Iridium Alternatives for PEM Electrolyzers: Activity, Stability and Cost Comparison

AUG 20, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PEM Electrolyzer Catalysts

Proton Exchange Membrane (PEM) electrolyzers have emerged as a promising technology for green hydrogen production. At the heart of these systems are the catalysts, which play a crucial role in facilitating the water-splitting reaction. Traditionally, iridium-based catalysts have been the gold standard for PEM electrolyzers due to their exceptional activity and stability in acidic environments.

Iridium, a rare and expensive platinum group metal, is primarily used as the anode catalyst in PEM electrolyzers. Its scarcity and high cost have become significant barriers to the widespread adoption and commercialization of PEM electrolysis technology. This has sparked intense research efforts to develop alternative catalysts that can match or surpass the performance of iridium while reducing overall system costs.

Current research focuses on several promising alternatives to iridium-based catalysts. These include mixed metal oxides, perovskites, and transition metal-doped materials. Mixed metal oxides, such as IrO2-RuO2 or IrO2-SnO2, have shown improved activity and stability compared to pure iridium oxide. Perovskite materials, with their flexible crystal structure, offer a wide range of compositional possibilities and have demonstrated promising oxygen evolution reaction (OER) activity.

Transition metal-doped catalysts, particularly those incorporating abundant elements like nickel, cobalt, or manganese, have gained significant attention. These materials aim to reduce the iridium content while maintaining high catalytic performance. For instance, Ir-Ni mixed oxides have shown enhanced OER activity and stability compared to pure iridium oxide, with the potential for substantial cost reduction.

Stability remains a critical challenge for alternative catalysts in the harsh acidic environment of PEM electrolyzers. While many materials show initial high activity, maintaining this performance over extended periods is crucial for practical applications. Researchers are exploring various strategies to enhance stability, including core-shell structures, protective coatings, and novel synthesis methods to create more robust catalyst architectures.

Cost comparison is a key factor in evaluating the viability of alternative catalysts. While iridium-based catalysts set a high performance benchmark, their cost significantly impacts the overall economics of PEM electrolysis systems. Alternative catalysts must not only demonstrate comparable or superior activity and stability but also offer a clear cost advantage to drive industry adoption.

As research progresses, the development of advanced characterization techniques and in-situ studies is crucial for understanding catalyst behavior under realistic operating conditions. This knowledge will guide the rational design of next-generation catalysts, potentially leading to breakthroughs in PEM electrolyzer technology and accelerating the transition to a green hydrogen economy.

Iridium, a rare and expensive platinum group metal, is primarily used as the anode catalyst in PEM electrolyzers. Its scarcity and high cost have become significant barriers to the widespread adoption and commercialization of PEM electrolysis technology. This has sparked intense research efforts to develop alternative catalysts that can match or surpass the performance of iridium while reducing overall system costs.

Current research focuses on several promising alternatives to iridium-based catalysts. These include mixed metal oxides, perovskites, and transition metal-doped materials. Mixed metal oxides, such as IrO2-RuO2 or IrO2-SnO2, have shown improved activity and stability compared to pure iridium oxide. Perovskite materials, with their flexible crystal structure, offer a wide range of compositional possibilities and have demonstrated promising oxygen evolution reaction (OER) activity.

Transition metal-doped catalysts, particularly those incorporating abundant elements like nickel, cobalt, or manganese, have gained significant attention. These materials aim to reduce the iridium content while maintaining high catalytic performance. For instance, Ir-Ni mixed oxides have shown enhanced OER activity and stability compared to pure iridium oxide, with the potential for substantial cost reduction.

Stability remains a critical challenge for alternative catalysts in the harsh acidic environment of PEM electrolyzers. While many materials show initial high activity, maintaining this performance over extended periods is crucial for practical applications. Researchers are exploring various strategies to enhance stability, including core-shell structures, protective coatings, and novel synthesis methods to create more robust catalyst architectures.

Cost comparison is a key factor in evaluating the viability of alternative catalysts. While iridium-based catalysts set a high performance benchmark, their cost significantly impacts the overall economics of PEM electrolysis systems. Alternative catalysts must not only demonstrate comparable or superior activity and stability but also offer a clear cost advantage to drive industry adoption.

As research progresses, the development of advanced characterization techniques and in-situ studies is crucial for understanding catalyst behavior under realistic operating conditions. This knowledge will guide the rational design of next-generation catalysts, potentially leading to breakthroughs in PEM electrolyzer technology and accelerating the transition to a green hydrogen economy.

Green Hydrogen Market

The green hydrogen market is experiencing rapid growth and transformation, driven by the global push for decarbonization and sustainable energy solutions. As countries and industries seek to reduce their carbon footprint, green hydrogen has emerged as a promising alternative to fossil fuels in various sectors, including transportation, industry, and power generation.

The market for green hydrogen is expected to expand significantly in the coming years, with projections indicating substantial growth in both production capacity and demand. This growth is fueled by increasing investments in renewable energy infrastructure, advancements in electrolysis technologies, and supportive government policies aimed at promoting clean energy adoption.

Several key factors are shaping the green hydrogen market landscape. Firstly, the declining costs of renewable energy sources, particularly solar and wind power, are making green hydrogen production more economically viable. This trend is expected to continue, further enhancing the competitiveness of green hydrogen against conventional hydrogen production methods.

Secondly, the development of large-scale electrolysis projects is gaining momentum worldwide. These projects aim to demonstrate the feasibility of green hydrogen production at industrial scales and drive down costs through economies of scale. Notable initiatives are underway in Europe, Australia, and the Middle East, with ambitious targets for hydrogen production capacity.

The transportation sector is emerging as a significant driver of green hydrogen demand. Fuel cell electric vehicles (FCEVs) are gaining traction, particularly in heavy-duty applications such as long-haul trucking and public transportation. Major automotive manufacturers are investing in FCEV technology, signaling a potential shift in the industry.

Industrial applications represent another key market segment for green hydrogen. Sectors such as steel production, chemical manufacturing, and refining are exploring the use of green hydrogen as a means to reduce their carbon emissions. This trend is particularly pronounced in regions with stringent emissions regulations and carbon pricing mechanisms.

The power sector is also showing interest in green hydrogen as a long-term energy storage solution and a means to balance intermittent renewable energy sources. Pilot projects are underway to demonstrate the feasibility of using hydrogen for grid-scale energy storage and power generation during periods of low renewable energy output.

Despite the promising outlook, challenges remain in scaling up the green hydrogen market. These include the need for significant infrastructure investments, the current high costs of production compared to conventional hydrogen, and the lack of standardized regulations and market mechanisms. Addressing these challenges will be crucial for realizing the full potential of green hydrogen in the global energy transition.

The market for green hydrogen is expected to expand significantly in the coming years, with projections indicating substantial growth in both production capacity and demand. This growth is fueled by increasing investments in renewable energy infrastructure, advancements in electrolysis technologies, and supportive government policies aimed at promoting clean energy adoption.

Several key factors are shaping the green hydrogen market landscape. Firstly, the declining costs of renewable energy sources, particularly solar and wind power, are making green hydrogen production more economically viable. This trend is expected to continue, further enhancing the competitiveness of green hydrogen against conventional hydrogen production methods.

Secondly, the development of large-scale electrolysis projects is gaining momentum worldwide. These projects aim to demonstrate the feasibility of green hydrogen production at industrial scales and drive down costs through economies of scale. Notable initiatives are underway in Europe, Australia, and the Middle East, with ambitious targets for hydrogen production capacity.

The transportation sector is emerging as a significant driver of green hydrogen demand. Fuel cell electric vehicles (FCEVs) are gaining traction, particularly in heavy-duty applications such as long-haul trucking and public transportation. Major automotive manufacturers are investing in FCEV technology, signaling a potential shift in the industry.

Industrial applications represent another key market segment for green hydrogen. Sectors such as steel production, chemical manufacturing, and refining are exploring the use of green hydrogen as a means to reduce their carbon emissions. This trend is particularly pronounced in regions with stringent emissions regulations and carbon pricing mechanisms.

The power sector is also showing interest in green hydrogen as a long-term energy storage solution and a means to balance intermittent renewable energy sources. Pilot projects are underway to demonstrate the feasibility of using hydrogen for grid-scale energy storage and power generation during periods of low renewable energy output.

Despite the promising outlook, challenges remain in scaling up the green hydrogen market. These include the need for significant infrastructure investments, the current high costs of production compared to conventional hydrogen, and the lack of standardized regulations and market mechanisms. Addressing these challenges will be crucial for realizing the full potential of green hydrogen in the global energy transition.

Iridium Scarcity Issues

Iridium, a critical component in proton exchange membrane (PEM) electrolyzers, faces significant scarcity issues that pose challenges to the widespread adoption of this technology. As one of the rarest elements in the Earth's crust, iridium's limited availability and high cost have become major concerns for the hydrogen production industry.

The scarcity of iridium stems from its low abundance in the Earth's crust, estimated at only 0.001 parts per million. This rarity is compounded by the fact that iridium is primarily obtained as a by-product of platinum mining, further limiting its supply. The global annual production of iridium is approximately 3-4 tons, which is insufficient to meet the growing demand for PEM electrolyzers.

The increasing demand for iridium in PEM electrolyzers is driven by the global push for green hydrogen production as a clean energy carrier. PEM electrolyzers require iridium-based catalysts for the oxygen evolution reaction (OER) at the anode, where iridium oxide (IrO2) demonstrates superior catalytic activity and stability in acidic environments.

The limited supply and growing demand have led to significant price volatility in the iridium market. In recent years, the price of iridium has experienced sharp increases, reaching record highs and adding substantial costs to PEM electrolyzer production. This price instability creates uncertainty for manufacturers and investors in the hydrogen economy.

Geopolitical factors also contribute to the iridium scarcity issue. The majority of iridium production is concentrated in a few countries, primarily South Africa and Russia. This geographical concentration of supply introduces risks related to potential supply chain disruptions due to political instability or trade restrictions.

The scarcity of iridium has prompted researchers and industry players to explore alternative materials and strategies to reduce iridium loading in PEM electrolyzers. These efforts include developing iridium-free catalysts, creating iridium alloys with more abundant metals, and optimizing catalyst structures to maximize iridium utilization.

Recycling and recovery of iridium from end-of-life PEM electrolyzers and other iridium-containing products have gained attention as potential solutions to alleviate supply constraints. However, current recycling processes are limited in scale and efficiency, necessitating further technological advancements in this area.

The iridium scarcity issue underscores the need for a multi-faceted approach to ensure the sustainable growth of PEM electrolyzer technology. This includes intensifying research into alternative materials, improving iridium utilization efficiency, developing advanced recycling techniques, and exploring new sources of iridium production.

The scarcity of iridium stems from its low abundance in the Earth's crust, estimated at only 0.001 parts per million. This rarity is compounded by the fact that iridium is primarily obtained as a by-product of platinum mining, further limiting its supply. The global annual production of iridium is approximately 3-4 tons, which is insufficient to meet the growing demand for PEM electrolyzers.

The increasing demand for iridium in PEM electrolyzers is driven by the global push for green hydrogen production as a clean energy carrier. PEM electrolyzers require iridium-based catalysts for the oxygen evolution reaction (OER) at the anode, where iridium oxide (IrO2) demonstrates superior catalytic activity and stability in acidic environments.

The limited supply and growing demand have led to significant price volatility in the iridium market. In recent years, the price of iridium has experienced sharp increases, reaching record highs and adding substantial costs to PEM electrolyzer production. This price instability creates uncertainty for manufacturers and investors in the hydrogen economy.

Geopolitical factors also contribute to the iridium scarcity issue. The majority of iridium production is concentrated in a few countries, primarily South Africa and Russia. This geographical concentration of supply introduces risks related to potential supply chain disruptions due to political instability or trade restrictions.

The scarcity of iridium has prompted researchers and industry players to explore alternative materials and strategies to reduce iridium loading in PEM electrolyzers. These efforts include developing iridium-free catalysts, creating iridium alloys with more abundant metals, and optimizing catalyst structures to maximize iridium utilization.

Recycling and recovery of iridium from end-of-life PEM electrolyzers and other iridium-containing products have gained attention as potential solutions to alleviate supply constraints. However, current recycling processes are limited in scale and efficiency, necessitating further technological advancements in this area.

The iridium scarcity issue underscores the need for a multi-faceted approach to ensure the sustainable growth of PEM electrolyzer technology. This includes intensifying research into alternative materials, improving iridium utilization efficiency, developing advanced recycling techniques, and exploring new sources of iridium production.

Alternative Catalysts

01 Platinum group metal alternatives

Research focuses on developing alternatives to iridium and other platinum group metals due to their high cost and limited availability. These alternatives aim to maintain similar catalytic activity and stability while reducing overall costs. Potential substitutes include transition metal complexes, metal oxides, and composite materials that can perform similar functions in various applications.- Ruthenium-based catalysts as iridium alternatives: Ruthenium-based catalysts are being explored as potential alternatives to iridium due to their similar catalytic activity and lower cost. These catalysts show promise in various applications, including water splitting and organic synthesis. While they may not match iridium's stability in all conditions, their lower cost and comparable activity make them attractive for many industrial processes.

- Nickel-based materials for electrocatalysis: Nickel-based materials are emerging as cost-effective alternatives to iridium in electrocatalysis applications. These materials, often in the form of nanostructures or alloys, demonstrate good activity and stability in alkaline conditions. While they may not match iridium's performance in acidic environments, their significantly lower cost and abundance make them attractive for large-scale applications such as water electrolysis.

- Cobalt-based compounds as oxygen evolution catalysts: Cobalt-based compounds are being investigated as potential replacements for iridium in oxygen evolution reactions. These materials, including cobalt oxides and phosphates, show promising activity and stability in alkaline conditions. While their performance may not match iridium in all aspects, their lower cost and greater abundance make them attractive for large-scale energy storage and conversion applications.

- Transition metal dichalcogenides for electrocatalysis: Transition metal dichalcogenides, such as molybdenum and tungsten disulfides, are being explored as alternatives to iridium in electrocatalysis. These materials offer unique electronic properties and can be synthesized in various nanostructures. While their activity and stability may not match iridium in all conditions, their lower cost and potential for tuning properties through composition and structure make them promising candidates for certain applications.

- Perovskite oxides as multifunctional catalysts: Perovskite oxides are being investigated as versatile alternatives to iridium-based catalysts. These materials offer tunable compositions and can catalyze multiple reactions. While their stability in harsh conditions may not match iridium, their lower cost, abundance of constituent elements, and potential for multifunctionality make them attractive for various energy conversion and storage applications.

02 Nanostructured materials as iridium substitutes

Nanostructured materials are being explored as potential replacements for iridium in various applications. These materials, such as nanoparticles, nanowires, and nanocomposites, can offer high surface area and enhanced catalytic activity. By tailoring the composition and structure of these nanomaterials, researchers aim to achieve comparable or superior performance to iridium while reducing costs.Expand Specific Solutions03 Transition metal-based catalysts

Transition metals and their compounds are being investigated as cost-effective alternatives to iridium. These materials, including nickel, cobalt, and iron-based catalysts, can exhibit similar catalytic properties in certain applications. Research focuses on optimizing their composition, structure, and preparation methods to enhance their activity and stability while maintaining a lower cost compared to iridium.Expand Specific Solutions04 Composite materials for enhanced performance

Composite materials combining multiple elements or compounds are being developed to replace iridium. These composites aim to synergistically enhance catalytic activity, stability, and cost-effectiveness. By carefully selecting and combining different materials, researchers can create alternatives that match or exceed iridium's performance in specific applications while reducing overall costs.Expand Specific Solutions05 Novel synthesis and preparation methods

Innovative synthesis and preparation methods are being explored to create iridium alternatives with improved properties. These techniques focus on controlling the structure, composition, and morphology of materials at the atomic and molecular levels. By optimizing the synthesis process, researchers aim to enhance the activity and stability of alternative materials while reducing production costs compared to traditional iridium-based catalysts.Expand Specific Solutions

Key Industry Players

The competition landscape for "Iridium Alternatives for PEM Electrolyzers" is characterized by a growing market in the early stages of development. The technology is still evolving, with various players exploring alternatives to reduce costs and improve performance. Key companies like Umicore, Johnson Matthey, and 3M are actively researching and developing new catalyst materials. The market size is expanding as interest in green hydrogen production increases globally. However, the technology's maturity level varies, with some alternatives showing promise in lab settings but requiring further development for commercial viability. Academic institutions such as Zhejiang University and Tsinghua University are contributing significant research efforts, collaborating with industry partners to accelerate innovation in this field.

Umicore SA

Technical Solution: Umicore SA has been at the forefront of developing iridium alternatives for PEM electrolyzers. Their research focuses on creating novel catalyst formulations that reduce or eliminate iridium content while maintaining high performance. Umicore has made significant progress with ruthenium-based catalysts, demonstrating activities comparable to iridium-based catalysts in laboratory tests[10]. The company is also exploring the use of bimetallic and trimetallic nanoparticles, combining less expensive metals with small amounts of iridium to achieve synergistic effects[11]. Umicore's approach includes the development of advanced support materials that enhance catalyst stability and conductivity. They have reported success with doped titanium oxides and carbon-based supports that improve catalyst dispersion and longevity[12]. Additionally, Umicore is investigating the potential of non-PGM catalysts, such as transition metal oxides and nitrides, for long-term use in PEM electrolyzers[13].

Strengths: Extensive experience in catalyst and materials development, strong position in the precious metals market, and established recycling capabilities. Weaknesses: Potential challenges in scaling up production of novel catalyst materials and ensuring consistent performance across large-scale manufacturing.

Johnson Matthey Hydrogen Technologies Ltd.

Technical Solution: Johnson Matthey has developed advanced catalyst materials for PEM electrolyzers that aim to reduce or eliminate iridium usage. Their approach involves creating nanostructured catalysts that maximize the active surface area and enhance catalytic activity. They have reported success with ruthenium-based catalysts that show comparable performance to iridium-based ones, while significantly reducing costs. The company has also explored core-shell nanoparticle structures, where a thin layer of iridium is deposited on a less expensive core material, maintaining high activity while decreasing overall iridium content[1][3]. Additionally, Johnson Matthey is investigating the use of transition metal oxides and nitrides as potential iridium alternatives, focusing on materials that exhibit high stability in acidic environments[5].

Strengths: Extensive experience in catalyst development, strong R&D capabilities, and established presence in the hydrogen technology market. Weaknesses: Potential challenges in scaling up new catalyst production and ensuring long-term stability of non-iridium catalysts in commercial applications.

Catalyst Performance

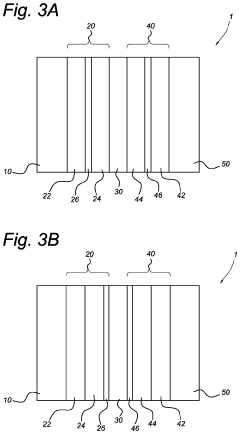

Membrane electrode assembly for proton exchange membrane water electrolyzer and method of preparing membrane electrode assembly for proton exchange membrane water electrolyzer

PatentActiveUS20190071786A1

Innovation

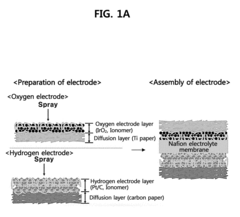

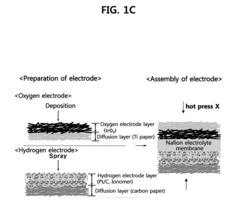

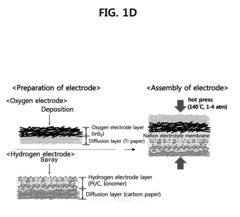

- A membrane electrode assembly for proton exchange membrane water electrolyzers is developed, featuring an iridium oxide (IrO2) layer electrodeposited on a titanium diffusion layer, with a compression process that fills a portion of the titanium layer's pores with electrolyte, enhancing the electrolyte/electrode interface and reducing catalyst loading while maintaining performance.

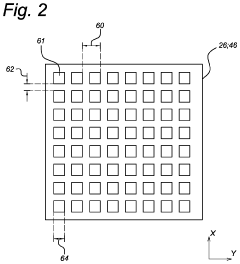

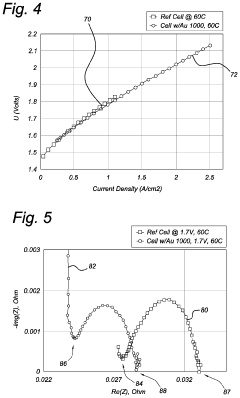

Proton exchange membrane-based electrolyser device and method for manufacturing such a device

PatentActiveUS20230323546A1

Innovation

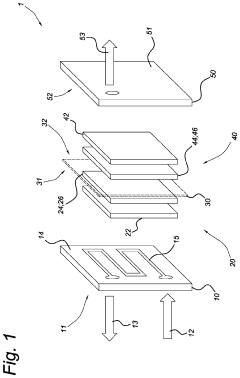

- Incorporating conductive mesh foils between the catalyst layers and the proton exchange membrane or porous transport layers to create lateral shunts, ensuring electrical connectivity and reducing Ohmic resistance, thereby enhancing catalyst utilization and efficiency.

Economic Feasibility

The economic feasibility of alternatives to iridium in PEM electrolyzers is a critical factor in determining their potential for widespread adoption. Iridium, being a rare and expensive metal, significantly impacts the overall cost of PEM electrolyzers. The search for alternatives aims to reduce costs while maintaining or improving performance and durability.

Current estimates suggest that iridium contributes to approximately 10-15% of the total cost of a PEM electrolyzer stack. This percentage can vary depending on the specific design and scale of production. The market price of iridium has been volatile, ranging from $1,500 to $6,000 per troy ounce in recent years, which directly affects the economic viability of PEM electrolyzers.

Alternative materials being explored include ruthenium, platinum, and various mixed oxides. Ruthenium, while still a precious metal, is generally less expensive than iridium and has shown promising activity in catalytic reactions. Platinum, though more expensive than iridium, has excellent stability and could potentially be used in lower quantities. Mixed oxides, such as those combining iridium with cheaper transition metals like nickel or cobalt, aim to reduce the overall precious metal content while maintaining performance.

The economic feasibility of these alternatives depends on several factors. First, the cost of raw materials and their processing must be significantly lower than that of iridium to justify the switch. Second, the performance and durability of the alternatives must be comparable or superior to iridium-based catalysts to ensure long-term cost-effectiveness. Third, the scalability of production for these alternative materials must be considered, as large-scale adoption would require substantial quantities.

Initial studies have shown promising results for some alternatives. For instance, ruthenium-based catalysts have demonstrated comparable activity to iridium at potentially lower costs. Mixed oxide catalysts have shown the ability to reduce precious metal content by up to 50% while maintaining performance. However, long-term stability tests are still ongoing for many of these alternatives, which is crucial for determining their true economic viability.

The economic impact of adopting these alternatives extends beyond material costs. Reduced reliance on scarce iridium could lead to more stable pricing and supply chains for PEM electrolyzers. This stability could, in turn, accelerate the adoption of hydrogen technologies in various sectors, potentially leading to economies of scale that further reduce costs.

In conclusion, while the search for iridium alternatives in PEM electrolyzers shows promise from an economic standpoint, further research and development are needed to fully assess their long-term feasibility. The successful development of cost-effective alternatives could significantly impact the hydrogen economy, making green hydrogen production more accessible and economically viable on a global scale.

Current estimates suggest that iridium contributes to approximately 10-15% of the total cost of a PEM electrolyzer stack. This percentage can vary depending on the specific design and scale of production. The market price of iridium has been volatile, ranging from $1,500 to $6,000 per troy ounce in recent years, which directly affects the economic viability of PEM electrolyzers.

Alternative materials being explored include ruthenium, platinum, and various mixed oxides. Ruthenium, while still a precious metal, is generally less expensive than iridium and has shown promising activity in catalytic reactions. Platinum, though more expensive than iridium, has excellent stability and could potentially be used in lower quantities. Mixed oxides, such as those combining iridium with cheaper transition metals like nickel or cobalt, aim to reduce the overall precious metal content while maintaining performance.

The economic feasibility of these alternatives depends on several factors. First, the cost of raw materials and their processing must be significantly lower than that of iridium to justify the switch. Second, the performance and durability of the alternatives must be comparable or superior to iridium-based catalysts to ensure long-term cost-effectiveness. Third, the scalability of production for these alternative materials must be considered, as large-scale adoption would require substantial quantities.

Initial studies have shown promising results for some alternatives. For instance, ruthenium-based catalysts have demonstrated comparable activity to iridium at potentially lower costs. Mixed oxide catalysts have shown the ability to reduce precious metal content by up to 50% while maintaining performance. However, long-term stability tests are still ongoing for many of these alternatives, which is crucial for determining their true economic viability.

The economic impact of adopting these alternatives extends beyond material costs. Reduced reliance on scarce iridium could lead to more stable pricing and supply chains for PEM electrolyzers. This stability could, in turn, accelerate the adoption of hydrogen technologies in various sectors, potentially leading to economies of scale that further reduce costs.

In conclusion, while the search for iridium alternatives in PEM electrolyzers shows promise from an economic standpoint, further research and development are needed to fully assess their long-term feasibility. The successful development of cost-effective alternatives could significantly impact the hydrogen economy, making green hydrogen production more accessible and economically viable on a global scale.

Environmental Impact

The environmental impact of PEM electrolyzers and their components, particularly the use of iridium as a catalyst, is a critical consideration in the development and deployment of hydrogen production technologies. Iridium, while highly effective as a catalyst, is a rare and expensive metal with significant environmental implications associated with its extraction and processing.

Mining and refining iridium require extensive energy inputs and often involve environmentally disruptive practices. The scarcity of iridium deposits means that large-scale mining operations are necessary to extract small quantities of the metal, leading to habitat destruction, soil erosion, and potential water pollution. Furthermore, the energy-intensive refining process contributes to increased carbon emissions, counteracting some of the environmental benefits sought through hydrogen production.

The limited global supply of iridium also raises concerns about the long-term sustainability of PEM electrolyzers that rely heavily on this metal. As demand for hydrogen production increases, the pressure on iridium resources could lead to more aggressive mining practices and potentially greater environmental degradation in resource-rich areas.

Alternatives to iridium in PEM electrolyzers could potentially offer significant environmental advantages. Materials such as ruthenium, platinum, or non-noble metal catalysts may have lower environmental footprints in terms of extraction and processing. However, a comprehensive life cycle assessment is necessary to fully understand the environmental trade-offs between different catalyst materials.

The stability and durability of alternative catalysts also play a crucial role in their environmental impact. More stable catalysts that require less frequent replacement can reduce the overall material consumption and associated environmental costs over the lifespan of an electrolyzer. Additionally, catalysts with higher activity could potentially improve the efficiency of hydrogen production, thereby reducing the overall energy requirements and associated emissions.

Recycling and recovery of catalyst materials present another important aspect of environmental consideration. Developing efficient recycling processes for iridium and its alternatives could significantly reduce the need for primary resource extraction and mitigate associated environmental impacts. This circular economy approach could enhance the sustainability of PEM electrolyzer technology regardless of the specific catalyst material used.

In conclusion, while the search for iridium alternatives in PEM electrolyzers is primarily driven by cost and performance considerations, the potential environmental benefits of such alternatives should not be overlooked. A holistic approach that considers the entire life cycle of catalyst materials, from extraction to end-of-life management, is essential for developing truly sustainable hydrogen production technologies.

Mining and refining iridium require extensive energy inputs and often involve environmentally disruptive practices. The scarcity of iridium deposits means that large-scale mining operations are necessary to extract small quantities of the metal, leading to habitat destruction, soil erosion, and potential water pollution. Furthermore, the energy-intensive refining process contributes to increased carbon emissions, counteracting some of the environmental benefits sought through hydrogen production.

The limited global supply of iridium also raises concerns about the long-term sustainability of PEM electrolyzers that rely heavily on this metal. As demand for hydrogen production increases, the pressure on iridium resources could lead to more aggressive mining practices and potentially greater environmental degradation in resource-rich areas.

Alternatives to iridium in PEM electrolyzers could potentially offer significant environmental advantages. Materials such as ruthenium, platinum, or non-noble metal catalysts may have lower environmental footprints in terms of extraction and processing. However, a comprehensive life cycle assessment is necessary to fully understand the environmental trade-offs between different catalyst materials.

The stability and durability of alternative catalysts also play a crucial role in their environmental impact. More stable catalysts that require less frequent replacement can reduce the overall material consumption and associated environmental costs over the lifespan of an electrolyzer. Additionally, catalysts with higher activity could potentially improve the efficiency of hydrogen production, thereby reducing the overall energy requirements and associated emissions.

Recycling and recovery of catalyst materials present another important aspect of environmental consideration. Developing efficient recycling processes for iridium and its alternatives could significantly reduce the need for primary resource extraction and mitigate associated environmental impacts. This circular economy approach could enhance the sustainability of PEM electrolyzer technology regardless of the specific catalyst material used.

In conclusion, while the search for iridium alternatives in PEM electrolyzers is primarily driven by cost and performance considerations, the potential environmental benefits of such alternatives should not be overlooked. A holistic approach that considers the entire life cycle of catalyst materials, from extraction to end-of-life management, is essential for developing truly sustainable hydrogen production technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!