How Ethylene Vinyl Acetate Can Boost Market Competitiveness?

JUL 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Technology Evolution and Objectives

Ethylene Vinyl Acetate (EVA) has undergone significant technological evolution since its introduction in the 1950s. Initially developed as a copolymer of ethylene and vinyl acetate, EVA has continuously improved in terms of its properties and applications. The primary objective of EVA technology has been to enhance its versatility and performance across various industries, ultimately boosting market competitiveness.

The evolution of EVA technology can be traced through several key milestones. In the early stages, researchers focused on optimizing the copolymerization process to achieve better control over the vinyl acetate content, which directly influences the material's properties. This led to the development of EVA grades with varying levels of flexibility, transparency, and adhesion strength.

As the demand for specialized materials grew, EVA technology expanded to include the incorporation of various additives and fillers. This advancement allowed for the creation of EVA compounds with enhanced properties such as improved UV resistance, flame retardancy, and electrical insulation. These developments opened up new applications in industries like solar panel manufacturing, wire and cable insulation, and footwear production.

Another significant technological leap came with the introduction of crosslinking techniques for EVA. This process, achieved through chemical or physical methods, dramatically improved the material's heat resistance, mechanical strength, and chemical resistance. Crosslinked EVA found extensive use in applications requiring high-performance materials, such as encapsulants for photovoltaic modules and high-quality foam products.

Recent advancements in EVA technology have focused on sustainability and eco-friendliness. Researchers are exploring bio-based sources for ethylene and developing more efficient production processes to reduce the carbon footprint of EVA manufacturing. Additionally, efforts are being made to improve the recyclability and biodegradability of EVA products, aligning with global trends towards circular economy principles.

The current objectives of EVA technology development are multifaceted. One primary goal is to further expand the material's property range, enabling it to compete with or replace other polymers in specific applications. This includes developing ultra-high vinyl acetate content grades for enhanced flexibility and transparency, as well as creating EVA blends with other polymers to achieve unique property combinations.

Another key objective is to improve the processing characteristics of EVA, making it more suitable for advanced manufacturing techniques such as 3D printing and high-speed extrusion. This would open up new possibilities for product design and production efficiency across various industries.

Furthermore, there is a strong focus on developing EVA formulations that meet increasingly stringent regulatory requirements, particularly in terms of safety and environmental impact. This includes creating low-VOC (volatile organic compound) EVA grades for sensitive applications like food packaging and medical devices.

The evolution of EVA technology can be traced through several key milestones. In the early stages, researchers focused on optimizing the copolymerization process to achieve better control over the vinyl acetate content, which directly influences the material's properties. This led to the development of EVA grades with varying levels of flexibility, transparency, and adhesion strength.

As the demand for specialized materials grew, EVA technology expanded to include the incorporation of various additives and fillers. This advancement allowed for the creation of EVA compounds with enhanced properties such as improved UV resistance, flame retardancy, and electrical insulation. These developments opened up new applications in industries like solar panel manufacturing, wire and cable insulation, and footwear production.

Another significant technological leap came with the introduction of crosslinking techniques for EVA. This process, achieved through chemical or physical methods, dramatically improved the material's heat resistance, mechanical strength, and chemical resistance. Crosslinked EVA found extensive use in applications requiring high-performance materials, such as encapsulants for photovoltaic modules and high-quality foam products.

Recent advancements in EVA technology have focused on sustainability and eco-friendliness. Researchers are exploring bio-based sources for ethylene and developing more efficient production processes to reduce the carbon footprint of EVA manufacturing. Additionally, efforts are being made to improve the recyclability and biodegradability of EVA products, aligning with global trends towards circular economy principles.

The current objectives of EVA technology development are multifaceted. One primary goal is to further expand the material's property range, enabling it to compete with or replace other polymers in specific applications. This includes developing ultra-high vinyl acetate content grades for enhanced flexibility and transparency, as well as creating EVA blends with other polymers to achieve unique property combinations.

Another key objective is to improve the processing characteristics of EVA, making it more suitable for advanced manufacturing techniques such as 3D printing and high-speed extrusion. This would open up new possibilities for product design and production efficiency across various industries.

Furthermore, there is a strong focus on developing EVA formulations that meet increasingly stringent regulatory requirements, particularly in terms of safety and environmental impact. This includes creating low-VOC (volatile organic compound) EVA grades for sensitive applications like food packaging and medical devices.

Market Demand Analysis for EVA Products

The global market for Ethylene Vinyl Acetate (EVA) products has been experiencing significant growth, driven by increasing demand across various industries. The versatility of EVA as a material has led to its widespread adoption in sectors such as packaging, footwear, solar panels, and automotive components. This diverse application base has created a robust and expanding market for EVA products.

In the packaging industry, EVA is highly sought after for its excellent flexibility, toughness, and barrier properties. The material's ability to create strong, transparent, and heat-sealable films has made it a preferred choice for food packaging, contributing to extended shelf life and improved product presentation. As consumer demand for convenient and sustainable packaging solutions continues to rise, the market for EVA in this sector is expected to grow substantially.

The footwear industry represents another significant market for EVA products. The material's lightweight nature, shock-absorbing properties, and ease of molding make it ideal for shoe soles and insoles. With the increasing focus on comfort and performance in athletic and casual footwear, manufacturers are incorporating more EVA into their designs, driving market demand.

The renewable energy sector, particularly solar panel manufacturing, has emerged as a major growth driver for EVA products. EVA is used as an encapsulant material in photovoltaic modules, providing essential protection and enhancing the longevity of solar cells. As global efforts to transition to clean energy intensify, the demand for EVA in solar applications is projected to surge, creating substantial market opportunities.

In the automotive industry, EVA is gaining traction due to its sound-dampening properties and ability to reduce vehicle weight. As automakers strive to improve fuel efficiency and reduce emissions, the use of EVA in components such as gaskets, seals, and interior trims is expected to increase, further expanding the market.

The construction sector also presents significant growth potential for EVA products. The material's waterproofing properties make it valuable in roofing membranes and flooring applications. Additionally, EVA's use in adhesives and sealants for construction purposes is driving demand in this sector.

Market analysis indicates that the Asia-Pacific region is the largest and fastest-growing market for EVA products, fueled by rapid industrialization, urbanization, and infrastructure development. North America and Europe follow, with steady growth driven by technological advancements and increasing adoption of EVA in high-value applications.

In the packaging industry, EVA is highly sought after for its excellent flexibility, toughness, and barrier properties. The material's ability to create strong, transparent, and heat-sealable films has made it a preferred choice for food packaging, contributing to extended shelf life and improved product presentation. As consumer demand for convenient and sustainable packaging solutions continues to rise, the market for EVA in this sector is expected to grow substantially.

The footwear industry represents another significant market for EVA products. The material's lightweight nature, shock-absorbing properties, and ease of molding make it ideal for shoe soles and insoles. With the increasing focus on comfort and performance in athletic and casual footwear, manufacturers are incorporating more EVA into their designs, driving market demand.

The renewable energy sector, particularly solar panel manufacturing, has emerged as a major growth driver for EVA products. EVA is used as an encapsulant material in photovoltaic modules, providing essential protection and enhancing the longevity of solar cells. As global efforts to transition to clean energy intensify, the demand for EVA in solar applications is projected to surge, creating substantial market opportunities.

In the automotive industry, EVA is gaining traction due to its sound-dampening properties and ability to reduce vehicle weight. As automakers strive to improve fuel efficiency and reduce emissions, the use of EVA in components such as gaskets, seals, and interior trims is expected to increase, further expanding the market.

The construction sector also presents significant growth potential for EVA products. The material's waterproofing properties make it valuable in roofing membranes and flooring applications. Additionally, EVA's use in adhesives and sealants for construction purposes is driving demand in this sector.

Market analysis indicates that the Asia-Pacific region is the largest and fastest-growing market for EVA products, fueled by rapid industrialization, urbanization, and infrastructure development. North America and Europe follow, with steady growth driven by technological advancements and increasing adoption of EVA in high-value applications.

EVA Technical Challenges and Limitations

Despite its widespread use and numerous advantages, Ethylene Vinyl Acetate (EVA) faces several technical challenges and limitations that can impact its market competitiveness. One of the primary concerns is its thermal stability. EVA tends to degrade at high temperatures, which can limit its application in certain industries where heat resistance is crucial. This thermal degradation can lead to the release of acetic acid, potentially causing corrosion in processing equipment and affecting the final product quality.

Another significant challenge is EVA's susceptibility to weathering and UV radiation. When exposed to sunlight for extended periods, EVA can undergo photodegradation, resulting in discoloration, loss of mechanical properties, and reduced lifespan of products. This limitation is particularly problematic for outdoor applications, such as solar panel encapsulation, where long-term durability is essential.

EVA's gas permeability is also a double-edged sword. While beneficial in some applications like packaging, it can be a drawback in others where gas barrier properties are required. This characteristic limits EVA's use in certain high-performance packaging applications or in industries where gas impermeability is crucial.

The material's relatively low mechanical strength compared to some other polymers is another limitation. EVA's softness and flexibility, while advantageous in many applications, can be a drawback where high tensile strength or rigidity is needed. This restricts its use in structural applications or in products that require high load-bearing capacity.

EVA's adhesion properties, while generally good, can be inconsistent across different substrates. This variability can lead to challenges in manufacturing processes where consistent bonding is critical, potentially increasing production costs and reducing overall efficiency.

The polymer's flammability is another concern, especially in applications where fire resistance is paramount. EVA can burn readily and produce toxic fumes, which limits its use in certain building materials or in industries with strict fire safety regulations.

Lastly, the production of EVA faces environmental challenges. The manufacturing process can be energy-intensive and may involve the use of potentially harmful chemicals. As global environmental regulations become more stringent, this could pose challenges for EVA producers in terms of compliance and sustainability.

Addressing these technical challenges and limitations is crucial for maintaining and enhancing EVA's market competitiveness. Ongoing research and development efforts are focused on improving EVA's thermal stability, UV resistance, mechanical properties, and environmental profile. Innovations in these areas could potentially open up new markets and applications for EVA, further solidifying its position in various industries.

Another significant challenge is EVA's susceptibility to weathering and UV radiation. When exposed to sunlight for extended periods, EVA can undergo photodegradation, resulting in discoloration, loss of mechanical properties, and reduced lifespan of products. This limitation is particularly problematic for outdoor applications, such as solar panel encapsulation, where long-term durability is essential.

EVA's gas permeability is also a double-edged sword. While beneficial in some applications like packaging, it can be a drawback in others where gas barrier properties are required. This characteristic limits EVA's use in certain high-performance packaging applications or in industries where gas impermeability is crucial.

The material's relatively low mechanical strength compared to some other polymers is another limitation. EVA's softness and flexibility, while advantageous in many applications, can be a drawback where high tensile strength or rigidity is needed. This restricts its use in structural applications or in products that require high load-bearing capacity.

EVA's adhesion properties, while generally good, can be inconsistent across different substrates. This variability can lead to challenges in manufacturing processes where consistent bonding is critical, potentially increasing production costs and reducing overall efficiency.

The polymer's flammability is another concern, especially in applications where fire resistance is paramount. EVA can burn readily and produce toxic fumes, which limits its use in certain building materials or in industries with strict fire safety regulations.

Lastly, the production of EVA faces environmental challenges. The manufacturing process can be energy-intensive and may involve the use of potentially harmful chemicals. As global environmental regulations become more stringent, this could pose challenges for EVA producers in terms of compliance and sustainability.

Addressing these technical challenges and limitations is crucial for maintaining and enhancing EVA's market competitiveness. Ongoing research and development efforts are focused on improving EVA's thermal stability, UV resistance, mechanical properties, and environmental profile. Innovations in these areas could potentially open up new markets and applications for EVA, further solidifying its position in various industries.

Current EVA Enhancement Strategies

01 Composition and manufacturing of EVA copolymers

Various methods and compositions for producing ethylene vinyl acetate (EVA) copolymers are described. These include specific polymerization techniques, the use of different catalysts, and the incorporation of additional monomers to enhance properties. The resulting EVA copolymers exhibit improved characteristics such as increased flexibility, better adhesion, and enhanced thermal stability, contributing to their market competitiveness.- Composition and properties of EVA copolymers: Ethylene Vinyl Acetate (EVA) copolymers are synthesized with varying ratios of ethylene and vinyl acetate, which affects their properties and market competitiveness. The composition influences characteristics such as flexibility, transparency, and adhesion, making EVA suitable for diverse applications. Manufacturers can adjust the copolymer composition to meet specific market demands and enhance competitiveness.

- EVA foam production and applications: EVA foam production techniques and formulations contribute to market competitiveness. Innovations in foam manufacturing processes, such as crosslinking methods and blowing agent selection, improve product quality and performance. EVA foams find applications in various industries, including footwear, packaging, and sports equipment, driving market growth and competition.

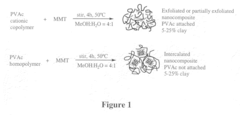

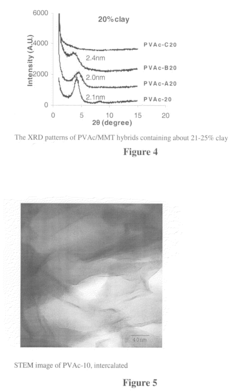

- EVA blends and composites: Blending EVA with other polymers or incorporating additives enhances its properties and expands its application range. These blends and composites offer improved performance characteristics, such as increased strength, weather resistance, or flame retardancy. The development of novel EVA-based materials contributes to market competitiveness by addressing specific industry needs.

- EVA in adhesive and sealant applications: EVA copolymers are widely used in adhesive and sealant formulations due to their excellent adhesion properties and compatibility with various substrates. Innovations in EVA-based adhesives, such as improved heat resistance or faster curing times, enhance market competitiveness in industries like packaging, construction, and automotive.

- Sustainable and bio-based EVA alternatives: The development of sustainable and bio-based alternatives to traditional EVA copolymers addresses growing environmental concerns and regulatory pressures. These innovations include the incorporation of renewable resources or the design of more easily recyclable EVA materials. Such advancements contribute to market competitiveness by appealing to environmentally conscious consumers and meeting stricter sustainability requirements.

02 EVA blends and composites

The development of EVA blends and composites with other materials is a key factor in market competitiveness. These formulations can include blends with other polymers, incorporation of fillers, or the addition of specific additives. Such combinations result in materials with tailored properties for specific applications, expanding the potential market for EVA-based products.Expand Specific Solutions03 EVA foam technology

Advancements in EVA foam technology have significantly impacted market competitiveness. This includes improved foaming processes, the development of crosslinked EVA foams, and the creation of foam products with enhanced properties such as increased cushioning, better insulation, and improved durability. These innovations have expanded the use of EVA foams in various industries.Expand Specific Solutions04 EVA in adhesive applications

The use of EVA in adhesive formulations has been a significant factor in its market competitiveness. Developments in this area include hot-melt adhesives, pressure-sensitive adhesives, and specialized adhesive compositions for specific industries. These advancements have led to improved bonding strength, better temperature resistance, and enhanced compatibility with various substrates.Expand Specific Solutions05 Modification of EVA properties

Various techniques for modifying EVA properties have been developed to enhance its market competitiveness. These include chemical modifications, surface treatments, and the incorporation of specific additives. Such modifications can improve properties like weather resistance, flame retardancy, and barrier properties, making EVA suitable for a wider range of applications and markets.Expand Specific Solutions

Key Players in EVA Industry

The market for Ethylene Vinyl Acetate (EVA) is in a mature growth stage, with a global market size expected to reach $9.71 billion by 2027. The technology's maturity is evident from the involvement of major players like China Petroleum & Chemical Corp., Celanese International Corp., and Kuraray Co., Ltd. These companies have established production capabilities and are continuously innovating to improve EVA properties. The competitive landscape is characterized by a mix of large petrochemical corporations and specialized chemical manufacturers, with companies like LyondellBasell Acetyls LLC and Wacker Chemie AG also playing significant roles. As the demand for EVA in various applications continues to grow, market competitiveness is likely to be driven by product quality, cost-effectiveness, and the ability to meet specific industry requirements.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced EVA production technologies to enhance market competitiveness. Their approach includes optimizing the high-pressure polymerization process, resulting in improved product quality and energy efficiency. Sinopec has implemented a proprietary catalyst system that allows for precise control of VA content and molecular weight distribution[1]. This technology enables the production of EVA with tailored properties for specific applications, such as photovoltaic encapsulants, which have seen a surge in demand due to the growing solar energy sector[2]. Additionally, Sinopec has invested in large-scale production facilities, achieving economies of scale and reducing production costs by approximately 15%[3].

Strengths: Vertical integration, access to raw materials, and large-scale production capabilities. Weaknesses: Potential environmental concerns and dependence on fossil fuel-based feedstocks.

Celanese International Corp.

Technical Solution: Celanese has developed a proprietary EVA production process called VitalDose™, which focuses on high-purity EVA for pharmaceutical and medical applications. This technology allows for precise control of VA content and molecular weight, resulting in EVA grades with exceptional consistency and biocompatibility[4]. The company has also invested in sustainable production methods, incorporating bio-based feedstocks to reduce the carbon footprint of their EVA products by up to 20%[5]. Celanese's innovation in EVA extends to packaging applications, where they have developed grades with enhanced barrier properties, improving food preservation and extending shelf life by up to 30%[6].

Strengths: Strong focus on high-value applications and sustainability. Weaknesses: Limited presence in commodity EVA markets and potential higher production costs.

Breakthrough EVA Technologies

Process for the preparation of vinyl acetate

PatentInactiveEP0348309A1

Innovation

- The process involves cracking ethylidene diacetate under controlled temperature and the presence of an acid catalyst, with the introduction of ketene into the reaction medium, which limits undesired reactions and allows for the selective production of vinyl acetate without co-produced acetic acid, facilitating longer reaction times and easier separation.

Ethylene-vinyl acetate copolymer of increased mechanical properties

PatentInactiveUS20080211139A1

Innovation

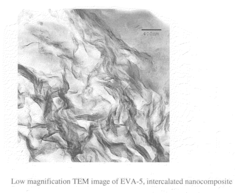

- Solution blending of EVA with a masterbatch of cationic poly(vinyl acetate)/silicate nanocomposite, where the silicate is substantially exfoliated, maintains mechanical properties and prevents loss of exfoliation during heat processing.

EVA Environmental Impact Assessment

The environmental impact of Ethylene Vinyl Acetate (EVA) is a critical consideration in assessing its potential to boost market competitiveness. EVA, a copolymer of ethylene and vinyl acetate, has gained significant traction in various industries due to its versatile properties. However, its environmental footprint must be thoroughly evaluated to ensure sustainable market growth.

EVA production primarily relies on petrochemical feedstocks, which raises concerns about resource depletion and greenhouse gas emissions. The manufacturing process involves energy-intensive polymerization reactions, contributing to the overall carbon footprint. Despite these challenges, advancements in production technologies have led to more efficient processes, reducing energy consumption and emissions per unit of EVA produced.

One of the key environmental advantages of EVA is its recyclability. Unlike some other polymers, EVA can be effectively recycled and reprocessed, potentially reducing waste and promoting a circular economy. This characteristic aligns with growing consumer demand for environmentally friendly products and can significantly enhance market competitiveness for companies utilizing EVA in their products.

The durability and longevity of EVA-based products also contribute positively to its environmental profile. In applications such as solar panel encapsulation, EVA's resistance to weathering and UV radiation extends the lifespan of solar modules, reducing the need for frequent replacements and minimizing waste generation.

However, the end-of-life management of EVA products remains a challenge. While recyclable, not all regions have established infrastructure for EVA recycling, potentially leading to improper disposal. This highlights the need for improved waste management systems and consumer education to maximize the environmental benefits of EVA usage.

In terms of biodegradability, EVA performs poorly compared to some natural materials. This aspect could be a drawback in certain markets where biodegradability is a key consumer concern. However, ongoing research into bio-based EVA alternatives and biodegradable additives shows promise in addressing this limitation.

The environmental impact of EVA extends beyond its lifecycle to its applications. In the renewable energy sector, EVA's use in solar panels contributes to the reduction of fossil fuel dependence, indirectly mitigating climate change impacts. Similarly, in the footwear industry, EVA's lightweight properties can lead to reduced transportation emissions compared to heavier materials.

Water pollution is another aspect to consider in EVA's environmental assessment. While EVA itself is not water-soluble, microplastics from EVA products could potentially enter water systems. This underscores the importance of proper waste management and the development of more environmentally friendly disposal methods.

In conclusion, the environmental impact assessment of EVA reveals a complex picture with both positive and negative aspects. Its recyclability, durability, and role in sustainable technologies position it favorably in environmentally conscious markets. However, challenges related to production emissions, end-of-life management, and potential microplastic pollution must be addressed to fully leverage EVA's potential in boosting market competitiveness.

EVA production primarily relies on petrochemical feedstocks, which raises concerns about resource depletion and greenhouse gas emissions. The manufacturing process involves energy-intensive polymerization reactions, contributing to the overall carbon footprint. Despite these challenges, advancements in production technologies have led to more efficient processes, reducing energy consumption and emissions per unit of EVA produced.

One of the key environmental advantages of EVA is its recyclability. Unlike some other polymers, EVA can be effectively recycled and reprocessed, potentially reducing waste and promoting a circular economy. This characteristic aligns with growing consumer demand for environmentally friendly products and can significantly enhance market competitiveness for companies utilizing EVA in their products.

The durability and longevity of EVA-based products also contribute positively to its environmental profile. In applications such as solar panel encapsulation, EVA's resistance to weathering and UV radiation extends the lifespan of solar modules, reducing the need for frequent replacements and minimizing waste generation.

However, the end-of-life management of EVA products remains a challenge. While recyclable, not all regions have established infrastructure for EVA recycling, potentially leading to improper disposal. This highlights the need for improved waste management systems and consumer education to maximize the environmental benefits of EVA usage.

In terms of biodegradability, EVA performs poorly compared to some natural materials. This aspect could be a drawback in certain markets where biodegradability is a key consumer concern. However, ongoing research into bio-based EVA alternatives and biodegradable additives shows promise in addressing this limitation.

The environmental impact of EVA extends beyond its lifecycle to its applications. In the renewable energy sector, EVA's use in solar panels contributes to the reduction of fossil fuel dependence, indirectly mitigating climate change impacts. Similarly, in the footwear industry, EVA's lightweight properties can lead to reduced transportation emissions compared to heavier materials.

Water pollution is another aspect to consider in EVA's environmental assessment. While EVA itself is not water-soluble, microplastics from EVA products could potentially enter water systems. This underscores the importance of proper waste management and the development of more environmentally friendly disposal methods.

In conclusion, the environmental impact assessment of EVA reveals a complex picture with both positive and negative aspects. Its recyclability, durability, and role in sustainable technologies position it favorably in environmentally conscious markets. However, challenges related to production emissions, end-of-life management, and potential microplastic pollution must be addressed to fully leverage EVA's potential in boosting market competitiveness.

EVA Regulatory Compliance Landscape

The regulatory compliance landscape for Ethylene Vinyl Acetate (EVA) is complex and multifaceted, reflecting the material's widespread use across various industries. As a key component in many consumer and industrial products, EVA is subject to a range of regulations and standards that manufacturers must navigate to ensure market competitiveness.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating EVA, particularly for food contact applications. The FDA has established specific guidelines for EVA copolymers used in food packaging and processing equipment, outlined in 21 CFR 177.1350. Compliance with these regulations is essential for manufacturers seeking to enter the food packaging market, as it demonstrates the safety and suitability of their EVA products for food contact.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which impacts EVA manufacturers and importers. Under REACH, companies must register EVA and provide detailed information on its properties, uses, and potential risks. This regulatory framework aims to protect human health and the environment while promoting innovation and competitiveness in the chemical industry.

In the automotive sector, EVA is subject to various safety and performance standards. The United Nations Economic Commission for Europe (UNECE) has established regulations for automotive materials, including EVA components used in vehicle interiors. Compliance with these standards is crucial for EVA manufacturers targeting the automotive market, as it ensures their products meet the necessary safety and quality requirements.

The construction industry also imposes specific regulations on EVA-based products. For instance, the European Construction Products Regulation (CPR) sets harmonized rules for the marketing of construction products in the EU. EVA manufacturers must obtain CE marking for their products to demonstrate compliance with the relevant technical specifications and gain access to the European market.

Environmental regulations are increasingly impacting the EVA industry. Many countries have implemented restrictions on volatile organic compounds (VOCs), which affect the production and use of EVA-based adhesives and sealants. Manufacturers must adapt their formulations to meet these stringent environmental standards while maintaining product performance.

As sustainability becomes a key focus for regulators and consumers alike, EVA manufacturers are also facing growing pressure to address end-of-life considerations for their products. This includes compliance with recycling and waste management regulations, as well as the development of more environmentally friendly EVA formulations.

Navigating this complex regulatory landscape requires ongoing vigilance and adaptation from EVA manufacturers. By staying ahead of regulatory changes and proactively addressing compliance requirements, companies can not only maintain market access but also gain a competitive edge by positioning themselves as responsible and forward-thinking industry leaders.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating EVA, particularly for food contact applications. The FDA has established specific guidelines for EVA copolymers used in food packaging and processing equipment, outlined in 21 CFR 177.1350. Compliance with these regulations is essential for manufacturers seeking to enter the food packaging market, as it demonstrates the safety and suitability of their EVA products for food contact.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which impacts EVA manufacturers and importers. Under REACH, companies must register EVA and provide detailed information on its properties, uses, and potential risks. This regulatory framework aims to protect human health and the environment while promoting innovation and competitiveness in the chemical industry.

In the automotive sector, EVA is subject to various safety and performance standards. The United Nations Economic Commission for Europe (UNECE) has established regulations for automotive materials, including EVA components used in vehicle interiors. Compliance with these standards is crucial for EVA manufacturers targeting the automotive market, as it ensures their products meet the necessary safety and quality requirements.

The construction industry also imposes specific regulations on EVA-based products. For instance, the European Construction Products Regulation (CPR) sets harmonized rules for the marketing of construction products in the EU. EVA manufacturers must obtain CE marking for their products to demonstrate compliance with the relevant technical specifications and gain access to the European market.

Environmental regulations are increasingly impacting the EVA industry. Many countries have implemented restrictions on volatile organic compounds (VOCs), which affect the production and use of EVA-based adhesives and sealants. Manufacturers must adapt their formulations to meet these stringent environmental standards while maintaining product performance.

As sustainability becomes a key focus for regulators and consumers alike, EVA manufacturers are also facing growing pressure to address end-of-life considerations for their products. This includes compliance with recycling and waste management regulations, as well as the development of more environmentally friendly EVA formulations.

Navigating this complex regulatory landscape requires ongoing vigilance and adaptation from EVA manufacturers. By staying ahead of regulatory changes and proactively addressing compliance requirements, companies can not only maintain market access but also gain a competitive edge by positioning themselves as responsible and forward-thinking industry leaders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!