Roadmap For Industrial Adoption Of Liquid Metal Electronics

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Liquid Metal Electronics Background and Objectives

Liquid metal electronics represents a revolutionary frontier in the field of flexible and stretchable electronics, with roots dating back to the early 2000s. This emerging technology leverages the unique properties of gallium-based alloys, particularly their low melting points and high electrical conductivity, to create electronic components that can maintain functionality while being deformed, stretched, or reconfigured. The evolution of this technology has accelerated significantly over the past decade, transitioning from laboratory curiosities to potential commercial applications.

The historical trajectory of liquid metal electronics began with fundamental research into the physical and chemical properties of gallium alloys, particularly eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan). These materials exhibit remarkable characteristics: they remain liquid at room temperature, possess excellent electrical conductivity comparable to many solid metals, and demonstrate unique surface tension properties that can be manipulated through various stimuli.

Technical development in this field has progressed through several distinct phases. Initial research focused on basic material characterization and handling techniques to overcome challenges related to gallium's oxidation behavior and wetting properties. This was followed by proof-of-concept demonstrations of simple circuits and components, eventually leading to more sophisticated applications including reconfigurable antennas, soft sensors, and self-healing electronics.

The current technical landscape shows promising advances in manufacturing methods, encapsulation techniques, and integration strategies. Researchers have developed various approaches for patterning and deploying liquid metals, including microfluidic channels, direct writing, and controlled injection methods. These innovations have expanded the potential application space significantly.

The primary objectives for industrial adoption of liquid metal electronics center on several key areas. First, establishing scalable and cost-effective manufacturing processes that can transition from laboratory demonstrations to commercial production. Second, developing standardized material formulations and handling protocols to ensure consistency and reliability. Third, creating design frameworks and modeling tools that account for the unique mechanical and electrical behaviors of liquid metal components.

Additional technical goals include improving the long-term stability of liquid metal systems, enhancing compatibility with existing electronic manufacturing infrastructure, and addressing environmental and safety considerations associated with gallium-based materials. The field also aims to identify and develop "killer applications" where the unique properties of liquid metals provide compelling advantages over conventional electronic technologies.

The ultimate vision for liquid metal electronics encompasses transformative applications across multiple industries, including wearable health monitoring, soft robotics, reconfigurable communication systems, and next-generation human-machine interfaces. Realizing this vision requires coordinated advancement across materials science, electronic engineering, and manufacturing technology domains.

The historical trajectory of liquid metal electronics began with fundamental research into the physical and chemical properties of gallium alloys, particularly eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan). These materials exhibit remarkable characteristics: they remain liquid at room temperature, possess excellent electrical conductivity comparable to many solid metals, and demonstrate unique surface tension properties that can be manipulated through various stimuli.

Technical development in this field has progressed through several distinct phases. Initial research focused on basic material characterization and handling techniques to overcome challenges related to gallium's oxidation behavior and wetting properties. This was followed by proof-of-concept demonstrations of simple circuits and components, eventually leading to more sophisticated applications including reconfigurable antennas, soft sensors, and self-healing electronics.

The current technical landscape shows promising advances in manufacturing methods, encapsulation techniques, and integration strategies. Researchers have developed various approaches for patterning and deploying liquid metals, including microfluidic channels, direct writing, and controlled injection methods. These innovations have expanded the potential application space significantly.

The primary objectives for industrial adoption of liquid metal electronics center on several key areas. First, establishing scalable and cost-effective manufacturing processes that can transition from laboratory demonstrations to commercial production. Second, developing standardized material formulations and handling protocols to ensure consistency and reliability. Third, creating design frameworks and modeling tools that account for the unique mechanical and electrical behaviors of liquid metal components.

Additional technical goals include improving the long-term stability of liquid metal systems, enhancing compatibility with existing electronic manufacturing infrastructure, and addressing environmental and safety considerations associated with gallium-based materials. The field also aims to identify and develop "killer applications" where the unique properties of liquid metals provide compelling advantages over conventional electronic technologies.

The ultimate vision for liquid metal electronics encompasses transformative applications across multiple industries, including wearable health monitoring, soft robotics, reconfigurable communication systems, and next-generation human-machine interfaces. Realizing this vision requires coordinated advancement across materials science, electronic engineering, and manufacturing technology domains.

Industrial Market Demand Analysis

The liquid metal electronics market is experiencing significant growth driven by the unique properties of these materials, particularly gallium-based alloys like Galinstan. Current market analysis indicates a compound annual growth rate exceeding 18% for flexible and stretchable electronics, with liquid metal components representing an increasingly important segment. This growth trajectory is supported by expanding applications across multiple industries seeking alternatives to traditional rigid electronic systems.

Healthcare represents one of the most promising markets for liquid metal electronics, with demand for wearable medical devices projected to reach $27 billion by 2026. The biocompatibility of certain liquid metal formulations makes them ideal for implantable sensors, health monitoring systems, and soft robotics for surgical applications. Medical device manufacturers are particularly interested in liquid metal solutions that can maintain electrical performance while conforming to complex anatomical structures.

The consumer electronics sector presents another substantial market opportunity, particularly for devices requiring flexibility, durability, and heat dissipation capabilities. Manufacturers of smartphones, tablets, and wearable technology are actively exploring liquid metal interconnects to replace conventional wiring in next-generation devices. Market research indicates that consumers are willing to pay premium prices for electronic devices offering enhanced flexibility and durability, creating a viable commercial pathway for liquid metal integration.

Industrial automation and robotics represent a third major market segment, with particular emphasis on soft robotics applications. The ability of liquid metal to maintain conductivity while undergoing extreme deformation addresses a critical need in industrial environments where traditional electronics fail under mechanical stress. Factory automation systems incorporating liquid metal components are demonstrating superior performance in high-vibration environments and applications requiring frequent reconfiguration.

Defense and aerospace industries are investing heavily in liquid metal electronics for specialized applications including reconfigurable antennas, impact-resistant communication systems, and adaptive camouflage technologies. These high-value applications, while representing smaller volume markets, offer significant revenue potential due to premium pricing structures and performance requirements that conventional electronics cannot meet.

Market barriers include manufacturing scalability challenges, with current production methods primarily limited to laboratory settings. Industry surveys indicate that 78% of potential industrial adopters cite manufacturing consistency as their primary concern. Additionally, long-term reliability data remains limited, creating hesitation among industries with stringent durability requirements such as automotive and aerospace sectors.

Healthcare represents one of the most promising markets for liquid metal electronics, with demand for wearable medical devices projected to reach $27 billion by 2026. The biocompatibility of certain liquid metal formulations makes them ideal for implantable sensors, health monitoring systems, and soft robotics for surgical applications. Medical device manufacturers are particularly interested in liquid metal solutions that can maintain electrical performance while conforming to complex anatomical structures.

The consumer electronics sector presents another substantial market opportunity, particularly for devices requiring flexibility, durability, and heat dissipation capabilities. Manufacturers of smartphones, tablets, and wearable technology are actively exploring liquid metal interconnects to replace conventional wiring in next-generation devices. Market research indicates that consumers are willing to pay premium prices for electronic devices offering enhanced flexibility and durability, creating a viable commercial pathway for liquid metal integration.

Industrial automation and robotics represent a third major market segment, with particular emphasis on soft robotics applications. The ability of liquid metal to maintain conductivity while undergoing extreme deformation addresses a critical need in industrial environments where traditional electronics fail under mechanical stress. Factory automation systems incorporating liquid metal components are demonstrating superior performance in high-vibration environments and applications requiring frequent reconfiguration.

Defense and aerospace industries are investing heavily in liquid metal electronics for specialized applications including reconfigurable antennas, impact-resistant communication systems, and adaptive camouflage technologies. These high-value applications, while representing smaller volume markets, offer significant revenue potential due to premium pricing structures and performance requirements that conventional electronics cannot meet.

Market barriers include manufacturing scalability challenges, with current production methods primarily limited to laboratory settings. Industry surveys indicate that 78% of potential industrial adopters cite manufacturing consistency as their primary concern. Additionally, long-term reliability data remains limited, creating hesitation among industries with stringent durability requirements such as automotive and aerospace sectors.

Global Technical Status and Barriers

Liquid metal electronics has witnessed significant advancements globally, with research centers in North America, Europe, Asia-Pacific, and Australia leading innovation efforts. The United States maintains a strong position through university research programs at institutions like Harvard, MIT, and Carnegie Mellon, focusing on fundamental properties and novel applications of gallium-based alloys. China has emerged as a formidable competitor, with institutions like Tsinghua University and the Chinese Academy of Sciences pioneering practical applications in flexible electronics and self-healing circuits.

European research, particularly in Germany and the United Kingdom, has concentrated on environmental sustainability aspects of liquid metal technologies, developing eco-friendly formulations and recycling methodologies. Australia, through RMIT University and the University of Wollongong, has made notable contributions to liquid metal printing technologies and biocompatible applications.

Despite these advancements, significant technical barriers impede widespread industrial adoption. Material stability presents a primary challenge, as liquid metals like gallium alloys tend to oxidize rapidly when exposed to air, forming a surface oxide layer that alters electrical and mechanical properties. This oxidation process complicates manufacturing processes and long-term reliability of devices.

Compatibility issues with conventional electronics manufacturing infrastructure represent another substantial hurdle. Current production lines are optimized for solid-state components, requiring significant retooling and process development to accommodate liquid metal integration. The high surface tension of liquid metals also creates difficulties in achieving precise patterning and controlled deposition at microscale dimensions.

Standardization remains underdeveloped, with no universally accepted testing protocols or performance metrics specifically designed for liquid metal electronics. This lack of standardization complicates quality control and hampers industry-wide adoption by creating uncertainty around reliability and performance expectations.

Cost factors present additional barriers, as gallium and indium—key components in most liquid metal alloys—face supply constraints and price volatility. The specialized handling requirements and complex processing techniques further increase manufacturing costs compared to conventional electronic materials.

Regulatory frameworks for liquid metal electronics remain incomplete in most jurisdictions, creating uncertainty regarding safety standards, disposal protocols, and environmental compliance. This regulatory ambiguity discourages investment and commercial development, particularly for consumer applications where safety certification is paramount.

European research, particularly in Germany and the United Kingdom, has concentrated on environmental sustainability aspects of liquid metal technologies, developing eco-friendly formulations and recycling methodologies. Australia, through RMIT University and the University of Wollongong, has made notable contributions to liquid metal printing technologies and biocompatible applications.

Despite these advancements, significant technical barriers impede widespread industrial adoption. Material stability presents a primary challenge, as liquid metals like gallium alloys tend to oxidize rapidly when exposed to air, forming a surface oxide layer that alters electrical and mechanical properties. This oxidation process complicates manufacturing processes and long-term reliability of devices.

Compatibility issues with conventional electronics manufacturing infrastructure represent another substantial hurdle. Current production lines are optimized for solid-state components, requiring significant retooling and process development to accommodate liquid metal integration. The high surface tension of liquid metals also creates difficulties in achieving precise patterning and controlled deposition at microscale dimensions.

Standardization remains underdeveloped, with no universally accepted testing protocols or performance metrics specifically designed for liquid metal electronics. This lack of standardization complicates quality control and hampers industry-wide adoption by creating uncertainty around reliability and performance expectations.

Cost factors present additional barriers, as gallium and indium—key components in most liquid metal alloys—face supply constraints and price volatility. The specialized handling requirements and complex processing techniques further increase manufacturing costs compared to conventional electronic materials.

Regulatory frameworks for liquid metal electronics remain incomplete in most jurisdictions, creating uncertainty regarding safety standards, disposal protocols, and environmental compliance. This regulatory ambiguity discourages investment and commercial development, particularly for consumer applications where safety certification is paramount.

Current Industrial Implementation Solutions

01 Liquid metal cooling systems for electronics

Liquid metals are used as cooling agents in electronic devices due to their excellent thermal conductivity. These cooling systems help dissipate heat from high-performance components, preventing overheating and improving device reliability. The liquid metal can be circulated through channels or chambers in direct contact with heat-generating components, providing efficient heat transfer and temperature regulation in compact electronic devices.- Liquid metal cooling systems for electronics: Liquid metal cooling systems utilize the high thermal conductivity of liquid metals to efficiently dissipate heat from electronic components. These systems can include heat exchangers, thermal interfaces, and circulation mechanisms that transfer heat away from critical components. The liquid metal's superior thermal properties allow for more effective cooling compared to traditional methods, enabling higher performance in compact electronic devices.

- Liquid metal electronic interconnects and switches: Liquid metals can be used to create flexible, reconfigurable electronic interconnects and switches. These systems leverage the electrical conductivity and fluidity of liquid metals to form dynamic connections between components. Applications include adaptive circuits, self-healing electronics, and reconfigurable systems that can change their electrical pathways on demand, offering advantages in flexibility and resilience over solid conductors.

- Thermal management solutions using liquid metal: Advanced thermal management solutions incorporate liquid metals as thermal interface materials between heat-generating components and cooling systems. These solutions include specialized encapsulation methods, pump systems for circulation, and composite materials that combine liquid metals with other substances to optimize heat transfer. The high thermal conductivity of liquid metals enables more efficient heat dissipation in high-performance computing and power electronics.

- Liquid metal-based electronic packaging: Electronic packaging technologies that incorporate liquid metals provide enhanced thermal and electrical performance. These include specialized containers, encapsulation methods, and integration techniques that allow liquid metals to be safely incorporated into electronic devices. The packaging solutions address challenges such as preventing leakage, managing oxidation, and ensuring compatibility with other materials while maintaining the beneficial properties of liquid metals.

- Liquid metal-based flexible and stretchable electronics: Flexible and stretchable electronic systems utilize liquid metals to create deformable circuits and components that can maintain functionality while being bent, stretched, or twisted. These technologies include methods for patterning liquid metal, embedding it in elastomeric substrates, and creating stable liquid metal-based components. Applications range from wearable devices to soft robotics, where traditional rigid electronics would fail under mechanical stress.

02 Liquid metal interconnects and circuit components

Liquid metals are utilized as flexible, self-healing electrical interconnects in electronic devices. These materials can maintain electrical conductivity while being stretched or deformed, making them ideal for flexible and wearable electronics. Liquid metal alloys like gallium-indium can be patterned to create stretchable circuits, switches, and other electronic components that maintain functionality under mechanical stress.Expand Specific Solutions03 Thermal interface materials using liquid metals

Liquid metals serve as high-performance thermal interface materials between electronic components and heat sinks. These materials fill microscopic gaps between surfaces, significantly improving thermal conductivity compared to conventional thermal pastes. The application of liquid metal thermal interfaces in processors and graphics cards enhances cooling efficiency, allowing for higher performance and overclocking capabilities while maintaining safe operating temperatures.Expand Specific Solutions04 Liquid metal-based display technologies

Liquid metals are employed in advanced display technologies, offering unique properties for pixel formation and manipulation. These displays utilize the reflective properties and electrical conductivity of liquid metals to create high-contrast, energy-efficient screens. The ability to control liquid metal movement through electrical signals enables dynamic pixel formation, potentially revolutionizing display technology with improved brightness, contrast, and energy efficiency.Expand Specific Solutions05 Liquid metal packaging and encapsulation for electronics

Liquid metals are used for packaging and encapsulation of electronic components, providing both thermal management and electromagnetic shielding. These materials can conform to irregular shapes, filling voids and creating seamless contacts between components. The encapsulation protects sensitive electronics from environmental factors while simultaneously conducting heat away from critical components, extending device lifespan and improving reliability in harsh operating conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The industrial adoption of liquid metal electronics is currently in an early growth phase, characterized by increasing research activity and emerging commercial applications. The global market for liquid metal electronics is projected to expand significantly, driven by demand for flexible, stretchable, and self-healing electronic devices. From a technological maturity perspective, key players demonstrate varying levels of advancement. Beijing Dream Ink Technology leads in electronic additive manufacturing with its eamp technology, while research institutions like Technical Institute of Physics & Chemistry CAS and Tsinghua Shenzhen International Graduate School are advancing fundamental science. Corporate entities including Intel, Sony, and Xerox are exploring applications in next-generation computing and display technologies. International collaboration between academic institutions and industry partners is accelerating development, with specialized companies like Yunnan Kewei Liquid Metal Valley emerging to bridge research-to-market gaps.

Beijing Dream Ink Technology Co., Ltd.

Technical Solution: Beijing Dream Ink has developed a comprehensive industrial roadmap for liquid metal electronics centered on their proprietary "Direct Liquid Metal Writing" (DLMW) technology. Their approach utilizes gallium-based alloys modified with specific additives to control viscosity and surface tension, enabling direct writing on various substrates without requiring complex equipment. The company's roadmap outlines a three-phase adoption strategy: (1) near-term commercialization of printed sensors and antennas (2022-2024), (2) mid-term development of self-healing circuits and interconnects (2024-2027), and (3) long-term integration with traditional electronics manufacturing (2027-2030). Their technology has been successfully implemented in wearable health monitoring devices, demonstrating superior durability under mechanical deformation compared to conventional flexible electronics. Dream Ink has established manufacturing partnerships with consumer electronics companies and is scaling production to meet growing demand for stretchable electronics in healthcare and IoT applications.

Strengths: Low-cost manufacturing approach reduces barriers to industrial adoption; room-temperature processing compatible with heat-sensitive substrates; self-healing capabilities provide unique advantage for reliability. Weaknesses: Pattern resolution currently limited compared to photolithography techniques; challenges with long-term stability in high-humidity environments; requires specialized handling procedures during manufacturing.

Technical Institute of Physics & Chemistry CAS

Technical Solution: The Technical Institute of Physics & Chemistry of the Chinese Academy of Sciences has pioneered fundamental research in liquid metal electronics with significant industrial applications. Their roadmap centers on their patented "liquid metal enabled electronics" (LMEE) platform that utilizes eutectic gallium-indium (EGaIn) and gallium-indium-tin (Galinstan) alloys. The institute has developed novel surface modification techniques that overcome oxidation issues, enabling stable liquid metal patterns with enhanced electrical performance. Their industrial adoption strategy includes three key phases: (1) immediate commercialization of liquid metal thermal interface materials for electronics cooling (2022-2024), (2) mid-term development of reconfigurable circuits and antennas (2024-2027), and (3) long-term integration with traditional semiconductor manufacturing for hybrid rigid-soft electronics (2027-2030). The institute has established partnerships with electronics manufacturers to implement their cooling solutions in high-performance computing systems, demonstrating 30-40% improved thermal management compared to conventional materials.

Strengths: Strong fundamental research capabilities with extensive patent portfolio; established industrial partnerships accelerate technology transfer; advanced surface modification techniques solve key oxidation challenges. Weaknesses: Some applications still limited by the mechanical stability of liquid metal patterns; scaling production to industrial volumes remains challenging; higher material costs compared to conventional electronics materials.

Critical Patents and Technical Innovations

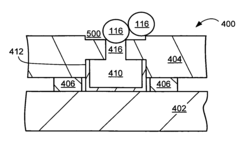

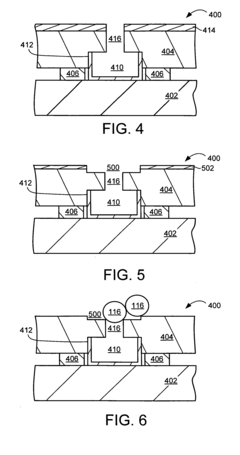

Liquid metal processing and dispensing for liquid metal devices

PatentInactiveUS20050231070A1

Innovation

- A method of manufacturing liquid metal devices by solidifying liquid metal into solid metal balls, which are then liquefied to flow into the device, creating a compact and reliable structure with a long service life, using a temperature-controlled chamber and screens to separate and size the balls, and a wafer bonding process for sealing.

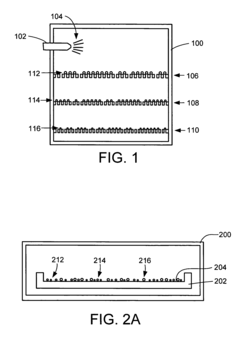

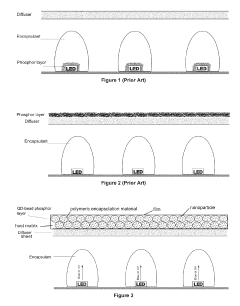

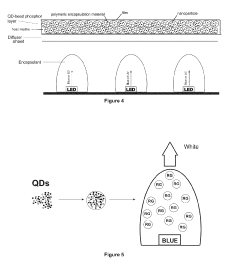

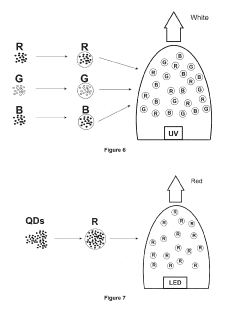

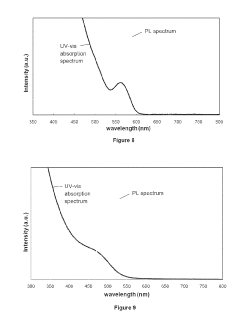

Semiconductor nanoparticle-based light emitting materials

PatentActiveUS20190267515A1

Innovation

- Development of heavy metal-free light emitting layers using semiconductor nanoparticles embedded within a polymeric encapsulation medium, allowing for efficient light emission in the visible spectrum and tunable colors, achieved by encapsulating QDs in beads to enhance stability and processability.

Manufacturing Scalability Challenges

The transition from laboratory research to industrial-scale production represents one of the most significant challenges for liquid metal electronics. Current manufacturing processes for liquid metal-based devices remain largely manual, labor-intensive, and difficult to standardize, creating substantial barriers to mass production and commercial viability.

Pattern transfer techniques, which have been successful for conventional electronics, face unique challenges when applied to liquid metals. The fluid nature of these materials complicates traditional lithographic processes, requiring specialized equipment and modified methodologies. Existing attempts at scaling production have encountered issues with metal oxidation, inconsistent patterning, and substrate compatibility limitations.

Encapsulation technologies present another critical manufacturing hurdle. Liquid metal components require robust containment systems to prevent leakage while maintaining electrical performance. Current encapsulation methods often involve complex multi-step processes that are difficult to automate and scale. The development of standardized, high-throughput encapsulation techniques remains an active research area with significant implications for manufacturing feasibility.

Material handling systems represent a third major challenge. Unlike solid conductors, liquid metals require specialized dispensing equipment, precise temperature control, and contamination prevention measures. The development of automated systems capable of accurately depositing and manipulating liquid metals at industrial scales has progressed slowly, with few commercially viable solutions currently available.

Quality control and testing methodologies for liquid metal electronics also lag behind those for conventional electronics. The dynamic nature of these materials necessitates new approaches to reliability testing, performance verification, and defect identification. Current inspection techniques often fail to detect subtle issues that may affect long-term device performance.

Cost considerations further complicate manufacturing scalability. While gallium-based liquid metals offer performance advantages, their raw material costs exceed those of traditional conductors like copper. Process inefficiencies and material waste during manufacturing further increase production expenses, making it difficult for liquid metal electronics to achieve price competitiveness without significant process optimization.

Addressing these manufacturing challenges requires coordinated efforts across multiple disciplines. Innovations in materials science, equipment design, and process engineering will be essential for developing scalable production methodologies. Strategic partnerships between academic institutions, equipment manufacturers, and electronics producers could accelerate progress toward commercially viable manufacturing solutions for liquid metal electronics.

Pattern transfer techniques, which have been successful for conventional electronics, face unique challenges when applied to liquid metals. The fluid nature of these materials complicates traditional lithographic processes, requiring specialized equipment and modified methodologies. Existing attempts at scaling production have encountered issues with metal oxidation, inconsistent patterning, and substrate compatibility limitations.

Encapsulation technologies present another critical manufacturing hurdle. Liquid metal components require robust containment systems to prevent leakage while maintaining electrical performance. Current encapsulation methods often involve complex multi-step processes that are difficult to automate and scale. The development of standardized, high-throughput encapsulation techniques remains an active research area with significant implications for manufacturing feasibility.

Material handling systems represent a third major challenge. Unlike solid conductors, liquid metals require specialized dispensing equipment, precise temperature control, and contamination prevention measures. The development of automated systems capable of accurately depositing and manipulating liquid metals at industrial scales has progressed slowly, with few commercially viable solutions currently available.

Quality control and testing methodologies for liquid metal electronics also lag behind those for conventional electronics. The dynamic nature of these materials necessitates new approaches to reliability testing, performance verification, and defect identification. Current inspection techniques often fail to detect subtle issues that may affect long-term device performance.

Cost considerations further complicate manufacturing scalability. While gallium-based liquid metals offer performance advantages, their raw material costs exceed those of traditional conductors like copper. Process inefficiencies and material waste during manufacturing further increase production expenses, making it difficult for liquid metal electronics to achieve price competitiveness without significant process optimization.

Addressing these manufacturing challenges requires coordinated efforts across multiple disciplines. Innovations in materials science, equipment design, and process engineering will be essential for developing scalable production methodologies. Strategic partnerships between academic institutions, equipment manufacturers, and electronics producers could accelerate progress toward commercially viable manufacturing solutions for liquid metal electronics.

Environmental and Safety Considerations

The industrial adoption of liquid metal electronics necessitates thorough consideration of environmental and safety aspects throughout the product lifecycle. Gallium-based liquid metals, while offering promising electronic applications, contain elements that require careful handling and disposal protocols. Current research indicates that gallium and its alloys exhibit significantly lower toxicity compared to mercury-based alternatives, positioning them as environmentally preferable options for liquid metal electronics.

Manufacturing processes involving liquid metals present specific challenges regarding worker exposure to metal vapors and potential spills. Implementation of closed-system handling equipment and specialized ventilation systems has proven effective in minimizing these risks. Industry leaders have developed standardized safety protocols that include regular monitoring of workplace air quality and mandatory personal protective equipment when handling liquid metal compounds.

Lifecycle assessment studies reveal that the environmental footprint of liquid metal electronics depends heavily on end-of-life management strategies. The high recoverability rate of gallium (exceeding 85% in controlled recycling environments) presents an opportunity for establishing circular economy models within this emerging industry. Several pioneering manufacturers have already implemented take-back programs for liquid metal components, demonstrating the feasibility of closed-loop systems.

Regulatory frameworks governing liquid metal electronics vary significantly across global markets, creating compliance challenges for international deployment. The European Union's RoHS and REACH regulations currently permit gallium-based liquid metals but require comprehensive documentation of handling procedures and disposal methods. In contrast, North American regulations focus primarily on workplace safety aspects rather than end-product restrictions.

Emerging research on biocompatibility indicates that encapsulated liquid metal systems present minimal leaching risks when properly engineered. This has significant implications for wearable and implantable electronic applications, where direct human contact is unavoidable. However, long-term environmental persistence studies remain limited, highlighting a critical knowledge gap that requires attention before widespread industrial adoption.

Industry consortia have begun developing voluntary standards for environmental stewardship in liquid metal electronics, including guidelines for material sourcing, manufacturing waste reduction, and product recyclability. These initiatives represent important steps toward establishing sustainability benchmarks for this emerging technology sector, though broader regulatory harmonization remains necessary for global market development.

Manufacturing processes involving liquid metals present specific challenges regarding worker exposure to metal vapors and potential spills. Implementation of closed-system handling equipment and specialized ventilation systems has proven effective in minimizing these risks. Industry leaders have developed standardized safety protocols that include regular monitoring of workplace air quality and mandatory personal protective equipment when handling liquid metal compounds.

Lifecycle assessment studies reveal that the environmental footprint of liquid metal electronics depends heavily on end-of-life management strategies. The high recoverability rate of gallium (exceeding 85% in controlled recycling environments) presents an opportunity for establishing circular economy models within this emerging industry. Several pioneering manufacturers have already implemented take-back programs for liquid metal components, demonstrating the feasibility of closed-loop systems.

Regulatory frameworks governing liquid metal electronics vary significantly across global markets, creating compliance challenges for international deployment. The European Union's RoHS and REACH regulations currently permit gallium-based liquid metals but require comprehensive documentation of handling procedures and disposal methods. In contrast, North American regulations focus primarily on workplace safety aspects rather than end-product restrictions.

Emerging research on biocompatibility indicates that encapsulated liquid metal systems present minimal leaching risks when properly engineered. This has significant implications for wearable and implantable electronic applications, where direct human contact is unavoidable. However, long-term environmental persistence studies remain limited, highlighting a critical knowledge gap that requires attention before widespread industrial adoption.

Industry consortia have begun developing voluntary standards for environmental stewardship in liquid metal electronics, including guidelines for material sourcing, manufacturing waste reduction, and product recyclability. These initiatives represent important steps toward establishing sustainability benchmarks for this emerging technology sector, though broader regulatory harmonization remains necessary for global market development.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!