Liquid Metal Alloy Selection Guide Conductivity And Melting Point

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Technology Background and Objectives

Liquid metals have emerged as a fascinating class of materials that combine the electrical conductivity of metals with the fluidity of liquids at or near room temperature. The history of liquid metal technology dates back to the early 20th century, with mercury being the first widely used liquid metal. However, due to mercury's toxicity concerns, research has progressively shifted toward safer alternatives, particularly gallium-based alloys since the 1990s.

The evolution of liquid metal technology has accelerated significantly in the past two decades, driven by increasing demands in flexible electronics, thermal management systems, and soft robotics. Gallium and its alloys, including eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan), have become focal points of research due to their low toxicity and favorable melting points below room temperature.

Current technological trends indicate a growing interest in engineering liquid metal alloys with precisely controlled properties, particularly electrical conductivity and melting point characteristics. These two properties are critical determinants for application suitability across various industries. The ability to maintain high conductivity while achieving specific melting point ranges enables liquid metals to serve in environments ranging from cryogenic applications to high-temperature industrial processes.

The primary technical objective in liquid metal alloy selection is to establish systematic guidelines that correlate composition ratios with resultant electrical conductivity and melting point behaviors. This involves understanding the complex interplay between atomic structure, electron mobility, and phase transition dynamics in multi-component metallic systems.

Additionally, researchers aim to develop predictive models that can accelerate the discovery of novel liquid metal compositions with application-specific property profiles. Machine learning approaches combined with high-throughput experimental validation are emerging as powerful tools in this domain, potentially reducing development cycles from years to months.

Another critical objective is to address the oxidation challenges that plague many liquid metal systems, particularly those based on gallium. Surface oxidation significantly impacts both conductivity and flow behavior, necessitating innovative surface treatment strategies or protective encapsulation techniques.

The field is also witnessing increased efforts toward sustainability, with research focusing on reducing reliance on rare or expensive elements like indium, and exploring more abundant alternatives that maintain desirable conductivity and melting characteristics.

The evolution of liquid metal technology has accelerated significantly in the past two decades, driven by increasing demands in flexible electronics, thermal management systems, and soft robotics. Gallium and its alloys, including eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan), have become focal points of research due to their low toxicity and favorable melting points below room temperature.

Current technological trends indicate a growing interest in engineering liquid metal alloys with precisely controlled properties, particularly electrical conductivity and melting point characteristics. These two properties are critical determinants for application suitability across various industries. The ability to maintain high conductivity while achieving specific melting point ranges enables liquid metals to serve in environments ranging from cryogenic applications to high-temperature industrial processes.

The primary technical objective in liquid metal alloy selection is to establish systematic guidelines that correlate composition ratios with resultant electrical conductivity and melting point behaviors. This involves understanding the complex interplay between atomic structure, electron mobility, and phase transition dynamics in multi-component metallic systems.

Additionally, researchers aim to develop predictive models that can accelerate the discovery of novel liquid metal compositions with application-specific property profiles. Machine learning approaches combined with high-throughput experimental validation are emerging as powerful tools in this domain, potentially reducing development cycles from years to months.

Another critical objective is to address the oxidation challenges that plague many liquid metal systems, particularly those based on gallium. Surface oxidation significantly impacts both conductivity and flow behavior, necessitating innovative surface treatment strategies or protective encapsulation techniques.

The field is also witnessing increased efforts toward sustainability, with research focusing on reducing reliance on rare or expensive elements like indium, and exploring more abundant alternatives that maintain desirable conductivity and melting characteristics.

Market Applications and Demand Analysis

The liquid metal alloy market is experiencing significant growth driven by the increasing demand for materials with unique combinations of conductivity and low melting points across multiple industries. The global market for advanced conductive materials, including liquid metal alloys, is projected to reach $12.7 billion by 2026, with a compound annual growth rate of 8.3% from 2021. This growth is primarily fueled by the expanding electronics, healthcare, and renewable energy sectors.

In the electronics industry, the miniaturization trend and the need for efficient thermal management systems have created substantial demand for liquid metal alloys. These materials offer superior thermal conductivity compared to traditional thermal interface materials, making them ideal for high-performance computing applications, gaming consoles, and mobile devices. The consumer electronics segment alone accounts for approximately 35% of the current liquid metal alloy market.

The healthcare sector represents another significant market for liquid metal alloys, particularly in medical devices and implantable electronics. The biocompatibility of certain gallium-based alloys, combined with their electrical conductivity properties, makes them suitable for applications in flexible bioelectronics, neural interfaces, and soft robotics. Market analysis indicates a 12.5% annual growth rate in medical applications of liquid metal alloys over the next five years.

Renewable energy systems, particularly concentrated solar power plants and advanced battery technologies, are emerging as major consumers of liquid metal alloys. These materials serve as efficient heat transfer mediums and conductive components in energy storage systems. The energy sector's demand for liquid metal alloys is expected to grow at 10.2% annually through 2025.

Automotive and aerospace industries are also showing increased interest in liquid metal alloys for thermal management systems and specialized electronic components. With the rise of electric vehicles and more sophisticated avionics systems, these sectors are projected to increase their consumption of liquid metal alloys by 15% year-over-year.

Regional market analysis reveals that North America and Asia-Pacific currently dominate the liquid metal alloy market, accounting for 38% and 42% of global demand respectively. However, Europe is showing the fastest growth rate at 9.7% annually, driven by stringent environmental regulations promoting advanced materials with recyclable properties.

The market demand is increasingly focused on alloys that offer customizable melting points and conductivity profiles, allowing manufacturers to select materials precisely tailored to their application requirements. This trend toward application-specific formulations is reshaping the supplier landscape, with specialized producers gaining market share against traditional metal suppliers.

In the electronics industry, the miniaturization trend and the need for efficient thermal management systems have created substantial demand for liquid metal alloys. These materials offer superior thermal conductivity compared to traditional thermal interface materials, making them ideal for high-performance computing applications, gaming consoles, and mobile devices. The consumer electronics segment alone accounts for approximately 35% of the current liquid metal alloy market.

The healthcare sector represents another significant market for liquid metal alloys, particularly in medical devices and implantable electronics. The biocompatibility of certain gallium-based alloys, combined with their electrical conductivity properties, makes them suitable for applications in flexible bioelectronics, neural interfaces, and soft robotics. Market analysis indicates a 12.5% annual growth rate in medical applications of liquid metal alloys over the next five years.

Renewable energy systems, particularly concentrated solar power plants and advanced battery technologies, are emerging as major consumers of liquid metal alloys. These materials serve as efficient heat transfer mediums and conductive components in energy storage systems. The energy sector's demand for liquid metal alloys is expected to grow at 10.2% annually through 2025.

Automotive and aerospace industries are also showing increased interest in liquid metal alloys for thermal management systems and specialized electronic components. With the rise of electric vehicles and more sophisticated avionics systems, these sectors are projected to increase their consumption of liquid metal alloys by 15% year-over-year.

Regional market analysis reveals that North America and Asia-Pacific currently dominate the liquid metal alloy market, accounting for 38% and 42% of global demand respectively. However, Europe is showing the fastest growth rate at 9.7% annually, driven by stringent environmental regulations promoting advanced materials with recyclable properties.

The market demand is increasingly focused on alloys that offer customizable melting points and conductivity profiles, allowing manufacturers to select materials precisely tailored to their application requirements. This trend toward application-specific formulations is reshaping the supplier landscape, with specialized producers gaining market share against traditional metal suppliers.

Current Challenges in Liquid Metal Alloy Development

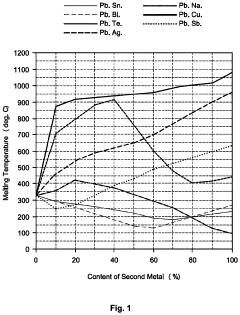

Despite significant advancements in liquid metal alloy development, several critical challenges continue to impede progress in creating optimal materials that balance conductivity and melting point requirements. The fundamental challenge lies in the inherent trade-off between electrical conductivity and melting temperature. Alloys with higher gallium content typically offer lower melting points but sacrifice conductivity, while those with higher silver or copper content provide superior conductivity but elevate melting temperatures beyond practical application thresholds.

Material stability presents another significant obstacle, as many liquid metal alloys exhibit problematic oxidation behavior when exposed to air. Surface oxidation creates a passivation layer that alters electrical properties and can compromise interfacial connections in electronic applications. This oxidation process accelerates at elevated temperatures, further complicating the development of stable alloys for high-temperature applications.

Wettability and adhesion characteristics pose substantial engineering challenges. Many liquid metal alloys demonstrate poor wetting behavior on common substrate materials, resulting in inconsistent electrical contact and unreliable performance in practical applications. Current research struggles to develop surface modification techniques or alloy compositions that maintain both desired electrical properties and appropriate surface interaction behaviors.

Manufacturing scalability remains problematic for advanced liquid metal alloys. Laboratory-scale production methods often involve precise composition control and specialized processing conditions that prove difficult to translate to industrial-scale manufacturing. The high cost of constituent elements like gallium, indium, and silver further exacerbates economic feasibility concerns for mass production.

Environmental and toxicity considerations create regulatory hurdles for widespread adoption. While gallium-based alloys generally present lower toxicity profiles than mercury, certain alloying elements introduce environmental concerns. The electronics industry increasingly demands materials that comply with RoHS (Restriction of Hazardous Substances) and similar regulations, limiting the viable composition space for new alloy development.

Thermal management issues persist in applications requiring sustained current flow. Joule heating effects can alter the viscosity and flow characteristics of liquid metal alloys during operation, potentially leading to performance degradation or failure in electronic systems. Current research has yet to fully characterize these dynamic behaviors under various operating conditions.

Standardization of testing protocols and performance metrics represents another significant challenge. The relatively nascent field lacks universally accepted methodologies for evaluating critical properties like long-term stability, conductivity under various conditions, and compatibility with different substrate materials, hampering meaningful comparison between emerging alloy formulations.

Material stability presents another significant obstacle, as many liquid metal alloys exhibit problematic oxidation behavior when exposed to air. Surface oxidation creates a passivation layer that alters electrical properties and can compromise interfacial connections in electronic applications. This oxidation process accelerates at elevated temperatures, further complicating the development of stable alloys for high-temperature applications.

Wettability and adhesion characteristics pose substantial engineering challenges. Many liquid metal alloys demonstrate poor wetting behavior on common substrate materials, resulting in inconsistent electrical contact and unreliable performance in practical applications. Current research struggles to develop surface modification techniques or alloy compositions that maintain both desired electrical properties and appropriate surface interaction behaviors.

Manufacturing scalability remains problematic for advanced liquid metal alloys. Laboratory-scale production methods often involve precise composition control and specialized processing conditions that prove difficult to translate to industrial-scale manufacturing. The high cost of constituent elements like gallium, indium, and silver further exacerbates economic feasibility concerns for mass production.

Environmental and toxicity considerations create regulatory hurdles for widespread adoption. While gallium-based alloys generally present lower toxicity profiles than mercury, certain alloying elements introduce environmental concerns. The electronics industry increasingly demands materials that comply with RoHS (Restriction of Hazardous Substances) and similar regulations, limiting the viable composition space for new alloy development.

Thermal management issues persist in applications requiring sustained current flow. Joule heating effects can alter the viscosity and flow characteristics of liquid metal alloys during operation, potentially leading to performance degradation or failure in electronic systems. Current research has yet to fully characterize these dynamic behaviors under various operating conditions.

Standardization of testing protocols and performance metrics represents another significant challenge. The relatively nascent field lacks universally accepted methodologies for evaluating critical properties like long-term stability, conductivity under various conditions, and compatibility with different substrate materials, hampering meaningful comparison between emerging alloy formulations.

Existing Alloy Formulations and Performance Metrics

01 Gallium-based liquid metal alloys

Gallium-based liquid metal alloys are known for their low melting points and high electrical conductivity. These alloys typically contain gallium as the primary component, often combined with indium, tin, or zinc. They remain liquid at or near room temperature while maintaining excellent electrical conductivity properties. These characteristics make them suitable for various applications including flexible electronics, thermal management systems, and as replacements for mercury in certain applications.- Gallium-based liquid metal alloys: Gallium-based liquid metal alloys are known for their low melting points and high electrical conductivity. These alloys typically contain gallium as the primary component, often combined with indium, tin, or zinc. They remain liquid at or near room temperature while maintaining excellent electrical conductivity properties. These characteristics make them suitable for applications in flexible electronics, thermal management systems, and as replacements for mercury in various applications.

- Bismuth and lead-based liquid metal alloys: Bismuth and lead-based liquid metal alloys offer a combination of relatively low melting points and good electrical conductivity. These alloys can be formulated with various compositions to achieve specific melting point requirements. The addition of other elements such as tin, cadmium, or indium can further lower the melting point while maintaining adequate conductivity. These alloys are commonly used in thermal interfaces, soldering applications, and heat transfer systems.

- Sodium-potassium liquid metal alloys: Sodium-potassium (NaK) liquid metal alloys exhibit high thermal and electrical conductivity with low melting points. These alloys remain liquid at room temperature in certain compositions and are particularly valued for their heat transfer capabilities. The ratio of sodium to potassium can be adjusted to optimize melting point and conductivity properties for specific applications. These alloys are primarily used in nuclear reactors, heat exchange systems, and specialized cooling applications.

- Mercury substitutes with enhanced conductivity: Various liquid metal alloys have been developed as environmentally friendly alternatives to mercury while maintaining high electrical conductivity. These substitute alloys typically combine elements like gallium, indium, tin, and zinc in specific proportions to achieve mercury-like properties without the associated toxicity. These alloys are engineered to provide comparable electrical performance while offering safer handling characteristics and reduced environmental impact. Applications include electrical switches, sensors, and thermometers.

- Thermal management applications of liquid metal alloys: Liquid metal alloys with optimized conductivity and melting point properties are increasingly used in thermal management applications. These alloys provide superior heat transfer capabilities compared to conventional thermal interface materials. Their ability to conform to surfaces while maintaining high thermal conductivity makes them ideal for cooling high-performance electronics and power systems. The formulations can be tailored to specific operating temperature ranges while maintaining their liquid state and conductive properties throughout the intended application temperature range.

02 Bismuth and lead-based liquid metal alloys

Bismuth and lead-based liquid metal alloys offer unique combinations of melting points and conductivity properties. These alloys typically have higher melting points than gallium-based alternatives but still lower than many conventional metals. They provide good electrical and thermal conductivity while offering advantages in terms of cost and availability. Applications include heat transfer systems, soldering, and specialized electrical contacts where specific melting point and conductivity characteristics are required.Expand Specific Solutions03 Thermal conductivity enhancement in liquid metal alloys

Various methods and compositions have been developed to enhance the thermal conductivity of liquid metal alloys. These include the addition of specific elements or nanoparticles to the base alloy, creating composite structures, or modifying the microstructure through processing techniques. Enhanced thermal conductivity is particularly valuable in heat transfer applications, cooling systems, and thermal management solutions for electronics and industrial processes.Expand Specific Solutions04 Electrical conductivity optimization in liquid metal alloys

Techniques for optimizing the electrical conductivity of liquid metal alloys involve careful control of composition, purity levels, and processing methods. By adjusting the ratio of constituent elements and minimizing impurities, the electrical conductivity can be significantly enhanced. These highly conductive liquid metal alloys are used in applications such as flexible electronics, electromagnetic shielding, and electrical interconnects where traditional solid conductors are unsuitable.Expand Specific Solutions05 Low melting point liquid metal alloys for specialized applications

Specialized liquid metal alloys with particularly low melting points have been developed for applications requiring phase change at specific temperatures. These alloys often incorporate eutectic compositions to achieve melting points well below those of individual constituent elements. Applications include thermal switches, self-healing electronics, reconfigurable components, and heat-activated mechanisms where precise control over the solid-to-liquid transition temperature is critical while maintaining adequate electrical and thermal conductivity.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The liquid metal alloy technology market is currently in a growth phase, with increasing applications in electronics, automotive, and medical sectors. The market size is estimated to be expanding at a CAGR of 8-10%, driven by demand for flexible electronics and thermal management solutions. Technologically, the field shows varying maturity levels, with companies like Beijing Dream Ink Technology pioneering electronic additive manufacturing applications, while established players such as Fujitsu and DuPont focus on industrial-scale implementations. Research institutions including Sichuan University and National Institute for Materials Science are advancing fundamental properties optimization. The competitive landscape features specialized startups (Faradion) alongside industrial giants (BYD, Siemens), indicating a diversifying ecosystem where conductivity-melting point trade-offs remain a key development focus.

Sichuan University

Technical Solution: Sichuan University has developed a comprehensive liquid metal alloy selection methodology specifically targeting the conductivity-melting point balance. Their research team has created a series of gallium-indium-tin (Ga-In-Sn) alloys with systematically varied compositions to achieve precise control over both electrical conductivity and melting temperature. Their proprietary EGaInSn alloy demonstrates electrical conductivity of 3.4×10^6 S/m with a melting point of 10.6°C. The university has also pioneered novel surface modification techniques using thiols and other organic compounds to reduce oxidation issues that typically plague liquid metal applications. Their research extends to creating liquid metal composites by incorporating metallic micro/nanoparticles (Cu, Ag) to enhance conductivity while maintaining low melting points, achieving up to 30% conductivity improvement without significantly raising melting temperatures.

Strengths: Strong fundamental research capabilities in liquid metal chemistry and physics; innovative approaches to surface modification that enhance practical applications; extensive characterization facilities. Weaknesses: May face challenges in scaling laboratory techniques to industrial production; academic focus might limit immediate commercial implementation of technologies.

Google Technology Holdings LLC

Technical Solution: Google Technology Holdings has developed advanced liquid metal alloy technologies for next-generation flexible electronics and thermal management systems. Their proprietary gallium-indium-tin (Ga-In-Sn) alloy formulations are specifically engineered to maintain high electrical conductivity (>3.0×10^6 S/m) while offering customizable melting points ranging from -19°C to 30°C. Google's innovation lies in their computational materials science approach, utilizing machine learning algorithms to predict and optimize alloy compositions based on desired conductivity and melting point specifications. Their liquid metal technology incorporates proprietary surface treatments to minimize oxidation issues and enhance wettability on various substrates. Google has also pioneered microfluidic delivery systems for precise liquid metal deposition in complex electronic architectures, enabling self-healing circuits and reconfigurable electronic components for their consumer electronics and data center cooling applications.

Strengths: Extensive computational resources and AI capabilities for materials optimization; strong integration with existing product ecosystems; robust intellectual property portfolio. Weaknesses: Less specialized in materials science compared to dedicated materials companies; technologies primarily developed for internal applications rather than as standalone commercial offerings.

Key Patents and Research in Liquid Metal Conductivity

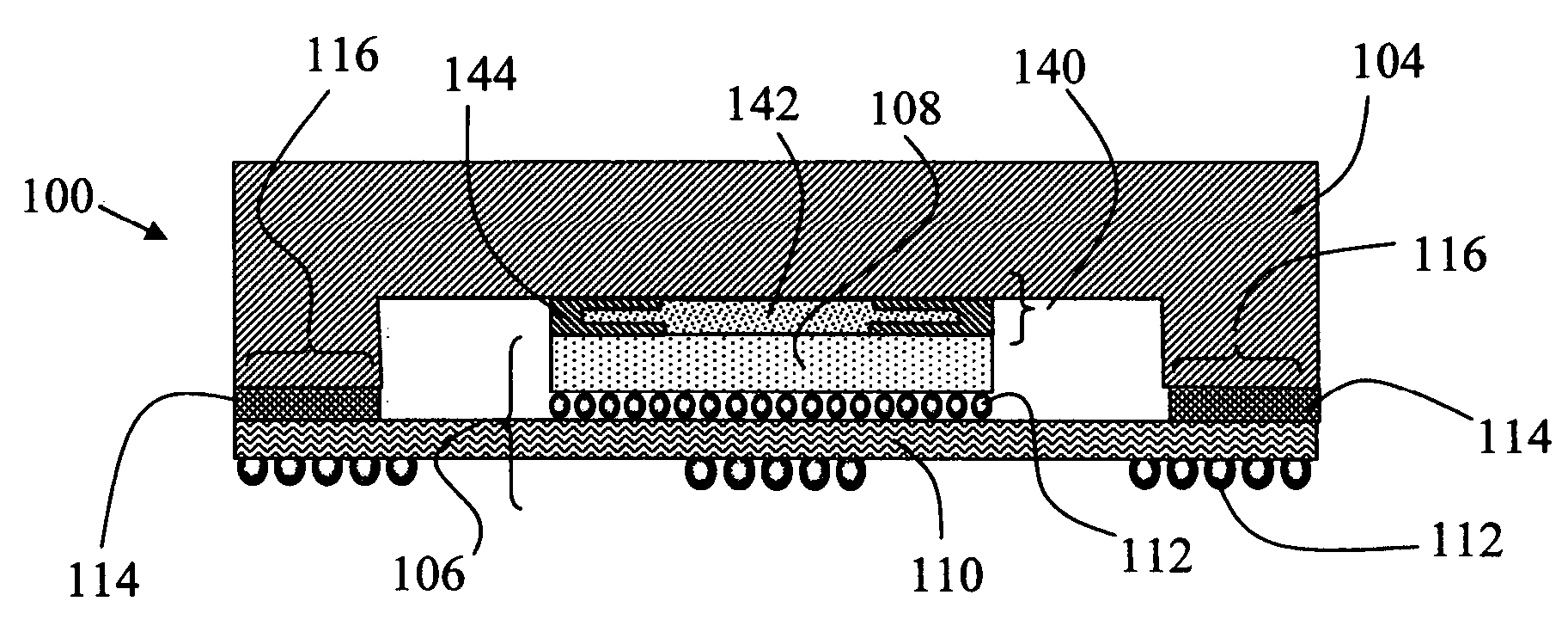

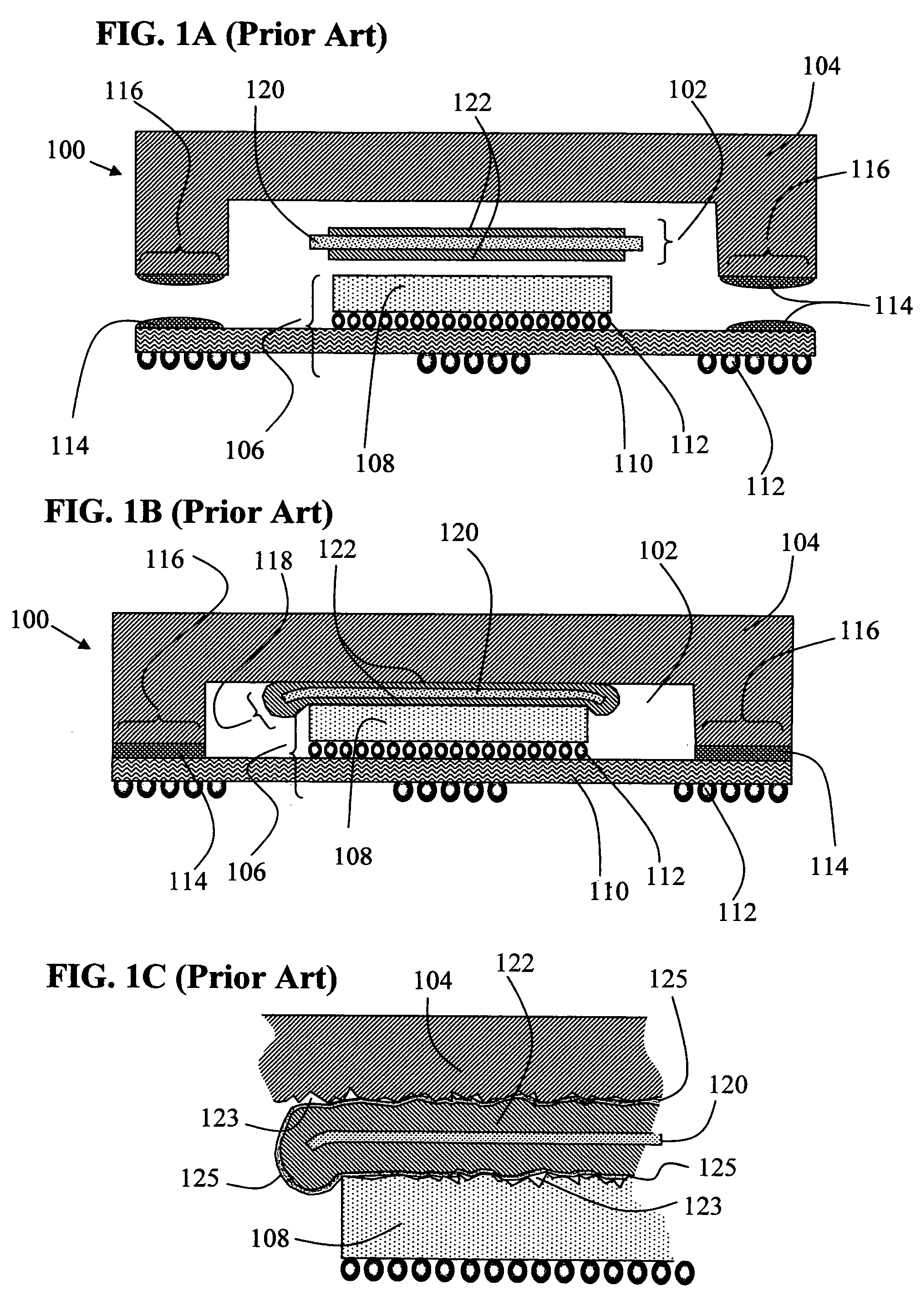

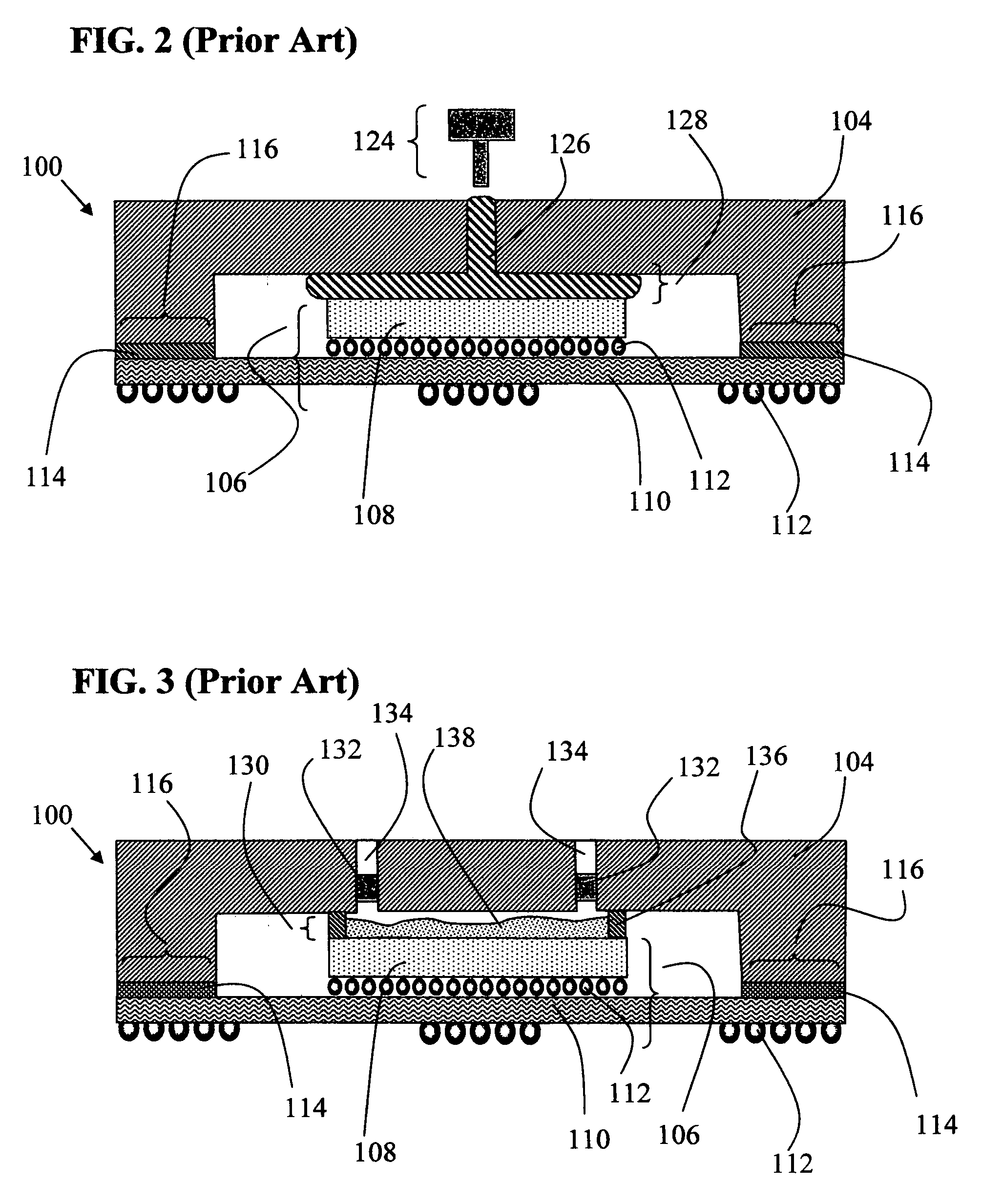

Liquid metal thermal interface material system

PatentInactiveUS20060118925A1

Innovation

- A metal thermal interface system that incorporates a metallic seal member with a metallic interface composition, including oxygen gettering elements and corrosion inhibitors, which flows and fills surface asperities to create a hermetic seal, reducing thermal impedance and preventing migration, while using moisture desiccants and encapsulants to enhance stability and reliability.

Apparatus and method

PatentPendingUS20220181040A1

Innovation

- An apparatus and method involving melting the lead article to form a second article with a predetermined thickness, allowing for through-thickness detection and excision of radioactive contamination using radiation detectors and a cutter, thereby reducing residual contamination and enabling categorization as Low Level Waste or recycling.

Environmental and Safety Considerations

When working with liquid metal alloys for electrical applications, environmental and safety considerations must be thoroughly addressed. Gallium-based liquid metal alloys, while offering excellent conductivity and low melting points, present unique challenges. These materials, particularly gallium-indium-tin (Galinstan) and gallium-indium (EGaIn) alloys, contain elements that require careful handling and disposal protocols to prevent environmental contamination.

The toxicity profiles of liquid metal components vary significantly. Gallium itself exhibits relatively low toxicity compared to mercury, making it a preferred alternative in many applications. However, indium and tin components may pose moderate health risks through prolonged exposure. Workplace safety protocols should include proper ventilation systems, as some alloys may release metal vapors when heated above certain temperatures. Personal protective equipment, including chemical-resistant gloves and eye protection, is essential when handling these materials to prevent skin contact and potential irritation.

Environmental considerations extend to the entire lifecycle of liquid metal alloys. Mining and extraction processes for constituent metals, particularly gallium and indium, can have significant environmental footprints. Responsible sourcing from suppliers with documented environmental management systems helps mitigate these upstream impacts. During application development, containment strategies must be implemented to prevent leakage into surrounding environments, as liquid metals can potentially interact with and damage other materials or electronic components.

End-of-life management presents another critical consideration. Unlike conventional solid metals, liquid alloys may require specialized recycling processes. Establishing closed-loop systems for collection and reprocessing can significantly reduce environmental impact while recovering valuable materials. Some jurisdictions classify certain liquid metal wastes as hazardous materials, necessitating compliance with specific disposal regulations and documentation requirements.

Oxidation behavior also influences environmental compatibility. Gallium-based alloys typically form a thin oxide layer when exposed to air, which can affect both performance and handling characteristics. This oxidation process may alter the environmental mobility of the metals and should be factored into risk assessments. For applications in consumer electronics or medical devices, additional biocompatibility testing may be required to ensure safety in case of accidental exposure.

Regulatory frameworks governing liquid metal alloys continue to evolve as these materials find wider application. Manufacturers must monitor developments in materials legislation, particularly regarding restricted substances lists and reporting requirements in different global markets. Proactive engagement with regulatory standards can prevent costly redesigns and ensure market access for products incorporating liquid metal technology.

The toxicity profiles of liquid metal components vary significantly. Gallium itself exhibits relatively low toxicity compared to mercury, making it a preferred alternative in many applications. However, indium and tin components may pose moderate health risks through prolonged exposure. Workplace safety protocols should include proper ventilation systems, as some alloys may release metal vapors when heated above certain temperatures. Personal protective equipment, including chemical-resistant gloves and eye protection, is essential when handling these materials to prevent skin contact and potential irritation.

Environmental considerations extend to the entire lifecycle of liquid metal alloys. Mining and extraction processes for constituent metals, particularly gallium and indium, can have significant environmental footprints. Responsible sourcing from suppliers with documented environmental management systems helps mitigate these upstream impacts. During application development, containment strategies must be implemented to prevent leakage into surrounding environments, as liquid metals can potentially interact with and damage other materials or electronic components.

End-of-life management presents another critical consideration. Unlike conventional solid metals, liquid alloys may require specialized recycling processes. Establishing closed-loop systems for collection and reprocessing can significantly reduce environmental impact while recovering valuable materials. Some jurisdictions classify certain liquid metal wastes as hazardous materials, necessitating compliance with specific disposal regulations and documentation requirements.

Oxidation behavior also influences environmental compatibility. Gallium-based alloys typically form a thin oxide layer when exposed to air, which can affect both performance and handling characteristics. This oxidation process may alter the environmental mobility of the metals and should be factored into risk assessments. For applications in consumer electronics or medical devices, additional biocompatibility testing may be required to ensure safety in case of accidental exposure.

Regulatory frameworks governing liquid metal alloys continue to evolve as these materials find wider application. Manufacturers must monitor developments in materials legislation, particularly regarding restricted substances lists and reporting requirements in different global markets. Proactive engagement with regulatory standards can prevent costly redesigns and ensure market access for products incorporating liquid metal technology.

Manufacturing Scalability Assessment

The scalability of liquid metal alloy manufacturing processes represents a critical factor in their commercial viability. Current production methods for gallium-based liquid metal alloys (such as Galinstan) involve relatively straightforward alloying processes, but face significant challenges when scaled to industrial volumes. The primary limitation stems from the restricted global supply of gallium, with annual production estimated at approximately 300-400 metric tons, primarily as a byproduct of aluminum and zinc refining. This supply constraint creates a bottleneck for widespread adoption across multiple industries.

Manufacturing processes for liquid metal alloys require precise temperature control and environmental conditions to maintain optimal conductivity properties. Small-scale production typically employs batch processing techniques, which become increasingly inefficient at larger scales due to challenges in maintaining homogeneous mixing and preventing oxidation. The transition to continuous flow manufacturing processes presents promising opportunities for scalability but requires substantial capital investment in specialized equipment capable of handling the unique properties of these materials.

Cost analysis reveals that raw material expenses constitute approximately 60-75% of total production costs for gallium-based liquid metal alloys, with processing accounting for the remainder. As production scales increase, economies of scale primarily affect processing costs rather than material costs, highlighting the importance of supply chain optimization. Alternative alloy compositions utilizing more abundant elements like indium and tin may offer improved scalability pathways, though often with trade-offs in electrical conductivity or melting point characteristics.

Environmental considerations also impact manufacturing scalability, particularly regarding waste management and recycling capabilities. Current recovery rates for gallium from end-of-life products remain below 15%, presenting both a challenge and opportunity for circular economy approaches. Implementing closed-loop manufacturing systems could significantly enhance long-term scalability while reducing environmental impact.

Regional manufacturing capabilities vary considerably, with China dominating global gallium production (approximately 95% of supply). This geographic concentration creates potential supply chain vulnerabilities that may impact large-scale manufacturing initiatives. Diversification of supply sources represents a strategic priority for ensuring manufacturing resilience, with emerging extraction technologies from non-traditional sources showing promise for expanding the available material base.

Manufacturing processes for liquid metal alloys require precise temperature control and environmental conditions to maintain optimal conductivity properties. Small-scale production typically employs batch processing techniques, which become increasingly inefficient at larger scales due to challenges in maintaining homogeneous mixing and preventing oxidation. The transition to continuous flow manufacturing processes presents promising opportunities for scalability but requires substantial capital investment in specialized equipment capable of handling the unique properties of these materials.

Cost analysis reveals that raw material expenses constitute approximately 60-75% of total production costs for gallium-based liquid metal alloys, with processing accounting for the remainder. As production scales increase, economies of scale primarily affect processing costs rather than material costs, highlighting the importance of supply chain optimization. Alternative alloy compositions utilizing more abundant elements like indium and tin may offer improved scalability pathways, though often with trade-offs in electrical conductivity or melting point characteristics.

Environmental considerations also impact manufacturing scalability, particularly regarding waste management and recycling capabilities. Current recovery rates for gallium from end-of-life products remain below 15%, presenting both a challenge and opportunity for circular economy approaches. Implementing closed-loop manufacturing systems could significantly enhance long-term scalability while reducing environmental impact.

Regional manufacturing capabilities vary considerably, with China dominating global gallium production (approximately 95% of supply). This geographic concentration creates potential supply chain vulnerabilities that may impact large-scale manufacturing initiatives. Diversification of supply sources represents a strategic priority for ensuring manufacturing resilience, with emerging extraction technologies from non-traditional sources showing promise for expanding the available material base.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!