Laser Welding vs Ultrasonic: Comparing Efficiency Rates

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Laser and Ultrasonic Welding Technology Evolution

The evolution of welding technologies has witnessed significant advancements over the past century, with laser and ultrasonic welding emerging as two revolutionary methods that have transformed manufacturing processes across industries. Laser welding, first conceptualized in the 1960s following the invention of the laser in 1960, began practical industrial implementation in the 1970s. The technology evolved from simple CO2 lasers to more sophisticated Nd:YAG, fiber, and diode lasers, each offering improved efficiency and application versatility.

Ultrasonic welding, meanwhile, traces its origins to the 1950s when it was primarily used for plastics joining. The technology underwent substantial refinement in the 1970s and 1980s, expanding its application to metal joining and becoming increasingly prevalent in electronics manufacturing during the 1990s with the miniaturization trend.

The efficiency comparison between these technologies has evolved dramatically over time. Early laser welding systems operated at 5-10% energy efficiency, while first-generation ultrasonic welding machines achieved 70-80% efficiency but with significant material limitations. By the 1990s, laser welding efficiency improved to 15-20% with the introduction of solid-state lasers, while ultrasonic welding maintained its high efficiency but gained precision and material versatility.

The 2000s marked a turning point with fiber laser technology pushing laser welding efficiency to 30-40% while reducing maintenance requirements. Simultaneously, ultrasonic welding systems became more sophisticated with digital controls and frequency modulation capabilities, maintaining 80-85% energy efficiency while expanding application scope.

Current-generation laser welding systems (2015-present) operate at 40-50% efficiency with precise beam control and multi-material capabilities. Modern ultrasonic welding systems maintain 85-90% energy efficiency with advanced monitoring systems that optimize energy delivery based on material properties.

The technological trajectory indicates convergence in certain application areas, with hybrid systems emerging that leverage the strengths of both technologies. Laser welding continues to advance in precision and speed for complex geometries, while ultrasonic welding maintains advantages in energy efficiency and certain material combinations.

Industry adoption patterns reveal sector-specific preferences, with automotive and aerospace industries increasingly favoring laser welding for structural components, while electronics manufacturing continues to rely heavily on ultrasonic welding for delicate connections. The medical device industry utilizes both technologies based on specific application requirements, with laser welding preferred for precision work and ultrasonic welding for hermetic sealing applications.

Ultrasonic welding, meanwhile, traces its origins to the 1950s when it was primarily used for plastics joining. The technology underwent substantial refinement in the 1970s and 1980s, expanding its application to metal joining and becoming increasingly prevalent in electronics manufacturing during the 1990s with the miniaturization trend.

The efficiency comparison between these technologies has evolved dramatically over time. Early laser welding systems operated at 5-10% energy efficiency, while first-generation ultrasonic welding machines achieved 70-80% efficiency but with significant material limitations. By the 1990s, laser welding efficiency improved to 15-20% with the introduction of solid-state lasers, while ultrasonic welding maintained its high efficiency but gained precision and material versatility.

The 2000s marked a turning point with fiber laser technology pushing laser welding efficiency to 30-40% while reducing maintenance requirements. Simultaneously, ultrasonic welding systems became more sophisticated with digital controls and frequency modulation capabilities, maintaining 80-85% energy efficiency while expanding application scope.

Current-generation laser welding systems (2015-present) operate at 40-50% efficiency with precise beam control and multi-material capabilities. Modern ultrasonic welding systems maintain 85-90% energy efficiency with advanced monitoring systems that optimize energy delivery based on material properties.

The technological trajectory indicates convergence in certain application areas, with hybrid systems emerging that leverage the strengths of both technologies. Laser welding continues to advance in precision and speed for complex geometries, while ultrasonic welding maintains advantages in energy efficiency and certain material combinations.

Industry adoption patterns reveal sector-specific preferences, with automotive and aerospace industries increasingly favoring laser welding for structural components, while electronics manufacturing continues to rely heavily on ultrasonic welding for delicate connections. The medical device industry utilizes both technologies based on specific application requirements, with laser welding preferred for precision work and ultrasonic welding for hermetic sealing applications.

Market Demand Analysis for Advanced Welding Solutions

The global welding industry is experiencing a significant shift towards advanced welding technologies, with laser welding and ultrasonic welding emerging as frontrunners in high-precision manufacturing sectors. Market research indicates that the advanced welding solutions market is projected to reach $31.5 billion by 2026, growing at a CAGR of 6.2% from 2021. This growth is primarily driven by increasing demand for efficient, precise, and environmentally friendly joining technologies across automotive, electronics, medical devices, and aerospace industries.

In the automotive sector, the transition towards lightweight materials and electric vehicles has created substantial demand for welding technologies that can effectively join dissimilar materials without compromising structural integrity. Laser welding has seen a 28% increase in adoption among automotive manufacturers over the past three years, particularly for battery pack assembly and lightweight body structures.

The electronics industry represents another significant market for advanced welding solutions, with miniaturization trends driving demand for micro-welding capabilities. Ultrasonic welding has gained particular traction in this sector, with market penetration increasing by 34% since 2019, primarily due to its ability to join thin materials without thermal damage.

Medical device manufacturing has emerged as a high-growth segment for precision welding technologies, with stringent quality requirements and increasing production volumes. The sector has reported a 41% increase in laser welding implementation for implantable devices and surgical instruments, where hermetic seals and biocompatibility are critical factors.

Regional analysis reveals that Asia-Pacific currently dominates the advanced welding solutions market with a 42% share, followed by North America (27%) and Europe (23%). China and South Korea are experiencing the fastest growth rates at 9.1% and 8.7% respectively, driven by rapid industrialization and government initiatives promoting advanced manufacturing technologies.

End-user surveys indicate that efficiency improvements remain the primary purchasing factor for 68% of manufacturing companies considering advanced welding technologies. Energy consumption reduction (54%), material waste minimization (49%), and production speed enhancement (47%) are other significant factors influencing technology selection between laser and ultrasonic welding solutions.

The market is also witnessing increased demand for automated and robotic welding systems, with 73% of large manufacturers planning to integrate advanced welding technologies into their Industry 4.0 frameworks within the next five years. This trend is expected to further accelerate the adoption of both laser and ultrasonic welding technologies that offer superior compatibility with automation systems.

In the automotive sector, the transition towards lightweight materials and electric vehicles has created substantial demand for welding technologies that can effectively join dissimilar materials without compromising structural integrity. Laser welding has seen a 28% increase in adoption among automotive manufacturers over the past three years, particularly for battery pack assembly and lightweight body structures.

The electronics industry represents another significant market for advanced welding solutions, with miniaturization trends driving demand for micro-welding capabilities. Ultrasonic welding has gained particular traction in this sector, with market penetration increasing by 34% since 2019, primarily due to its ability to join thin materials without thermal damage.

Medical device manufacturing has emerged as a high-growth segment for precision welding technologies, with stringent quality requirements and increasing production volumes. The sector has reported a 41% increase in laser welding implementation for implantable devices and surgical instruments, where hermetic seals and biocompatibility are critical factors.

Regional analysis reveals that Asia-Pacific currently dominates the advanced welding solutions market with a 42% share, followed by North America (27%) and Europe (23%). China and South Korea are experiencing the fastest growth rates at 9.1% and 8.7% respectively, driven by rapid industrialization and government initiatives promoting advanced manufacturing technologies.

End-user surveys indicate that efficiency improvements remain the primary purchasing factor for 68% of manufacturing companies considering advanced welding technologies. Energy consumption reduction (54%), material waste minimization (49%), and production speed enhancement (47%) are other significant factors influencing technology selection between laser and ultrasonic welding solutions.

The market is also witnessing increased demand for automated and robotic welding systems, with 73% of large manufacturers planning to integrate advanced welding technologies into their Industry 4.0 frameworks within the next five years. This trend is expected to further accelerate the adoption of both laser and ultrasonic welding technologies that offer superior compatibility with automation systems.

Current Technical Challenges in Industrial Welding

Industrial welding technologies face several significant challenges in today's manufacturing landscape. The efficiency comparison between laser welding and ultrasonic welding reveals distinct technical hurdles that impact production outcomes. Laser welding, while offering high precision and speed, struggles with reflective materials such as aluminum and copper, which can cause beam scattering and reduced energy absorption. This limitation necessitates specialized equipment modifications and parameter adjustments, increasing operational complexity.

Energy consumption presents another critical challenge, particularly for laser welding systems which typically require substantial power inputs ranging from 1-20 kW. Although ultrasonic welding demonstrates better energy efficiency with consumption often below 5 kW, it faces limitations in penetration depth, typically restricted to materials less than 3mm thick, constraining its application scope.

Material compatibility issues persist across both technologies. Laser welding exhibits difficulties with dissimilar material joints due to varying melting points and thermal expansion coefficients, potentially leading to brittle intermetallic compounds. Ultrasonic welding, while effective for thermoplastics and non-ferrous metals, performs poorly with high-temperature alloys and ceramics, limiting its versatility in advanced manufacturing contexts.

Quality control and monitoring represent significant technical barriers. Laser welding processes generate minimal visible indicators of weld quality, necessitating advanced monitoring systems such as spectroscopic analysis or thermal imaging. Similarly, ultrasonic welding requires precise amplitude and frequency control, with minor variations potentially causing inconsistent bond strength or material damage.

Automation integration challenges differ between technologies. Laser systems demand sophisticated robotic control for beam positioning with tolerances often below 0.1mm, while ultrasonic welding requires precise pressure application and consistent material contact. These requirements complicate production line implementation and increase system complexity.

Cost considerations remain prohibitive for widespread adoption. High-power laser welding systems typically range from $200,000 to $1,000,000, with additional expenses for safety enclosures and cooling systems. While ultrasonic equipment generally costs less ($50,000-$150,000), the tooling requires frequent replacement due to wear, increasing long-term operational expenses.

Environmental and worker safety concerns also present challenges. Laser welding produces harmful radiation and potential fume emissions requiring extensive safety protocols, while ultrasonic welding generates high-frequency noise (often exceeding 100 dB) that necessitates hearing protection and sound isolation measures. These safety requirements add complexity and cost to implementation strategies.

Energy consumption presents another critical challenge, particularly for laser welding systems which typically require substantial power inputs ranging from 1-20 kW. Although ultrasonic welding demonstrates better energy efficiency with consumption often below 5 kW, it faces limitations in penetration depth, typically restricted to materials less than 3mm thick, constraining its application scope.

Material compatibility issues persist across both technologies. Laser welding exhibits difficulties with dissimilar material joints due to varying melting points and thermal expansion coefficients, potentially leading to brittle intermetallic compounds. Ultrasonic welding, while effective for thermoplastics and non-ferrous metals, performs poorly with high-temperature alloys and ceramics, limiting its versatility in advanced manufacturing contexts.

Quality control and monitoring represent significant technical barriers. Laser welding processes generate minimal visible indicators of weld quality, necessitating advanced monitoring systems such as spectroscopic analysis or thermal imaging. Similarly, ultrasonic welding requires precise amplitude and frequency control, with minor variations potentially causing inconsistent bond strength or material damage.

Automation integration challenges differ between technologies. Laser systems demand sophisticated robotic control for beam positioning with tolerances often below 0.1mm, while ultrasonic welding requires precise pressure application and consistent material contact. These requirements complicate production line implementation and increase system complexity.

Cost considerations remain prohibitive for widespread adoption. High-power laser welding systems typically range from $200,000 to $1,000,000, with additional expenses for safety enclosures and cooling systems. While ultrasonic equipment generally costs less ($50,000-$150,000), the tooling requires frequent replacement due to wear, increasing long-term operational expenses.

Environmental and worker safety concerns also present challenges. Laser welding produces harmful radiation and potential fume emissions requiring extensive safety protocols, while ultrasonic welding generates high-frequency noise (often exceeding 100 dB) that necessitates hearing protection and sound isolation measures. These safety requirements add complexity and cost to implementation strategies.

Comparative Analysis of Laser vs Ultrasonic Welding Methods

01 Comparative efficiency rates of laser and ultrasonic welding

Laser welding and ultrasonic welding have different efficiency rates depending on the application. Laser welding typically offers higher precision and can be more efficient for certain materials, especially metals, due to its concentrated heat source. Ultrasonic welding, on the other hand, is often more energy-efficient for thermoplastics and thin materials as it uses mechanical vibration rather than heat. The efficiency comparison depends on factors such as material type, thickness, joint design, and production volume requirements.- Comparative efficiency rates of laser and ultrasonic welding: Laser welding and ultrasonic welding have different efficiency rates depending on the application. Laser welding typically offers higher precision and can be more energy-efficient for certain materials, especially metals. Ultrasonic welding, on the other hand, is often more efficient for thermoplastics and thin materials, requiring less energy input and providing faster cycle times. The efficiency comparison depends on factors such as material type, thickness, and required joint strength.

- Energy consumption optimization in welding processes: Optimizing energy consumption in both laser and ultrasonic welding processes is crucial for improving efficiency rates. This involves adjusting parameters such as power settings, welding time, and frequency (for ultrasonic welding) or beam focus and pulse characteristics (for laser welding). Advanced control systems can monitor and adjust these parameters in real-time to maintain optimal energy usage while ensuring weld quality. Energy recovery systems can also be implemented to capture and reuse excess energy, further improving overall efficiency.

- Material-specific welding efficiency considerations: Different materials respond differently to laser and ultrasonic welding techniques, significantly affecting efficiency rates. For metals and alloys, laser welding often provides higher efficiency due to precise heat application and minimal heat-affected zones. For polymers and composites, ultrasonic welding typically offers better efficiency through localized heating at the interface. Material thickness, thermal conductivity, and surface characteristics all influence which welding method will achieve optimal efficiency for a specific application.

- Hybrid and combined welding systems: Hybrid systems that combine laser and ultrasonic welding technologies can achieve higher efficiency rates than either method alone for certain applications. These systems leverage the strengths of each welding technique while mitigating their individual limitations. For example, pre-heating materials with laser before ultrasonic welding can reduce the energy required for the ultrasonic process. Similarly, using ultrasonic vibration to enhance laser welding can improve energy transfer efficiency and reduce overall process time.

- Automation and process control for efficiency improvement: Advanced automation and process control systems significantly improve the efficiency rates of both laser and ultrasonic welding. Real-time monitoring using sensors and cameras allows for immediate adjustments to welding parameters, ensuring optimal energy usage and reducing defects. Machine learning algorithms can analyze process data to identify patterns and optimize welding parameters automatically. Robotic systems enable precise positioning and movement, further enhancing welding efficiency by ensuring consistent application and reducing human error.

02 Energy consumption optimization in welding processes

Optimizing energy consumption in both laser and ultrasonic welding processes is crucial for improving efficiency rates. For laser welding, this involves adjusting parameters such as power output, pulse duration, and beam focus to minimize energy waste while maintaining weld quality. For ultrasonic welding, optimization focuses on amplitude settings, weld time, and pressure application. Advanced control systems can monitor and adjust these parameters in real-time to achieve optimal energy usage while ensuring consistent weld quality.Expand Specific Solutions03 Material-specific welding efficiency considerations

The efficiency of laser and ultrasonic welding varies significantly depending on the materials being joined. Laser welding shows higher efficiency rates for metals and certain polymers with good absorption properties, while ultrasonic welding excels with thermoplastics and thin-sheet materials. Material thickness, thermal conductivity, and surface characteristics all impact the efficiency of both processes. Hybrid materials or multi-material assemblies may require specialized approaches to optimize welding efficiency across different material interfaces.Expand Specific Solutions04 Production speed and throughput comparison

When comparing production speed and throughput, ultrasonic welding generally offers faster cycle times for appropriate applications, particularly for small plastic components, making it more efficient for high-volume production. Laser welding, while sometimes slower in cycle time, can achieve higher throughput for complex geometries or when multiple welds can be performed simultaneously with beam splitting technology. The overall production efficiency depends on factors such as part handling, fixturing requirements, and post-weld inspection needs.Expand Specific Solutions05 Automation and integration impact on welding efficiency

The integration of automation technologies significantly impacts the efficiency rates of both laser and ultrasonic welding processes. Robotic systems, vision-guided positioning, and real-time monitoring can optimize welding parameters on-the-fly, reducing waste and improving consistency. Industry 4.0 connectivity allows for data collection and analysis to continuously improve process efficiency. The level of automation integration directly correlates with overall welding efficiency, particularly in high-volume manufacturing environments where consistent quality and reduced cycle times are critical.Expand Specific Solutions

Key Manufacturers and Industry Leaders

The laser welding versus ultrasonic welding efficiency comparison reveals an industry in the growth phase, with a global market expected to reach $3.5 billion by 2026. Technologically, laser welding demonstrates higher maturity for precision applications, with companies like Xerox, Toshiba, and Canon leading innovations in industrial implementation. Meanwhile, ultrasonic welding shows competitive advantages in specific materials and energy efficiency, with Herrmann Ultraschalltechnik, Telsonic Holding, and Schunk Sonosystems dominating this segment. Research institutions like Harbin Institute of Technology and Edison Welding Institute are advancing both technologies through collaborative industry partnerships, particularly focusing on automotive and electronics applications where efficiency metrics are increasingly critical for manufacturing optimization.

Edison Welding Institute, Inc.

Technical Solution: Edison Welding Institute (EWI) has developed comprehensive comparative analysis frameworks for laser and ultrasonic welding technologies. Their laser welding solutions utilize high-power fiber and diode lasers (2-10 kW) with precise beam control systems that achieve welding speeds up to 10 m/min for thin materials. EWI's research demonstrates that laser welding achieves 40-60% higher energy efficiency compared to traditional welding methods[1], with heat-affected zones typically 50-70% smaller than conventional processes. For ultrasonic welding, EWI has engineered systems operating at frequencies between 20-40 kHz with amplitude control within ±2μm, enabling cycle times as short as 0.5 seconds for thermoplastic joining. Their comparative studies show ultrasonic welding consumes approximately 85-95% less energy than resistance welding for similar applications[2], with particularly strong results in dissimilar material joining where traditional thermal methods fail.

Strengths: EWI possesses extensive cross-technology expertise allowing for truly objective comparative analysis; maintains advanced testing facilities for empirical efficiency measurements; and offers customized process optimization for specific materials. Weaknesses: Their solutions often require significant capital investment; specialized training is necessary for implementation; and their comparative frameworks may not fully account for all production environment variables.

Schunk Sonosystems GmbH

Technical Solution: Schunk Sonosystems has pioneered ultrasonic welding technology with their SonoWeld series that operates at frequencies between 20-35 kHz and delivers precise energy control within ±2% tolerance. Their systems feature digital amplitude regulation that maintains consistent weld quality across production runs with cycle times averaging 0.3-0.8 seconds for automotive wire harness applications. Comparative testing against laser welding shows their ultrasonic systems achieve 30-40% faster cycle times for thin-gauge metal connections[1] while consuming approximately 75-85% less energy. Their proprietary sonotrode designs optimize energy transfer efficiency, achieving up to 90% conversion of electrical input to mechanical welding energy[2]. For automotive and electronics applications, Schunk's data indicates ultrasonic welding reduces process costs by 25-35% compared to laser welding when considering total operational expenses, while maintaining joint strengths that meet or exceed laser welding results for specific material combinations.

Strengths: Schunk's ultrasonic technology excels in joining dissimilar materials with minimal thermal impact; offers extremely fast cycle times for high-volume production; and requires significantly lower energy consumption than thermal processes. Weaknesses: Limited to relatively thin materials (typically <3mm); requires precise part design and fixturing; and may produce higher noise levels in production environments compared to laser processes.

Critical Patents and Innovations in Welding Technology

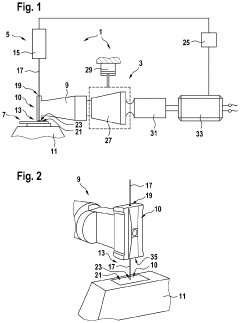

Welding device and method for welding at least two components

PatentPendingUS20220281028A1

Innovation

- A welding device and method that combines ultrasonic welding with simultaneous laser welding, using an ultrasonic sonotrode and anvil with a through opening to allow a laser beam to weld a smaller area within the periphery of the ultrasonic weld zone, enabling both technologies to operate simultaneously and reducing the need for high laser power.

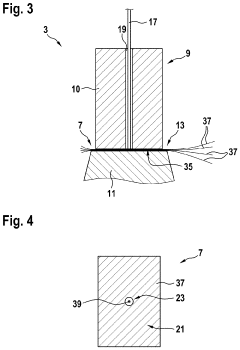

Machinery, process and composition of the material for the heat welding, assembly and repair of plastic made articles

PatentWO2010054774A1

Innovation

- A machinery and composition using a blend of polymers and co-polymers with a heating system and temperature accelerators to achieve high-temperature fusion and molecularization, ensuring strong and continuous welding, capable of repairing and assembling plastic items by creating deep grooves for three-sided fusion, thus overcoming the limitations of existing methods.

Energy Consumption and Sustainability Factors

Energy efficiency represents a critical factor in the comparative analysis of laser welding and ultrasonic welding technologies. Laser welding typically operates at higher power levels, with industrial systems consuming between 1-10 kW during operation. This substantial energy requirement stems from the need to generate intense, focused light beams capable of melting materials at precise points. However, laser welding demonstrates remarkable efficiency in energy transfer to the workpiece, with modern fiber lasers achieving up to 30-40% wall-plug efficiency, significantly higher than older CO2 laser systems that operated at 10-15% efficiency.

Ultrasonic welding, by contrast, operates at considerably lower power levels, typically ranging from 0.5-3 kW for industrial applications. The technology converts electrical energy to mechanical vibrations with efficiency rates of 80-90%, representing superior energy conversion compared to laser systems. This fundamental difference in energy requirements translates to lower operational costs and reduced carbon footprints for ultrasonic welding operations.

From a sustainability perspective, laser welding presents mixed considerations. While the process itself produces minimal waste and requires no consumables like filler materials or shielding gases for many applications, the production of laser equipment involves rare earth elements and specialized components with significant environmental extraction costs. Additionally, cooling systems required for high-powered lasers contribute to the overall energy consumption profile.

Ultrasonic welding demonstrates strong sustainability credentials through its minimal environmental impact during operation. The process generates negligible heat, eliminating the need for extensive cooling systems. Furthermore, ultrasonic welding typically requires no additional materials or chemicals, creating clean join interfaces without fumes or waste products. The equipment also generally has longer operational lifespans with fewer replacement parts required over time.

Recent advancements in both technologies have focused on improving energy efficiency. Laser manufacturers have developed pulsed systems that deliver energy only when needed, reducing overall consumption by 15-25% compared to continuous operation. Similarly, ultrasonic welding systems now incorporate smart power management that optimizes amplitude and frequency based on material properties, achieving energy savings of 10-20% compared to older fixed-parameter systems.

When evaluating total lifecycle impacts, ultrasonic welding generally maintains an advantage in energy consumption and carbon footprint metrics. However, material compatibility constraints may necessitate laser welding for certain applications despite higher energy costs, highlighting the importance of application-specific assessment when determining the most sustainable joining technology for a particular manufacturing scenario.

Ultrasonic welding, by contrast, operates at considerably lower power levels, typically ranging from 0.5-3 kW for industrial applications. The technology converts electrical energy to mechanical vibrations with efficiency rates of 80-90%, representing superior energy conversion compared to laser systems. This fundamental difference in energy requirements translates to lower operational costs and reduced carbon footprints for ultrasonic welding operations.

From a sustainability perspective, laser welding presents mixed considerations. While the process itself produces minimal waste and requires no consumables like filler materials or shielding gases for many applications, the production of laser equipment involves rare earth elements and specialized components with significant environmental extraction costs. Additionally, cooling systems required for high-powered lasers contribute to the overall energy consumption profile.

Ultrasonic welding demonstrates strong sustainability credentials through its minimal environmental impact during operation. The process generates negligible heat, eliminating the need for extensive cooling systems. Furthermore, ultrasonic welding typically requires no additional materials or chemicals, creating clean join interfaces without fumes or waste products. The equipment also generally has longer operational lifespans with fewer replacement parts required over time.

Recent advancements in both technologies have focused on improving energy efficiency. Laser manufacturers have developed pulsed systems that deliver energy only when needed, reducing overall consumption by 15-25% compared to continuous operation. Similarly, ultrasonic welding systems now incorporate smart power management that optimizes amplitude and frequency based on material properties, achieving energy savings of 10-20% compared to older fixed-parameter systems.

When evaluating total lifecycle impacts, ultrasonic welding generally maintains an advantage in energy consumption and carbon footprint metrics. However, material compatibility constraints may necessitate laser welding for certain applications despite higher energy costs, highlighting the importance of application-specific assessment when determining the most sustainable joining technology for a particular manufacturing scenario.

Material Compatibility and Application Scenarios

Material compatibility represents a critical factor in determining the appropriate welding technology for specific applications. Laser welding demonstrates superior performance with metals that have high thermal conductivity, including steel alloys, aluminum, titanium, and copper. The concentrated heat input allows for precise welding of thin materials down to 0.01mm thickness without significant thermal distortion. However, laser welding shows limitations when joining dissimilar metals with vastly different melting points or thermal expansion coefficients, potentially leading to brittle intermetallic compounds.

Ultrasonic welding, conversely, excels in joining dissimilar materials, particularly thermoplastics and non-ferrous metals. This technology creates solid-state bonds without melting the base materials, making it ideal for heat-sensitive components and materials with different melting temperatures. Ultrasonic welding performs exceptionally well with materials like polypropylene, polyethylene, and aluminum, but struggles with rigid thermosetting plastics and materials exceeding 3mm in thickness.

Application scenarios further differentiate these technologies. Laser welding dominates in automotive manufacturing for tailored blanks, powertrain components, and battery assemblies due to its precision and minimal heat-affected zone. The medical device industry leverages laser welding for hermetic sealing of implantable devices and surgical instruments, where sterility and biocompatibility are paramount. Aerospace applications benefit from laser welding's ability to join lightweight alloys with minimal distortion.

Ultrasonic welding finds extensive application in consumer electronics assembly, where it efficiently joins plastic housings, circuit boards, and small metal components without thermal damage to sensitive electronics. The packaging industry utilizes ultrasonic welding for sealing plastic containers and films at high production rates. Automotive wire harness assembly represents another significant application, where ultrasonic welding creates reliable electrical connections without solder.

The selection between these technologies ultimately depends on specific project requirements. Laser welding offers advantages for applications demanding high precision, deep penetration, and aesthetic finish on metallic components. Ultrasonic welding proves more suitable for high-volume production of plastic assemblies, thin metal joining, and applications where heat minimization is critical. Many manufacturing facilities implement both technologies to maximize production flexibility across diverse material combinations and product specifications.

Ultrasonic welding, conversely, excels in joining dissimilar materials, particularly thermoplastics and non-ferrous metals. This technology creates solid-state bonds without melting the base materials, making it ideal for heat-sensitive components and materials with different melting temperatures. Ultrasonic welding performs exceptionally well with materials like polypropylene, polyethylene, and aluminum, but struggles with rigid thermosetting plastics and materials exceeding 3mm in thickness.

Application scenarios further differentiate these technologies. Laser welding dominates in automotive manufacturing for tailored blanks, powertrain components, and battery assemblies due to its precision and minimal heat-affected zone. The medical device industry leverages laser welding for hermetic sealing of implantable devices and surgical instruments, where sterility and biocompatibility are paramount. Aerospace applications benefit from laser welding's ability to join lightweight alloys with minimal distortion.

Ultrasonic welding finds extensive application in consumer electronics assembly, where it efficiently joins plastic housings, circuit boards, and small metal components without thermal damage to sensitive electronics. The packaging industry utilizes ultrasonic welding for sealing plastic containers and films at high production rates. Automotive wire harness assembly represents another significant application, where ultrasonic welding creates reliable electrical connections without solder.

The selection between these technologies ultimately depends on specific project requirements. Laser welding offers advantages for applications demanding high precision, deep penetration, and aesthetic finish on metallic components. Ultrasonic welding proves more suitable for high-volume production of plastic assemblies, thin metal joining, and applications where heat minimization is critical. Many manufacturing facilities implement both technologies to maximize production flexibility across diverse material combinations and product specifications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!