How to Reduce Lithium Chloride Production Costs

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Chloride Production Background and Objectives

Lithium chloride production has evolved significantly over the past decades, transitioning from a niche chemical process to a critical component in the global energy transition. The compound serves as a key intermediate in lithium metal production and is increasingly important in battery technologies, pharmaceuticals, air conditioning systems, and various industrial applications. Historical production methods primarily relied on mineral extraction from salt flats and hard rock mining, with subsequent chemical processing to isolate lithium compounds.

The global lithium market has experienced unprecedented growth, with demand projected to increase by 500% by 2030, primarily driven by electric vehicle battery production. This surge has placed immense pressure on production systems to scale efficiently while managing costs. Current production costs for lithium chloride range from $5,000 to $7,000 per ton, with significant variations based on production method, geographical location, and energy inputs.

The technical evolution of lithium chloride production has progressed through several distinct phases: traditional brine evaporation methods, hard rock extraction processes, and more recently, direct lithium extraction (DLE) technologies. Each advancement has aimed to improve yield rates, reduce processing time, and minimize environmental impact, though cost optimization remains a persistent challenge across all approaches.

Primary cost drivers in lithium chloride production include energy consumption (particularly in evaporation and crystallization processes), chemical reagents, water usage, waste management, and labor. The energy intensity of conventional production methods represents approximately 30-40% of total production costs, highlighting a critical area for potential optimization.

The technical objectives for cost reduction in lithium chloride production focus on several key areas: developing energy-efficient extraction and processing technologies, improving lithium recovery rates from primary sources, reducing chemical reagent consumption, minimizing water usage through closed-loop systems, and exploring alternative lithium sources including recycled materials and unconventional brines.

Geographical considerations significantly impact production economics, with production facilities traditionally concentrated in the "Lithium Triangle" of South America (Chile, Argentina, Bolivia), Australia, and increasingly China. Each region presents distinct advantages and challenges related to resource quality, infrastructure, regulatory frameworks, and proximity to end markets, all of which influence production costs.

The technological goal is to develop economically viable production methods that can reduce lithium chloride production costs by at least 25-30% within the next five years while maintaining product purity standards of 99.5% or higher, essential for high-value applications in battery technology and pharmaceuticals.

The global lithium market has experienced unprecedented growth, with demand projected to increase by 500% by 2030, primarily driven by electric vehicle battery production. This surge has placed immense pressure on production systems to scale efficiently while managing costs. Current production costs for lithium chloride range from $5,000 to $7,000 per ton, with significant variations based on production method, geographical location, and energy inputs.

The technical evolution of lithium chloride production has progressed through several distinct phases: traditional brine evaporation methods, hard rock extraction processes, and more recently, direct lithium extraction (DLE) technologies. Each advancement has aimed to improve yield rates, reduce processing time, and minimize environmental impact, though cost optimization remains a persistent challenge across all approaches.

Primary cost drivers in lithium chloride production include energy consumption (particularly in evaporation and crystallization processes), chemical reagents, water usage, waste management, and labor. The energy intensity of conventional production methods represents approximately 30-40% of total production costs, highlighting a critical area for potential optimization.

The technical objectives for cost reduction in lithium chloride production focus on several key areas: developing energy-efficient extraction and processing technologies, improving lithium recovery rates from primary sources, reducing chemical reagent consumption, minimizing water usage through closed-loop systems, and exploring alternative lithium sources including recycled materials and unconventional brines.

Geographical considerations significantly impact production economics, with production facilities traditionally concentrated in the "Lithium Triangle" of South America (Chile, Argentina, Bolivia), Australia, and increasingly China. Each region presents distinct advantages and challenges related to resource quality, infrastructure, regulatory frameworks, and proximity to end markets, all of which influence production costs.

The technological goal is to develop economically viable production methods that can reduce lithium chloride production costs by at least 25-30% within the next five years while maintaining product purity standards of 99.5% or higher, essential for high-value applications in battery technology and pharmaceuticals.

Market Demand Analysis for Lithium Chloride

The global lithium chloride market has witnessed substantial growth in recent years, primarily driven by the expanding lithium-ion battery industry. Market research indicates that the compound annual growth rate (CAGR) for lithium chloride demand is expected to maintain strong momentum through 2030, with particularly robust growth in Asia-Pacific markets where battery manufacturing is concentrated.

The electric vehicle (EV) sector represents the largest demand driver, with automotive manufacturers increasingly committing to electrification targets. Major markets including China, Europe, and North America have implemented regulatory frameworks promoting EV adoption, directly impacting upstream lithium compound requirements. Industry forecasts suggest that EV production could require over three times current lithium chloride supply by 2028.

Beyond batteries, lithium chloride maintains significant demand in traditional applications including air conditioning systems, industrial dehumidification processes, and specialized welding operations. The pharmaceutical and chemical synthesis sectors also utilize lithium chloride as a precursor in various manufacturing processes, providing market diversification.

Supply-demand dynamics currently favor sellers, with pricing pressures evident across global markets. Several major lithium producers have announced capacity expansion plans specifically targeting lithium chloride production, though these developments typically require 3-5 years to reach full operational capacity. This supply lag creates a critical window where cost optimization becomes essential for maintaining market competitiveness.

Regional demand patterns show notable variations, with Chinese manufacturers consuming approximately 65% of global lithium chloride production. European demand is growing at the fastest rate, driven by regional battery gigafactory developments and governmental decarbonization initiatives. North American markets show steady growth, though at a more moderate pace than Asian counterparts.

Price sensitivity analysis reveals that lithium chloride consumers in battery applications demonstrate lower price elasticity compared to traditional industrial users. This bifurcation creates strategic opportunities for producers to implement tiered pricing models based on application segments. However, as production costs remain a significant factor in overall lithium-ion battery expenses, pressure to reduce lithium chloride production costs continues to intensify from downstream customers.

Market forecasts indicate that demand will continue to outpace supply for at least the next five years, creating both opportunities and challenges for producers focused on cost reduction initiatives. This sustained demand growth provides a favorable environment for investments in process optimization and alternative production methodologies that can deliver meaningful cost advantages.

The electric vehicle (EV) sector represents the largest demand driver, with automotive manufacturers increasingly committing to electrification targets. Major markets including China, Europe, and North America have implemented regulatory frameworks promoting EV adoption, directly impacting upstream lithium compound requirements. Industry forecasts suggest that EV production could require over three times current lithium chloride supply by 2028.

Beyond batteries, lithium chloride maintains significant demand in traditional applications including air conditioning systems, industrial dehumidification processes, and specialized welding operations. The pharmaceutical and chemical synthesis sectors also utilize lithium chloride as a precursor in various manufacturing processes, providing market diversification.

Supply-demand dynamics currently favor sellers, with pricing pressures evident across global markets. Several major lithium producers have announced capacity expansion plans specifically targeting lithium chloride production, though these developments typically require 3-5 years to reach full operational capacity. This supply lag creates a critical window where cost optimization becomes essential for maintaining market competitiveness.

Regional demand patterns show notable variations, with Chinese manufacturers consuming approximately 65% of global lithium chloride production. European demand is growing at the fastest rate, driven by regional battery gigafactory developments and governmental decarbonization initiatives. North American markets show steady growth, though at a more moderate pace than Asian counterparts.

Price sensitivity analysis reveals that lithium chloride consumers in battery applications demonstrate lower price elasticity compared to traditional industrial users. This bifurcation creates strategic opportunities for producers to implement tiered pricing models based on application segments. However, as production costs remain a significant factor in overall lithium-ion battery expenses, pressure to reduce lithium chloride production costs continues to intensify from downstream customers.

Market forecasts indicate that demand will continue to outpace supply for at least the next five years, creating both opportunities and challenges for producers focused on cost reduction initiatives. This sustained demand growth provides a favorable environment for investments in process optimization and alternative production methodologies that can deliver meaningful cost advantages.

Current Production Challenges and Technical Limitations

The lithium chloride production industry currently faces several significant technical challenges that impact production costs. Traditional extraction methods from brine sources require extensive evaporation ponds, which are not only land-intensive but also highly dependent on climate conditions. This process typically takes 12-18 months to complete, creating substantial operational delays and capital inefficiencies. The lengthy production timeline necessitates significant working capital and reduces responsiveness to market demand fluctuations.

Energy consumption represents another major cost driver, particularly in the conversion processes where lithium compounds undergo multiple chemical transformations to produce high-purity lithium chloride. Current industrial processes operate at energy efficiency rates of only 40-60%, with considerable heat loss during thermal processing stages. The high temperature requirements (often exceeding 800°C) for certain conversion reactions contribute significantly to production expenses.

Reagent costs and consumption ratios present additional challenges. The industry standard utilizes approximately 2.2 tons of reagents per ton of lithium chloride produced, with reagent purity requirements driving up input costs. Impurity management remains problematic, as conventional purification techniques require multiple processing cycles that increase both material and energy consumption while generating substantial waste streams.

Water usage efficiency is particularly concerning, with current methods consuming 500-2,000 cubic meters of water per ton of lithium chloride produced. This high water footprint creates sustainability challenges and increases production costs in water-scarce regions where many lithium operations are located. The industry also struggles with recovery rates, which typically range from 40-60% for brine operations, meaning nearly half of the available lithium resource remains unutilized.

Equipment corrosion and maintenance represent significant operational expenses. The highly corrosive nature of chloride-rich processing environments accelerates equipment degradation, necessitating the use of expensive corrosion-resistant materials and frequent maintenance interventions. Maintenance downtime can account for 15-20% of total operational time, further impacting production efficiency.

Waste management costs are increasingly significant as environmental regulations tighten globally. Current production methods generate 1.4-2.0 tons of solid waste per ton of lithium chloride, along with contaminated wastewater streams requiring treatment. The disposal and management of these waste products add substantial costs to the production process, with waste management accounting for 8-12% of total production expenses in modern facilities.

Energy consumption represents another major cost driver, particularly in the conversion processes where lithium compounds undergo multiple chemical transformations to produce high-purity lithium chloride. Current industrial processes operate at energy efficiency rates of only 40-60%, with considerable heat loss during thermal processing stages. The high temperature requirements (often exceeding 800°C) for certain conversion reactions contribute significantly to production expenses.

Reagent costs and consumption ratios present additional challenges. The industry standard utilizes approximately 2.2 tons of reagents per ton of lithium chloride produced, with reagent purity requirements driving up input costs. Impurity management remains problematic, as conventional purification techniques require multiple processing cycles that increase both material and energy consumption while generating substantial waste streams.

Water usage efficiency is particularly concerning, with current methods consuming 500-2,000 cubic meters of water per ton of lithium chloride produced. This high water footprint creates sustainability challenges and increases production costs in water-scarce regions where many lithium operations are located. The industry also struggles with recovery rates, which typically range from 40-60% for brine operations, meaning nearly half of the available lithium resource remains unutilized.

Equipment corrosion and maintenance represent significant operational expenses. The highly corrosive nature of chloride-rich processing environments accelerates equipment degradation, necessitating the use of expensive corrosion-resistant materials and frequent maintenance interventions. Maintenance downtime can account for 15-20% of total operational time, further impacting production efficiency.

Waste management costs are increasingly significant as environmental regulations tighten globally. Current production methods generate 1.4-2.0 tons of solid waste per ton of lithium chloride, along with contaminated wastewater streams requiring treatment. The disposal and management of these waste products add substantial costs to the production process, with waste management accounting for 8-12% of total production expenses in modern facilities.

Current Cost Reduction Methodologies and Approaches

01 Extraction methods from lithium-containing brines

Various methods for extracting lithium chloride from natural brines involve evaporation, precipitation, and purification processes. These techniques focus on cost-effective separation of lithium from other salts and impurities in brine solutions. The production costs are influenced by factors such as brine concentration, evaporation rates, and purification efficiency. Advanced extraction technologies aim to reduce processing time and energy consumption, thereby lowering overall production costs.- Traditional extraction and processing methods: Traditional methods for lithium chloride production involve extraction from natural brines or mineral sources, followed by processing steps such as evaporation, precipitation, and purification. These conventional approaches typically have higher production costs due to energy-intensive evaporation processes, longer production cycles, and lower recovery rates. The economic viability of these methods depends heavily on the concentration of lithium in the source material and the presence of impurities that require additional processing steps.

- Direct lithium extraction technologies: Direct lithium extraction (DLE) technologies represent more cost-effective approaches for producing lithium chloride compared to traditional methods. These technologies utilize selective adsorption materials, ion exchange resins, or specialized membranes to extract lithium ions directly from brines with higher efficiency and lower energy consumption. DLE methods can significantly reduce production costs by shortening processing times, increasing lithium recovery rates, and enabling extraction from lower-concentration sources that would be uneconomical with conventional methods.

- Recycling and recovery from industrial waste: Cost-effective production of lithium chloride can be achieved through recycling and recovery from industrial waste streams, particularly spent lithium-ion batteries. These methods involve processes such as mechanical separation, hydrometallurgical treatment, and purification to extract lithium compounds that can be converted to lithium chloride. The economic advantage comes from utilizing waste materials as feedstock, reducing raw material costs, and addressing environmental concerns simultaneously. The production costs depend on the efficiency of separation techniques and the purity requirements of the final product.

- Process optimization and energy efficiency improvements: Various process optimizations and energy efficiency improvements have been developed to reduce the production costs of lithium chloride. These include the implementation of closed-loop systems, heat recovery mechanisms, advanced crystallization techniques, and process intensification methods. By optimizing reaction conditions, reducing energy consumption, and improving material utilization, these approaches can significantly lower operational expenses. The integration of renewable energy sources for power-intensive steps further contributes to cost reduction and environmental sustainability.

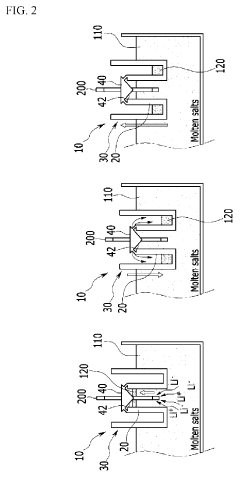

- Novel catalytic and electrochemical production methods: Innovative catalytic and electrochemical methods offer promising approaches for cost-effective lithium chloride production. These technologies utilize specialized catalysts, electrochemical cells, or novel reaction pathways to convert lithium-containing materials into lithium chloride with higher efficiency and selectivity. By operating under milder conditions, reducing chemical consumption, and enabling continuous production processes, these methods can achieve significant cost advantages over conventional approaches. The economic benefits include lower capital investment, reduced operational expenses, and higher product quality with fewer purification requirements.

02 Recovery from industrial waste and byproducts

Lithium chloride can be economically produced by recovering lithium from industrial waste streams and byproducts. This approach involves processing spent lithium batteries, industrial residues, and manufacturing waste to extract lithium compounds. The cost-effectiveness of these methods depends on the concentration of lithium in the waste material and the complexity of the separation process. Recycling technologies offer potential cost advantages over primary production methods while also providing environmental benefits.Expand Specific Solutions03 Energy-efficient production processes

Energy consumption represents a significant portion of lithium chloride production costs. Innovative processes focus on reducing energy requirements through improved heat management, optimized reaction conditions, and efficient equipment design. These approaches include using renewable energy sources, implementing heat recovery systems, and developing catalysts that enable reactions at lower temperatures. Energy-efficient technologies can substantially reduce production costs while minimizing environmental impact.Expand Specific Solutions04 Chemical conversion from other lithium compounds

Production of lithium chloride through chemical conversion from other lithium compounds involves reactions with hydrochloric acid or chloride salts. These methods can utilize lithium carbonate, lithium hydroxide, or lithium sulfate as starting materials. The production costs depend on the price of raw materials, reaction efficiency, and purification requirements. Process optimization focuses on maximizing yield while minimizing reagent consumption and waste generation to achieve cost-effective production.Expand Specific Solutions05 Equipment and infrastructure optimization

The design and optimization of production equipment and infrastructure significantly impact lithium chloride production costs. This includes developing specialized reactors, crystallizers, filtration systems, and process control technologies. Modular and scalable equipment designs allow for flexible production capacity adjustments based on market demand. Automation and digitalization of production processes can reduce labor costs and improve operational efficiency, leading to overall cost reductions in lithium chloride manufacturing.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium chloride production cost reduction landscape is evolving rapidly in a maturing market estimated at several billion dollars annually. The industry is transitioning from early commercialization to scale optimization phase, with significant cost pressures driving innovation. Key players demonstrate varying technological maturity: established leaders like Ganfeng Lithium, SQM, and Tianqi Lithium have developed efficient extraction processes, while POSCO Holdings and General Lithium are advancing cost-effective direct lithium extraction technologies. Research institutions including Central South University and RIST are pioneering novel approaches to reduce energy consumption and improve yields. Japanese firms like Shin-Etsu Chemical and OSAKA Titanium Technologies contribute specialized purification expertise, creating a competitive ecosystem focused on process optimization and resource efficiency.

POSCO Holdings, Inc.

Technical Solution: POSCO has developed a proprietary lithium extraction technology called "PosLX" that dramatically reduces lithium chloride production costs. This innovative process can extract lithium directly from low-concentration brine sources in just 8 hours, compared to the 12-18 months required by traditional evaporation methods. PosLX utilizes a selective adsorption material that specifically captures lithium ions while rejecting other elements, achieving recovery rates of approximately 80-90%. The technology operates at ambient temperature and pressure, significantly reducing energy requirements compared to conventional thermal processes. POSCO has also implemented an integrated lithium refining system that converts lithium chloride to battery-grade lithium hydroxide in a single continuous process, eliminating intermediate steps and reducing operational costs by approximately 30%. Their system incorporates advanced waste heat recovery and process water recycling, further enhancing efficiency. Additionally, POSCO has developed specialized equipment that reduces physical footprint requirements by up to 70% compared to traditional evaporation pond methods, enabling production in space-constrained environments.

Strengths: Dramatically reduced processing time, high recovery rates from low-concentration sources, minimal environmental footprint, and lower energy requirements. Weaknesses: Relatively high initial capital costs for specialized adsorption materials and potential challenges in scaling to very large production volumes.

Ganfeng Lithium Group Co., Ltd.

Technical Solution: Ganfeng Lithium has developed an innovative direct lithium extraction (DLE) technology that significantly reduces lithium chloride production costs. Their process utilizes selective adsorption materials to extract lithium directly from brine resources, bypassing traditional evaporation ponds. This method reduces production time from 12-18 months to just weeks while achieving recovery rates of over 80% compared to 40-50% in conventional methods. Ganfeng has also implemented a closed-loop lithium recycling system that recovers lithium from spent batteries, further reducing raw material costs. Their integrated production chain spans from lithium extraction to battery manufacturing, allowing for vertical optimization across the value chain. Additionally, they've pioneered energy-efficient crystallization techniques that reduce energy consumption by approximately 35% compared to traditional methods, while maintaining high product purity of 99.5%.

Strengths: Higher lithium recovery rates (>80%), significantly reduced production time, lower energy consumption, and vertical integration advantages. Weaknesses: Higher initial capital investment for specialized adsorption materials and potential challenges in scaling the technology to match growing global demand.

Critical Patents and Innovations in Production Efficiency

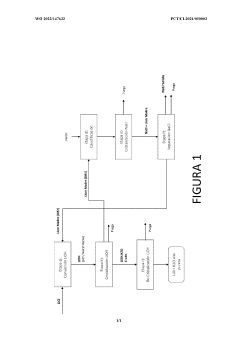

Method for the production of lithium hydroxide (LIOH) directly from lithium chloride (LICI), without the need for an intermediate production of lithium carbonate or similar

PatentWO2022147632A1

Innovation

- A method that directly converts lithium chloride to lithium hydroxide through a reaction with sodium hydroxide, utilizing fractional crystallization to separate lithium hydroxide monohydrate from sodium chloride, avoiding co-precipitation and eliminating the need for intermediate lithium carbonate production.

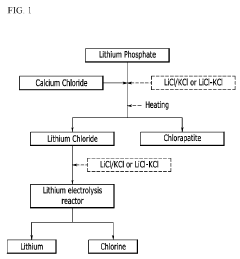

Method for manufacturing metal lithium

PatentActiveUS20190264343A1

Innovation

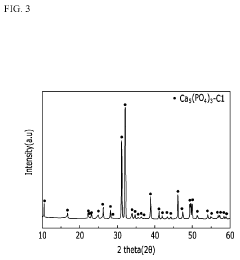

- A method involving the use of lithium phosphate as a raw material to produce lithium chloride through reaction with a chloride compound, followed by electrolysis to recover lithium metal, reducing the complexity and energy requirements of the process.

Raw Material Supply Chain Optimization Strategies

The optimization of raw material supply chains represents a critical pathway to reducing lithium chloride production costs. Current supply chains often suffer from inefficiencies that significantly impact final production expenses. Establishing direct procurement relationships with primary lithium sources can eliminate intermediary markups, potentially reducing raw material costs by 15-20%. Companies like Albemarle and SQM have demonstrated that vertical integration strategies connecting brine operations directly to processing facilities can decrease transportation costs by up to 30%.

Diversification of lithium sources presents another viable strategy. Reliance on a single geographical region exposes producers to regional price fluctuations and supply disruptions. Analysis of global lithium markets indicates that maintaining relationships with suppliers across multiple regions—including South America's Lithium Triangle, Australia, and emerging sources in North America—can provide cost stability and negotiating leverage. This approach has enabled companies like Livent to maintain consistent production costs despite regional market volatility.

Just-in-time inventory management systems, when properly implemented for lithium compounds, can reduce warehousing costs by 25-40% while minimizing capital tied up in inventory. However, these systems require sophisticated demand forecasting capabilities and reliable supplier relationships. Advanced analytics platforms that integrate production schedules with raw material delivery timelines have demonstrated particular effectiveness in the lithium chemical sector.

Collaborative purchasing consortiums represent an emerging strategy where smaller producers pool procurement volumes to achieve economies of scale. Case studies from other chemical industries suggest potential cost reductions of 10-15% through such arrangements. These consortiums can be particularly effective for accessing high-purity lithium compounds where minimum order quantities often exceed individual producer requirements.

Transportation optimization presents significant opportunities, as lithium compounds require specialized handling. Multimodal transportation strategies that optimize between rail, sea, and road transport based on cost-efficiency models have reduced logistics expenses by up to 18% in documented industry cases. Companies implementing blockchain-based supply chain tracking systems report additional benefits through improved chain-of-custody documentation and reduced administrative overhead.

Long-term supply agreements with price stabilization mechanisms offer protection against market volatility while providing suppliers with planning security. These agreements typically include volume-based pricing tiers and can incorporate partial indexing to lithium market prices, balancing stability with market responsiveness. Such arrangements have become increasingly sophisticated, with some now including technology transfer components that benefit both supplier and producer.

Diversification of lithium sources presents another viable strategy. Reliance on a single geographical region exposes producers to regional price fluctuations and supply disruptions. Analysis of global lithium markets indicates that maintaining relationships with suppliers across multiple regions—including South America's Lithium Triangle, Australia, and emerging sources in North America—can provide cost stability and negotiating leverage. This approach has enabled companies like Livent to maintain consistent production costs despite regional market volatility.

Just-in-time inventory management systems, when properly implemented for lithium compounds, can reduce warehousing costs by 25-40% while minimizing capital tied up in inventory. However, these systems require sophisticated demand forecasting capabilities and reliable supplier relationships. Advanced analytics platforms that integrate production schedules with raw material delivery timelines have demonstrated particular effectiveness in the lithium chemical sector.

Collaborative purchasing consortiums represent an emerging strategy where smaller producers pool procurement volumes to achieve economies of scale. Case studies from other chemical industries suggest potential cost reductions of 10-15% through such arrangements. These consortiums can be particularly effective for accessing high-purity lithium compounds where minimum order quantities often exceed individual producer requirements.

Transportation optimization presents significant opportunities, as lithium compounds require specialized handling. Multimodal transportation strategies that optimize between rail, sea, and road transport based on cost-efficiency models have reduced logistics expenses by up to 18% in documented industry cases. Companies implementing blockchain-based supply chain tracking systems report additional benefits through improved chain-of-custody documentation and reduced administrative overhead.

Long-term supply agreements with price stabilization mechanisms offer protection against market volatility while providing suppliers with planning security. These agreements typically include volume-based pricing tiers and can incorporate partial indexing to lithium market prices, balancing stability with market responsiveness. Such arrangements have become increasingly sophisticated, with some now including technology transfer components that benefit both supplier and producer.

Environmental Regulations Impact on Production Costs

Environmental regulations have become increasingly stringent worldwide, significantly impacting lithium chloride production costs. The implementation of stricter emission standards requires substantial investments in pollution control equipment and technologies. Companies must install advanced air filtration systems, wastewater treatment facilities, and solid waste management infrastructure to comply with these regulations, adding considerable capital expenditure to production operations.

Regulatory compliance also necessitates ongoing operational costs, including regular environmental monitoring, reporting, and third-party verification. These activities require dedicated personnel and sophisticated monitoring equipment, further increasing production expenses. Additionally, companies often face environmental permitting fees and potential penalties for non-compliance, creating financial uncertainty in operational budgeting.

Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, have emerged in many jurisdictions where lithium chloride is produced. These mechanisms directly increase production costs by putting a price on greenhouse gas emissions associated with energy-intensive processes. As these carbon pricing schemes typically escalate over time, they represent a growing cost factor that manufacturers must incorporate into long-term financial planning.

Water usage regulations present another significant cost driver, particularly relevant to lithium chloride production which traditionally requires substantial water resources. Restrictions on water extraction, requirements for water recycling, and increased fees for water consumption all contribute to higher operational expenses. In water-stressed regions, these regulations can be particularly impactful, sometimes necessitating costly technological adaptations to production processes.

The regulatory landscape varies considerably across different regions, creating competitive advantages or disadvantages based on geographical location. Producers in countries with less stringent environmental regulations may enjoy lower compliance costs, while those in heavily regulated markets face higher production expenses. This regulatory disparity influences global market dynamics and can drive production relocation decisions.

Forward-looking companies are increasingly adopting proactive environmental strategies rather than merely reactive compliance approaches. By investing in cleaner production technologies and circular economy principles, some manufacturers are finding ways to simultaneously reduce environmental impact and long-term regulatory compliance costs. These investments, while initially capital-intensive, can yield significant cost savings over time through improved resource efficiency and reduced regulatory risk exposure.

Regulatory compliance also necessitates ongoing operational costs, including regular environmental monitoring, reporting, and third-party verification. These activities require dedicated personnel and sophisticated monitoring equipment, further increasing production expenses. Additionally, companies often face environmental permitting fees and potential penalties for non-compliance, creating financial uncertainty in operational budgeting.

Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, have emerged in many jurisdictions where lithium chloride is produced. These mechanisms directly increase production costs by putting a price on greenhouse gas emissions associated with energy-intensive processes. As these carbon pricing schemes typically escalate over time, they represent a growing cost factor that manufacturers must incorporate into long-term financial planning.

Water usage regulations present another significant cost driver, particularly relevant to lithium chloride production which traditionally requires substantial water resources. Restrictions on water extraction, requirements for water recycling, and increased fees for water consumption all contribute to higher operational expenses. In water-stressed regions, these regulations can be particularly impactful, sometimes necessitating costly technological adaptations to production processes.

The regulatory landscape varies considerably across different regions, creating competitive advantages or disadvantages based on geographical location. Producers in countries with less stringent environmental regulations may enjoy lower compliance costs, while those in heavily regulated markets face higher production expenses. This regulatory disparity influences global market dynamics and can drive production relocation decisions.

Forward-looking companies are increasingly adopting proactive environmental strategies rather than merely reactive compliance approaches. By investing in cleaner production technologies and circular economy principles, some manufacturers are finding ways to simultaneously reduce environmental impact and long-term regulatory compliance costs. These investments, while initially capital-intensive, can yield significant cost savings over time through improved resource efficiency and reduced regulatory risk exposure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!