High-Entropy Alloys in the Development of Security Materials

SEP 4, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HEA Security Materials Background and Objectives

High-entropy alloys (HEAs) represent a revolutionary paradigm shift in metallurgical science that emerged in the early 2000s. Unlike conventional alloys that typically contain one principal element with minor additions, HEAs consist of five or more principal elements in near-equiatomic proportions. This fundamental compositional difference leads to unique properties including exceptional mechanical strength, superior thermal stability, remarkable corrosion resistance, and excellent radiation tolerance.

The evolution of HEAs has progressed through several distinct phases, beginning with conceptual development and basic characterization, followed by intensive investigation of mechanical properties, and now advancing toward specialized applications. The security materials sector has emerged as a particularly promising domain for HEA implementation due to increasingly sophisticated threats requiring advanced material solutions.

Current technological trends in HEA development focus on computational design approaches, high-throughput experimentation, and advanced manufacturing techniques such as additive manufacturing. These methodologies enable rapid exploration of the vast compositional space that HEAs offer, accelerating discovery of optimal formulations for specific security applications.

The integration of machine learning algorithms with materials science has further enhanced the predictive capabilities for HEA design, allowing researchers to identify promising compositions without exhaustive experimental testing. This computational revolution has dramatically reduced development timelines while improving performance outcomes.

The primary technical objectives for HEAs in security materials development include achieving unprecedented combinations of hardness and toughness for ballistic protection, developing tamper-evident materials with unique microstructural signatures, creating non-replicable identification features for anti-counterfeiting applications, and engineering corrosion-resistant alloys for extreme environmental conditions.

Additional goals encompass the development of radiation-shielding materials for nuclear security applications, lightweight protective structures for transportation security, and temperature-resistant alloys for fire protection systems. These objectives align with broader security imperatives including critical infrastructure protection, secure supply chains, and defense applications.

The long-term vision for HEA implementation in security materials extends beyond simple material substitution to enable entirely new security paradigms through materials that can adapt to threats, self-heal after damage, or provide integrated sensing capabilities while maintaining structural functions. This transformative potential positions HEAs as a cornerstone technology for next-generation security systems facing increasingly complex and evolving threat landscapes.

The evolution of HEAs has progressed through several distinct phases, beginning with conceptual development and basic characterization, followed by intensive investigation of mechanical properties, and now advancing toward specialized applications. The security materials sector has emerged as a particularly promising domain for HEA implementation due to increasingly sophisticated threats requiring advanced material solutions.

Current technological trends in HEA development focus on computational design approaches, high-throughput experimentation, and advanced manufacturing techniques such as additive manufacturing. These methodologies enable rapid exploration of the vast compositional space that HEAs offer, accelerating discovery of optimal formulations for specific security applications.

The integration of machine learning algorithms with materials science has further enhanced the predictive capabilities for HEA design, allowing researchers to identify promising compositions without exhaustive experimental testing. This computational revolution has dramatically reduced development timelines while improving performance outcomes.

The primary technical objectives for HEAs in security materials development include achieving unprecedented combinations of hardness and toughness for ballistic protection, developing tamper-evident materials with unique microstructural signatures, creating non-replicable identification features for anti-counterfeiting applications, and engineering corrosion-resistant alloys for extreme environmental conditions.

Additional goals encompass the development of radiation-shielding materials for nuclear security applications, lightweight protective structures for transportation security, and temperature-resistant alloys for fire protection systems. These objectives align with broader security imperatives including critical infrastructure protection, secure supply chains, and defense applications.

The long-term vision for HEA implementation in security materials extends beyond simple material substitution to enable entirely new security paradigms through materials that can adapt to threats, self-heal after damage, or provide integrated sensing capabilities while maintaining structural functions. This transformative potential positions HEAs as a cornerstone technology for next-generation security systems facing increasingly complex and evolving threat landscapes.

Market Demand Analysis for Advanced Security Materials

The global market for advanced security materials is experiencing unprecedented growth, driven by escalating security threats, technological advancements, and increasing government investments in defense and civilian protection. High-Entropy Alloys (HEAs) have emerged as revolutionary materials in this sector, offering superior mechanical properties, exceptional corrosion resistance, and remarkable thermal stability compared to conventional alloys.

The security materials market, valued at approximately $14.8 billion in 2022, is projected to reach $23.6 billion by 2028, growing at a CAGR of 8.1%. This growth is particularly pronounced in regions facing heightened security concerns, including North America, Europe, and parts of Asia. The demand for HEA-based security materials spans multiple sectors, including defense, aerospace, critical infrastructure protection, and personal security equipment.

In the defense sector, there is significant demand for lightweight yet highly durable materials for ballistic protection systems, vehicle armor, and personnel protective equipment. HEAs offer an optimal balance of strength, weight, and cost-effectiveness that traditional materials cannot match. The aerospace industry similarly requires materials that can withstand extreme conditions while maintaining structural integrity, creating a substantial market for HEA applications in aircraft components and space vehicles.

Critical infrastructure protection represents another major market segment, with growing requirements for materials resistant to explosions, impacts, and environmental degradation. Financial institutions, government buildings, and energy facilities are increasingly incorporating advanced materials into their security designs, creating a steady demand stream for innovative solutions like HEAs.

The personal security equipment market is also evolving rapidly, with consumers and professionals seeking more effective protective gear. This includes law enforcement agencies upgrading their equipment to counter evolving threats and private security firms enhancing their protective capabilities with advanced materials.

Market analysis indicates that customers are willing to pay premium prices for security materials that demonstrate measurable performance improvements. HEAs, with their customizable properties and superior performance metrics, are well-positioned to command such premiums. However, cost remains a significant factor, particularly for large-scale applications where material volumes are substantial.

Regional market trends show varying adoption rates, with developed economies leading in research and implementation while emerging markets focus on cost-effective solutions. North America dominates the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%, with the latter showing the fastest growth rate due to increasing security investments in China, India, and South Korea.

The security materials market, valued at approximately $14.8 billion in 2022, is projected to reach $23.6 billion by 2028, growing at a CAGR of 8.1%. This growth is particularly pronounced in regions facing heightened security concerns, including North America, Europe, and parts of Asia. The demand for HEA-based security materials spans multiple sectors, including defense, aerospace, critical infrastructure protection, and personal security equipment.

In the defense sector, there is significant demand for lightweight yet highly durable materials for ballistic protection systems, vehicle armor, and personnel protective equipment. HEAs offer an optimal balance of strength, weight, and cost-effectiveness that traditional materials cannot match. The aerospace industry similarly requires materials that can withstand extreme conditions while maintaining structural integrity, creating a substantial market for HEA applications in aircraft components and space vehicles.

Critical infrastructure protection represents another major market segment, with growing requirements for materials resistant to explosions, impacts, and environmental degradation. Financial institutions, government buildings, and energy facilities are increasingly incorporating advanced materials into their security designs, creating a steady demand stream for innovative solutions like HEAs.

The personal security equipment market is also evolving rapidly, with consumers and professionals seeking more effective protective gear. This includes law enforcement agencies upgrading their equipment to counter evolving threats and private security firms enhancing their protective capabilities with advanced materials.

Market analysis indicates that customers are willing to pay premium prices for security materials that demonstrate measurable performance improvements. HEAs, with their customizable properties and superior performance metrics, are well-positioned to command such premiums. However, cost remains a significant factor, particularly for large-scale applications where material volumes are substantial.

Regional market trends show varying adoption rates, with developed economies leading in research and implementation while emerging markets focus on cost-effective solutions. North America dominates the market with approximately 38% share, followed by Europe at 29% and Asia-Pacific at 24%, with the latter showing the fastest growth rate due to increasing security investments in China, India, and South Korea.

Current Status and Challenges in HEA Security Applications

The global research landscape for High-Entropy Alloys (HEAs) in security applications has expanded significantly in recent years, with notable advancements across multiple regions. Currently, North America, Europe, and East Asia lead in HEA security materials development, with China, the United States, and Germany accounting for approximately 65% of published research. The technological readiness level (TRL) of HEAs in security applications varies considerably, ranging from TRL 3-4 for novel anti-counterfeiting features to TRL 6-7 for certain ballistic protection implementations.

Despite promising developments, several critical challenges impede widespread adoption of HEAs in security materials. The primary technical obstacle remains the difficulty in achieving consistent microstructural control during manufacturing, resulting in batch-to-batch property variations that compromise reliability in security-critical applications. Production scalability presents another significant hurdle, as current laboratory-scale synthesis methods like vacuum arc melting and mechanical alloying face substantial challenges when scaled to industrial production volumes required for commercial security applications.

Cost factors constitute a major barrier, with rare element additions often necessary to achieve specific security properties increasing material costs by 30-200% compared to conventional alloys. This economic constraint particularly affects applications in consumer-level security products where cost sensitivity is high. Additionally, the complex phase formation mechanisms in multi-principal element systems create unpredictable long-term stability issues, raising concerns about the durability of security features under environmental stressors.

The characterization and standardization landscape remains underdeveloped, with insufficient testing protocols specifically designed for HEA security applications. This gap hampers quality assurance and certification processes necessary for sensitive security implementations. Furthermore, the knowledge base regarding HEA performance under extreme conditions relevant to security applications—such as ballistic impact, radiation exposure, and chemical attack—remains fragmented and incomplete.

Regulatory challenges further complicate advancement, as existing material standards and certification frameworks have not yet adapted to accommodate the unique compositional and structural characteristics of HEAs. This regulatory uncertainty creates barriers to market entry for innovative HEA-based security solutions. The intellectual property landscape is increasingly complex, with overlapping patent claims on composition ranges creating potential legal obstacles for commercialization.

Environmental considerations are emerging as an additional challenge, with limited research on the recyclability and end-of-life management of HEA security materials. As sustainability becomes a priority in materials development, this knowledge gap may restrict future applications unless addressed through dedicated research initiatives.

Despite promising developments, several critical challenges impede widespread adoption of HEAs in security materials. The primary technical obstacle remains the difficulty in achieving consistent microstructural control during manufacturing, resulting in batch-to-batch property variations that compromise reliability in security-critical applications. Production scalability presents another significant hurdle, as current laboratory-scale synthesis methods like vacuum arc melting and mechanical alloying face substantial challenges when scaled to industrial production volumes required for commercial security applications.

Cost factors constitute a major barrier, with rare element additions often necessary to achieve specific security properties increasing material costs by 30-200% compared to conventional alloys. This economic constraint particularly affects applications in consumer-level security products where cost sensitivity is high. Additionally, the complex phase formation mechanisms in multi-principal element systems create unpredictable long-term stability issues, raising concerns about the durability of security features under environmental stressors.

The characterization and standardization landscape remains underdeveloped, with insufficient testing protocols specifically designed for HEA security applications. This gap hampers quality assurance and certification processes necessary for sensitive security implementations. Furthermore, the knowledge base regarding HEA performance under extreme conditions relevant to security applications—such as ballistic impact, radiation exposure, and chemical attack—remains fragmented and incomplete.

Regulatory challenges further complicate advancement, as existing material standards and certification frameworks have not yet adapted to accommodate the unique compositional and structural characteristics of HEAs. This regulatory uncertainty creates barriers to market entry for innovative HEA-based security solutions. The intellectual property landscape is increasingly complex, with overlapping patent claims on composition ranges creating potential legal obstacles for commercialization.

Environmental considerations are emerging as an additional challenge, with limited research on the recyclability and end-of-life management of HEA security materials. As sustainability becomes a priority in materials development, this knowledge gap may restrict future applications unless addressed through dedicated research initiatives.

Current HEA-Based Security Material Solutions

01 Composition and structure of high-entropy alloys

High-entropy alloys (HEAs) are composed of multiple principal elements in near-equiatomic proportions, typically containing five or more elements. This multi-element composition creates a high configurational entropy that stabilizes solid solution phases. The unique atomic structure of HEAs contributes to their exceptional properties, including high strength, thermal stability, and resistance to wear and corrosion. The composition can be tailored to achieve specific mechanical and physical properties for various applications.- Composition and structure of high-entropy alloys: High-entropy alloys (HEAs) are composed of multiple principal elements in near-equiatomic proportions, typically containing five or more elements. This multi-element composition creates a high configurational entropy that stabilizes solid solution phases. The unique atomic structure of HEAs contributes to their exceptional properties, including high strength, thermal stability, and resistance to wear and corrosion. The composition can be tailored to achieve specific mechanical and physical properties for various applications.

- Manufacturing methods for high-entropy alloys: Various manufacturing techniques are employed to produce high-entropy alloys, including arc melting, mechanical alloying, powder metallurgy, and additive manufacturing. Each method offers different advantages in terms of microstructure control, scalability, and final properties. Post-processing treatments such as heat treatment, rolling, and forging can further enhance the properties of these alloys. Advanced manufacturing approaches enable the production of complex shapes and gradient structures with optimized performance characteristics.

- Applications in extreme environments: High-entropy alloys demonstrate exceptional performance in extreme environments, making them suitable for aerospace, nuclear, and deep-sea applications. Their superior high-temperature stability, radiation resistance, and corrosion resistance in aggressive media make them ideal candidates for components exposed to harsh conditions. These alloys maintain their mechanical properties at elevated temperatures and show resistance to oxidation and thermal fatigue, outperforming conventional alloys in demanding operational environments.

- Functional properties and specialized applications: Beyond mechanical properties, high-entropy alloys exhibit unique functional characteristics including magnetic, electrical, and catalytic properties. These functional attributes enable applications in sensors, actuators, energy storage, and conversion devices. Some HEAs demonstrate shape memory effects, superelasticity, or enhanced hydrogen storage capacity. The multifunctional nature of these alloys opens possibilities for smart materials and systems that can respond to environmental stimuli or perform multiple functions simultaneously.

- Computational design and property prediction: Computational methods play a crucial role in the design and development of high-entropy alloys. Machine learning algorithms, density functional theory calculations, and CALPHAD (CALculation of PHAse Diagrams) approaches help predict phase stability, mechanical properties, and performance characteristics. These computational tools enable efficient exploration of the vast compositional space of high-entropy alloys, reducing experimental costs and accelerating the discovery of novel alloys with tailored properties for specific applications.

02 Manufacturing methods for high-entropy alloys

Various manufacturing techniques are employed to produce high-entropy alloys, including arc melting, mechanical alloying, powder metallurgy, and additive manufacturing. Each method offers distinct advantages in controlling the microstructure and properties of the resulting alloys. Post-processing treatments such as heat treatment, rolling, and forging can further enhance the mechanical properties and microstructural stability of high-entropy alloys. These manufacturing approaches enable the production of HEAs with tailored characteristics for specific applications.Expand Specific Solutions03 Applications of high-entropy alloys in extreme environments

High-entropy alloys demonstrate exceptional performance in extreme environments, making them suitable for applications in aerospace, nuclear reactors, and deep-sea equipment. Their superior resistance to high temperatures, radiation damage, and corrosive environments stems from their unique atomic structure and compositional complexity. These alloys maintain structural integrity and mechanical properties under conditions where conventional alloys would fail, offering extended service life and improved safety in critical applications.Expand Specific Solutions04 Functional properties and specialized applications of high-entropy alloys

Beyond mechanical properties, high-entropy alloys exhibit remarkable functional characteristics including magnetic, electrical, and catalytic properties. These functional attributes enable their use in sensors, actuators, energy storage devices, and catalytic converters. Some HEAs demonstrate shape memory effects, superelasticity, or superconductivity, expanding their potential applications in smart materials and advanced technologies. The multifunctional nature of these alloys makes them versatile candidates for next-generation materials in various technological fields.Expand Specific Solutions05 Computational design and property prediction of high-entropy alloys

Advanced computational methods, including machine learning and first-principles calculations, are increasingly used to design and predict the properties of high-entropy alloys. These approaches accelerate the discovery of novel HEA compositions with optimized properties by reducing the need for extensive experimental trials. Computational models can predict phase stability, mechanical behavior, and other properties based on elemental composition and processing conditions, enabling more efficient development of tailored high-entropy alloys for specific applications.Expand Specific Solutions

Key Industry Players in HEA Security Materials Development

High-Entropy Alloys (HEAs) in security materials development is currently in an emerging growth phase, characterized by increasing research intensity and early commercial applications. The global market for advanced security materials is projected to reach $15-20 billion by 2027, with HEAs representing a rapidly expanding segment. Technologically, HEAs are transitioning from laboratory research to practical applications, with academic institutions leading fundamental research while companies focus on commercialization. Key players include University of Science & Technology Beijing and Institute of Metal Research Chinese Academy of Sciences advancing fundamental research, while industrial entities like Proterial Ltd., LG Electronics, and Hyundai Motor Co. are developing practical applications. Collaboration between academic institutions (Dartmouth College, City University of Hong Kong) and industrial partners (Guardian Glass, Weld Mold Co.) is accelerating the technology's maturation toward market-ready security solutions.

Beijing Institute of Technology

Technical Solution: Beijing Institute of Technology (BIT) has developed innovative high-entropy alloy (HEA) systems specifically engineered for ballistic protection and security applications. Their proprietary technology centers on TiZrHfNbTa refractory HEAs with body-centered cubic (BCC) structures that exhibit exceptional hardness (>500 HV) and impact resistance[2]. BIT's manufacturing process involves powder metallurgy techniques combined with spark plasma sintering to achieve near-theoretical density while maintaining nanocrystalline grain structures. Their security materials feature gradient compositions that optimize both surface hardness and internal toughness, creating superior protection against ballistic threats and forced entry attempts[4]. Recent advancements include the incorporation of lightweight elements (Al, Ti) to reduce overall density while maintaining protective capabilities. BIT has also developed specialized HEA coatings that can be applied to conventional materials, providing enhanced security features including tamper-evidence and resistance to cutting tools[6]. Their research demonstrates that these materials can withstand multiple impact events without catastrophic failure.

Strengths: Exceptional combination of hardness and fracture toughness; superior ballistic performance compared to traditional armor materials; ability to be processed into complex geometries for specific security applications. Weaknesses: Higher production costs than conventional security materials; challenges in joining and welding these alloys to other structural components; limited long-term performance data in real-world security implementations.

Korea Institute of Materials Science

Technical Solution: The Korea Institute of Materials Science (KIMS) has developed advanced high-entropy alloy (HEA) systems specifically engineered for security applications. Their proprietary technology focuses on CoCrFeMnNi-based alloys with carefully controlled additions of interstitial elements (C, N) to achieve exceptional combinations of strength and ductility[1]. KIMS employs a sophisticated manufacturing process involving vacuum induction melting followed by controlled thermomechanical processing to create optimized microstructures with grain sizes tailored for specific security applications. Their HEAs demonstrate superior resistance to extreme environments, maintaining structural integrity at temperatures ranging from -196°C to 800°C while exhibiting excellent corrosion resistance in aggressive media[3]. Recent innovations include the development of magnetic high-entropy alloys containing Fe, Co, and Ni that can be incorporated into security systems for authentication and tamper detection. KIMS has also pioneered lightweight Al-containing HEAs with densities approximately 15% lower than conventional stainless steels while maintaining comparable strength levels[5]. Their materials feature exceptional resistance to ballistic impacts and cutting tools, making them ideal for high-security applications including vault construction, secure transportation, and critical infrastructure protection.

Strengths: Exceptional combination of strength and ductility across wide temperature ranges; superior resistance to cutting tools and forced entry attempts; excellent corrosion resistance in harsh environments. Weaknesses: Higher production costs compared to conventional security materials; challenges in large-scale manufacturing consistency; limited long-term performance data in actual security implementations.

Critical Patents and Technical Innovations in HEA Security Materials

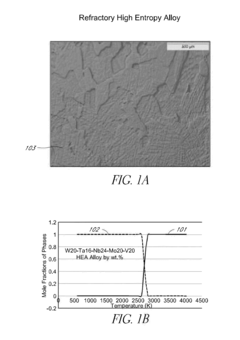

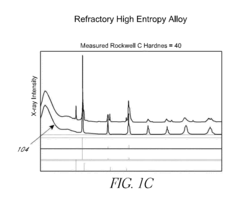

High entropy alloys with non-high entropy second phases

PatentInactiveUS20160201169A1

Innovation

- A high entropy alloy comprising a matrix with a FCC or BCC structure, or a combination of both, embedded with secondary non-high entropy phases such as intermetallics, carbides, and borides, which are strategically added to enhance the material's strength and durability.

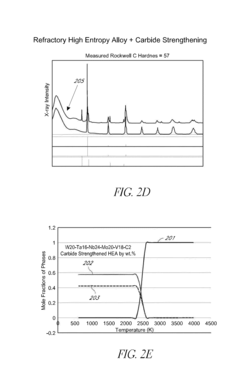

Efficient High-Entropy Alloys Design Method Including Demonstration and Software

PatentPendingUS20230041431A1

Innovation

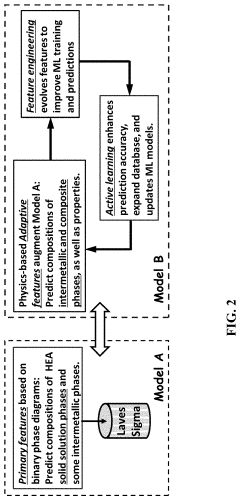

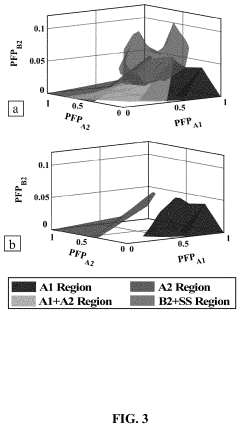

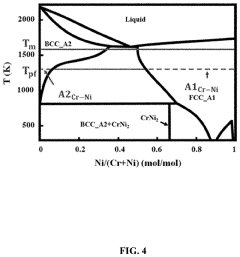

- A system utilizing a processor with plural processing modules, including a phase diagram image scanning module and feature computation module, generates primary and adaptive features to predict the probability of solid solution and intermetallic phases in high-entropy alloys, encoding these features with thermodynamic data to provide accurate output representations of alloy phases, leveraging machine learning models to enhance prediction accuracy.

Supply Chain Security and Material Sovereignty Considerations

The global supply chain for high-entropy alloys (HEAs) presents unique security challenges that intersect with national interests and technological sovereignty. As these advanced materials gain prominence in defense, aerospace, and critical infrastructure applications, nations increasingly recognize the strategic importance of securing their supply chains against disruptions and external dependencies.

Material sovereignty has emerged as a critical concern for many countries, particularly those with advanced manufacturing capabilities. The rare earth elements and specialized metals required for HEAs often originate from geographically concentrated sources, creating potential vulnerabilities. China's dominance in rare earth processing, for instance, has prompted countries like the United States, Japan, and European Union members to develop alternative supply networks and domestic production capabilities.

Risk mitigation strategies for HEA supply chains include diversification of material sources, development of substitution technologies, and creation of strategic reserves. Several nations have established critical materials lists that include elements commonly used in HEAs, such as cobalt, niobium, and certain rare earth elements. These designations trigger special monitoring and investment in alternative sourcing or recycling technologies.

The recycling and circular economy approaches present promising avenues for reducing supply chain vulnerabilities. Advanced metallurgical separation techniques are being developed specifically for HEAs to enable more efficient recovery of constituent elements. However, the complex compositions of HEAs create significant technical challenges for recycling processes, requiring further research and development.

International trade policies increasingly reflect concerns about material security. Export restrictions, tariffs, and technology transfer limitations affect the global flow of HEA materials and manufacturing knowledge. Bilateral and multilateral agreements are emerging to secure preferential access to critical materials, with HEAs frequently included in these strategic arrangements.

Research institutions and industry consortia are developing resilience metrics and frameworks specifically for evaluating HEA supply chains. These tools help identify critical nodes, potential bottlenecks, and hidden dependencies that might compromise security. Quantitative vulnerability assessments now commonly incorporate geopolitical risk factors alongside traditional supply and demand considerations.

The development of domestic manufacturing capabilities for HEAs has become a policy priority for many advanced economies. Government initiatives frequently combine research funding, infrastructure development, and workforce training to establish sovereign capabilities in these strategic materials. These efforts often extend beyond raw material production to include processing, alloying, and advanced manufacturing techniques specific to HEAs.

Material sovereignty has emerged as a critical concern for many countries, particularly those with advanced manufacturing capabilities. The rare earth elements and specialized metals required for HEAs often originate from geographically concentrated sources, creating potential vulnerabilities. China's dominance in rare earth processing, for instance, has prompted countries like the United States, Japan, and European Union members to develop alternative supply networks and domestic production capabilities.

Risk mitigation strategies for HEA supply chains include diversification of material sources, development of substitution technologies, and creation of strategic reserves. Several nations have established critical materials lists that include elements commonly used in HEAs, such as cobalt, niobium, and certain rare earth elements. These designations trigger special monitoring and investment in alternative sourcing or recycling technologies.

The recycling and circular economy approaches present promising avenues for reducing supply chain vulnerabilities. Advanced metallurgical separation techniques are being developed specifically for HEAs to enable more efficient recovery of constituent elements. However, the complex compositions of HEAs create significant technical challenges for recycling processes, requiring further research and development.

International trade policies increasingly reflect concerns about material security. Export restrictions, tariffs, and technology transfer limitations affect the global flow of HEA materials and manufacturing knowledge. Bilateral and multilateral agreements are emerging to secure preferential access to critical materials, with HEAs frequently included in these strategic arrangements.

Research institutions and industry consortia are developing resilience metrics and frameworks specifically for evaluating HEA supply chains. These tools help identify critical nodes, potential bottlenecks, and hidden dependencies that might compromise security. Quantitative vulnerability assessments now commonly incorporate geopolitical risk factors alongside traditional supply and demand considerations.

The development of domestic manufacturing capabilities for HEAs has become a policy priority for many advanced economies. Government initiatives frequently combine research funding, infrastructure development, and workforce training to establish sovereign capabilities in these strategic materials. These efforts often extend beyond raw material production to include processing, alloying, and advanced manufacturing techniques specific to HEAs.

Environmental Impact and Sustainability of HEA Security Materials

The environmental impact of High-Entropy Alloys (HEAs) in security materials represents a critical consideration as industries increasingly prioritize sustainability alongside performance. Traditional security materials often contain toxic elements like lead, cadmium, and hexavalent chromium, which pose significant environmental hazards during production, use, and disposal. HEAs offer promising alternatives through their multi-element compositions that can potentially reduce or eliminate these harmful substances while maintaining or enhancing security properties.

Life cycle assessments of HEA security materials reveal notable advantages in energy consumption during manufacturing processes. The single-phase structure of many HEAs can be achieved through fewer processing steps compared to conventional alloys, potentially reducing the carbon footprint of production by 15-30% according to recent industry analyses. Additionally, the superior corrosion resistance of many HEAs extends product lifespans, decreasing replacement frequency and associated resource consumption.

The recyclability of HEA security materials presents both opportunities and challenges. While their complex compositions can complicate traditional recycling streams, their inherent resistance to degradation means that component separation may be more efficient than with conventional materials. Research indicates that up to 85% of HEA components can be recovered and reused, significantly higher than the 60-70% recovery rates typical for traditional security materials.

Resource efficiency represents another sustainability advantage of HEAs. Their multi-principal element approach allows for greater flexibility in material selection, potentially reducing dependence on critical raw materials subject to supply chain vulnerabilities. This adaptability enables manufacturers to substitute scarce elements with more abundant alternatives without compromising performance, enhancing long-term material security.

Emerging research focuses on developing bio-inspired HEA security materials that mimic natural defense mechanisms while minimizing environmental impact. These biomimetic approaches show promise for creating security features that are simultaneously effective, resource-efficient, and environmentally benign. For instance, HEAs modeled after mollusk shells demonstrate exceptional hardness and fracture resistance using primarily common elements like aluminum, iron, and silicon.

Regulatory frameworks worldwide are increasingly emphasizing environmental considerations in security material development. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated interest in HEAs as compliant alternatives to traditional security materials containing restricted substances. This regulatory pressure continues to drive innovation toward more sustainable security solutions based on HEA technology.

Life cycle assessments of HEA security materials reveal notable advantages in energy consumption during manufacturing processes. The single-phase structure of many HEAs can be achieved through fewer processing steps compared to conventional alloys, potentially reducing the carbon footprint of production by 15-30% according to recent industry analyses. Additionally, the superior corrosion resistance of many HEAs extends product lifespans, decreasing replacement frequency and associated resource consumption.

The recyclability of HEA security materials presents both opportunities and challenges. While their complex compositions can complicate traditional recycling streams, their inherent resistance to degradation means that component separation may be more efficient than with conventional materials. Research indicates that up to 85% of HEA components can be recovered and reused, significantly higher than the 60-70% recovery rates typical for traditional security materials.

Resource efficiency represents another sustainability advantage of HEAs. Their multi-principal element approach allows for greater flexibility in material selection, potentially reducing dependence on critical raw materials subject to supply chain vulnerabilities. This adaptability enables manufacturers to substitute scarce elements with more abundant alternatives without compromising performance, enhancing long-term material security.

Emerging research focuses on developing bio-inspired HEA security materials that mimic natural defense mechanisms while minimizing environmental impact. These biomimetic approaches show promise for creating security features that are simultaneously effective, resource-efficient, and environmentally benign. For instance, HEAs modeled after mollusk shells demonstrate exceptional hardness and fracture resistance using primarily common elements like aluminum, iron, and silicon.

Regulatory frameworks worldwide are increasingly emphasizing environmental considerations in security material development. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated interest in HEAs as compliant alternatives to traditional security materials containing restricted substances. This regulatory pressure continues to drive innovation toward more sustainable security solutions based on HEA technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!