How to Propel Ethylene Vinyl Acetate into New Markets?

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Market Expansion Background and Objectives

Ethylene Vinyl Acetate (EVA) has been a staple in various industries for decades, primarily known for its applications in packaging, footwear, and solar panel encapsulation. However, as markets evolve and new technological advancements emerge, there is a pressing need to explore and capitalize on untapped potential for EVA in novel sectors. This technical research report aims to investigate and outline strategies for propelling EVA into new markets, thereby expanding its commercial footprint and driving innovation.

The primary objective of this study is to identify and analyze emerging market opportunities for EVA, considering its unique properties such as flexibility, durability, and low-temperature toughness. By examining current market trends, technological advancements, and shifting consumer demands, we seek to uncover areas where EVA can offer significant value propositions and competitive advantages.

A comprehensive review of EVA's historical development reveals its journey from a niche polymer to a versatile material with widespread applications. Initially developed in the 1950s, EVA has seen continuous improvements in its production processes and formulations, leading to enhanced performance characteristics. This evolution has positioned EVA as a crucial component in various products, from flexible packaging to sports equipment.

The current global market for EVA is substantial, with steady growth projected in traditional sectors. However, to ensure long-term sustainability and capitalize on emerging opportunities, it is imperative to explore new avenues for market expansion. This necessitates a thorough analysis of technological trends, such as advancements in material science, additive manufacturing, and sustainable practices, which could open doors for EVA in previously unexplored domains.

Key technological objectives for this research include identifying potential modifications or enhancements to EVA that could broaden its applicability, exploring novel processing techniques that could enable new product forms, and investigating synergies with other materials or technologies that could create unique value propositions. Additionally, we aim to assess the feasibility of EVA in addressing emerging market needs, particularly in sectors prioritizing sustainability, energy efficiency, and advanced functionality.

By aligning EVA's inherent properties with evolving market demands and technological capabilities, this research seeks to chart a course for strategic market expansion. The findings will serve as a foundation for developing targeted R&D initiatives, guiding product development efforts, and informing long-term business strategies to position EVA at the forefront of innovation in new and dynamic markets.

The primary objective of this study is to identify and analyze emerging market opportunities for EVA, considering its unique properties such as flexibility, durability, and low-temperature toughness. By examining current market trends, technological advancements, and shifting consumer demands, we seek to uncover areas where EVA can offer significant value propositions and competitive advantages.

A comprehensive review of EVA's historical development reveals its journey from a niche polymer to a versatile material with widespread applications. Initially developed in the 1950s, EVA has seen continuous improvements in its production processes and formulations, leading to enhanced performance characteristics. This evolution has positioned EVA as a crucial component in various products, from flexible packaging to sports equipment.

The current global market for EVA is substantial, with steady growth projected in traditional sectors. However, to ensure long-term sustainability and capitalize on emerging opportunities, it is imperative to explore new avenues for market expansion. This necessitates a thorough analysis of technological trends, such as advancements in material science, additive manufacturing, and sustainable practices, which could open doors for EVA in previously unexplored domains.

Key technological objectives for this research include identifying potential modifications or enhancements to EVA that could broaden its applicability, exploring novel processing techniques that could enable new product forms, and investigating synergies with other materials or technologies that could create unique value propositions. Additionally, we aim to assess the feasibility of EVA in addressing emerging market needs, particularly in sectors prioritizing sustainability, energy efficiency, and advanced functionality.

By aligning EVA's inherent properties with evolving market demands and technological capabilities, this research seeks to chart a course for strategic market expansion. The findings will serve as a foundation for developing targeted R&D initiatives, guiding product development efforts, and informing long-term business strategies to position EVA at the forefront of innovation in new and dynamic markets.

EVA Demand Analysis in Emerging Markets

The demand for Ethylene Vinyl Acetate (EVA) in emerging markets is experiencing significant growth, driven by various factors that highlight its versatility and potential for new applications. As developing economies continue to expand, the construction sector has become a key driver for EVA demand. The material's excellent properties, including flexibility, durability, and weather resistance, make it ideal for use in solar panel encapsulation, a rapidly growing industry in many emerging markets as they shift towards renewable energy sources.

In the footwear industry, EVA's lightweight and cushioning properties have led to increased adoption in markets such as India, Brazil, and Southeast Asian countries. As these regions see rising disposable incomes and growing consumer awareness of comfort and performance in footwear, the demand for EVA-based products is expected to surge. This trend is further amplified by the expansion of global sportswear brands into these markets, introducing advanced EVA-based shoe technologies.

The packaging industry in emerging markets is another sector driving EVA demand. As e-commerce continues to grow, there is an increasing need for protective packaging materials. EVA's shock-absorbing properties make it an excellent choice for protecting fragile items during shipping, a crucial factor in markets with developing logistics infrastructure.

In the automotive sector, emerging markets are seeing a rise in vehicle production and sales. EVA's use in automotive interiors, particularly for dashboard components and sound insulation, is growing as manufacturers seek to improve vehicle quality and comfort while maintaining cost-effectiveness. This trend is particularly evident in countries like China, India, and Mexico, where the automotive industry is rapidly expanding.

The medical and healthcare sectors in emerging markets also present significant opportunities for EVA applications. As healthcare infrastructure improves, there is an increasing demand for medical-grade EVA in products such as medical tubing, drug delivery systems, and prosthetics. The material's biocompatibility and flexibility make it an attractive option for these applications.

Agricultural applications of EVA are gaining traction in emerging markets as well. The material's use in greenhouse films and crop protection products is growing, particularly in regions focusing on improving agricultural productivity and sustainability. Countries in Africa and South America are showing increased interest in EVA-based agricultural solutions.

To capitalize on these emerging market opportunities, companies should focus on developing tailored EVA formulations that meet specific regional needs and regulations. Collaborations with local manufacturers and distributors can help in understanding market nuances and establishing a strong presence. Additionally, investing in education and technical support for end-users in these markets can drive adoption and open up new applications for EVA, further propelling its growth in emerging economies.

In the footwear industry, EVA's lightweight and cushioning properties have led to increased adoption in markets such as India, Brazil, and Southeast Asian countries. As these regions see rising disposable incomes and growing consumer awareness of comfort and performance in footwear, the demand for EVA-based products is expected to surge. This trend is further amplified by the expansion of global sportswear brands into these markets, introducing advanced EVA-based shoe technologies.

The packaging industry in emerging markets is another sector driving EVA demand. As e-commerce continues to grow, there is an increasing need for protective packaging materials. EVA's shock-absorbing properties make it an excellent choice for protecting fragile items during shipping, a crucial factor in markets with developing logistics infrastructure.

In the automotive sector, emerging markets are seeing a rise in vehicle production and sales. EVA's use in automotive interiors, particularly for dashboard components and sound insulation, is growing as manufacturers seek to improve vehicle quality and comfort while maintaining cost-effectiveness. This trend is particularly evident in countries like China, India, and Mexico, where the automotive industry is rapidly expanding.

The medical and healthcare sectors in emerging markets also present significant opportunities for EVA applications. As healthcare infrastructure improves, there is an increasing demand for medical-grade EVA in products such as medical tubing, drug delivery systems, and prosthetics. The material's biocompatibility and flexibility make it an attractive option for these applications.

Agricultural applications of EVA are gaining traction in emerging markets as well. The material's use in greenhouse films and crop protection products is growing, particularly in regions focusing on improving agricultural productivity and sustainability. Countries in Africa and South America are showing increased interest in EVA-based agricultural solutions.

To capitalize on these emerging market opportunities, companies should focus on developing tailored EVA formulations that meet specific regional needs and regulations. Collaborations with local manufacturers and distributors can help in understanding market nuances and establishing a strong presence. Additionally, investing in education and technical support for end-users in these markets can drive adoption and open up new applications for EVA, further propelling its growth in emerging economies.

Current EVA Applications and Limitations

Ethylene Vinyl Acetate (EVA) has established itself as a versatile material with applications across various industries. Currently, EVA finds extensive use in the production of solar panel encapsulants, where its excellent transparency, low water absorption, and high electrical resistivity make it an ideal choice. The footwear industry also heavily relies on EVA for the production of midsoles and outsoles, capitalizing on its lightweight nature, shock absorption properties, and durability.

In the packaging sector, EVA is widely used for flexible packaging films due to its excellent sealing properties and resistance to puncture and tear. The material's low-temperature toughness and flexibility have made it popular in the production of hot melt adhesives, which are used in various applications from bookbinding to product assembly.

Despite its widespread use, EVA faces certain limitations that hinder its expansion into new markets. One significant challenge is its limited temperature resistance. EVA begins to soften at relatively low temperatures, restricting its use in high-temperature applications. This characteristic limits its potential in automotive and industrial sectors where heat resistance is crucial.

Another limitation is EVA's moderate barrier properties. While suitable for many packaging applications, it falls short in scenarios requiring high oxygen or moisture barriers. This constraint prevents EVA from penetrating markets that demand superior barrier performance, such as certain food packaging or high-end electronic component protection.

EVA's susceptibility to UV degradation is another factor limiting its outdoor applications. Without proper additives or protective measures, prolonged exposure to sunlight can lead to discoloration and deterioration of mechanical properties. This limitation poses challenges in expanding EVA's use in long-term outdoor applications beyond its current scope.

The material's relatively low tensile strength compared to some other polymers restricts its use in high-stress applications. While EVA excels in flexibility and impact resistance, it may not be suitable for applications requiring high load-bearing capacity or structural integrity.

Furthermore, EVA's limited chemical resistance narrows its applicability in certain industrial environments. It can be degraded by strong acids, bases, and some organic solvents, limiting its use in chemical processing or storage applications.

To propel EVA into new markets, these limitations need to be addressed through innovative formulations, blending with other materials, or developing new processing techniques. Enhancing EVA's heat resistance, improving its barrier properties, and increasing its UV stability could open up new application areas. Additionally, exploring surface modification techniques or developing multi-layer structures incorporating EVA could help overcome some of its inherent limitations while leveraging its beneficial properties.

In the packaging sector, EVA is widely used for flexible packaging films due to its excellent sealing properties and resistance to puncture and tear. The material's low-temperature toughness and flexibility have made it popular in the production of hot melt adhesives, which are used in various applications from bookbinding to product assembly.

Despite its widespread use, EVA faces certain limitations that hinder its expansion into new markets. One significant challenge is its limited temperature resistance. EVA begins to soften at relatively low temperatures, restricting its use in high-temperature applications. This characteristic limits its potential in automotive and industrial sectors where heat resistance is crucial.

Another limitation is EVA's moderate barrier properties. While suitable for many packaging applications, it falls short in scenarios requiring high oxygen or moisture barriers. This constraint prevents EVA from penetrating markets that demand superior barrier performance, such as certain food packaging or high-end electronic component protection.

EVA's susceptibility to UV degradation is another factor limiting its outdoor applications. Without proper additives or protective measures, prolonged exposure to sunlight can lead to discoloration and deterioration of mechanical properties. This limitation poses challenges in expanding EVA's use in long-term outdoor applications beyond its current scope.

The material's relatively low tensile strength compared to some other polymers restricts its use in high-stress applications. While EVA excels in flexibility and impact resistance, it may not be suitable for applications requiring high load-bearing capacity or structural integrity.

Furthermore, EVA's limited chemical resistance narrows its applicability in certain industrial environments. It can be degraded by strong acids, bases, and some organic solvents, limiting its use in chemical processing or storage applications.

To propel EVA into new markets, these limitations need to be addressed through innovative formulations, blending with other materials, or developing new processing techniques. Enhancing EVA's heat resistance, improving its barrier properties, and increasing its UV stability could open up new application areas. Additionally, exploring surface modification techniques or developing multi-layer structures incorporating EVA could help overcome some of its inherent limitations while leveraging its beneficial properties.

Innovative EVA Formulation Strategies

01 Composition and synthesis of EVA copolymers

Ethylene Vinyl Acetate (EVA) copolymers are synthesized through the copolymerization of ethylene and vinyl acetate monomers. The composition and properties of EVA can be adjusted by varying the ratio of these monomers, allowing for a wide range of applications. The synthesis process often involves high-pressure polymerization techniques and may include the use of catalysts to control the reaction.- Composition and properties of Ethylene Vinyl Acetate (EVA): Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate. It combines the properties of polyethylene and polyvinyl acetate, offering flexibility, toughness, and good adhesion. The ratio of ethylene to vinyl acetate can be varied to adjust the properties of the resulting material, such as flexibility, clarity, and impact resistance.

- EVA in adhesive applications: EVA is widely used in adhesive formulations due to its excellent adhesion properties and compatibility with various substrates. It is particularly useful in hot melt adhesives, where it provides good thermal stability and flexibility. EVA-based adhesives are used in packaging, bookbinding, and other industrial applications.

- EVA in foam and encapsulation applications: EVA is used to produce foams and encapsulation materials for various industries. In foam applications, it provides cushioning and insulation properties. For encapsulation, EVA protects sensitive components from environmental factors. These applications are found in footwear, sports equipment, and electronics industries.

- Modification and blending of EVA: EVA can be modified or blended with other polymers to enhance its properties or create new materials with specific characteristics. This includes crosslinking, grafting, and blending with other polymers such as polyethylene or polypropylene. These modifications can improve heat resistance, mechanical properties, or compatibility with other materials.

- EVA in film and packaging applications: EVA is used in the production of flexible films and packaging materials. Its properties, such as clarity, flexibility, and low-temperature toughness, make it suitable for food packaging, agricultural films, and other packaging applications. EVA can be processed using various methods, including extrusion and blow molding, to create films and packaging products.

02 EVA blends and composites

EVA copolymers are often blended with other polymers or materials to create composites with enhanced properties. These blends can improve characteristics such as flexibility, impact resistance, or thermal stability. Common blend components include polyethylene, polypropylene, and various fillers or reinforcing agents. The resulting composites find applications in diverse industries, including packaging, automotive, and construction.Expand Specific Solutions03 EVA foam production and applications

EVA foams are produced by incorporating blowing agents into the polymer matrix and subjecting it to specific processing conditions. These foams exhibit excellent cushioning properties, low density, and good chemical resistance. They are widely used in the production of footwear, sports equipment, and packaging materials. The foam structure can be tailored to achieve specific properties such as density, cell size, and compression set.Expand Specific Solutions04 Modification of EVA properties

The properties of EVA copolymers can be modified through various techniques, including crosslinking, grafting, and the addition of functional groups. These modifications can enhance characteristics such as heat resistance, adhesion, or compatibility with other materials. Crosslinking, for example, can be achieved through radiation or chemical methods, resulting in improved thermal and mechanical properties.Expand Specific Solutions05 EVA in adhesive and sealant applications

EVA copolymers are extensively used in the formulation of hot melt adhesives and sealants. Their low melting point, good adhesion to various substrates, and flexibility make them ideal for these applications. EVA-based adhesives are used in packaging, bookbinding, and product assembly. The adhesive properties can be further enhanced by incorporating tackifiers, waxes, or other additives to meet specific performance requirements.Expand Specific Solutions

Key EVA Manufacturers and Competitors

The market for Ethylene Vinyl Acetate (EVA) is in a mature growth stage, with a global market size expected to reach $12.8 billion by 2027. The technology is well-established, with major players like China Petroleum & Chemical Corp., Celanese International Corp., and Saudi Basic Industries Corp. leading the industry. These companies have extensive experience in EVA production and application development. The competitive landscape is characterized by ongoing research and development efforts to expand EVA's applications in emerging sectors such as renewable energy and advanced materials. Companies like Resonac Holdings Corp. and LyondellBasell Acetyls LLC are focusing on product innovations to differentiate themselves in this competitive market.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a novel approach to propel Ethylene Vinyl Acetate (EVA) into new markets by focusing on high-performance EVA for photovoltaic encapsulants. Their advanced production process utilizes a proprietary catalyst system that allows for precise control of VA content and molecular weight distribution[1]. This results in EVA with superior optical transmittance, excellent weatherability, and enhanced adhesion properties. Sinopec has also invested in large-scale production facilities, capable of producing over 200,000 tons of EVA annually[2], enabling them to meet the growing demand in the solar energy sector. Additionally, they are exploring EVA applications in 3D printing filaments and high-performance footwear, leveraging their material's unique combination of flexibility and durability[3].

Strengths: Established market presence, large production capacity, and advanced catalyst technology. Weaknesses: Heavy reliance on traditional petrochemical markets, potential environmental concerns associated with production processes.

Celanese International Corp.

Technical Solution: Celanese International Corp. has developed a strategy to expand EVA into new markets by focusing on specialty grades and innovative applications. Their VitalDose® EVA drug delivery platform represents a significant breakthrough, allowing for controlled release of pharmaceuticals over extended periods[1]. This technology has opened up new opportunities in the medical and healthcare sectors. Celanese has also introduced EVA grades specifically designed for 3D printing, addressing the growing demand for flexible and durable filaments in additive manufacturing[2]. In the automotive sector, they have developed high-performance EVA grades for wire and cable applications, offering improved heat resistance and durability[3]. Celanese's approach includes collaborations with end-users to develop tailored solutions, such as their partnership with footwear manufacturers to create EVA foams with enhanced cushioning and energy return properties[4].

Strengths: Strong R&D capabilities, diverse product portfolio, and established presence in specialty markets. Weaknesses: Higher production costs for specialty grades, potential competition from alternative materials in some applications.

Breakthrough EVA Properties and Patents

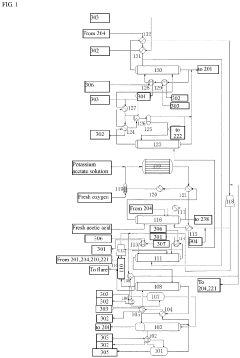

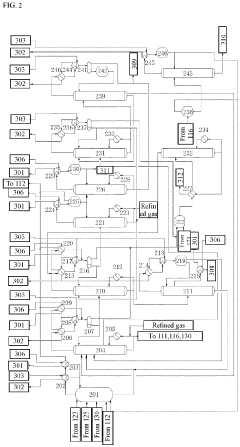

Preparation method of vinyl acetate by ethylene process and device thereof

PatentPendingEP4371972A1

Innovation

- A novel process incorporating an ethylene recovery membrane assembly, refined VAC tower side-draw stream additions, and improved cooling methods using circulating and chilled water for high-purity vinyl acetate production, reducing emissions and preventing material leakage by recovering ethylene and optimizing the distillation process.

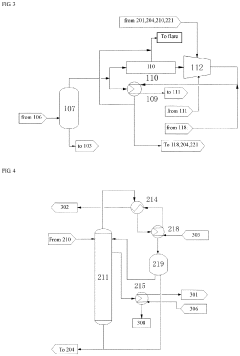

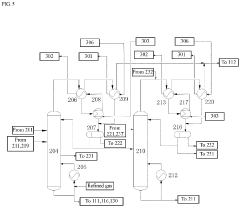

Integrated process for the production of vinyl acetate from acetic acid via ethyl acetate

PatentInactiveEP2382179A1

Innovation

- An integrated process involving the hydrogenation of acetic acid to form ethyl acetate with high selectivity, followed by pyrolysis to produce ethylene, and subsequent reaction with molecular oxygen over a suitable catalyst to form vinyl acetate, using a bimetallic catalyst system such as platinum and copper or palladium and cobalt supported on a catalyst support.

Environmental Impact of EVA Production and Use

The production and use of Ethylene Vinyl Acetate (EVA) have significant environmental implications that must be carefully considered as the material expands into new markets. The manufacturing process of EVA involves the polymerization of ethylene and vinyl acetate, which requires substantial energy inputs and generates various emissions. The primary environmental concerns include greenhouse gas emissions, volatile organic compound (VOC) releases, and potential water pollution from chemical spills or improper waste disposal.

During EVA production, the energy-intensive processes contribute to carbon dioxide emissions, impacting climate change. Additionally, the use of solvents and other chemicals in the manufacturing process can lead to the release of VOCs, which contribute to air pollution and may have adverse effects on human health and the environment. Proper emission control technologies and adherence to environmental regulations are crucial to mitigate these impacts.

Water usage and potential contamination are also significant environmental considerations in EVA production. The manufacturing process requires substantial amounts of water for cooling and cleaning, and there is a risk of chemical runoff or accidental spills that could affect local water sources. Implementing robust water management systems and treatment facilities is essential to minimize these risks.

The disposal and end-of-life management of EVA products present another set of environmental challenges. While EVA is recyclable, the recycling process is not widely established, and many EVA products end up in landfills or incineration facilities. Improving recycling infrastructure and developing more efficient recycling technologies for EVA materials are critical steps in reducing the environmental footprint of these products.

As EVA expands into new markets, there is an opportunity to address these environmental concerns through innovative approaches. Developing bio-based or recycled content EVA formulations could reduce the reliance on fossil fuel-derived raw materials. Additionally, implementing cleaner production technologies and circular economy principles in manufacturing processes could significantly decrease the environmental impact of EVA production.

The durability and versatility of EVA products can contribute to sustainability in certain applications. For instance, in the solar panel industry, EVA's use as an encapsulant material extends the lifespan of photovoltaic modules, indirectly contributing to renewable energy production and reduced carbon emissions. Similarly, in the footwear industry, EVA's lightweight and durable properties can lead to longer-lasting products, potentially reducing overall material consumption and waste.

To propel EVA into new markets responsibly, manufacturers and industry stakeholders must prioritize environmental stewardship. This includes investing in research and development for greener production methods, improving energy efficiency in manufacturing facilities, and exploring alternative raw materials. Furthermore, collaborating with recycling companies and waste management organizations to establish effective collection and recycling programs for EVA products is crucial for minimizing the material's end-of-life environmental impact.

During EVA production, the energy-intensive processes contribute to carbon dioxide emissions, impacting climate change. Additionally, the use of solvents and other chemicals in the manufacturing process can lead to the release of VOCs, which contribute to air pollution and may have adverse effects on human health and the environment. Proper emission control technologies and adherence to environmental regulations are crucial to mitigate these impacts.

Water usage and potential contamination are also significant environmental considerations in EVA production. The manufacturing process requires substantial amounts of water for cooling and cleaning, and there is a risk of chemical runoff or accidental spills that could affect local water sources. Implementing robust water management systems and treatment facilities is essential to minimize these risks.

The disposal and end-of-life management of EVA products present another set of environmental challenges. While EVA is recyclable, the recycling process is not widely established, and many EVA products end up in landfills or incineration facilities. Improving recycling infrastructure and developing more efficient recycling technologies for EVA materials are critical steps in reducing the environmental footprint of these products.

As EVA expands into new markets, there is an opportunity to address these environmental concerns through innovative approaches. Developing bio-based or recycled content EVA formulations could reduce the reliance on fossil fuel-derived raw materials. Additionally, implementing cleaner production technologies and circular economy principles in manufacturing processes could significantly decrease the environmental impact of EVA production.

The durability and versatility of EVA products can contribute to sustainability in certain applications. For instance, in the solar panel industry, EVA's use as an encapsulant material extends the lifespan of photovoltaic modules, indirectly contributing to renewable energy production and reduced carbon emissions. Similarly, in the footwear industry, EVA's lightweight and durable properties can lead to longer-lasting products, potentially reducing overall material consumption and waste.

To propel EVA into new markets responsibly, manufacturers and industry stakeholders must prioritize environmental stewardship. This includes investing in research and development for greener production methods, improving energy efficiency in manufacturing facilities, and exploring alternative raw materials. Furthermore, collaborating with recycling companies and waste management organizations to establish effective collection and recycling programs for EVA products is crucial for minimizing the material's end-of-life environmental impact.

Cross-industry Collaboration Opportunities for EVA

Cross-industry collaboration presents a significant opportunity for expanding the applications of Ethylene Vinyl Acetate (EVA) into new markets. By leveraging the unique properties of EVA, such as its flexibility, durability, and adhesive qualities, partnerships across various industries can lead to innovative product developments and market expansions.

In the automotive sector, collaborations between EVA manufacturers and car makers could result in the development of lightweight, noise-reducing components. EVA's shock-absorbing properties make it an excellent candidate for use in interior panels, floor mats, and insulation materials. By working closely with automotive engineers, EVA producers can tailor their formulations to meet specific performance requirements, potentially replacing traditional materials with more cost-effective and environmentally friendly alternatives.

The renewable energy industry offers another promising avenue for EVA collaboration. Partnerships between solar panel manufacturers and EVA producers can lead to improvements in photovoltaic module encapsulation. By developing EVA formulations with enhanced UV resistance and thermal stability, these collaborations can contribute to increased solar panel efficiency and longevity. This could potentially accelerate the adoption of solar energy technologies in both residential and commercial applications.

In the healthcare sector, collaborations between EVA manufacturers and medical device companies could result in the creation of innovative products. EVA's biocompatibility and flexibility make it suitable for various medical applications, such as wound dressings, orthopedic supports, and drug delivery systems. By combining expertise in material science with medical knowledge, these partnerships can address unmet needs in patient care and potentially revolutionize certain medical treatments.

The construction industry presents yet another opportunity for EVA collaboration. By partnering with building material manufacturers, EVA producers can develop advanced insulation materials, waterproofing membranes, and sealants. These collaborations could lead to more energy-efficient buildings and improved construction techniques, addressing the growing demand for sustainable building solutions.

In the field of consumer electronics, partnerships between EVA manufacturers and device makers could result in the development of impact-resistant casings, flexible displays, and improved wearable technologies. EVA's ability to be molded into complex shapes while maintaining its protective properties makes it an attractive material for innovative product designs.

To facilitate these cross-industry collaborations, it is crucial for EVA manufacturers to establish dedicated research and development teams focused on exploring new applications. These teams should actively engage with potential partners across various industries, participating in trade shows, conferences, and collaborative research projects. By fostering an open innovation ecosystem, EVA producers can tap into diverse expertise and accelerate the development of novel applications.

In the automotive sector, collaborations between EVA manufacturers and car makers could result in the development of lightweight, noise-reducing components. EVA's shock-absorbing properties make it an excellent candidate for use in interior panels, floor mats, and insulation materials. By working closely with automotive engineers, EVA producers can tailor their formulations to meet specific performance requirements, potentially replacing traditional materials with more cost-effective and environmentally friendly alternatives.

The renewable energy industry offers another promising avenue for EVA collaboration. Partnerships between solar panel manufacturers and EVA producers can lead to improvements in photovoltaic module encapsulation. By developing EVA formulations with enhanced UV resistance and thermal stability, these collaborations can contribute to increased solar panel efficiency and longevity. This could potentially accelerate the adoption of solar energy technologies in both residential and commercial applications.

In the healthcare sector, collaborations between EVA manufacturers and medical device companies could result in the creation of innovative products. EVA's biocompatibility and flexibility make it suitable for various medical applications, such as wound dressings, orthopedic supports, and drug delivery systems. By combining expertise in material science with medical knowledge, these partnerships can address unmet needs in patient care and potentially revolutionize certain medical treatments.

The construction industry presents yet another opportunity for EVA collaboration. By partnering with building material manufacturers, EVA producers can develop advanced insulation materials, waterproofing membranes, and sealants. These collaborations could lead to more energy-efficient buildings and improved construction techniques, addressing the growing demand for sustainable building solutions.

In the field of consumer electronics, partnerships between EVA manufacturers and device makers could result in the development of impact-resistant casings, flexible displays, and improved wearable technologies. EVA's ability to be molded into complex shapes while maintaining its protective properties makes it an attractive material for innovative product designs.

To facilitate these cross-industry collaborations, it is crucial for EVA manufacturers to establish dedicated research and development teams focused on exploring new applications. These teams should actively engage with potential partners across various industries, participating in trade shows, conferences, and collaborative research projects. By fostering an open innovation ecosystem, EVA producers can tap into diverse expertise and accelerate the development of novel applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!