Flexible Electronics Vs Traditional Components: Cost Efficiency Metrics

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible Electronics Evolution and Objectives

Flexible electronics represents a revolutionary departure from conventional rigid electronic components, evolving from early experiments with conductive polymers in the 1970s to today's sophisticated flexible displays, sensors, and circuits. This technological evolution has been driven by the fundamental limitations of traditional electronics, particularly in applications requiring conformability, lightweight design, and integration with non-planar surfaces.

The development trajectory of flexible electronics has witnessed several pivotal milestones. The 1990s marked the emergence of organic light-emitting diodes (OLEDs) on flexible substrates, while the early 2000s saw significant advancements in flexible thin-film transistors. The 2010s brought breakthroughs in materials science, including stretchable conductors and semiconductors, enabling electronics that can bend, fold, and stretch while maintaining functionality.

Cost efficiency metrics between flexible electronics and traditional components have historically favored conventional technologies due to established manufacturing infrastructure and economies of scale. Traditional silicon-based electronics benefit from decades of process optimization and massive production volumes, resulting in predictable and often lower per-unit costs. However, this cost advantage is increasingly challenged as flexible electronics manufacturing techniques mature.

The primary objectives of current flexible electronics development center on achieving cost parity with traditional components while leveraging unique advantages in form factor and functionality. This includes developing scalable manufacturing processes that reduce production costs, improving yield rates, and extending device lifetimes to compete with the reliability of conventional electronics.

Material innovation represents another critical objective, focusing on alternatives to expensive materials like indium tin oxide (ITO) commonly used in flexible displays. Researchers are exploring carbon-based conductors, silver nanowires, and other novel materials that offer comparable performance at reduced costs.

Energy efficiency metrics also factor prominently in the comparison between flexible and traditional electronics. While flexible devices often require less material and can potentially operate with lower power consumption, manufacturing processes for flexible electronics currently tend to be more energy-intensive per functional unit, presenting opportunities for optimization.

The long-term technological goal is to establish flexible electronics not merely as an alternative to traditional components but as a preferred solution in applications where conformability, weight, and integration capabilities deliver substantial value that offsets any remaining cost premium. This transition requires continued innovation in materials, manufacturing processes, and design methodologies to achieve cost efficiency metrics that make flexible electronics commercially viable across broader market segments.

The development trajectory of flexible electronics has witnessed several pivotal milestones. The 1990s marked the emergence of organic light-emitting diodes (OLEDs) on flexible substrates, while the early 2000s saw significant advancements in flexible thin-film transistors. The 2010s brought breakthroughs in materials science, including stretchable conductors and semiconductors, enabling electronics that can bend, fold, and stretch while maintaining functionality.

Cost efficiency metrics between flexible electronics and traditional components have historically favored conventional technologies due to established manufacturing infrastructure and economies of scale. Traditional silicon-based electronics benefit from decades of process optimization and massive production volumes, resulting in predictable and often lower per-unit costs. However, this cost advantage is increasingly challenged as flexible electronics manufacturing techniques mature.

The primary objectives of current flexible electronics development center on achieving cost parity with traditional components while leveraging unique advantages in form factor and functionality. This includes developing scalable manufacturing processes that reduce production costs, improving yield rates, and extending device lifetimes to compete with the reliability of conventional electronics.

Material innovation represents another critical objective, focusing on alternatives to expensive materials like indium tin oxide (ITO) commonly used in flexible displays. Researchers are exploring carbon-based conductors, silver nanowires, and other novel materials that offer comparable performance at reduced costs.

Energy efficiency metrics also factor prominently in the comparison between flexible and traditional electronics. While flexible devices often require less material and can potentially operate with lower power consumption, manufacturing processes for flexible electronics currently tend to be more energy-intensive per functional unit, presenting opportunities for optimization.

The long-term technological goal is to establish flexible electronics not merely as an alternative to traditional components but as a preferred solution in applications where conformability, weight, and integration capabilities deliver substantial value that offsets any remaining cost premium. This transition requires continued innovation in materials, manufacturing processes, and design methodologies to achieve cost efficiency metrics that make flexible electronics commercially viable across broader market segments.

Market Demand Analysis for Flexible Electronic Solutions

The global market for flexible electronics has been experiencing robust growth, with a compound annual growth rate (CAGR) exceeding 11% since 2018. This acceleration is primarily driven by increasing demand across multiple sectors including consumer electronics, healthcare, automotive, and aerospace industries. Market research indicates that the flexible electronics market is projected to reach approximately $42 billion by 2027, reflecting the expanding applications and growing consumer preference for portable, lightweight, and adaptable electronic solutions.

Consumer electronics remains the dominant sector for flexible electronics adoption, accounting for nearly 40% of the total market share. The demand for wearable devices, foldable smartphones, and curved displays has created significant market pull for flexible electronic components. Healthcare applications represent the fastest-growing segment, with a CAGR of approximately 15%, fueled by innovations in flexible biosensors, smart patches, and implantable medical devices that offer improved patient comfort and continuous monitoring capabilities.

Regional analysis reveals that Asia-Pacific currently leads the market with approximately 45% share, followed by North America and Europe. China, South Korea, and Japan are particularly significant manufacturing hubs, while North America and Europe demonstrate strong research and development activities. Emerging economies in Southeast Asia and Latin America are showing increasing adoption rates as manufacturing costs decrease and technology becomes more accessible.

Market surveys indicate that end-users are increasingly willing to pay premium prices for products incorporating flexible electronics, particularly when they offer tangible benefits in terms of durability, form factor, and functionality. However, price sensitivity remains a critical factor, with cost premiums exceeding 30% significantly limiting mass-market adoption. This highlights the importance of achieving cost efficiency in flexible electronics manufacturing to expand market penetration.

Industry forecasts suggest that as production scales and manufacturing processes mature, the cost differential between flexible and traditional rigid electronics will narrow considerably. Current estimates indicate that flexible electronics typically cost 40-60% more than their rigid counterparts, but this gap is expected to reduce to 15-25% within the next five years as economies of scale are realized and production yields improve.

Consumer behavior analysis reveals growing awareness and preference for sustainable and environmentally friendly electronic products. Flexible electronics offer advantages in this regard through potential material efficiency, reduced weight (leading to lower transportation emissions), and in some applications, extended product lifecycles. This alignment with sustainability trends represents an additional market driver that may accelerate adoption despite current cost premiums.

Consumer electronics remains the dominant sector for flexible electronics adoption, accounting for nearly 40% of the total market share. The demand for wearable devices, foldable smartphones, and curved displays has created significant market pull for flexible electronic components. Healthcare applications represent the fastest-growing segment, with a CAGR of approximately 15%, fueled by innovations in flexible biosensors, smart patches, and implantable medical devices that offer improved patient comfort and continuous monitoring capabilities.

Regional analysis reveals that Asia-Pacific currently leads the market with approximately 45% share, followed by North America and Europe. China, South Korea, and Japan are particularly significant manufacturing hubs, while North America and Europe demonstrate strong research and development activities. Emerging economies in Southeast Asia and Latin America are showing increasing adoption rates as manufacturing costs decrease and technology becomes more accessible.

Market surveys indicate that end-users are increasingly willing to pay premium prices for products incorporating flexible electronics, particularly when they offer tangible benefits in terms of durability, form factor, and functionality. However, price sensitivity remains a critical factor, with cost premiums exceeding 30% significantly limiting mass-market adoption. This highlights the importance of achieving cost efficiency in flexible electronics manufacturing to expand market penetration.

Industry forecasts suggest that as production scales and manufacturing processes mature, the cost differential between flexible and traditional rigid electronics will narrow considerably. Current estimates indicate that flexible electronics typically cost 40-60% more than their rigid counterparts, but this gap is expected to reduce to 15-25% within the next five years as economies of scale are realized and production yields improve.

Consumer behavior analysis reveals growing awareness and preference for sustainable and environmentally friendly electronic products. Flexible electronics offer advantages in this regard through potential material efficiency, reduced weight (leading to lower transportation emissions), and in some applications, extended product lifecycles. This alignment with sustainability trends represents an additional market driver that may accelerate adoption despite current cost premiums.

Current State and Challenges in Flexible Electronics Manufacturing

Flexible electronics manufacturing has evolved significantly over the past decade, yet remains in a transitional phase between laboratory innovation and mass production. Currently, the global market for flexible electronics stands at approximately $31.6 billion, with projections indicating growth to over $73 billion by 2027. Despite this promising trajectory, several critical challenges impede cost-efficient manufacturing at scale.

Production yield rates represent a primary concern, with current flexible electronics manufacturing achieving only 60-75% yield compared to 90-95% for traditional rigid electronics. This disparity directly impacts unit economics and overall cost efficiency. The primary contributing factors include material inconsistencies, handling complexities during production, and quality control challenges unique to flexible substrates.

Material costs continue to present significant barriers. Specialized substrates such as polyimide and PDMS typically cost 3-5 times more than traditional FR-4 circuit boards. Similarly, stretchable conductive inks and flexible semiconductors command premium prices due to limited production volumes and specialized formulations. These elevated material costs currently account for 40-60% of total production expenses in flexible electronics manufacturing.

Manufacturing infrastructure represents another substantial challenge. Existing electronics production facilities require significant modifications or complete redesigns to accommodate flexible substrates. The capital expenditure for converting traditional electronics manufacturing lines to flexible electronics production ranges from $15-50 million depending on scale and complexity. This investment barrier has limited widespread adoption to only the largest manufacturers.

Process integration challenges further complicate manufacturing efficiency. Traditional electronics manufacturing relies on established processes optimized over decades, while flexible electronics often require novel techniques such as roll-to-roll processing, laser direct structuring, and specialized bonding methods. The integration of these processes into cohesive production systems remains technically challenging and resource-intensive.

Quality control methodologies for flexible electronics present unique difficulties. Traditional testing equipment and protocols are often inadequate for evaluating performance under bending, stretching, and other mechanical stresses. New testing paradigms are still being developed, with standardization efforts lagging behind innovation.

Geographically, flexible electronics manufacturing capabilities are concentrated primarily in East Asia (particularly Japan, South Korea, and Taiwan), with emerging capacity in North America and Europe. This concentration creates supply chain vulnerabilities and potential bottlenecks in global production capacity.

Regulatory frameworks and industry standards for flexible electronics remain underdeveloped compared to traditional electronics manufacturing. This regulatory uncertainty adds complexity to production planning and quality assurance processes, further impacting cost efficiency metrics when comparing flexible solutions to traditional components.

Production yield rates represent a primary concern, with current flexible electronics manufacturing achieving only 60-75% yield compared to 90-95% for traditional rigid electronics. This disparity directly impacts unit economics and overall cost efficiency. The primary contributing factors include material inconsistencies, handling complexities during production, and quality control challenges unique to flexible substrates.

Material costs continue to present significant barriers. Specialized substrates such as polyimide and PDMS typically cost 3-5 times more than traditional FR-4 circuit boards. Similarly, stretchable conductive inks and flexible semiconductors command premium prices due to limited production volumes and specialized formulations. These elevated material costs currently account for 40-60% of total production expenses in flexible electronics manufacturing.

Manufacturing infrastructure represents another substantial challenge. Existing electronics production facilities require significant modifications or complete redesigns to accommodate flexible substrates. The capital expenditure for converting traditional electronics manufacturing lines to flexible electronics production ranges from $15-50 million depending on scale and complexity. This investment barrier has limited widespread adoption to only the largest manufacturers.

Process integration challenges further complicate manufacturing efficiency. Traditional electronics manufacturing relies on established processes optimized over decades, while flexible electronics often require novel techniques such as roll-to-roll processing, laser direct structuring, and specialized bonding methods. The integration of these processes into cohesive production systems remains technically challenging and resource-intensive.

Quality control methodologies for flexible electronics present unique difficulties. Traditional testing equipment and protocols are often inadequate for evaluating performance under bending, stretching, and other mechanical stresses. New testing paradigms are still being developed, with standardization efforts lagging behind innovation.

Geographically, flexible electronics manufacturing capabilities are concentrated primarily in East Asia (particularly Japan, South Korea, and Taiwan), with emerging capacity in North America and Europe. This concentration creates supply chain vulnerabilities and potential bottlenecks in global production capacity.

Regulatory frameworks and industry standards for flexible electronics remain underdeveloped compared to traditional electronics manufacturing. This regulatory uncertainty adds complexity to production planning and quality assurance processes, further impacting cost efficiency metrics when comparing flexible solutions to traditional components.

Cost Comparison Methodologies: Flexible vs Traditional Electronics

01 Manufacturing cost comparison between flexible and traditional electronics

Flexible electronics often require specialized manufacturing processes that can initially be more expensive than traditional component production. However, advancements in roll-to-roll processing and printed electronics are gradually reducing these costs. The initial investment in flexible electronics manufacturing equipment remains higher, but the gap is narrowing as technology matures and economies of scale are achieved.- Manufacturing cost comparison between flexible and traditional electronics: Flexible electronics often have higher initial manufacturing costs compared to traditional rigid components due to specialized materials and production processes. However, these costs can be offset by reduced assembly complexity, lower material usage, and the ability to produce components in continuous roll-to-roll processes rather than batch manufacturing. The overall cost efficiency depends on production volume, with flexible electronics becoming more cost-competitive at larger scales.

- Material cost considerations in flexible electronics: Flexible electronic components utilize specialized materials such as conductive polymers, flexible substrates, and stretchable conductors that typically cost more than traditional rigid materials like silicon and FR4 circuit boards. However, these materials often allow for thinner designs and reduced overall material usage. The durability of flexible materials can also lead to longer product lifespans and lower replacement costs, improving the long-term cost efficiency despite higher initial material investments.

- Energy efficiency and operational cost benefits: Flexible electronic systems often consume less power than their traditional counterparts due to their lightweight nature and optimized designs. The reduced energy consumption translates to lower operational costs over the product lifecycle. Additionally, flexible electronics can be integrated with energy harvesting technologies more effectively, further reducing power requirements and associated costs. These operational savings can significantly offset the higher initial investment in flexible electronic components.

- Integration and assembly cost advantages: Flexible electronics offer significant cost advantages in system integration and assembly compared to traditional components. Their conformable nature allows for simplified installation in complex geometries and curved surfaces, reducing assembly time and labor costs. The ability to combine multiple functions on a single flexible substrate eliminates the need for numerous discrete components and interconnects, streamlining production processes and reducing overall system complexity and associated costs.

- Lifecycle cost analysis and sustainability factors: When evaluating the total cost of ownership, flexible electronics often demonstrate advantages in transportation, maintenance, and end-of-life disposal costs. Their lightweight nature reduces shipping expenses, while their durability can decrease maintenance requirements. Additionally, some flexible electronic materials are more easily recyclable or biodegradable than traditional components, potentially reducing environmental compliance costs and supporting sustainability initiatives. These lifecycle factors contribute to the overall cost efficiency comparison between flexible and traditional electronic systems.

02 Material cost efficiency in flexible electronics

Flexible electronics utilize specialized materials such as conductive polymers, flexible substrates, and stretchable inks that currently cost more than traditional rigid materials like silicon and fiberglass. However, these materials often require less quantity per device and can reduce waste during manufacturing. The development of new composite materials is further improving the cost-efficiency ratio for flexible electronic components.Expand Specific Solutions03 Lifecycle cost benefits of flexible electronics

While initial production costs may be higher, flexible electronics often demonstrate superior lifecycle cost efficiency. Their resistance to mechanical stress and ability to conform to various shapes results in fewer failures and longer operational lifespans in certain applications. Additionally, the reduced weight and volume of flexible components can lead to significant savings in transportation and installation costs over the product lifecycle.Expand Specific Solutions04 Energy consumption and operational efficiency

Flexible electronic systems typically consume less power than their traditional counterparts due to their lightweight nature and innovative circuit designs. This energy efficiency translates to lower operational costs over time, particularly in battery-powered or energy-harvesting applications. The thermal management advantages of flexible systems also contribute to reduced cooling requirements and associated energy costs in many implementations.Expand Specific Solutions05 Integration and system-level cost advantages

Flexible electronics enable novel integration approaches that can reduce overall system complexity and assembly costs. By conforming to available spaces and potentially eliminating connectors, housings, and mounting hardware, flexible systems can achieve significant cost reductions at the system level. This integration advantage becomes particularly evident in applications where space constraints or form factors would otherwise require complex and expensive traditional solutions.Expand Specific Solutions

Key Industry Players in Flexible Electronics Ecosystem

The flexible electronics market is experiencing rapid growth, transitioning from early adoption to mainstream commercialization, with a projected market size exceeding $40 billion by 2030. The technology maturity varies across applications, with companies demonstrating different specialization levels. Academic institutions like Arizona State University and North China Electric Power University are advancing fundamental research, while industrial players show varying degrees of commercialization success. Companies like Robert Bosch GmbH and Sumitomo Electric Industries have established strong positions in automotive applications, while Nano Dimension Technologies focuses on 3D printed electronics. State Grid companies and Phoenix Contact are exploring flexible electronics for power infrastructure, creating a competitive landscape where collaboration between research institutions and manufacturers is driving innovation and cost efficiency improvements.

Robert Bosch GmbH

Technical Solution: Bosch has developed an integrated approach to flexible electronics that focuses on automotive and industrial applications. Their technology platform combines traditional electronic components with flexible interconnect technologies to create robust systems for harsh environments. Bosch's manufacturing process utilizes automated precision placement of rigid components onto flexible substrates, with proprietary bonding techniques that maintain reliability under mechanical stress. Their cost efficiency metrics demonstrate a 25-35% reduction in assembly costs for complex electronic systems compared to traditional rigid PCB approaches. Bosch has particularly focused on optimizing the reliability-to-cost ratio, developing testing protocols that ensure flexible electronics meet automotive-grade durability standards while remaining cost-competitive. Their manufacturing approach incorporates design-for-manufacturing principles that reduce the number of process steps by approximately 40% compared to conventional electronics assembly. Bosch's flexible electronics solutions enable new form factors that reduce installation costs in vehicles and industrial equipment, with case studies showing overall system cost reductions of 15-20% when accounting for the entire product lifecycle.

Strengths: Exceptional reliability engineering ensures flexible electronics meet stringent automotive and industrial requirements. Strong integration with existing manufacturing infrastructure reduces implementation costs. Weaknesses: More conservative approach to flexible electronics limits some potential cost advantages. Solutions often more expensive than consumer-grade flexible electronics due to higher reliability requirements.

Nano Dimension Technologies Ltd.

Technical Solution: Nano Dimension has pioneered a revolutionary approach to flexible electronics manufacturing through their DragonFly additive manufacturing system. This platform utilizes proprietary materials and precision deposition technology to create multi-layer printed circuit boards (PCBs) with embedded components. Their system enables direct printing of both conductive and dielectric materials in a single process, eliminating traditional manufacturing steps. The company's AME (Additively Manufactured Electronics) technology allows for the creation of non-planar, conformal electronics that can be integrated into complex 3D structures. Their cost efficiency metrics demonstrate up to 80% reduction in prototyping costs compared to traditional PCB manufacturing, with production times reduced from weeks to hours. The technology enables rapid design iterations without tooling costs, significantly improving time-to-market for electronic products while reducing material waste by approximately 90% compared to subtractive manufacturing methods.

Strengths: Eliminates need for multiple manufacturing steps and tooling, dramatically reducing fixed costs for low-volume production. Enables complex geometries impossible with traditional manufacturing. Weaknesses: Higher material costs per unit compared to mass-produced traditional electronics, making it less cost-effective for very high-volume production. Limited to certain types of electronic components and materials.

Critical Technologies Enabling Cost-Efficient Flexible Electronics

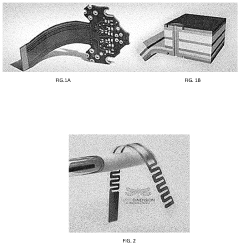

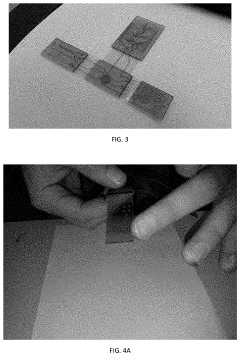

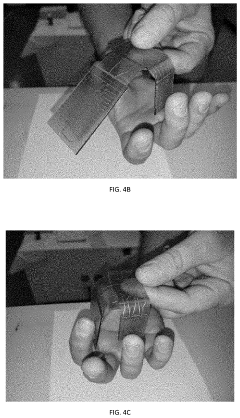

Flexible and conformal electronics using rigid substrates

PatentActiveUS20200092982A1

Innovation

- A flexible electronics assembly is created by geometrically modifying a single-piece substrate to include a localized region of flexibility with a lower rigidity than the surrounding regions, using compliant joints like lamina emergent torsional (LET) joints to allow angular deflection without stressing the electronic components, and incorporating electrically conducting traces for connectivity.

Rigid-flexible printed circuit bord fabrication using inkjet printing

PatentActiveUS20200037451A1

Innovation

- The use of a multi-head inkjet printing system with flexible and rigid conductive and dielectric ink compositions, allowing for direct printing of rigid-flexible electronic objects, which includes a combination of print heads for resin, metallic, and conductive inks, controlled by a computer-aided manufacturing module for precise layer formation and curing.

Supply Chain Considerations for Flexible Electronics Production

The flexible electronics supply chain differs fundamentally from traditional electronics manufacturing, presenting both unique challenges and opportunities for cost optimization. The production ecosystem begins with specialized raw materials, including conductive polymers, flexible substrates, and stretchable inks, which often have limited supplier networks compared to conventional electronics components. This supply constraint can lead to higher material costs and potential procurement vulnerabilities.

Manufacturing processes for flexible electronics require specialized equipment that differs significantly from traditional PCB production lines. While conventional electronics benefit from decades of manufacturing optimization and economies of scale, flexible electronics production often involves newer, less standardized processes such as roll-to-roll printing, laser direct structuring, and inkjet deposition technologies. The capital investment for these specialized production facilities remains high, though costs are gradually decreasing as adoption increases.

Inventory management presents another critical consideration in the flexible electronics supply chain. The shelf life of certain materials used in flexible electronics, particularly conductive inks and some polymer substrates, may be shorter than traditional components, requiring more sophisticated just-in-time inventory systems and potentially increasing logistics costs.

Transportation and handling requirements also differ substantially. Flexible components may require specialized packaging to prevent deformation during transit, yet simultaneously benefit from reduced weight and volume compared to rigid components. This duality creates opportunities for logistics cost savings in the later stages of the supply chain, particularly in shipping finished products to end markets.

Quality control processes represent a significant supply chain consideration, as testing methodologies for flexible electronics often require specialized equipment capable of evaluating performance under bending, stretching, or folding conditions. These unique testing requirements add complexity to the quality assurance process compared to traditional electronics manufacturing.

Regional manufacturing capabilities for flexible electronics remain concentrated in specific innovation hubs, primarily in East Asia, North America, and Western Europe. This geographic concentration can impact supply chain resilience and lead times, particularly when compared to the more globally distributed manufacturing ecosystem for traditional electronics components.

As production volumes increase, economies of scale are beginning to emerge, gradually reducing the cost differential between flexible and traditional electronics manufacturing. Industry analysts project that supply chain optimization could potentially reduce production costs by 30-40% over the next five years as manufacturing processes mature and supplier networks expand.

Manufacturing processes for flexible electronics require specialized equipment that differs significantly from traditional PCB production lines. While conventional electronics benefit from decades of manufacturing optimization and economies of scale, flexible electronics production often involves newer, less standardized processes such as roll-to-roll printing, laser direct structuring, and inkjet deposition technologies. The capital investment for these specialized production facilities remains high, though costs are gradually decreasing as adoption increases.

Inventory management presents another critical consideration in the flexible electronics supply chain. The shelf life of certain materials used in flexible electronics, particularly conductive inks and some polymer substrates, may be shorter than traditional components, requiring more sophisticated just-in-time inventory systems and potentially increasing logistics costs.

Transportation and handling requirements also differ substantially. Flexible components may require specialized packaging to prevent deformation during transit, yet simultaneously benefit from reduced weight and volume compared to rigid components. This duality creates opportunities for logistics cost savings in the later stages of the supply chain, particularly in shipping finished products to end markets.

Quality control processes represent a significant supply chain consideration, as testing methodologies for flexible electronics often require specialized equipment capable of evaluating performance under bending, stretching, or folding conditions. These unique testing requirements add complexity to the quality assurance process compared to traditional electronics manufacturing.

Regional manufacturing capabilities for flexible electronics remain concentrated in specific innovation hubs, primarily in East Asia, North America, and Western Europe. This geographic concentration can impact supply chain resilience and lead times, particularly when compared to the more globally distributed manufacturing ecosystem for traditional electronics components.

As production volumes increase, economies of scale are beginning to emerge, gradually reducing the cost differential between flexible and traditional electronics manufacturing. Industry analysts project that supply chain optimization could potentially reduce production costs by 30-40% over the next five years as manufacturing processes mature and supplier networks expand.

Sustainability Impact of Flexible vs Traditional Electronics

The environmental implications of flexible electronics versus traditional rigid components represent a critical dimension in evaluating their overall viability. Flexible electronics demonstrate significant sustainability advantages through reduced material consumption, with typical flexible circuits requiring 60-75% less raw material than their rigid counterparts. This material efficiency translates directly into reduced resource extraction and associated environmental degradation.

Manufacturing processes for flexible electronics generally consume less energy, with studies indicating a 30-40% reduction in energy requirements compared to traditional electronics manufacturing. This efficiency stems from lower temperature processing requirements and fewer production steps. Additionally, flexible electronics typically generate less waste during production, with some manufacturers reporting waste reduction of up to 50% compared to conventional electronics fabrication.

The extended lifecycle of flexible components further enhances their sustainability profile. Their inherent resistance to mechanical stress and physical damage can extend operational lifespans by 25-35% in appropriate applications, reducing replacement frequency and associated electronic waste generation. When devices do reach end-of-life, flexible electronics often offer improved recyclability prospects, as their simpler material composition facilitates more effective material recovery.

Carbon footprint analyses reveal that flexible electronics generally produce 20-30% lower greenhouse gas emissions across their lifecycle compared to rigid alternatives. This reduction stems from combined efficiencies in materials, manufacturing, transportation, and extended product lifespans. Transportation-related emissions are particularly reduced due to the lighter weight and more compact form factors of flexible components.

However, certain sustainability challenges persist. Some flexible electronics utilize specialized polymers and adhesives that may present recycling complications or contain potentially harmful substances. The novelty of these materials means that established recycling infrastructure may be inadequate for optimal material recovery, potentially offsetting some environmental benefits.

Water consumption patterns also differ significantly between manufacturing approaches. While traditional electronics manufacturing is notoriously water-intensive, flexible electronics production can reduce water requirements by 15-25% through alternative processing techniques and reduced chemical treatments. This water conservation aspect becomes increasingly significant as electronics manufacturing expands in water-stressed regions.

The sustainability equation ultimately depends on application-specific factors including usage patterns, deployment environments, and end-of-life management. As flexible electronics technology matures, lifecycle assessment methodologies must evolve to accurately capture these nuanced environmental impacts and guide development toward truly sustainable electronic systems.

Manufacturing processes for flexible electronics generally consume less energy, with studies indicating a 30-40% reduction in energy requirements compared to traditional electronics manufacturing. This efficiency stems from lower temperature processing requirements and fewer production steps. Additionally, flexible electronics typically generate less waste during production, with some manufacturers reporting waste reduction of up to 50% compared to conventional electronics fabrication.

The extended lifecycle of flexible components further enhances their sustainability profile. Their inherent resistance to mechanical stress and physical damage can extend operational lifespans by 25-35% in appropriate applications, reducing replacement frequency and associated electronic waste generation. When devices do reach end-of-life, flexible electronics often offer improved recyclability prospects, as their simpler material composition facilitates more effective material recovery.

Carbon footprint analyses reveal that flexible electronics generally produce 20-30% lower greenhouse gas emissions across their lifecycle compared to rigid alternatives. This reduction stems from combined efficiencies in materials, manufacturing, transportation, and extended product lifespans. Transportation-related emissions are particularly reduced due to the lighter weight and more compact form factors of flexible components.

However, certain sustainability challenges persist. Some flexible electronics utilize specialized polymers and adhesives that may present recycling complications or contain potentially harmful substances. The novelty of these materials means that established recycling infrastructure may be inadequate for optimal material recovery, potentially offsetting some environmental benefits.

Water consumption patterns also differ significantly between manufacturing approaches. While traditional electronics manufacturing is notoriously water-intensive, flexible electronics production can reduce water requirements by 15-25% through alternative processing techniques and reduced chemical treatments. This water conservation aspect becomes increasingly significant as electronics manufacturing expands in water-stressed regions.

The sustainability equation ultimately depends on application-specific factors including usage patterns, deployment environments, and end-of-life management. As flexible electronics technology matures, lifecycle assessment methodologies must evolve to accurately capture these nuanced environmental impacts and guide development toward truly sustainable electronic systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!