Lithium Hydroxide Vs Lithium Carbonate: Efficiency In Batteries

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Battery Materials Evolution and Objectives

The evolution of lithium battery materials has undergone significant transformation since the commercialization of lithium-ion batteries by Sony in 1991. Initially, these batteries utilized lithium cobalt oxide (LCO) as cathode material paired with graphite anodes. The subsequent decades witnessed the development of alternative cathode materials including lithium manganese oxide (LMO), lithium iron phosphate (LFP), and lithium nickel manganese cobalt oxide (NMC) to address limitations in energy density, safety, and cost.

A critical aspect of this evolution has been the precursor materials used in battery production, particularly the comparison between lithium hydroxide (LiOH) and lithium carbonate (Li₂CO₃). Historically, lithium carbonate dominated the market due to its lower production costs and established extraction methods. However, the industry has been progressively shifting toward lithium hydroxide, especially for high-nickel cathode formulations that require higher sintering temperatures.

The technical objectives driving this evolution center around enhancing energy density, improving charging rates, extending cycle life, and reducing costs. Energy density improvements have been particularly crucial for electric vehicle applications, where the weight and volume constraints directly impact vehicle range. The industry has achieved approximately 5-8% annual improvements in energy density over the past decade through material innovations.

Safety considerations have also shaped material evolution objectives, with thermal stability being a paramount concern. The thermal decomposition characteristics of different lithium compounds significantly influence battery safety profiles, pushing research toward more stable material compositions and structures.

Cost reduction remains a persistent objective, with raw material expenses constituting approximately 60-70% of battery cell costs. The industry aims to reduce dependency on expensive elements like cobalt while maintaining or improving performance metrics. This has accelerated research into cobalt-free cathodes and alternative lithium sources.

Looking forward, the technical roadmap focuses on solid-state electrolytes, silicon-composite anodes, and high-nickel/low-cobalt cathodes. The efficiency comparison between lithium hydroxide and lithium carbonate becomes increasingly relevant in this context, as next-generation battery chemistries may have different precursor requirements and processing parameters.

The overarching goal is to achieve batteries with energy densities exceeding 400 Wh/kg at the cell level (compared to current 250-300 Wh/kg), charging times under 10 minutes, cycle life beyond 1,000 full cycles, and costs below $100/kWh—all while maintaining stringent safety standards and reducing environmental impact throughout the supply chain.

A critical aspect of this evolution has been the precursor materials used in battery production, particularly the comparison between lithium hydroxide (LiOH) and lithium carbonate (Li₂CO₃). Historically, lithium carbonate dominated the market due to its lower production costs and established extraction methods. However, the industry has been progressively shifting toward lithium hydroxide, especially for high-nickel cathode formulations that require higher sintering temperatures.

The technical objectives driving this evolution center around enhancing energy density, improving charging rates, extending cycle life, and reducing costs. Energy density improvements have been particularly crucial for electric vehicle applications, where the weight and volume constraints directly impact vehicle range. The industry has achieved approximately 5-8% annual improvements in energy density over the past decade through material innovations.

Safety considerations have also shaped material evolution objectives, with thermal stability being a paramount concern. The thermal decomposition characteristics of different lithium compounds significantly influence battery safety profiles, pushing research toward more stable material compositions and structures.

Cost reduction remains a persistent objective, with raw material expenses constituting approximately 60-70% of battery cell costs. The industry aims to reduce dependency on expensive elements like cobalt while maintaining or improving performance metrics. This has accelerated research into cobalt-free cathodes and alternative lithium sources.

Looking forward, the technical roadmap focuses on solid-state electrolytes, silicon-composite anodes, and high-nickel/low-cobalt cathodes. The efficiency comparison between lithium hydroxide and lithium carbonate becomes increasingly relevant in this context, as next-generation battery chemistries may have different precursor requirements and processing parameters.

The overarching goal is to achieve batteries with energy densities exceeding 400 Wh/kg at the cell level (compared to current 250-300 Wh/kg), charging times under 10 minutes, cycle life beyond 1,000 full cycles, and costs below $100/kWh—all while maintaining stringent safety standards and reducing environmental impact throughout the supply chain.

Market Analysis of Lithium Compounds in Battery Industry

The global lithium compounds market for battery applications has experienced unprecedented growth, driven primarily by the rapid expansion of electric vehicle (EV) production and increasing adoption of energy storage systems. The market value of lithium compounds specifically for battery applications reached approximately $7.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 18.3% through 2030. This remarkable growth trajectory is reshaping the dynamics of both the mining and battery manufacturing sectors.

Lithium hydroxide (LiOH) and lithium carbonate (Li₂CO₃) represent the two dominant lithium compounds in the battery industry, together accounting for over 90% of lithium usage in battery cathode materials. Historically, lithium carbonate has been the predominant compound, but market trends show a significant shift toward lithium hydroxide, particularly for high-performance applications. This transition is evidenced by the price premium that lithium hydroxide commands, typically 15-20% higher than lithium carbonate in global markets.

Demand segmentation reveals distinct patterns across different battery chemistries. Lithium iron phosphate (LFP) batteries exclusively utilize lithium carbonate, while nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) chemistries increasingly favor lithium hydroxide, especially in higher nickel formulations. This differentiation has created two parallel market trajectories with varying growth rates and supply chain considerations.

Regional analysis shows China dominating the processing capacity for both compounds, controlling approximately 60% of global lithium hydroxide production and 75% of lithium carbonate refining. However, significant investments are underway in Australia, North America, and Europe to diversify the supply chain, with over $12 billion committed to new lithium processing facilities between 2022 and 2025.

Supply constraints remain a critical market factor, with lithium hydroxide facing more severe production bottlenecks due to its more complex manufacturing process. This has resulted in periodic price volatility, with spot prices for battery-grade lithium hydroxide reaching historic highs of $78,000 per tonne in late 2022, before moderating in 2023.

Consumer preferences and regulatory frameworks are increasingly influencing market dynamics. Automotive manufacturers are making strategic decisions between NMC/NCA (requiring lithium hydroxide) and LFP (using lithium carbonate) based on performance requirements, cost considerations, and regional supply security. Meanwhile, government initiatives promoting domestic battery supply chains in North America and Europe are reshaping traditional market flows and creating new demand centers outside of Asia.

Lithium hydroxide (LiOH) and lithium carbonate (Li₂CO₃) represent the two dominant lithium compounds in the battery industry, together accounting for over 90% of lithium usage in battery cathode materials. Historically, lithium carbonate has been the predominant compound, but market trends show a significant shift toward lithium hydroxide, particularly for high-performance applications. This transition is evidenced by the price premium that lithium hydroxide commands, typically 15-20% higher than lithium carbonate in global markets.

Demand segmentation reveals distinct patterns across different battery chemistries. Lithium iron phosphate (LFP) batteries exclusively utilize lithium carbonate, while nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) chemistries increasingly favor lithium hydroxide, especially in higher nickel formulations. This differentiation has created two parallel market trajectories with varying growth rates and supply chain considerations.

Regional analysis shows China dominating the processing capacity for both compounds, controlling approximately 60% of global lithium hydroxide production and 75% of lithium carbonate refining. However, significant investments are underway in Australia, North America, and Europe to diversify the supply chain, with over $12 billion committed to new lithium processing facilities between 2022 and 2025.

Supply constraints remain a critical market factor, with lithium hydroxide facing more severe production bottlenecks due to its more complex manufacturing process. This has resulted in periodic price volatility, with spot prices for battery-grade lithium hydroxide reaching historic highs of $78,000 per tonne in late 2022, before moderating in 2023.

Consumer preferences and regulatory frameworks are increasingly influencing market dynamics. Automotive manufacturers are making strategic decisions between NMC/NCA (requiring lithium hydroxide) and LFP (using lithium carbonate) based on performance requirements, cost considerations, and regional supply security. Meanwhile, government initiatives promoting domestic battery supply chains in North America and Europe are reshaping traditional market flows and creating new demand centers outside of Asia.

Technical Comparison and Limitations of Li2CO3 vs LiOH

Lithium carbonate (Li2CO3) and lithium hydroxide (LiOH) serve as critical precursors in lithium-ion battery cathode production, yet they exhibit distinct technical characteristics that significantly impact battery performance. Li2CO3 has historically been the dominant precursor due to its established production processes and lower manufacturing costs. However, its conversion efficiency in high-nickel cathode materials is notably lower than LiOH, requiring additional energy-intensive processing steps that can introduce impurities and reduce final product quality.

LiOH demonstrates superior technical performance in several key aspects. When used in nickel-rich cathodes (NMC811, NCA), LiOH enables higher energy density batteries with improved cycle life. The reaction kinetics of LiOH are more favorable, allowing for lower synthesis temperatures (650-700°C compared to 800-850°C for Li2CO3), which reduces energy consumption and minimizes unwanted side reactions during cathode material production.

The crystalline structure of cathode materials synthesized using LiOH typically shows better uniformity and fewer defects, contributing to enhanced electrochemical stability and reduced capacity fade during cycling. This translates to batteries with longer operational lifespans and more stable performance characteristics, particularly under high discharge rate conditions.

A significant limitation of Li2CO3 is its decomposition behavior during high-temperature processing, which releases CO2 that can create structural defects in cathode materials. These defects become particularly problematic in high-nickel formulations, where structural stability is already challenging to maintain. LiOH avoids this issue by releasing only water vapor during decomposition, resulting in fewer structural imperfections.

From a production efficiency standpoint, LiOH enables more streamlined manufacturing processes with fewer steps and lower energy requirements. However, this advantage is partially offset by LiOH's higher hygroscopic nature, which necessitates more stringent handling and storage conditions to prevent moisture absorption and degradation.

The technical gap between these precursors becomes most apparent in next-generation battery chemistries. For high-voltage cathodes operating above 4.3V, materials synthesized with LiOH demonstrate significantly better capacity retention and thermal stability. Similarly, in silicon-based anode systems, batteries utilizing LiOH-derived cathodes show reduced interfacial resistance growth over extended cycling.

Despite LiOH's technical advantages, Li2CO3 maintains relevance in specific applications, particularly in LFP (lithium iron phosphate) cathodes where the benefits of LiOH are less pronounced and the lower cost of Li2CO3 becomes the determining factor. The choice between these precursors ultimately depends on the specific battery chemistry, performance requirements, and economic considerations of the end application.

LiOH demonstrates superior technical performance in several key aspects. When used in nickel-rich cathodes (NMC811, NCA), LiOH enables higher energy density batteries with improved cycle life. The reaction kinetics of LiOH are more favorable, allowing for lower synthesis temperatures (650-700°C compared to 800-850°C for Li2CO3), which reduces energy consumption and minimizes unwanted side reactions during cathode material production.

The crystalline structure of cathode materials synthesized using LiOH typically shows better uniformity and fewer defects, contributing to enhanced electrochemical stability and reduced capacity fade during cycling. This translates to batteries with longer operational lifespans and more stable performance characteristics, particularly under high discharge rate conditions.

A significant limitation of Li2CO3 is its decomposition behavior during high-temperature processing, which releases CO2 that can create structural defects in cathode materials. These defects become particularly problematic in high-nickel formulations, where structural stability is already challenging to maintain. LiOH avoids this issue by releasing only water vapor during decomposition, resulting in fewer structural imperfections.

From a production efficiency standpoint, LiOH enables more streamlined manufacturing processes with fewer steps and lower energy requirements. However, this advantage is partially offset by LiOH's higher hygroscopic nature, which necessitates more stringent handling and storage conditions to prevent moisture absorption and degradation.

The technical gap between these precursors becomes most apparent in next-generation battery chemistries. For high-voltage cathodes operating above 4.3V, materials synthesized with LiOH demonstrate significantly better capacity retention and thermal stability. Similarly, in silicon-based anode systems, batteries utilizing LiOH-derived cathodes show reduced interfacial resistance growth over extended cycling.

Despite LiOH's technical advantages, Li2CO3 maintains relevance in specific applications, particularly in LFP (lithium iron phosphate) cathodes where the benefits of LiOH are less pronounced and the lower cost of Li2CO3 becomes the determining factor. The choice between these precursors ultimately depends on the specific battery chemistry, performance requirements, and economic considerations of the end application.

Current Production Methods and Performance Metrics

01 Production methods for lithium compounds

Various methods for producing lithium hydroxide and lithium carbonate with improved efficiency have been developed. These include direct conversion processes from lithium-containing raw materials, optimized precipitation techniques, and innovative extraction methods. These production methods aim to increase yield, reduce energy consumption, and minimize waste generation during the manufacturing of lithium compounds essential for battery applications.- Production methods for lithium hydroxide from lithium carbonate: Various methods have been developed to efficiently convert lithium carbonate to lithium hydroxide, which is a critical process in lithium battery manufacturing. These methods include precipitation techniques, electrochemical processes, and direct conversion using calcium hydroxide. The efficiency of these conversion processes significantly impacts production costs and environmental footprint of lithium compounds used in battery applications.

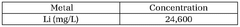

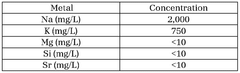

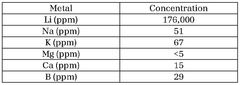

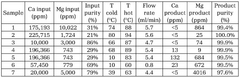

- Purification techniques for lithium compounds: Advanced purification methods for lithium hydroxide and lithium carbonate are essential for achieving battery-grade materials. These techniques include recrystallization, ion exchange, solvent extraction, and membrane filtration processes that remove impurities such as sodium, calcium, magnesium and other metal ions. Higher purity levels directly correlate with improved battery performance and longevity.

- Energy efficiency in lithium compound processing: Energy consumption during lithium hydroxide and lithium carbonate production represents a significant cost factor and environmental consideration. Innovations focus on reducing thermal energy requirements through process optimization, heat recovery systems, and alternative reaction pathways. Lower temperature processes and catalytic approaches have demonstrated substantial improvements in energy efficiency while maintaining product quality.

- Direct lithium extraction technologies: Novel direct lithium extraction (DLE) technologies are being developed to efficiently obtain lithium compounds from brine resources and other sources. These methods offer advantages over traditional evaporation techniques, including faster processing times, higher recovery rates, and reduced environmental impact. Selective adsorption materials, ion exchange resins, and electrochemical systems enable more efficient production of lithium hydroxide and carbonate.

- Comparative efficiency of lithium hydroxide vs. lithium carbonate in battery applications: Research comparing the performance efficiency of lithium hydroxide versus lithium carbonate in battery cathode materials shows significant differences. Lithium hydroxide generally enables higher-nickel cathode chemistries and requires lower processing temperatures, resulting in energy savings and improved battery performance. The choice between these compounds impacts manufacturing efficiency, battery energy density, cycle life, and overall production costs.

02 Purification techniques for lithium compounds

Advanced purification techniques have been developed to enhance the quality and efficiency of lithium hydroxide and lithium carbonate production. These techniques include selective crystallization, membrane filtration, ion exchange processes, and solvent extraction methods. Purification is crucial for removing impurities that can negatively impact the performance of lithium compounds in battery applications and other industrial uses.Expand Specific Solutions03 Conversion processes between lithium hydroxide and lithium carbonate

Efficient conversion processes between lithium hydroxide and lithium carbonate have been developed to meet varying market demands. These processes include optimized reaction conditions, catalytic methods, and continuous flow systems that allow for the interconversion of these compounds with minimal energy consumption and high yield. The ability to efficiently convert between these compounds provides flexibility in lithium compound production.Expand Specific Solutions04 Recovery and recycling of lithium compounds

Methods for recovering and recycling lithium compounds from various sources, including spent batteries and industrial waste streams, have been developed to improve overall efficiency and sustainability. These methods include hydrometallurgical processes, selective precipitation, and electrochemical techniques that enable the recovery of high-purity lithium hydroxide and lithium carbonate. Recycling reduces the need for primary lithium extraction and minimizes environmental impact.Expand Specific Solutions05 Energy-efficient processing of lithium compounds

Energy-efficient processing techniques for lithium hydroxide and lithium carbonate production have been developed to reduce operational costs and environmental impact. These include low-temperature synthesis routes, microwave-assisted processes, and optimized reactor designs that minimize energy consumption while maintaining high product quality. Energy efficiency is a critical factor in the economic viability of lithium compound production for battery applications.Expand Specific Solutions

Key Manufacturers and Supply Chain Analysis

The lithium battery market is experiencing rapid growth, currently in a mature expansion phase with increasing demand for high-performance energy storage solutions. The global market size for lithium battery materials is projected to reach significant scale as electric vehicle adoption accelerates. Regarding technical efficiency, lithium hydroxide is emerging as the preferred precursor for high-nickel cathode materials over traditional lithium carbonate due to superior performance characteristics. Leading players like LG Energy Solution, Panasonic Energy, and CATL (Ningde Amperex Technology) are investing heavily in lithium hydroxide processing capabilities, while companies such as Sumitomo Chemical, Tanaka Chemical, and StoreDot are advancing material innovations to enhance battery efficiency. Traditional electronics manufacturers like Toshiba, Sony, and Hitachi are leveraging their expertise to develop next-generation battery technologies with improved energy density and charging capabilities.

Ningde Amperex Technology Ltd.

Technical Solution: CATL (Ningde Amperex Technology) has pioneered a hybrid approach that strategically utilizes both lithium hydroxide and lithium carbonate in their battery production. Their technology selectively employs lithium hydroxide for high-nickel cathode materials (NCM811, NCA) where its superior reactivity at lower temperatures provides significant advantages. For their LFP (lithium iron phosphate) batteries, they've optimized lithium carbonate usage, recognizing its cost-effectiveness and stability benefits in this chemistry. CATL has developed a proprietary pre-lithiation technique that compensates for lithium loss during cycling, which is particularly effective when combined with lithium hydroxide in high-energy density applications. Their research demonstrates that this selective application approach results in a 15-20% improvement in energy density for high-nickel batteries while maintaining cost efficiency across their product portfolio.

Strengths: Versatile technology platform that optimizes material selection based on specific battery chemistry requirements, balancing performance and cost. Their approach allows for supply chain flexibility by utilizing both precursor materials. Weaknesses: More complex manufacturing processes requiring separate supply chains and production lines for different battery chemistries, potentially increasing operational complexity.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced battery technologies that utilize both lithium hydroxide and lithium carbonate as cathode precursors. Their proprietary manufacturing process optimizes the use of lithium hydroxide for high-nickel cathodes (NCM and NCA) which enables higher energy density batteries. Their research shows that lithium hydroxide produces cathode materials with more uniform particle size distribution and better electrochemical performance compared to lithium carbonate-based processes. LG has implemented a direct precipitation method that reduces impurities in the final cathode material when using lithium hydroxide, resulting in batteries with longer cycle life and improved thermal stability. Their data indicates up to 10% higher capacity retention after 1000 cycles when using lithium hydroxide-based cathodes compared to lithium carbonate alternatives.

Strengths: Superior performance in high-nickel cathodes, better cycle life, and improved thermal stability. Their process requires lower reaction temperatures with lithium hydroxide, reducing energy consumption during manufacturing. Weaknesses: Higher raw material costs for battery-grade lithium hydroxide compared to lithium carbonate, and greater sensitivity to moisture during production processes.

Critical Patents in Lithium Hydroxide Processing

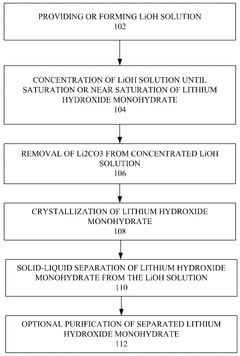

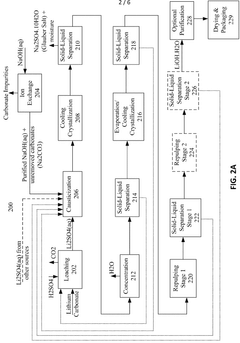

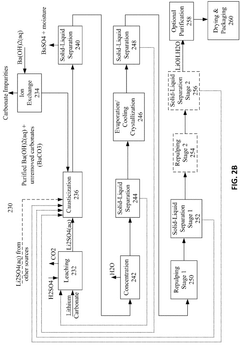

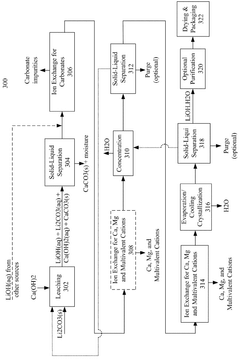

Process to produce battery grade lithium hydroxide monohydrate with low content of carbonate

PatentWO2025058985A1

Innovation

- A process involving the formation of a concentrated lithium hydroxide solution, removal of lithium carbonate through solid-liquid separation, crystallization of lithium hydroxide monohydrate, and subsequent separation to achieve low carbonate content.

Lithium purification process

PatentWO2025120543A1

Innovation

- A simplified and cost-effective lithium purification process involving a two-vessel continuous-loop crystallization method that achieves high-purity lithium carbonate (99.9 wt%) from crude lithium carbonate in a single step, reducing the need for pre-processing and reagents.

Environmental Impact Assessment of Production Processes

The production processes of lithium hydroxide and lithium carbonate present distinct environmental footprints that significantly influence their sustainability profiles in battery manufacturing. Lithium hydroxide production typically follows two main routes: the traditional lime method and the newer electrolysis process. The lime method involves reacting lithium carbonate with calcium hydroxide, generating substantial calcium carbonate waste—approximately 1.5 tons per ton of lithium hydroxide produced. This waste requires proper disposal and contributes to land use challenges.

Conversely, lithium carbonate production primarily utilizes brine evaporation or hard-rock mining methods. Brine evaporation, while energy-efficient, consumes approximately 500,000 gallons of water per ton of lithium carbonate, placing immense pressure on water resources in often arid regions like the "Lithium Triangle" of South America. Hard-rock mining for lithium carbonate generates significant overburden and tailings, with estimates suggesting 15-20 tons of waste rock per ton of lithium carbonate.

Carbon emissions profiles differ markedly between these compounds. Lithium hydroxide production via the traditional route emits approximately 15-20 tons of CO₂ equivalent per ton of product, while newer electrolysis methods have reduced this to 5-7 tons. Lithium carbonate production generates 9-12 tons of CO₂ equivalent per ton when derived from hard rock, and 3-5 tons when extracted from brines, demonstrating a lower carbon footprint in certain production scenarios.

Water consumption metrics reveal lithium hydroxide production requires 50-70 cubic meters of water per ton using conventional methods, while lithium carbonate from brine operations consumes 200-400 cubic meters per ton—a substantial difference with implications for water-stressed regions. Energy requirements also diverge, with lithium hydroxide production demanding 25-40 GJ/ton compared to lithium carbonate's 10-15 GJ/ton from brine operations.

Recent technological innovations are addressing these environmental concerns. Closed-loop water systems in lithium hydroxide production have demonstrated 60-70% reductions in freshwater requirements. Direct lithium extraction technologies for lithium carbonate are showing promise in reducing land footprint by 70% and water consumption by up to 90% compared to traditional evaporation ponds, though these remain in early commercial deployment phases.

The environmental assessment must also consider end-of-life implications, as lithium hydroxide-based batteries typically offer enhanced recyclability due to simpler cathode chemistry decomposition, potentially reducing the lifecycle environmental impact despite higher initial production footprints.

Conversely, lithium carbonate production primarily utilizes brine evaporation or hard-rock mining methods. Brine evaporation, while energy-efficient, consumes approximately 500,000 gallons of water per ton of lithium carbonate, placing immense pressure on water resources in often arid regions like the "Lithium Triangle" of South America. Hard-rock mining for lithium carbonate generates significant overburden and tailings, with estimates suggesting 15-20 tons of waste rock per ton of lithium carbonate.

Carbon emissions profiles differ markedly between these compounds. Lithium hydroxide production via the traditional route emits approximately 15-20 tons of CO₂ equivalent per ton of product, while newer electrolysis methods have reduced this to 5-7 tons. Lithium carbonate production generates 9-12 tons of CO₂ equivalent per ton when derived from hard rock, and 3-5 tons when extracted from brines, demonstrating a lower carbon footprint in certain production scenarios.

Water consumption metrics reveal lithium hydroxide production requires 50-70 cubic meters of water per ton using conventional methods, while lithium carbonate from brine operations consumes 200-400 cubic meters per ton—a substantial difference with implications for water-stressed regions. Energy requirements also diverge, with lithium hydroxide production demanding 25-40 GJ/ton compared to lithium carbonate's 10-15 GJ/ton from brine operations.

Recent technological innovations are addressing these environmental concerns. Closed-loop water systems in lithium hydroxide production have demonstrated 60-70% reductions in freshwater requirements. Direct lithium extraction technologies for lithium carbonate are showing promise in reducing land footprint by 70% and water consumption by up to 90% compared to traditional evaporation ponds, though these remain in early commercial deployment phases.

The environmental assessment must also consider end-of-life implications, as lithium hydroxide-based batteries typically offer enhanced recyclability due to simpler cathode chemistry decomposition, potentially reducing the lifecycle environmental impact despite higher initial production footprints.

Cost-Efficiency Analysis and Economic Viability

The economic comparison between lithium hydroxide and lithium carbonate reveals significant cost implications for battery manufacturers and the broader electric vehicle industry. Currently, lithium hydroxide commands a premium price, averaging 15-20% higher than lithium carbonate in global markets. This price differential stems from the more complex production process for lithium hydroxide and its growing demand for high-nickel cathode materials.

Production economics heavily favor lithium carbonate in terms of raw material costs and processing efficiency. Lithium carbonate can be produced directly from brine operations at approximately $3,500-5,000 per ton, while lithium hydroxide typically requires an additional conversion step, pushing costs to $5,000-7,000 per ton. However, this initial cost disadvantage must be evaluated against downstream battery performance benefits.

When analyzing total cost of ownership across the battery lifecycle, lithium hydroxide demonstrates compelling advantages despite higher upfront costs. Batteries utilizing lithium hydroxide cathodes typically deliver 20-30% greater energy density, translating to extended range capabilities in electric vehicles. This performance improvement can justify the premium, particularly in high-end EV applications where range anxiety remains a consumer concern.

Supply chain considerations further complicate the economic equation. Lithium carbonate benefits from established production infrastructure and more geographically diverse supply sources. Conversely, lithium hydroxide production capacity is more concentrated, creating potential supply vulnerabilities that could impact pricing stability. Recent investments in lithium hydroxide production facilities in Australia, China, and North America aim to address this imbalance.

Market forecasts indicate a gradual narrowing of the price gap between these compounds as lithium hydroxide production scales. Industry analysts project that by 2025-2027, increased production efficiency and competition may reduce the premium for lithium hydroxide to approximately 10-15%. This trend could accelerate adoption in mid-market electric vehicles, expanding beyond current premium applications.

Return on investment calculations demonstrate that despite higher initial material costs, lithium hydroxide-based batteries can deliver superior economic value in applications requiring high energy density and extended cycle life. The 5-year total cost analysis shows a potential 8-12% advantage for lithium hydroxide in high-performance applications, though lithium carbonate maintains cost advantages in less demanding use cases.

Production economics heavily favor lithium carbonate in terms of raw material costs and processing efficiency. Lithium carbonate can be produced directly from brine operations at approximately $3,500-5,000 per ton, while lithium hydroxide typically requires an additional conversion step, pushing costs to $5,000-7,000 per ton. However, this initial cost disadvantage must be evaluated against downstream battery performance benefits.

When analyzing total cost of ownership across the battery lifecycle, lithium hydroxide demonstrates compelling advantages despite higher upfront costs. Batteries utilizing lithium hydroxide cathodes typically deliver 20-30% greater energy density, translating to extended range capabilities in electric vehicles. This performance improvement can justify the premium, particularly in high-end EV applications where range anxiety remains a consumer concern.

Supply chain considerations further complicate the economic equation. Lithium carbonate benefits from established production infrastructure and more geographically diverse supply sources. Conversely, lithium hydroxide production capacity is more concentrated, creating potential supply vulnerabilities that could impact pricing stability. Recent investments in lithium hydroxide production facilities in Australia, China, and North America aim to address this imbalance.

Market forecasts indicate a gradual narrowing of the price gap between these compounds as lithium hydroxide production scales. Industry analysts project that by 2025-2027, increased production efficiency and competition may reduce the premium for lithium hydroxide to approximately 10-15%. This trend could accelerate adoption in mid-market electric vehicles, expanding beyond current premium applications.

Return on investment calculations demonstrate that despite higher initial material costs, lithium hydroxide-based batteries can deliver superior economic value in applications requiring high energy density and extended cycle life. The 5-year total cost analysis shows a potential 8-12% advantage for lithium hydroxide in high-performance applications, though lithium carbonate maintains cost advantages in less demanding use cases.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!