How To Benchmark Lithium Hydroxide's Usage In Battery Anodes

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Battery Anode Background and Objectives

Lithium-ion batteries have revolutionized energy storage since their commercial introduction in the early 1990s. The evolution of these batteries has been marked by continuous improvements in energy density, cycle life, and safety features. Initially focused on consumer electronics applications, lithium-ion technology has expanded dramatically into electric vehicles and grid storage systems, driving unprecedented demand for battery materials including lithium hydroxide.

The technological trajectory of lithium hydroxide in battery anodes represents a significant shift from traditional graphite-based systems. Historically, battery anodes have predominantly utilized graphite materials, with lithium intercalation occurring during charging cycles. However, as energy density requirements have increased, particularly for electric vehicle applications, researchers have explored alternative anode materials and manufacturing processes where lithium hydroxide plays a crucial role.

The incorporation of lithium hydroxide in anode production has emerged as a promising approach to enhance battery performance. This technique, often referred to as pre-lithiation, addresses the irreversible capacity loss during the first charge-discharge cycle by providing additional lithium ions. The evolution of this technology has accelerated in recent years, with significant research efforts focused on optimizing lithium hydroxide integration methods and understanding the resulting electrochemical mechanisms.

Current technological objectives in this field center on establishing standardized benchmarking methodologies to accurately assess lithium hydroxide's contribution to anode performance. These objectives include developing reproducible testing protocols that can quantify capacity retention, rate capability, and cycle life improvements attributable to lithium hydroxide incorporation. Additionally, researchers aim to understand the relationship between lithium hydroxide purity grades, particle morphology, and resulting battery performance metrics.

The technological landscape is further complicated by emerging silicon and silicon-graphite composite anodes, where lithium hydroxide plays an even more critical role in compensating for silicon's substantial first-cycle capacity loss. As these next-generation anode materials move toward commercialization, the need for robust benchmarking methodologies becomes increasingly urgent.

Looking forward, the technological trajectory points toward more sophisticated pre-lithiation techniques, potentially including in-situ formation of lithium compounds during electrode manufacturing. This evolution necessitates corresponding advances in analytical techniques to characterize lithium distribution, reactivity, and electrochemical behavior within complex anode structures.

The ultimate technological goal remains establishing clear, industry-accepted standards for evaluating lithium hydroxide's effectiveness in various anode systems, enabling manufacturers to optimize material selection and processing parameters for maximum battery performance and longevity.

The technological trajectory of lithium hydroxide in battery anodes represents a significant shift from traditional graphite-based systems. Historically, battery anodes have predominantly utilized graphite materials, with lithium intercalation occurring during charging cycles. However, as energy density requirements have increased, particularly for electric vehicle applications, researchers have explored alternative anode materials and manufacturing processes where lithium hydroxide plays a crucial role.

The incorporation of lithium hydroxide in anode production has emerged as a promising approach to enhance battery performance. This technique, often referred to as pre-lithiation, addresses the irreversible capacity loss during the first charge-discharge cycle by providing additional lithium ions. The evolution of this technology has accelerated in recent years, with significant research efforts focused on optimizing lithium hydroxide integration methods and understanding the resulting electrochemical mechanisms.

Current technological objectives in this field center on establishing standardized benchmarking methodologies to accurately assess lithium hydroxide's contribution to anode performance. These objectives include developing reproducible testing protocols that can quantify capacity retention, rate capability, and cycle life improvements attributable to lithium hydroxide incorporation. Additionally, researchers aim to understand the relationship between lithium hydroxide purity grades, particle morphology, and resulting battery performance metrics.

The technological landscape is further complicated by emerging silicon and silicon-graphite composite anodes, where lithium hydroxide plays an even more critical role in compensating for silicon's substantial first-cycle capacity loss. As these next-generation anode materials move toward commercialization, the need for robust benchmarking methodologies becomes increasingly urgent.

Looking forward, the technological trajectory points toward more sophisticated pre-lithiation techniques, potentially including in-situ formation of lithium compounds during electrode manufacturing. This evolution necessitates corresponding advances in analytical techniques to characterize lithium distribution, reactivity, and electrochemical behavior within complex anode structures.

The ultimate technological goal remains establishing clear, industry-accepted standards for evaluating lithium hydroxide's effectiveness in various anode systems, enabling manufacturers to optimize material selection and processing parameters for maximum battery performance and longevity.

Market Analysis of Lithium Hydroxide in Battery Industry

The global lithium hydroxide market has experienced significant growth in recent years, primarily driven by its increasing application in battery technologies, particularly for electric vehicles (EVs). The market value reached approximately $3.5 billion in 2022 and is projected to grow at a CAGR of 9.2% through 2030, reflecting the expanding demand for high-performance battery materials.

Lithium hydroxide has emerged as a critical component in the battery industry due to its superior properties compared to lithium carbonate, especially for high-nickel cathode materials that enable greater energy density and longer driving ranges for EVs. The market demand is concentrated in regions with substantial EV manufacturing capabilities, with Asia-Pacific accounting for over 65% of global consumption, followed by Europe at 20% and North America at 12%.

China dominates the lithium hydroxide production landscape, controlling approximately 60% of global production capacity. This concentration has created supply chain vulnerabilities for Western manufacturers, prompting initiatives in the US and EU to develop domestic production capabilities through strategic investments and policy support.

Price volatility has been a significant concern in the lithium hydroxide market, with prices surging by over 400% between 2020 and 2022 before experiencing a correction in 2023. This volatility has impacted battery manufacturers' cost structures and accelerated research into alternative materials and recycling technologies.

The battery-grade lithium hydroxide segment commands a premium price, typically 15-20% higher than technical-grade material, due to the stringent purity requirements (99.5% minimum) necessary for high-performance batteries. This quality differential has created market stratification, with specialized producers focusing exclusively on battery-grade material.

Market forecasts indicate that demand for lithium hydroxide will outpace lithium carbonate by 2025, primarily due to the shift toward high-nickel cathode chemistries in premium EV applications. This transition is expected to create supply constraints, potentially leading to renewed price pressures and strategic stockpiling by major battery manufacturers.

Emerging applications in grid storage systems are creating a secondary demand driver for lithium hydroxide, with utility-scale projects expected to consume an additional 15,000 metric tons annually by 2025. This diversification of end-use applications provides market resilience but also intensifies competition for limited supplies.

Lithium hydroxide has emerged as a critical component in the battery industry due to its superior properties compared to lithium carbonate, especially for high-nickel cathode materials that enable greater energy density and longer driving ranges for EVs. The market demand is concentrated in regions with substantial EV manufacturing capabilities, with Asia-Pacific accounting for over 65% of global consumption, followed by Europe at 20% and North America at 12%.

China dominates the lithium hydroxide production landscape, controlling approximately 60% of global production capacity. This concentration has created supply chain vulnerabilities for Western manufacturers, prompting initiatives in the US and EU to develop domestic production capabilities through strategic investments and policy support.

Price volatility has been a significant concern in the lithium hydroxide market, with prices surging by over 400% between 2020 and 2022 before experiencing a correction in 2023. This volatility has impacted battery manufacturers' cost structures and accelerated research into alternative materials and recycling technologies.

The battery-grade lithium hydroxide segment commands a premium price, typically 15-20% higher than technical-grade material, due to the stringent purity requirements (99.5% minimum) necessary for high-performance batteries. This quality differential has created market stratification, with specialized producers focusing exclusively on battery-grade material.

Market forecasts indicate that demand for lithium hydroxide will outpace lithium carbonate by 2025, primarily due to the shift toward high-nickel cathode chemistries in premium EV applications. This transition is expected to create supply constraints, potentially leading to renewed price pressures and strategic stockpiling by major battery manufacturers.

Emerging applications in grid storage systems are creating a secondary demand driver for lithium hydroxide, with utility-scale projects expected to consume an additional 15,000 metric tons annually by 2025. This diversification of end-use applications provides market resilience but also intensifies competition for limited supplies.

Current Technical Challenges in Lithium Hydroxide Anode Applications

Despite the promising potential of lithium hydroxide in battery anodes, several significant technical challenges currently impede its widespread adoption and optimal utilization. The primary challenge lies in the reactivity of lithium hydroxide with atmospheric carbon dioxide, which forms lithium carbonate and compromises the material's electrochemical properties. This high reactivity necessitates stringent handling protocols and specialized storage conditions, increasing manufacturing complexity and costs.

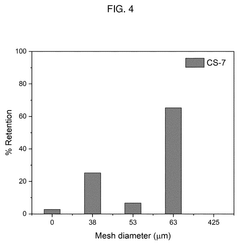

The inconsistent particle size distribution of commercially available lithium hydroxide presents another major obstacle. Variations in particle morphology and size significantly impact electrode fabrication processes, affecting slurry rheology, coating uniformity, and ultimately electrode performance. Achieving consistent particle characteristics remains difficult at industrial scale, leading to batch-to-batch variations in anode quality.

Moisture sensitivity poses a substantial challenge in lithium hydroxide processing. When exposed to humidity, lithium hydroxide readily absorbs water, forming hydrates that alter its physical properties and electrochemical behavior. This hygroscopic nature complicates manufacturing processes and can lead to degraded battery performance if not properly controlled throughout the production chain.

The integration of lithium hydroxide into existing anode formulations faces compatibility issues with conventional binders and electrolytes. The alkaline nature of lithium hydroxide can degrade commonly used polyvinylidene fluoride (PVDF) binders and react unfavorably with certain electrolyte components, necessitating the development of alternative binding systems and electrolyte formulations specifically optimized for lithium hydroxide-containing anodes.

Scaling production while maintaining quality presents significant engineering challenges. Current synthesis methods for high-purity lithium hydroxide suitable for battery applications are energy-intensive and often involve multiple purification steps. The trade-off between purity, cost, and production volume remains a critical bottleneck for widespread implementation in commercial battery systems.

Standardization of testing protocols specifically designed for lithium hydroxide in anode applications is notably lacking. Without established benchmarking methodologies, comparing research results across different laboratories and translating them to industrial applications becomes problematic. This absence of standardized evaluation frameworks hinders progress in optimizing lithium hydroxide usage in anodes.

Long-term stability concerns persist regarding lithium hydroxide in anode formulations. Under repeated charge-discharge cycles, the chemical and structural evolution of lithium hydroxide within the anode matrix remains incompletely understood. Potential phase transformations, reactivity with other electrode components, and contribution to solid-electrolyte interphase (SEI) formation require further investigation to ensure battery longevity and safety.

The inconsistent particle size distribution of commercially available lithium hydroxide presents another major obstacle. Variations in particle morphology and size significantly impact electrode fabrication processes, affecting slurry rheology, coating uniformity, and ultimately electrode performance. Achieving consistent particle characteristics remains difficult at industrial scale, leading to batch-to-batch variations in anode quality.

Moisture sensitivity poses a substantial challenge in lithium hydroxide processing. When exposed to humidity, lithium hydroxide readily absorbs water, forming hydrates that alter its physical properties and electrochemical behavior. This hygroscopic nature complicates manufacturing processes and can lead to degraded battery performance if not properly controlled throughout the production chain.

The integration of lithium hydroxide into existing anode formulations faces compatibility issues with conventional binders and electrolytes. The alkaline nature of lithium hydroxide can degrade commonly used polyvinylidene fluoride (PVDF) binders and react unfavorably with certain electrolyte components, necessitating the development of alternative binding systems and electrolyte formulations specifically optimized for lithium hydroxide-containing anodes.

Scaling production while maintaining quality presents significant engineering challenges. Current synthesis methods for high-purity lithium hydroxide suitable for battery applications are energy-intensive and often involve multiple purification steps. The trade-off between purity, cost, and production volume remains a critical bottleneck for widespread implementation in commercial battery systems.

Standardization of testing protocols specifically designed for lithium hydroxide in anode applications is notably lacking. Without established benchmarking methodologies, comparing research results across different laboratories and translating them to industrial applications becomes problematic. This absence of standardized evaluation frameworks hinders progress in optimizing lithium hydroxide usage in anodes.

Long-term stability concerns persist regarding lithium hydroxide in anode formulations. Under repeated charge-discharge cycles, the chemical and structural evolution of lithium hydroxide within the anode matrix remains incompletely understood. Potential phase transformations, reactivity with other electrode components, and contribution to solid-electrolyte interphase (SEI) formation require further investigation to ensure battery longevity and safety.

Benchmark Methodologies for Lithium Hydroxide Anode Performance

01 Production methods for lithium hydroxide

Various methods for producing lithium hydroxide are described, including extraction from lithium-containing minerals, conversion from lithium carbonate, and electrochemical processes. These methods aim to improve yield, purity, and efficiency in the production of lithium hydroxide, which is a critical material for battery manufacturing. The processes often involve multiple steps including leaching, purification, crystallization, and drying to achieve high-quality lithium hydroxide suitable for commercial applications.- Production methods for lithium hydroxide: Various methods for producing lithium hydroxide are disclosed, including extraction from lithium-containing minerals, conversion from lithium carbonate, and direct production processes. These methods aim to establish benchmarks for efficient and cost-effective production of high-purity lithium hydroxide suitable for battery applications. The processes often involve specific reaction conditions, purification steps, and quality control measures to meet industry standards.

- Quality benchmarks and purity standards: Establishing quality benchmarks and purity standards for lithium hydroxide is crucial for its application in high-performance batteries. These standards typically include specifications for impurity levels, particle size distribution, moisture content, and chemical composition. Standardized testing methods and analytical techniques are employed to verify compliance with these benchmarks, ensuring consistent performance in end-use applications.

- Lithium hydroxide in battery applications: Lithium hydroxide serves as a critical material in the production of cathode materials for lithium-ion batteries. Its use as a precursor helps achieve specific performance benchmarks in terms of energy density, cycle life, and thermal stability. The grade and quality of lithium hydroxide directly impact battery performance metrics, with battery manufacturers establishing strict specifications to ensure consistent product quality and performance.

- Market benchmarks and economic considerations: Market benchmarks for lithium hydroxide include pricing indices, supply-demand dynamics, and production costs. These benchmarks serve as reference points for contract negotiations, investment decisions, and strategic planning in the lithium industry. Economic considerations include production efficiency, energy consumption, reagent usage, and environmental compliance costs, all of which contribute to establishing competitive benchmarks in the global market.

- Environmental and sustainability benchmarks: Environmental and sustainability benchmarks for lithium hydroxide production focus on reducing carbon footprint, water usage, waste generation, and overall environmental impact. These benchmarks include metrics for energy efficiency, greenhouse gas emissions, water recycling rates, and land use. Sustainable production methods aim to establish new industry standards that balance economic viability with environmental responsibility throughout the lithium hydroxide value chain.

02 Quality benchmarks and purity standards

Establishing quality benchmarks and purity standards for lithium hydroxide is essential for battery-grade applications. These standards typically specify maximum allowable levels of impurities such as sodium, potassium, calcium, and heavy metals. High-purity lithium hydroxide with minimal contaminants is required to ensure optimal battery performance, longevity, and safety. Various analytical techniques are employed to verify compliance with these quality benchmarks, including spectroscopic methods and chromatography.Expand Specific Solutions03 Lithium hydroxide applications in battery technology

Lithium hydroxide serves as a critical precursor in the manufacturing of cathode materials for lithium-ion batteries. It is particularly valuable for producing high-nickel cathode materials that enable greater energy density and improved performance in electric vehicle batteries. The use of high-quality lithium hydroxide can lead to batteries with enhanced cycle life, faster charging capabilities, and improved thermal stability. Research continues to optimize the use of lithium hydroxide in next-generation battery technologies.Expand Specific Solutions04 Environmental impact and sustainable production

Sustainable production methods for lithium hydroxide focus on reducing environmental footprint through water conservation, energy efficiency, and waste minimization. Direct lithium extraction technologies aim to decrease land disturbance compared to traditional evaporation ponds. Closed-loop systems for recycling process water and reagents are being developed to minimize resource consumption. Additionally, carbon footprint reduction strategies include using renewable energy sources in production facilities and optimizing transportation logistics for raw materials and finished products.Expand Specific Solutions05 Market analysis and economic considerations

The lithium hydroxide market is characterized by increasing demand driven primarily by the growth in electric vehicle production. Benchmark pricing is influenced by factors including production costs, supply-demand dynamics, and product quality specifications. Regional differences in production capabilities and costs create varying market conditions globally. Strategic investments in lithium hydroxide production facilities are occurring in multiple regions to secure supply chains for battery manufacturing. Long-term contracts between producers and battery manufacturers are becoming more common to ensure stable supply and pricing.Expand Specific Solutions

Key Industry Players in Lithium Hydroxide Battery Materials

The lithium hydroxide battery anode market is in a growth phase, characterized by increasing demand driven by electric vehicle adoption. Market size is expanding rapidly, with projections showing significant growth as major automotive manufacturers like Volkswagen, Toyota, and Nissan transition to electric fleets. Technologically, the field is advancing from early-stage development toward commercial maturity, with key players demonstrating varying levels of expertise. Leading battery manufacturers including LG Energy Solution, Samsung SDI, and LG Chem are at the forefront of lithium hydroxide anode technology development, while specialized companies like Sion Power and SES Holdings are pushing innovation boundaries with next-generation lithium-metal batteries. Research institutions such as Nanyang Technological University and Industrial Technology Research Institute are contributing fundamental advancements that could accelerate commercial applications.

LG Chem Ltd.

Technical Solution: LG Chem has developed a comprehensive benchmarking methodology for lithium hydroxide usage in battery anodes, focusing on silicon-based composite anodes. Their approach involves a multi-parameter assessment framework that evaluates lithium hydroxide's effectiveness as a pre-lithiation agent. The company utilizes differential electrochemical mass spectrometry (DEMS) to quantify gas evolution during initial cycling, correlating this with lithium hydroxide concentration. Their proprietary "LiOH Efficiency Index" measures the ratio of lithium ions effectively incorporated into the anode structure versus total lithium hydroxide input. LG Chem's benchmarking protocol includes accelerated aging tests at elevated temperatures (45-60°C) to determine long-term stability of lithium hydroxide-treated anodes, with performance metrics tracked over 1000+ cycles. The company has established standardized testing conditions including specific current densities (0.1-3C), temperature ranges (-20°C to 60°C), and humidity controls to ensure reproducible results across different material batches.

Strengths: Comprehensive multi-parameter assessment framework allows for detailed performance comparison across different lithium hydroxide formulations. Their established correlation between lithium hydroxide concentration and first-cycle efficiency provides clear optimization pathways. Weaknesses: The benchmarking methodology is primarily optimized for silicon-composite anodes and may require significant modification for other anode chemistries. Their approach requires specialized analytical equipment that may not be accessible to smaller research facilities.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has pioneered an advanced benchmarking system for lithium hydroxide utilization in next-generation anode materials, particularly focusing on high-capacity silicon and graphite composites. Their methodology employs a three-tiered evaluation approach: first, quantitative analysis of lithium consumption during SEI formation using isotopic lithium tracing (Li-6 vs. Li-7); second, in-situ electrochemical impedance spectroscopy to monitor interface resistance changes as a function of lithium hydroxide concentration; and third, post-mortem surface analysis using XPS and TOF-SIMS to quantify lithium distribution. Samsung's benchmarking protocol standardizes testing parameters including particle size distribution of lithium hydroxide (1-5μm), mixing homogeneity assessment via automated optical inspection, and precise humidity control during electrode preparation (maintained at <0.5% RH). Their proprietary "LiOH Utilization Efficiency" metric calculates the percentage of lithium hydroxide that effectively contributes to counteracting first-cycle capacity loss, with values typically ranging from 65-85% depending on anode composition and processing conditions.

Strengths: Their isotopic lithium tracing methodology provides unprecedented insight into exactly how lithium hydroxide is consumed during battery formation. The standardized testing protocols ensure highly reproducible results across different material batches and manufacturing facilities. Weaknesses: The benchmarking system requires sophisticated analytical instrumentation and expertise, making it difficult to implement in smaller research settings. Their approach is heavily optimized for their specific silicon-graphite composite formulations and may not translate directly to other anode chemistries.

Critical Patents and Research on Lithium Hydroxide Anode Technology

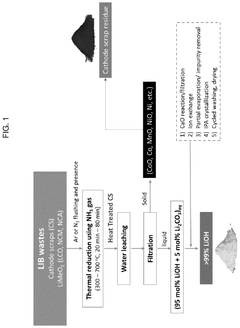

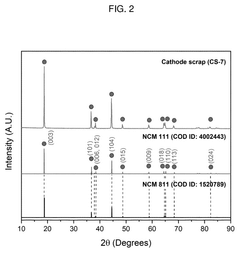

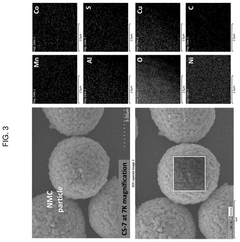

Method of direct lithium hydroxide production from lithium-ion battery waste

PatentPendingUS20250154017A1

Innovation

- A method involving the thermo-chemical reduction of LIB waste cathode scraps using ammonia gas (NH3) as a reducing agent, followed by water leaching to selectively extract lithium as lithium hydroxide (LiOH), achieving high lithium leaching efficiency exceeding 90%.

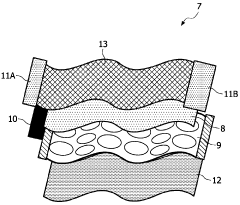

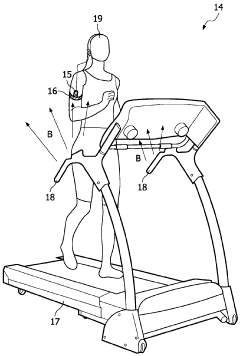

Wearable rechargeable power system and electronic device

PatentWO2009147587A1

Innovation

- A wearable rechargeable power system utilizing magnetoelectric conversion means that converts a magnetic field into electrical energy, allowing for deformable attachment to the body and integration with garments, enabling convenient recharging without the need for bulky power sources within devices.

Environmental Impact Assessment of Lithium Hydroxide Production

The environmental impact of lithium hydroxide production represents a critical consideration in the sustainable development of battery technologies. Current extraction methods, particularly from brine deposits, consume significant water resources—approximately 500,000 gallons per ton of lithium produced—creating substantial ecological pressure in water-scarce regions like Chile's Atacama Desert and Argentina's Salar de Olaroz.

Energy consumption throughout the production chain presents another significant environmental challenge. The conversion process from lithium carbonate to lithium hydroxide requires approximately 5-7 MWh of energy per ton produced, contributing to greenhouse gas emissions when powered by non-renewable sources. Hard-rock mining operations, increasingly common as demand rises, generate approximately 15 tons of CO2 equivalent per ton of lithium hydroxide—significantly higher than brine-based extraction methods.

Waste management issues further complicate the environmental profile of lithium hydroxide production. The process generates tailings containing potentially harmful substances including sulfuric acid, heavy metals, and processing chemicals. These byproducts require careful management to prevent soil contamination and water pollution. Recent industry data indicates that each ton of lithium hydroxide produced from spodumene generates approximately 7-10 tons of solid waste material.

Land use transformation represents another significant impact, with open-pit mining operations for spodumene disrupting local ecosystems and biodiversity. Satellite imagery analysis from major production sites in Australia shows an average land disturbance of 8-12 hectares per kiloton of annual production capacity.

Water pollution risks are particularly concerning, with documented cases of lithium extraction operations increasing salinity levels in surrounding water bodies and potentially introducing processing chemicals into groundwater systems. Monitoring data from South American operations has detected elevated concentrations of lithium, boron, and manganese in groundwater adjacent to production facilities.

Recent life cycle assessments comparing different production pathways indicate that direct lithium extraction technologies may reduce environmental impacts by 30-50% compared to conventional methods, though these technologies remain in early commercial deployment stages. The industry is increasingly adopting water recycling systems, renewable energy integration, and improved waste management protocols to address these environmental challenges, with leading producers targeting 30% reduction in water consumption and 40% reduction in carbon emissions by 2030.

Energy consumption throughout the production chain presents another significant environmental challenge. The conversion process from lithium carbonate to lithium hydroxide requires approximately 5-7 MWh of energy per ton produced, contributing to greenhouse gas emissions when powered by non-renewable sources. Hard-rock mining operations, increasingly common as demand rises, generate approximately 15 tons of CO2 equivalent per ton of lithium hydroxide—significantly higher than brine-based extraction methods.

Waste management issues further complicate the environmental profile of lithium hydroxide production. The process generates tailings containing potentially harmful substances including sulfuric acid, heavy metals, and processing chemicals. These byproducts require careful management to prevent soil contamination and water pollution. Recent industry data indicates that each ton of lithium hydroxide produced from spodumene generates approximately 7-10 tons of solid waste material.

Land use transformation represents another significant impact, with open-pit mining operations for spodumene disrupting local ecosystems and biodiversity. Satellite imagery analysis from major production sites in Australia shows an average land disturbance of 8-12 hectares per kiloton of annual production capacity.

Water pollution risks are particularly concerning, with documented cases of lithium extraction operations increasing salinity levels in surrounding water bodies and potentially introducing processing chemicals into groundwater systems. Monitoring data from South American operations has detected elevated concentrations of lithium, boron, and manganese in groundwater adjacent to production facilities.

Recent life cycle assessments comparing different production pathways indicate that direct lithium extraction technologies may reduce environmental impacts by 30-50% compared to conventional methods, though these technologies remain in early commercial deployment stages. The industry is increasingly adopting water recycling systems, renewable energy integration, and improved waste management protocols to address these environmental challenges, with leading producers targeting 30% reduction in water consumption and 40% reduction in carbon emissions by 2030.

Supply Chain Security for Battery-Grade Lithium Hydroxide

The security of the lithium hydroxide supply chain represents a critical concern for battery manufacturers globally, particularly as the demand for lithium-ion batteries continues to surge with the expansion of electric vehicle markets and renewable energy storage systems. Battery-grade lithium hydroxide requires stringent purity levels exceeding 99.5%, with minimal metallic impurities, making its production and sourcing particularly challenging.

Current supply chain vulnerabilities stem from geographic concentration, with approximately 60% of lithium hydroxide production capacity concentrated in China, followed by significant operations in Australia and Chile. This concentration creates inherent risks of supply disruption due to geopolitical tensions, trade restrictions, or natural disasters affecting key production regions.

The conversion process from lithium carbonate to lithium hydroxide introduces additional supply chain complexities, as it requires specialized facilities and expertise. Recent market volatility has seen lithium hydroxide prices fluctuate by over 300% within 18-month periods, creating significant challenges for long-term procurement planning and cost management for battery manufacturers.

Regulatory frameworks governing lithium extraction and processing vary significantly across jurisdictions, creating compliance challenges for global supply chains. The European Union's Battery Regulation and the United States' Inflation Reduction Act have introduced new requirements for material traceability and environmental impact disclosure, adding layers of complexity to international lithium hydroxide sourcing.

Emerging supply chain security strategies include vertical integration, with major battery manufacturers acquiring stakes in lithium mining operations and processing facilities. Strategic stockpiling has also gained traction, with some manufacturers maintaining 6-12 month reserves of battery-grade lithium hydroxide to mitigate short-term supply disruptions.

Technological innovations in recycling present promising opportunities for reducing supply chain dependencies. Advanced hydrometallurgical processes can now recover up to 95% of lithium from spent batteries, though commercial-scale implementation remains limited. Alternative sourcing methods, including extraction from geothermal brines and seawater, are advancing but remain years from commercial viability.

For benchmarking lithium hydroxide's usage in battery anodes specifically, supply chain security metrics should include supplier diversification indices, geographic risk exposure assessments, and material qualification timelines for new suppliers. Companies leading in supply chain security typically maintain relationships with at least three qualified suppliers across different geographic regions and invest in alternative material research to reduce dependency on single material streams.

Current supply chain vulnerabilities stem from geographic concentration, with approximately 60% of lithium hydroxide production capacity concentrated in China, followed by significant operations in Australia and Chile. This concentration creates inherent risks of supply disruption due to geopolitical tensions, trade restrictions, or natural disasters affecting key production regions.

The conversion process from lithium carbonate to lithium hydroxide introduces additional supply chain complexities, as it requires specialized facilities and expertise. Recent market volatility has seen lithium hydroxide prices fluctuate by over 300% within 18-month periods, creating significant challenges for long-term procurement planning and cost management for battery manufacturers.

Regulatory frameworks governing lithium extraction and processing vary significantly across jurisdictions, creating compliance challenges for global supply chains. The European Union's Battery Regulation and the United States' Inflation Reduction Act have introduced new requirements for material traceability and environmental impact disclosure, adding layers of complexity to international lithium hydroxide sourcing.

Emerging supply chain security strategies include vertical integration, with major battery manufacturers acquiring stakes in lithium mining operations and processing facilities. Strategic stockpiling has also gained traction, with some manufacturers maintaining 6-12 month reserves of battery-grade lithium hydroxide to mitigate short-term supply disruptions.

Technological innovations in recycling present promising opportunities for reducing supply chain dependencies. Advanced hydrometallurgical processes can now recover up to 95% of lithium from spent batteries, though commercial-scale implementation remains limited. Alternative sourcing methods, including extraction from geothermal brines and seawater, are advancing but remain years from commercial viability.

For benchmarking lithium hydroxide's usage in battery anodes specifically, supply chain security metrics should include supplier diversification indices, geographic risk exposure assessments, and material qualification timelines for new suppliers. Companies leading in supply chain security typically maintain relationships with at least three qualified suppliers across different geographic regions and invest in alternative material research to reduce dependency on single material streams.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!