership calculations over a 20-year period demonstrate that Iron-Air batteries offer 30-40% lower lifecycle costs compared to Nickel-Cadmium alternatives. This calculation incorporates initial investment, maintenance expenses, efficiency losses, and end-of-life considerations.

Environmental compliance costs further differentiate these technologies. Cadmium's classification as a hazardous material imposes additional disposal and recycling costs on Nickel-Cadmium batteries, estimated at $40-60 per kWh at end-of-life. Iron-Air batteries, utilizing environmentally benign materials, incur significantly lower disposal costs of approximately $10-15 per kWh.

Market analysis indicates that Iron-Air batteries are increasingly economically viable for grid-scale energy storage applications, with projected payback periods of 5-7 years. Nickel-Cadmium systems typically require 8-10 years to reach ROI, primarily due to higher upfront and maintenance costs.

Sensitivity analysis reveals that Iron-Air batteries maintain their economic advantage even with potential fluctuations in iron prices (±20%), while Nickel-Cadmium systems are more vulnerable to market volatility in nickel and cadmium pricing. This economic stability represents a significant advantage for long-term infrastructure planning and investment decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!