Economic Assessments of Hydrochloric Acid Investments

JUL 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HCl Industry Background

Hydrochloric acid (HCl) has been a cornerstone of the chemical industry for decades, playing a crucial role in various industrial processes and applications. The HCl industry has evolved significantly since its inception, driven by technological advancements and changing market demands.

Initially, HCl production was primarily a byproduct of the chlor-alkali process, which produces chlorine and sodium hydroxide. As demand for HCl grew, dedicated production methods were developed to meet the increasing market needs. The Mannheim process and the direct synthesis of HCl from hydrogen and chlorine became prominent production methods, allowing for greater control over quality and quantity.

The HCl industry has experienced steady growth over the years, with applications expanding across diverse sectors. The chemical industry remains the largest consumer, utilizing HCl in the production of various chemicals, including vinyl chloride monomer (VCM) for PVC production. Other significant end-use sectors include steel pickling, oil well acidizing, and food processing.

Global HCl production has seen a shift in recent years, with Asia-Pacific emerging as the dominant region due to rapid industrialization and increased demand from various end-use industries. China, in particular, has become a major producer and consumer of HCl, influencing global market dynamics.

Environmental regulations have played a significant role in shaping the HCl industry. Stricter emission controls and waste management requirements have led to the development of more efficient and environmentally friendly production processes. This has also driven innovation in recycling and recovery technologies, aiming to minimize the environmental impact of HCl production and usage.

The pricing of HCl has historically been volatile, influenced by factors such as raw material costs, energy prices, and supply-demand dynamics. The cyclical nature of some end-use industries, particularly the construction and automotive sectors, has contributed to fluctuations in HCl demand and pricing.

Recent years have seen a growing interest in high-purity HCl for specialized applications in the semiconductor and pharmaceutical industries. This trend has led to investments in advanced purification technologies and the development of ultra-pure HCl production facilities.

The HCl industry continues to face challenges and opportunities. On one hand, concerns about the corrosive nature of HCl and its potential environmental impact have led to the exploration of alternatives in some applications. On the other hand, emerging applications in areas such as lithium extraction for batteries and rare earth element processing present new growth avenues for the industry.

Initially, HCl production was primarily a byproduct of the chlor-alkali process, which produces chlorine and sodium hydroxide. As demand for HCl grew, dedicated production methods were developed to meet the increasing market needs. The Mannheim process and the direct synthesis of HCl from hydrogen and chlorine became prominent production methods, allowing for greater control over quality and quantity.

The HCl industry has experienced steady growth over the years, with applications expanding across diverse sectors. The chemical industry remains the largest consumer, utilizing HCl in the production of various chemicals, including vinyl chloride monomer (VCM) for PVC production. Other significant end-use sectors include steel pickling, oil well acidizing, and food processing.

Global HCl production has seen a shift in recent years, with Asia-Pacific emerging as the dominant region due to rapid industrialization and increased demand from various end-use industries. China, in particular, has become a major producer and consumer of HCl, influencing global market dynamics.

Environmental regulations have played a significant role in shaping the HCl industry. Stricter emission controls and waste management requirements have led to the development of more efficient and environmentally friendly production processes. This has also driven innovation in recycling and recovery technologies, aiming to minimize the environmental impact of HCl production and usage.

The pricing of HCl has historically been volatile, influenced by factors such as raw material costs, energy prices, and supply-demand dynamics. The cyclical nature of some end-use industries, particularly the construction and automotive sectors, has contributed to fluctuations in HCl demand and pricing.

Recent years have seen a growing interest in high-purity HCl for specialized applications in the semiconductor and pharmaceutical industries. This trend has led to investments in advanced purification technologies and the development of ultra-pure HCl production facilities.

The HCl industry continues to face challenges and opportunities. On one hand, concerns about the corrosive nature of HCl and its potential environmental impact have led to the exploration of alternatives in some applications. On the other hand, emerging applications in areas such as lithium extraction for batteries and rare earth element processing present new growth avenues for the industry.

Market Demand Analysis

The global hydrochloric acid market has shown steady growth in recent years, driven by increasing demand from various industries. The market size was valued at approximately $7.8 billion in 2020 and is projected to reach $9.6 billion by 2026, growing at a CAGR of 3.5% during the forecast period. This growth is primarily attributed to the expanding applications of hydrochloric acid in diverse sectors such as steel pickling, oil well acidizing, food processing, and chemical manufacturing.

The steel industry remains the largest consumer of hydrochloric acid, accounting for nearly 40% of the total market share. The acid is extensively used in steel pickling processes to remove rust and scale from steel surfaces, enhancing the quality of the final product. With the global steel production expected to increase, particularly in emerging economies like China and India, the demand for hydrochloric acid in this sector is anticipated to rise significantly.

The oil and gas industry is another major consumer of hydrochloric acid, where it is used for well acidizing to improve production rates. As exploration and production activities continue to expand, especially in unconventional oil and gas reserves, the demand for hydrochloric acid in this sector is expected to grow. The market is also witnessing increased demand from the food processing industry, where hydrochloric acid is used as a food additive and in the production of various food products.

Geographically, Asia-Pacific dominates the hydrochloric acid market, accounting for over 40% of the global market share. This dominance is attributed to the rapid industrialization, growing manufacturing sector, and increasing investments in infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe follow as the second and third largest markets, respectively, driven by the presence of established chemical and manufacturing industries.

The market demand analysis also reveals a growing trend towards the use of by-product hydrochloric acid, which is generated as a result of other chemical processes. This trend is driven by environmental concerns and the need for cost-effective production methods. Additionally, there is an increasing focus on the development of high-purity hydrochloric acid for specialized applications in the semiconductor and pharmaceutical industries, presenting new opportunities for market growth.

However, the market faces challenges such as stringent environmental regulations regarding the production and handling of hydrochloric acid, as well as the availability of alternatives in certain applications. These factors may impact the market growth to some extent, necessitating investments in sustainable production methods and the development of eco-friendly alternatives.

The steel industry remains the largest consumer of hydrochloric acid, accounting for nearly 40% of the total market share. The acid is extensively used in steel pickling processes to remove rust and scale from steel surfaces, enhancing the quality of the final product. With the global steel production expected to increase, particularly in emerging economies like China and India, the demand for hydrochloric acid in this sector is anticipated to rise significantly.

The oil and gas industry is another major consumer of hydrochloric acid, where it is used for well acidizing to improve production rates. As exploration and production activities continue to expand, especially in unconventional oil and gas reserves, the demand for hydrochloric acid in this sector is expected to grow. The market is also witnessing increased demand from the food processing industry, where hydrochloric acid is used as a food additive and in the production of various food products.

Geographically, Asia-Pacific dominates the hydrochloric acid market, accounting for over 40% of the global market share. This dominance is attributed to the rapid industrialization, growing manufacturing sector, and increasing investments in infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe follow as the second and third largest markets, respectively, driven by the presence of established chemical and manufacturing industries.

The market demand analysis also reveals a growing trend towards the use of by-product hydrochloric acid, which is generated as a result of other chemical processes. This trend is driven by environmental concerns and the need for cost-effective production methods. Additionally, there is an increasing focus on the development of high-purity hydrochloric acid for specialized applications in the semiconductor and pharmaceutical industries, presenting new opportunities for market growth.

However, the market faces challenges such as stringent environmental regulations regarding the production and handling of hydrochloric acid, as well as the availability of alternatives in certain applications. These factors may impact the market growth to some extent, necessitating investments in sustainable production methods and the development of eco-friendly alternatives.

Technical Challenges

The economic assessment of hydrochloric acid investments faces several technical challenges that require careful consideration. One of the primary obstacles is the corrosive nature of hydrochloric acid, which necessitates specialized equipment and materials for its production, storage, and transportation. This corrosivity significantly impacts the longevity of infrastructure and increases maintenance costs, making it crucial to factor these expenses into long-term economic projections.

Another challenge lies in the energy-intensive nature of hydrochloric acid production processes. The most common method, the chlor-alkali process, requires substantial electrical energy input, which can vary significantly in cost depending on the location and energy sources available. This variability in energy costs across different regions can greatly influence the economic viability of investments and must be carefully evaluated in feasibility studies.

Environmental regulations pose a significant technical hurdle for hydrochloric acid investments. Stringent emission control requirements necessitate advanced scrubbing systems and waste treatment facilities, adding complexity and cost to production facilities. Moreover, the evolving nature of environmental legislation creates uncertainty in long-term cost projections, as future regulatory changes may require additional capital expenditures to maintain compliance.

The transportation of hydrochloric acid presents another set of technical challenges. Due to its hazardous nature, specialized tankers, pipelines, and handling equipment are required, which can substantially increase logistical costs. The risk of accidents during transport also necessitates comprehensive safety measures and insurance coverage, further impacting the overall economic assessment.

Market volatility in both raw material supply and product demand adds another layer of complexity to economic assessments. The price fluctuations of key inputs, such as natural gas or salt, can significantly affect production costs. Similarly, demand fluctuations in major end-use industries, such as steel production or chemical manufacturing, can impact revenue projections and return on investment calculations.

Technological advancements in alternative acid production methods or substitute products also pose a challenge to long-term investment strategies. Emerging technologies, such as membrane-based electrolysis or bio-based acid production, may disrupt traditional hydrochloric acid markets, potentially rendering existing investments less competitive over time.

Lastly, the scale of production facilities presents a technical and economic challenge. Achieving economies of scale is crucial for profitability, but larger facilities require higher initial capital investments and may face limitations in terms of market absorption capacity or transportation infrastructure. Balancing these factors to determine the optimal scale of investment is a complex task that significantly impacts the overall economic assessment.

Another challenge lies in the energy-intensive nature of hydrochloric acid production processes. The most common method, the chlor-alkali process, requires substantial electrical energy input, which can vary significantly in cost depending on the location and energy sources available. This variability in energy costs across different regions can greatly influence the economic viability of investments and must be carefully evaluated in feasibility studies.

Environmental regulations pose a significant technical hurdle for hydrochloric acid investments. Stringent emission control requirements necessitate advanced scrubbing systems and waste treatment facilities, adding complexity and cost to production facilities. Moreover, the evolving nature of environmental legislation creates uncertainty in long-term cost projections, as future regulatory changes may require additional capital expenditures to maintain compliance.

The transportation of hydrochloric acid presents another set of technical challenges. Due to its hazardous nature, specialized tankers, pipelines, and handling equipment are required, which can substantially increase logistical costs. The risk of accidents during transport also necessitates comprehensive safety measures and insurance coverage, further impacting the overall economic assessment.

Market volatility in both raw material supply and product demand adds another layer of complexity to economic assessments. The price fluctuations of key inputs, such as natural gas or salt, can significantly affect production costs. Similarly, demand fluctuations in major end-use industries, such as steel production or chemical manufacturing, can impact revenue projections and return on investment calculations.

Technological advancements in alternative acid production methods or substitute products also pose a challenge to long-term investment strategies. Emerging technologies, such as membrane-based electrolysis or bio-based acid production, may disrupt traditional hydrochloric acid markets, potentially rendering existing investments less competitive over time.

Lastly, the scale of production facilities presents a technical and economic challenge. Achieving economies of scale is crucial for profitability, but larger facilities require higher initial capital investments and may face limitations in terms of market absorption capacity or transportation infrastructure. Balancing these factors to determine the optimal scale of investment is a complex task that significantly impacts the overall economic assessment.

Current HCl Solutions

01 Production methods of hydrochloric acid

Various methods are employed for the production of hydrochloric acid, including direct synthesis from hydrogen and chlorine, as a byproduct in chlorination processes, and through the reaction of sulfuric acid with sodium chloride. These methods are optimized for efficiency and purity in industrial settings.- Production and purification of hydrochloric acid: Various methods and processes for producing and purifying hydrochloric acid, including industrial-scale production techniques and purification steps to obtain high-quality acid for different applications.

- Applications in chemical processing: Hydrochloric acid is widely used in chemical processing industries for various purposes, such as pH adjustment, metal treatment, and as a reagent in chemical reactions. It plays a crucial role in many industrial processes and manufacturing operations.

- Environmental and safety considerations: Handling and storage of hydrochloric acid require specific safety measures and environmental considerations. This includes proper containment, neutralization techniques, and disposal methods to minimize risks and environmental impact.

- Hydrochloric acid in water treatment: The use of hydrochloric acid in water treatment processes, including pH adjustment, scale removal, and disinfection. It is employed in both industrial and municipal water treatment facilities to improve water quality and system efficiency.

- Recovery and recycling of hydrochloric acid: Methods and systems for recovering and recycling hydrochloric acid from industrial processes, reducing waste and improving resource efficiency. This includes techniques for capturing, purifying, and reusing the acid in various applications.

02 Purification and concentration techniques

Techniques for purifying and concentrating hydrochloric acid involve distillation, membrane separation, and adsorption processes. These methods aim to remove impurities and achieve desired concentration levels for various industrial applications.Expand Specific Solutions03 Applications in chemical processing

Hydrochloric acid is widely used in chemical processing, including metal treatment, pH regulation, and as a catalyst in various reactions. It plays a crucial role in industries such as steel production, water treatment, and pharmaceutical manufacturing.Expand Specific Solutions04 Safety and handling equipment

Specialized equipment and safety measures are essential for handling hydrochloric acid due to its corrosive nature. This includes acid-resistant storage tanks, protective gear, and emergency response systems to mitigate risks associated with acid exposure and spills.Expand Specific Solutions05 Environmental impact and waste management

Managing the environmental impact of hydrochloric acid involves proper disposal methods, neutralization techniques, and recycling processes. Efforts are made to minimize emissions and develop eco-friendly alternatives in industrial processes where possible.Expand Specific Solutions

Key Industry Players

The economic assessment of hydrochloric acid investments reveals a competitive landscape in a mature industry with steady market growth. The global hydrochloric acid market is characterized by established players like China Petroleum & Chemical Corp., Schlumberger, and Mitsubishi Gas Chemical Co., alongside emerging companies such as Fluid Energy Group Ltd. and Dorf Ketal Chemicals FZE. The market size is substantial, driven by diverse applications in chemical processing, oil and gas, and water treatment. Technological maturity varies, with larger corporations focusing on process optimization and environmental sustainability, while smaller firms like Easymining Sweden AB and WIAB Water Innovation AB are exploring innovative applications and production methods.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an innovative approach to hydrochloric acid investments in the petrochemical industry. Their strategy involves implementing advanced acid recovery and recycling systems, which significantly reduce raw material costs and environmental impact. Sinopec has invested in membrane-based separation technologies that allow for the efficient recovery of HCl from waste streams, achieving recovery rates of up to 98%[1]. Additionally, they have developed a proprietary catalytic process that converts recovered HCl into high-value chlorinated products, creating a circular economy within their operations[3]. This integrated approach not only minimizes waste but also generates additional revenue streams from what was previously considered a disposal challenge.

Strengths: Cost-effective, environmentally friendly, creates additional revenue streams. Weaknesses: High initial investment costs, requires specialized expertise for implementation and maintenance.

Schlumberger Canada Ltd.

Technical Solution: Schlumberger Canada Ltd. has pioneered an innovative approach to hydrochloric acid investments in the oil and gas industry. Their strategy focuses on developing smart acid systems that optimize well stimulation processes while minimizing environmental impact. Schlumberger's VDA (Viscoelastic Diverting Acid) technology combines HCl with specialized polymers, creating a self-diverting acid system that improves fluid distribution in heterogeneous reservoirs[2]. This results in more efficient stimulation treatments, reducing the overall acid volume required by up to 40% compared to conventional methods[4]. Furthermore, Schlumberger has invested in real-time monitoring and control systems that allow for precise acid placement and reaction monitoring, maximizing treatment effectiveness while minimizing formation damage risks.

Strengths: Improved efficiency, reduced environmental impact, enhanced well productivity. Weaknesses: Higher upfront costs, requires specialized equipment and expertise.

Innovative Technologies

Using Synthetic Acid Compositions as Alternatives to Conventional Acids in The Oil And Gas Industry

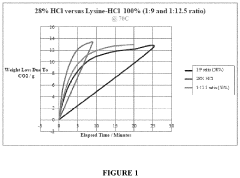

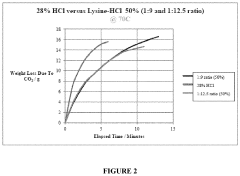

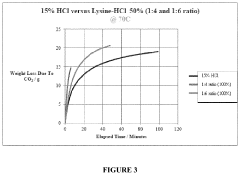

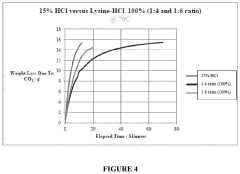

PatentActiveUS20230086463A1

Innovation

- An aqueous synthetic acid composition comprising lysine and hydrogen chloride in specific molar ratios, which provides low corrosion rates, biodegradability, controlled reaction rates, and thermal stability up to 220°C, reducing toxicity and environmental impact while maintaining the effectiveness of hydrochloric acid.

Synthetic Acid Compositions Alternatives to Conventional Acids in the Oil and Gas Industry

PatentActiveUS20170275522A1

Innovation

- A synthetic acid composition comprising urea and hydrogen chloride in a specific molar ratio, combined with phosphonic acids and metal iodides, which reduces corrosion, toxicity, and reactivity, while being biodegradable and compatible with high salinity fluids, allowing for controlled reactions and improved handling and storage.

Economic Impact Factors

The economic impact factors of hydrochloric acid investments are multifaceted and require careful consideration. Market demand plays a crucial role, with the global hydrochloric acid market expected to grow at a CAGR of 5.2% from 2021 to 2028. This growth is primarily driven by increasing applications in various industries, including steel pickling, oil well acidizing, and chemical manufacturing.

Raw material costs significantly influence the economic viability of hydrochloric acid production. The primary feedstock, hydrogen chloride, is often a byproduct of chlor-alkali processes. Fluctuations in chlorine and caustic soda markets can indirectly affect hydrochloric acid production costs. Additionally, energy costs, particularly electricity for electrolysis processes, contribute substantially to overall production expenses.

Transportation and storage costs are critical factors due to the corrosive nature of hydrochloric acid. Investments in specialized equipment, such as rubber-lined tanks and acid-resistant piping, are necessary to ensure safe handling and storage. These infrastructure requirements can significantly impact initial capital expenditures and ongoing operational costs.

Regulatory compliance is another crucial economic factor. Environmental regulations regarding emissions control and waste management can necessitate substantial investments in pollution control technologies. Moreover, occupational safety standards require implementation of robust safety measures, further adding to operational costs.

Market competition and pricing dynamics also play a vital role in the economic assessment. The hydrochloric acid market is characterized by the presence of several large-scale producers and numerous regional players. This competitive landscape can lead to price pressures, potentially affecting profit margins. However, opportunities for product differentiation, such as high-purity grades for electronics manufacturing, can provide avenues for premium pricing.

Technological advancements in production processes can significantly impact the economic viability of investments. Innovations in membrane cell technology and improved recycling methods can enhance production efficiency and reduce environmental impact, potentially leading to long-term cost savings.

Lastly, geopolitical factors and trade policies can influence the economics of hydrochloric acid investments. Tariffs, trade agreements, and regional supply-demand imbalances can affect market access and pricing strategies, necessitating careful consideration of global market dynamics in investment decisions.

Raw material costs significantly influence the economic viability of hydrochloric acid production. The primary feedstock, hydrogen chloride, is often a byproduct of chlor-alkali processes. Fluctuations in chlorine and caustic soda markets can indirectly affect hydrochloric acid production costs. Additionally, energy costs, particularly electricity for electrolysis processes, contribute substantially to overall production expenses.

Transportation and storage costs are critical factors due to the corrosive nature of hydrochloric acid. Investments in specialized equipment, such as rubber-lined tanks and acid-resistant piping, are necessary to ensure safe handling and storage. These infrastructure requirements can significantly impact initial capital expenditures and ongoing operational costs.

Regulatory compliance is another crucial economic factor. Environmental regulations regarding emissions control and waste management can necessitate substantial investments in pollution control technologies. Moreover, occupational safety standards require implementation of robust safety measures, further adding to operational costs.

Market competition and pricing dynamics also play a vital role in the economic assessment. The hydrochloric acid market is characterized by the presence of several large-scale producers and numerous regional players. This competitive landscape can lead to price pressures, potentially affecting profit margins. However, opportunities for product differentiation, such as high-purity grades for electronics manufacturing, can provide avenues for premium pricing.

Technological advancements in production processes can significantly impact the economic viability of investments. Innovations in membrane cell technology and improved recycling methods can enhance production efficiency and reduce environmental impact, potentially leading to long-term cost savings.

Lastly, geopolitical factors and trade policies can influence the economics of hydrochloric acid investments. Tariffs, trade agreements, and regional supply-demand imbalances can affect market access and pricing strategies, necessitating careful consideration of global market dynamics in investment decisions.

Environmental Regulations

Environmental regulations play a crucial role in shaping the economic landscape of hydrochloric acid investments. These regulations are designed to mitigate the potential environmental impacts associated with the production, transportation, and use of hydrochloric acid, a highly corrosive and potentially hazardous substance.

In recent years, regulatory bodies worldwide have implemented increasingly stringent measures to control emissions and ensure proper handling of hydrochloric acid. The Clean Air Act in the United States, for instance, classifies hydrochloric acid as a Hazardous Air Pollutant (HAP), subjecting its production facilities to rigorous emission standards and monitoring requirements.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict guidelines on the registration and assessment of chemical substances, including hydrochloric acid. This regulatory framework necessitates comprehensive safety data sheets and risk assessments, potentially increasing compliance costs for manufacturers and importers.

Many countries have also implemented specific regulations governing the transportation of hydrochloric acid. These regulations often require specialized containment systems, labeling, and handling procedures to minimize the risk of spills or accidents during transit. Compliance with these transportation regulations can significantly impact the logistics and distribution costs associated with hydrochloric acid investments.

Waste management regulations present another critical aspect of environmental compliance for hydrochloric acid producers. The disposal of byproducts and waste streams from hydrochloric acid production must adhere to strict guidelines to prevent soil and water contamination. In some jurisdictions, this may necessitate investment in advanced treatment technologies or the development of recycling processes to minimize waste generation.

The evolving nature of environmental regulations poses both challenges and opportunities for investors in the hydrochloric acid sector. While compliance costs may increase, companies that proactively adopt cleaner production technologies and robust environmental management systems may gain a competitive advantage in the market.

Furthermore, the push towards circular economy principles in many regions is driving innovation in hydrochloric acid recycling and recovery processes. This trend may open new avenues for investment in technologies that can extract value from waste streams while simultaneously reducing environmental impact.

As global efforts to combat climate change intensify, future regulations may also target the carbon footprint of hydrochloric acid production. Investors should anticipate potential carbon pricing mechanisms or incentives for low-carbon production methods, which could significantly influence the long-term economics of hydrochloric acid investments.

In recent years, regulatory bodies worldwide have implemented increasingly stringent measures to control emissions and ensure proper handling of hydrochloric acid. The Clean Air Act in the United States, for instance, classifies hydrochloric acid as a Hazardous Air Pollutant (HAP), subjecting its production facilities to rigorous emission standards and monitoring requirements.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict guidelines on the registration and assessment of chemical substances, including hydrochloric acid. This regulatory framework necessitates comprehensive safety data sheets and risk assessments, potentially increasing compliance costs for manufacturers and importers.

Many countries have also implemented specific regulations governing the transportation of hydrochloric acid. These regulations often require specialized containment systems, labeling, and handling procedures to minimize the risk of spills or accidents during transit. Compliance with these transportation regulations can significantly impact the logistics and distribution costs associated with hydrochloric acid investments.

Waste management regulations present another critical aspect of environmental compliance for hydrochloric acid producers. The disposal of byproducts and waste streams from hydrochloric acid production must adhere to strict guidelines to prevent soil and water contamination. In some jurisdictions, this may necessitate investment in advanced treatment technologies or the development of recycling processes to minimize waste generation.

The evolving nature of environmental regulations poses both challenges and opportunities for investors in the hydrochloric acid sector. While compliance costs may increase, companies that proactively adopt cleaner production technologies and robust environmental management systems may gain a competitive advantage in the market.

Furthermore, the push towards circular economy principles in many regions is driving innovation in hydrochloric acid recycling and recovery processes. This trend may open new avenues for investment in technologies that can extract value from waste streams while simultaneously reducing environmental impact.

As global efforts to combat climate change intensify, future regulations may also target the carbon footprint of hydrochloric acid production. Investors should anticipate potential carbon pricing mechanisms or incentives for low-carbon production methods, which could significantly influence the long-term economics of hydrochloric acid investments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!