Lithium Hydroxide Recycling: Efficiency In Battery Production

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Hydroxide Recycling Evolution and Objectives

Lithium hydroxide has emerged as a critical component in the production of high-performance lithium-ion batteries, particularly for electric vehicles (EVs) and energy storage systems. The evolution of lithium hydroxide recycling technology can be traced back to the early 2000s when the first commercial lithium-ion batteries began to reach end-of-life status. Initially, recycling efforts focused primarily on recovering cobalt and nickel due to their higher economic value, with lithium recovery being a secondary consideration.

By 2010, as lithium prices began to rise and concerns about resource scarcity emerged, researchers and industry players started developing more sophisticated recycling processes specifically targeting lithium recovery. The period between 2010 and 2015 saw significant advancements in hydrometallurgical and pyrometallurgical techniques for lithium extraction from spent batteries, though efficiency rates remained relatively low at 30-50%.

The technological breakthrough period occurred between 2015 and 2020, when direct recycling methods emerged, allowing for the recovery of battery-grade lithium hydroxide without extensive reprocessing. This coincided with the rapid expansion of the EV market, creating both urgency and economic incentives for more efficient recycling solutions.

Current recycling technologies have evolved to achieve recovery rates of 70-90% for lithium hydroxide, representing a substantial improvement over earlier methods. These advancements have been driven by a combination of regulatory pressures, sustainability initiatives, and economic factors related to lithium supply security.

The primary objectives of modern lithium hydroxide recycling technology development are multifaceted. First, to achieve near-complete (>95%) recovery of lithium from end-of-life batteries while maintaining battery-grade purity standards. Second, to reduce energy consumption and environmental impact of the recycling process itself, as early methods were often energy-intensive and chemical-heavy.

Additional objectives include developing scalable technologies capable of handling the projected surge in spent lithium-ion batteries expected in the coming decade, with estimates suggesting over 2 million tons of lithium-ion batteries reaching end-of-life annually by 2030. There is also a focus on creating flexible recycling systems that can adapt to evolving battery chemistries and formats.

The ultimate goal is to establish a closed-loop system for lithium hydroxide, where recycled materials can directly re-enter the battery production chain with minimal quality degradation, thereby reducing dependence on primary mining operations and associated environmental impacts while supporting the sustainable growth of the electric vehicle and renewable energy storage sectors.

By 2010, as lithium prices began to rise and concerns about resource scarcity emerged, researchers and industry players started developing more sophisticated recycling processes specifically targeting lithium recovery. The period between 2010 and 2015 saw significant advancements in hydrometallurgical and pyrometallurgical techniques for lithium extraction from spent batteries, though efficiency rates remained relatively low at 30-50%.

The technological breakthrough period occurred between 2015 and 2020, when direct recycling methods emerged, allowing for the recovery of battery-grade lithium hydroxide without extensive reprocessing. This coincided with the rapid expansion of the EV market, creating both urgency and economic incentives for more efficient recycling solutions.

Current recycling technologies have evolved to achieve recovery rates of 70-90% for lithium hydroxide, representing a substantial improvement over earlier methods. These advancements have been driven by a combination of regulatory pressures, sustainability initiatives, and economic factors related to lithium supply security.

The primary objectives of modern lithium hydroxide recycling technology development are multifaceted. First, to achieve near-complete (>95%) recovery of lithium from end-of-life batteries while maintaining battery-grade purity standards. Second, to reduce energy consumption and environmental impact of the recycling process itself, as early methods were often energy-intensive and chemical-heavy.

Additional objectives include developing scalable technologies capable of handling the projected surge in spent lithium-ion batteries expected in the coming decade, with estimates suggesting over 2 million tons of lithium-ion batteries reaching end-of-life annually by 2030. There is also a focus on creating flexible recycling systems that can adapt to evolving battery chemistries and formats.

The ultimate goal is to establish a closed-loop system for lithium hydroxide, where recycled materials can directly re-enter the battery production chain with minimal quality degradation, thereby reducing dependence on primary mining operations and associated environmental impacts while supporting the sustainable growth of the electric vehicle and renewable energy storage sectors.

Market Demand Analysis for Recycled Lithium Hydroxide

The global market for recycled lithium hydroxide is experiencing unprecedented growth, driven primarily by the exponential expansion of the electric vehicle (EV) industry. Current projections indicate that the global lithium-ion battery market will reach approximately $129.3 billion by 2027, with a compound annual growth rate of 18.1% from 2020. This surge directly translates to increased demand for lithium hydroxide, a critical component in cathode materials for high-performance batteries.

Battery manufacturers are facing mounting pressure to secure stable lithium hydroxide supplies amid growing concerns about raw material shortages. Industry reports reveal that lithium demand is expected to triple by 2025, creating a significant supply gap that recycling can help address. The recycled lithium hydroxide market specifically is projected to grow at a CAGR of 29.6% through 2030, outpacing the growth rate of primary lithium production.

Environmental regulations are becoming increasingly stringent across major markets, particularly in the European Union where the proposed Battery Directive mandates specific recycling efficiency rates for lithium-ion batteries. Similar regulatory frameworks are emerging in North America and Asia, creating regulatory-driven demand for recycled materials. These regulations typically require 50-70% material recovery rates, establishing a compliance-based market for recycled lithium compounds.

Consumer preferences are shifting noticeably toward sustainably manufactured products. Market research indicates that 73% of global consumers are willing to pay premium prices for products with verifiable sustainability credentials. Major automotive manufacturers including Tesla, Volkswagen, and BMW have publicly committed to increasing the percentage of recycled materials in their battery supply chains, responding directly to this consumer sentiment.

The economic case for lithium hydroxide recycling is strengthening as technology improves. Recent cost analyses demonstrate that recycled lithium hydroxide can achieve price parity with virgin materials when production scales exceed 10,000 metric tons annually. This economic viability is attracting significant investment, with venture capital funding for battery recycling technologies exceeding $3.5 billion in 2022 alone.

Regional market dynamics show varying levels of maturity. China currently dominates the recycling ecosystem with approximately 70% of global capacity, while European and North American markets are experiencing rapid growth from a smaller base. Emerging economies in South America and Southeast Asia represent untapped markets with significant growth potential as domestic EV adoption increases.

The market structure is evolving from fragmented operations toward vertical integration, with battery manufacturers increasingly investing in recycling capabilities to secure material supplies. This trend indicates a maturing market that recognizes recycled lithium hydroxide as a strategic resource rather than merely a waste management solution.

Battery manufacturers are facing mounting pressure to secure stable lithium hydroxide supplies amid growing concerns about raw material shortages. Industry reports reveal that lithium demand is expected to triple by 2025, creating a significant supply gap that recycling can help address. The recycled lithium hydroxide market specifically is projected to grow at a CAGR of 29.6% through 2030, outpacing the growth rate of primary lithium production.

Environmental regulations are becoming increasingly stringent across major markets, particularly in the European Union where the proposed Battery Directive mandates specific recycling efficiency rates for lithium-ion batteries. Similar regulatory frameworks are emerging in North America and Asia, creating regulatory-driven demand for recycled materials. These regulations typically require 50-70% material recovery rates, establishing a compliance-based market for recycled lithium compounds.

Consumer preferences are shifting noticeably toward sustainably manufactured products. Market research indicates that 73% of global consumers are willing to pay premium prices for products with verifiable sustainability credentials. Major automotive manufacturers including Tesla, Volkswagen, and BMW have publicly committed to increasing the percentage of recycled materials in their battery supply chains, responding directly to this consumer sentiment.

The economic case for lithium hydroxide recycling is strengthening as technology improves. Recent cost analyses demonstrate that recycled lithium hydroxide can achieve price parity with virgin materials when production scales exceed 10,000 metric tons annually. This economic viability is attracting significant investment, with venture capital funding for battery recycling technologies exceeding $3.5 billion in 2022 alone.

Regional market dynamics show varying levels of maturity. China currently dominates the recycling ecosystem with approximately 70% of global capacity, while European and North American markets are experiencing rapid growth from a smaller base. Emerging economies in South America and Southeast Asia represent untapped markets with significant growth potential as domestic EV adoption increases.

The market structure is evolving from fragmented operations toward vertical integration, with battery manufacturers increasingly investing in recycling capabilities to secure material supplies. This trend indicates a maturing market that recognizes recycled lithium hydroxide as a strategic resource rather than merely a waste management solution.

Global Lithium Recycling Status and Technical Barriers

The global lithium recycling landscape presents a complex picture of technological advancement, regional disparities, and persistent challenges. Currently, lithium recycling rates remain suboptimal worldwide, with estimates suggesting that less than 5% of lithium-ion batteries undergo comprehensive recycling processes. This low recycling rate represents a significant missed opportunity in the circular economy of battery materials, particularly as demand for lithium continues to surge with the expansion of electric vehicle markets.

Geographically, China leads the global lithium recycling industry, having established advanced industrial-scale facilities that process approximately 70% of the world's recycled lithium materials. The European Union follows with growing recycling infrastructure, driven by stringent regulatory frameworks such as the Battery Directive and the recent Circular Economy Action Plan. North America, despite its technological capabilities, lags behind in terms of operational recycling capacity, though recent investments signal potential growth.

The primary technical barriers to efficient lithium hydroxide recycling begin with collection and sorting challenges. Battery collection systems remain fragmented across regions, with inconsistent protocols for handling, transportation, and storage of end-of-life batteries. The heterogeneity of battery designs further complicates automated sorting processes, as different manufacturers employ varying cathode chemistries and structural configurations.

Preprocessing techniques represent another significant hurdle. Current mechanical separation methods often result in material losses and contamination, reducing the purity and value of recovered materials. The energy-intensive nature of these processes also diminishes the net environmental benefit of recycling operations.

Hydrometallurgical and pyrometallurgical extraction processes, while effective, face efficiency limitations. Hydrometallurgical approaches typically achieve lithium recovery rates between 50-80%, with challenges in selective leaching and separation from other elements. Pyrometallurgical methods, though capable of handling mixed battery inputs, often result in lithium losses to slag phases, with recovery rates rarely exceeding 60% without additional processing steps.

Economic barriers further impede industry growth, as recycling operations struggle to achieve cost competitiveness with primary lithium production. The capital expenditure required for establishing advanced recycling facilities remains prohibitively high, while fluctuating lithium prices create uncertainty for long-term investment planning.

Regulatory inconsistencies across jurisdictions create additional complications. The absence of standardized classification systems for battery waste, varying extended producer responsibility schemes, and divergent safety protocols impede the development of efficient transnational recycling networks. These technical and systemic barriers collectively constrain the scaling of lithium hydroxide recycling, despite its critical importance to sustainable battery production.

Geographically, China leads the global lithium recycling industry, having established advanced industrial-scale facilities that process approximately 70% of the world's recycled lithium materials. The European Union follows with growing recycling infrastructure, driven by stringent regulatory frameworks such as the Battery Directive and the recent Circular Economy Action Plan. North America, despite its technological capabilities, lags behind in terms of operational recycling capacity, though recent investments signal potential growth.

The primary technical barriers to efficient lithium hydroxide recycling begin with collection and sorting challenges. Battery collection systems remain fragmented across regions, with inconsistent protocols for handling, transportation, and storage of end-of-life batteries. The heterogeneity of battery designs further complicates automated sorting processes, as different manufacturers employ varying cathode chemistries and structural configurations.

Preprocessing techniques represent another significant hurdle. Current mechanical separation methods often result in material losses and contamination, reducing the purity and value of recovered materials. The energy-intensive nature of these processes also diminishes the net environmental benefit of recycling operations.

Hydrometallurgical and pyrometallurgical extraction processes, while effective, face efficiency limitations. Hydrometallurgical approaches typically achieve lithium recovery rates between 50-80%, with challenges in selective leaching and separation from other elements. Pyrometallurgical methods, though capable of handling mixed battery inputs, often result in lithium losses to slag phases, with recovery rates rarely exceeding 60% without additional processing steps.

Economic barriers further impede industry growth, as recycling operations struggle to achieve cost competitiveness with primary lithium production. The capital expenditure required for establishing advanced recycling facilities remains prohibitively high, while fluctuating lithium prices create uncertainty for long-term investment planning.

Regulatory inconsistencies across jurisdictions create additional complications. The absence of standardized classification systems for battery waste, varying extended producer responsibility schemes, and divergent safety protocols impede the development of efficient transnational recycling networks. These technical and systemic barriers collectively constrain the scaling of lithium hydroxide recycling, despite its critical importance to sustainable battery production.

Current Lithium Hydroxide Extraction Methodologies

01 Hydrometallurgical processes for lithium hydroxide recovery

Hydrometallurgical processes involve using aqueous solutions to extract lithium hydroxide from various sources. These methods typically include leaching, precipitation, and crystallization steps to separate lithium from impurities. The processes can achieve high recovery rates by optimizing parameters such as temperature, pH, and reaction time. Advanced hydrometallurgical techniques enable efficient recycling of lithium from spent batteries and other lithium-containing waste streams.- Direct recycling methods for lithium hydroxide: Direct recycling methods focus on recovering lithium hydroxide from spent materials with minimal chemical transformation. These processes typically involve mechanical separation, selective leaching, and purification steps to isolate lithium hydroxide directly. This approach minimizes energy consumption and chemical usage while maintaining high recovery rates. The methods often include crushing, sieving, and magnetic separation followed by specific extraction techniques that target lithium compounds.

- Hydrometallurgical processes for lithium hydroxide recovery: Hydrometallurgical processes utilize aqueous solutions to extract and recover lithium hydroxide from various sources. These methods typically involve leaching with acids or bases, followed by precipitation, crystallization, and purification steps. The processes can achieve high efficiency by optimizing parameters such as pH, temperature, and reaction time. Advanced techniques may incorporate selective ion exchange resins or solvent extraction to enhance purity and recovery rates.

- Thermal treatment methods for lithium hydroxide recycling: Thermal treatment methods involve high-temperature processes to recover lithium hydroxide from waste materials. These techniques include calcination, roasting, and pyrometallurgical treatments that transform lithium-containing compounds into forms that are more easily recoverable. The processes often require precise temperature control and may be combined with subsequent hydrometallurgical steps to achieve high efficiency. Energy optimization is crucial for maintaining economic viability of these methods.

- Electrochemical recycling techniques for lithium hydroxide: Electrochemical recycling techniques utilize electrical current to selectively recover lithium hydroxide from waste streams. These methods include electrodeposition, electrodialysis, and electrochemical precipitation processes that can achieve high purity recovery. The techniques often offer advantages in terms of energy efficiency and environmental impact compared to conventional methods. By controlling voltage, current density, and electrolyte composition, these processes can be optimized for maximum lithium hydroxide recovery efficiency.

- Integrated recycling systems for lithium hydroxide from batteries: Integrated recycling systems combine multiple technologies to efficiently recover lithium hydroxide specifically from spent lithium-ion batteries. These comprehensive approaches typically include disassembly, physical separation, chemical treatment, and refining steps in a coordinated process flow. The systems often incorporate automated sorting, mechanical preprocessing, and multiple recovery stages to maximize efficiency. Advanced integrated systems may utilize artificial intelligence for process optimization and quality control to ensure high-purity lithium hydroxide recovery.

02 Direct recycling methods from spent lithium-ion batteries

Direct recycling methods focus on recovering lithium hydroxide directly from spent lithium-ion batteries without extensive chemical transformations. These approaches often involve mechanical separation followed by selective extraction of lithium compounds. The methods preserve the crystal structure of lithium-containing materials, reducing energy consumption and processing steps. Innovations in direct recycling have significantly improved efficiency by minimizing material loss during battery dismantling and separation processes.Expand Specific Solutions03 Electrochemical recovery techniques

Electrochemical techniques utilize electrical current to selectively recover lithium hydroxide from solution. These methods employ specialized electrodes and membrane systems to concentrate lithium ions and convert them to lithium hydroxide. Electrochemical recovery offers advantages in terms of purity of the recovered product and reduced chemical consumption. Recent innovations have focused on improving energy efficiency and electrode durability to enhance the economic viability of these processes.Expand Specific Solutions04 Thermal treatment and pyrometallurgical processes

Thermal treatment and pyrometallurgical processes involve high-temperature operations to recover lithium hydroxide from various sources. These methods typically include calcination, smelting, and reduction steps to convert lithium compounds into recoverable forms. The high-temperature approach can effectively handle mixed material streams and achieve high throughput. Process innovations have focused on reducing energy consumption and improving the selectivity of lithium recovery from complex waste materials.Expand Specific Solutions05 Integrated closed-loop recycling systems

Integrated closed-loop systems combine multiple recovery techniques to maximize lithium hydroxide recycling efficiency. These comprehensive approaches incorporate preprocessing, extraction, purification, and conversion steps within a single operational framework. By integrating various technologies, these systems minimize waste generation and maximize resource recovery. Advanced process control and optimization strategies enable these systems to adapt to varying feed compositions while maintaining high recovery rates and product quality.Expand Specific Solutions

Key Industry Players in Battery Recycling Ecosystem

The lithium hydroxide recycling market is currently in a growth phase, driven by increasing demand for sustainable battery production solutions. The global market size is expanding rapidly, projected to reach significant scale as electric vehicle adoption accelerates. Technologically, the field shows varying maturity levels across different approaches. Leading companies like Guangdong Bangpu Recycling Technology (CATL subsidiary) and Northvolt Revolt are pioneering advanced recycling methods with commercial-scale operations, while Tesla and LG Energy Solution are integrating recycling into their battery production ecosystems. Research institutions like Xiamen University and Rice University are developing next-generation techniques. Emerging players such as Li Industries and 24M Technologies are introducing innovative approaches to improve efficiency and reduce environmental impact, creating a competitive landscape that balances established industrial players with technology-focused entrants.

Guangdong Bangpu Recycling Technology Co., Ltd.

Technical Solution: Guangdong Bangpu has developed a comprehensive lithium hydroxide recycling system specifically designed for lithium-ion battery production. Their technology employs a direct regeneration process that extracts lithium hydroxide from spent batteries with minimal chemical transformation steps. The process begins with mechanical pre-treatment including crushing and sorting, followed by a hydrometallurgical approach using selective leaching agents to isolate lithium compounds. Their proprietary precipitation method achieves lithium hydroxide with purity exceeding 99.5%, suitable for direct reuse in new battery cathode materials. The company has implemented a closed-loop water system that reduces water consumption by approximately 40% compared to conventional methods, while their energy-efficient thermal treatment reduces carbon emissions by an estimated 30% per ton of processed material.

Strengths: High recovery rate (>95%) of lithium from spent batteries with battery-grade purity output. Integrated production line reduces transportation costs and carbon footprint. Weaknesses: Process requires significant initial capital investment and specialized equipment that may limit scalability for smaller operations. Technology is more effective with certain battery chemistries than others.|

SK Innovation Co., Ltd.

Technical Solution: SK Innovation has pioneered an advanced lithium hydroxide recycling technology called "SK Closed-Loop System" that focuses on direct extraction from battery production waste and end-of-life batteries. Their process utilizes a selective leaching technique with proprietary solvents that specifically target lithium compounds while minimizing contamination from other metals. The technology incorporates a multi-stage purification process including solvent extraction, ion exchange, and crystallization to produce battery-grade lithium hydroxide with purity levels exceeding 99.9%. SK Innovation's system is particularly notable for its ability to process mixed cathode chemistries without pre-sorting, significantly reducing preprocessing costs. The company has reported energy consumption reductions of approximately 35% compared to primary lithium hydroxide production methods, with water usage reduced by nearly 70% through advanced recycling systems. Their pilot plant has demonstrated capacity to recover over 80 tons of lithium hydroxide annually from battery manufacturing scrap.

Strengths: Highly efficient process with minimal chemical waste generation and ability to handle mixed battery chemistries. Lower operating costs compared to traditional recycling methods due to reduced energy and reagent consumption. Weaknesses: Technology requires sophisticated control systems and specialized expertise. Process economics still depend on sufficient scale and consistent feedstock quality.|

Critical Patents in Lithium Recovery Processes

Method of direct lithium hydroxide production from lithium-ion battery waste

PatentPendingUS20250154017A1

Innovation

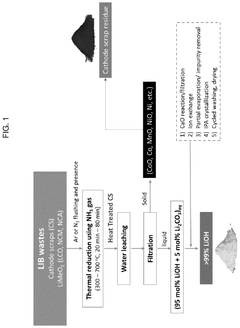

- A method involving the thermo-chemical reduction of LIB waste cathode scraps using ammonia gas (NH3) as a reducing agent, followed by water leaching to selectively extract lithium as lithium hydroxide (LiOH), achieving high lithium leaching efficiency exceeding 90%.

Method for recovering active metal of lithium secondary battery

PatentWO2019199015A1

Innovation

- A method involving hydrogen reduction and water washing of a waste lithium-containing mixture to produce high-purity lithium hydroxide as a precursor, using a fluidized bed reactor and nitrogen-purged conditions to separate and purify lithium from transition metals, thereby enhancing the selectivity and purity of the lithium precursor.

Environmental Impact Assessment of Recycling Processes

The recycling of lithium hydroxide in battery production presents significant environmental implications that warrant comprehensive assessment. Traditional lithium extraction methods involve extensive mining operations that result in habitat destruction, soil degradation, and water pollution. By contrast, recycling processes offer substantial environmental benefits, potentially reducing the ecological footprint of battery production by up to 70% compared to primary extraction methods.

Water consumption represents a critical environmental factor in lithium hydroxide recycling. Conventional extraction techniques may require up to 500,000 gallons of water per ton of lithium produced, whereas advanced recycling technologies have demonstrated reductions to approximately 200,000 gallons per ton. This water efficiency becomes particularly significant in water-stressed regions where lithium processing facilities often operate.

Carbon emissions associated with lithium hydroxide recycling processes vary considerably depending on the technology employed. Hydrometallurgical approaches typically generate 2.5-3.5 tons of CO2 equivalent per ton of recycled lithium hydroxide, while pyrometallurgical methods may produce 4.0-5.5 tons. These figures compare favorably against the 15-20 tons of CO2 equivalent typically associated with primary lithium production.

Chemical waste management presents another environmental dimension requiring assessment. Recycling processes utilizing organic solvents generate hazardous waste streams that necessitate specialized treatment. Recent innovations in solvent-free recycling technologies have demonstrated potential reductions in hazardous waste generation by approximately 60%, though these approaches remain in early commercial deployment phases.

Energy consumption metrics indicate that lithium hydroxide recycling requires between 5-8 MWh per ton of recovered material, representing approximately 35-45% of the energy required for primary production. The environmental impact of this energy consumption depends significantly on the regional energy mix, with facilities powered by renewable energy demonstrating substantially lower lifecycle emissions.

Land use impacts of recycling facilities are considerably less extensive than those of mining operations. A typical recycling facility processing 10,000 tons of battery materials annually requires approximately 5-7 hectares of land, compared to lithium mining operations that may disturb hundreds or thousands of hectares for equivalent production volumes.

Comprehensive lifecycle assessment studies indicate that optimized lithium hydroxide recycling processes can achieve net environmental benefits within 2-3 years of operation when compared to primary production methods. These assessments typically consider factors including resource depletion, ecosystem toxicity, and human health impacts across the entire value chain.

Water consumption represents a critical environmental factor in lithium hydroxide recycling. Conventional extraction techniques may require up to 500,000 gallons of water per ton of lithium produced, whereas advanced recycling technologies have demonstrated reductions to approximately 200,000 gallons per ton. This water efficiency becomes particularly significant in water-stressed regions where lithium processing facilities often operate.

Carbon emissions associated with lithium hydroxide recycling processes vary considerably depending on the technology employed. Hydrometallurgical approaches typically generate 2.5-3.5 tons of CO2 equivalent per ton of recycled lithium hydroxide, while pyrometallurgical methods may produce 4.0-5.5 tons. These figures compare favorably against the 15-20 tons of CO2 equivalent typically associated with primary lithium production.

Chemical waste management presents another environmental dimension requiring assessment. Recycling processes utilizing organic solvents generate hazardous waste streams that necessitate specialized treatment. Recent innovations in solvent-free recycling technologies have demonstrated potential reductions in hazardous waste generation by approximately 60%, though these approaches remain in early commercial deployment phases.

Energy consumption metrics indicate that lithium hydroxide recycling requires between 5-8 MWh per ton of recovered material, representing approximately 35-45% of the energy required for primary production. The environmental impact of this energy consumption depends significantly on the regional energy mix, with facilities powered by renewable energy demonstrating substantially lower lifecycle emissions.

Land use impacts of recycling facilities are considerably less extensive than those of mining operations. A typical recycling facility processing 10,000 tons of battery materials annually requires approximately 5-7 hectares of land, compared to lithium mining operations that may disturb hundreds or thousands of hectares for equivalent production volumes.

Comprehensive lifecycle assessment studies indicate that optimized lithium hydroxide recycling processes can achieve net environmental benefits within 2-3 years of operation when compared to primary production methods. These assessments typically consider factors including resource depletion, ecosystem toxicity, and human health impacts across the entire value chain.

Regulatory Framework for Battery Material Recovery

The regulatory landscape for battery material recovery is rapidly evolving as governments worldwide recognize the strategic importance of lithium and other critical battery materials. The European Union leads with its Battery Directive and the more recent European Green Deal, which mandates specific recovery rates for lithium (70% by 2030) and establishes extended producer responsibility frameworks. These regulations create a legal obligation for manufacturers to finance and implement end-of-life management solutions for lithium-ion batteries.

In North America, regulations vary by jurisdiction, with California's AB 2832 establishing a Lithium-ion Car Battery Recycling Advisory Group to develop policy recommendations. At the federal level, the U.S. Department of Energy's ReCell Center focuses on developing cost-effective recycling processes, while the Infrastructure Investment and Jobs Act of 2021 allocates significant funding for battery material recovery research and implementation.

Asian markets present a diverse regulatory approach. China's policy framework includes the "New Energy Vehicle Industry Development Plan" which emphasizes a circular economy for battery materials. Japan implements the Act on Recycling of Specified Kinds of Home Appliances, which has been expanded to include lithium-ion batteries, while South Korea's Resource Circulation Act establishes collection and recycling targets.

Emerging international standards are creating consistency across markets. The ISO/TC 333 committee is developing standards specifically for lithium recovery from end-of-life batteries, while the Global Battery Alliance is working on a "battery passport" system to track materials throughout the value chain, facilitating regulatory compliance and material recovery.

Compliance challenges remain significant for industry participants. The complex and fragmented nature of regulations across different jurisdictions creates operational difficulties for global manufacturers. Traceability requirements demand sophisticated tracking systems, while varying recovery rate targets necessitate continuous technological innovation to meet increasingly stringent standards.

Future regulatory trends point toward harmonization of international standards, implementation of carbon footprint requirements for battery production, and the development of more comprehensive extended producer responsibility schemes. These evolving frameworks will likely drive increased investment in lithium hydroxide recovery technologies and create market advantages for companies that develop efficient recycling processes.

In North America, regulations vary by jurisdiction, with California's AB 2832 establishing a Lithium-ion Car Battery Recycling Advisory Group to develop policy recommendations. At the federal level, the U.S. Department of Energy's ReCell Center focuses on developing cost-effective recycling processes, while the Infrastructure Investment and Jobs Act of 2021 allocates significant funding for battery material recovery research and implementation.

Asian markets present a diverse regulatory approach. China's policy framework includes the "New Energy Vehicle Industry Development Plan" which emphasizes a circular economy for battery materials. Japan implements the Act on Recycling of Specified Kinds of Home Appliances, which has been expanded to include lithium-ion batteries, while South Korea's Resource Circulation Act establishes collection and recycling targets.

Emerging international standards are creating consistency across markets. The ISO/TC 333 committee is developing standards specifically for lithium recovery from end-of-life batteries, while the Global Battery Alliance is working on a "battery passport" system to track materials throughout the value chain, facilitating regulatory compliance and material recovery.

Compliance challenges remain significant for industry participants. The complex and fragmented nature of regulations across different jurisdictions creates operational difficulties for global manufacturers. Traceability requirements demand sophisticated tracking systems, while varying recovery rate targets necessitate continuous technological innovation to meet increasingly stringent standards.

Future regulatory trends point toward harmonization of international standards, implementation of carbon footprint requirements for battery production, and the development of more comprehensive extended producer responsibility schemes. These evolving frameworks will likely drive increased investment in lithium hydroxide recovery technologies and create market advantages for companies that develop efficient recycling processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!