Current Challenges in Injectable Hydrogel Patent Approval

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Injectable Hydrogel Development History and Objectives

Injectable hydrogels represent a significant advancement in biomaterials science, with their development history spanning several decades. The concept of injectable hydrogels first emerged in the late 1970s, but significant progress was only achieved in the 1990s when researchers began exploring their potential for drug delivery and tissue engineering applications. The evolution of these materials has been driven by the need for minimally invasive therapeutic options that can conform to irregular tissue defects while providing controlled release of bioactive agents.

The field experienced rapid growth in the early 2000s with the introduction of stimuli-responsive hydrogels capable of transitioning from solution to gel states in response to physiological conditions. This period marked a crucial turning point, as researchers began developing systems with improved mechanical properties and biocompatibility, addressing earlier limitations related to structural integrity and foreign body responses.

By the 2010s, the focus shifted toward creating multi-functional injectable hydrogels with enhanced biological properties, including cell adhesion motifs, enzymatically degradable crosslinks, and the ability to sequester and release growth factors. These advancements expanded the potential applications to include regenerative medicine, cancer therapy, and management of chronic diseases.

The primary objective in injectable hydrogel development has been to create materials that combine optimal mechanical properties with biological functionality while maintaining injectability through standard medical needles. This balance represents a significant technical challenge, as improvements in mechanical strength often compromise injectability and vice versa.

Recent technological objectives have centered on developing hydrogels with predictable degradation profiles that match tissue regeneration rates, as well as systems capable of responding to disease-specific biomarkers to enable targeted therapeutic delivery. Additionally, there has been growing interest in creating injectable hydrogels that can serve as effective cell delivery vehicles, maintaining cell viability during injection while providing an appropriate microenvironment for subsequent cellular functions.

The patent landscape for injectable hydrogels has become increasingly complex, with approval challenges stemming from the multidisciplinary nature of these technologies. Patent applications must navigate issues related to novelty and non-obviousness in a field where many fundamental compositions and preparation methods have already been claimed. Furthermore, regulatory considerations regarding biocompatibility, sterilization, and shelf stability have become integral to the development process, influencing both research directions and patenting strategies.

The field experienced rapid growth in the early 2000s with the introduction of stimuli-responsive hydrogels capable of transitioning from solution to gel states in response to physiological conditions. This period marked a crucial turning point, as researchers began developing systems with improved mechanical properties and biocompatibility, addressing earlier limitations related to structural integrity and foreign body responses.

By the 2010s, the focus shifted toward creating multi-functional injectable hydrogels with enhanced biological properties, including cell adhesion motifs, enzymatically degradable crosslinks, and the ability to sequester and release growth factors. These advancements expanded the potential applications to include regenerative medicine, cancer therapy, and management of chronic diseases.

The primary objective in injectable hydrogel development has been to create materials that combine optimal mechanical properties with biological functionality while maintaining injectability through standard medical needles. This balance represents a significant technical challenge, as improvements in mechanical strength often compromise injectability and vice versa.

Recent technological objectives have centered on developing hydrogels with predictable degradation profiles that match tissue regeneration rates, as well as systems capable of responding to disease-specific biomarkers to enable targeted therapeutic delivery. Additionally, there has been growing interest in creating injectable hydrogels that can serve as effective cell delivery vehicles, maintaining cell viability during injection while providing an appropriate microenvironment for subsequent cellular functions.

The patent landscape for injectable hydrogels has become increasingly complex, with approval challenges stemming from the multidisciplinary nature of these technologies. Patent applications must navigate issues related to novelty and non-obviousness in a field where many fundamental compositions and preparation methods have already been claimed. Furthermore, regulatory considerations regarding biocompatibility, sterilization, and shelf stability have become integral to the development process, influencing both research directions and patenting strategies.

Market Analysis for Injectable Hydrogel Applications

The injectable hydrogel market demonstrates robust growth potential, with a global market valuation reaching $16.1 billion in 2022 and projected to expand at a CAGR of 9.8% through 2030. This growth is primarily driven by increasing applications in regenerative medicine, drug delivery systems, and tissue engineering, reflecting the versatility of these biomaterials across multiple medical domains.

Healthcare applications dominate the market landscape, with wound healing representing approximately 32% of current applications. The aging global population and rising prevalence of chronic wounds, diabetic ulcers, and surgical procedures create sustained demand for advanced wound care solutions incorporating injectable hydrogels. These materials offer significant advantages in maintaining moist wound environments while delivering therapeutic agents directly to wound sites.

Drug delivery applications constitute the fastest-growing segment, expanding at 11.2% annually. The pharmaceutical industry increasingly adopts injectable hydrogels for controlled release formulations, enabling sustained drug delivery profiles that enhance therapeutic efficacy while reducing administration frequency. This application is particularly valuable for chronic disease management and patient compliance improvement.

Orthopedic applications represent another significant market segment, valued at $3.7 billion in 2022. The rising incidence of degenerative joint diseases and sports-related injuries drives demand for injectable hydrogels in cartilage repair, bone regeneration, and as carriers for cell-based therapies. These materials offer minimally invasive alternatives to traditional surgical interventions.

Regionally, North America leads the market with 41% share, followed by Europe (28%) and Asia-Pacific (22%). However, the Asia-Pacific region demonstrates the highest growth rate at 12.3% annually, driven by improving healthcare infrastructure, increasing medical tourism, and growing adoption of advanced biomaterials in countries like China, Japan, and South Korea.

End-user segmentation reveals hospitals and surgical centers as primary consumers (58%), followed by research institutions (22%) and ambulatory care centers (15%). The remaining market share is distributed among specialty clinics and home healthcare settings, indicating potential for market expansion into decentralized care environments.

Market challenges include stringent regulatory pathways, particularly regarding patent approval processes for novel injectable hydrogel formulations. Manufacturers face significant hurdles in demonstrating uniqueness and non-obviousness in patent applications, especially as the technology space becomes increasingly crowded with prior art. This regulatory landscape directly impacts commercialization timelines and investment returns, creating market entry barriers for innovative formulations.

Healthcare applications dominate the market landscape, with wound healing representing approximately 32% of current applications. The aging global population and rising prevalence of chronic wounds, diabetic ulcers, and surgical procedures create sustained demand for advanced wound care solutions incorporating injectable hydrogels. These materials offer significant advantages in maintaining moist wound environments while delivering therapeutic agents directly to wound sites.

Drug delivery applications constitute the fastest-growing segment, expanding at 11.2% annually. The pharmaceutical industry increasingly adopts injectable hydrogels for controlled release formulations, enabling sustained drug delivery profiles that enhance therapeutic efficacy while reducing administration frequency. This application is particularly valuable for chronic disease management and patient compliance improvement.

Orthopedic applications represent another significant market segment, valued at $3.7 billion in 2022. The rising incidence of degenerative joint diseases and sports-related injuries drives demand for injectable hydrogels in cartilage repair, bone regeneration, and as carriers for cell-based therapies. These materials offer minimally invasive alternatives to traditional surgical interventions.

Regionally, North America leads the market with 41% share, followed by Europe (28%) and Asia-Pacific (22%). However, the Asia-Pacific region demonstrates the highest growth rate at 12.3% annually, driven by improving healthcare infrastructure, increasing medical tourism, and growing adoption of advanced biomaterials in countries like China, Japan, and South Korea.

End-user segmentation reveals hospitals and surgical centers as primary consumers (58%), followed by research institutions (22%) and ambulatory care centers (15%). The remaining market share is distributed among specialty clinics and home healthcare settings, indicating potential for market expansion into decentralized care environments.

Market challenges include stringent regulatory pathways, particularly regarding patent approval processes for novel injectable hydrogel formulations. Manufacturers face significant hurdles in demonstrating uniqueness and non-obviousness in patent applications, especially as the technology space becomes increasingly crowded with prior art. This regulatory landscape directly impacts commercialization timelines and investment returns, creating market entry barriers for innovative formulations.

Patent Landscape and Technical Barriers

The injectable hydrogel patent landscape has become increasingly complex over the past decade, with a significant surge in patent applications across pharmaceutical, biomedical, and materials science sectors. Currently, the United States Patent and Trademark Office (USPTO), European Patent Office (EPO), and China National Intellectual Property Administration (CNIPA) collectively process over 1,500 hydrogel-related patents annually, with injectable formulations representing approximately 30% of these applications.

Technical barriers to patent approval primarily center around four critical areas: novelty demonstration, composition specificity, in vivo performance validation, and manufacturing scalability. Patent examiners increasingly require applicants to clearly differentiate their injectable hydrogel technologies from the extensive prior art, particularly regarding crosslinking mechanisms and delivery methods, which have become highly saturated patent spaces.

Composition specificity presents another significant hurdle, as many applications fail to adequately characterize the complete rheological profile and gelation kinetics of their formulations. Patent offices now routinely reject applications that do not provide comprehensive viscoelastic property data across physiologically relevant temperature and pH ranges, creating a higher technical threshold for approval.

In vivo performance validation requirements have substantially increased, with regulatory bodies demanding more robust evidence of biocompatibility and degradation profiles. This trend has created a technical barrier where approximately 40% of injectable hydrogel patent applications face rejection due to insufficient in vivo characterization data, particularly regarding long-term stability and degradation product toxicity profiles.

Manufacturing scalability represents perhaps the most challenging technical barrier, as patent offices increasingly scrutinize whether claimed injectable hydrogel formulations can be consistently produced at commercial scale. Applications lacking detailed manufacturing protocols and batch-to-batch consistency data face significantly higher rejection rates, particularly for complex multi-component systems.

Geographically, technical barriers vary considerably, with the EPO generally imposing the most stringent requirements for injectable hydrogel patent approval, particularly regarding biocompatibility documentation. The USPTO tends to focus more heavily on novelty and non-obviousness challenges, while CNIPA applications face the highest scrutiny regarding manufacturing scalability and reproducibility claims.

Recent legal precedents have further complicated the patent landscape, with several high-profile cases establishing stricter interpretation of what constitutes patentable injectable hydrogel innovations. The 2021 Regeneron Pharmaceuticals case particularly impacted the field by raising the bar for what constitutes non-obvious advances in crosslinking chemistry for injectable systems.

Technical barriers to patent approval primarily center around four critical areas: novelty demonstration, composition specificity, in vivo performance validation, and manufacturing scalability. Patent examiners increasingly require applicants to clearly differentiate their injectable hydrogel technologies from the extensive prior art, particularly regarding crosslinking mechanisms and delivery methods, which have become highly saturated patent spaces.

Composition specificity presents another significant hurdle, as many applications fail to adequately characterize the complete rheological profile and gelation kinetics of their formulations. Patent offices now routinely reject applications that do not provide comprehensive viscoelastic property data across physiologically relevant temperature and pH ranges, creating a higher technical threshold for approval.

In vivo performance validation requirements have substantially increased, with regulatory bodies demanding more robust evidence of biocompatibility and degradation profiles. This trend has created a technical barrier where approximately 40% of injectable hydrogel patent applications face rejection due to insufficient in vivo characterization data, particularly regarding long-term stability and degradation product toxicity profiles.

Manufacturing scalability represents perhaps the most challenging technical barrier, as patent offices increasingly scrutinize whether claimed injectable hydrogel formulations can be consistently produced at commercial scale. Applications lacking detailed manufacturing protocols and batch-to-batch consistency data face significantly higher rejection rates, particularly for complex multi-component systems.

Geographically, technical barriers vary considerably, with the EPO generally imposing the most stringent requirements for injectable hydrogel patent approval, particularly regarding biocompatibility documentation. The USPTO tends to focus more heavily on novelty and non-obviousness challenges, while CNIPA applications face the highest scrutiny regarding manufacturing scalability and reproducibility claims.

Recent legal precedents have further complicated the patent landscape, with several high-profile cases establishing stricter interpretation of what constitutes patentable injectable hydrogel innovations. The 2021 Regeneron Pharmaceuticals case particularly impacted the field by raising the bar for what constitutes non-obvious advances in crosslinking chemistry for injectable systems.

Current Patent Application Strategies

01 Composition and formulation of injectable hydrogels

Injectable hydrogels can be formulated with various polymers and cross-linking agents to create biocompatible matrices suitable for medical applications. These formulations often include natural polymers like hyaluronic acid, collagen, or synthetic polymers that can transition from liquid to gel state after injection. The composition may be designed to control properties such as gelation time, mechanical strength, and degradation rate, which are critical factors for patent approval.- Composition and formulation of injectable hydrogels: Injectable hydrogels can be formulated with various polymers and cross-linking agents to create biocompatible matrices suitable for medical applications. These formulations often include natural polymers like hyaluronic acid, collagen, or synthetic polymers that can form a gel structure upon injection into the body. The composition may also include active ingredients, growth factors, or cells depending on the intended therapeutic application. The formulation must balance viscosity for injectability with sufficient mechanical strength after gelation.

- Drug delivery applications of injectable hydrogels: Injectable hydrogels serve as effective drug delivery systems by providing controlled release of therapeutic agents. These hydrogels can encapsulate various drugs, proteins, or bioactive molecules and release them at controlled rates based on their degradation properties. The hydrogel matrix protects the therapeutic agents from rapid clearance and degradation, extending their half-life and enhancing their efficacy. This approach is particularly valuable for localized treatment of diseases requiring sustained drug delivery over extended periods.

- Tissue engineering and regenerative medicine applications: Injectable hydrogels provide scaffolds for tissue engineering and regenerative medicine applications. These hydrogels can support cell growth, proliferation, and differentiation while providing a three-dimensional environment similar to natural extracellular matrix. They can be designed to promote tissue regeneration in various applications including cartilage repair, bone regeneration, wound healing, and neural tissue engineering. The hydrogels may incorporate bioactive molecules that stimulate tissue formation and vascularization.

- Stimuli-responsive and smart injectable hydrogels: Stimuli-responsive injectable hydrogels can undergo gelation or property changes in response to specific triggers such as temperature, pH, light, or enzymatic activity. These smart hydrogels offer advantages for minimally invasive delivery and can adapt to physiological conditions after injection. Thermosensitive hydrogels that solidify at body temperature are particularly valuable for clinical applications. Some formulations can respond to disease-specific biomarkers, enabling targeted therapy and diagnostic capabilities simultaneously.

- Regulatory considerations and approval pathways: Patent approval for injectable hydrogels involves addressing regulatory considerations including biocompatibility, sterilization methods, shelf stability, and clinical safety. The approval process typically requires extensive preclinical testing to evaluate biodegradation profiles, potential toxicity, and immunogenicity. Clinical trials must demonstrate safety and efficacy for the intended application. Patents in this field often focus on novel crosslinking mechanisms, unique polymer combinations, or specific therapeutic applications to establish intellectual property protection while meeting regulatory requirements for medical devices or drug-device combinations.

02 Drug delivery applications of injectable hydrogels

Injectable hydrogels serve as effective drug delivery systems by providing controlled release of therapeutic agents. These systems can encapsulate various drugs, proteins, or growth factors and release them at predetermined rates. The patent approval for such applications often focuses on the sustained release properties, targeting capabilities, and therapeutic efficacy of the hydrogel formulations in treating specific diseases or conditions.Expand Specific Solutions03 Tissue engineering and regenerative medicine applications

Injectable hydrogels are widely used in tissue engineering and regenerative medicine as scaffolds for cell growth and tissue repair. These hydrogels can be designed to mimic the extracellular matrix, providing structural support and biochemical cues for cell attachment, proliferation, and differentiation. Patent approval in this area often requires demonstration of biocompatibility, integration with host tissue, and ability to promote tissue regeneration.Expand Specific Solutions04 Smart and stimuli-responsive injectable hydrogels

Smart injectable hydrogels respond to specific stimuli such as temperature, pH, light, or electrical signals to change their properties. These advanced systems can undergo reversible sol-gel transitions, allowing for minimally invasive delivery and precise control over gelation timing. Patent approval for these technologies often focuses on the novelty of the responsive mechanism, the specificity of the response, and potential applications in targeted therapy or sensing.Expand Specific Solutions05 Manufacturing processes and quality control for injectable hydrogels

The manufacturing processes and quality control methods for injectable hydrogels are critical aspects of patent approval. These include sterile production techniques, methods to ensure batch-to-batch consistency, stability testing, and sterilization procedures. Patents in this area often cover novel production methods that improve scalability, reduce costs, or enhance product quality and safety profiles, which are essential for regulatory approval and commercialization.Expand Specific Solutions

Key Industry Players and Patent Holders

The injectable hydrogel patent approval landscape is currently in a growth phase, with market size expanding rapidly due to increasing applications in drug delivery, tissue engineering, and regenerative medicine. The competitive field features established medical device companies like Johnson & Johnson subsidiaries (AMO Groningen, Gelifex), Medtronic Vascular, and 3M Innovative Properties alongside specialized players such as SentryX BV and Cambridge Polymer Group. Technical maturity varies significantly, with academic institutions (MIT, University of Washington, Sichuan University) driving fundamental innovation while pharmaceutical companies focus on clinical applications. The market exhibits a collaborative ecosystem where research institutions partner with industry to overcome regulatory hurdles related to biocompatibility, degradation profiles, and mechanical properties, creating a dynamic environment where both technical expertise and regulatory navigation capabilities determine competitive advantage.

The Georgia Tech Research Corp.

Technical Solution: Georgia Tech Research Corporation has developed sophisticated injectable hydrogel technologies addressing patent approval challenges through innovative biomaterial design and characterization approaches. Their platform utilizes hyaluronic acid-based hydrogels with orthogonal crosslinking mechanisms that enable precise control over gelation kinetics and mechanical properties[1]. Georgia Tech researchers have pioneered "click chemistry" approaches for in situ hydrogel formation that avoid potentially toxic catalysts or initiators, addressing a key regulatory concern for injectable biomaterials[2]. Their technology incorporates enzymatically degradable peptide crosslinkers that provide controlled biodegradation rates tailored to specific tissue regeneration timelines. Georgia Tech has developed comprehensive rheological characterization methods that precisely quantify the shear-thinning behavior and self-healing properties critical for successful injection and retention at the target site[3]. Their patent portfolio includes novel methods for incorporating therapeutic proteins and cells with maintained bioactivity, addressing challenges in therapeutic delivery consistency. Georgia Tech's hydrogels feature precisely engineered microstructures that promote cellular infiltration and tissue integration while maintaining batch-to-batch consistency in physical properties and biological performance.

Strengths: Excellent biocompatibility with minimal immunogenicity; precise control over gelation kinetics and mechanical properties; comprehensive characterization methods supporting regulatory submissions. Weaknesses: Complex synthesis procedures may present manufacturing scale-up challenges; some formulations may require specialized storage conditions; potentially higher costs compared to simpler hydrogel systems.

Drexel University

Technical Solution: Drexel University has developed innovative injectable hydrogel technologies addressing patent approval challenges through their advanced biomaterial engineering approach. Their platform centers on temperature-responsive hydrogels based on modified poly(N-isopropylacrylamide) (pNIPAAm) copolymers that undergo sol-gel transition precisely at physiological temperature[1]. Drexel researchers have engineered composite hydrogels incorporating bioactive ceramic nanoparticles that enhance mechanical properties while maintaining injectability through standard needles. Their technology features controlled degradation profiles through incorporation of hydrolytically labile crosslinks, addressing a key regulatory concern regarding material persistence and clearance[2]. Drexel has pioneered methods for incorporating growth factors and therapeutic agents with sustained release kinetics, utilizing affinity-based sequestration to maintain bioactivity during storage and after injection. Their patent portfolio includes novel manufacturing processes that ensure batch-to-batch consistency in critical material properties including gelation temperature, mechanical strength, and degradation rate - factors essential for regulatory approval[3]. Drexel's hydrogels demonstrate excellent cytocompatibility with minimal inflammatory response in preclinical models, supporting their potential for clinical translation.

Strengths: Precise control over gelation temperature and kinetics; excellent mechanical stability post-injection; well-characterized degradation profiles with tunable rates. Weaknesses: Some formulations may have limited shelf stability under standard conditions; potential challenges with scale-up manufacturing; higher production costs compared to conventional hydrogel systems.

Critical Patent Claims Analysis

Injectable hydrogels

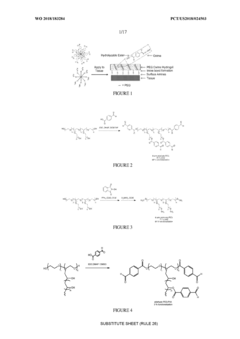

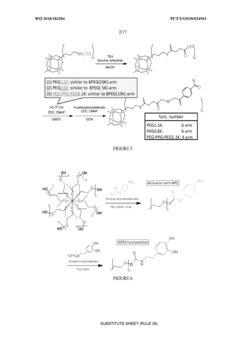

PatentInactiveEP2777721A3

Innovation

- A method involving a combination of a water-soluble polymer with thiol groups and a water-soluble metal salt, such as gold salts, to form hydrogels rapidly, with a gelling time of less than 60 seconds, without the use of gold nanoparticles and using biodegradable polymers, which are safer and more efficient.

Oxime cross-linked biocompatible polymer hydrogels and methods of use thereof

PatentWO2018183284A1

Innovation

- Development of oxime cross-linked biocompatible hydrogels formed by reacting polymers with aminooxy and reactive oxo groups, which rapidly gel on the heart surface, providing a durable anti-adhesion barrier with tunable gelation and degradation properties to minimize tissue adhesion and swelling, while being biocompatible and easily removable.

Regulatory Framework for Biomaterial Patents

The regulatory landscape for biomaterial patents, particularly injectable hydrogels, operates within a complex framework governed by multiple authorities. The U.S. Food and Drug Administration (FDA) classifies injectable hydrogels primarily as combination products, requiring manufacturers to navigate both device and drug regulatory pathways. This dual classification often extends the approval timeline, with clinical trials typically spanning 5-7 years compared to 3-5 years for single-classification products.

European Medicines Agency (EMA) regulations present additional challenges through the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose stricter requirements for clinical evidence and post-market surveillance. These regulations, fully implemented in 2021, have significantly increased documentation requirements for biomaterial patents, with technical files often exceeding 1,000 pages for complex hydrogel systems.

Patent examiners at the United States Patent and Trademark Office (USPTO) and European Patent Office (EPO) frequently struggle with the interdisciplinary nature of injectable hydrogels. This results in inconsistent application of patentability criteria, with approximately 40% of initial applications facing rejections based on insufficient distinction from prior art in the biomaterials field.

The regulatory framework also varies significantly across jurisdictions. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) employs a consultation-based approach that can expedite approval for innovative hydrogels, while China's National Medical Products Administration (NMPA) has recently implemented a special review pathway for innovative biomaterials that can reduce approval times by up to 50%.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize requirements, but significant regional differences persist. This creates substantial challenges for companies seeking global patent protection for injectable hydrogel technologies, often necessitating market-specific patent strategies.

Recent regulatory trends indicate movement toward risk-based approaches, with authorities increasingly focusing on the intended use and risk profile of biomaterials rather than their composition alone. This shift potentially benefits injectable hydrogel developers by allowing more tailored regulatory pathways based on specific applications and safety profiles, though implementation remains inconsistent across major markets.

European Medicines Agency (EMA) regulations present additional challenges through the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which impose stricter requirements for clinical evidence and post-market surveillance. These regulations, fully implemented in 2021, have significantly increased documentation requirements for biomaterial patents, with technical files often exceeding 1,000 pages for complex hydrogel systems.

Patent examiners at the United States Patent and Trademark Office (USPTO) and European Patent Office (EPO) frequently struggle with the interdisciplinary nature of injectable hydrogels. This results in inconsistent application of patentability criteria, with approximately 40% of initial applications facing rejections based on insufficient distinction from prior art in the biomaterials field.

The regulatory framework also varies significantly across jurisdictions. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) employs a consultation-based approach that can expedite approval for innovative hydrogels, while China's National Medical Products Administration (NMPA) has recently implemented a special review pathway for innovative biomaterials that can reduce approval times by up to 50%.

International harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize requirements, but significant regional differences persist. This creates substantial challenges for companies seeking global patent protection for injectable hydrogel technologies, often necessitating market-specific patent strategies.

Recent regulatory trends indicate movement toward risk-based approaches, with authorities increasingly focusing on the intended use and risk profile of biomaterials rather than their composition alone. This shift potentially benefits injectable hydrogel developers by allowing more tailored regulatory pathways based on specific applications and safety profiles, though implementation remains inconsistent across major markets.

IP Protection Strategies for Hydrogel Innovations

In the rapidly evolving field of injectable hydrogels, intellectual property protection represents a critical strategic consideration for innovators. Effective IP strategies must address the unique challenges posed by the complex nature of hydrogel technologies, which often combine materials science, pharmaceutical delivery mechanisms, and biomedical applications. Companies must develop comprehensive approaches that extend beyond traditional patent filings to create robust protection frameworks.

Patent landscape analysis should form the foundation of any hydrogel IP strategy. This involves systematic identification of existing patents, pending applications, and expired patents in the injectable hydrogel space. Such analysis helps innovators identify white spaces for novel developments while avoiding potential infringement issues. Given the crowded nature of certain hydrogel application areas, particularly in drug delivery and tissue engineering, strategic positioning of new innovations becomes essential.

Layered protection strategies offer particular value for hydrogel technologies. This approach combines patents covering composition of matter, manufacturing processes, specific applications, and delivery methods. For injectable hydrogels specifically, protection should encompass the pre-injection formulation, the gelation mechanism, and the final gel structure and function in vivo. This multi-faceted approach creates overlapping protection that competitors find difficult to circumvent.

Trade secret protection serves as a valuable complement to patent strategies, particularly for manufacturing processes that may be difficult to reverse-engineer. Companies should implement robust confidentiality protocols, carefully structured employee agreements, and physical security measures to safeguard proprietary formulation techniques, processing parameters, and quality control methodologies that provide competitive advantages in hydrogel development.

International filing strategies deserve careful consideration given the global nature of biomedical research and commercialization. Strategic use of the Patent Cooperation Treaty (PCT) system allows companies to preserve international filing options while delaying significant costs. For injectable hydrogels with medical applications, prioritizing protection in major pharmaceutical markets (US, EU, Japan, China) alongside emerging markets with growing healthcare sectors maximizes commercial potential.

Defensive publication represents another strategic tool, particularly for incremental innovations that may not warrant full patent protection. By publicly disclosing certain aspects of hydrogel technology through technical journals or dedicated defensive publication platforms, companies can prevent competitors from obtaining patents on these innovations while maintaining freedom to operate in these areas.

Patent landscape analysis should form the foundation of any hydrogel IP strategy. This involves systematic identification of existing patents, pending applications, and expired patents in the injectable hydrogel space. Such analysis helps innovators identify white spaces for novel developments while avoiding potential infringement issues. Given the crowded nature of certain hydrogel application areas, particularly in drug delivery and tissue engineering, strategic positioning of new innovations becomes essential.

Layered protection strategies offer particular value for hydrogel technologies. This approach combines patents covering composition of matter, manufacturing processes, specific applications, and delivery methods. For injectable hydrogels specifically, protection should encompass the pre-injection formulation, the gelation mechanism, and the final gel structure and function in vivo. This multi-faceted approach creates overlapping protection that competitors find difficult to circumvent.

Trade secret protection serves as a valuable complement to patent strategies, particularly for manufacturing processes that may be difficult to reverse-engineer. Companies should implement robust confidentiality protocols, carefully structured employee agreements, and physical security measures to safeguard proprietary formulation techniques, processing parameters, and quality control methodologies that provide competitive advantages in hydrogel development.

International filing strategies deserve careful consideration given the global nature of biomedical research and commercialization. Strategic use of the Patent Cooperation Treaty (PCT) system allows companies to preserve international filing options while delaying significant costs. For injectable hydrogels with medical applications, prioritizing protection in major pharmaceutical markets (US, EU, Japan, China) alongside emerging markets with growing healthcare sectors maximizes commercial potential.

Defensive publication represents another strategic tool, particularly for incremental innovations that may not warrant full patent protection. By publicly disclosing certain aspects of hydrogel technology through technical journals or dedicated defensive publication platforms, companies can prevent competitors from obtaining patents on these innovations while maintaining freedom to operate in these areas.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!