How to Overcome Barriers in Ethylene Vinyl Acetate Utilization?

JUL 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Utilization Background and Objectives

Ethylene Vinyl Acetate (EVA) has emerged as a versatile polymer with a wide range of applications across various industries. The development of EVA technology can be traced back to the 1950s when it was first synthesized by DuPont. Since then, EVA has undergone significant advancements in terms of its production processes, properties, and applications.

The evolution of EVA technology has been driven by the increasing demand for materials with enhanced flexibility, durability, and thermal properties. Over the years, researchers and industry professionals have focused on improving EVA's performance characteristics, such as its melt flow index, vinyl acetate content, and crosslinking capabilities. These efforts have led to the development of specialized EVA grades tailored for specific applications.

In recent years, the global EVA market has experienced steady growth, with projections indicating continued expansion in the coming decades. This growth is primarily attributed to the rising demand for EVA in sectors such as packaging, footwear, solar panels, and automotive industries. The versatility of EVA has made it an attractive choice for manufacturers seeking cost-effective and high-performance materials.

Despite its widespread adoption, EVA utilization faces several challenges that need to be addressed to unlock its full potential. These barriers include limitations in high-temperature applications, susceptibility to certain chemicals, and environmental concerns related to its disposal and recycling. Overcoming these obstacles is crucial for expanding EVA's market share and ensuring its long-term sustainability.

The primary objective of this technical research report is to explore innovative approaches to overcome the barriers in EVA utilization. By examining the current state of EVA technology, identifying key challenges, and investigating potential solutions, we aim to provide valuable insights for industry stakeholders and researchers. This report will focus on several key areas, including enhancing EVA's thermal stability, improving its chemical resistance, and developing more sustainable production and recycling methods.

Furthermore, this research seeks to uncover emerging trends and technologies that could revolutionize EVA utilization. By analyzing cutting-edge research and development initiatives, we aim to identify promising avenues for future innovation in EVA applications. This includes exploring novel additives, processing techniques, and hybrid materials that could address existing limitations and open up new possibilities for EVA usage across various industries.

The evolution of EVA technology has been driven by the increasing demand for materials with enhanced flexibility, durability, and thermal properties. Over the years, researchers and industry professionals have focused on improving EVA's performance characteristics, such as its melt flow index, vinyl acetate content, and crosslinking capabilities. These efforts have led to the development of specialized EVA grades tailored for specific applications.

In recent years, the global EVA market has experienced steady growth, with projections indicating continued expansion in the coming decades. This growth is primarily attributed to the rising demand for EVA in sectors such as packaging, footwear, solar panels, and automotive industries. The versatility of EVA has made it an attractive choice for manufacturers seeking cost-effective and high-performance materials.

Despite its widespread adoption, EVA utilization faces several challenges that need to be addressed to unlock its full potential. These barriers include limitations in high-temperature applications, susceptibility to certain chemicals, and environmental concerns related to its disposal and recycling. Overcoming these obstacles is crucial for expanding EVA's market share and ensuring its long-term sustainability.

The primary objective of this technical research report is to explore innovative approaches to overcome the barriers in EVA utilization. By examining the current state of EVA technology, identifying key challenges, and investigating potential solutions, we aim to provide valuable insights for industry stakeholders and researchers. This report will focus on several key areas, including enhancing EVA's thermal stability, improving its chemical resistance, and developing more sustainable production and recycling methods.

Furthermore, this research seeks to uncover emerging trends and technologies that could revolutionize EVA utilization. By analyzing cutting-edge research and development initiatives, we aim to identify promising avenues for future innovation in EVA applications. This includes exploring novel additives, processing techniques, and hybrid materials that could address existing limitations and open up new possibilities for EVA usage across various industries.

Market Demand Analysis for EVA Products

The global market for Ethylene Vinyl Acetate (EVA) products has been experiencing steady growth, driven by increasing demand across various industries. The versatility of EVA, with its unique combination of flexibility, toughness, and adhesion properties, has led to its widespread adoption in sectors such as packaging, footwear, solar panels, and automotive.

In the packaging industry, EVA is increasingly used for flexible packaging solutions, particularly in food and beverage applications. The material's excellent barrier properties against moisture and gases make it ideal for preserving product freshness and extending shelf life. This trend is expected to continue as consumers demand more sustainable and convenient packaging options.

The footwear industry represents another significant market for EVA products. The material's lightweight nature, shock absorption capabilities, and durability have made it a popular choice for shoe soles and insoles. As the global athletic footwear market expands, driven by increasing health consciousness and sports participation, the demand for EVA in this sector is projected to grow substantially.

The solar energy industry has emerged as a key driver for EVA demand. EVA encapsulants are crucial components in photovoltaic modules, providing protection and insulation for solar cells. With the global push towards renewable energy sources and the declining costs of solar technology, the demand for EVA in this sector is expected to surge in the coming years.

In the automotive industry, EVA is gaining traction for its use in interior components, sound dampening materials, and wire and cable insulation. As vehicle manufacturers focus on lightweight materials to improve fuel efficiency and reduce emissions, EVA's low density and excellent performance characteristics make it an attractive option.

The construction sector also presents significant opportunities for EVA products. The material's applications in adhesives, sealants, and waterproofing membranes are driving demand, particularly in regions with growing infrastructure development and renovation activities.

Geographically, Asia-Pacific remains the largest market for EVA products, with China and India leading the growth. The region's robust manufacturing sector, coupled with increasing urbanization and consumer spending, is fueling demand across various end-use industries. North America and Europe follow, with steady growth driven by technological advancements and sustainability initiatives.

Despite the positive outlook, challenges such as raw material price volatility and environmental concerns regarding plastic waste persist. However, ongoing research and development efforts are focused on improving EVA's recyclability and developing bio-based alternatives, which could further expand market opportunities and address sustainability concerns.

In the packaging industry, EVA is increasingly used for flexible packaging solutions, particularly in food and beverage applications. The material's excellent barrier properties against moisture and gases make it ideal for preserving product freshness and extending shelf life. This trend is expected to continue as consumers demand more sustainable and convenient packaging options.

The footwear industry represents another significant market for EVA products. The material's lightweight nature, shock absorption capabilities, and durability have made it a popular choice for shoe soles and insoles. As the global athletic footwear market expands, driven by increasing health consciousness and sports participation, the demand for EVA in this sector is projected to grow substantially.

The solar energy industry has emerged as a key driver for EVA demand. EVA encapsulants are crucial components in photovoltaic modules, providing protection and insulation for solar cells. With the global push towards renewable energy sources and the declining costs of solar technology, the demand for EVA in this sector is expected to surge in the coming years.

In the automotive industry, EVA is gaining traction for its use in interior components, sound dampening materials, and wire and cable insulation. As vehicle manufacturers focus on lightweight materials to improve fuel efficiency and reduce emissions, EVA's low density and excellent performance characteristics make it an attractive option.

The construction sector also presents significant opportunities for EVA products. The material's applications in adhesives, sealants, and waterproofing membranes are driving demand, particularly in regions with growing infrastructure development and renovation activities.

Geographically, Asia-Pacific remains the largest market for EVA products, with China and India leading the growth. The region's robust manufacturing sector, coupled with increasing urbanization and consumer spending, is fueling demand across various end-use industries. North America and Europe follow, with steady growth driven by technological advancements and sustainability initiatives.

Despite the positive outlook, challenges such as raw material price volatility and environmental concerns regarding plastic waste persist. However, ongoing research and development efforts are focused on improving EVA's recyclability and developing bio-based alternatives, which could further expand market opportunities and address sustainability concerns.

Current Challenges in EVA Processing

Ethylene Vinyl Acetate (EVA) processing faces several significant challenges that hinder its widespread utilization in various industries. One of the primary obstacles is the material's sensitivity to processing conditions, particularly temperature and shear stress. EVA's low melting point and thermal degradation at higher temperatures create a narrow processing window, making it difficult to achieve optimal properties without compromising the material's integrity.

The viscosity of EVA also presents a challenge during processing. As a copolymer, its rheological behavior can be complex and highly dependent on the vinyl acetate content. This variability in flow characteristics can lead to inconsistencies in product quality and difficulties in maintaining precise control over the manufacturing process. Additionally, the adhesive nature of EVA can cause issues with equipment fouling and product release, requiring specialized handling techniques and equipment modifications.

Another significant barrier in EVA processing is the potential for gel formation. Crosslinking reactions can occur during processing, especially at elevated temperatures or in the presence of certain additives, leading to the formation of gels that can compromise the material's performance and appearance. This issue is particularly problematic in applications requiring high optical clarity or smooth surface finishes.

The incorporation of additives and fillers into EVA formulations also presents challenges. Achieving uniform dispersion of these components can be difficult due to the polymer's viscosity and processing limitations. Inadequate dispersion can result in inconsistent material properties and reduced performance in the final product. Furthermore, some additives may interact unfavorably with EVA, leading to degradation or undesired changes in the material's properties.

EVA's moisture sensitivity is another factor that complicates processing. The material can absorb moisture from the environment, which can lead to processing defects such as bubbles or voids in the final product. This necessitates careful handling and storage procedures, as well as potential pre-drying steps before processing, adding complexity and cost to the manufacturing process.

Lastly, the environmental impact of EVA processing poses challenges in terms of sustainability and regulatory compliance. The release of volatile organic compounds (VOCs) during processing, particularly from the vinyl acetate component, requires careful management and may necessitate the implementation of emission control systems. Additionally, the recyclability and end-of-life considerations for EVA products are becoming increasingly important, driving the need for innovative processing techniques that facilitate material recovery and reuse.

The viscosity of EVA also presents a challenge during processing. As a copolymer, its rheological behavior can be complex and highly dependent on the vinyl acetate content. This variability in flow characteristics can lead to inconsistencies in product quality and difficulties in maintaining precise control over the manufacturing process. Additionally, the adhesive nature of EVA can cause issues with equipment fouling and product release, requiring specialized handling techniques and equipment modifications.

Another significant barrier in EVA processing is the potential for gel formation. Crosslinking reactions can occur during processing, especially at elevated temperatures or in the presence of certain additives, leading to the formation of gels that can compromise the material's performance and appearance. This issue is particularly problematic in applications requiring high optical clarity or smooth surface finishes.

The incorporation of additives and fillers into EVA formulations also presents challenges. Achieving uniform dispersion of these components can be difficult due to the polymer's viscosity and processing limitations. Inadequate dispersion can result in inconsistent material properties and reduced performance in the final product. Furthermore, some additives may interact unfavorably with EVA, leading to degradation or undesired changes in the material's properties.

EVA's moisture sensitivity is another factor that complicates processing. The material can absorb moisture from the environment, which can lead to processing defects such as bubbles or voids in the final product. This necessitates careful handling and storage procedures, as well as potential pre-drying steps before processing, adding complexity and cost to the manufacturing process.

Lastly, the environmental impact of EVA processing poses challenges in terms of sustainability and regulatory compliance. The release of volatile organic compounds (VOCs) during processing, particularly from the vinyl acetate component, requires careful management and may necessitate the implementation of emission control systems. Additionally, the recyclability and end-of-life considerations for EVA products are becoming increasingly important, driving the need for innovative processing techniques that facilitate material recovery and reuse.

Existing Solutions for EVA Utilization

01 Composition and properties of EVA barriers

Ethylene Vinyl Acetate (EVA) barriers are composed of copolymers with varying ratios of ethylene and vinyl acetate. These materials offer excellent barrier properties against gases, moisture, and chemicals. The composition can be tailored to achieve specific performance characteristics such as flexibility, transparency, and adhesion.- Composition and properties of EVA barriers: Ethylene Vinyl Acetate (EVA) barriers are composed of copolymers with varying ratios of ethylene and vinyl acetate. These materials offer excellent barrier properties against gases, moisture, and chemicals. The composition can be tailored to achieve specific performance characteristics such as flexibility, transparency, and adhesion.

- Manufacturing processes for EVA barriers: Various manufacturing processes are employed to produce EVA barriers, including extrusion, co-extrusion, and lamination techniques. These processes allow for the creation of multi-layer structures, enhancing the overall barrier performance. Specific processing conditions and additives can be used to optimize the barrier properties and physical characteristics of the final product.

- Modifications and blends to enhance barrier properties: EVA barriers can be modified or blended with other polymers or additives to enhance their barrier properties. This may include the incorporation of nanoparticles, cross-linking agents, or other functional additives. These modifications can improve gas and moisture barrier performance, as well as mechanical properties and chemical resistance.

- Applications of EVA barriers: EVA barriers find applications in various industries, including packaging, construction, automotive, and solar panel encapsulation. They are used in food packaging to extend shelf life, in construction as vapor barriers, and in photovoltaic modules to protect solar cells. The versatility of EVA barriers makes them suitable for a wide range of applications requiring protection against environmental factors.

- Recycling and environmental considerations: As environmental concerns grow, research is focused on developing recyclable EVA barrier materials and improving their end-of-life management. This includes the development of compatibilizers for mixed plastic waste streams containing EVA, as well as exploring bio-based alternatives to traditional EVA barriers. Efforts are also being made to reduce the environmental impact of EVA barrier production processes.

02 Manufacturing processes for EVA barriers

Various manufacturing processes are employed to produce EVA barriers, including extrusion, blow molding, and film casting. These processes can be optimized to enhance the barrier properties and overall performance of the material. Techniques such as crosslinking and orientation can be used to further improve the barrier characteristics.Expand Specific Solutions03 Modifications and additives for enhanced barrier performance

EVA barriers can be modified with various additives and fillers to enhance their barrier properties. These modifications may include the incorporation of nanoparticles, compatibilizers, or other polymers to create blends or composites with improved gas and moisture barrier characteristics.Expand Specific Solutions04 Applications of EVA barriers

EVA barriers find applications in various industries, including packaging, automotive, construction, and electronics. They are used in food packaging, solar panel encapsulation, wire and cable insulation, and as moisture barriers in building materials. The versatility of EVA barriers makes them suitable for a wide range of applications requiring protection against environmental factors.Expand Specific Solutions05 Recycling and environmental considerations of EVA barriers

As sustainability becomes increasingly important, research is focused on developing recyclable EVA barrier materials and improving end-of-life management. This includes the development of biodegradable EVA formulations, recycling processes for EVA-based products, and the use of bio-based feedstocks in EVA production to reduce environmental impact.Expand Specific Solutions

Key Players in EVA Industry

The ethylene vinyl acetate (EVA) market is in a mature growth stage, with a global market size expected to reach $9.7 billion by 2025. The competitive landscape is characterized by established players like Celanese, DuPont, and Kuraray, alongside emerging companies focusing on innovative applications. Technological advancements are driving market growth, with key players investing in R&D to improve EVA properties and expand its use in sectors such as solar panels, packaging, and footwear. China Petroleum & Chemical Corp. and LG Chem are leveraging their petrochemical expertise to gain market share, while companies like Borealis and EMS-CHEMIE are focusing on specialty EVA grades for high-performance applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced catalytic technologies to improve the production efficiency of ethylene vinyl acetate (EVA). Their approach involves using novel zeolite catalysts with optimized pore structures to enhance the selectivity and yield of EVA copolymerization[1]. This technology allows for better control of the vinyl acetate content in the final product, ranging from 10% to 40%, which is crucial for tailoring EVA properties to specific applications[2]. Sinopec has also implemented a continuous production process that reduces energy consumption by approximately 15% compared to traditional batch methods[3]. Additionally, they have developed a proprietary stabilization system that enhances the thermal and UV resistance of EVA, extending its lifespan in outdoor applications by up to 30%[4].

Strengths: Advanced catalyst technology, improved energy efficiency, and enhanced product stability. Weaknesses: Potential high initial investment costs for implementing new technologies and possible limitations in very high vinyl acetate content EVA production.

Celanese International Corp.

Technical Solution: Celanese International Corp. has pioneered a novel approach to EVA production using a high-pressure tubular reactor system. This technology allows for precise control of the copolymerization process, resulting in EVA with a more uniform distribution of vinyl acetate content[5]. The company has also developed a proprietary additive package that significantly improves the melt flow properties of EVA, enhancing its processability in various applications such as film extrusion and injection molding[6]. Celanese's innovation extends to the development of specialty EVA grades with ultra-low gel content, which is particularly beneficial for high-clarity film applications in the packaging industry[7]. Furthermore, they have implemented an advanced degassing technology that reduces residual vinyl acetate monomer levels to less than 0.1 ppm, addressing safety concerns in food contact applications[8].

Strengths: High-precision copolymerization control, improved melt flow properties, and ultra-low gel content grades. Weaknesses: Potentially higher production costs due to specialized equipment and processes, which may limit competitiveness in commodity EVA markets.

Core Innovations in EVA Processing

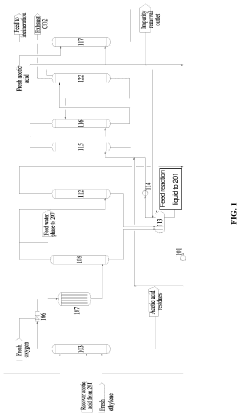

Integrated process for the production of vinyl acetate from acetic acid via ethyl acetate

PatentInactiveEP2382179A1

Innovation

- An integrated process involving the hydrogenation of acetic acid to form ethyl acetate with high selectivity, followed by pyrolysis to produce ethylene, and subsequent reaction with molecular oxygen over a suitable catalyst to form vinyl acetate, using a bimetallic catalyst system such as platinum and copper or palladium and cobalt supported on a catalyst support.

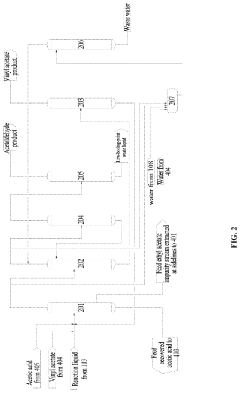

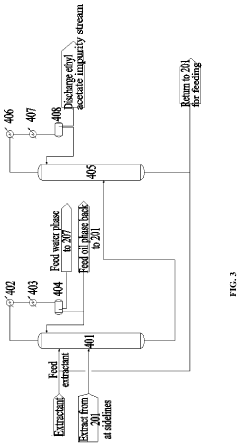

Method for producing vinyl acetate

PatentActiveUS20230312452A1

Innovation

- A method involving a gas phase oxidation process with a system integration that includes specific towers and reactors for ethylene recovery, acetic acid evaporation, oxygen mixing, and separation processes, utilizing acetic acid as an extractant in the rectifying and separating towers to enhance the separation of vinyl acetate from ethyl acetate.

Environmental Impact of EVA Production

The production of Ethylene Vinyl Acetate (EVA) has significant environmental implications that must be carefully considered. The manufacturing process involves the use of petrochemical feedstocks, which are derived from non-renewable resources and contribute to greenhouse gas emissions. The polymerization reaction requires high temperatures and pressures, consuming substantial amounts of energy and further increasing the carbon footprint of EVA production.

One of the primary environmental concerns is the release of volatile organic compounds (VOCs) during the manufacturing process. These emissions can contribute to air pollution and the formation of ground-level ozone, potentially impacting both human health and ecosystems. Additionally, the use of solvents and other chemicals in EVA production may lead to water pollution if not properly managed and treated.

The disposal of EVA products at the end of their lifecycle presents another environmental challenge. While EVA is technically recyclable, the process is often complex and energy-intensive due to the material's cross-linked structure. As a result, a significant portion of EVA waste ends up in landfills or is incinerated, contributing to soil and air pollution.

However, the industry has been making efforts to mitigate these environmental impacts. Some manufacturers have implemented closed-loop systems to recover and reuse solvents, reducing both emissions and waste. Others have invested in more energy-efficient production technologies, such as improved reactor designs and heat recovery systems, to lower the overall energy consumption and associated carbon emissions.

There is also a growing trend towards the development of bio-based EVA alternatives. These materials use renewable feedstocks, such as plant-based ethylene, to reduce reliance on fossil fuels and potentially lower the overall environmental impact. While still in the early stages, this approach shows promise for creating more sustainable EVA products in the future.

Life cycle assessments (LCAs) have become an essential tool for evaluating the environmental impact of EVA production. These comprehensive analyses consider all stages of the product's life, from raw material extraction to disposal, providing valuable insights into areas where improvements can be made. By identifying hotspots in the production process, manufacturers can focus their efforts on the most impactful environmental interventions.

As regulations around environmental protection become more stringent, EVA producers are increasingly adopting cleaner production practices. This includes implementing advanced emission control technologies, optimizing resource use, and exploring circular economy principles to minimize waste generation. The industry's ongoing efforts to address environmental concerns will be crucial in ensuring the sustainable future of EVA production and utilization.

One of the primary environmental concerns is the release of volatile organic compounds (VOCs) during the manufacturing process. These emissions can contribute to air pollution and the formation of ground-level ozone, potentially impacting both human health and ecosystems. Additionally, the use of solvents and other chemicals in EVA production may lead to water pollution if not properly managed and treated.

The disposal of EVA products at the end of their lifecycle presents another environmental challenge. While EVA is technically recyclable, the process is often complex and energy-intensive due to the material's cross-linked structure. As a result, a significant portion of EVA waste ends up in landfills or is incinerated, contributing to soil and air pollution.

However, the industry has been making efforts to mitigate these environmental impacts. Some manufacturers have implemented closed-loop systems to recover and reuse solvents, reducing both emissions and waste. Others have invested in more energy-efficient production technologies, such as improved reactor designs and heat recovery systems, to lower the overall energy consumption and associated carbon emissions.

There is also a growing trend towards the development of bio-based EVA alternatives. These materials use renewable feedstocks, such as plant-based ethylene, to reduce reliance on fossil fuels and potentially lower the overall environmental impact. While still in the early stages, this approach shows promise for creating more sustainable EVA products in the future.

Life cycle assessments (LCAs) have become an essential tool for evaluating the environmental impact of EVA production. These comprehensive analyses consider all stages of the product's life, from raw material extraction to disposal, providing valuable insights into areas where improvements can be made. By identifying hotspots in the production process, manufacturers can focus their efforts on the most impactful environmental interventions.

As regulations around environmental protection become more stringent, EVA producers are increasingly adopting cleaner production practices. This includes implementing advanced emission control technologies, optimizing resource use, and exploring circular economy principles to minimize waste generation. The industry's ongoing efforts to address environmental concerns will be crucial in ensuring the sustainable future of EVA production and utilization.

Regulatory Framework for EVA Usage

The regulatory framework for Ethylene Vinyl Acetate (EVA) usage plays a crucial role in shaping its utilization across various industries. As EVA finds applications in diverse sectors such as packaging, solar panels, and footwear, regulatory bodies have established guidelines to ensure its safe and responsible use.

In the United States, the Food and Drug Administration (FDA) regulates EVA usage in food contact materials. The agency has approved EVA for use in food packaging and other food-related applications, provided it meets specific composition and purity requirements. Manufacturers must comply with these regulations to ensure the safety of EVA-based products that come into contact with food.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which affects EVA usage. Under REACH, manufacturers and importers of EVA must register the substance and provide safety information. This regulation aims to protect human health and the environment while promoting innovation in the chemical industry.

In the solar energy sector, EVA is widely used as an encapsulant material for photovoltaic modules. Regulatory bodies such as the International Electrotechnical Commission (IEC) have established standards for EVA-based encapsulants, including durability and performance requirements. Compliance with these standards is essential for manufacturers to ensure the reliability and longevity of solar panels.

Environmental regulations also impact EVA usage, particularly in terms of waste management and recycling. Many countries have implemented extended producer responsibility (EPR) programs, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling. This has led to increased efforts in developing recycling technologies for EVA-based products.

Occupational health and safety regulations govern the handling and processing of EVA in industrial settings. Agencies such as the Occupational Safety and Health Administration (OSHA) in the United States provide guidelines for worker protection, including exposure limits and safety measures for handling EVA and its associated chemicals.

As the use of EVA expands into new applications, regulatory frameworks continue to evolve. Emerging areas of concern include the potential environmental impact of EVA microplastics and the need for sustainable alternatives. Regulatory bodies are increasingly focusing on promoting circular economy principles, which may lead to new requirements for EVA manufacturers and users in terms of product design, recyclability, and end-of-life management.

In the United States, the Food and Drug Administration (FDA) regulates EVA usage in food contact materials. The agency has approved EVA for use in food packaging and other food-related applications, provided it meets specific composition and purity requirements. Manufacturers must comply with these regulations to ensure the safety of EVA-based products that come into contact with food.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which affects EVA usage. Under REACH, manufacturers and importers of EVA must register the substance and provide safety information. This regulation aims to protect human health and the environment while promoting innovation in the chemical industry.

In the solar energy sector, EVA is widely used as an encapsulant material for photovoltaic modules. Regulatory bodies such as the International Electrotechnical Commission (IEC) have established standards for EVA-based encapsulants, including durability and performance requirements. Compliance with these standards is essential for manufacturers to ensure the reliability and longevity of solar panels.

Environmental regulations also impact EVA usage, particularly in terms of waste management and recycling. Many countries have implemented extended producer responsibility (EPR) programs, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling. This has led to increased efforts in developing recycling technologies for EVA-based products.

Occupational health and safety regulations govern the handling and processing of EVA in industrial settings. Agencies such as the Occupational Safety and Health Administration (OSHA) in the United States provide guidelines for worker protection, including exposure limits and safety measures for handling EVA and its associated chemicals.

As the use of EVA expands into new applications, regulatory frameworks continue to evolve. Emerging areas of concern include the potential environmental impact of EVA microplastics and the need for sustainable alternatives. Regulatory bodies are increasingly focusing on promoting circular economy principles, which may lead to new requirements for EVA manufacturers and users in terms of product design, recyclability, and end-of-life management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!