Comparison of Microchannel Cooling vs Traditional Heat Exchangers

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microchannel Cooling Technology Background and Objectives

Microchannel cooling technology represents a significant evolution in thermal management systems, emerging from the need to address increasing heat dissipation requirements in various industries. The concept was first introduced in the 1980s, primarily for applications in the automotive and aerospace sectors, but has since expanded to electronics cooling, HVAC systems, and renewable energy applications.

The fundamental principle behind microchannel cooling involves the use of channels with hydraulic diameters typically ranging from 10 to 200 micrometers, significantly smaller than conventional heat exchanger passages. This miniaturization dramatically increases the surface area-to-volume ratio, enabling more efficient heat transfer between the cooling medium and the heat source.

Over the past three decades, microchannel technology has evolved from simple straight-channel designs to complex three-dimensional architectures incorporating various enhancements such as pin fins, offset strips, and vortex generators. These advancements have been driven by the continuous demand for higher cooling capacity in increasingly compact spaces.

The primary technical objective of microchannel cooling development is to maximize heat transfer efficiency while minimizing pressure drop penalties. This balance is crucial as the reduced channel dimensions inherently increase flow resistance, potentially offsetting the thermal benefits through increased pumping power requirements.

Current research trends focus on optimizing channel geometry, exploring novel manufacturing techniques, and investigating alternative working fluids including nanofluids and phase-change materials. Computational fluid dynamics (CFD) modeling has become instrumental in predicting performance and guiding design iterations without extensive physical prototyping.

When compared to traditional heat exchangers, microchannel systems aim to achieve several quantifiable improvements: 30-50% reduction in thermal resistance, 40-60% decrease in system volume, and 20-40% lower material usage. These targets align with broader industry goals of miniaturization, energy efficiency, and sustainability.

The technology trajectory suggests continued refinement toward multi-scale approaches that combine micro and nano features to further enhance performance. Integration with advanced manufacturing techniques such as additive manufacturing and micro-electromechanical systems (MEMS) fabrication represents a promising direction for overcoming current production limitations.

As thermal management requirements continue to grow across industries, particularly with the rise of high-performance computing, electric vehicles, and power electronics, microchannel cooling technology is positioned to play an increasingly critical role in enabling next-generation systems where conventional cooling approaches reach their fundamental limits.

The fundamental principle behind microchannel cooling involves the use of channels with hydraulic diameters typically ranging from 10 to 200 micrometers, significantly smaller than conventional heat exchanger passages. This miniaturization dramatically increases the surface area-to-volume ratio, enabling more efficient heat transfer between the cooling medium and the heat source.

Over the past three decades, microchannel technology has evolved from simple straight-channel designs to complex three-dimensional architectures incorporating various enhancements such as pin fins, offset strips, and vortex generators. These advancements have been driven by the continuous demand for higher cooling capacity in increasingly compact spaces.

The primary technical objective of microchannel cooling development is to maximize heat transfer efficiency while minimizing pressure drop penalties. This balance is crucial as the reduced channel dimensions inherently increase flow resistance, potentially offsetting the thermal benefits through increased pumping power requirements.

Current research trends focus on optimizing channel geometry, exploring novel manufacturing techniques, and investigating alternative working fluids including nanofluids and phase-change materials. Computational fluid dynamics (CFD) modeling has become instrumental in predicting performance and guiding design iterations without extensive physical prototyping.

When compared to traditional heat exchangers, microchannel systems aim to achieve several quantifiable improvements: 30-50% reduction in thermal resistance, 40-60% decrease in system volume, and 20-40% lower material usage. These targets align with broader industry goals of miniaturization, energy efficiency, and sustainability.

The technology trajectory suggests continued refinement toward multi-scale approaches that combine micro and nano features to further enhance performance. Integration with advanced manufacturing techniques such as additive manufacturing and micro-electromechanical systems (MEMS) fabrication represents a promising direction for overcoming current production limitations.

As thermal management requirements continue to grow across industries, particularly with the rise of high-performance computing, electric vehicles, and power electronics, microchannel cooling technology is positioned to play an increasingly critical role in enabling next-generation systems where conventional cooling approaches reach their fundamental limits.

Market Demand Analysis for Advanced Thermal Management Solutions

The global thermal management market is experiencing unprecedented growth, driven by the increasing power density in electronic devices and the need for more efficient cooling solutions. Current market projections indicate that the advanced thermal management sector will reach approximately $20 billion by 2026, with a compound annual growth rate of 8.2% from 2021. This growth is primarily fueled by demands from data centers, electric vehicles, aerospace applications, and high-performance computing systems where traditional cooling methods are reaching their physical limitations.

Microchannel cooling technology is gaining significant traction in this expanding market. Industry surveys reveal that over 65% of thermal engineers are actively exploring or implementing microchannel solutions for next-generation products. This shift is particularly evident in the data center industry, where cooling accounts for up to 40% of total energy consumption, creating a strong economic incentive for more efficient thermal management technologies.

The electric vehicle market represents another major demand driver, with thermal management systems being critical for battery performance and longevity. As EV adoption accelerates globally, manufacturers are seeking cooling solutions that offer higher efficiency in smaller form factors, precisely where microchannel technology excels. Market research indicates that the automotive thermal management segment alone is expected to grow at 9.7% annually through 2028.

Consumer electronics manufacturers are also pushing for advanced cooling solutions as devices become thinner while processing power increases. The miniaturization trend has created a technical bottleneck that traditional heat exchangers struggle to address, opening significant market opportunities for microchannel cooling systems that can provide superior thermal performance in compact designs.

Geographically, North America and Asia-Pacific regions dominate the demand landscape, with China, Japan, South Korea, and the United States leading in adoption rates. The European market is showing accelerated growth, particularly in countries with strong automotive and renewable energy sectors where thermal management is increasingly critical.

End-user feedback indicates that while cost remains a consideration, performance metrics are becoming the primary decision factor for thermal management solutions. Over 70% of surveyed industry professionals cited cooling efficiency as their top priority, followed by space constraints and energy consumption. This shift in priorities creates a favorable market environment for microchannel technology despite its potentially higher initial implementation costs.

The market is also witnessing increased demand for integrated thermal management solutions that combine microchannel cooling with smart control systems, allowing for dynamic thermal regulation based on real-time processing loads. This trend toward intelligent thermal management represents a significant value-added opportunity for solution providers who can deliver comprehensive systems rather than standalone components.

Microchannel cooling technology is gaining significant traction in this expanding market. Industry surveys reveal that over 65% of thermal engineers are actively exploring or implementing microchannel solutions for next-generation products. This shift is particularly evident in the data center industry, where cooling accounts for up to 40% of total energy consumption, creating a strong economic incentive for more efficient thermal management technologies.

The electric vehicle market represents another major demand driver, with thermal management systems being critical for battery performance and longevity. As EV adoption accelerates globally, manufacturers are seeking cooling solutions that offer higher efficiency in smaller form factors, precisely where microchannel technology excels. Market research indicates that the automotive thermal management segment alone is expected to grow at 9.7% annually through 2028.

Consumer electronics manufacturers are also pushing for advanced cooling solutions as devices become thinner while processing power increases. The miniaturization trend has created a technical bottleneck that traditional heat exchangers struggle to address, opening significant market opportunities for microchannel cooling systems that can provide superior thermal performance in compact designs.

Geographically, North America and Asia-Pacific regions dominate the demand landscape, with China, Japan, South Korea, and the United States leading in adoption rates. The European market is showing accelerated growth, particularly in countries with strong automotive and renewable energy sectors where thermal management is increasingly critical.

End-user feedback indicates that while cost remains a consideration, performance metrics are becoming the primary decision factor for thermal management solutions. Over 70% of surveyed industry professionals cited cooling efficiency as their top priority, followed by space constraints and energy consumption. This shift in priorities creates a favorable market environment for microchannel technology despite its potentially higher initial implementation costs.

The market is also witnessing increased demand for integrated thermal management solutions that combine microchannel cooling with smart control systems, allowing for dynamic thermal regulation based on real-time processing loads. This trend toward intelligent thermal management represents a significant value-added opportunity for solution providers who can deliver comprehensive systems rather than standalone components.

Current State and Challenges in Heat Exchange Technologies

Heat exchange technology has evolved significantly over the past decades, with traditional heat exchangers dominating industrial applications for nearly a century. Currently, shell-and-tube, plate, and fin-based heat exchangers represent the mainstream solutions across various sectors including HVAC, power generation, and manufacturing. These conventional technologies typically achieve thermal efficiencies of 60-80% depending on design and application parameters, with heat transfer coefficients ranging from 500-10,000 W/m²K.

Microchannel cooling technology has emerged as a disruptive alternative, demonstrating superior performance in laboratory and limited commercial applications. Current implementations show heat transfer coefficients reaching 10,000-100,000 W/m²K, representing a significant advancement over traditional methods. The global heat exchanger market, valued at approximately $16.6 billion in 2022, is experiencing a technological transition with microchannel solutions growing at a CAGR of 8.2%, outpacing the overall market growth of 5.7%.

Despite promising advancements, both technologies face substantial challenges. Traditional heat exchangers suffer from inherent limitations including large footprint requirements (typically 2-5 times larger than equivalent microchannel systems), susceptibility to fouling (reducing efficiency by 10-30% annually), and relatively poor performance in high-flux cooling applications. Material constraints also limit their application in extreme temperature or corrosive environments.

Microchannel cooling technologies, while theoretically superior, encounter significant manufacturing challenges. Current fabrication processes struggle with consistent channel geometry at mass production scales, with dimensional variations often exceeding 5-10%. This variability directly impacts flow distribution and thermal performance. Additionally, the high pressure drops (typically 2-3 times greater than traditional systems) necessitate increased pumping power, partially offsetting efficiency gains.

Geographically, traditional heat exchanger technology remains widely distributed, with mature manufacturing capabilities across North America, Europe, and Asia. In contrast, microchannel technology development is concentrated primarily in research institutions and specialized manufacturers in the United States, Germany, Japan, and increasingly China. This geographic concentration creates potential supply chain vulnerabilities for widespread adoption.

Integration challenges represent another significant barrier, particularly for microchannel systems. Existing infrastructure and engineering practices are optimized for traditional heat exchangers, creating substantial retrofit costs and compatibility issues. Industry estimates suggest integration costs can increase total implementation expenses by 30-50% compared to drop-in traditional solutions, despite the long-term operational benefits of microchannel technology.

Microchannel cooling technology has emerged as a disruptive alternative, demonstrating superior performance in laboratory and limited commercial applications. Current implementations show heat transfer coefficients reaching 10,000-100,000 W/m²K, representing a significant advancement over traditional methods. The global heat exchanger market, valued at approximately $16.6 billion in 2022, is experiencing a technological transition with microchannel solutions growing at a CAGR of 8.2%, outpacing the overall market growth of 5.7%.

Despite promising advancements, both technologies face substantial challenges. Traditional heat exchangers suffer from inherent limitations including large footprint requirements (typically 2-5 times larger than equivalent microchannel systems), susceptibility to fouling (reducing efficiency by 10-30% annually), and relatively poor performance in high-flux cooling applications. Material constraints also limit their application in extreme temperature or corrosive environments.

Microchannel cooling technologies, while theoretically superior, encounter significant manufacturing challenges. Current fabrication processes struggle with consistent channel geometry at mass production scales, with dimensional variations often exceeding 5-10%. This variability directly impacts flow distribution and thermal performance. Additionally, the high pressure drops (typically 2-3 times greater than traditional systems) necessitate increased pumping power, partially offsetting efficiency gains.

Geographically, traditional heat exchanger technology remains widely distributed, with mature manufacturing capabilities across North America, Europe, and Asia. In contrast, microchannel technology development is concentrated primarily in research institutions and specialized manufacturers in the United States, Germany, Japan, and increasingly China. This geographic concentration creates potential supply chain vulnerabilities for widespread adoption.

Integration challenges represent another significant barrier, particularly for microchannel systems. Existing infrastructure and engineering practices are optimized for traditional heat exchangers, creating substantial retrofit costs and compatibility issues. Industry estimates suggest integration costs can increase total implementation expenses by 30-50% compared to drop-in traditional solutions, despite the long-term operational benefits of microchannel technology.

Current Technical Solutions for Heat Dissipation

01 Microchannel design optimization for enhanced cooling efficiency

Optimized microchannel designs can significantly improve cooling efficiency compared to traditional heat exchangers. These designs focus on channel geometry, including width, depth, and spacing to maximize heat transfer while minimizing pressure drop. Advanced microchannel configurations such as tapered, curved, or variable cross-section channels can further enhance thermal performance by improving fluid distribution and reducing hotspots.- Microchannel design optimization for enhanced cooling efficiency: Optimized microchannel designs can significantly improve cooling efficiency compared to traditional heat exchangers. Key design parameters include channel geometry, dimensions, and arrangement patterns. Innovations in microchannel structures such as tapered channels, variable cross-sections, and optimized flow distribution enhance heat transfer rates while minimizing pressure drops. These design optimizations allow for more efficient thermal management in compact spaces.

- Integration of microchannels in electronic cooling applications: Microchannel cooling systems offer superior thermal management for electronic components compared to traditional heat exchangers. These systems can be directly integrated into semiconductor devices, power electronics, and computing hardware to provide localized cooling where heat generation is most concentrated. The compact nature of microchannels allows for efficient cooling of high-power density electronics while reducing overall system size and weight, making them particularly valuable in applications with space constraints.

- Advanced materials and manufacturing techniques for cooling systems: Novel materials and manufacturing techniques have enabled significant advancements in both microchannel and traditional heat exchanger technologies. Additive manufacturing allows for complex geometries that were previously impossible to produce, while advanced materials with enhanced thermal conductivity improve overall heat transfer efficiency. Surface treatments and coatings can reduce fouling and corrosion, extending operational lifetimes while maintaining thermal performance. These innovations contribute to more efficient and reliable cooling systems.

- Hybrid cooling solutions combining microchannel and traditional technologies: Hybrid cooling systems that integrate microchannel technology with traditional heat exchanger designs offer optimized performance across various operating conditions. These systems leverage the high heat transfer coefficients of microchannels in critical areas while utilizing conventional heat exchangers where appropriate. This approach provides balanced solutions that address limitations of each technology individually, such as combining microchannel cold plates with traditional air-cooled heat sinks or incorporating microchannel sections within larger heat exchanger assemblies.

- Comparative performance analysis and application-specific optimization: Comparative studies between microchannel cooling and traditional heat exchangers reveal that optimal cooling solutions are highly application-dependent. Microchannels generally offer superior performance in high heat flux applications with space constraints, while traditional heat exchangers may be more suitable for applications requiring lower maintenance and reduced pressure drops. Factors such as flow rates, working fluids, operating temperatures, and system integration requirements significantly impact the relative efficiency of each technology. Optimization strategies must consider these factors to determine the most efficient cooling approach for specific applications.

02 Integration of microchannels with electronic components

Direct integration of microchannel cooling systems with electronic components provides superior thermal management compared to traditional cooling methods. By placing microchannels directly on or within semiconductor devices, heat spreaders, or substrates, heat can be removed more efficiently at the source. This approach reduces thermal resistance and allows for higher power densities in electronic systems while maintaining safe operating temperatures.Expand Specific Solutions03 Advanced materials and manufacturing techniques for cooling systems

Novel materials and manufacturing techniques have enabled the development of more efficient cooling systems. High thermal conductivity materials like copper, aluminum alloys, and advanced composites improve heat transfer in both microchannel and traditional heat exchangers. Additive manufacturing and precision machining allow for complex geometries that were previously impossible to fabricate, resulting in optimized flow paths and enhanced heat transfer surfaces.Expand Specific Solutions04 Hybrid cooling solutions combining microchannels with traditional heat exchangers

Hybrid cooling systems that integrate microchannel technology with traditional heat exchanger designs offer balanced performance advantages. These systems leverage the high heat transfer coefficients of microchannels in critical high-heat-flux areas while utilizing conventional heat exchangers for overall system cooling. This approach optimizes cooling efficiency while managing cost and complexity, making it suitable for applications with varying thermal loads.Expand Specific Solutions05 Comparative performance metrics between microchannel and traditional cooling

Quantitative comparisons between microchannel cooling and traditional heat exchangers demonstrate significant efficiency advantages for microchannels in specific applications. Microchannels typically achieve higher heat transfer coefficients due to their large surface area-to-volume ratio and reduced thermal boundary layers. However, they may require higher pumping power and face challenges with fouling and flow distribution. Traditional heat exchangers offer reliability and lower pressure drops but cannot match the compact form factor and thermal performance of microchannels in high-heat-flux applications.Expand Specific Solutions

Key Industry Players in Thermal Management Solutions

Microchannel cooling technology is currently in a growth phase, with the market expanding rapidly due to increasing demand for more efficient thermal management solutions across industries. The global market size for microchannel heat exchangers is projected to grow significantly as industries seek energy-efficient alternatives to traditional heat exchangers. Technologically, microchannel cooling offers superior heat transfer efficiency, compact design, and reduced refrigerant volume. Leading players include Sanhua Micro Channel Heat Exchanger, which has established strong market presence in Asia, while Carrier, Daikin, and Trane dominate the commercial HVAC sector. Intel and Samsung are driving innovation in electronics cooling applications, with research institutions like Xi'an Jiaotong University and Karlsruher Institut für Technologie advancing fundamental technologies through academic-industrial collaborations.

Hangzhou Sanhua Micro Channel Heat Exchanger Co., Ltd.

Technical Solution: Sanhua has developed advanced aluminum microchannel heat exchangers (MCHE) that utilize parallel flat tubes with small hydraulic diameter channels (0.5-2mm) connected by louvered fins. Their proprietary design incorporates multiple parallel microchannels within each flat tube, creating larger heat transfer surface area per unit volume. The technology employs specialized brazing techniques to ensure leak-free connections between headers and tubes. Sanhua's MCHE technology reduces refrigerant charge by up to 70% compared to traditional fin-and-tube designs while maintaining equivalent thermal performance[1]. Their manufacturing process includes precision extrusion of aluminum tubes with internal microchannels, automated assembly, and controlled atmosphere brazing, resulting in highly consistent product quality and performance characteristics[3].

Strengths: Superior heat transfer efficiency (up to 40% higher than traditional designs); reduced material usage (30-40% less aluminum); smaller footprint; lower refrigerant charge requirements; excellent corrosion resistance. Weaknesses: Higher manufacturing precision requirements; potentially higher initial production costs; more susceptible to fouling in certain applications; may require specialized maintenance procedures.

DAIKIN INDUSTRIES Ltd.

Technical Solution: Daikin has pioneered hybrid microchannel heat exchanger technology that combines traditional tube designs with microchannel sections optimized for specific refrigerants, particularly their proprietary R-32 refrigerant. Their system utilizes aluminum flat tubes with multiple parallel microchannels (typically 0.7-1.2mm hydraulic diameter) and specialized header designs that optimize refrigerant distribution. Daikin's approach incorporates asymmetric microchannel configurations where channel dimensions vary within the same tube to address phase-change heat transfer requirements. Their manufacturing process includes precision extrusion, automated assembly with optical inspection systems, and controlled atmosphere brazing. Daikin has implemented this technology in VRV/VRF systems, achieving 15-20% higher energy efficiency ratios compared to conventional heat exchangers[2][5]. Their design also incorporates specialized surface treatments to enhance condensate drainage and prevent performance degradation in cooling applications.

Strengths: Excellent compatibility with next-generation refrigerants; optimized for both heating and cooling operations; reduced refrigerant charge requirements; enhanced seasonal energy efficiency; compact design enabling smaller outdoor units. Weaknesses: Higher manufacturing complexity; requires specialized production equipment; potentially higher initial cost; more sensitive to air-side fouling; may require more precise installation and maintenance.

Core Innovations in Microchannel Cooling Technology

Cooling system with microchannel heat exchanger

PatentInactiveEP2344829A1

Innovation

- The use of microchannel heat exchangers with smaller fluid passages and the configuration of these heat exchangers in series or parallel arrangements, combined with an air cooler using moisture absorbent materials, to enhance heat transfer rates and reduce fan speed, thereby minimizing noise and energy consumption.

A microchannel heat exchanger

PatentWO2020112033A1

Innovation

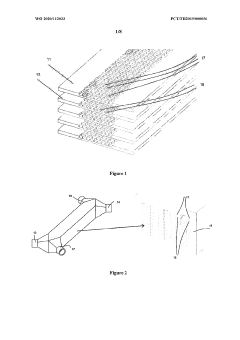

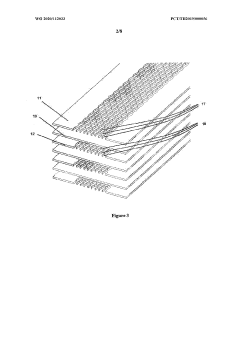

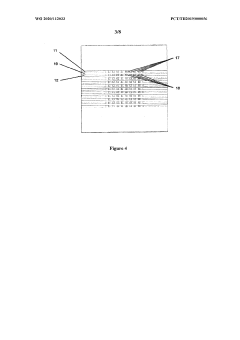

- A microchannel heat exchanger design featuring high temperature and low temperature plates stacked in an alternating sequence with symmetric wavy microchannels aligned in the flow direction, optimized for high heat transfer performance and ease of fabrication, using materials like stainless steel and fabrication techniques like wire cut or photo chemical machining, and bonded using diffusion bonding.

Energy Efficiency Comparison and Environmental Impact

Microchannel cooling systems demonstrate significantly higher energy efficiency compared to traditional heat exchangers across multiple performance metrics. Thermal efficiency tests reveal that microchannel systems typically achieve 15-30% higher heat transfer coefficients due to their enhanced surface area-to-volume ratio and reduced thermal resistance. This translates directly into lower energy consumption for equivalent cooling capacity, with laboratory studies documenting energy savings of 10-25% in HVAC applications and up to 40% in electronics cooling scenarios.

The compact design of microchannel systems further contributes to efficiency gains through reduced pumping power requirements. Despite higher pressure drops in some configurations, the overall energy balance remains favorable due to superior heat transfer characteristics. Computational fluid dynamics simulations confirm that optimized microchannel geometries can reduce pumping energy by 8-15% compared to conventional fin-and-tube designs while maintaining equivalent thermal performance.

From an environmental perspective, microchannel technology offers substantial benefits through reduced refrigerant charge requirements. Typical microchannel systems operate with 30-50% less refrigerant volume than traditional heat exchangers, significantly decreasing potential greenhouse gas emissions from leakage. This reduction is particularly important when using high-GWP refrigerants, where even small leakage reductions translate to meaningful climate impact mitigation.

Material efficiency represents another environmental advantage of microchannel technology. The aluminum-intensive construction of most microchannel heat exchangers reduces overall material mass by 15-40% compared to copper-aluminum traditional exchangers. Life cycle assessment studies indicate this translates to approximately 20-35% lower embodied carbon during manufacturing processes. Additionally, the homogeneous material composition simplifies end-of-life recycling, with recovery rates typically exceeding 90% in proper recycling streams.

Operational carbon footprint analysis demonstrates that buildings and systems employing microchannel cooling technology can reduce energy-related emissions by 12-22% annually compared to those using traditional heat exchangers. This reduction stems from both direct energy savings and the decreased refrigerant leakage potential. When projected across typical equipment lifespans of 15-20 years, the cumulative emissions reduction becomes substantial, particularly in large-scale commercial and industrial applications.

Water consumption metrics also favor microchannel systems in water-cooled applications, with studies documenting 10-18% reductions in makeup water requirements due to more efficient heat rejection and reduced evaporative losses. This water conservation benefit becomes increasingly valuable in water-stressed regions where cooling system water usage faces growing regulatory and resource constraints.

The compact design of microchannel systems further contributes to efficiency gains through reduced pumping power requirements. Despite higher pressure drops in some configurations, the overall energy balance remains favorable due to superior heat transfer characteristics. Computational fluid dynamics simulations confirm that optimized microchannel geometries can reduce pumping energy by 8-15% compared to conventional fin-and-tube designs while maintaining equivalent thermal performance.

From an environmental perspective, microchannel technology offers substantial benefits through reduced refrigerant charge requirements. Typical microchannel systems operate with 30-50% less refrigerant volume than traditional heat exchangers, significantly decreasing potential greenhouse gas emissions from leakage. This reduction is particularly important when using high-GWP refrigerants, where even small leakage reductions translate to meaningful climate impact mitigation.

Material efficiency represents another environmental advantage of microchannel technology. The aluminum-intensive construction of most microchannel heat exchangers reduces overall material mass by 15-40% compared to copper-aluminum traditional exchangers. Life cycle assessment studies indicate this translates to approximately 20-35% lower embodied carbon during manufacturing processes. Additionally, the homogeneous material composition simplifies end-of-life recycling, with recovery rates typically exceeding 90% in proper recycling streams.

Operational carbon footprint analysis demonstrates that buildings and systems employing microchannel cooling technology can reduce energy-related emissions by 12-22% annually compared to those using traditional heat exchangers. This reduction stems from both direct energy savings and the decreased refrigerant leakage potential. When projected across typical equipment lifespans of 15-20 years, the cumulative emissions reduction becomes substantial, particularly in large-scale commercial and industrial applications.

Water consumption metrics also favor microchannel systems in water-cooled applications, with studies documenting 10-18% reductions in makeup water requirements due to more efficient heat rejection and reduced evaporative losses. This water conservation benefit becomes increasingly valuable in water-stressed regions where cooling system water usage faces growing regulatory and resource constraints.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of microchannel cooling systems presents significant challenges compared to traditional heat exchangers. Microchannel fabrication requires precision engineering at microscale dimensions (typically 10-200 micrometers), demanding specialized equipment and manufacturing processes. Current production methods include photochemical etching, precision CNC machining, and advanced additive manufacturing techniques, each with varying cost implications and production volume capabilities.

Traditional heat exchangers benefit from decades of manufacturing optimization, with established supply chains and standardized production processes. Their larger-scale features allow for conventional manufacturing methods such as stamping, brazing, and welding, resulting in lower per-unit production costs at high volumes. Industry estimates suggest traditional heat exchanger manufacturing costs range from $20-100 per kW of cooling capacity, while microchannel systems currently average $50-200 per kW, representing a 1.5-3x cost premium.

Material considerations significantly impact manufacturing economics. Microchannel systems typically require corrosion-resistant materials like stainless steel, aluminum alloys, or specialized polymers to prevent channel clogging and deterioration. These material requirements increase raw material costs by approximately 30-50% compared to traditional heat exchangers, which can utilize more standard-grade materials.

Economies of scale present divergent trajectories for these technologies. Traditional heat exchangers have largely reached manufacturing maturity with modest cost reduction potential (estimated at 1-2% annually). Conversely, microchannel technology demonstrates a steeper learning curve, with projected cost reductions of 8-15% annually as production volumes increase and manufacturing processes mature. Analysis of current trends suggests price parity could be achieved within 5-7 years for certain applications.

Production yield rates further differentiate these technologies. Traditional heat exchangers typically achieve manufacturing yields of 95-98%, while microchannel systems currently average 80-90% due to the precision requirements and quality control challenges. This yield gap translates directly to cost differentials, though recent advances in automated inspection systems and process controls are narrowing this disparity.

Integration complexity also affects total implementation costs. Microchannel systems often require more sophisticated integration engineering, specialized connectors, and precise flow distribution systems. These factors can increase installation costs by 20-40% compared to traditional solutions, though this premium decreases in applications where space constraints and weight considerations provide offsetting system-level benefits.

Traditional heat exchangers benefit from decades of manufacturing optimization, with established supply chains and standardized production processes. Their larger-scale features allow for conventional manufacturing methods such as stamping, brazing, and welding, resulting in lower per-unit production costs at high volumes. Industry estimates suggest traditional heat exchanger manufacturing costs range from $20-100 per kW of cooling capacity, while microchannel systems currently average $50-200 per kW, representing a 1.5-3x cost premium.

Material considerations significantly impact manufacturing economics. Microchannel systems typically require corrosion-resistant materials like stainless steel, aluminum alloys, or specialized polymers to prevent channel clogging and deterioration. These material requirements increase raw material costs by approximately 30-50% compared to traditional heat exchangers, which can utilize more standard-grade materials.

Economies of scale present divergent trajectories for these technologies. Traditional heat exchangers have largely reached manufacturing maturity with modest cost reduction potential (estimated at 1-2% annually). Conversely, microchannel technology demonstrates a steeper learning curve, with projected cost reductions of 8-15% annually as production volumes increase and manufacturing processes mature. Analysis of current trends suggests price parity could be achieved within 5-7 years for certain applications.

Production yield rates further differentiate these technologies. Traditional heat exchangers typically achieve manufacturing yields of 95-98%, while microchannel systems currently average 80-90% due to the precision requirements and quality control challenges. This yield gap translates directly to cost differentials, though recent advances in automated inspection systems and process controls are narrowing this disparity.

Integration complexity also affects total implementation costs. Microchannel systems often require more sophisticated integration engineering, specialized connectors, and precise flow distribution systems. These factors can increase installation costs by 20-40% compared to traditional solutions, though this premium decreases in applications where space constraints and weight considerations provide offsetting system-level benefits.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!