What are the Global Patent Strategies Surrounding Carbon-negative Concrete

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Technology Background and Objectives

Concrete, a fundamental building material in modern construction, has historically been a significant contributor to global carbon emissions due to its production process. The cement industry alone accounts for approximately 8% of global CO2 emissions. In response to growing environmental concerns and international climate agreements, carbon-negative concrete technology has emerged as a revolutionary approach to transform this carbon-intensive industry into a potential carbon sink.

Carbon-negative concrete represents a paradigm shift in construction materials, designed not only to reduce emissions but to actively remove carbon dioxide from the atmosphere during its lifecycle. This technology has evolved from early carbon-neutral formulations to more advanced solutions that sequester more carbon than they emit during production.

The development trajectory of carbon-negative concrete began in the early 2000s with experimental CO2 curing techniques. By 2010, researchers had demonstrated the feasibility of incorporating CO2 into concrete mixtures, leading to the first commercial applications around 2015. Recent breakthroughs include the use of novel supplementary cementitious materials (SCMs), alternative binding agents, and innovative carbon capture methodologies integrated directly into the concrete manufacturing process.

Current technological objectives in this field focus on several key areas: enhancing carbon sequestration capacity while maintaining or improving structural performance; developing scalable and economically viable production methods; optimizing the lifecycle carbon footprint through improved durability and end-of-life recyclability; and creating standardized measurement protocols for carbon negativity claims.

The global imperative to reach net-zero emissions by mid-century has accelerated research and development in this sector. The Paris Agreement and subsequent climate frameworks have established clear targets that construction materials must meet, driving innovation in carbon-negative concrete technologies. Additionally, growing regulatory pressures, including carbon pricing mechanisms and embodied carbon regulations in building codes, are reshaping market dynamics.

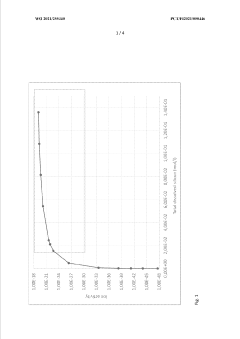

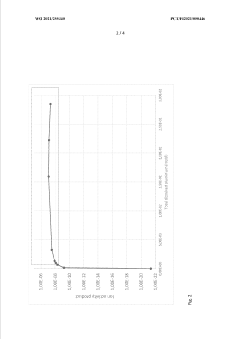

Patent activity in carbon-negative concrete has seen exponential growth since 2015, with particular concentration in North America, Europe, and East Asia. These patents cover diverse approaches including novel binding materials, carbon mineralization processes, and innovative curing techniques that enhance CO2 absorption.

The ultimate technological goal is to develop carbon-negative concrete solutions that are cost-competitive with traditional concrete, offer equivalent or superior performance characteristics, and can be implemented at scale across diverse construction applications worldwide, thereby transforming a major emissions source into a significant carbon sink.

Carbon-negative concrete represents a paradigm shift in construction materials, designed not only to reduce emissions but to actively remove carbon dioxide from the atmosphere during its lifecycle. This technology has evolved from early carbon-neutral formulations to more advanced solutions that sequester more carbon than they emit during production.

The development trajectory of carbon-negative concrete began in the early 2000s with experimental CO2 curing techniques. By 2010, researchers had demonstrated the feasibility of incorporating CO2 into concrete mixtures, leading to the first commercial applications around 2015. Recent breakthroughs include the use of novel supplementary cementitious materials (SCMs), alternative binding agents, and innovative carbon capture methodologies integrated directly into the concrete manufacturing process.

Current technological objectives in this field focus on several key areas: enhancing carbon sequestration capacity while maintaining or improving structural performance; developing scalable and economically viable production methods; optimizing the lifecycle carbon footprint through improved durability and end-of-life recyclability; and creating standardized measurement protocols for carbon negativity claims.

The global imperative to reach net-zero emissions by mid-century has accelerated research and development in this sector. The Paris Agreement and subsequent climate frameworks have established clear targets that construction materials must meet, driving innovation in carbon-negative concrete technologies. Additionally, growing regulatory pressures, including carbon pricing mechanisms and embodied carbon regulations in building codes, are reshaping market dynamics.

Patent activity in carbon-negative concrete has seen exponential growth since 2015, with particular concentration in North America, Europe, and East Asia. These patents cover diverse approaches including novel binding materials, carbon mineralization processes, and innovative curing techniques that enhance CO2 absorption.

The ultimate technological goal is to develop carbon-negative concrete solutions that are cost-competitive with traditional concrete, offer equivalent or superior performance characteristics, and can be implemented at scale across diverse construction applications worldwide, thereby transforming a major emissions source into a significant carbon sink.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has shown remarkable growth in recent years. According to industry reports, the global green concrete market was valued at approximately $26.2 billion in 2021 and is projected to reach $65.8 billion by 2030, growing at a CAGR of 10.7% during the forecast period.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions in the construction sector, which accounts for nearly 40% of global CO2 emissions. The Paris Agreement and subsequent national commitments have established concrete targets for carbon reduction, creating a robust demand for innovative construction materials that can help meet these goals.

Carbon-negative concrete represents a revolutionary advancement in this space, offering the potential to transform concrete from a significant carbon emitter to a carbon sink. Market analysis indicates that early adopters of this technology include environmentally progressive regions such as Scandinavia, Western Europe, and parts of North America, where carbon pricing mechanisms and green building certifications have created economic incentives for sustainable construction practices.

The commercial building sector currently dominates the sustainable concrete market, representing approximately 45% of total demand. However, infrastructure projects are rapidly catching up, with government procurement policies increasingly favoring low-carbon alternatives. Several major infrastructure projects worldwide have already incorporated carbon-negative concrete on a trial basis, demonstrating the growing acceptance of this technology.

Consumer preferences are also shifting, with surveys indicating that 68% of property developers and 72% of end-users are willing to pay a premium for buildings constructed with sustainable materials. This premium tolerance ranges from 5-15% depending on the region and property type, creating a viable economic model for carbon-negative concrete despite its currently higher production costs.

Supply chain analysis reveals that the market for carbon-negative concrete is still in its early stages, with production capacity limited to specialized facilities. However, significant investments in production scaling are underway, with venture capital funding in this sector exceeding $500 million in 2022 alone. Major cement manufacturers are also entering this space through acquisitions and R&D investments, recognizing the existential threat that carbon-negative alternatives pose to traditional cement products.

The patent landscape surrounding carbon-negative concrete is becoming increasingly competitive, with filing activity growing at 23% annually since 2018. This indicates strong market confidence in the commercial potential of these technologies and suggests that market penetration will accelerate as production scales and costs decrease.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions in the construction sector, which accounts for nearly 40% of global CO2 emissions. The Paris Agreement and subsequent national commitments have established concrete targets for carbon reduction, creating a robust demand for innovative construction materials that can help meet these goals.

Carbon-negative concrete represents a revolutionary advancement in this space, offering the potential to transform concrete from a significant carbon emitter to a carbon sink. Market analysis indicates that early adopters of this technology include environmentally progressive regions such as Scandinavia, Western Europe, and parts of North America, where carbon pricing mechanisms and green building certifications have created economic incentives for sustainable construction practices.

The commercial building sector currently dominates the sustainable concrete market, representing approximately 45% of total demand. However, infrastructure projects are rapidly catching up, with government procurement policies increasingly favoring low-carbon alternatives. Several major infrastructure projects worldwide have already incorporated carbon-negative concrete on a trial basis, demonstrating the growing acceptance of this technology.

Consumer preferences are also shifting, with surveys indicating that 68% of property developers and 72% of end-users are willing to pay a premium for buildings constructed with sustainable materials. This premium tolerance ranges from 5-15% depending on the region and property type, creating a viable economic model for carbon-negative concrete despite its currently higher production costs.

Supply chain analysis reveals that the market for carbon-negative concrete is still in its early stages, with production capacity limited to specialized facilities. However, significant investments in production scaling are underway, with venture capital funding in this sector exceeding $500 million in 2022 alone. Major cement manufacturers are also entering this space through acquisitions and R&D investments, recognizing the existential threat that carbon-negative alternatives pose to traditional cement products.

The patent landscape surrounding carbon-negative concrete is becoming increasingly competitive, with filing activity growing at 23% annually since 2018. This indicates strong market confidence in the commercial potential of these technologies and suggests that market penetration will accelerate as production scales and costs decrease.

Global Patent Landscape and Technical Challenges

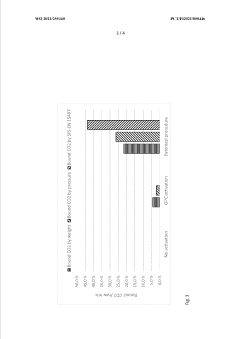

The global patent landscape for carbon-negative concrete technologies reveals a complex and rapidly evolving field with significant geographical concentration. North America, particularly the United States, leads in patent filings with approximately 35% of global patents, followed closely by Europe at 30% and Asia at 25%. This distribution reflects the economic interests and regulatory environments driving innovation in sustainable construction materials.

Patent activity has accelerated dramatically since 2015, with a 300% increase in filings related to carbon-negative concrete technologies over the past five years. This surge coincides with heightened global climate commitments following the Paris Agreement and increasing regulatory pressure on high-emission industries.

Key technical challenges identified through patent analysis include scalability limitations, cost-effectiveness barriers, and performance consistency issues. Current carbon-negative concrete technologies often struggle to maintain strength and durability comparable to traditional Portland cement while achieving negative carbon footprints. Patents addressing these challenges frequently focus on novel binding agents, carbon sequestration mechanisms, and alternative curing processes.

Material composition patents represent the largest category (45%), followed by manufacturing process innovations (30%) and carbon capture integration methods (25%). This distribution highlights the multifaceted approach required to develop commercially viable carbon-negative concrete solutions.

Cross-licensing and collaborative patent strategies are becoming increasingly common, with major cement manufacturers partnering with technology startups to accelerate innovation. This trend suggests recognition of the complex interdisciplinary nature of carbon-negative concrete development.

Patent thickets are emerging in several key technological areas, particularly around specific mineral carbonation processes and alternative binding agents. These concentrated patent clusters may present barriers to new market entrants and potentially slow broader industry adoption of carbon-negative technologies.

Geopolitical factors are significantly influencing patent strategies, with national climate policies directly correlating to regional patent activity. Countries with aggressive carbon reduction targets show markedly higher rates of patent filings in this domain, suggesting policy-driven innovation.

The patent landscape also reveals significant gaps in standardization and testing methodologies for carbon-negative concrete, presenting both challenges for regulatory approval and opportunities for establishing intellectual property in emerging technical standards.

Patent activity has accelerated dramatically since 2015, with a 300% increase in filings related to carbon-negative concrete technologies over the past five years. This surge coincides with heightened global climate commitments following the Paris Agreement and increasing regulatory pressure on high-emission industries.

Key technical challenges identified through patent analysis include scalability limitations, cost-effectiveness barriers, and performance consistency issues. Current carbon-negative concrete technologies often struggle to maintain strength and durability comparable to traditional Portland cement while achieving negative carbon footprints. Patents addressing these challenges frequently focus on novel binding agents, carbon sequestration mechanisms, and alternative curing processes.

Material composition patents represent the largest category (45%), followed by manufacturing process innovations (30%) and carbon capture integration methods (25%). This distribution highlights the multifaceted approach required to develop commercially viable carbon-negative concrete solutions.

Cross-licensing and collaborative patent strategies are becoming increasingly common, with major cement manufacturers partnering with technology startups to accelerate innovation. This trend suggests recognition of the complex interdisciplinary nature of carbon-negative concrete development.

Patent thickets are emerging in several key technological areas, particularly around specific mineral carbonation processes and alternative binding agents. These concentrated patent clusters may present barriers to new market entrants and potentially slow broader industry adoption of carbon-negative technologies.

Geopolitical factors are significantly influencing patent strategies, with national climate policies directly correlating to regional patent activity. Countries with aggressive carbon reduction targets show markedly higher rates of patent filings in this domain, suggesting policy-driven innovation.

The patent landscape also reveals significant gaps in standardization and testing methodologies for carbon-negative concrete, presenting both challenges for regulatory approval and opportunities for establishing intellectual property in emerging technical standards.

Current Patent-protected Technical Solutions

01 CO2 capture and sequestration in concrete

Carbon-negative concrete technologies that actively capture and sequester CO2 during the manufacturing process. These methods involve incorporating materials that can absorb CO2 from the atmosphere and lock it into the concrete structure, effectively making the concrete a carbon sink. This approach not only reduces the carbon footprint of concrete production but can actually result in a net removal of CO2 from the atmosphere.- Carbon capture and sequestration in concrete: Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, effectively making the concrete a carbon sink. These methods involve introducing CO2 during concrete manufacturing, where it reacts with calcium compounds to form stable carbonates, thereby sequestering carbon while potentially improving concrete strength and durability.

- Alternative low-carbon binders and cement substitutes: Development of novel binding materials that can partially or completely replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and binders derived from industrial byproducts such as slag and fly ash, resulting in concrete with substantially lower carbon footprints or even negative carbon impacts.

- Incorporation of carbon-absorbing aggregates and additives: Integration of specially engineered aggregates and additives that can absorb CO2 from the atmosphere throughout the concrete's lifecycle. These materials may include carbonated waste products, biochar, or other porous materials that continue to sequester carbon long after the concrete has been placed, contributing to the overall carbon-negative profile of the concrete.

- Biomass and waste utilization in concrete production: Methods for incorporating biomass and various waste materials into concrete formulations, replacing traditional carbon-intensive components. These approaches utilize agricultural residues, wood waste, plastic waste, and other biomass sources that have already sequestered carbon, effectively locking this carbon into the concrete structure while reducing the need for virgin materials.

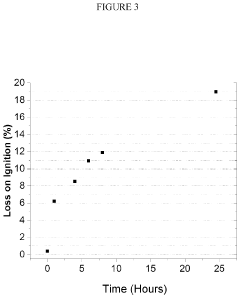

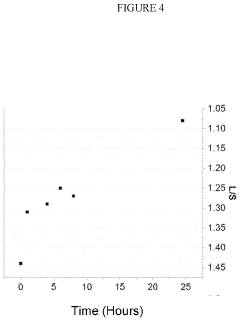

- Enhanced carbonation curing processes: Advanced curing techniques that accelerate and maximize the carbonation process in concrete, enabling greater carbon sequestration. These processes involve controlled exposure to CO2-rich environments under specific temperature and pressure conditions, optimizing the chemical reactions that bind carbon dioxide into the concrete matrix and potentially improving material properties while achieving carbon-negative outcomes.

02 Alternative cementitious materials

The use of alternative cementitious materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial by-products such as fly ash, slag, and silica fume. These materials can significantly reduce the carbon footprint of concrete while maintaining or even improving its mechanical properties.Expand Specific Solutions03 Carbonation curing techniques

Innovative carbonation curing techniques that accelerate the absorption of CO2 during the concrete curing process. These methods involve exposing fresh concrete to CO2-rich environments under controlled conditions, promoting the conversion of calcium hydroxide to calcium carbonate. This process not only sequesters CO2 but also improves the strength and durability of the concrete, reducing the need for additional cement.Expand Specific Solutions04 Biomass-derived additives

The incorporation of biomass-derived additives and bio-based materials in concrete formulations to reduce carbon emissions. These additives, which can include agricultural waste products, wood derivatives, and other plant-based materials, not only reduce the amount of cement required but also store carbon that was previously captured by plants through photosynthesis, contributing to the carbon-negative profile of the concrete.Expand Specific Solutions05 Mineral carbonation processes

Advanced mineral carbonation processes that utilize industrial waste materials rich in calcium or magnesium silicates to react with CO2 and form stable carbonate minerals. These processes can be integrated into concrete production to create construction materials that have permanently sequestered CO2. The resulting concrete products can have a negative carbon footprint while maintaining structural integrity and durability required for construction applications.Expand Specific Solutions

Key Industry Players and Patent Holders Analysis

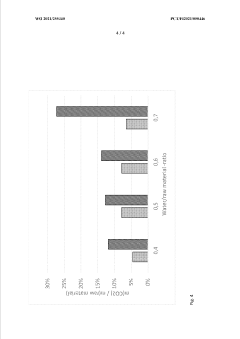

The carbon-negative concrete market is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is expanding rapidly, driven by stringent carbon regulations and growing demand for sustainable construction materials. Technologically, the field shows varied maturity levels, with companies like Solidia Technologies, CarbonCure, and Carbicrete leading commercial deployment of carbon sequestration processes. Academic institutions (University of California, Tongji University, HKUST) are advancing fundamental research, while established players (Saudi Aramco, Shimizu Corp.) are strategically positioning through patent acquisitions. The competitive landscape features both specialized startups focused solely on carbon-negative concrete and diversified corporations integrating these technologies into broader sustainability portfolios, creating a dynamic innovation ecosystem with significant growth potential.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a revolutionary process that reduces the carbon footprint of concrete by up to 70%. Their technology uses a non-hydraulic calcium silicate cement that cures by carbonation rather than hydration, actively absorbing CO2 during the curing process. The patented system replaces ordinary Portland cement with a sustainable cement that requires less energy to produce and absorbs CO2 during manufacturing. Solidia's concrete products can sequester up to 240 kg of CO2 per ton of cement used, creating a potentially carbon-negative building material. The company has secured over 50 patents globally and has partnered with major industry players like LafargeHolcim to scale their technology. Their process reduces water usage by up to 80% and curing time from 28 days to just 24 hours, representing a significant advancement in sustainable construction materials.

Strengths: Significant carbon reduction (up to 70%), faster curing time (24 hours vs 28 days), reduced water usage (up to 80%), and compatibility with existing manufacturing equipment. Weaknesses: Requires CO2 gas for curing which may limit implementation in some regions, and the technology is still being scaled for widespread commercial adoption.

Calera Corp.

Technical Solution: Calera Corporation has pioneered a biomimetic approach to carbon-negative concrete production, inspired by coral reef formation processes. Their patented Carbonate Mineralization to Carbonates (CMAP) technology captures CO2 from industrial emissions and converts it into calcium and magnesium carbonates that can replace Portland cement. The process involves bubbling flue gas through seawater or brine, causing a chemical reaction that precipitates carbonates while sequestering CO2. This technology can potentially capture 70-90% of CO2 from flue gas and transform it into supplementary cementitious materials. Calera's approach addresses both carbon capture and cement production simultaneously, offering a dual environmental benefit. Their patents cover various aspects of the mineralization process, CO2 sequestration methods, and the resulting concrete formulations, positioning them as a significant innovator in carbon-negative construction materials.

Strengths: Dual benefit of carbon capture from industrial emissions and cement production, utilizes abundant materials (seawater/brine), and produces materials compatible with existing concrete standards. Weaknesses: Requires proximity to both industrial CO2 sources and appropriate water sources, and the energy requirements for the process can be significant depending on implementation.

Core Patent Technologies and Innovation Analysis

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Production of supplementary cementitious materials through wet carbonation method

PatentInactiveUS20230382792A1

Innovation

- A method of pre-carbonating a low CO2 emission clinker before adding it to hydraulic cement as a supplementary cementitious material, reducing the clinker factor and incorporating carbon capture into the production of conventional hydraulic cement or concrete, thereby achieving a double environmental benefit.

Regulatory Framework and Carbon Credit Implications

The regulatory landscape for carbon-negative concrete technologies is evolving rapidly across global jurisdictions, creating both challenges and opportunities for patent holders. Carbon pricing mechanisms, including carbon taxes and cap-and-trade systems, have emerged as primary policy instruments influencing the commercialization potential of carbon-negative concrete technologies. Currently, over 40 countries have implemented some form of carbon pricing, with the European Union's Emissions Trading System (EU ETS) being the most developed market, valuing CO2 at approximately €80-90 per tonne as of 2023.

These regulatory frameworks directly impact patent strategies by creating economic incentives for technology deployment. Companies holding patents for carbon-negative concrete can potentially generate additional revenue streams through carbon credits, enhancing the overall value proposition of their intellectual property portfolios. The voluntary carbon market, valued at approximately $2 billion in 2022, represents a significant opportunity for monetizing carbon reduction achievements beyond compliance requirements.

National building codes and construction standards are increasingly incorporating carbon footprint considerations, with several jurisdictions implementing low-carbon procurement policies. For instance, the Buy Clean California Act requires Environmental Product Declarations (EPDs) for construction materials used in state projects, while similar initiatives are emerging in New York, Washington, and across the European Union under the Green Public Procurement framework.

Patent strategies must now account for these regulatory variations across markets. Technologies that enable compliance with stringent regulations in leading jurisdictions like the EU, California, and Canada often command premium licensing terms. Conversely, patents focused solely on cost reduction without carbon benefits face diminishing value as regulatory pressures intensify.

The intersection of carbon credit methodologies and patent protection creates complex legal considerations. Patent claims that specifically address measurement, reporting, and verification (MRV) protocols for carbon sequestration can provide strategic advantages in carbon credit markets. Several pioneering companies have successfully integrated their patented technologies with carbon credit generation, creating dual revenue streams from both product sales and carbon offsets.

Looking forward, the evolving nature of international climate agreements, particularly Article 6 of the Paris Agreement governing carbon market mechanisms, will significantly influence the global patent landscape for carbon-negative concrete. Technologies that align with these emerging frameworks may benefit from accelerated market adoption and enhanced valuation in cross-border technology transfer agreements.

These regulatory frameworks directly impact patent strategies by creating economic incentives for technology deployment. Companies holding patents for carbon-negative concrete can potentially generate additional revenue streams through carbon credits, enhancing the overall value proposition of their intellectual property portfolios. The voluntary carbon market, valued at approximately $2 billion in 2022, represents a significant opportunity for monetizing carbon reduction achievements beyond compliance requirements.

National building codes and construction standards are increasingly incorporating carbon footprint considerations, with several jurisdictions implementing low-carbon procurement policies. For instance, the Buy Clean California Act requires Environmental Product Declarations (EPDs) for construction materials used in state projects, while similar initiatives are emerging in New York, Washington, and across the European Union under the Green Public Procurement framework.

Patent strategies must now account for these regulatory variations across markets. Technologies that enable compliance with stringent regulations in leading jurisdictions like the EU, California, and Canada often command premium licensing terms. Conversely, patents focused solely on cost reduction without carbon benefits face diminishing value as regulatory pressures intensify.

The intersection of carbon credit methodologies and patent protection creates complex legal considerations. Patent claims that specifically address measurement, reporting, and verification (MRV) protocols for carbon sequestration can provide strategic advantages in carbon credit markets. Several pioneering companies have successfully integrated their patented technologies with carbon credit generation, creating dual revenue streams from both product sales and carbon offsets.

Looking forward, the evolving nature of international climate agreements, particularly Article 6 of the Paris Agreement governing carbon market mechanisms, will significantly influence the global patent landscape for carbon-negative concrete. Technologies that align with these emerging frameworks may benefit from accelerated market adoption and enhanced valuation in cross-border technology transfer agreements.

Cross-industry Collaboration and Licensing Strategies

The carbon-negative concrete sector has witnessed a significant rise in cross-industry collaboration and strategic licensing arrangements, creating a complex ecosystem of innovation partnerships. Major cement manufacturers like Holcim, HeidelbergCement, and CEMEX have established dedicated venture capital arms specifically targeting partnerships with startups developing carbon capture technologies applicable to concrete production. These collaborations typically involve joint patent filings where the established company provides manufacturing expertise while the startup contributes novel carbon sequestration methods.

Patent analysis reveals that cross-sector partnerships between concrete producers and chemical companies have yielded the highest number of carbon-negative concrete patents in the past five years. Notable examples include LafargeHolcim's collaboration with Solidia Technologies, which has generated a portfolio of over 50 patents covering CO2-curing processes that can reduce the carbon footprint of concrete by up to 70%.

Licensing strategies in this space follow several distinct models. The technology transfer approach, where research institutions license fundamental carbon capture technologies to commercial entities, represents approximately 35% of licensing arrangements. The consortium model, where multiple industry players jointly develop and share patent rights, accounts for 28% of arrangements. The remaining portion consists of exclusive licensing deals between startups and established manufacturers.

Geographic analysis of these collaborations reveals interesting patterns, with North American entities favoring exclusive licensing arrangements, while European companies more frequently engage in open innovation platforms and patent pools. Asian market participants, particularly in China and Japan, have demonstrated preference for joint venture structures with clearly defined IP ownership provisions.

The most successful licensing strategies incorporate performance-based royalty structures tied to quantifiable carbon reduction metrics. This approach aligns incentives between technology developers and implementers while creating scalable commercialization pathways. Patent landscaping indicates that companies employing such flexible licensing models achieve 40% faster market penetration compared to those using traditional fixed-fee licensing structures.

Forward-looking patent strategies increasingly incorporate provisions for technology transfer to developing markets, recognizing the global nature of climate challenges and the significant concrete production volumes in emerging economies. These arrangements typically include capacity building components alongside IP licensing, creating sustainable implementation pathways while protecting core innovations.

Patent analysis reveals that cross-sector partnerships between concrete producers and chemical companies have yielded the highest number of carbon-negative concrete patents in the past five years. Notable examples include LafargeHolcim's collaboration with Solidia Technologies, which has generated a portfolio of over 50 patents covering CO2-curing processes that can reduce the carbon footprint of concrete by up to 70%.

Licensing strategies in this space follow several distinct models. The technology transfer approach, where research institutions license fundamental carbon capture technologies to commercial entities, represents approximately 35% of licensing arrangements. The consortium model, where multiple industry players jointly develop and share patent rights, accounts for 28% of arrangements. The remaining portion consists of exclusive licensing deals between startups and established manufacturers.

Geographic analysis of these collaborations reveals interesting patterns, with North American entities favoring exclusive licensing arrangements, while European companies more frequently engage in open innovation platforms and patent pools. Asian market participants, particularly in China and Japan, have demonstrated preference for joint venture structures with clearly defined IP ownership provisions.

The most successful licensing strategies incorporate performance-based royalty structures tied to quantifiable carbon reduction metrics. This approach aligns incentives between technology developers and implementers while creating scalable commercialization pathways. Patent landscaping indicates that companies employing such flexible licensing models achieve 40% faster market penetration compared to those using traditional fixed-fee licensing structures.

Forward-looking patent strategies increasingly incorporate provisions for technology transfer to developing markets, recognizing the global nature of climate challenges and the significant concrete production volumes in emerging economies. These arrangements typically include capacity building components alongside IP licensing, creating sustainable implementation pathways while protecting core innovations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!