Hydrofluoric Acid Applications in Semiconductor Manufacturing

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HF Acid Evolution and Objectives in Semiconductor Industry

Hydrofluoric acid (HF) has been a cornerstone in semiconductor manufacturing since the industry's inception in the 1960s. Initially employed primarily for basic cleaning processes, HF acid applications have evolved significantly alongside the advancement of semiconductor technology. The progression from micron to nanometer-scale features in integrated circuits has demanded increasingly precise and controlled etching and cleaning capabilities, positioning HF as a critical enabler of modern semiconductor fabrication.

The evolution of HF usage in semiconductor manufacturing can be traced through several distinct phases. In the early era (1960s-1980s), dilute HF solutions were predominantly used for native oxide removal and basic surface cleaning. The middle period (1980s-2000s) saw the refinement of HF applications with the introduction of buffered oxide etch (BOE) formulations, which provided better control over etching rates and improved selectivity. The contemporary phase (2000s-present) has witnessed the development of ultra-dilute HF solutions, vapor-phase HF processes, and precisely controlled HF-based chemistries tailored for specific applications in advanced node manufacturing.

The primary objective of HF acid utilization in modern semiconductor fabrication is to achieve atomic-level precision in material removal while maintaining absolute cleanliness of the silicon surface. This is particularly crucial as the industry pushes toward 3nm and beyond technology nodes, where even single-atom defects can significantly impact device performance. Specific technical goals include developing HF-based processes that offer enhanced selectivity between different materials, minimal surface roughening, and compatibility with increasingly complex device architectures.

Environmental and safety considerations have also become paramount objectives in HF technology development. The semiconductor industry aims to reduce HF consumption through more efficient processes, implement closed-loop recycling systems, and develop alternative chemistries with comparable performance but reduced hazards. These objectives align with broader sustainability goals and increasingly stringent regulatory requirements worldwide.

Looking forward, the industry is pursuing several ambitious objectives for HF technology, including the development of single-wafer processes with precise dosing capabilities, integration with advanced metrology for real-time process control, and formulation of specialized HF mixtures compatible with new materials being introduced in advanced semiconductor devices. Additionally, there is significant interest in developing "green" alternatives that maintain the unique capabilities of HF while reducing environmental impact and safety risks.

The evolution of HF usage in semiconductor manufacturing can be traced through several distinct phases. In the early era (1960s-1980s), dilute HF solutions were predominantly used for native oxide removal and basic surface cleaning. The middle period (1980s-2000s) saw the refinement of HF applications with the introduction of buffered oxide etch (BOE) formulations, which provided better control over etching rates and improved selectivity. The contemporary phase (2000s-present) has witnessed the development of ultra-dilute HF solutions, vapor-phase HF processes, and precisely controlled HF-based chemistries tailored for specific applications in advanced node manufacturing.

The primary objective of HF acid utilization in modern semiconductor fabrication is to achieve atomic-level precision in material removal while maintaining absolute cleanliness of the silicon surface. This is particularly crucial as the industry pushes toward 3nm and beyond technology nodes, where even single-atom defects can significantly impact device performance. Specific technical goals include developing HF-based processes that offer enhanced selectivity between different materials, minimal surface roughening, and compatibility with increasingly complex device architectures.

Environmental and safety considerations have also become paramount objectives in HF technology development. The semiconductor industry aims to reduce HF consumption through more efficient processes, implement closed-loop recycling systems, and develop alternative chemistries with comparable performance but reduced hazards. These objectives align with broader sustainability goals and increasingly stringent regulatory requirements worldwide.

Looking forward, the industry is pursuing several ambitious objectives for HF technology, including the development of single-wafer processes with precise dosing capabilities, integration with advanced metrology for real-time process control, and formulation of specialized HF mixtures compatible with new materials being introduced in advanced semiconductor devices. Additionally, there is significant interest in developing "green" alternatives that maintain the unique capabilities of HF while reducing environmental impact and safety risks.

Market Analysis of HF Acid in Semiconductor Manufacturing

The global market for hydrofluoric acid (HF) in semiconductor manufacturing has experienced significant growth over the past decade, driven primarily by the expanding electronics industry and increasing demand for advanced semiconductor devices. The market value reached approximately $290 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% through 2028, potentially reaching $430 million by the end of the forecast period.

Asia-Pacific dominates the market landscape, accounting for over 65% of global consumption, with Taiwan, South Korea, and China being the primary consumers. This regional concentration aligns with the geographical distribution of semiconductor fabrication facilities, where Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics operate their most advanced production lines.

The demand for HF acid in semiconductor manufacturing is closely tied to silicon wafer production volumes and technological node advancements. As the industry continues its transition to smaller nodes (5nm, 3nm, and beyond), the requirements for high-purity HF acid have become more stringent, creating a premium segment within the market that commands higher profit margins.

Market segmentation reveals that electronic-grade HF acid (>99.99% purity) represents the fastest-growing segment, essential for advanced chip manufacturing processes. This segment is expected to grow at 8.2% CAGR, outpacing the overall market growth rate due to increasing demand for ultra-high purity chemicals in leading-edge semiconductor fabrication.

Supply chain dynamics have shifted significantly since 2020, with manufacturers placing greater emphasis on supply security and geographical diversification. The COVID-19 pandemic and subsequent geopolitical tensions highlighted vulnerabilities in the global supply chain, prompting semiconductor manufacturers to secure multiple sourcing options for critical materials including HF acid.

Price trends indicate moderate volatility, with a general upward trajectory observed since 2021. The average price increased by approximately 12% between 2021 and 2023, driven by rising production costs, stringent environmental regulations, and temporary supply constraints. However, long-term contracts between major suppliers and semiconductor manufacturers have helped stabilize pricing for large-volume consumers.

Market concentration remains relatively high, with the top five suppliers controlling approximately 70% of the global market. Key players include Stella Chemifa Corporation, Solvay, Honeywell, Morita Chemical Industries, and Formosa Daikin Advanced Chemicals. Recent market developments include increased investment in local production facilities near semiconductor manufacturing hubs to minimize supply chain risks and reduce transportation challenges associated with this hazardous material.

Asia-Pacific dominates the market landscape, accounting for over 65% of global consumption, with Taiwan, South Korea, and China being the primary consumers. This regional concentration aligns with the geographical distribution of semiconductor fabrication facilities, where Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics operate their most advanced production lines.

The demand for HF acid in semiconductor manufacturing is closely tied to silicon wafer production volumes and technological node advancements. As the industry continues its transition to smaller nodes (5nm, 3nm, and beyond), the requirements for high-purity HF acid have become more stringent, creating a premium segment within the market that commands higher profit margins.

Market segmentation reveals that electronic-grade HF acid (>99.99% purity) represents the fastest-growing segment, essential for advanced chip manufacturing processes. This segment is expected to grow at 8.2% CAGR, outpacing the overall market growth rate due to increasing demand for ultra-high purity chemicals in leading-edge semiconductor fabrication.

Supply chain dynamics have shifted significantly since 2020, with manufacturers placing greater emphasis on supply security and geographical diversification. The COVID-19 pandemic and subsequent geopolitical tensions highlighted vulnerabilities in the global supply chain, prompting semiconductor manufacturers to secure multiple sourcing options for critical materials including HF acid.

Price trends indicate moderate volatility, with a general upward trajectory observed since 2021. The average price increased by approximately 12% between 2021 and 2023, driven by rising production costs, stringent environmental regulations, and temporary supply constraints. However, long-term contracts between major suppliers and semiconductor manufacturers have helped stabilize pricing for large-volume consumers.

Market concentration remains relatively high, with the top five suppliers controlling approximately 70% of the global market. Key players include Stella Chemifa Corporation, Solvay, Honeywell, Morita Chemical Industries, and Formosa Daikin Advanced Chemicals. Recent market developments include increased investment in local production facilities near semiconductor manufacturing hubs to minimize supply chain risks and reduce transportation challenges associated with this hazardous material.

Current HF Applications and Technical Challenges

Hydrofluoric acid (HF) serves as a critical chemical in semiconductor manufacturing processes, primarily utilized for its unique ability to etch silicon dioxide and other materials with high selectivity. In current semiconductor fabrication, HF is employed in various concentrations and formulations across multiple production stages.

The most widespread application of HF is in wet etching processes, where it selectively removes silicon dioxide layers while leaving silicon substrates relatively intact. This property makes it invaluable for creating precise patterns and structures in integrated circuits. Typically used in diluted forms ranging from 1% to 49% concentrations, HF solutions are carefully controlled to achieve specific etch rates and profiles.

In advanced cleaning procedures, HF-based chemistries are essential components of standard cleaning solutions like RCA clean (SC1 and SC2). These solutions remove particulates, organic contaminants, and metallic impurities from wafer surfaces, ensuring the high purity required for subsequent processing steps. The industry has developed specialized HF mixtures, including buffered oxide etch (BOE) solutions that combine HF with ammonium fluoride to stabilize pH and provide more controlled etching rates.

Despite its utility, HF applications face significant technical challenges. Safety concerns represent the foremost issue, as HF is extremely hazardous, causing severe burns and potential systemic toxicity through skin contact. This necessitates rigorous safety protocols and specialized handling equipment, increasing operational complexity and costs.

Process control presents another major challenge, particularly as semiconductor feature sizes continue to shrink below 5nm. At these dimensions, even nanometer-scale variations in etch depth or profile can critically impact device performance. Achieving consistent results requires precise control of concentration, temperature, and exposure time, which becomes increasingly difficult at advanced nodes.

Environmental considerations also pose substantial challenges. HF waste requires specialized treatment before disposal, and regulatory requirements for HF emissions and waste management continue to tighten globally. The semiconductor industry faces mounting pressure to reduce or eliminate HF usage due to these environmental concerns.

Additionally, HF's compatibility with new materials used in advanced semiconductor devices presents ongoing technical hurdles. As manufacturers incorporate novel materials like high-k dielectrics, metal gates, and compound semiconductors, traditional HF processes often require significant modification or replacement to maintain selectivity and prevent damage to these sensitive materials.

The industry is actively pursuing alternatives to traditional HF processes, including dry etching techniques, vapor-phase etching, and development of less hazardous chemical substitutes, though each alternative brings its own set of technical challenges and limitations.

The most widespread application of HF is in wet etching processes, where it selectively removes silicon dioxide layers while leaving silicon substrates relatively intact. This property makes it invaluable for creating precise patterns and structures in integrated circuits. Typically used in diluted forms ranging from 1% to 49% concentrations, HF solutions are carefully controlled to achieve specific etch rates and profiles.

In advanced cleaning procedures, HF-based chemistries are essential components of standard cleaning solutions like RCA clean (SC1 and SC2). These solutions remove particulates, organic contaminants, and metallic impurities from wafer surfaces, ensuring the high purity required for subsequent processing steps. The industry has developed specialized HF mixtures, including buffered oxide etch (BOE) solutions that combine HF with ammonium fluoride to stabilize pH and provide more controlled etching rates.

Despite its utility, HF applications face significant technical challenges. Safety concerns represent the foremost issue, as HF is extremely hazardous, causing severe burns and potential systemic toxicity through skin contact. This necessitates rigorous safety protocols and specialized handling equipment, increasing operational complexity and costs.

Process control presents another major challenge, particularly as semiconductor feature sizes continue to shrink below 5nm. At these dimensions, even nanometer-scale variations in etch depth or profile can critically impact device performance. Achieving consistent results requires precise control of concentration, temperature, and exposure time, which becomes increasingly difficult at advanced nodes.

Environmental considerations also pose substantial challenges. HF waste requires specialized treatment before disposal, and regulatory requirements for HF emissions and waste management continue to tighten globally. The semiconductor industry faces mounting pressure to reduce or eliminate HF usage due to these environmental concerns.

Additionally, HF's compatibility with new materials used in advanced semiconductor devices presents ongoing technical hurdles. As manufacturers incorporate novel materials like high-k dielectrics, metal gates, and compound semiconductors, traditional HF processes often require significant modification or replacement to maintain selectivity and prevent damage to these sensitive materials.

The industry is actively pursuing alternatives to traditional HF processes, including dry etching techniques, vapor-phase etching, and development of less hazardous chemical substitutes, though each alternative brings its own set of technical challenges and limitations.

Contemporary HF Acid Processing Solutions

01 Etching and cleaning applications in semiconductor manufacturing

Hydrofluoric acid is widely used in semiconductor manufacturing processes for etching silicon dioxide and cleaning silicon wafers. It effectively removes oxide layers, contaminants, and residues from semiconductor surfaces. Various formulations and concentrations of hydrofluoric acid are employed depending on the specific requirements of the etching or cleaning process, often in combination with other chemicals to enhance performance and control etch rates.- Etching applications of hydrofluoric acid: Hydrofluoric acid is widely used as an etching agent in semiconductor manufacturing and glass processing. It effectively removes silicon dioxide layers and can be used to create specific patterns on silicon wafers. The etching process can be controlled by adjusting the concentration of the acid and adding buffering agents. This application is crucial in the production of microelectronic devices and specialized glass products.

- Purification and recovery methods for hydrofluoric acid: Various techniques have been developed to purify and recover hydrofluoric acid from industrial waste streams. These methods include distillation, adsorption, membrane filtration, and chemical precipitation. Purification is essential to remove contaminants such as metal ions and organic compounds that can affect the performance of the acid in industrial applications. Recovery systems help reduce environmental impact and operational costs by allowing the acid to be reused.

- Safety measures and handling of hydrofluoric acid: Due to its highly corrosive nature and ability to penetrate skin, specialized safety protocols are necessary when handling hydrofluoric acid. These include the use of specific personal protective equipment, neutralizing agents, and emergency response procedures. Specialized containment systems, ventilation requirements, and storage conditions are also critical to prevent accidents and exposure. Training programs for personnel working with hydrofluoric acid focus on hazard awareness and proper handling techniques.

- Production methods of hydrofluoric acid: Industrial production of hydrofluoric acid typically involves the reaction of calcium fluoride (fluorspar) with concentrated sulfuric acid. Alternative production methods include the treatment of fluorosilicic acid and the processing of fluoride-containing waste streams. The production process requires specialized equipment due to the corrosive nature of the acid, including reactors lined with acid-resistant materials and specialized distillation columns for purification.

- Applications in chemical synthesis and catalysis: Hydrofluoric acid serves as an important reagent and catalyst in various chemical synthesis processes. It is used in the production of fluorine-containing compounds, including pharmaceuticals, agrochemicals, and fluoropolymers. As a catalyst, it facilitates alkylation reactions in petroleum refining and promotes certain organic transformations. The acid's unique properties make it valuable for specific chemical reactions that are difficult to achieve with other acids.

02 Production and purification methods of hydrofluoric acid

Various methods are employed for the production and purification of hydrofluoric acid. These include processes for manufacturing high-purity hydrofluoric acid from fluoride-containing raw materials, techniques for removing impurities, and systems for handling and storing the acid safely. Advanced purification methods are particularly important for applications requiring ultra-pure hydrofluoric acid, such as in the electronics industry.Expand Specific Solutions03 Treatment and neutralization of hydrofluoric acid waste

Environmental and safety concerns necessitate effective methods for treating and neutralizing hydrofluoric acid waste. These include processes for converting hydrofluoric acid into less hazardous compounds, recovery systems for recycling the acid, and neutralization techniques using various reagents. Waste treatment approaches aim to minimize environmental impact while complying with regulatory requirements for disposal of fluoride-containing effluents.Expand Specific Solutions04 Safety measures and handling protocols for hydrofluoric acid

Due to its highly corrosive and toxic nature, specialized safety measures and handling protocols are essential when working with hydrofluoric acid. These include the use of specific protective equipment, emergency response procedures for exposure incidents, specialized storage containers, and detection systems to monitor for leaks or spills. Training protocols and safety guidelines are developed to minimize risks associated with hydrofluoric acid handling.Expand Specific Solutions05 Industrial applications beyond semiconductor manufacturing

Hydrofluoric acid has numerous industrial applications beyond semiconductor manufacturing. It is used in glass etching and polishing, metal surface treatment and cleaning, fluorochemical production, and as a catalyst in various chemical processes. Different concentrations and formulations are employed depending on the specific application requirements, often with additives to enhance performance or reduce hazards associated with the acid.Expand Specific Solutions

Leading Suppliers and Semiconductor Manufacturers

The hydrofluoric acid semiconductor manufacturing market is currently in a growth phase, with increasing demand driven by the expansion of semiconductor fabrication facilities worldwide. The market size is projected to reach significant volumes as chip production continues to accelerate globally. From a technological maturity perspective, established players like Taiwan Semiconductor Manufacturing Co. (TSMC) and Lam Research are leading implementation of advanced etching processes, while chemical specialists such as Do-Fluoride New Materials, Stella Chemifa, and Resonac Holdings have developed high-purity HF formulations critical for modern semiconductor manufacturing. Companies including Air Liquide and Merck are advancing safety protocols and delivery systems, while newer entrants like RAM Technology and Runma Chemical are focusing on specialized applications and environmental considerations, creating a competitive landscape balanced between established leaders and innovative specialists.

Resonac Holdings Corp.

Technical Solution: Resonac (formerly Showa Denko) has developed specialized high-purity hydrofluoric acid products for semiconductor manufacturing with metal impurity levels below 100 parts per trillion. Their technology includes proprietary purification processes that remove critical contaminants through multi-stage filtration and specialized packaging systems that prevent contamination during transport and storage. Resonac's HF products feature specialized additives that enhance etching selectivity between different materials, particularly useful in complex multi-layer semiconductor structures. They have engineered specialized dilution and blending systems that can prepare custom HF mixtures on-site with concentration accuracy of ±0.1%. Their technology also includes specialized vapor-phase HF generation systems for anhydrous applications in semiconductor processing, particularly useful for selective etching of sacrificial layers in MEMS device manufacturing.

Strengths: Exceptional purity control; specialized formulations for different semiconductor applications; integrated quality control systems; strong presence in Asian semiconductor manufacturing markets. Weaknesses: More limited global distribution compared to larger competitors; some specialized formulations require careful handling protocols; higher costs for custom solutions.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has developed advanced hydrofluoric acid (HF) etching processes for their leading-edge semiconductor manufacturing. Their approach includes ultra-dilute HF solutions (as low as 0.5%) for critical oxide removal steps in advanced nodes (5nm and below). TSMC implements closed-loop HF delivery systems with real-time monitoring and precise temperature control to maintain consistent etch rates. Their manufacturing facilities feature advanced abatement systems that neutralize HF waste streams before disposal, achieving over 99.9% removal efficiency. TSMC has also pioneered vapor-phase HF etching techniques that allow for more controlled and selective etching of sacrificial oxide layers in their 3D chip stacking technologies, enabling higher aspect ratio features with minimal undercut.

Strengths: Industry-leading process control systems for HF application with nanometer-level precision; comprehensive safety protocols; advanced waste treatment capabilities. Weaknesses: High implementation costs; requires specialized equipment and extensive engineering expertise; process is highly sensitive to environmental variations.

Key Patents and Innovations in HF Etching Processes

Hydrofluoric acid reprocessing for semiconductor standards

PatentInactiveUS4936955A

Innovation

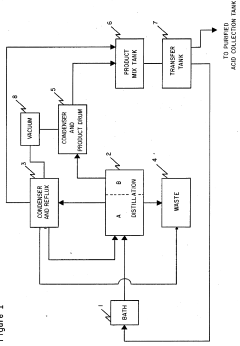

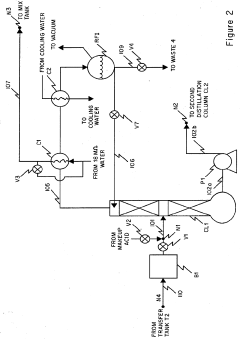

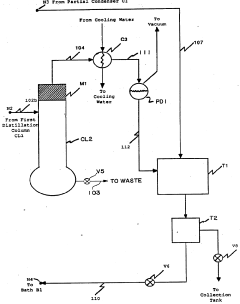

- A two-step distillation process operating at reduced pressure and temperature, using plastic vessels and conduit lines, where spent acid is mixed with makeup acid, distilled in two columns, and the resulting hydrofluoric acid is condensed and diluted to meet semiconductor industry standards.

Method of purifying hydrofluoric acid and purification apparatus

PatentWO2005092786A1

Innovation

- Dissolving fluorine gas in hydrofluoric acid containing arsenic compounds, allowing the mixture to react for a sufficient time, and then distilling it to achieve ultra-high-purity hydrofluoric acid by adding 50 ppm or more of fluorine gas and retaining the mixture for at least 5 minutes.

Safety Protocols and Environmental Regulations

The semiconductor manufacturing industry's reliance on hydrofluoric acid (HF) necessitates rigorous safety protocols and compliance with increasingly stringent environmental regulations. OSHA and semiconductor industry associations have established comprehensive safety standards specifically for HF handling, requiring specialized personal protective equipment including chemical-resistant suits, gloves, face shields, and respiratory protection. These standards mandate regular equipment inspections and certification to prevent catastrophic failures that could release toxic fumes.

Emergency response protocols for HF exposure are particularly critical due to its ability to penetrate skin and cause deep tissue damage without immediate symptoms. Modern semiconductor facilities implement sophisticated detection systems with parts-per-billion sensitivity to identify HF leaks before they reach dangerous levels. These systems are integrated with automated emergency response mechanisms that can neutralize spills and ventilate affected areas within seconds of detection.

Environmental regulations governing HF usage have evolved significantly in the past decade. The EPA's Toxic Substances Control Act amendments have progressively lowered permissible emission levels, with the most recent standards requiring 99.99% capture efficiency for HF emissions. The European Union's REACH regulations classify HF as a substance of very high concern, mandating substitution plans and strict reporting requirements for semiconductor manufacturers operating in EU territories.

Waste management protocols for HF-containing effluents involve multi-stage neutralization processes using calcium compounds to form insoluble calcium fluoride precipitates. Advanced treatment facilities employ ion exchange technologies and membrane filtration systems to further reduce fluoride concentrations to below 2 ppm before discharge, exceeding most regulatory requirements of 10-15 ppm.

The semiconductor industry has responded to these challenges through collaborative initiatives like the Semiconductor Environmental Safety and Health Association's HF Reduction Program, which has developed innovative recycling technologies that can recover and purify up to 80% of HF from waste streams. These closed-loop systems significantly reduce both procurement costs and environmental impact.

Recent regulatory trends indicate movement toward zero-discharge requirements for HF in several key semiconductor manufacturing regions, particularly in Taiwan and South Korea. This regulatory pressure is accelerating research into alternative etching technologies that could potentially eliminate or drastically reduce HF usage while maintaining the precision required for advanced node semiconductor fabrication.

Emergency response protocols for HF exposure are particularly critical due to its ability to penetrate skin and cause deep tissue damage without immediate symptoms. Modern semiconductor facilities implement sophisticated detection systems with parts-per-billion sensitivity to identify HF leaks before they reach dangerous levels. These systems are integrated with automated emergency response mechanisms that can neutralize spills and ventilate affected areas within seconds of detection.

Environmental regulations governing HF usage have evolved significantly in the past decade. The EPA's Toxic Substances Control Act amendments have progressively lowered permissible emission levels, with the most recent standards requiring 99.99% capture efficiency for HF emissions. The European Union's REACH regulations classify HF as a substance of very high concern, mandating substitution plans and strict reporting requirements for semiconductor manufacturers operating in EU territories.

Waste management protocols for HF-containing effluents involve multi-stage neutralization processes using calcium compounds to form insoluble calcium fluoride precipitates. Advanced treatment facilities employ ion exchange technologies and membrane filtration systems to further reduce fluoride concentrations to below 2 ppm before discharge, exceeding most regulatory requirements of 10-15 ppm.

The semiconductor industry has responded to these challenges through collaborative initiatives like the Semiconductor Environmental Safety and Health Association's HF Reduction Program, which has developed innovative recycling technologies that can recover and purify up to 80% of HF from waste streams. These closed-loop systems significantly reduce both procurement costs and environmental impact.

Recent regulatory trends indicate movement toward zero-discharge requirements for HF in several key semiconductor manufacturing regions, particularly in Taiwan and South Korea. This regulatory pressure is accelerating research into alternative etching technologies that could potentially eliminate or drastically reduce HF usage while maintaining the precision required for advanced node semiconductor fabrication.

Economic Impact and Supply Chain Considerations

Hydrofluoric acid (HF) represents a critical component in semiconductor manufacturing with substantial economic implications across the global technology supply chain. The semiconductor industry, valued at over $550 billion globally, relies heavily on HF for silicon wafer etching, cleaning processes, and oxide removal operations. This dependency creates significant economic ripple effects throughout the technology ecosystem.

The economic impact of HF in semiconductor manufacturing extends beyond direct production costs. While HF itself accounts for only 2-3% of semiconductor manufacturing material expenses, disruptions in its supply chain can trigger production delays costing manufacturers millions of dollars daily. The 2019 explosion at a Penfluorooctanoic acid plant in Japan demonstrated this vulnerability, causing temporary production halts at multiple semiconductor facilities and contributing to global chip shortages.

Supply chain considerations for HF are particularly complex due to its hazardous nature and specialized handling requirements. Transportation regulations, storage limitations, and safety protocols add significant overhead costs to its distribution network. The geographic concentration of high-purity HF production—primarily in China, Japan, and South Korea—creates strategic vulnerabilities for semiconductor manufacturers in other regions, particularly as geopolitical tensions increase.

Recent trade restrictions and export controls have further complicated the HF supply landscape. The semiconductor industry has responded by implementing several risk mitigation strategies, including vertical integration of chemical supply chains, development of on-site HF recycling technologies, and research into alternative etching compounds with less volatile supply dynamics.

The economic calculus of HF usage is also evolving due to environmental compliance costs. Stringent regulations regarding HF waste management and emissions control have increased operational expenses for semiconductor manufacturers, particularly in Europe and North America. These regulatory pressures have accelerated investment in closed-loop HF recycling systems, which despite high initial capital requirements, offer long-term economic and environmental benefits.

For semiconductor manufacturers, securing stable HF supply chains has become a board-level strategic priority. Companies are increasingly diversifying supplier relationships, building strategic reserves, and investing in long-term contracts with premium pricing to ensure supply security. This trend has created new market opportunities for chemical suppliers capable of meeting the semiconductor industry's exacting purity standards while providing supply chain resilience.

The economic impact of HF in semiconductor manufacturing extends beyond direct production costs. While HF itself accounts for only 2-3% of semiconductor manufacturing material expenses, disruptions in its supply chain can trigger production delays costing manufacturers millions of dollars daily. The 2019 explosion at a Penfluorooctanoic acid plant in Japan demonstrated this vulnerability, causing temporary production halts at multiple semiconductor facilities and contributing to global chip shortages.

Supply chain considerations for HF are particularly complex due to its hazardous nature and specialized handling requirements. Transportation regulations, storage limitations, and safety protocols add significant overhead costs to its distribution network. The geographic concentration of high-purity HF production—primarily in China, Japan, and South Korea—creates strategic vulnerabilities for semiconductor manufacturers in other regions, particularly as geopolitical tensions increase.

Recent trade restrictions and export controls have further complicated the HF supply landscape. The semiconductor industry has responded by implementing several risk mitigation strategies, including vertical integration of chemical supply chains, development of on-site HF recycling technologies, and research into alternative etching compounds with less volatile supply dynamics.

The economic calculus of HF usage is also evolving due to environmental compliance costs. Stringent regulations regarding HF waste management and emissions control have increased operational expenses for semiconductor manufacturers, particularly in Europe and North America. These regulatory pressures have accelerated investment in closed-loop HF recycling systems, which despite high initial capital requirements, offer long-term economic and environmental benefits.

For semiconductor manufacturers, securing stable HF supply chains has become a board-level strategic priority. Companies are increasingly diversifying supplier relationships, building strategic reserves, and investing in long-term contracts with premium pricing to ensure supply security. This trend has created new market opportunities for chemical suppliers capable of meeting the semiconductor industry's exacting purity standards while providing supply chain resilience.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!