How Patents Influence Microchannel Cooling Development

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microchannel Cooling Patent Landscape and Development Goals

Microchannel cooling technology has evolved significantly over the past three decades, with patents playing a crucial role in shaping its development trajectory. The concept originated in the 1980s when researchers at Stanford University first demonstrated the enhanced heat transfer capabilities of microchannels. Since then, the technology has progressed through several distinct phases, each marked by patent-driven innovations addressing specific thermal management challenges.

The evolution of microchannel cooling patents reveals a clear trend from fundamental concepts to application-specific solutions. Early patents (1985-1995) focused primarily on basic microchannel structures and manufacturing techniques, establishing the foundational principles. The second wave of patents (1995-2005) expanded into material innovations and integration methods, particularly for electronics cooling applications.

From 2005 to 2015, patent activity shifted toward optimization of flow distribution, pressure drop reduction, and enhanced heat transfer surfaces. This period saw significant growth in patents addressing two-phase cooling solutions, which offer substantially higher heat transfer coefficients compared to single-phase approaches. The most recent patent landscape (2015-present) demonstrates increased focus on system-level integration, smart cooling solutions with embedded sensors, and advanced manufacturing techniques including 3D printing of complex microchannel geometries.

Current technological goals in the microchannel cooling domain center around several key objectives. First, achieving heat flux capabilities exceeding 500 W/cm² to address the thermal demands of next-generation high-performance computing and power electronics. Second, developing uniform cooling solutions that eliminate hotspots while maintaining minimal temperature gradients across devices. Third, reducing pumping power requirements through innovative channel designs and surface modifications.

Additional development goals include enhancing reliability for long-term operation in harsh environments, miniaturization for space-constrained applications, and cost reduction through simplified manufacturing processes. Patents are increasingly focusing on sustainability aspects, with innovations targeting reduced water consumption and energy-efficient operation.

The patent landscape indicates emerging interest in hybrid cooling solutions that combine microchannels with other cooling technologies such as thermoelectric cooling or phase change materials. These hybrid approaches aim to overcome the inherent limitations of standalone microchannel systems, particularly for applications with highly variable thermal loads.

As the technology continues to mature, patent activity is expected to increasingly focus on industry-specific implementations, with customized solutions for data centers, electric vehicles, aerospace applications, and medical devices representing the next frontier in microchannel cooling development.

The evolution of microchannel cooling patents reveals a clear trend from fundamental concepts to application-specific solutions. Early patents (1985-1995) focused primarily on basic microchannel structures and manufacturing techniques, establishing the foundational principles. The second wave of patents (1995-2005) expanded into material innovations and integration methods, particularly for electronics cooling applications.

From 2005 to 2015, patent activity shifted toward optimization of flow distribution, pressure drop reduction, and enhanced heat transfer surfaces. This period saw significant growth in patents addressing two-phase cooling solutions, which offer substantially higher heat transfer coefficients compared to single-phase approaches. The most recent patent landscape (2015-present) demonstrates increased focus on system-level integration, smart cooling solutions with embedded sensors, and advanced manufacturing techniques including 3D printing of complex microchannel geometries.

Current technological goals in the microchannel cooling domain center around several key objectives. First, achieving heat flux capabilities exceeding 500 W/cm² to address the thermal demands of next-generation high-performance computing and power electronics. Second, developing uniform cooling solutions that eliminate hotspots while maintaining minimal temperature gradients across devices. Third, reducing pumping power requirements through innovative channel designs and surface modifications.

Additional development goals include enhancing reliability for long-term operation in harsh environments, miniaturization for space-constrained applications, and cost reduction through simplified manufacturing processes. Patents are increasingly focusing on sustainability aspects, with innovations targeting reduced water consumption and energy-efficient operation.

The patent landscape indicates emerging interest in hybrid cooling solutions that combine microchannels with other cooling technologies such as thermoelectric cooling or phase change materials. These hybrid approaches aim to overcome the inherent limitations of standalone microchannel systems, particularly for applications with highly variable thermal loads.

As the technology continues to mature, patent activity is expected to increasingly focus on industry-specific implementations, with customized solutions for data centers, electric vehicles, aerospace applications, and medical devices representing the next frontier in microchannel cooling development.

Market Demand Analysis for Advanced Thermal Management Solutions

The thermal management solutions market is experiencing unprecedented growth driven by the increasing power density in electronic devices across multiple industries. Current market analysis indicates that the global thermal management market is projected to grow significantly through 2030, with advanced cooling technologies like microchannel cooling gaining substantial market share. This growth is primarily fueled by the semiconductor industry's continuous miniaturization efforts and the rising thermal challenges in high-performance computing environments.

Data centers represent one of the largest market segments demanding advanced thermal management solutions. With the global data center industry expanding rapidly to support cloud computing, AI workloads, and big data applications, cooling systems now account for approximately 40% of data center energy consumption. Microchannel cooling technologies offer potential energy efficiency improvements of 25-30% compared to traditional air cooling methods, creating a compelling value proposition for data center operators seeking to reduce operational costs.

The consumer electronics sector presents another significant market opportunity. As smartphones, tablets, and laptops continue to pack more processing power into thinner form factors, thermal constraints have become a primary design limitation. Market research indicates that consumers increasingly value devices that maintain peak performance without thermal throttling, creating demand for more effective cooling solutions that can be integrated into compact designs.

Automotive electronics, particularly in electric vehicles and autonomous driving systems, constitute a rapidly growing market segment. The thermal management requirements for battery systems, power electronics, and computing platforms in next-generation vehicles are driving innovation in liquid cooling technologies. Industry forecasts suggest that the automotive thermal management market will grow at a compound annual rate exceeding the broader thermal solutions market.

Industrial applications and high-performance computing represent additional significant market segments. The increasing adoption of edge computing, AI accelerators, and specialized processing hardware has created demand for cooling solutions capable of handling extreme heat fluxes. Research institutions and technology companies are actively seeking thermal management technologies that can support the next generation of supercomputers and specialized AI hardware.

Market analysis reveals that customers across these segments are prioritizing several key factors: energy efficiency, reliability, compact form factors, and total cost of ownership. Solutions that can demonstrate superior performance in these areas while offering compatibility with existing manufacturing processes are positioned to capture significant market share. The patent landscape in microchannel cooling technologies directly influences which solutions can be commercialized and which market segments can be addressed by different industry players.

Data centers represent one of the largest market segments demanding advanced thermal management solutions. With the global data center industry expanding rapidly to support cloud computing, AI workloads, and big data applications, cooling systems now account for approximately 40% of data center energy consumption. Microchannel cooling technologies offer potential energy efficiency improvements of 25-30% compared to traditional air cooling methods, creating a compelling value proposition for data center operators seeking to reduce operational costs.

The consumer electronics sector presents another significant market opportunity. As smartphones, tablets, and laptops continue to pack more processing power into thinner form factors, thermal constraints have become a primary design limitation. Market research indicates that consumers increasingly value devices that maintain peak performance without thermal throttling, creating demand for more effective cooling solutions that can be integrated into compact designs.

Automotive electronics, particularly in electric vehicles and autonomous driving systems, constitute a rapidly growing market segment. The thermal management requirements for battery systems, power electronics, and computing platforms in next-generation vehicles are driving innovation in liquid cooling technologies. Industry forecasts suggest that the automotive thermal management market will grow at a compound annual rate exceeding the broader thermal solutions market.

Industrial applications and high-performance computing represent additional significant market segments. The increasing adoption of edge computing, AI accelerators, and specialized processing hardware has created demand for cooling solutions capable of handling extreme heat fluxes. Research institutions and technology companies are actively seeking thermal management technologies that can support the next generation of supercomputers and specialized AI hardware.

Market analysis reveals that customers across these segments are prioritizing several key factors: energy efficiency, reliability, compact form factors, and total cost of ownership. Solutions that can demonstrate superior performance in these areas while offering compatibility with existing manufacturing processes are positioned to capture significant market share. The patent landscape in microchannel cooling technologies directly influences which solutions can be commercialized and which market segments can be addressed by different industry players.

Current Patent Challenges in Microchannel Cooling Technology

The patent landscape in microchannel cooling technology presents several significant challenges that impede innovation and market growth. One primary obstacle is the increasing patent thicket, where overlapping intellectual property rights create a complex web that new entrants must navigate. Major corporations like IBM, Intel, and Asetek hold extensive patent portfolios covering fundamental microchannel designs and manufacturing processes, effectively creating barriers to entry for smaller companies and startups.

Patent quality issues further complicate the field, with many patents containing overly broad claims that extend protection beyond actual innovations. This breadth creates uncertainty about freedom to operate and increases litigation risks. The semiconductor and high-performance computing industries particularly suffer from these ambiguities, as cooling solutions become increasingly critical to product performance.

Cross-licensing complexities represent another significant challenge. As microchannel cooling technology integrates multiple technical domains—fluid dynamics, materials science, and electronic design—developers often need licenses from multiple patent holders. This fragmentation increases transaction costs and delays product development cycles, sometimes by 12-18 months according to industry reports.

Geographic patent disparities create additional complications. Patent protection strategies vary significantly between regions, with the United States and Japan leading in patent filings while emerging markets show different enforcement standards. This inconsistency forces companies to develop region-specific IP strategies, increasing compliance costs and market entry barriers.

The rapid pace of technological advancement further exacerbates these challenges. The average lifecycle of microchannel cooling innovations has shortened to approximately 3-5 years, while patent protection lasts for 20 years. This mismatch creates situations where patents protect outdated technologies while still blocking new developments, particularly in areas like 3D microchannel structures and phase-change cooling mechanisms.

Standard-essential patents (SEPs) present unique challenges in the cooling industry. As standardization efforts increase for thermal management interfaces, determining fair, reasonable, and non-discriminatory (FRAND) licensing terms becomes contentious. Recent disputes between cooling technology providers highlight the difficulties in establishing equitable licensing frameworks that balance innovation incentives with market access.

Patent enforcement costs have also risen dramatically, with the average microchannel cooling patent litigation in the United States exceeding $3 million. This financial burden disproportionately affects smaller innovators and academic institutions, potentially redirecting resources from R&D to legal protection.

Patent quality issues further complicate the field, with many patents containing overly broad claims that extend protection beyond actual innovations. This breadth creates uncertainty about freedom to operate and increases litigation risks. The semiconductor and high-performance computing industries particularly suffer from these ambiguities, as cooling solutions become increasingly critical to product performance.

Cross-licensing complexities represent another significant challenge. As microchannel cooling technology integrates multiple technical domains—fluid dynamics, materials science, and electronic design—developers often need licenses from multiple patent holders. This fragmentation increases transaction costs and delays product development cycles, sometimes by 12-18 months according to industry reports.

Geographic patent disparities create additional complications. Patent protection strategies vary significantly between regions, with the United States and Japan leading in patent filings while emerging markets show different enforcement standards. This inconsistency forces companies to develop region-specific IP strategies, increasing compliance costs and market entry barriers.

The rapid pace of technological advancement further exacerbates these challenges. The average lifecycle of microchannel cooling innovations has shortened to approximately 3-5 years, while patent protection lasts for 20 years. This mismatch creates situations where patents protect outdated technologies while still blocking new developments, particularly in areas like 3D microchannel structures and phase-change cooling mechanisms.

Standard-essential patents (SEPs) present unique challenges in the cooling industry. As standardization efforts increase for thermal management interfaces, determining fair, reasonable, and non-discriminatory (FRAND) licensing terms becomes contentious. Recent disputes between cooling technology providers highlight the difficulties in establishing equitable licensing frameworks that balance innovation incentives with market access.

Patent enforcement costs have also risen dramatically, with the average microchannel cooling patent litigation in the United States exceeding $3 million. This financial burden disproportionately affects smaller innovators and academic institutions, potentially redirecting resources from R&D to legal protection.

Existing Patented Solutions for Microchannel Cooling Systems

01 Electronic device cooling with microchannels

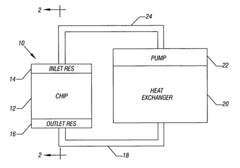

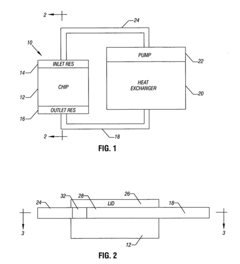

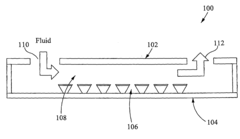

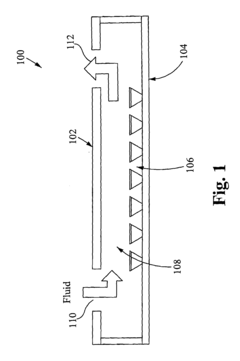

Microchannel cooling systems are used for thermal management of electronic devices such as processors, integrated circuits, and power electronics. These systems incorporate small channels directly into or adjacent to heat-generating components to efficiently remove heat through liquid cooling. The microchannels maximize surface area for heat transfer while minimizing the required coolant volume, making them particularly effective for high-power density applications where traditional cooling methods are insufficient.- Electronic device cooling systems: Microchannel cooling systems designed specifically for electronic components such as processors, integrated circuits, and power modules. These systems utilize small channels to circulate coolant directly through or adjacent to heat-generating components, enabling efficient heat dissipation in compact electronic devices. The microchannels maximize surface area contact with the coolant, allowing for improved thermal management in high-performance computing applications.

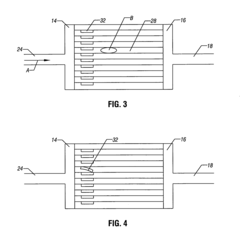

- Advanced microchannel heat exchanger designs: Innovative heat exchanger designs incorporating microchannels with optimized geometries, flow patterns, and materials. These designs include multi-layer structures, variable channel dimensions, and specialized surface treatments to enhance heat transfer efficiency. Some designs feature integrated manifolds for improved coolant distribution and reduced pressure drop, while others incorporate phase-change cooling mechanisms to take advantage of latent heat absorption.

- Cooling solutions for high-power applications: Microchannel cooling systems developed for high-power applications such as data centers, power electronics, and industrial equipment. These systems can handle significant heat loads through parallel channel arrangements, high flow rates, and advanced coolants. The designs often incorporate redundancy features and can be scaled to accommodate varying thermal management requirements while maintaining efficiency and reliability under demanding operating conditions.

- Manufacturing techniques for microchannel coolers: Specialized manufacturing methods for producing microchannel cooling systems, including advanced etching, additive manufacturing, micro-machining, and bonding techniques. These processes enable the creation of precise channel geometries with optimal surface characteristics for enhanced heat transfer. Some techniques focus on cost-effective mass production, while others emphasize creating complex three-dimensional cooling structures that would be impossible with conventional manufacturing approaches.

- Integration of microchannels with thermal management systems: Approaches for integrating microchannel cooling into comprehensive thermal management systems, including hybrid cooling solutions that combine microchannels with other cooling technologies. These integrated systems may incorporate sensors, control mechanisms, and smart algorithms to optimize cooling performance based on real-time thermal conditions. The integration enables more efficient overall system design by strategically placing microchannel coolers where they provide the greatest benefit while using complementary cooling methods elsewhere.

02 Microchannel heat exchanger designs

Various designs of microchannel heat exchangers have been developed to optimize cooling efficiency. These include parallel channel arrangements, serpentine patterns, manifold designs for uniform flow distribution, and hierarchical channel structures. Advanced designs incorporate features such as pin fins, enhanced surface textures, and variable channel geometries to improve heat transfer coefficients while managing pressure drop. These innovations enable higher cooling capacity in compact form factors for applications ranging from electronics to power systems.Expand Specific Solutions03 Two-phase cooling in microchannels

Two-phase cooling systems utilize the phase change of the working fluid (typically from liquid to vapor) within microchannels to significantly enhance heat transfer efficiency. This approach leverages the latent heat of vaporization to remove large amounts of heat while maintaining relatively uniform temperatures. The technology addresses challenges such as flow instability, pressure drop management, and vapor quality control to achieve optimal cooling performance for high-heat-flux applications like data centers, power electronics, and advanced computing systems.Expand Specific Solutions04 Microchannel cooling for specialized applications

Microchannel cooling has been adapted for specialized applications beyond traditional electronics cooling. These include thermal management for laser systems, medical devices, aerospace components, and renewable energy systems. The technology has been modified to address unique requirements such as extreme temperature conditions, limited space constraints, weight restrictions, and reliability demands. Specialized microchannel designs incorporate application-specific features like integrated sensors, redundant flow paths, or materials compatible with harsh environments.Expand Specific Solutions05 Manufacturing techniques for microchannel cooling systems

Advanced manufacturing techniques have been developed to produce microchannel cooling systems with precise geometries and optimal performance. These include additive manufacturing (3D printing), chemical etching, micro-machining, and advanced bonding methods. These fabrication approaches enable complex channel geometries, multi-layer structures, and integration of cooling systems directly into components. Manufacturing innovations have focused on reducing production costs, improving reliability, and enabling mass production while maintaining the precise dimensions required for efficient microchannel cooling.Expand Specific Solutions

Key Patent Holders and Industry Competitors Analysis

The microchannel cooling technology market is currently in a growth phase, characterized by increasing adoption across high-performance computing and electronics sectors. The global market size is expanding rapidly, driven by data center cooling demands and thermal management challenges in advanced electronics. From a technical maturity perspective, the landscape shows varied development levels, with Intel and IBM leading commercial implementation through significant patent portfolios focused on integrated cooling solutions. Samsung and GlobalFoundries are advancing semiconductor-specific applications, while research institutions like Rochester Institute of Technology and Auburn University contribute fundamental innovations. Companies like Forced Physics and 3M Innovative Properties are developing specialized solutions, indicating the technology's transition from research to commercial applications across multiple industries.

Intel Corp.

Technical Solution: Intel has pioneered microchannel cooling technology through extensive patent development, focusing on integrated solutions for high-performance computing systems. Their approach involves embedding microchannels directly into silicon substrates and heat spreaders to manage thermal issues in densely packed processors. Intel's patents cover various aspects including multi-layer microchannel structures that allow coolant to flow through different levels of the chip stack, optimizing heat dissipation from hotspots. They've developed specialized manifold designs that ensure uniform coolant distribution across large die areas, critical for their high-power server processors. Intel has also patented innovative coolant formulations specifically engineered for microchannel applications, enhancing thermal conductivity while minimizing electrical risks[1][3]. Their recent patents focus on two-phase cooling systems that leverage phase change effects within microchannels to significantly increase heat transfer efficiency.

Strengths: Intel's microchannel cooling patents are tightly integrated with their semiconductor manufacturing expertise, allowing for solutions that can be implemented at the wafer level. Their extensive R&D resources enable comprehensive testing and validation. Weaknesses: Their solutions are often optimized specifically for x86 architecture requirements, potentially limiting broader application. The proprietary nature of their cooling technologies may create vendor lock-in for system integrators.

International Business Machines Corp.

Technical Solution: IBM has developed an extensive patent portfolio around microchannel cooling technologies, particularly focused on high-density computing applications like data centers and supercomputers. Their approach centers on hierarchical cooling networks that distribute coolant through progressively smaller channels, optimizing flow dynamics while minimizing pumping power requirements. IBM's patents describe sophisticated microstructures etched into silicon that create turbulent flow patterns to enhance heat transfer coefficients at the fluid-solid interface. They've pioneered "hot spot-targeted" cooling designs where microchannel density increases in areas of highest thermal generation[2]. IBM has also patented innovative manufacturing techniques for creating 3D microchannel networks within multi-chip modules, allowing coolant to flow between stacked dies. Their recent patents focus on smart cooling systems that dynamically adjust coolant flow rates based on real-time thermal monitoring, optimizing energy efficiency while maintaining safe operating temperatures across complex computing systems[4].

Strengths: IBM's microchannel cooling patents demonstrate exceptional integration with high-performance computing systems and data center infrastructure. Their solutions address both chip-level and system-level thermal management challenges comprehensively. Weaknesses: Implementation of IBM's advanced cooling technologies often requires specialized manufacturing capabilities and infrastructure modifications, increasing adoption costs. Some of their more complex solutions may face reliability challenges in long-term deployment scenarios.

Critical Patent Analysis of Core Microchannel Cooling Technologies

Microfluidic cooling of integrated circuits

PatentInactiveUS20060227512A1

Innovation

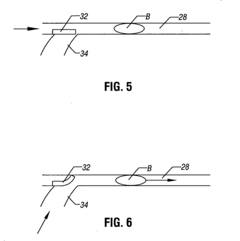

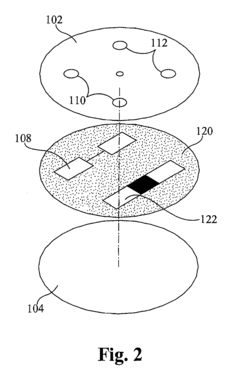

- Incorporating heat-activated bimetal flap valves within the microchannels to deflect and flush out bubbles by reducing the flow cross-section and breaking the meniscus force, allowing fluid to flow and prevent bubble obstruction, with optional alternate flow passages for enhanced bubble removal.

Stable cavity-induced two-phase heat transfer in silicon microchannels

PatentInactiveUS20080295996A1

Innovation

- Microscopic pyramidal cavities with square mouths are etched into the base of silicon microchannels to promote controlled nucleation and stabilize the two-phase flow, enhancing heat transfer efficiency.

Patent Strategy Recommendations for Microchannel Cooling R&D

To effectively leverage patents in microchannel cooling technology development, organizations must adopt strategic approaches that balance innovation protection with competitive advantage. A comprehensive patent strategy should begin with thorough landscape analysis, identifying white spaces where new intellectual property can be developed without infringing existing patents. This requires regular monitoring of patent databases and competitor filings to understand emerging trends and potential threats.

Cross-licensing agreements represent a valuable strategic tool, particularly in the microchannel cooling sector where fundamental technologies may be protected by multiple entities. By establishing mutually beneficial licensing relationships with key patent holders, companies can gain access to critical technologies while reducing litigation risks and development costs. These arrangements can accelerate time-to-market for new cooling solutions.

Defensive patenting should be incorporated as a core element of R&D strategy. This involves creating patent portfolios that protect not only current technologies but also potential future development paths. Strategic patent filing around core innovations creates a protective barrier that deters competitors from entering specific technical domains and provides negotiating leverage in potential disputes.

Open innovation approaches can complement traditional patent strategies. Selective participation in patent pools or industry standards organizations may provide access to broader technology ecosystems while maintaining protection for proprietary innovations. This balanced approach allows companies to benefit from collaborative development while preserving competitive differentiation in key areas.

Geographic considerations are increasingly important in microchannel cooling patent strategy. Different filing strategies may be appropriate for different markets based on manufacturing locations, target customers, and competitive landscape. Prioritizing patent protection in regions with strong enforcement mechanisms and significant market potential maximizes return on intellectual property investment.

Patent quality should take precedence over quantity. Resources should be focused on developing robust patents with broad claims covering fundamental aspects of microchannel cooling technology rather than numerous narrow patents. High-quality patents that withstand validity challenges provide stronger protection and greater licensing potential than larger portfolios of questionable enforceability.

Finally, organizations should establish clear processes for invention disclosure, evaluation, and patent decision-making that align with broader business objectives. Regular review of the patent portfolio ensures continued relevance to product roadmaps and market conditions, allowing for strategic abandonment of patents that no longer provide value.

Cross-licensing agreements represent a valuable strategic tool, particularly in the microchannel cooling sector where fundamental technologies may be protected by multiple entities. By establishing mutually beneficial licensing relationships with key patent holders, companies can gain access to critical technologies while reducing litigation risks and development costs. These arrangements can accelerate time-to-market for new cooling solutions.

Defensive patenting should be incorporated as a core element of R&D strategy. This involves creating patent portfolios that protect not only current technologies but also potential future development paths. Strategic patent filing around core innovations creates a protective barrier that deters competitors from entering specific technical domains and provides negotiating leverage in potential disputes.

Open innovation approaches can complement traditional patent strategies. Selective participation in patent pools or industry standards organizations may provide access to broader technology ecosystems while maintaining protection for proprietary innovations. This balanced approach allows companies to benefit from collaborative development while preserving competitive differentiation in key areas.

Geographic considerations are increasingly important in microchannel cooling patent strategy. Different filing strategies may be appropriate for different markets based on manufacturing locations, target customers, and competitive landscape. Prioritizing patent protection in regions with strong enforcement mechanisms and significant market potential maximizes return on intellectual property investment.

Patent quality should take precedence over quantity. Resources should be focused on developing robust patents with broad claims covering fundamental aspects of microchannel cooling technology rather than numerous narrow patents. High-quality patents that withstand validity challenges provide stronger protection and greater licensing potential than larger portfolios of questionable enforceability.

Finally, organizations should establish clear processes for invention disclosure, evaluation, and patent decision-making that align with broader business objectives. Regular review of the patent portfolio ensures continued relevance to product roadmaps and market conditions, allowing for strategic abandonment of patents that no longer provide value.

Cross-Industry Applications and Licensing Opportunities

Microchannel cooling technology, initially developed for electronics thermal management, has demonstrated remarkable versatility across multiple industries. The semiconductor industry remains the primary beneficiary, with patents enabling efficient heat dissipation in increasingly dense chip architectures. However, patent analysis reveals significant cross-pollination into automotive applications, particularly for electric vehicle battery thermal management systems where precise temperature control directly impacts performance and safety.

Aerospace and defense sectors have adapted microchannel cooling patents for high-performance computing systems and power electronics in extreme environments. These adaptations have generated specialized licensing agreements between technology originators and aerospace manufacturers, creating new revenue streams for patent holders while accelerating innovation in mission-critical systems.

Medical device manufacturers have licensed microchannel cooling technologies for applications ranging from laser surgery equipment to wearable diagnostic devices. The miniaturization capabilities inherent in microchannel designs have proven particularly valuable for implantable medical technologies where thermal management must occur within extremely confined spaces.

Renewable energy systems represent an emerging application area, with concentrated solar power and high-density power electronics for wind turbines benefiting from microchannel cooling innovations. Patent cross-licensing between electronics and renewable energy companies has accelerated technology transfer in this domain.

Data center cooling represents perhaps the most lucrative licensing opportunity, with patents covering liquid-cooled server designs commanding premium licensing fees. Companies holding foundational microchannel cooling patents have established strategic licensing programs specifically targeting hyperscale data center operators seeking to reduce cooling costs and increase computing density.

The telecommunications sector has emerged as another significant licensing market, particularly for 5G infrastructure where heat dissipation challenges in compact base stations have driven adoption of microchannel solutions. Patent portfolios that address these specific implementation challenges have seen substantial licensing activity.

Industrial manufacturing equipment, particularly for processes requiring precise temperature control such as injection molding and additive manufacturing, represents another cross-industry application area. Patents covering specialized microchannel designs for these applications have created niche licensing opportunities for technology developers with domain-specific expertise.

The diversification of microchannel cooling applications has created a complex licensing landscape where patents originally developed for one industry find unexpected applications in others, often requiring specialized adaptation and implementation knowledge that extends beyond the original patent claims.

Aerospace and defense sectors have adapted microchannel cooling patents for high-performance computing systems and power electronics in extreme environments. These adaptations have generated specialized licensing agreements between technology originators and aerospace manufacturers, creating new revenue streams for patent holders while accelerating innovation in mission-critical systems.

Medical device manufacturers have licensed microchannel cooling technologies for applications ranging from laser surgery equipment to wearable diagnostic devices. The miniaturization capabilities inherent in microchannel designs have proven particularly valuable for implantable medical technologies where thermal management must occur within extremely confined spaces.

Renewable energy systems represent an emerging application area, with concentrated solar power and high-density power electronics for wind turbines benefiting from microchannel cooling innovations. Patent cross-licensing between electronics and renewable energy companies has accelerated technology transfer in this domain.

Data center cooling represents perhaps the most lucrative licensing opportunity, with patents covering liquid-cooled server designs commanding premium licensing fees. Companies holding foundational microchannel cooling patents have established strategic licensing programs specifically targeting hyperscale data center operators seeking to reduce cooling costs and increase computing density.

The telecommunications sector has emerged as another significant licensing market, particularly for 5G infrastructure where heat dissipation challenges in compact base stations have driven adoption of microchannel solutions. Patent portfolios that address these specific implementation challenges have seen substantial licensing activity.

Industrial manufacturing equipment, particularly for processes requiring precise temperature control such as injection molding and additive manufacturing, represents another cross-industry application area. Patents covering specialized microchannel designs for these applications have created niche licensing opportunities for technology developers with domain-specific expertise.

The diversification of microchannel cooling applications has created a complex licensing landscape where patents originally developed for one industry find unexpected applications in others, often requiring specialized adaptation and implementation knowledge that extends beyond the original patent claims.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!