How Ethylene Vinyl Acetate Facilitates Market Expansion?

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Technology Evolution and Objectives

Ethylene Vinyl Acetate (EVA) has emerged as a versatile and innovative material, revolutionizing various industries and facilitating significant market expansion. The evolution of EVA technology can be traced back to the 1950s when it was first developed as a copolymer of ethylene and vinyl acetate. Since then, continuous advancements in polymerization techniques and material science have propelled EVA to the forefront of numerous applications.

The primary objective of EVA technology development has been to create a material that combines the flexibility and elasticity of rubber with the processability and cost-effectiveness of thermoplastics. This unique combination of properties has enabled EVA to penetrate markets previously dominated by traditional materials, driving expansion across diverse sectors.

One of the key milestones in EVA technology evolution was the development of controlled vinyl acetate content, allowing manufacturers to tailor the material's properties for specific applications. This breakthrough opened up new possibilities in industries such as footwear, packaging, and solar panel encapsulation, significantly expanding market opportunities.

The advent of advanced crosslinking techniques further enhanced EVA's performance characteristics, leading to improved heat resistance, durability, and chemical stability. These advancements have been crucial in expanding EVA's market presence in high-value applications such as automotive components, medical devices, and aerospace materials.

Recent technological objectives in EVA development have focused on sustainability and environmental considerations. Researchers and manufacturers are exploring bio-based feedstocks and developing more efficient production processes to reduce the carbon footprint of EVA materials. This aligns with growing market demands for eco-friendly solutions and has the potential to unlock new market segments.

Another significant goal in EVA technology evolution is the enhancement of its barrier properties. Ongoing research aims to improve EVA's resistance to gas and moisture permeation, making it an attractive option for advanced packaging solutions and extending its applications in the food and pharmaceutical industries.

The continuous pursuit of higher performance EVA grades remains a key objective, with efforts focused on increasing thermal conductivity, improving flame retardancy, and enhancing UV resistance. These advancements are critical for expanding EVA's market share in demanding applications such as wire and cable insulation, photovoltaic modules, and high-performance sports equipment.

As EVA technology continues to evolve, the overarching goal is to push the boundaries of material science, creating innovative solutions that address emerging market needs and drive further expansion across industries. The future of EVA lies in its ability to adapt to changing technological landscapes and consumer preferences, ensuring its relevance and growth in an ever-evolving global market.

The primary objective of EVA technology development has been to create a material that combines the flexibility and elasticity of rubber with the processability and cost-effectiveness of thermoplastics. This unique combination of properties has enabled EVA to penetrate markets previously dominated by traditional materials, driving expansion across diverse sectors.

One of the key milestones in EVA technology evolution was the development of controlled vinyl acetate content, allowing manufacturers to tailor the material's properties for specific applications. This breakthrough opened up new possibilities in industries such as footwear, packaging, and solar panel encapsulation, significantly expanding market opportunities.

The advent of advanced crosslinking techniques further enhanced EVA's performance characteristics, leading to improved heat resistance, durability, and chemical stability. These advancements have been crucial in expanding EVA's market presence in high-value applications such as automotive components, medical devices, and aerospace materials.

Recent technological objectives in EVA development have focused on sustainability and environmental considerations. Researchers and manufacturers are exploring bio-based feedstocks and developing more efficient production processes to reduce the carbon footprint of EVA materials. This aligns with growing market demands for eco-friendly solutions and has the potential to unlock new market segments.

Another significant goal in EVA technology evolution is the enhancement of its barrier properties. Ongoing research aims to improve EVA's resistance to gas and moisture permeation, making it an attractive option for advanced packaging solutions and extending its applications in the food and pharmaceutical industries.

The continuous pursuit of higher performance EVA grades remains a key objective, with efforts focused on increasing thermal conductivity, improving flame retardancy, and enhancing UV resistance. These advancements are critical for expanding EVA's market share in demanding applications such as wire and cable insulation, photovoltaic modules, and high-performance sports equipment.

As EVA technology continues to evolve, the overarching goal is to push the boundaries of material science, creating innovative solutions that address emerging market needs and drive further expansion across industries. The future of EVA lies in its ability to adapt to changing technological landscapes and consumer preferences, ensuring its relevance and growth in an ever-evolving global market.

Market Demand Analysis for EVA Products

The market demand for Ethylene Vinyl Acetate (EVA) products has been experiencing significant growth across various industries, driven by its versatile properties and wide range of applications. EVA's unique combination of flexibility, toughness, and resistance to UV radiation and stress-cracking has made it a preferred material in sectors such as footwear, packaging, solar panels, and automotive components.

In the footwear industry, EVA has become a staple material for midsoles and outsoles due to its lightweight nature, excellent shock absorption, and durability. The growing health consciousness and increasing participation in sports and fitness activities have boosted the demand for comfortable and high-performance footwear, consequently driving the market for EVA-based shoe components.

The packaging sector has also witnessed a surge in EVA demand, particularly in the food and beverage industry. EVA's superior sealing properties, clarity, and flexibility make it an ideal choice for flexible packaging applications. The rise of e-commerce and the increasing need for sustainable packaging solutions have further propelled the adoption of EVA-based materials in this sector.

The renewable energy sector, specifically the solar panel industry, has emerged as a significant driver for EVA market expansion. EVA is extensively used as an encapsulant material in photovoltaic modules, providing excellent adhesion, optical transparency, and weather resistance. The global push towards clean energy and the rapid growth of solar installations worldwide have substantially increased the demand for EVA in this application.

In the automotive industry, EVA has found applications in various components such as gaskets, seals, and interior trims. The material's ability to withstand extreme temperatures, resist chemicals, and provide excellent noise reduction properties has made it a preferred choice for automotive manufacturers. As the automotive sector continues to evolve with a focus on lightweight and fuel-efficient vehicles, the demand for EVA-based components is expected to grow.

The construction industry has also contributed to the expanding market for EVA products. EVA-based adhesives and sealants are widely used in construction applications due to their strong bonding properties and resistance to moisture and weathering. The growing construction activities in emerging economies and the increasing focus on energy-efficient buildings have boosted the demand for EVA-based materials in this sector.

Furthermore, the medical and healthcare industry has shown increasing interest in EVA products. The material's biocompatibility, flexibility, and ease of sterilization make it suitable for various medical applications, including drug delivery systems, medical tubing, and prosthetics. The ongoing advancements in healthcare technologies and the growing emphasis on personalized medicine are expected to drive further demand for EVA in this sector.

In the footwear industry, EVA has become a staple material for midsoles and outsoles due to its lightweight nature, excellent shock absorption, and durability. The growing health consciousness and increasing participation in sports and fitness activities have boosted the demand for comfortable and high-performance footwear, consequently driving the market for EVA-based shoe components.

The packaging sector has also witnessed a surge in EVA demand, particularly in the food and beverage industry. EVA's superior sealing properties, clarity, and flexibility make it an ideal choice for flexible packaging applications. The rise of e-commerce and the increasing need for sustainable packaging solutions have further propelled the adoption of EVA-based materials in this sector.

The renewable energy sector, specifically the solar panel industry, has emerged as a significant driver for EVA market expansion. EVA is extensively used as an encapsulant material in photovoltaic modules, providing excellent adhesion, optical transparency, and weather resistance. The global push towards clean energy and the rapid growth of solar installations worldwide have substantially increased the demand for EVA in this application.

In the automotive industry, EVA has found applications in various components such as gaskets, seals, and interior trims. The material's ability to withstand extreme temperatures, resist chemicals, and provide excellent noise reduction properties has made it a preferred choice for automotive manufacturers. As the automotive sector continues to evolve with a focus on lightweight and fuel-efficient vehicles, the demand for EVA-based components is expected to grow.

The construction industry has also contributed to the expanding market for EVA products. EVA-based adhesives and sealants are widely used in construction applications due to their strong bonding properties and resistance to moisture and weathering. The growing construction activities in emerging economies and the increasing focus on energy-efficient buildings have boosted the demand for EVA-based materials in this sector.

Furthermore, the medical and healthcare industry has shown increasing interest in EVA products. The material's biocompatibility, flexibility, and ease of sterilization make it suitable for various medical applications, including drug delivery systems, medical tubing, and prosthetics. The ongoing advancements in healthcare technologies and the growing emphasis on personalized medicine are expected to drive further demand for EVA in this sector.

EVA Technical Challenges and Limitations

Despite its widespread use and versatility, Ethylene Vinyl Acetate (EVA) faces several technical challenges and limitations that can impact its market expansion potential. One of the primary issues is its thermal stability. EVA begins to degrade at relatively low temperatures, typically around 150°C, which limits its application in high-temperature environments. This thermal sensitivity can lead to the release of acetic acid, potentially causing corrosion in processing equipment and affecting the quality of the final product.

Another significant challenge is EVA's susceptibility to weathering and UV radiation. When exposed to sunlight for extended periods, EVA can undergo photodegradation, resulting in discoloration, loss of mechanical properties, and eventual material failure. This limitation is particularly problematic for outdoor applications, such as solar panel encapsulation, where long-term durability is crucial.

EVA's gas permeability characteristics also present challenges in certain applications. While its barrier properties are sufficient for many uses, it falls short in high-performance packaging applications that require excellent oxygen and moisture barriers. This limitation restricts EVA's potential in the food packaging industry, where maintaining product freshness is paramount.

The material's relatively low mechanical strength compared to some other polymers is another limitation. EVA's softness and flexibility, while advantageous in many applications, can be a drawback where high tensile strength or rigidity is required. This restricts its use in structural applications and limits its potential to replace more robust materials in certain markets.

EVA's adhesion properties, while generally good, can be inconsistent across different substrates. This variability can lead to challenges in bonding EVA to certain materials, potentially limiting its use in multi-layer structures or composite materials. Improving adhesion often requires surface treatments or the use of additional adhesives, which can increase production costs and complexity.

Furthermore, the production of EVA copolymers with high vinyl acetate content (>40%) presents technical difficulties. These high-VA content grades are desirable for their enhanced flexibility and clarity, but they are challenging to produce consistently and in large quantities. This limitation can restrict the availability of specialized EVA grades for high-end applications.

Lastly, the environmental impact of EVA production and disposal is an emerging concern. As sustainability becomes increasingly important in material selection, the non-biodegradable nature of EVA and the energy-intensive production process pose challenges to its long-term market expansion, particularly in environmentally conscious markets and applications.

Another significant challenge is EVA's susceptibility to weathering and UV radiation. When exposed to sunlight for extended periods, EVA can undergo photodegradation, resulting in discoloration, loss of mechanical properties, and eventual material failure. This limitation is particularly problematic for outdoor applications, such as solar panel encapsulation, where long-term durability is crucial.

EVA's gas permeability characteristics also present challenges in certain applications. While its barrier properties are sufficient for many uses, it falls short in high-performance packaging applications that require excellent oxygen and moisture barriers. This limitation restricts EVA's potential in the food packaging industry, where maintaining product freshness is paramount.

The material's relatively low mechanical strength compared to some other polymers is another limitation. EVA's softness and flexibility, while advantageous in many applications, can be a drawback where high tensile strength or rigidity is required. This restricts its use in structural applications and limits its potential to replace more robust materials in certain markets.

EVA's adhesion properties, while generally good, can be inconsistent across different substrates. This variability can lead to challenges in bonding EVA to certain materials, potentially limiting its use in multi-layer structures or composite materials. Improving adhesion often requires surface treatments or the use of additional adhesives, which can increase production costs and complexity.

Furthermore, the production of EVA copolymers with high vinyl acetate content (>40%) presents technical difficulties. These high-VA content grades are desirable for their enhanced flexibility and clarity, but they are challenging to produce consistently and in large quantities. This limitation can restrict the availability of specialized EVA grades for high-end applications.

Lastly, the environmental impact of EVA production and disposal is an emerging concern. As sustainability becomes increasingly important in material selection, the non-biodegradable nature of EVA and the energy-intensive production process pose challenges to its long-term market expansion, particularly in environmentally conscious markets and applications.

Current EVA Production Methods

01 EVA foam material development

Advancements in EVA foam material formulations and manufacturing processes are driving market expansion. These innovations include improved durability, flexibility, and performance characteristics, making EVA foam suitable for a wider range of applications in industries such as footwear, sports equipment, and packaging.- EVA foam material development: Advancements in EVA foam material formulations and manufacturing processes are expanding market opportunities. These developments include improved durability, flexibility, and performance characteristics, making EVA foam suitable for a wider range of applications in industries such as footwear, sports equipment, and packaging.

- EVA copolymer modifications: Research into modifying EVA copolymers through various techniques such as crosslinking, blending with other polymers, or incorporating additives is driving market expansion. These modifications enhance properties like heat resistance, adhesion, and mechanical strength, opening up new applications in sectors like automotive, construction, and electronics.

- Sustainable and bio-based EVA alternatives: Development of sustainable and bio-based alternatives to traditional EVA is a growing trend in the market. These eco-friendly options aim to reduce environmental impact while maintaining or improving performance, attracting environmentally conscious consumers and industries seeking greener materials.

- EVA in renewable energy applications: The expansion of the renewable energy sector, particularly solar power, is driving demand for EVA in photovoltaic module encapsulation. Ongoing research focuses on improving EVA's UV resistance, transparency, and long-term stability for solar panel applications, contributing to market growth in the energy sector.

- EVA processing technology advancements: Innovations in EVA processing technologies, such as improved extrusion techniques, injection molding, and foam manufacturing processes, are enabling more efficient production and expanding product possibilities. These advancements are reducing production costs and allowing for more complex and customized EVA products, further driving market expansion.

02 Sustainable and eco-friendly EVA solutions

The development of sustainable and eco-friendly EVA formulations is opening new market opportunities. This includes biodegradable EVA compounds, recycled EVA materials, and production processes with reduced environmental impact, addressing growing consumer demand for environmentally responsible products.Expand Specific Solutions03 EVA copolymer modifications

Ongoing research in EVA copolymer modifications is expanding its application range. These modifications enhance properties such as adhesion, thermal resistance, and chemical compatibility, allowing EVA to penetrate new markets in industries like automotive, construction, and electronics.Expand Specific Solutions04 EVA in renewable energy applications

The growing renewable energy sector is driving EVA market expansion, particularly in solar panel encapsulation. Innovations in EVA formulations for improved weatherability, UV resistance, and long-term performance are key factors in this market growth.Expand Specific Solutions05 EVA processing technology advancements

Improvements in EVA processing technologies are facilitating market growth. This includes advancements in extrusion, injection molding, and foam manufacturing techniques, enabling more efficient production, better quality control, and the ability to create complex EVA-based products for various industries.Expand Specific Solutions

Key Players in EVA Industry

The market for Ethylene Vinyl Acetate (EVA) is in a mature growth stage, with a global market size expected to reach significant levels in the coming years. The technology's maturity is evident from the involvement of major players across various industries. Companies like DuPont de Nemours, LyondellBasell, and Celanese are leading in EVA production, leveraging their extensive chemical expertise. Chinese firms such as Sinopec and Jiangsu Sopo are also making significant strides, indicating the technology's global reach. The diverse applications of EVA, from solar panels to footwear, are driving market expansion, with companies like Borealis and Hanwha Chemical focusing on innovative EVA-based solutions. This competitive landscape suggests a well-established but still evolving market with potential for further growth and technological advancements.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced ethylene vinyl acetate (EVA) production technologies to facilitate market expansion. Their process involves high-pressure tubular reactors for EVA copolymerization, achieving precise control over vinyl acetate content (typically 10-40%) [1]. Sinopec has implemented a continuous bulk polymerization method, which allows for efficient production of EVA with varying melt flow rates and densities [2]. The company has also invested in catalyst research, developing proprietary metallocene catalysts that enable the production of EVA with enhanced properties such as improved clarity, flexibility, and stress crack resistance [3]. Additionally, Sinopec has integrated its EVA production with its existing ethylene and vinyl acetate monomer facilities, creating a vertically integrated supply chain that reduces costs and improves market competitiveness [4].

Strengths: Vertically integrated production, advanced catalyst technology, and ability to produce a wide range of EVA grades. Weaknesses: Potential overcapacity in the domestic market and reliance on imported vinyl acetate monomer for some facilities.

Celanese International Corp.

Technical Solution: Celanese has developed a proprietary EVA production process called VitalDose™, which focuses on pharmaceutical and medical applications. This technology allows for the production of high-purity EVA with controlled release properties, enabling its use in drug delivery systems and medical devices [1]. The company's EVA grades range from 9% to 40% vinyl acetate content, offering tailored solutions for various applications [2]. Celanese has also implemented a continuous emulsion polymerization process for EVA production, which results in improved product consistency and reduced energy consumption [3]. Furthermore, the company has invested in research to develop EVA-based composites and blends, expanding its application in areas such as photovoltaic encapsulants and packaging materials [4]. Celanese's global production network, including facilities in North America, Europe, and Asia, allows for strategic market expansion and localized supply [5].

Strengths: Specialized high-value applications, global production network, and advanced emulsion polymerization technology. Weaknesses: Higher production costs compared to bulk polymerization methods and potential vulnerability to raw material price fluctuations.

Innovative EVA Applications

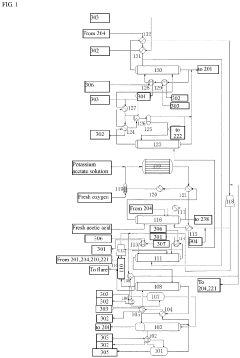

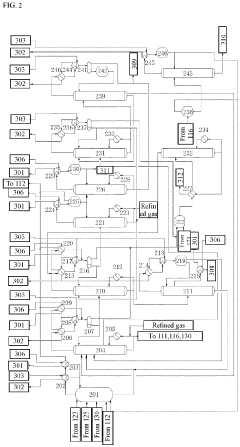

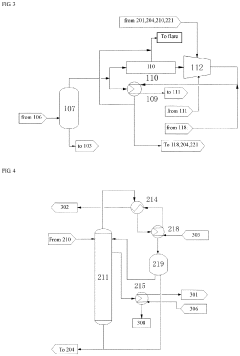

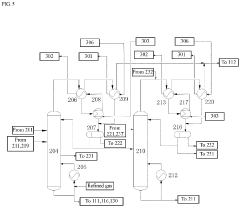

Preparation method of vinyl acetate by ethylene process and device thereof

PatentPendingEP4371972A1

Innovation

- A novel process incorporating an ethylene recovery membrane assembly, refined VAC tower side-draw stream additions, and improved cooling methods using circulating and chilled water for high-purity vinyl acetate production, reducing emissions and preventing material leakage by recovering ethylene and optimizing the distillation process.

Method for preparing ethylene-vinyl acetate with low melt index

PatentWO2014181991A1

Innovation

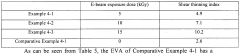

- Applying an electron beam with a defined exposure dose to an ethylene-vinyl acetate resin composition with a vinyl acetate content of 15 to 50 wt% to reduce the melt index to 10 g/10 min or less, thereby enhancing mechanical properties and processability without the need for additional modifiers like peroxides.

Environmental Impact of EVA

The environmental impact of Ethylene Vinyl Acetate (EVA) is a crucial consideration in its market expansion. EVA, a copolymer of ethylene and vinyl acetate, has gained significant traction in various industries due to its versatile properties. However, its widespread use has raised concerns about its ecological footprint throughout its lifecycle.

During the production phase, EVA manufacturing processes consume substantial energy and resources. The polymerization of ethylene and vinyl acetate monomers requires high temperatures and pressures, contributing to greenhouse gas emissions. Additionally, the use of petrochemical feedstocks in EVA production raises questions about resource depletion and the long-term sustainability of raw material sourcing.

In terms of product use, EVA's durability and resistance to degradation offer both advantages and challenges from an environmental perspective. While these properties extend product lifespans, potentially reducing waste, they also mean that EVA products persist in the environment for extended periods when discarded improperly. This persistence can lead to accumulation in ecosystems, potentially affecting wildlife and natural habitats.

The end-of-life management of EVA products presents another significant environmental challenge. EVA's cross-linked structure makes it difficult to recycle through conventional methods. As a result, many EVA products end up in landfills or incineration facilities, contributing to waste accumulation and potential air pollution. However, recent advancements in recycling technologies have shown promise in improving the recyclability of EVA materials, offering potential solutions to this issue.

Despite these challenges, EVA's environmental impact is not entirely negative. Its lightweight nature and excellent insulation properties contribute to energy efficiency in various applications, such as in solar panel encapsulation and building materials. This energy-saving potential during the use phase can partially offset the environmental costs associated with production and disposal.

As market expansion continues, there is a growing focus on developing more sustainable EVA formulations and production processes. Research into bio-based alternatives and improved recycling methods aims to address the environmental concerns associated with traditional EVA. These efforts, coupled with increasing regulatory pressure and consumer demand for eco-friendly products, are driving innovation in the EVA industry towards more sustainable practices.

In conclusion, while EVA offers significant benefits that have facilitated its market expansion, its environmental impact remains a complex issue. Balancing the material's performance advantages with ecological considerations will be crucial for its continued growth and acceptance in various markets. The industry's response to these environmental challenges will likely shape the future trajectory of EVA's market expansion and its role in sustainable product development.

During the production phase, EVA manufacturing processes consume substantial energy and resources. The polymerization of ethylene and vinyl acetate monomers requires high temperatures and pressures, contributing to greenhouse gas emissions. Additionally, the use of petrochemical feedstocks in EVA production raises questions about resource depletion and the long-term sustainability of raw material sourcing.

In terms of product use, EVA's durability and resistance to degradation offer both advantages and challenges from an environmental perspective. While these properties extend product lifespans, potentially reducing waste, they also mean that EVA products persist in the environment for extended periods when discarded improperly. This persistence can lead to accumulation in ecosystems, potentially affecting wildlife and natural habitats.

The end-of-life management of EVA products presents another significant environmental challenge. EVA's cross-linked structure makes it difficult to recycle through conventional methods. As a result, many EVA products end up in landfills or incineration facilities, contributing to waste accumulation and potential air pollution. However, recent advancements in recycling technologies have shown promise in improving the recyclability of EVA materials, offering potential solutions to this issue.

Despite these challenges, EVA's environmental impact is not entirely negative. Its lightweight nature and excellent insulation properties contribute to energy efficiency in various applications, such as in solar panel encapsulation and building materials. This energy-saving potential during the use phase can partially offset the environmental costs associated with production and disposal.

As market expansion continues, there is a growing focus on developing more sustainable EVA formulations and production processes. Research into bio-based alternatives and improved recycling methods aims to address the environmental concerns associated with traditional EVA. These efforts, coupled with increasing regulatory pressure and consumer demand for eco-friendly products, are driving innovation in the EVA industry towards more sustainable practices.

In conclusion, while EVA offers significant benefits that have facilitated its market expansion, its environmental impact remains a complex issue. Balancing the material's performance advantages with ecological considerations will be crucial for its continued growth and acceptance in various markets. The industry's response to these environmental challenges will likely shape the future trajectory of EVA's market expansion and its role in sustainable product development.

EVA Regulatory Landscape

The regulatory landscape for Ethylene Vinyl Acetate (EVA) plays a crucial role in facilitating market expansion across various industries. As a versatile copolymer, EVA's applications span from packaging to footwear, solar panels, and medical devices. Understanding and navigating the regulatory framework is essential for manufacturers and businesses seeking to leverage EVA's potential in new markets.

In the food packaging sector, EVA must comply with stringent regulations set by agencies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These bodies establish guidelines for food contact materials, ensuring that EVA-based packaging does not leach harmful substances into food products. Compliance with these regulations opens doors for EVA in the vast and growing food packaging market.

The medical device industry presents another significant opportunity for EVA expansion, but it comes with its own set of regulatory challenges. Manufacturers must adhere to standards set by regulatory bodies like the FDA in the United States and the European Medicines Agency (EMA) in Europe. These regulations focus on biocompatibility, sterilization processes, and overall safety of EVA-based medical devices. Meeting these requirements allows EVA to penetrate the lucrative medical device market, particularly in applications such as tubing, drug delivery systems, and prosthetics.

In the renewable energy sector, EVA's use in solar panel encapsulation is subject to regulations concerning durability, weather resistance, and environmental impact. Compliance with standards set by organizations like the International Electrotechnical Commission (IEC) is crucial for market acceptance. As governments worldwide push for increased adoption of solar energy, adherence to these regulations positions EVA as a key material in the expanding solar panel market.

The footwear industry, another significant market for EVA, faces regulations related to consumer safety and environmental protection. In many regions, footwear must meet specific standards for slip resistance, durability, and chemical composition. Additionally, growing environmental concerns have led to regulations promoting the use of recyclable and sustainable materials, creating opportunities for EVA formulations that meet these criteria.

As global awareness of environmental issues grows, regulations surrounding the recyclability and disposal of EVA products are becoming increasingly important. Many countries are implementing stricter waste management policies, encouraging the development of EVA formulations that are easier to recycle or biodegrade. Manufacturers who can innovate in this area stand to gain a competitive edge in environmentally conscious markets.

In conclusion, the regulatory landscape for EVA is complex and varies across industries and regions. However, by understanding and complying with these regulations, manufacturers can unlock new market opportunities and drive expansion. The ability to navigate this regulatory environment effectively is becoming a key differentiator in the competitive EVA market, enabling companies to capitalize on the material's versatility and expand into new applications and geographical regions.

In the food packaging sector, EVA must comply with stringent regulations set by agencies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These bodies establish guidelines for food contact materials, ensuring that EVA-based packaging does not leach harmful substances into food products. Compliance with these regulations opens doors for EVA in the vast and growing food packaging market.

The medical device industry presents another significant opportunity for EVA expansion, but it comes with its own set of regulatory challenges. Manufacturers must adhere to standards set by regulatory bodies like the FDA in the United States and the European Medicines Agency (EMA) in Europe. These regulations focus on biocompatibility, sterilization processes, and overall safety of EVA-based medical devices. Meeting these requirements allows EVA to penetrate the lucrative medical device market, particularly in applications such as tubing, drug delivery systems, and prosthetics.

In the renewable energy sector, EVA's use in solar panel encapsulation is subject to regulations concerning durability, weather resistance, and environmental impact. Compliance with standards set by organizations like the International Electrotechnical Commission (IEC) is crucial for market acceptance. As governments worldwide push for increased adoption of solar energy, adherence to these regulations positions EVA as a key material in the expanding solar panel market.

The footwear industry, another significant market for EVA, faces regulations related to consumer safety and environmental protection. In many regions, footwear must meet specific standards for slip resistance, durability, and chemical composition. Additionally, growing environmental concerns have led to regulations promoting the use of recyclable and sustainable materials, creating opportunities for EVA formulations that meet these criteria.

As global awareness of environmental issues grows, regulations surrounding the recyclability and disposal of EVA products are becoming increasingly important. Many countries are implementing stricter waste management policies, encouraging the development of EVA formulations that are easier to recycle or biodegrade. Manufacturers who can innovate in this area stand to gain a competitive edge in environmentally conscious markets.

In conclusion, the regulatory landscape for EVA is complex and varies across industries and regions. However, by understanding and complying with these regulations, manufacturers can unlock new market opportunities and drive expansion. The ability to navigate this regulatory environment effectively is becoming a key differentiator in the competitive EVA market, enabling companies to capitalize on the material's versatility and expand into new applications and geographical regions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!