Flexible Electronics Vs Glass Fibers: Cost-Performance Balance

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Electronics and Glass Fibers: Evolution and Objectives

Flexible electronics and glass fibers represent two distinct technological trajectories that have evolved significantly over the past decades. Flexible electronics emerged in the 1960s with the development of thin-film transistors, but gained substantial momentum in the 1990s with the advent of organic semiconductors and conductive polymers. This technology enables electronic circuits to be printed on flexible substrates such as plastic, paper, or fabric, allowing for bendable, stretchable, and conformable electronic devices.

Glass fibers, conversely, have a longer industrial history dating back to the 1930s when they were first mass-produced for insulation purposes. The optical transmission capabilities of glass fibers were recognized in the 1950s, leading to the development of fiber optics for telecommunications in the 1970s. Since then, glass fiber technology has evolved to support increasingly higher data transmission rates and greater durability.

The technological evolution of flexible electronics has been driven by the pursuit of lightweight, conformable, and potentially lower-cost alternatives to rigid electronics. Key milestones include the development of organic light-emitting diodes (OLEDs) in the 1980s, flexible displays in the early 2000s, and more recently, stretchable electronics that can withstand significant deformation while maintaining functionality.

Glass fiber technology has evolved along a different path, focusing on improving signal transmission quality, reducing attenuation, increasing bandwidth capacity, and enhancing mechanical strength. The introduction of single-mode fibers in the 1980s and photonic crystal fibers in the 1990s represented significant advances in this field.

The convergence of these technologies presents interesting possibilities and challenges. While traditionally separate, there are emerging applications where flexible electronics and glass fibers complement each other, such as in smart textiles incorporating both technologies for sensing and communication functions.

The primary objective in comparing flexible electronics and glass fibers is to establish a comprehensive cost-performance framework that enables informed decision-making for specific applications. This includes evaluating manufacturing scalability, material costs, durability under various environmental conditions, energy efficiency, and performance metrics relevant to particular use cases.

Additionally, this technological assessment aims to identify potential synergies between these technologies and opportunities for hybrid solutions that leverage the strengths of both approaches. Understanding the fundamental trade-offs between flexibility, durability, cost, and performance will guide future research directions and investment priorities in these complementary technological domains.

Glass fibers, conversely, have a longer industrial history dating back to the 1930s when they were first mass-produced for insulation purposes. The optical transmission capabilities of glass fibers were recognized in the 1950s, leading to the development of fiber optics for telecommunications in the 1970s. Since then, glass fiber technology has evolved to support increasingly higher data transmission rates and greater durability.

The technological evolution of flexible electronics has been driven by the pursuit of lightweight, conformable, and potentially lower-cost alternatives to rigid electronics. Key milestones include the development of organic light-emitting diodes (OLEDs) in the 1980s, flexible displays in the early 2000s, and more recently, stretchable electronics that can withstand significant deformation while maintaining functionality.

Glass fiber technology has evolved along a different path, focusing on improving signal transmission quality, reducing attenuation, increasing bandwidth capacity, and enhancing mechanical strength. The introduction of single-mode fibers in the 1980s and photonic crystal fibers in the 1990s represented significant advances in this field.

The convergence of these technologies presents interesting possibilities and challenges. While traditionally separate, there are emerging applications where flexible electronics and glass fibers complement each other, such as in smart textiles incorporating both technologies for sensing and communication functions.

The primary objective in comparing flexible electronics and glass fibers is to establish a comprehensive cost-performance framework that enables informed decision-making for specific applications. This includes evaluating manufacturing scalability, material costs, durability under various environmental conditions, energy efficiency, and performance metrics relevant to particular use cases.

Additionally, this technological assessment aims to identify potential synergies between these technologies and opportunities for hybrid solutions that leverage the strengths of both approaches. Understanding the fundamental trade-offs between flexibility, durability, cost, and performance will guide future research directions and investment priorities in these complementary technological domains.

Market Demand Analysis for Flexible vs Rigid Electronic Solutions

The flexible electronics market has witnessed substantial growth in recent years, driven by increasing demand for lightweight, portable, and wearable devices. Market research indicates that the global flexible electronics market is projected to reach $42 billion by 2027, growing at a CAGR of approximately 11% from 2022. This growth trajectory significantly outpaces traditional rigid electronic solutions, which maintain a larger but slower-growing market share.

Consumer electronics represents the largest application segment for flexible electronics, accounting for nearly 40% of market demand. The healthcare sector follows closely, with wearable medical devices and smart health monitoring systems driving adoption. Automotive and aerospace industries are emerging as high-potential markets, particularly for flexible displays and sensors that can conform to non-planar surfaces.

Despite the promising growth, cost remains a significant barrier to widespread adoption of flexible electronics. Current manufacturing processes for flexible substrates and components can be 30-50% more expensive than traditional rigid electronics production. This cost differential is particularly pronounced in high-volume consumer applications where price sensitivity is high.

Performance considerations also influence market demand patterns. While rigid solutions based on glass fibers offer superior thermal stability and electrical performance in demanding environments, flexible electronics provide unique advantages in space-constrained applications and those requiring mechanical flexibility. Market research shows that 68% of electronics manufacturers are actively seeking solutions that balance these performance attributes with reasonable cost structures.

Regional analysis reveals varying adoption patterns. Asia-Pacific leads in flexible electronics manufacturing capacity, with South Korea, Japan, and Taiwan housing major production facilities. North America and Europe demonstrate stronger demand in specialized applications such as medical devices and defense electronics, where performance requirements often outweigh cost considerations.

Industry surveys indicate that 73% of electronics design engineers anticipate incorporating flexible components into their products within the next five years. However, 62% cite cost as the primary obstacle to immediate implementation. This suggests a significant latent demand that could be unlocked through manufacturing innovations that reduce production costs.

The market is increasingly segmented between high-performance applications where rigid solutions remain dominant and emerging use cases where flexibility offers compelling advantages. This bifurcation is expected to persist, with flexible electronics gradually expanding into new application domains as manufacturing economies of scale improve the cost-performance balance.

Consumer electronics represents the largest application segment for flexible electronics, accounting for nearly 40% of market demand. The healthcare sector follows closely, with wearable medical devices and smart health monitoring systems driving adoption. Automotive and aerospace industries are emerging as high-potential markets, particularly for flexible displays and sensors that can conform to non-planar surfaces.

Despite the promising growth, cost remains a significant barrier to widespread adoption of flexible electronics. Current manufacturing processes for flexible substrates and components can be 30-50% more expensive than traditional rigid electronics production. This cost differential is particularly pronounced in high-volume consumer applications where price sensitivity is high.

Performance considerations also influence market demand patterns. While rigid solutions based on glass fibers offer superior thermal stability and electrical performance in demanding environments, flexible electronics provide unique advantages in space-constrained applications and those requiring mechanical flexibility. Market research shows that 68% of electronics manufacturers are actively seeking solutions that balance these performance attributes with reasonable cost structures.

Regional analysis reveals varying adoption patterns. Asia-Pacific leads in flexible electronics manufacturing capacity, with South Korea, Japan, and Taiwan housing major production facilities. North America and Europe demonstrate stronger demand in specialized applications such as medical devices and defense electronics, where performance requirements often outweigh cost considerations.

Industry surveys indicate that 73% of electronics design engineers anticipate incorporating flexible components into their products within the next five years. However, 62% cite cost as the primary obstacle to immediate implementation. This suggests a significant latent demand that could be unlocked through manufacturing innovations that reduce production costs.

The market is increasingly segmented between high-performance applications where rigid solutions remain dominant and emerging use cases where flexibility offers compelling advantages. This bifurcation is expected to persist, with flexible electronics gradually expanding into new application domains as manufacturing economies of scale improve the cost-performance balance.

Technical Challenges and Current Limitations in Both Technologies

Despite significant advancements in both flexible electronics and glass fiber technologies, each faces distinct technical challenges that impact their cost-performance balance. Flexible electronics currently struggle with durability issues, as repeated bending and folding can lead to microscopic fractures in conductive pathways. This degradation significantly reduces device lifespan compared to rigid alternatives, particularly in high-stress applications. Additionally, manufacturing yields remain problematic, with defect rates during production of flexible substrates substantially higher than those for conventional electronics, driving up costs.

Performance limitations also persist in flexible electronics. Electron mobility in flexible semiconductor materials typically achieves only 10-30% of the performance seen in crystalline silicon, resulting in slower processing speeds and higher power consumption. This creates a fundamental trade-off between flexibility and computational capability that engineers must constantly navigate.

For glass fiber technology, manufacturing precision presents a major challenge. The production of high-quality optical fibers requires extraordinarily precise control of material purity and dimensional consistency. Even minor variations in the core-cladding interface can dramatically increase signal attenuation, limiting effective transmission distances. The drawing process for ultra-thin fibers also faces yield challenges at industrial scales, particularly for specialty fibers with complex refractive index profiles.

Temperature sensitivity remains problematic for both technologies. Flexible electronics experience significant performance drift across operating temperature ranges, with conductivity and semiconductor characteristics changing unpredictably in extreme conditions. Glass fibers, while more stable, still suffer from thermal expansion issues that can cause signal degradation in environments with rapid temperature fluctuations.

Cost factors create additional barriers to widespread adoption. For flexible electronics, the specialized materials required (including transparent conductive oxides and flexible substrates) remain significantly more expensive than traditional rigid circuit board materials. Similarly, the high-purity silica and complex doping compounds needed for advanced optical fibers drive up production costs, particularly for specialty applications requiring rare-earth elements.

Integration challenges further complicate implementation. Flexible electronics often require specialized interconnect solutions that maintain functionality during flexing, adding complexity and cost. Glass fiber systems demand precise alignment tolerances measured in micrometers, necessitating expensive positioning equipment and skilled technicians for installation and maintenance.

These technical limitations create a complex landscape where engineers must carefully balance performance requirements against cost constraints, often making application-specific compromises that limit the universal applicability of either technology.

Performance limitations also persist in flexible electronics. Electron mobility in flexible semiconductor materials typically achieves only 10-30% of the performance seen in crystalline silicon, resulting in slower processing speeds and higher power consumption. This creates a fundamental trade-off between flexibility and computational capability that engineers must constantly navigate.

For glass fiber technology, manufacturing precision presents a major challenge. The production of high-quality optical fibers requires extraordinarily precise control of material purity and dimensional consistency. Even minor variations in the core-cladding interface can dramatically increase signal attenuation, limiting effective transmission distances. The drawing process for ultra-thin fibers also faces yield challenges at industrial scales, particularly for specialty fibers with complex refractive index profiles.

Temperature sensitivity remains problematic for both technologies. Flexible electronics experience significant performance drift across operating temperature ranges, with conductivity and semiconductor characteristics changing unpredictably in extreme conditions. Glass fibers, while more stable, still suffer from thermal expansion issues that can cause signal degradation in environments with rapid temperature fluctuations.

Cost factors create additional barriers to widespread adoption. For flexible electronics, the specialized materials required (including transparent conductive oxides and flexible substrates) remain significantly more expensive than traditional rigid circuit board materials. Similarly, the high-purity silica and complex doping compounds needed for advanced optical fibers drive up production costs, particularly for specialty applications requiring rare-earth elements.

Integration challenges further complicate implementation. Flexible electronics often require specialized interconnect solutions that maintain functionality during flexing, adding complexity and cost. Glass fiber systems demand precise alignment tolerances measured in micrometers, necessitating expensive positioning equipment and skilled technicians for installation and maintenance.

These technical limitations create a complex landscape where engineers must carefully balance performance requirements against cost constraints, often making application-specific compromises that limit the universal applicability of either technology.

Current Cost-Performance Trade-off Solutions

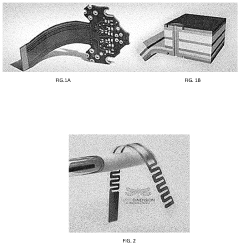

01 Glass fiber reinforced flexible electronic substrates

Glass fibers can be incorporated into flexible electronic substrates to enhance mechanical strength while maintaining flexibility. These composite materials offer improved dimensional stability and thermal resistance compared to purely polymer-based substrates. The integration of glass fibers in specific orientations and concentrations allows manufacturers to achieve an optimal balance between flexibility and durability, making these materials suitable for applications requiring both bendability and structural integrity.- Glass fiber reinforced flexible electronic substrates: Glass fibers can be incorporated into flexible electronic substrates to enhance mechanical strength while maintaining flexibility. These composite materials offer improved dimensional stability and thermal resistance compared to purely polymer-based substrates. The integration of glass fibers in specific orientations and concentrations allows manufacturers to optimize the balance between flexibility and durability, resulting in cost-effective solutions for flexible electronic applications.

- Cost-effective manufacturing processes for flexible glass electronics: Various manufacturing techniques have been developed to balance the cost and performance of flexible glass-based electronics. These include roll-to-roll processing, selective glass fiber placement, and hybrid manufacturing approaches that combine traditional and advanced fabrication methods. These processes aim to reduce material waste, energy consumption, and production time while maintaining the high performance characteristics required for flexible electronic applications.

- Optical and electrical performance optimization in glass fiber flexible electronics: Glass fibers can be engineered to enhance both the optical and electrical properties of flexible electronic devices. By controlling the composition, diameter, and surface treatment of glass fibers, manufacturers can achieve optimal light transmission, signal integrity, and electromagnetic shielding. These optimizations contribute to improved device performance while maintaining cost-effectiveness through reduced material usage and enhanced functionality.

- Durability and environmental resistance of glass fiber flexible electronics: Glass fiber reinforced flexible electronics demonstrate superior durability and resistance to environmental factors compared to conventional flexible substrates. The incorporation of glass fibers provides enhanced resistance to moisture, chemicals, temperature fluctuations, and mechanical stress. This improved durability extends the lifespan of flexible electronic devices, offering better long-term cost performance despite potentially higher initial manufacturing costs.

- Novel glass fiber compositions and structures for flexible electronics: Innovative glass fiber compositions and structural arrangements have been developed specifically for flexible electronic applications. These include ultra-thin glass fibers, specialized glass formulations with enhanced flexibility, and hierarchical structures that distribute mechanical stress. These advancements allow for thinner, lighter, and more flexible electronic devices while maintaining essential performance characteristics and addressing cost considerations through material efficiency and multifunctionality.

02 Cost-effective manufacturing processes for glass fiber electronics

Various manufacturing techniques have been developed to balance the cost and performance of glass fiber-based flexible electronics. These include specialized lamination processes, selective fiber placement, and hybrid manufacturing approaches that combine traditional electronics fabrication with textile processing methods. These processes aim to reduce production costs while maintaining the high performance characteristics of glass fiber reinforced electronic components, enabling more widespread commercial adoption.Expand Specific Solutions03 Optical and electrical properties optimization

The integration of glass fibers in flexible electronics requires careful optimization of both optical and electrical properties. Specialized coatings and treatments for glass fibers can enhance their compatibility with conductive elements while maintaining transparency where needed. This balance is crucial for applications such as flexible displays, photovoltaics, and sensing devices where both light transmission and electrical conductivity are essential performance parameters.Expand Specific Solutions04 Durability and environmental resistance enhancements

Glass fiber reinforcement significantly improves the environmental resistance of flexible electronic devices. These composite materials demonstrate superior resistance to moisture, chemicals, and temperature fluctuations compared to conventional flexible substrates. Special surface treatments and fiber compositions can be tailored to specific environmental challenges, creating a cost-effective approach to extending device lifespan and reliability in harsh operating conditions.Expand Specific Solutions05 Novel glass fiber compositions for specialized electronic applications

Advanced glass fiber formulations have been developed specifically for flexible electronics applications. These include ultra-thin fibers, specialized glass compositions with enhanced electrical properties, and hybrid organic-inorganic materials. These novel materials offer improved performance characteristics such as higher bend radius tolerance, better thermal management, and enhanced signal integrity, while maintaining a reasonable cost structure for commercial viability.Expand Specific Solutions

Industry Leaders and Competitive Landscape Analysis

The flexible electronics market is experiencing rapid growth, currently in its early commercialization phase with an expanding market size driven by consumer electronics applications. While glass fibers offer established reliability and lower production costs, flexible electronics provide superior design versatility and adaptability for emerging applications. Leading players like Samsung Electronics and BOE Technology are advancing flexible display technologies, while Corning and Jushi Group dominate the glass fiber sector with mature manufacturing processes. Companies such as Liquid Wire and Industrial Technology Research Institute are developing hybrid solutions that balance cost and performance. The technology landscape is evolving toward specialized applications where each material's unique properties can be optimally leveraged, with cost-performance considerations driving adoption in different market segments.

Samsung Electronics Co., Ltd.

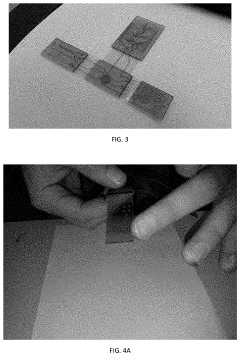

Technical Solution: Samsung Electronics has developed advanced flexible electronics technologies that utilize ultra-thin polyimide substrates with thickness below 100 micrometers to create bendable and foldable displays. Their approach incorporates low-temperature polysilicon (LTPS) and organic light-emitting diode (OLED) technologies to achieve flexibility while maintaining electronic performance. Samsung's solution includes a neutral plane design that positions sensitive electronic components at the center of the bending radius to minimize strain during flexing. They've also pioneered stretchable interconnect technologies using serpentine metal traces that can accommodate up to 30% strain without performance degradation. Their manufacturing process employs roll-to-roll techniques that significantly reduce production costs compared to traditional batch processing methods used in rigid electronics manufacturing.

Strengths: Superior flexibility allowing for novel form factors like foldable phones; lower weight compared to glass-based solutions; improved durability against drops and impacts; potential for higher volume manufacturing through roll-to-roll processing. Weaknesses: Higher initial production costs; lower thermal stability compared to glass fiber solutions; potential reliability issues at fold points over extended use cycles.

Corning, Inc.

Technical Solution: Corning has developed specialized glass fiber solutions that compete directly with flexible electronics through their Willow Glass technology. This ultra-thin (100 micrometers or less) flexible glass maintains the superior optical clarity, thermal stability, and barrier properties of traditional glass while offering limited flexibility. Their manufacturing process utilizes a proprietary fusion draw process that creates atomically smooth surfaces without requiring polishing, significantly reducing production costs. Corning's glass fibers provide exceptional dimensional stability under thermal stress (withstanding temperatures up to 600°C) and superior barrier properties against oxygen and moisture penetration (water vapor transmission rates below 10^-6 g/m²/day). They've also developed specialized handling systems that enable roll-to-roll processing of their glass materials, addressing one of the traditional limitations of glass in high-volume manufacturing scenarios.

Strengths: Superior optical transparency (>99% transmission); excellent barrier properties against moisture and oxygen; exceptional thermal stability; chemical resistance; established manufacturing infrastructure. Weaknesses: Limited flexibility compared to polymer-based electronics; higher brittleness requiring specialized handling; higher weight than polymer alternatives; more complex integration with electronic components.

Key Patents and Technical Breakthroughs in Material Science

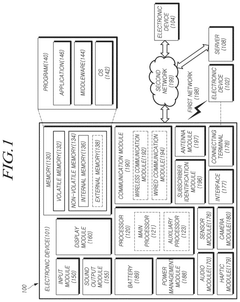

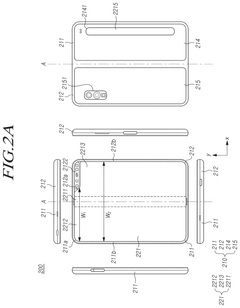

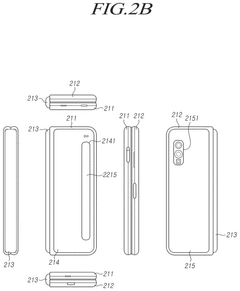

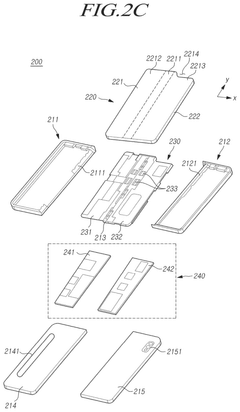

Flexible electronic device

PatentPendingUS20250008010A1

Innovation

- A flexible electronic device design featuring a patterned window with geometric and rib patterns that enhance impact resistance by distributing external forces, incorporating a composite stacked structure with a display panel, adhesive layers, and a protective layer, allowing for both flexibility and durability.

Rigid-flexible printed circuit bord fabrication using inkjet printing

PatentActiveUS20200037451A1

Innovation

- The use of a multi-head inkjet printing system with flexible and rigid conductive and dielectric ink compositions, allowing for direct printing of rigid-flexible electronic objects, which includes a combination of print heads for resin, metallic, and conductive inks, controlled by a computer-aided manufacturing module for precise layer formation and curing.

Manufacturing Process Comparison and Scalability Assessment

The manufacturing processes for flexible electronics and glass fibers represent two fundamentally different approaches with distinct implications for cost structure, production efficiency, and scalability. Flexible electronics typically employ additive manufacturing techniques such as printing, coating, and lamination on polymer substrates. These processes operate at relatively low temperatures (typically below 200°C) and can utilize roll-to-roll manufacturing for continuous production, significantly reducing per-unit costs at scale. However, the initial capital investment for specialized equipment remains substantial, with industrial-grade roll-to-roll systems costing between $1-5 million depending on complexity and precision requirements.

Glass fiber manufacturing, conversely, relies on high-temperature processes (1400-1600°C) involving drawing molten glass through platinum bushings to form continuous filaments. This energy-intensive process demands substantial thermal management infrastructure and specialized facilities. The established nature of glass fiber manufacturing means that production equipment is standardized and widely available, with lower technological barriers to entry compared to some cutting-edge flexible electronics processes.

Yield rates present a critical differentiator between these technologies. Current flexible electronics manufacturing achieves approximately 80-85% yield in optimized production environments, with defect rates increasing significantly as feature sizes decrease below 10 microns. Glass fiber manufacturing demonstrates more mature yield rates of 90-95%, reflecting decades of process optimization and standardization across the industry.

Scalability assessments reveal that flexible electronics benefit from theoretical advantages in throughput velocity, with modern roll-to-roll systems capable of processing 10-30 meters per minute. However, this advantage is often offset by more complex quality control requirements and greater sensitivity to environmental contaminants. Glass fiber manufacturing demonstrates robust scalability with established production lines capable of producing hundreds of kilometers of fiber daily with consistent quality parameters.

Environmental impact analyses indicate that flexible electronics manufacturing typically generates 30-40% less carbon emissions per functional unit compared to glass fiber production, primarily due to lower process temperatures. However, end-of-life recyclability currently favors glass fibers, with established recycling streams recovering approximately 25% of production waste compared to only 5-10% for flexible electronic components.

The labor intensity metrics reveal that glass fiber manufacturing has achieved greater automation, requiring approximately 0.3-0.5 labor hours per kilogram of finished product, while flexible electronics manufacturing currently demands 0.8-1.2 labor hours for equivalent functional output, reflecting the nascent state of process automation in this emerging field.

Glass fiber manufacturing, conversely, relies on high-temperature processes (1400-1600°C) involving drawing molten glass through platinum bushings to form continuous filaments. This energy-intensive process demands substantial thermal management infrastructure and specialized facilities. The established nature of glass fiber manufacturing means that production equipment is standardized and widely available, with lower technological barriers to entry compared to some cutting-edge flexible electronics processes.

Yield rates present a critical differentiator between these technologies. Current flexible electronics manufacturing achieves approximately 80-85% yield in optimized production environments, with defect rates increasing significantly as feature sizes decrease below 10 microns. Glass fiber manufacturing demonstrates more mature yield rates of 90-95%, reflecting decades of process optimization and standardization across the industry.

Scalability assessments reveal that flexible electronics benefit from theoretical advantages in throughput velocity, with modern roll-to-roll systems capable of processing 10-30 meters per minute. However, this advantage is often offset by more complex quality control requirements and greater sensitivity to environmental contaminants. Glass fiber manufacturing demonstrates robust scalability with established production lines capable of producing hundreds of kilometers of fiber daily with consistent quality parameters.

Environmental impact analyses indicate that flexible electronics manufacturing typically generates 30-40% less carbon emissions per functional unit compared to glass fiber production, primarily due to lower process temperatures. However, end-of-life recyclability currently favors glass fibers, with established recycling streams recovering approximately 25% of production waste compared to only 5-10% for flexible electronic components.

The labor intensity metrics reveal that glass fiber manufacturing has achieved greater automation, requiring approximately 0.3-0.5 labor hours per kilogram of finished product, while flexible electronics manufacturing currently demands 0.8-1.2 labor hours for equivalent functional output, reflecting the nascent state of process automation in this emerging field.

Environmental Impact and Sustainability Considerations

The environmental footprint of flexible electronics and glass fibers represents a critical dimension in their comparative analysis beyond mere cost and performance metrics. Flexible electronics manufacturing typically involves energy-intensive processes and potentially hazardous chemicals, including various solvents, etchants, and heavy metals. These materials pose significant environmental risks if not properly managed throughout the product lifecycle, from production to disposal.

Glass fiber production, while established and optimized over decades, consumes substantial energy during the high-temperature melting processes required for fiber drawing. However, the raw materials for glass fibers—primarily silica and various metal oxides—are generally abundant and less environmentally problematic than the rare earth elements and specialized compounds often required for advanced flexible electronic components.

Lifecycle assessment studies indicate that flexible electronics currently present greater end-of-life challenges. Their composite nature, combining multiple materials in thin layers, makes recycling technically difficult and often economically unfeasible. Conversely, glass fibers benefit from more established recycling infrastructures, though the recovery rates remain suboptimal in many regions due to contamination issues and the energy required to process used fibers.

Water consumption patterns differ significantly between these technologies. Flexible electronics manufacturing typically requires ultra-pure water for cleaning processes, generating substantial volumes of contaminated wastewater. Glass fiber production, while also water-intensive, generally produces less toxic effluent, though particulate emissions remain a concern.

Carbon footprint comparisons reveal that flexible electronics may offer advantages during the use phase through energy efficiency gains in final applications, potentially offsetting higher production impacts. This is particularly evident in applications like smart building materials, where flexible solar cells or sensors can contribute to overall system efficiency.

Emerging sustainable design approaches are addressing these environmental challenges. Bio-based substrates for flexible electronics and low-temperature manufacturing processes are reducing resource intensity, while glass fiber manufacturers are increasingly implementing closed-loop water systems and energy recovery technologies. Material innovation continues in both fields, with biodegradable polymers for flexible electronics and formulations that enable lower-temperature processing for glass fibers showing particular promise.

Regulatory frameworks worldwide are evolving to address the environmental implications of these technologies, with extended producer responsibility schemes and restrictions on hazardous substances increasingly shaping development trajectories and potentially altering the cost-performance equation as externalities become internalized in product pricing.

Glass fiber production, while established and optimized over decades, consumes substantial energy during the high-temperature melting processes required for fiber drawing. However, the raw materials for glass fibers—primarily silica and various metal oxides—are generally abundant and less environmentally problematic than the rare earth elements and specialized compounds often required for advanced flexible electronic components.

Lifecycle assessment studies indicate that flexible electronics currently present greater end-of-life challenges. Their composite nature, combining multiple materials in thin layers, makes recycling technically difficult and often economically unfeasible. Conversely, glass fibers benefit from more established recycling infrastructures, though the recovery rates remain suboptimal in many regions due to contamination issues and the energy required to process used fibers.

Water consumption patterns differ significantly between these technologies. Flexible electronics manufacturing typically requires ultra-pure water for cleaning processes, generating substantial volumes of contaminated wastewater. Glass fiber production, while also water-intensive, generally produces less toxic effluent, though particulate emissions remain a concern.

Carbon footprint comparisons reveal that flexible electronics may offer advantages during the use phase through energy efficiency gains in final applications, potentially offsetting higher production impacts. This is particularly evident in applications like smart building materials, where flexible solar cells or sensors can contribute to overall system efficiency.

Emerging sustainable design approaches are addressing these environmental challenges. Bio-based substrates for flexible electronics and low-temperature manufacturing processes are reducing resource intensity, while glass fiber manufacturers are increasingly implementing closed-loop water systems and energy recovery technologies. Material innovation continues in both fields, with biodegradable polymers for flexible electronics and formulations that enable lower-temperature processing for glass fibers showing particular promise.

Regulatory frameworks worldwide are evolving to address the environmental implications of these technologies, with extended producer responsibility schemes and restrictions on hazardous substances increasingly shaping development trajectories and potentially altering the cost-performance equation as externalities become internalized in product pricing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!