How Ethylene Vinyl Acetate Responds to Market Fluctuations?

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Market Dynamics

The Ethylene Vinyl Acetate (EVA) market is characterized by its dynamic nature, influenced by various factors that contribute to its fluctuations. As a key component in numerous industries, including solar panel manufacturing, footwear production, and packaging materials, EVA's market dynamics are closely tied to global economic trends and industry-specific demands.

One of the primary drivers of EVA market fluctuations is the volatility in raw material prices, particularly ethylene and vinyl acetate monomer (VAM). These feedstocks are derived from petroleum products, making the EVA market susceptible to changes in oil prices. When crude oil prices rise, it typically leads to increased production costs for EVA, which can result in higher market prices or reduced profit margins for manufacturers.

The demand for EVA is also heavily influenced by the performance of end-use industries. For instance, the solar energy sector has been a significant consumer of EVA in recent years, using it as an encapsulant material in photovoltaic modules. As such, government policies promoting renewable energy and solar installations can lead to increased demand for EVA, potentially driving up prices. Conversely, any slowdown in the solar industry can result in oversupply and price declines in the EVA market.

Seasonal factors play a role in EVA market dynamics as well. The construction and footwear industries, which are major consumers of EVA, often experience cyclical demand patterns. This seasonality can lead to fluctuations in EVA demand and pricing throughout the year, with manufacturers adjusting their production schedules accordingly.

Global trade dynamics and geopolitical events can significantly impact the EVA market. Trade disputes, tariffs, or changes in import/export regulations can disrupt supply chains and alter the competitive landscape. For example, anti-dumping duties imposed on EVA imports in certain regions can lead to shifts in global trade flows and regional price disparities.

Technological advancements and innovations in EVA production processes can also influence market dynamics. Improved manufacturing techniques that enhance efficiency or reduce costs can lead to changes in market competitiveness and pricing structures. Additionally, the development of new applications for EVA can open up new market segments, potentially altering supply-demand balances.

The EVA market's response to these fluctuations often involves adjustments in production capacities, inventory management strategies, and pricing policies. Manufacturers may choose to increase or decrease production based on market conditions, while traders and end-users may adjust their purchasing patterns to mitigate risks associated with price volatility.

One of the primary drivers of EVA market fluctuations is the volatility in raw material prices, particularly ethylene and vinyl acetate monomer (VAM). These feedstocks are derived from petroleum products, making the EVA market susceptible to changes in oil prices. When crude oil prices rise, it typically leads to increased production costs for EVA, which can result in higher market prices or reduced profit margins for manufacturers.

The demand for EVA is also heavily influenced by the performance of end-use industries. For instance, the solar energy sector has been a significant consumer of EVA in recent years, using it as an encapsulant material in photovoltaic modules. As such, government policies promoting renewable energy and solar installations can lead to increased demand for EVA, potentially driving up prices. Conversely, any slowdown in the solar industry can result in oversupply and price declines in the EVA market.

Seasonal factors play a role in EVA market dynamics as well. The construction and footwear industries, which are major consumers of EVA, often experience cyclical demand patterns. This seasonality can lead to fluctuations in EVA demand and pricing throughout the year, with manufacturers adjusting their production schedules accordingly.

Global trade dynamics and geopolitical events can significantly impact the EVA market. Trade disputes, tariffs, or changes in import/export regulations can disrupt supply chains and alter the competitive landscape. For example, anti-dumping duties imposed on EVA imports in certain regions can lead to shifts in global trade flows and regional price disparities.

Technological advancements and innovations in EVA production processes can also influence market dynamics. Improved manufacturing techniques that enhance efficiency or reduce costs can lead to changes in market competitiveness and pricing structures. Additionally, the development of new applications for EVA can open up new market segments, potentially altering supply-demand balances.

The EVA market's response to these fluctuations often involves adjustments in production capacities, inventory management strategies, and pricing policies. Manufacturers may choose to increase or decrease production based on market conditions, while traders and end-users may adjust their purchasing patterns to mitigate risks associated with price volatility.

Demand Analysis

The demand for Ethylene Vinyl Acetate (EVA) is closely tied to various industries, making it susceptible to market fluctuations. The packaging industry, particularly in food and beverage sectors, remains a significant driver of EVA demand. As consumer preferences shift towards sustainable and convenient packaging solutions, the demand for EVA in this sector continues to grow steadily.

The footwear industry represents another major market for EVA, with its use in shoe soles and insoles. The global footwear market's expansion, driven by rising disposable incomes and changing fashion trends, directly impacts EVA demand. However, this sector is also influenced by seasonal variations and economic cycles, leading to fluctuations in EVA consumption.

In the renewable energy sector, EVA plays a crucial role in the production of solar panels. The growing emphasis on clean energy and government initiatives supporting solar power installations have led to increased demand for EVA in photovoltaic encapsulants. This market segment shows strong growth potential but is also subject to policy changes and technological advancements in the solar industry.

The automotive industry's use of EVA in various components, such as gaskets, hoses, and wire insulation, links its demand to vehicle production rates. Economic factors affecting car sales, such as interest rates and consumer confidence, indirectly influence EVA demand in this sector.

Construction and building materials represent another significant market for EVA, particularly in applications like adhesives, sealants, and waterproofing membranes. The cyclical nature of the construction industry, influenced by factors such as interest rates, housing market conditions, and infrastructure spending, contributes to fluctuations in EVA demand.

The global EVA market is also affected by regional economic conditions and trade dynamics. Developing economies, particularly in Asia-Pacific, are driving growth in EVA consumption due to rapid industrialization and urbanization. However, trade tensions and tariff policies can impact the flow of EVA and its end products across borders, leading to shifts in regional demand patterns.

Raw material prices, particularly ethylene and vinyl acetate, significantly influence EVA production costs and, consequently, market dynamics. Fluctuations in oil prices and the availability of feedstock can lead to volatility in EVA pricing, affecting demand across various end-use industries.

The increasing focus on sustainability and environmental regulations also shapes EVA demand. As industries seek more eco-friendly alternatives, there is growing interest in bio-based and recyclable EVA formulations, potentially opening new market opportunities while challenging traditional EVA products.

The footwear industry represents another major market for EVA, with its use in shoe soles and insoles. The global footwear market's expansion, driven by rising disposable incomes and changing fashion trends, directly impacts EVA demand. However, this sector is also influenced by seasonal variations and economic cycles, leading to fluctuations in EVA consumption.

In the renewable energy sector, EVA plays a crucial role in the production of solar panels. The growing emphasis on clean energy and government initiatives supporting solar power installations have led to increased demand for EVA in photovoltaic encapsulants. This market segment shows strong growth potential but is also subject to policy changes and technological advancements in the solar industry.

The automotive industry's use of EVA in various components, such as gaskets, hoses, and wire insulation, links its demand to vehicle production rates. Economic factors affecting car sales, such as interest rates and consumer confidence, indirectly influence EVA demand in this sector.

Construction and building materials represent another significant market for EVA, particularly in applications like adhesives, sealants, and waterproofing membranes. The cyclical nature of the construction industry, influenced by factors such as interest rates, housing market conditions, and infrastructure spending, contributes to fluctuations in EVA demand.

The global EVA market is also affected by regional economic conditions and trade dynamics. Developing economies, particularly in Asia-Pacific, are driving growth in EVA consumption due to rapid industrialization and urbanization. However, trade tensions and tariff policies can impact the flow of EVA and its end products across borders, leading to shifts in regional demand patterns.

Raw material prices, particularly ethylene and vinyl acetate, significantly influence EVA production costs and, consequently, market dynamics. Fluctuations in oil prices and the availability of feedstock can lead to volatility in EVA pricing, affecting demand across various end-use industries.

The increasing focus on sustainability and environmental regulations also shapes EVA demand. As industries seek more eco-friendly alternatives, there is growing interest in bio-based and recyclable EVA formulations, potentially opening new market opportunities while challenging traditional EVA products.

Supply Chain Challenges

The supply chain for Ethylene Vinyl Acetate (EVA) faces significant challenges due to market fluctuations, which can have far-reaching impacts on production, distribution, and pricing. One of the primary issues is the volatility in raw material costs, particularly ethylene and vinyl acetate monomer. These key components are derived from petroleum, making them susceptible to oil price fluctuations and geopolitical tensions affecting oil-producing regions.

Transportation and logistics pose another major challenge in the EVA supply chain. As a global commodity, EVA relies heavily on international shipping. Disruptions in maritime transport, such as port congestions, container shortages, or regional conflicts, can lead to delays and increased freight costs. These factors contribute to supply uncertainties and can result in inventory management difficulties for manufacturers and distributors.

The EVA industry also grapples with capacity management issues. Market demand for EVA can be cyclical, influenced by factors such as construction activity, automotive production, and consumer goods manufacturing. This cyclicality often leads to periods of overcapacity or undersupply, creating challenges for producers in maintaining optimal production levels and managing fixed costs effectively.

Regulatory changes and environmental concerns add another layer of complexity to the EVA supply chain. Increasing focus on sustainability and carbon footprint reduction has led to stricter regulations on production processes and product compositions. Manufacturers must adapt to these evolving standards, which may require significant investments in new technologies or alternative raw materials, potentially disrupting established supply chains.

The global nature of the EVA market exposes it to trade policy changes and geopolitical risks. Tariffs, trade agreements, and diplomatic relations between major producing and consuming countries can significantly impact the flow of EVA and its raw materials across borders. This uncertainty requires companies to maintain flexible supply chain strategies and diversify their sourcing and distribution networks.

Lastly, the EVA supply chain is increasingly affected by technological advancements and digitalization. While these developments offer opportunities for improved efficiency and transparency, they also present challenges in terms of implementation costs, data security, and the need for skilled workforce adaptation. Companies must navigate these technological shifts to remain competitive and responsive to market fluctuations.

Transportation and logistics pose another major challenge in the EVA supply chain. As a global commodity, EVA relies heavily on international shipping. Disruptions in maritime transport, such as port congestions, container shortages, or regional conflicts, can lead to delays and increased freight costs. These factors contribute to supply uncertainties and can result in inventory management difficulties for manufacturers and distributors.

The EVA industry also grapples with capacity management issues. Market demand for EVA can be cyclical, influenced by factors such as construction activity, automotive production, and consumer goods manufacturing. This cyclicality often leads to periods of overcapacity or undersupply, creating challenges for producers in maintaining optimal production levels and managing fixed costs effectively.

Regulatory changes and environmental concerns add another layer of complexity to the EVA supply chain. Increasing focus on sustainability and carbon footprint reduction has led to stricter regulations on production processes and product compositions. Manufacturers must adapt to these evolving standards, which may require significant investments in new technologies or alternative raw materials, potentially disrupting established supply chains.

The global nature of the EVA market exposes it to trade policy changes and geopolitical risks. Tariffs, trade agreements, and diplomatic relations between major producing and consuming countries can significantly impact the flow of EVA and its raw materials across borders. This uncertainty requires companies to maintain flexible supply chain strategies and diversify their sourcing and distribution networks.

Lastly, the EVA supply chain is increasingly affected by technological advancements and digitalization. While these developments offer opportunities for improved efficiency and transparency, they also present challenges in terms of implementation costs, data security, and the need for skilled workforce adaptation. Companies must navigate these technological shifts to remain competitive and responsive to market fluctuations.

Production Technologies

01 Composition and synthesis of EVA copolymers

Ethylene Vinyl Acetate (EVA) copolymers are synthesized through the copolymerization of ethylene and vinyl acetate monomers. The composition and properties of EVA can be tailored by adjusting the ratio of these monomers and the polymerization conditions. This versatility allows for the production of EVA with varying degrees of flexibility, transparency, and adhesion properties.- Composition and synthesis of EVA copolymers: Ethylene Vinyl Acetate (EVA) copolymers are synthesized through the copolymerization of ethylene and vinyl acetate monomers. The composition and properties of EVA can be adjusted by varying the ratio of these monomers, resulting in materials with different characteristics suitable for various applications.

- EVA blends and modifications: EVA copolymers can be blended with other polymers or modified with additives to enhance their properties. These modifications can improve characteristics such as thermal stability, mechanical strength, and processability, making the resulting materials suitable for a wide range of applications in various industries.

- EVA foam production and applications: EVA foams are produced by incorporating blowing agents into the polymer matrix. These foams find applications in areas such as footwear, sports equipment, and packaging due to their lightweight nature, cushioning properties, and ability to absorb impact.

- EVA in adhesive and sealant formulations: EVA copolymers are widely used in adhesive and sealant formulations due to their excellent adhesion properties, flexibility, and compatibility with various substrates. These formulations find applications in packaging, construction, and automotive industries.

- EVA in film and packaging applications: EVA copolymers are extensively used in the production of films and packaging materials. Their properties, such as clarity, flexibility, and heat-sealability, make them suitable for food packaging, agricultural films, and other packaging applications that require specific barrier properties.

02 EVA blends and composites

EVA can be blended with other polymers or materials to create composites with enhanced properties. These blends often combine the flexibility and toughness of EVA with the specific attributes of other materials, resulting in improved performance for various applications. Common blend components include polyethylene, polypropylene, and various fillers or reinforcing agents.Expand Specific Solutions03 Modification and functionalization of EVA

EVA copolymers can be modified or functionalized to enhance specific properties or introduce new functionalities. This can involve grafting reactions, crosslinking, or the incorporation of additional functional groups. Such modifications can improve properties like adhesion, heat resistance, or compatibility with other materials.Expand Specific Solutions04 Processing and manufacturing of EVA products

EVA can be processed using various manufacturing techniques, including extrusion, injection molding, and film blowing. The processing conditions and methods significantly influence the final properties of EVA products. Specialized techniques may be employed to produce foams, sheets, or multi-layer structures for specific applications.Expand Specific Solutions05 Applications of EVA in various industries

EVA finds widespread use across multiple industries due to its versatile properties. It is commonly used in the production of flexible packaging, adhesives, solar panel encapsulants, footwear, and sports equipment. The material's properties, such as flexibility, impact resistance, and weather resistance, make it suitable for a wide range of applications.Expand Specific Solutions

Key Industry Players

The ethylene vinyl acetate (EVA) market is in a mature growth stage, characterized by steady demand across various industries. The global EVA market size is projected to reach approximately $9.5 billion by 2025, with a CAGR of around 4-5%. Technologically, EVA production is well-established, with major players like China Petroleum & Chemical Corp., Celanese International Corp., and Kuraray Co., Ltd. continuously improving product quality and manufacturing processes. These companies, along with others like DuPont de Nemours, Inc. and LG Chem Ltd., are investing in R&D to develop new applications and enhance EVA properties, indicating ongoing technological advancements in the field.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive strategy to address market fluctuations in Ethylene Vinyl Acetate (EVA) production. The company employs advanced process technologies, including high-pressure tubular reactors and solution polymerization, to produce a wide range of EVA grades[1]. Sinopec has implemented a flexible production system that allows for rapid adjustments in EVA output based on market demand. This system incorporates real-time monitoring of global EVA prices and inventory levels, enabling swift responses to market changes[2]. Additionally, Sinopec has invested in research and development to improve EVA quality and expand its application range, particularly in the photovoltaic industry, where EVA is used as an encapsulant material[3]. The company has also established strategic partnerships with downstream manufacturers to ensure stable demand and mitigate market risks.

Strengths: Vertical integration allows for better control over raw material costs; extensive distribution network in China provides market insights. Weaknesses: Heavy reliance on domestic market may limit global competitiveness; potential overcapacity issues in times of low demand.

Kuraray Co., Ltd.

Technical Solution: Kuraray Co., Ltd. has developed a sophisticated approach to managing EVA market fluctuations through its proprietary EVAL™ technology. The company's strategy focuses on producing high-value specialty EVA grades with enhanced barrier properties and superior mechanical strength[4]. Kuraray's EVAL™ EVA resins are engineered to maintain performance even with reduced thickness, allowing for material cost savings in various applications. To address market volatility, Kuraray has implemented a dynamic pricing model that adjusts based on raw material costs and market demand[5]. The company also emphasizes product diversification, developing EVA grades for emerging markets such as 3D printing filaments and medical devices, reducing dependence on traditional sectors[6]. Kuraray's global production network, with plants in Japan, the United States, and Belgium, enables the company to optimize production and distribution based on regional market conditions.

Strengths: Strong focus on high-value specialty grades; global production capabilities allow for market flexibility. Weaknesses: Higher production costs for specialty grades may limit competitiveness in commodity markets; reliance on petroleum-based raw materials exposes the company to oil price volatility.

Application Innovations

Low-temperature thermal laminating film and preparation method and application thereof

PatentActiveUS20190284452A1

Innovation

- A low-temperature thermal laminating film composed of a film substrate with an adhesive layer made from 70-90% ethylene-vinyl acetate resin, 5-25% tackifier, and 3-5% antioxidant, which allows for strong bonding without a tie layer, reducing energy consumption and environmental impact.

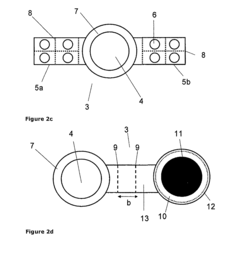

Packaging unit

PatentInactiveUS20100025399A1

Innovation

- A packaging unit comprising a container with a closure and receiving means for detachably fastening additive portions, such as fragrances or surfactants, which can be easily and inexpensively produced, allowing for customizable fragrance release and use on various products.

Regulatory Environment

The regulatory environment plays a crucial role in shaping the market dynamics of Ethylene Vinyl Acetate (EVA). As a versatile polymer with applications across various industries, EVA is subject to a complex web of regulations that can significantly impact its production, distribution, and consumption patterns.

Environmental regulations are particularly influential in the EVA market. Many countries have implemented stringent policies to reduce greenhouse gas emissions and promote sustainable manufacturing practices. These regulations often target the petrochemical industry, which includes EVA production. As a result, manufacturers may face increased costs associated with compliance, potentially affecting the supply and pricing of EVA in the market.

Safety regulations also play a significant role in the EVA industry. Given its use in consumer products such as footwear, packaging, and solar panels, EVA must meet specific safety standards. Changes in these standards can lead to shifts in demand, as manufacturers may need to reformulate their products or seek alternative materials to comply with new requirements.

Trade policies and tariffs can create market fluctuations for EVA. As a globally traded commodity, EVA is sensitive to changes in international trade agreements and import/export regulations. Tariffs imposed on raw materials or finished EVA products can alter the competitive landscape, potentially leading to price volatility and shifts in supply chains.

Intellectual property regulations impact the innovation landscape in the EVA market. Patent protections for new EVA formulations or production processes can create temporary monopolies, influencing market dynamics. Conversely, the expiration of key patents can lead to increased competition and potential price reductions.

Recycling and waste management regulations are becoming increasingly important in the EVA market. As governments worldwide push for more sustainable practices, manufacturers may face pressure to develop recyclable EVA products or implement take-back programs. These regulations can drive innovation in the industry but may also lead to increased costs and market uncertainties.

The pharmaceutical and medical device industries, which use EVA in various applications, are subject to strict regulatory oversight. Changes in regulations governing the use of materials in these sectors can have ripple effects on the EVA market, potentially opening new opportunities or creating challenges for existing applications.

As the regulatory landscape continues to evolve, companies operating in the EVA market must remain vigilant and adaptable. The ability to anticipate and respond to regulatory changes can be a key differentiator in navigating market fluctuations. Proactive engagement with regulatory bodies and industry associations can help companies stay ahead of potential changes and position themselves strategically in the market.

Environmental regulations are particularly influential in the EVA market. Many countries have implemented stringent policies to reduce greenhouse gas emissions and promote sustainable manufacturing practices. These regulations often target the petrochemical industry, which includes EVA production. As a result, manufacturers may face increased costs associated with compliance, potentially affecting the supply and pricing of EVA in the market.

Safety regulations also play a significant role in the EVA industry. Given its use in consumer products such as footwear, packaging, and solar panels, EVA must meet specific safety standards. Changes in these standards can lead to shifts in demand, as manufacturers may need to reformulate their products or seek alternative materials to comply with new requirements.

Trade policies and tariffs can create market fluctuations for EVA. As a globally traded commodity, EVA is sensitive to changes in international trade agreements and import/export regulations. Tariffs imposed on raw materials or finished EVA products can alter the competitive landscape, potentially leading to price volatility and shifts in supply chains.

Intellectual property regulations impact the innovation landscape in the EVA market. Patent protections for new EVA formulations or production processes can create temporary monopolies, influencing market dynamics. Conversely, the expiration of key patents can lead to increased competition and potential price reductions.

Recycling and waste management regulations are becoming increasingly important in the EVA market. As governments worldwide push for more sustainable practices, manufacturers may face pressure to develop recyclable EVA products or implement take-back programs. These regulations can drive innovation in the industry but may also lead to increased costs and market uncertainties.

The pharmaceutical and medical device industries, which use EVA in various applications, are subject to strict regulatory oversight. Changes in regulations governing the use of materials in these sectors can have ripple effects on the EVA market, potentially opening new opportunities or creating challenges for existing applications.

As the regulatory landscape continues to evolve, companies operating in the EVA market must remain vigilant and adaptable. The ability to anticipate and respond to regulatory changes can be a key differentiator in navigating market fluctuations. Proactive engagement with regulatory bodies and industry associations can help companies stay ahead of potential changes and position themselves strategically in the market.

Sustainability Factors

Sustainability factors play a crucial role in how Ethylene Vinyl Acetate (EVA) responds to market fluctuations. As environmental concerns continue to shape consumer preferences and regulatory landscapes, the EVA industry must adapt to ensure long-term viability and market resilience.

One of the primary sustainability factors influencing EVA's market response is the increasing demand for eco-friendly materials. As consumers become more environmentally conscious, there is a growing preference for products made from sustainable or recyclable materials. This trend has led to the development of bio-based EVA alternatives, which are derived from renewable resources such as sugarcane or corn. These sustainable options can help buffer against market fluctuations caused by volatile petroleum prices, as they are less dependent on fossil fuel feedstocks.

The circular economy concept is another sustainability factor impacting EVA's market dynamics. As governments and industries worldwide push for increased recycling and waste reduction, EVA manufacturers are exploring ways to improve the recyclability of their products. This includes developing new formulations that are easier to separate and recycle, as well as implementing take-back programs for end-of-life EVA products. Such initiatives can help stabilize market demand by creating closed-loop systems and reducing reliance on virgin materials.

Energy efficiency in EVA production is also a critical sustainability factor affecting market responses. As energy costs fluctuate and carbon pricing mechanisms become more prevalent, manufacturers are investing in more efficient production processes. This includes the adoption of advanced catalysts, process optimization, and the use of renewable energy sources in manufacturing facilities. These improvements can help reduce production costs and mitigate the impact of energy price volatility on EVA market prices.

The increasing focus on product lifecycle assessment (LCA) is another sustainability factor influencing EVA market dynamics. As companies and consumers become more aware of the environmental impact of products throughout their lifecycle, there is growing pressure to reduce the carbon footprint of EVA and its applications. This has led to innovations in lightweight EVA formulations for automotive and packaging applications, which can help reduce fuel consumption and transportation costs, thereby offering a competitive advantage in fluctuating markets.

Regulatory pressures related to sustainability also play a significant role in how EVA responds to market fluctuations. Stricter environmental regulations, such as those targeting single-use plastics or emissions reductions, can create both challenges and opportunities for the EVA industry. While compliance may initially increase costs, it can also drive innovation and create new market segments for sustainable EVA products, potentially offsetting negative market impacts.

In conclusion, sustainability factors are increasingly shaping the EVA industry's response to market fluctuations. By embracing eco-friendly materials, circular economy principles, energy efficiency, lifecycle assessments, and regulatory compliance, EVA manufacturers can enhance their resilience to market volatility while meeting growing demands for sustainable solutions.

One of the primary sustainability factors influencing EVA's market response is the increasing demand for eco-friendly materials. As consumers become more environmentally conscious, there is a growing preference for products made from sustainable or recyclable materials. This trend has led to the development of bio-based EVA alternatives, which are derived from renewable resources such as sugarcane or corn. These sustainable options can help buffer against market fluctuations caused by volatile petroleum prices, as they are less dependent on fossil fuel feedstocks.

The circular economy concept is another sustainability factor impacting EVA's market dynamics. As governments and industries worldwide push for increased recycling and waste reduction, EVA manufacturers are exploring ways to improve the recyclability of their products. This includes developing new formulations that are easier to separate and recycle, as well as implementing take-back programs for end-of-life EVA products. Such initiatives can help stabilize market demand by creating closed-loop systems and reducing reliance on virgin materials.

Energy efficiency in EVA production is also a critical sustainability factor affecting market responses. As energy costs fluctuate and carbon pricing mechanisms become more prevalent, manufacturers are investing in more efficient production processes. This includes the adoption of advanced catalysts, process optimization, and the use of renewable energy sources in manufacturing facilities. These improvements can help reduce production costs and mitigate the impact of energy price volatility on EVA market prices.

The increasing focus on product lifecycle assessment (LCA) is another sustainability factor influencing EVA market dynamics. As companies and consumers become more aware of the environmental impact of products throughout their lifecycle, there is growing pressure to reduce the carbon footprint of EVA and its applications. This has led to innovations in lightweight EVA formulations for automotive and packaging applications, which can help reduce fuel consumption and transportation costs, thereby offering a competitive advantage in fluctuating markets.

Regulatory pressures related to sustainability also play a significant role in how EVA responds to market fluctuations. Stricter environmental regulations, such as those targeting single-use plastics or emissions reductions, can create both challenges and opportunities for the EVA industry. While compliance may initially increase costs, it can also drive innovation and create new market segments for sustainable EVA products, potentially offsetting negative market impacts.

In conclusion, sustainability factors are increasingly shaping the EVA industry's response to market fluctuations. By embracing eco-friendly materials, circular economy principles, energy efficiency, lifecycle assessments, and regulatory compliance, EVA manufacturers can enhance their resilience to market volatility while meeting growing demands for sustainable solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!