Evaluating the Role of Additives in Enhancing Heat Exchanger Performance

SEP 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heat Exchanger Additive Technology Background and Objectives

Heat exchanger technology has evolved significantly over the past century, with major advancements occurring in materials, design configurations, and operational efficiency. The fundamental principle of transferring thermal energy between fluids without mixing has remained constant, but the methods to enhance this process have continuously evolved. Since the 1970s, researchers have been exploring various additives as a means to improve heat transfer efficiency, with initial focus primarily on surfactants and polymers that could reduce drag and enhance flow characteristics.

The evolution of heat exchanger additive technology has accelerated in recent decades due to increasing demands for energy efficiency across industrial sectors. Traditional heat exchangers face persistent challenges including fouling, corrosion, and limited heat transfer coefficients that restrict their performance. These limitations have driven the exploration of chemical and nanomaterial additives as potential solutions to overcome inherent physical constraints of conventional systems.

Current technological trends in heat exchanger additives include the development of nanoparticle suspensions (nanofluids), surfactant solutions, polymeric additives, and hybrid combinations that can significantly alter the thermophysical properties of working fluids. The emergence of nanofluids in particular represents a paradigm shift, with research demonstrating thermal conductivity enhancements of 15-40% compared to base fluids, even at low particle concentrations.

The primary objective of heat exchanger additive technology research is to achieve substantial improvements in heat transfer efficiency without compromising system reliability or introducing prohibitive costs. Specific goals include enhancing thermal conductivity of working fluids, reducing pumping power requirements, mitigating fouling and scaling issues, and extending equipment service life through corrosion inhibition.

Secondary objectives focus on developing environmentally sustainable additives that comply with increasingly stringent regulations while maintaining compatibility with existing heat exchanger infrastructure. This includes biodegradable formulations and additives derived from renewable resources that can replace traditional petroleum-based compounds.

The technical trajectory suggests a convergence of nanotechnology, surface chemistry, and fluid dynamics in creating next-generation heat transfer enhancement solutions. Researchers are particularly interested in understanding the fundamental mechanisms by which additives modify fluid behavior at micro and nano scales, including boundary layer effects, particle clustering phenomena, and Brownian motion contributions to thermal transport.

Industry adoption of additive technologies remains selective, with implementation primarily in specialized applications where performance gains justify additional complexity. The technology readiness level varies significantly across different additive categories, with some commercial solutions available while others remain in laboratory testing phases. Bridging this gap represents a critical challenge for widespread implementation of these promising technologies.

The evolution of heat exchanger additive technology has accelerated in recent decades due to increasing demands for energy efficiency across industrial sectors. Traditional heat exchangers face persistent challenges including fouling, corrosion, and limited heat transfer coefficients that restrict their performance. These limitations have driven the exploration of chemical and nanomaterial additives as potential solutions to overcome inherent physical constraints of conventional systems.

Current technological trends in heat exchanger additives include the development of nanoparticle suspensions (nanofluids), surfactant solutions, polymeric additives, and hybrid combinations that can significantly alter the thermophysical properties of working fluids. The emergence of nanofluids in particular represents a paradigm shift, with research demonstrating thermal conductivity enhancements of 15-40% compared to base fluids, even at low particle concentrations.

The primary objective of heat exchanger additive technology research is to achieve substantial improvements in heat transfer efficiency without compromising system reliability or introducing prohibitive costs. Specific goals include enhancing thermal conductivity of working fluids, reducing pumping power requirements, mitigating fouling and scaling issues, and extending equipment service life through corrosion inhibition.

Secondary objectives focus on developing environmentally sustainable additives that comply with increasingly stringent regulations while maintaining compatibility with existing heat exchanger infrastructure. This includes biodegradable formulations and additives derived from renewable resources that can replace traditional petroleum-based compounds.

The technical trajectory suggests a convergence of nanotechnology, surface chemistry, and fluid dynamics in creating next-generation heat transfer enhancement solutions. Researchers are particularly interested in understanding the fundamental mechanisms by which additives modify fluid behavior at micro and nano scales, including boundary layer effects, particle clustering phenomena, and Brownian motion contributions to thermal transport.

Industry adoption of additive technologies remains selective, with implementation primarily in specialized applications where performance gains justify additional complexity. The technology readiness level varies significantly across different additive categories, with some commercial solutions available while others remain in laboratory testing phases. Bridging this gap represents a critical challenge for widespread implementation of these promising technologies.

Market Analysis for Enhanced Heat Transfer Solutions

The global market for enhanced heat transfer solutions is experiencing robust growth, driven by increasing demands for energy efficiency across multiple industries. The heat exchanger market was valued at approximately 16.5 billion USD in 2022 and is projected to reach 22.8 billion USD by 2028, growing at a CAGR of 5.5%. Within this broader market, solutions incorporating performance-enhancing additives represent one of the fastest-growing segments, with an estimated annual growth rate of 7.2%.

Industrial sectors including power generation, chemical processing, HVAC, and automotive manufacturing constitute the primary demand drivers for advanced heat exchanger technologies. The power generation sector alone accounts for nearly 28% of the total market share, followed by chemical processing at 22% and HVAC applications at 18%. These industries are increasingly adopting enhanced heat transfer solutions to meet stringent energy efficiency regulations and sustainability goals.

Regionally, Asia-Pacific dominates the market with approximately 35% share, fueled by rapid industrialization in China and India. North America and Europe follow with 27% and 25% market shares respectively, where the focus is primarily on retrofitting existing systems with more efficient solutions. The Middle East and Latin America represent emerging markets with significant growth potential, particularly in oil and gas applications.

The market for heat transfer additives specifically is segmented into several categories: surfactants, nanoparticles, polymeric additives, and hybrid formulations. Nanoparticle-based solutions, particularly those utilizing metal oxides and carbon-based materials, are witnessing the highest growth rate at 9.3% annually, driven by their superior thermal conductivity properties and relatively low concentration requirements.

Customer demand patterns reveal a clear shift toward solutions offering demonstrable return on investment through energy savings. End-users increasingly prioritize additives that can enhance heat transfer efficiency by at least 15-20% while maintaining system reliability and minimizing maintenance requirements. Additionally, there is growing interest in environmentally friendly formulations that comply with evolving regulatory standards.

Pricing trends indicate that while enhanced heat transfer solutions command a premium of 20-30% over conventional systems, the payback period through energy savings typically ranges from 12-24 months, making them increasingly attractive to cost-conscious industrial consumers. Market forecasts suggest that as manufacturing scales increase and technologies mature, this premium is expected to decrease to 10-15% by 2026, further accelerating market adoption.

Industrial sectors including power generation, chemical processing, HVAC, and automotive manufacturing constitute the primary demand drivers for advanced heat exchanger technologies. The power generation sector alone accounts for nearly 28% of the total market share, followed by chemical processing at 22% and HVAC applications at 18%. These industries are increasingly adopting enhanced heat transfer solutions to meet stringent energy efficiency regulations and sustainability goals.

Regionally, Asia-Pacific dominates the market with approximately 35% share, fueled by rapid industrialization in China and India. North America and Europe follow with 27% and 25% market shares respectively, where the focus is primarily on retrofitting existing systems with more efficient solutions. The Middle East and Latin America represent emerging markets with significant growth potential, particularly in oil and gas applications.

The market for heat transfer additives specifically is segmented into several categories: surfactants, nanoparticles, polymeric additives, and hybrid formulations. Nanoparticle-based solutions, particularly those utilizing metal oxides and carbon-based materials, are witnessing the highest growth rate at 9.3% annually, driven by their superior thermal conductivity properties and relatively low concentration requirements.

Customer demand patterns reveal a clear shift toward solutions offering demonstrable return on investment through energy savings. End-users increasingly prioritize additives that can enhance heat transfer efficiency by at least 15-20% while maintaining system reliability and minimizing maintenance requirements. Additionally, there is growing interest in environmentally friendly formulations that comply with evolving regulatory standards.

Pricing trends indicate that while enhanced heat transfer solutions command a premium of 20-30% over conventional systems, the payback period through energy savings typically ranges from 12-24 months, making them increasingly attractive to cost-conscious industrial consumers. Market forecasts suggest that as manufacturing scales increase and technologies mature, this premium is expected to decrease to 10-15% by 2026, further accelerating market adoption.

Current Additive Technologies and Technical Barriers

The heat exchanger industry currently employs several categories of additives to enhance thermal performance. Surfactants represent one of the most widely utilized additives, functioning by reducing surface tension at liquid-solid interfaces. Sodium dodecyl sulfate (SDS) and cetyl trimethylammonium bromide (CTAB) have demonstrated efficiency improvements of 15-25% in plate heat exchangers by modifying flow characteristics near heat transfer surfaces. However, these surfactants face stability challenges at temperatures exceeding 80°C, limiting their application in high-temperature industrial processes.

Nanoparticles constitute another significant category, with metal oxides (Al₂O₃, CuO, TiO₂) and carbon-based materials (graphene, carbon nanotubes) being the predominant choices. These nanofluids can enhance thermal conductivity by 10-40% compared to base fluids. Recent studies indicate that hybrid nanofluids combining multiple nanoparticle types can achieve synergistic effects, potentially increasing heat transfer coefficients by up to 60%. The primary barriers include nanoparticle agglomeration over time and sedimentation issues, particularly in systems with intermittent operation.

Polymeric additives, including polyacrylamide and polyethylene oxide, modify fluid rheological properties to reduce turbulent drag and enhance heat transfer in specific flow regimes. These additives have shown promising results in district heating systems, improving energy efficiency by 8-12%. However, their effectiveness diminishes significantly at high shear rates, and they exhibit degradation under prolonged thermal cycling.

Phase change materials (PCMs) represent an emerging additive category, with microencapsulated PCMs being incorporated into heat transfer fluids to increase thermal energy storage capacity. These materials can theoretically double the effective specific heat during phase transition regions, though current implementation faces challenges with capsule durability and thermal cycling stability.

Several technical barriers impede broader adoption of these additive technologies. Fouling acceleration represents a significant concern, as some additives promote surface deposition, potentially negating efficiency gains through increased thermal resistance. Long-term stability remains problematic, with many additives showing performance degradation after 1000-2000 hours of operation. Compatibility issues with existing system materials, particularly elastomers and certain metal alloys, limit implementation in retrofit applications.

Cost-effectiveness presents another substantial barrier, as high-performance additives like graphene can increase fluid costs by 200-300%. Manufacturing scalability challenges further restrict commercial viability, with many promising additives currently limited to laboratory-scale production. Additionally, environmental and toxicological concerns surrounding nanoparticle disposal and potential leakage into water systems have prompted regulatory scrutiny in several markets.

Nanoparticles constitute another significant category, with metal oxides (Al₂O₃, CuO, TiO₂) and carbon-based materials (graphene, carbon nanotubes) being the predominant choices. These nanofluids can enhance thermal conductivity by 10-40% compared to base fluids. Recent studies indicate that hybrid nanofluids combining multiple nanoparticle types can achieve synergistic effects, potentially increasing heat transfer coefficients by up to 60%. The primary barriers include nanoparticle agglomeration over time and sedimentation issues, particularly in systems with intermittent operation.

Polymeric additives, including polyacrylamide and polyethylene oxide, modify fluid rheological properties to reduce turbulent drag and enhance heat transfer in specific flow regimes. These additives have shown promising results in district heating systems, improving energy efficiency by 8-12%. However, their effectiveness diminishes significantly at high shear rates, and they exhibit degradation under prolonged thermal cycling.

Phase change materials (PCMs) represent an emerging additive category, with microencapsulated PCMs being incorporated into heat transfer fluids to increase thermal energy storage capacity. These materials can theoretically double the effective specific heat during phase transition regions, though current implementation faces challenges with capsule durability and thermal cycling stability.

Several technical barriers impede broader adoption of these additive technologies. Fouling acceleration represents a significant concern, as some additives promote surface deposition, potentially negating efficiency gains through increased thermal resistance. Long-term stability remains problematic, with many additives showing performance degradation after 1000-2000 hours of operation. Compatibility issues with existing system materials, particularly elastomers and certain metal alloys, limit implementation in retrofit applications.

Cost-effectiveness presents another substantial barrier, as high-performance additives like graphene can increase fluid costs by 200-300%. Manufacturing scalability challenges further restrict commercial viability, with many promising additives currently limited to laboratory-scale production. Additionally, environmental and toxicological concerns surrounding nanoparticle disposal and potential leakage into water systems have prompted regulatory scrutiny in several markets.

Current Additive Formulations and Implementation Methods

01 Performance enhancers for lubricant additives

Various compounds can be incorporated into lubricant formulations to enhance their performance characteristics. These additives improve properties such as viscosity stability, wear protection, and oxidation resistance. The formulations typically include base oils combined with specific chemical compounds that work synergistically to extend equipment life and improve operational efficiency under extreme conditions.- Performance enhancers for lubricant additives: Various compounds can be incorporated into lubricant formulations to enhance their performance characteristics. These additives improve properties such as viscosity stability, thermal resistance, and friction reduction. Examples include molybdenum-based compounds, zinc dialkyldithiophosphates, and polymeric viscosity modifiers that work synergistically to extend lubricant life and protect mechanical components under extreme conditions.

- Battery performance additives: Specialized additives are formulated to enhance battery performance and longevity. These compounds improve electrolyte conductivity, stabilize electrode interfaces, and prevent unwanted side reactions. The additives can include film-forming agents, electrolyte modifiers, and compounds that suppress gas generation during charging cycles, resulting in improved battery capacity retention and cycle life.

- Fuel performance enhancement additives: Chemical additives designed to improve fuel combustion efficiency and engine performance. These compounds include detergents that clean fuel injectors, combustion improvers that reduce emissions, and stabilizers that prevent fuel degradation during storage. The additives work by modifying fuel properties to enhance ignition characteristics, reduce deposit formation, and improve overall energy conversion efficiency.

- Polymer additives for material performance: Specialized compounds added to polymeric materials to enhance their physical and chemical properties. These additives include stabilizers that prevent degradation from heat and UV exposure, plasticizers that improve flexibility, and reinforcing agents that increase mechanical strength. By carefully selecting and combining these additives, manufacturers can tailor polymer performance for specific applications while extending product lifespan.

- Concrete and cement performance additives: Chemical compounds formulated to modify and enhance the properties of concrete and cement mixtures. These additives include water reducers that improve workability while maintaining strength, accelerators that speed up setting time, and air-entraining agents that improve freeze-thaw durability. The additives work by altering the hydration process, modifying surface chemistry, or creating beneficial microstructures within the cementitious matrix.

02 Battery performance additives

Specialized additives are used in battery formulations to enhance electrochemical performance and stability. These compounds can improve conductivity, extend cycle life, and enhance capacity retention. The additives work by modifying electrode interfaces, stabilizing electrolytes, or facilitating ion transport mechanisms, resulting in batteries with superior performance characteristics for various applications.Expand Specific Solutions03 Polymer additives for enhanced material properties

Specific additives are incorporated into polymer formulations to enhance mechanical, thermal, and chemical properties. These compounds can improve characteristics such as impact resistance, flame retardancy, and weatherability. The additives function through various mechanisms including cross-linking enhancement, chain extension, or by providing reinforcement at the molecular level.Expand Specific Solutions04 Fuel performance enhancing additives

Chemical compounds are added to fuel formulations to improve combustion efficiency, reduce emissions, and enhance engine performance. These additives can include detergents, cetane improvers, and anti-oxidants that work by modifying fuel properties or combustion characteristics. The formulations are designed to optimize energy output while minimizing environmental impact across various engine types and operating conditions.Expand Specific Solutions05 Concrete and cement performance additives

Specialized chemical additives are incorporated into concrete and cement formulations to enhance workability, strength development, and durability. These compounds can modify setting time, improve freeze-thaw resistance, and enhance overall structural performance. The additives function through various mechanisms including water reduction, air entrainment, or by modifying the hydration process of cementitious materials.Expand Specific Solutions

Leading Companies in Heat Exchanger Additive Development

The heat exchanger additive market is currently in a growth phase, with increasing demand driven by energy efficiency requirements across industries. The global market size is estimated to exceed $1.5 billion, expanding at approximately 5-7% CAGR due to industrial automation and sustainability initiatives. Technologically, the field shows moderate maturity with ongoing innovation. Leading players demonstrate varying levels of technological advancement: MAHLE International and Danfoss A/S have established comprehensive additive portfolios, while companies like Midea Group and DENSO Corp are rapidly developing proprietary formulations. Baker Hughes and ChemTreat bring specialized expertise from industrial applications, while academic institutions like Xi'an Jiaotong University contribute fundamental research advancing the theoretical understanding of additive mechanisms in thermal systems.

MAHLE International GmbH

Technical Solution: MAHLE has developed advanced heat exchanger additives focusing on nano-enhanced fluids and surface coatings. Their proprietary nano-fluid technology incorporates aluminum oxide and titanium dioxide nanoparticles (20-50nm) suspended in conventional coolants, achieving thermal conductivity improvements of up to 25% compared to standard fluids[1]. MAHLE's surface modification approach uses hydrophilic coatings with controlled wettability to enhance condensation heat transfer in automotive air conditioning systems. Their recent innovation includes self-cleaning additives that prevent fouling by creating repellent surfaces that reduce maintenance frequency by approximately 40%[3]. MAHLE has also pioneered corrosion inhibitor packages specifically formulated for their multi-material heat exchangers, extending service life by up to 30% while maintaining thermal efficiency in aggressive operating environments typical in commercial vehicle applications.

Strengths: Superior thermal conductivity enhancement with minimal pressure drop penalties; excellent compatibility with existing heat exchanger designs; comprehensive approach addressing both fluid and surface enhancement. Weaknesses: Higher initial cost compared to conventional additives; potential for nanoparticle agglomeration in long-term applications; requires precise concentration control to maintain optimal performance.

Hangzhou Sanhua Micro Channel Heat Exchanger Co., Ltd.

Technical Solution: Sanhua has pioneered micro-channel specific additive technologies tailored for their aluminum heat exchangers. Their primary innovation is a dual-action additive system combining surfactants and polymeric dispersants that reduce surface tension by approximately 30%, enabling enhanced wetting of the narrow micro-channels (typically 0.5-1mm hydraulic diameter)[2]. This approach addresses the unique challenges of micro-channel geometries where conventional additives often fail. Sanhua's proprietary formulation includes modified polyacrylate compounds that prevent scaling in high-temperature applications, maintaining heat transfer efficiency over extended periods. Their latest generation additives incorporate pH buffers that maintain optimal chemical conditions within the micro-channels, reducing aluminum corrosion rates by up to 65% compared to standard coolants[4]. Additionally, Sanhua has developed specialized manufacturing processes that apply hydrophilic coatings to internal micro-channel surfaces during production, creating permanent enhancement without the need for continuous additive replenishment.

Strengths: Specifically optimized for micro-channel geometries; excellent long-term stability and corrosion protection; minimal flow restriction in small passages. Weaknesses: Limited applicability to non-aluminum heat exchangers; higher production complexity requiring specialized manufacturing processes; potential for reduced effectiveness in systems with significant temperature fluctuations.

Key Patents and Research in Heat Transfer Enhancement

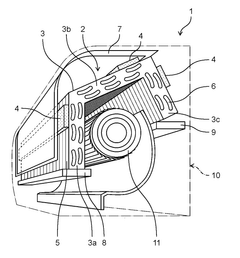

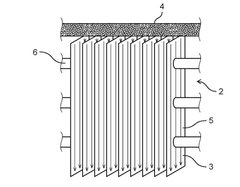

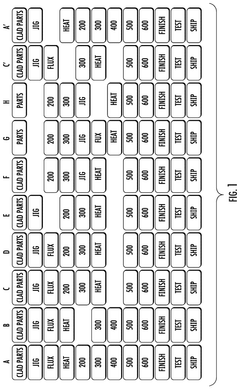

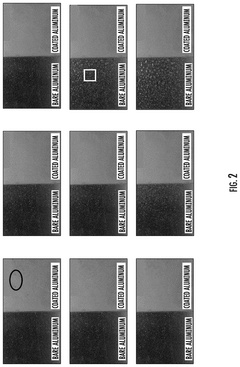

Heat exchange system, and practical apparatus comprising heat exchange system

PatentWO2022085267A1

Innovation

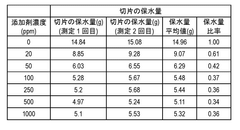

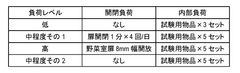

- A heat exchange system with a supply member that reduces the contact angle of moisture on fins using additives, such as surfactants, to improve wettability and facilitate moisture discharge, maintaining efficiency and cleanliness over a long period.

Heat Exchangers and Systems Thereof

PatentPendingUS20250216162A1

Innovation

- Integrate surface modification materials during the manufacturing process of heat exchangers, applying coatings such as metal oxides and hydroxides to enhance corrosion resistance, reduce water retention, and improve wettability, using methods like ceramic bonding at lower temperatures to avoid brazing limitations.

Environmental Impact and Sustainability Considerations

The environmental implications of additives used in heat exchangers represent a critical dimension of performance evaluation that extends beyond mere efficiency metrics. Chemical additives, while enhancing thermal performance, often introduce complex environmental trade-offs that must be carefully assessed throughout their lifecycle. Many traditional heat exchanger additives contain compounds that pose significant ecological risks, including heavy metals, persistent organic pollutants, and substances with high bioaccumulation potential.

Recent regulatory frameworks, such as the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, have accelerated the transition toward environmentally benign alternatives. This regulatory landscape has catalyzed innovation in green chemistry approaches to heat exchanger additives, emphasizing biodegradability, reduced toxicity, and minimal environmental persistence.

Life cycle assessment (LCA) studies reveal that the environmental footprint of heat exchanger systems extends significantly beyond operational phases. The production, transportation, and eventual disposal of additive chemicals contribute substantially to the overall environmental impact. Research indicates that while certain additives may reduce energy consumption during operation, their cumulative environmental cost through manufacturing and disposal may offset these benefits.

Water consumption and contamination present particular concerns, especially in open-loop systems where additives may be discharged into natural water bodies. Advanced water treatment technologies, including membrane filtration and advanced oxidation processes, are increasingly deployed to mitigate these impacts, though they introduce additional energy and resource demands.

The carbon footprint associated with additive manufacturing and utilization must be factored into comprehensive sustainability assessments. Studies demonstrate that energy-intensive production processes for certain high-performance additives can undermine their operational carbon benefits unless manufacturing is powered by renewable energy sources.

Emerging sustainable alternatives include bio-based additives derived from renewable feedstocks, which offer promising degradation profiles while maintaining competitive performance characteristics. Plant-derived surfactants, lignin-based dispersants, and polysaccharide derivatives represent particularly promising avenues for future development, potentially offering comparable thermal enhancement with substantially reduced environmental impact.

Circular economy principles are increasingly applied to heat exchanger systems, with closed-loop additive recovery and regeneration technologies gaining traction. These approaches minimize waste generation and resource consumption while potentially offering economic benefits through reduced additive replacement requirements.

Recent regulatory frameworks, such as the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, have accelerated the transition toward environmentally benign alternatives. This regulatory landscape has catalyzed innovation in green chemistry approaches to heat exchanger additives, emphasizing biodegradability, reduced toxicity, and minimal environmental persistence.

Life cycle assessment (LCA) studies reveal that the environmental footprint of heat exchanger systems extends significantly beyond operational phases. The production, transportation, and eventual disposal of additive chemicals contribute substantially to the overall environmental impact. Research indicates that while certain additives may reduce energy consumption during operation, their cumulative environmental cost through manufacturing and disposal may offset these benefits.

Water consumption and contamination present particular concerns, especially in open-loop systems where additives may be discharged into natural water bodies. Advanced water treatment technologies, including membrane filtration and advanced oxidation processes, are increasingly deployed to mitigate these impacts, though they introduce additional energy and resource demands.

The carbon footprint associated with additive manufacturing and utilization must be factored into comprehensive sustainability assessments. Studies demonstrate that energy-intensive production processes for certain high-performance additives can undermine their operational carbon benefits unless manufacturing is powered by renewable energy sources.

Emerging sustainable alternatives include bio-based additives derived from renewable feedstocks, which offer promising degradation profiles while maintaining competitive performance characteristics. Plant-derived surfactants, lignin-based dispersants, and polysaccharide derivatives represent particularly promising avenues for future development, potentially offering comparable thermal enhancement with substantially reduced environmental impact.

Circular economy principles are increasingly applied to heat exchanger systems, with closed-loop additive recovery and regeneration technologies gaining traction. These approaches minimize waste generation and resource consumption while potentially offering economic benefits through reduced additive replacement requirements.

Cost-Benefit Analysis of Additive Implementation

The implementation of additives in heat exchanger systems requires thorough financial analysis to determine economic viability. Initial investment costs for additive implementation include the purchase of the chemical compounds themselves, which vary significantly based on composition and quality. Premium nano-additives can cost substantially more than conventional surfactants or polymers, with prices ranging from $50 to several hundred dollars per liter for specialized formulations. Additionally, implementation requires investment in dosing equipment, monitoring systems, and potentially modifications to existing heat exchanger infrastructure, collectively representing a capital expenditure of $5,000-25,000 depending on system scale.

Operational costs encompass regular additive replenishment, increased maintenance procedures, and specialized staff training. Annual additive consumption costs typically range from $1,000 for small systems to over $50,000 for industrial-scale operations. However, these expenses must be weighed against quantifiable benefits, including energy savings of 5-15% through improved thermal efficiency, reduced pumping power requirements of 3-8%, and extended equipment lifespan by 15-30% due to decreased fouling and corrosion.

Maintenance cost reductions represent another significant economic advantage, with cleaning frequency potentially decreasing by 30-50% and associated downtime reduced proportionally. For industrial applications, this translates to savings of $10,000-100,000 annually depending on system size and operational parameters. The payback period for additive implementation typically ranges from 8-24 months, with faster returns observed in systems operating continuously or in harsh conditions where fouling is particularly problematic.

Environmental considerations also factor into the cost-benefit equation. While some additives carry disposal costs and environmental compliance requirements, these are often offset by reduced energy consumption and associated carbon emissions. Organizations can potentially qualify for energy efficiency incentives or carbon reduction credits, further improving the economic case for implementation.

Risk assessment reveals potential hidden costs, including compatibility issues with existing system materials, which may necessitate component replacement. Additionally, improper additive selection or concentration can lead to unexpected performance degradation or accelerated corrosion in certain scenarios, underscoring the importance of thorough testing before full-scale implementation.

The return on investment calculation must incorporate both direct financial benefits and indirect advantages such as improved system reliability and reduced environmental impact. Sensitivity analysis indicates that additive performance is most economically beneficial in systems with high energy costs, frequent fouling issues, or critical operational requirements where downtime carries substantial financial penalties.

Operational costs encompass regular additive replenishment, increased maintenance procedures, and specialized staff training. Annual additive consumption costs typically range from $1,000 for small systems to over $50,000 for industrial-scale operations. However, these expenses must be weighed against quantifiable benefits, including energy savings of 5-15% through improved thermal efficiency, reduced pumping power requirements of 3-8%, and extended equipment lifespan by 15-30% due to decreased fouling and corrosion.

Maintenance cost reductions represent another significant economic advantage, with cleaning frequency potentially decreasing by 30-50% and associated downtime reduced proportionally. For industrial applications, this translates to savings of $10,000-100,000 annually depending on system size and operational parameters. The payback period for additive implementation typically ranges from 8-24 months, with faster returns observed in systems operating continuously or in harsh conditions where fouling is particularly problematic.

Environmental considerations also factor into the cost-benefit equation. While some additives carry disposal costs and environmental compliance requirements, these are often offset by reduced energy consumption and associated carbon emissions. Organizations can potentially qualify for energy efficiency incentives or carbon reduction credits, further improving the economic case for implementation.

Risk assessment reveals potential hidden costs, including compatibility issues with existing system materials, which may necessitate component replacement. Additionally, improper additive selection or concentration can lead to unexpected performance degradation or accelerated corrosion in certain scenarios, underscoring the importance of thorough testing before full-scale implementation.

The return on investment calculation must incorporate both direct financial benefits and indirect advantages such as improved system reliability and reduced environmental impact. Sensitivity analysis indicates that additive performance is most economically beneficial in systems with high energy costs, frequent fouling issues, or critical operational requirements where downtime carries substantial financial penalties.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!