Evaluating Ethylene Vinyl Acetate’s Market Dynamics

JUL 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Market Overview

Ethylene Vinyl Acetate (EVA) has emerged as a versatile and widely used copolymer in various industries, driving significant market dynamics. The global EVA market has experienced steady growth over the past decade, with a compound annual growth rate (CAGR) of approximately 4-5%. This growth is primarily attributed to the increasing demand for EVA in applications such as solar panel encapsulation, packaging films, and footwear.

The market size for EVA was estimated at around USD 7.5 billion in 2020 and is projected to reach USD 10 billion by 2025. Asia-Pacific region dominates the EVA market, accounting for over 40% of the global share, followed by North America and Europe. China, in particular, has become a major producer and consumer of EVA, driven by its booming solar energy sector and packaging industry.

EVA's market is segmented based on type, end-use industry, and application. The most common types include Very Low Density EVA (VLDEVA), Low Density EVA (LDEVA), and Medium Density EVA (MDEVA). In terms of end-use industries, packaging, footwear, and solar panel manufacturing are the primary consumers of EVA.

The solar panel industry has been a significant driver of EVA demand, with the material being crucial for encapsulating photovoltaic cells. As renewable energy adoption increases globally, this sector is expected to continue fueling EVA market growth. The packaging industry also plays a vital role in EVA consumption, particularly in the food and beverage sector, where EVA is used for its excellent sealing properties and flexibility.

Market dynamics are influenced by several factors, including raw material prices, technological advancements, and regulatory policies. The price of ethylene, a key raw material for EVA production, has a significant impact on market trends. Fluctuations in oil prices directly affect ethylene costs, consequently influencing EVA pricing and market dynamics.

Technological innovations in EVA production and application are driving market evolution. Manufacturers are focusing on developing high-performance EVA grades to meet specific industry requirements, such as improved weather resistance for solar panels or enhanced barrier properties for packaging applications.

Regulatory policies, particularly those related to environmental concerns and sustainability, are shaping the EVA market. There is a growing emphasis on recyclable and bio-based EVA alternatives, which is expected to influence future market trends and product development strategies.

In conclusion, the EVA market demonstrates robust growth potential, driven by diverse applications across multiple industries. The interplay of technological advancements, regulatory landscape, and shifting consumer preferences continues to shape the market dynamics, presenting both opportunities and challenges for stakeholders in the EVA value chain.

The market size for EVA was estimated at around USD 7.5 billion in 2020 and is projected to reach USD 10 billion by 2025. Asia-Pacific region dominates the EVA market, accounting for over 40% of the global share, followed by North America and Europe. China, in particular, has become a major producer and consumer of EVA, driven by its booming solar energy sector and packaging industry.

EVA's market is segmented based on type, end-use industry, and application. The most common types include Very Low Density EVA (VLDEVA), Low Density EVA (LDEVA), and Medium Density EVA (MDEVA). In terms of end-use industries, packaging, footwear, and solar panel manufacturing are the primary consumers of EVA.

The solar panel industry has been a significant driver of EVA demand, with the material being crucial for encapsulating photovoltaic cells. As renewable energy adoption increases globally, this sector is expected to continue fueling EVA market growth. The packaging industry also plays a vital role in EVA consumption, particularly in the food and beverage sector, where EVA is used for its excellent sealing properties and flexibility.

Market dynamics are influenced by several factors, including raw material prices, technological advancements, and regulatory policies. The price of ethylene, a key raw material for EVA production, has a significant impact on market trends. Fluctuations in oil prices directly affect ethylene costs, consequently influencing EVA pricing and market dynamics.

Technological innovations in EVA production and application are driving market evolution. Manufacturers are focusing on developing high-performance EVA grades to meet specific industry requirements, such as improved weather resistance for solar panels or enhanced barrier properties for packaging applications.

Regulatory policies, particularly those related to environmental concerns and sustainability, are shaping the EVA market. There is a growing emphasis on recyclable and bio-based EVA alternatives, which is expected to influence future market trends and product development strategies.

In conclusion, the EVA market demonstrates robust growth potential, driven by diverse applications across multiple industries. The interplay of technological advancements, regulatory landscape, and shifting consumer preferences continues to shape the market dynamics, presenting both opportunities and challenges for stakeholders in the EVA value chain.

Demand Analysis

The global market for Ethylene Vinyl Acetate (EVA) has been experiencing significant growth, driven by its versatile applications across various industries. The demand for EVA is primarily fueled by its use in the production of solar panels, packaging materials, footwear, and adhesives. The solar energy sector, in particular, has emerged as a major consumer of EVA, with the material being crucial in the manufacturing of photovoltaic modules.

In the packaging industry, EVA's excellent flexibility, toughness, and barrier properties have led to increased adoption in food packaging and industrial films. The material's ability to provide superior sealing and protection has made it a preferred choice for manufacturers looking to enhance product shelf life and safety.

The footwear industry continues to be a substantial market for EVA, with the material being widely used in the production of midsoles and outsoles for athletic and casual shoes. EVA's lightweight nature, cushioning properties, and durability have contributed to its sustained demand in this sector.

The adhesives and sealants market has also shown a growing appetite for EVA-based products. The material's strong bonding capabilities and resistance to environmental factors have made it popular in construction, automotive, and consumer goods industries.

Geographically, Asia-Pacific has emerged as the largest consumer of EVA, with China leading the demand. The region's rapid industrialization, growing population, and increasing disposable income have contributed to the rising consumption of EVA-based products. North America and Europe follow, with steady demand from established industries and a focus on sustainable materials driving market growth.

The automotive sector presents a promising avenue for EVA demand growth. As vehicle manufacturers increasingly focus on lightweight materials to improve fuel efficiency and reduce emissions, EVA's potential in automotive interiors and components is being explored more extensively.

However, the market dynamics of EVA are not without challenges. Fluctuations in raw material prices, particularly ethylene, can impact production costs and market stability. Additionally, growing environmental concerns and regulations regarding plastic usage may influence future demand patterns, potentially driving innovation in biodegradable or recyclable EVA formulations.

Despite these challenges, the overall market outlook for EVA remains positive. The material's unique combination of properties, coupled with ongoing research and development efforts to enhance its performance and sustainability, suggests a continued upward trajectory in demand across multiple industries.

In the packaging industry, EVA's excellent flexibility, toughness, and barrier properties have led to increased adoption in food packaging and industrial films. The material's ability to provide superior sealing and protection has made it a preferred choice for manufacturers looking to enhance product shelf life and safety.

The footwear industry continues to be a substantial market for EVA, with the material being widely used in the production of midsoles and outsoles for athletic and casual shoes. EVA's lightweight nature, cushioning properties, and durability have contributed to its sustained demand in this sector.

The adhesives and sealants market has also shown a growing appetite for EVA-based products. The material's strong bonding capabilities and resistance to environmental factors have made it popular in construction, automotive, and consumer goods industries.

Geographically, Asia-Pacific has emerged as the largest consumer of EVA, with China leading the demand. The region's rapid industrialization, growing population, and increasing disposable income have contributed to the rising consumption of EVA-based products. North America and Europe follow, with steady demand from established industries and a focus on sustainable materials driving market growth.

The automotive sector presents a promising avenue for EVA demand growth. As vehicle manufacturers increasingly focus on lightweight materials to improve fuel efficiency and reduce emissions, EVA's potential in automotive interiors and components is being explored more extensively.

However, the market dynamics of EVA are not without challenges. Fluctuations in raw material prices, particularly ethylene, can impact production costs and market stability. Additionally, growing environmental concerns and regulations regarding plastic usage may influence future demand patterns, potentially driving innovation in biodegradable or recyclable EVA formulations.

Despite these challenges, the overall market outlook for EVA remains positive. The material's unique combination of properties, coupled with ongoing research and development efforts to enhance its performance and sustainability, suggests a continued upward trajectory in demand across multiple industries.

Technical Challenges

The global Ethylene Vinyl Acetate (EVA) market faces several technical challenges that impact its dynamics and future growth. One of the primary issues is the volatility of raw material prices, particularly ethylene and vinyl acetate monomer. These fluctuations directly affect production costs and, consequently, market pricing strategies, creating uncertainties for manufacturers and end-users alike.

Environmental concerns pose another significant challenge. The production of EVA involves petrochemical processes that generate greenhouse gas emissions. As global environmental regulations become more stringent, manufacturers are under pressure to develop cleaner production methods and more sustainable alternatives. This necessitates substantial investments in research and development, potentially affecting profit margins and market competitiveness.

Quality control and consistency in EVA production present ongoing technical hurdles. Achieving the desired balance of properties, such as flexibility, transparency, and adhesion, requires precise control over the polymerization process. Variations in production can lead to inconsistencies in the final product, affecting its performance in various applications and potentially limiting market expansion.

The recycling of EVA products remains a technical challenge due to its cross-linked structure, particularly in foam applications. As circular economy principles gain traction, the inability to efficiently recycle EVA could impact its long-term market viability, especially in industries prioritizing sustainability.

Innovation in EVA formulations to meet evolving industry needs presents both an opportunity and a challenge. Developing EVA grades with enhanced properties, such as improved heat resistance or UV stability, requires significant research efforts. The ability to create specialized formulations for emerging applications, like advanced solar panels or 3D printing materials, will be crucial for market growth but demands continuous technological advancements.

The scalability of production processes to meet growing demand, particularly in emerging markets, poses another technical challenge. Optimizing production efficiency while maintaining product quality and reducing environmental impact requires sophisticated engineering solutions and process innovations.

Lastly, the development of bio-based alternatives to traditional EVA is an emerging challenge. As the market shifts towards more sustainable materials, creating bio-EVA with comparable performance characteristics to petroleum-based EVA becomes increasingly important. This transition demands extensive research into alternative feedstocks and novel polymerization techniques, potentially reshaping the market landscape in the coming years.

Environmental concerns pose another significant challenge. The production of EVA involves petrochemical processes that generate greenhouse gas emissions. As global environmental regulations become more stringent, manufacturers are under pressure to develop cleaner production methods and more sustainable alternatives. This necessitates substantial investments in research and development, potentially affecting profit margins and market competitiveness.

Quality control and consistency in EVA production present ongoing technical hurdles. Achieving the desired balance of properties, such as flexibility, transparency, and adhesion, requires precise control over the polymerization process. Variations in production can lead to inconsistencies in the final product, affecting its performance in various applications and potentially limiting market expansion.

The recycling of EVA products remains a technical challenge due to its cross-linked structure, particularly in foam applications. As circular economy principles gain traction, the inability to efficiently recycle EVA could impact its long-term market viability, especially in industries prioritizing sustainability.

Innovation in EVA formulations to meet evolving industry needs presents both an opportunity and a challenge. Developing EVA grades with enhanced properties, such as improved heat resistance or UV stability, requires significant research efforts. The ability to create specialized formulations for emerging applications, like advanced solar panels or 3D printing materials, will be crucial for market growth but demands continuous technological advancements.

The scalability of production processes to meet growing demand, particularly in emerging markets, poses another technical challenge. Optimizing production efficiency while maintaining product quality and reducing environmental impact requires sophisticated engineering solutions and process innovations.

Lastly, the development of bio-based alternatives to traditional EVA is an emerging challenge. As the market shifts towards more sustainable materials, creating bio-EVA with comparable performance characteristics to petroleum-based EVA becomes increasingly important. This transition demands extensive research into alternative feedstocks and novel polymerization techniques, potentially reshaping the market landscape in the coming years.

Current EVA Solutions

01 EVA market growth and applications

The Ethylene Vinyl Acetate (EVA) market is experiencing significant growth due to its versatile applications across various industries. EVA is widely used in packaging, footwear, solar panels, and automotive sectors. The increasing demand for flexible and durable materials in these industries is driving the market expansion.- EVA market growth and applications: The Ethylene Vinyl Acetate (EVA) market is experiencing significant growth due to its versatile applications across various industries. EVA is widely used in packaging, footwear, solar panels, and automotive sectors. The increasing demand for flexible packaging and renewable energy sources is driving the market expansion.

- Technological advancements in EVA production: Ongoing research and development efforts are focused on improving EVA production processes and enhancing its properties. New technologies aim to increase production efficiency, reduce costs, and develop EVA grades with superior characteristics for specific applications.

- Environmental concerns and sustainability: The EVA market is influenced by growing environmental concerns and sustainability trends. Manufacturers are developing eco-friendly EVA formulations and exploring recycling options to address these issues. Biodegradable EVA variants are gaining attention in various industries.

- Competitive landscape and market players: The EVA market is characterized by intense competition among key players. Companies are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market position. Regional expansions and product innovations are common strategies employed by market leaders to gain a competitive edge.

- Regulatory impact on EVA market: Regulatory policies and standards play a crucial role in shaping the EVA market dynamics. Compliance with safety and quality regulations, particularly in industries like food packaging and medical devices, influences product development and market growth. Changes in trade policies and environmental regulations also impact the global EVA market.

02 Technological advancements in EVA production

Ongoing research and development efforts are focused on improving EVA production processes and enhancing its properties. New technologies are being developed to increase production efficiency, reduce costs, and create EVA with specific characteristics tailored to different applications.Expand Specific Solutions03 Environmental considerations and sustainability

The EVA market is influenced by growing environmental concerns and sustainability trends. Manufacturers are developing eco-friendly EVA formulations and exploring recycling options to address these issues. This shift towards sustainable practices is expected to impact market dynamics in the coming years.Expand Specific Solutions04 Competitive landscape and market players

The EVA market is characterized by intense competition among key players. Companies are focusing on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The competitive landscape is expected to evolve as new entrants and emerging technologies disrupt the market.Expand Specific Solutions05 Regional market trends and demand patterns

The EVA market exhibits varying trends and demand patterns across different regions. Factors such as industrialization, economic growth, and regulatory environments influence regional market dynamics. Emerging economies in Asia-Pacific are expected to drive significant growth in the EVA market due to rapid industrialization and increasing consumer demand.Expand Specific Solutions

Key Industry Players

The market for Ethylene Vinyl Acetate (EVA) is experiencing dynamic growth, driven by increasing demand across various industries. The market is in a mature stage but continues to expand, with a projected global market size reaching billions of dollars. Technologically, EVA production is well-established, with major players like China Petroleum & Chemical Corp., Celanese International Corp., and LG Chem Ltd. leading the way. These companies, along with others such as Wacker Chemie AG and Borealis AG, are investing in research and development to improve product quality and production efficiency. The competitive landscape is characterized by a mix of large petrochemical corporations and specialized chemical manufacturers, with ongoing innovation focused on enhancing EVA's properties for specific applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced EVA production technologies, including a proprietary high-pressure tubular reactor process. This process allows for precise control of vinyl acetate content and molecular weight distribution, resulting in EVA with tailored properties for specific applications[1]. Sinopec has also implemented a continuous solution polymerization technique that enhances production efficiency and product consistency[2]. The company's research efforts have led to the development of specialized EVA grades for photovoltaic encapsulants, which have shown improved weatherability and reduced yellowing compared to conventional EVA materials[3]. Additionally, Sinopec has invested in expanding its EVA production capacity, with new facilities capable of producing up to 100,000 tons per year[4].

Strengths: Vertically integrated operations, strong R&D capabilities, and large production capacity. Weaknesses: Potential overcapacity in the domestic market and exposure to fluctuating raw material prices.

Celanese International Corp.

Technical Solution: Celanese has developed a range of EVA products under its VitalDose® platform, specifically designed for controlled release drug delivery systems[1]. The company's EVA technology allows for customization of drug release rates by adjusting the vinyl acetate content and molecular weight of the polymer[2]. Celanese has also introduced EVA grades with enhanced thermal stability and optical clarity for photovoltaic applications, addressing the industry's need for more durable encapsulant materials[3]. Their proprietary manufacturing process enables the production of ultra-high molecular weight EVA, which offers improved mechanical properties and melt strength[4]. Additionally, Celanese has invested in sustainable production methods, including the use of bio-based feedstocks for certain EVA grades[5].

Strengths: Strong focus on high-value applications, extensive product customization capabilities. Weaknesses: Limited presence in commodity EVA markets, potential vulnerability to competition in specialized segments.

EVA Innovations

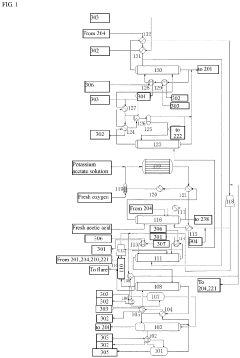

Integrated process for the production of acetic acid and vinyl acetate

PatentWO2007092188A8

Innovation

- An integrated process that reacts ethane with oxygen in the presence of a catalyst to produce ethylene and acetic acid, followed by reacting a portion of the ethylene and acetic acid to produce additional acetic acid and subsequently vinyl acetate, utilizing catalysts like Mo, Pd, and other metals in specific ratios to enhance selectivity and yield.

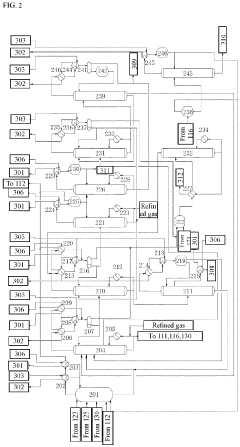

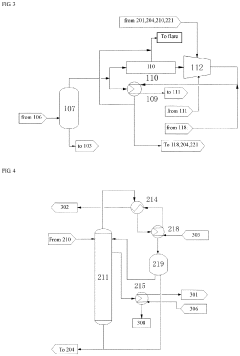

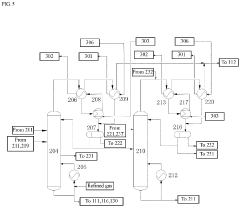

Preparation method of vinyl acetate by ethylene process and device thereof

PatentPendingEP4371972A1

Innovation

- A novel process incorporating an ethylene recovery membrane assembly, refined VAC tower side-draw stream additions, and improved cooling methods using circulating and chilled water for high-purity vinyl acetate production, reducing emissions and preventing material leakage by recovering ethylene and optimizing the distillation process.

Regulatory Framework

The regulatory framework surrounding Ethylene Vinyl Acetate (EVA) plays a crucial role in shaping its market dynamics. As a versatile copolymer with applications across various industries, EVA is subject to a complex web of regulations that vary by region and application.

In the United States, the Food and Drug Administration (FDA) regulates EVA's use in food contact materials and medical devices. The FDA's 21 CFR 177.1350 specifically addresses EVA copolymers for food contact applications, setting guidelines for composition and manufacturing processes. For medical devices, EVA must comply with biocompatibility standards outlined in ISO 10993.

The European Union's regulatory landscape for EVA is equally stringent. The European Chemicals Agency (ECHA) oversees EVA under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. Manufacturers and importers must register EVA and provide safety data when annual production or import exceeds one tonne. Additionally, the EU's Plastic Materials and Articles in Contact with Food Regulation (EU) No 10/2011 sets specific migration limits for EVA components in food packaging.

In Asia, Japan's Ministry of Health, Labour and Welfare regulates EVA in food contact materials through the Food Sanitation Act. China's GB standards, particularly GB 4806.1-2016 and GB 9685-2016, govern EVA's use in food packaging. These regulations impact the EVA market by influencing product formulations and manufacturing processes.

Environmental regulations also significantly affect EVA's market dynamics. The growing focus on sustainability has led to increased scrutiny of plastic materials, including EVA. In response, many countries have implemented or are considering regulations to promote recycling and reduce plastic waste. For instance, the EU's Circular Economy Action Plan aims to make all plastic packaging recyclable or reusable by 2030, potentially impacting EVA's use in packaging applications.

The automotive industry, a major consumer of EVA, faces stringent emissions regulations worldwide. These regulations indirectly influence EVA demand, as manufacturers seek lightweight materials to improve fuel efficiency. EVA's role in producing lightweight components aligns with these regulatory goals, potentially driving increased adoption in the automotive sector.

As global concerns about climate change intensify, regulations aimed at reducing carbon emissions are likely to impact EVA production and use. Energy-intensive manufacturing processes may face increased scrutiny, prompting innovation in more sustainable production methods. Additionally, the push for renewable and bio-based materials could lead to regulatory incentives for developing bio-based alternatives to traditional EVA formulations.

In the United States, the Food and Drug Administration (FDA) regulates EVA's use in food contact materials and medical devices. The FDA's 21 CFR 177.1350 specifically addresses EVA copolymers for food contact applications, setting guidelines for composition and manufacturing processes. For medical devices, EVA must comply with biocompatibility standards outlined in ISO 10993.

The European Union's regulatory landscape for EVA is equally stringent. The European Chemicals Agency (ECHA) oversees EVA under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. Manufacturers and importers must register EVA and provide safety data when annual production or import exceeds one tonne. Additionally, the EU's Plastic Materials and Articles in Contact with Food Regulation (EU) No 10/2011 sets specific migration limits for EVA components in food packaging.

In Asia, Japan's Ministry of Health, Labour and Welfare regulates EVA in food contact materials through the Food Sanitation Act. China's GB standards, particularly GB 4806.1-2016 and GB 9685-2016, govern EVA's use in food packaging. These regulations impact the EVA market by influencing product formulations and manufacturing processes.

Environmental regulations also significantly affect EVA's market dynamics. The growing focus on sustainability has led to increased scrutiny of plastic materials, including EVA. In response, many countries have implemented or are considering regulations to promote recycling and reduce plastic waste. For instance, the EU's Circular Economy Action Plan aims to make all plastic packaging recyclable or reusable by 2030, potentially impacting EVA's use in packaging applications.

The automotive industry, a major consumer of EVA, faces stringent emissions regulations worldwide. These regulations indirectly influence EVA demand, as manufacturers seek lightweight materials to improve fuel efficiency. EVA's role in producing lightweight components aligns with these regulatory goals, potentially driving increased adoption in the automotive sector.

As global concerns about climate change intensify, regulations aimed at reducing carbon emissions are likely to impact EVA production and use. Energy-intensive manufacturing processes may face increased scrutiny, prompting innovation in more sustainable production methods. Additionally, the push for renewable and bio-based materials could lead to regulatory incentives for developing bio-based alternatives to traditional EVA formulations.

Sustainability Impact

The sustainability impact of Ethylene Vinyl Acetate (EVA) in the market dynamics is a critical aspect that requires thorough examination. EVA, a copolymer of ethylene and vinyl acetate, has gained significant attention due to its versatile properties and wide range of applications. However, its environmental footprint and long-term sustainability have become increasingly important considerations in the evolving market landscape.

From a production standpoint, EVA manufacturing processes have traditionally been energy-intensive and reliant on fossil fuel-based raw materials. This has raised concerns about greenhouse gas emissions and the depletion of non-renewable resources. However, recent advancements in production technologies have led to more efficient processes, reducing energy consumption and minimizing waste generation. Some manufacturers have also begun exploring bio-based alternatives for ethylene production, which could potentially decrease the carbon footprint of EVA.

In terms of product lifecycle, EVA's durability and resistance to degradation have both positive and negative implications for sustainability. On one hand, these properties contribute to longer-lasting products, reducing the need for frequent replacements and potentially decreasing overall material consumption. On the other hand, the persistence of EVA in the environment after disposal poses challenges for waste management and recycling efforts.

The recycling of EVA products has been a significant focus area for improving sustainability. While EVA can be mechanically recycled, the process is often complicated by the presence of other materials in composite products. Chemical recycling methods are being developed to address this challenge, potentially enabling the recovery of raw materials for reuse in new EVA production. Additionally, some companies are exploring biodegradable additives that can enhance the decomposition of EVA under specific conditions, although these solutions are still in the early stages of development.

In the context of market dynamics, the sustainability impact of EVA is influencing consumer preferences and regulatory landscapes. Environmentally conscious consumers are increasingly demanding products with lower environmental impacts, driving manufacturers to innovate and improve the sustainability profile of EVA-based products. This trend is particularly evident in industries such as footwear, packaging, and solar panel manufacturing, where EVA is widely used.

Regulatory pressures are also shaping the sustainability trajectory of EVA. Many regions are implementing stricter environmental regulations, including extended producer responsibility and circular economy initiatives. These policies are encouraging manufacturers to invest in more sustainable production methods, improve product recyclability, and explore alternative materials with lower environmental impacts.

The sustainability impact of EVA is also driving collaborations across the value chain. Material suppliers, manufacturers, and recycling companies are forming partnerships to develop closed-loop systems for EVA products. These initiatives aim to improve collection, sorting, and recycling processes, ultimately reducing the environmental footprint of EVA throughout its lifecycle.

From a production standpoint, EVA manufacturing processes have traditionally been energy-intensive and reliant on fossil fuel-based raw materials. This has raised concerns about greenhouse gas emissions and the depletion of non-renewable resources. However, recent advancements in production technologies have led to more efficient processes, reducing energy consumption and minimizing waste generation. Some manufacturers have also begun exploring bio-based alternatives for ethylene production, which could potentially decrease the carbon footprint of EVA.

In terms of product lifecycle, EVA's durability and resistance to degradation have both positive and negative implications for sustainability. On one hand, these properties contribute to longer-lasting products, reducing the need for frequent replacements and potentially decreasing overall material consumption. On the other hand, the persistence of EVA in the environment after disposal poses challenges for waste management and recycling efforts.

The recycling of EVA products has been a significant focus area for improving sustainability. While EVA can be mechanically recycled, the process is often complicated by the presence of other materials in composite products. Chemical recycling methods are being developed to address this challenge, potentially enabling the recovery of raw materials for reuse in new EVA production. Additionally, some companies are exploring biodegradable additives that can enhance the decomposition of EVA under specific conditions, although these solutions are still in the early stages of development.

In the context of market dynamics, the sustainability impact of EVA is influencing consumer preferences and regulatory landscapes. Environmentally conscious consumers are increasingly demanding products with lower environmental impacts, driving manufacturers to innovate and improve the sustainability profile of EVA-based products. This trend is particularly evident in industries such as footwear, packaging, and solar panel manufacturing, where EVA is widely used.

Regulatory pressures are also shaping the sustainability trajectory of EVA. Many regions are implementing stricter environmental regulations, including extended producer responsibility and circular economy initiatives. These policies are encouraging manufacturers to invest in more sustainable production methods, improve product recyclability, and explore alternative materials with lower environmental impacts.

The sustainability impact of EVA is also driving collaborations across the value chain. Material suppliers, manufacturers, and recycling companies are forming partnerships to develop closed-loop systems for EVA products. These initiatives aim to improve collection, sorting, and recycling processes, ultimately reducing the environmental footprint of EVA throughout its lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!