Cost Reduction in Production of Lithium Iron Phosphate Batteries

AUG 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LFP Battery Cost Reduction Objectives

The primary objective of cost reduction in the production of Lithium Iron Phosphate (LFP) batteries is to enhance their economic viability and market competitiveness. As the demand for electric vehicles and energy storage systems continues to grow, reducing the production costs of LFP batteries becomes crucial for widespread adoption and sustainable growth in the industry.

One of the key targets is to optimize the raw material sourcing and processing. This involves developing more efficient methods for extracting and refining lithium, iron, and phosphate, as well as exploring alternative sources or recycling technologies to reduce dependency on primary resources. Additionally, improving the purity and consistency of these materials can lead to enhanced battery performance and reduced production costs.

Another significant objective is to streamline the manufacturing process. This includes automating production lines, implementing advanced quality control measures, and reducing energy consumption during manufacturing. By increasing production efficiency and yield rates, manufacturers can significantly lower the overall cost per unit of LFP batteries.

Enhancing the energy density of LFP batteries is also a critical goal. While LFP chemistry inherently has a lower energy density compared to some other lithium-ion battery types, improvements in this area can lead to reduced material usage and lower costs per kilowatt-hour of storage capacity. This involves research into advanced electrode materials, optimized cell designs, and improved electrolyte formulations.

Scaling up production capacity is another essential objective for cost reduction. As production volumes increase, economies of scale can be achieved, leading to lower costs per unit. This requires significant investment in manufacturing facilities and equipment, but can result in substantial long-term cost savings.

Reducing the complexity of battery pack design and assembly is also a key focus area. Simplifying the battery management systems, thermal management solutions, and overall pack architecture can lead to lower production costs and easier maintenance. This includes developing modular designs that can be easily scaled and adapted for different applications.

Lastly, improving the lifespan and cycle life of LFP batteries is crucial for long-term cost reduction. By enhancing the durability and performance of these batteries over time, manufacturers can reduce the total cost of ownership for end-users, making LFP batteries more attractive for various applications. This involves research into advanced electrode coatings, electrolyte additives, and charge/discharge management strategies.

One of the key targets is to optimize the raw material sourcing and processing. This involves developing more efficient methods for extracting and refining lithium, iron, and phosphate, as well as exploring alternative sources or recycling technologies to reduce dependency on primary resources. Additionally, improving the purity and consistency of these materials can lead to enhanced battery performance and reduced production costs.

Another significant objective is to streamline the manufacturing process. This includes automating production lines, implementing advanced quality control measures, and reducing energy consumption during manufacturing. By increasing production efficiency and yield rates, manufacturers can significantly lower the overall cost per unit of LFP batteries.

Enhancing the energy density of LFP batteries is also a critical goal. While LFP chemistry inherently has a lower energy density compared to some other lithium-ion battery types, improvements in this area can lead to reduced material usage and lower costs per kilowatt-hour of storage capacity. This involves research into advanced electrode materials, optimized cell designs, and improved electrolyte formulations.

Scaling up production capacity is another essential objective for cost reduction. As production volumes increase, economies of scale can be achieved, leading to lower costs per unit. This requires significant investment in manufacturing facilities and equipment, but can result in substantial long-term cost savings.

Reducing the complexity of battery pack design and assembly is also a key focus area. Simplifying the battery management systems, thermal management solutions, and overall pack architecture can lead to lower production costs and easier maintenance. This includes developing modular designs that can be easily scaled and adapted for different applications.

Lastly, improving the lifespan and cycle life of LFP batteries is crucial for long-term cost reduction. By enhancing the durability and performance of these batteries over time, manufacturers can reduce the total cost of ownership for end-users, making LFP batteries more attractive for various applications. This involves research into advanced electrode coatings, electrolyte additives, and charge/discharge management strategies.

LFP Battery Market Demand Analysis

The global market for lithium iron phosphate (LFP) batteries has experienced significant growth in recent years, driven by the increasing demand for electric vehicles (EVs) and energy storage systems. This surge in demand is primarily attributed to the superior safety, longer lifespan, and lower cost of LFP batteries compared to other lithium-ion battery chemistries.

In the automotive sector, LFP batteries have gained substantial traction, particularly in China, where they have become the preferred choice for many EV manufacturers. The lower cost of LFP batteries has enabled automakers to produce more affordable electric vehicles, thus accelerating EV adoption rates. This trend is expected to continue, with major global automakers increasingly incorporating LFP batteries into their EV lineups.

The energy storage market has also shown a strong preference for LFP batteries due to their stability and long cycle life. Grid-scale energy storage projects, residential solar-plus-storage systems, and commercial energy storage applications are driving demand for LFP batteries. The growing focus on renewable energy integration and grid stability further amplifies this demand.

Market analysts project the global LFP battery market to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is supported by favorable government policies promoting clean energy and electric mobility, as well as ongoing technological advancements that continue to improve LFP battery performance.

Despite the positive outlook, challenges remain in the LFP battery market. The rising costs of raw materials, particularly lithium and iron ore, have put pressure on manufacturers to optimize their production processes and reduce costs. Additionally, the dominance of Chinese manufacturers in the LFP battery market has raised concerns about supply chain resilience and geopolitical risks for global customers.

To address these challenges and meet the growing demand, there is a strong industry focus on cost reduction in LFP battery production. Manufacturers are investing in research and development to improve energy density, reduce material usage, and streamline manufacturing processes. Innovations in cathode materials, such as doping techniques and nano-structuring, are being explored to enhance battery performance while potentially reducing production costs.

The market demand for LFP batteries is also driving investments in new production facilities outside of China, as companies seek to diversify their supply chains and reduce dependence on a single geographic region. This trend is expected to lead to increased competition and potentially drive further cost reductions through economies of scale and technological innovations.

In the automotive sector, LFP batteries have gained substantial traction, particularly in China, where they have become the preferred choice for many EV manufacturers. The lower cost of LFP batteries has enabled automakers to produce more affordable electric vehicles, thus accelerating EV adoption rates. This trend is expected to continue, with major global automakers increasingly incorporating LFP batteries into their EV lineups.

The energy storage market has also shown a strong preference for LFP batteries due to their stability and long cycle life. Grid-scale energy storage projects, residential solar-plus-storage systems, and commercial energy storage applications are driving demand for LFP batteries. The growing focus on renewable energy integration and grid stability further amplifies this demand.

Market analysts project the global LFP battery market to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is supported by favorable government policies promoting clean energy and electric mobility, as well as ongoing technological advancements that continue to improve LFP battery performance.

Despite the positive outlook, challenges remain in the LFP battery market. The rising costs of raw materials, particularly lithium and iron ore, have put pressure on manufacturers to optimize their production processes and reduce costs. Additionally, the dominance of Chinese manufacturers in the LFP battery market has raised concerns about supply chain resilience and geopolitical risks for global customers.

To address these challenges and meet the growing demand, there is a strong industry focus on cost reduction in LFP battery production. Manufacturers are investing in research and development to improve energy density, reduce material usage, and streamline manufacturing processes. Innovations in cathode materials, such as doping techniques and nano-structuring, are being explored to enhance battery performance while potentially reducing production costs.

The market demand for LFP batteries is also driving investments in new production facilities outside of China, as companies seek to diversify their supply chains and reduce dependence on a single geographic region. This trend is expected to lead to increased competition and potentially drive further cost reductions through economies of scale and technological innovations.

LFP Production Challenges

The production of Lithium Iron Phosphate (LFP) batteries faces several significant challenges that impact cost reduction efforts. One of the primary obstacles is the complexity of the manufacturing process, which involves multiple stages and requires precise control over various parameters. This complexity often leads to higher production costs and potential quality issues.

Raw material costs represent a substantial portion of LFP battery production expenses. The sourcing and processing of key materials such as lithium, iron, and phosphorus can be subject to market fluctuations and supply chain disruptions. Additionally, the need for high-purity materials to ensure battery performance further drives up costs.

Energy consumption during production is another major challenge. The synthesis of LFP cathode materials typically requires high-temperature processes, which are energy-intensive and contribute significantly to overall production costs. Developing more energy-efficient synthesis methods remains a key focus for cost reduction.

Scale and automation present both opportunities and challenges. While scaling up production can lead to economies of scale, it also requires significant capital investment in equipment and facilities. Implementing automation to improve efficiency and reduce labor costs is essential but comes with its own set of technical and financial hurdles.

Quality control and consistency in LFP battery production are critical yet challenging aspects. Ensuring uniform particle size, crystal structure, and composition of the cathode material across large production batches is technically demanding and can lead to increased costs due to the need for sophisticated monitoring and control systems.

Environmental and safety regulations pose additional challenges. Compliance with stringent environmental standards and safety protocols in battery production adds to operational costs. Developing cleaner, safer production methods that meet regulatory requirements while maintaining cost-effectiveness is an ongoing challenge.

Intellectual property considerations also impact production costs. Many advanced LFP production techniques are protected by patents, which can limit access to cost-effective manufacturing methods or require licensing fees, potentially increasing production expenses.

Lastly, the rapid pace of technological advancement in battery technology creates a challenge in balancing current production optimization with future-proofing. Investments in current production methods may become obsolete as new, more efficient technologies emerge, necessitating a careful approach to long-term cost reduction strategies.

Raw material costs represent a substantial portion of LFP battery production expenses. The sourcing and processing of key materials such as lithium, iron, and phosphorus can be subject to market fluctuations and supply chain disruptions. Additionally, the need for high-purity materials to ensure battery performance further drives up costs.

Energy consumption during production is another major challenge. The synthesis of LFP cathode materials typically requires high-temperature processes, which are energy-intensive and contribute significantly to overall production costs. Developing more energy-efficient synthesis methods remains a key focus for cost reduction.

Scale and automation present both opportunities and challenges. While scaling up production can lead to economies of scale, it also requires significant capital investment in equipment and facilities. Implementing automation to improve efficiency and reduce labor costs is essential but comes with its own set of technical and financial hurdles.

Quality control and consistency in LFP battery production are critical yet challenging aspects. Ensuring uniform particle size, crystal structure, and composition of the cathode material across large production batches is technically demanding and can lead to increased costs due to the need for sophisticated monitoring and control systems.

Environmental and safety regulations pose additional challenges. Compliance with stringent environmental standards and safety protocols in battery production adds to operational costs. Developing cleaner, safer production methods that meet regulatory requirements while maintaining cost-effectiveness is an ongoing challenge.

Intellectual property considerations also impact production costs. Many advanced LFP production techniques are protected by patents, which can limit access to cost-effective manufacturing methods or require licensing fees, potentially increasing production expenses.

Lastly, the rapid pace of technological advancement in battery technology creates a challenge in balancing current production optimization with future-proofing. Investments in current production methods may become obsolete as new, more efficient technologies emerge, necessitating a careful approach to long-term cost reduction strategies.

Current Cost Reduction Strategies

01 Cost reduction through improved manufacturing processes

Advancements in manufacturing techniques for lithium iron phosphate (LFP) batteries have led to significant cost reductions. These improvements include optimized production lines, automated assembly processes, and more efficient use of raw materials. Such enhancements have resulted in lower production costs and increased scalability, making LFP batteries more economically viable for various applications.- Cost reduction through improved manufacturing processes: Advancements in manufacturing techniques for lithium iron phosphate (LFP) batteries have led to significant cost reductions. These improvements include optimized production lines, automated assembly processes, and more efficient use of raw materials. Such enhancements have resulted in lower production costs and increased scalability, making LFP batteries more economically viable for various applications.

- Material innovations to reduce battery costs: Research into alternative materials and compositions for LFP batteries has yielded promising results in terms of cost reduction. This includes the development of new cathode materials, electrolyte formulations, and binder systems that can enhance performance while lowering overall production expenses. These material innovations contribute to making LFP batteries more cost-competitive in the energy storage market.

- Recycling and circular economy approaches: Implementing recycling processes and adopting circular economy principles can significantly impact the cost of LFP batteries. By recovering and reusing valuable materials from end-of-life batteries, manufacturers can reduce raw material costs and minimize environmental impact. This approach not only lowers production expenses but also addresses sustainability concerns associated with battery production.

- Economies of scale and supply chain optimization: As demand for LFP batteries grows, manufacturers are benefiting from economies of scale, leading to reduced costs per unit. Additionally, optimizing supply chains through strategic partnerships, vertical integration, and localized production can further decrease expenses associated with transportation and logistics. These factors contribute to making LFP batteries more affordable and accessible in various markets.

- Performance improvements affecting overall cost: Enhancements in LFP battery performance, such as increased energy density, improved cycle life, and faster charging capabilities, can indirectly affect their cost-effectiveness. While these improvements may not directly reduce production costs, they can lead to lower total ownership costs for end-users. This makes LFP batteries more competitive in applications where long-term performance and reliability are crucial factors.

02 Material innovations to reduce battery costs

Research into alternative materials and compositions for LFP batteries has yielded promising results in terms of cost reduction. This includes the development of new cathode materials, electrolyte formulations, and binder systems that can enhance performance while lowering overall production expenses. These material innovations contribute to making LFP batteries more cost-competitive in the energy storage market.Expand Specific Solutions03 Recycling and second-life applications

The development of efficient recycling processes and second-life applications for LFP batteries has the potential to significantly reduce their overall cost. By recovering valuable materials from used batteries and repurposing them for less demanding applications, the lifecycle cost of LFP batteries can be lowered. This approach not only reduces raw material costs but also addresses environmental concerns.Expand Specific Solutions04 Economies of scale and supply chain optimization

As the production of LFP batteries increases, economies of scale are being realized, leading to lower per-unit costs. Additionally, optimizing the supply chain for raw materials and components has helped reduce overall expenses. This includes developing strategic partnerships with suppliers and improving logistics to minimize transportation and storage costs.Expand Specific Solutions05 Integration of advanced battery management systems

The incorporation of sophisticated battery management systems (BMS) in LFP batteries has led to improved performance and longevity, indirectly reducing costs. These systems optimize charging and discharging cycles, monitor battery health, and prevent overcharging or deep discharging. By extending the lifespan of LFP batteries and improving their efficiency, the overall cost of ownership is reduced.Expand Specific Solutions

Key LFP Battery Manufacturers

The cost reduction in production of Lithium Iron Phosphate (LFP) batteries is at a critical juncture, with the industry transitioning from early adoption to mainstream implementation. The market size is expanding rapidly, driven by increasing demand for electric vehicles and energy storage systems. Technologically, LFP batteries are reaching maturity, with companies like BYD, CATL (via Guangdong Bangpu), and Guoxuan High-Tech leading innovations. Emerging players such as Nano One Materials and Svolt Energy are introducing novel manufacturing processes, while established firms like Panasonic and LG Chem are adapting their expertise to LFP production. This competitive landscape is fostering accelerated advancements in cost-effective LFP battery manufacturing techniques.

Nano One Materials Corp.

Technical Solution: Nano One has developed a patented One-Pot process for the production of lithium iron phosphate (LFP) cathode materials. This innovative method combines all input materials in a single reaction, eliminating extra steps and reducing costs. The process uses lower cost lithium carbonate as feedstock, avoiding the need for lithium hydroxide[1]. Their M2CAM (Metal to Cathode Active Material) technology further reduces costs by using metal powders directly, eliminating the need for metal sulfates or other salts[2]. This approach reduces water consumption, wastewater, and energy intensity in the manufacturing process, leading to an estimated 50% reduction in production costs compared to conventional methods[3].

Strengths: Simplified production process, reduced raw material costs, lower environmental impact, and potential for significant cost savings. Weaknesses: May require retooling of existing production facilities, and the technology is still scaling up to commercial production levels.

BYD Co., Ltd.

Technical Solution: BYD has developed the Blade Battery, an innovative LFP battery design that significantly reduces production costs. The Blade Battery uses a cell-to-pack (CTP) design, eliminating the need for module housing and connectors[1]. This approach increases energy density by 50% compared to conventional LFP batteries[2]. BYD's production process incorporates advanced automation and AI-driven quality control, reducing labor costs and improving consistency. They have also implemented a vertical integration strategy, producing many key components in-house, which helps control costs and ensure supply chain stability[3]. Additionally, BYD has developed a water-based production process for cathode materials, reducing the use of organic solvents and lowering environmental impact and production costs[4].

Strengths: Increased energy density, simplified battery pack design, vertical integration for cost control, and environmentally friendly production processes. Weaknesses: Proprietary technology may limit adoption by other manufacturers, and the CTP design may present challenges for battery repair and replacement.

Innovative LFP Production Methods

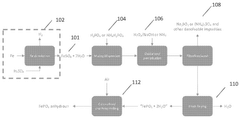

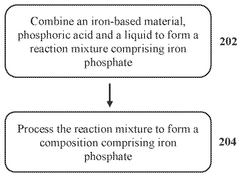

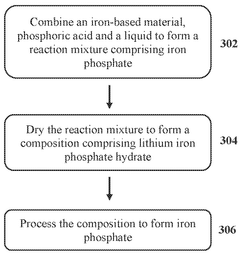

Iron phosphate synthesis which reduces waste products, and compositions thereof

PatentWO2025019435A1

Innovation

- A process involving the combination of an iron-based material, phosphoric acid, and a liquid to form a reaction mixture with a molar ratio of about 1:1.5 to 1.5:1, followed by processing to form a composition comprising iron phosphate, which reduces waste generation and simplifies the manufacturing steps.

Raw Material Supply Chain

The raw material supply chain for lithium iron phosphate (LFP) batteries plays a crucial role in cost reduction efforts. The primary components of LFP batteries include lithium carbonate, iron, and phosphorus, along with other materials such as graphite, copper, and aluminum. Securing a stable and cost-effective supply of these materials is essential for manufacturers to maintain competitive pricing in the market.

Lithium carbonate, a key ingredient in LFP batteries, has experienced significant price fluctuations in recent years due to increasing demand and limited supply. To address this challenge, battery manufacturers are exploring alternative lithium sources, such as direct lithium extraction from brine and recycling of used batteries. These methods have the potential to reduce dependency on traditional lithium mining operations and stabilize prices in the long term.

Iron and phosphorus, while more abundant than lithium, also contribute significantly to the overall cost of LFP batteries. Manufacturers are investigating ways to optimize the sourcing and processing of these materials to reduce expenses. This includes developing more efficient extraction methods and exploring alternative sources, such as iron-rich industrial waste and phosphorus recovered from wastewater treatment plants.

Vertical integration has emerged as a strategy for some battery manufacturers to gain better control over their supply chains. By acquiring or partnering with raw material suppliers, companies can reduce costs associated with intermediaries and better manage price volatility. This approach also allows for greater quality control and the ability to implement more sustainable practices throughout the supply chain.

Recycling and circular economy initiatives are gaining traction in the LFP battery industry. As the number of end-of-life batteries increases, manufacturers are developing more efficient recycling processes to recover valuable materials. This not only reduces the need for virgin raw materials but also helps mitigate environmental concerns associated with battery disposal.

Geopolitical factors and trade policies significantly impact the raw material supply chain for LFP batteries. Many key materials are concentrated in specific regions, making the industry vulnerable to supply disruptions and price fluctuations. To mitigate these risks, manufacturers are diversifying their supplier base and exploring domestic sources of raw materials where possible.

Technological advancements in material science are also contributing to cost reduction efforts in the raw material supply chain. Researchers are developing new cathode materials that require less lithium or utilize more abundant elements, potentially reducing the overall cost of battery production. Additionally, improvements in manufacturing processes are helping to optimize material usage and reduce waste, further driving down costs.

Lithium carbonate, a key ingredient in LFP batteries, has experienced significant price fluctuations in recent years due to increasing demand and limited supply. To address this challenge, battery manufacturers are exploring alternative lithium sources, such as direct lithium extraction from brine and recycling of used batteries. These methods have the potential to reduce dependency on traditional lithium mining operations and stabilize prices in the long term.

Iron and phosphorus, while more abundant than lithium, also contribute significantly to the overall cost of LFP batteries. Manufacturers are investigating ways to optimize the sourcing and processing of these materials to reduce expenses. This includes developing more efficient extraction methods and exploring alternative sources, such as iron-rich industrial waste and phosphorus recovered from wastewater treatment plants.

Vertical integration has emerged as a strategy for some battery manufacturers to gain better control over their supply chains. By acquiring or partnering with raw material suppliers, companies can reduce costs associated with intermediaries and better manage price volatility. This approach also allows for greater quality control and the ability to implement more sustainable practices throughout the supply chain.

Recycling and circular economy initiatives are gaining traction in the LFP battery industry. As the number of end-of-life batteries increases, manufacturers are developing more efficient recycling processes to recover valuable materials. This not only reduces the need for virgin raw materials but also helps mitigate environmental concerns associated with battery disposal.

Geopolitical factors and trade policies significantly impact the raw material supply chain for LFP batteries. Many key materials are concentrated in specific regions, making the industry vulnerable to supply disruptions and price fluctuations. To mitigate these risks, manufacturers are diversifying their supplier base and exploring domestic sources of raw materials where possible.

Technological advancements in material science are also contributing to cost reduction efforts in the raw material supply chain. Researchers are developing new cathode materials that require less lithium or utilize more abundant elements, potentially reducing the overall cost of battery production. Additionally, improvements in manufacturing processes are helping to optimize material usage and reduce waste, further driving down costs.

Environmental Impact Assessment

The environmental impact assessment of cost reduction strategies in the production of lithium iron phosphate (LFP) batteries is a critical consideration for sustainable development in the energy storage industry. As manufacturers seek to lower production costs, it is essential to evaluate the potential environmental consequences of these efforts.

One of the primary areas of focus is the sourcing and processing of raw materials. Cost-cutting measures in this phase may involve exploring alternative suppliers or extraction methods, which could have varying environmental implications. For instance, shifting to lower-cost mining operations might lead to increased land disturbance, water pollution, or habitat destruction if not properly managed. Conversely, innovations in extraction techniques could potentially reduce environmental harm while simultaneously lowering costs.

The manufacturing process itself presents opportunities for both cost reduction and environmental improvement. Energy-intensive steps, such as high-temperature synthesis of LFP cathode materials, are prime targets for optimization. Implementing more energy-efficient equipment or processes can significantly reduce both production costs and carbon emissions. Additionally, the adoption of cleaner energy sources for manufacturing facilities can further mitigate environmental impact while potentially offering long-term cost benefits.

Water usage in LFP battery production is another critical factor. Cost-reduction strategies that focus on water recycling and treatment not only lower operational expenses but also minimize the strain on local water resources. Improved water management systems can reduce the volume of wastewater generated and the associated treatment costs, while also mitigating potential contamination risks.

The choice of chemicals and solvents used in the production process also warrants careful consideration. While cheaper alternatives may exist, their environmental profiles must be thoroughly assessed. Substituting hazardous materials with more benign options can reduce both environmental risks and long-term liability costs associated with handling and disposal.

Waste reduction and recycling initiatives play a dual role in cost reduction and environmental protection. Implementing more efficient production processes that minimize material waste can lead to significant cost savings while reducing the environmental burden of disposal. Furthermore, developing and improving recycling technologies for LFP batteries at the end of their life cycle can create a more sustainable production loop and potentially provide a source of lower-cost raw materials for future battery production.

In conclusion, the environmental impact assessment of cost reduction strategies in LFP battery production reveals a complex interplay between economic and ecological considerations. While some cost-cutting measures may pose environmental risks, many opportunities exist for synergistic improvements that benefit both the bottom line and the planet. As the industry evolves, it is crucial to maintain a holistic view that balances immediate cost savings with long-term environmental sustainability.

One of the primary areas of focus is the sourcing and processing of raw materials. Cost-cutting measures in this phase may involve exploring alternative suppliers or extraction methods, which could have varying environmental implications. For instance, shifting to lower-cost mining operations might lead to increased land disturbance, water pollution, or habitat destruction if not properly managed. Conversely, innovations in extraction techniques could potentially reduce environmental harm while simultaneously lowering costs.

The manufacturing process itself presents opportunities for both cost reduction and environmental improvement. Energy-intensive steps, such as high-temperature synthesis of LFP cathode materials, are prime targets for optimization. Implementing more energy-efficient equipment or processes can significantly reduce both production costs and carbon emissions. Additionally, the adoption of cleaner energy sources for manufacturing facilities can further mitigate environmental impact while potentially offering long-term cost benefits.

Water usage in LFP battery production is another critical factor. Cost-reduction strategies that focus on water recycling and treatment not only lower operational expenses but also minimize the strain on local water resources. Improved water management systems can reduce the volume of wastewater generated and the associated treatment costs, while also mitigating potential contamination risks.

The choice of chemicals and solvents used in the production process also warrants careful consideration. While cheaper alternatives may exist, their environmental profiles must be thoroughly assessed. Substituting hazardous materials with more benign options can reduce both environmental risks and long-term liability costs associated with handling and disposal.

Waste reduction and recycling initiatives play a dual role in cost reduction and environmental protection. Implementing more efficient production processes that minimize material waste can lead to significant cost savings while reducing the environmental burden of disposal. Furthermore, developing and improving recycling technologies for LFP batteries at the end of their life cycle can create a more sustainable production loop and potentially provide a source of lower-cost raw materials for future battery production.

In conclusion, the environmental impact assessment of cost reduction strategies in LFP battery production reveals a complex interplay between economic and ecological considerations. While some cost-cutting measures may pose environmental risks, many opportunities exist for synergistic improvements that benefit both the bottom line and the planet. As the industry evolves, it is crucial to maintain a holistic view that balances immediate cost savings with long-term environmental sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!