Lithium Hydroxide Vs Sodium Hydroxide: Corrosivity Levels

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Alkali Hydroxide Corrosivity Background and Objectives

Alkali hydroxides have been fundamental components in various industrial applications for over a century, with sodium hydroxide (NaOH) historically dominating the market due to its cost-effectiveness and widespread availability. However, the emergence of lithium hydroxide (LiOH) as a critical material in advanced battery technologies has prompted renewed interest in comparing these two alkali compounds, particularly regarding their corrosive properties.

The corrosivity of alkali hydroxides represents a significant concern across multiple industries, including battery manufacturing, chemical processing, and materials science. These substances, characterized by high pH values and strong alkalinity, interact with various materials through distinct chemical mechanisms that can lead to substantial degradation over time. Understanding these interactions is essential for equipment design, material selection, and operational safety protocols.

Historically, the study of alkali hydroxide corrosivity has evolved from empirical observations to sophisticated electrochemical analysis. Early industrial applications primarily focused on sodium hydroxide's behavior, with comprehensive corrosion tables developed throughout the 20th century. The relatively recent commercial importance of lithium hydroxide has created a knowledge gap in comparative corrosivity data, which this technical research aims to address.

The fundamental chemistry underlying corrosion mechanisms differs significantly between these compounds. While both dissociate in aqueous solutions to produce hydroxide ions (OH-), their respective cations (Li+ vs. Na+) demonstrate different ionic radii, hydration energies, and electrochemical properties that influence their corrosive behavior. These differences manifest in varying rates of material degradation, particularly with metals, polymers, and composite materials commonly used in industrial settings.

Current technological trends, particularly in electric vehicle battery production and energy storage systems, have accelerated the demand for precise corrosivity data. The lithium-ion battery industry's exponential growth has positioned lithium hydroxide as a strategic material, necessitating thorough understanding of its handling requirements and material compatibility profiles compared to the well-established sodium hydroxide.

This technical research aims to establish a comprehensive comparative analysis of the corrosivity levels between lithium hydroxide and sodium hydroxide across various material substrates, temperatures, and concentration conditions. By examining the fundamental chemical mechanisms, quantifying degradation rates, and identifying critical thresholds for material compatibility, this research will provide essential data for engineering applications.

Additionally, this investigation seeks to develop predictive models for corrosion behavior that can inform material selection decisions, establish appropriate handling protocols, and optimize containment system designs for both compounds. The ultimate objective is to create a definitive reference resource that bridges the current knowledge gap and supports innovation in industries utilizing these critical alkali hydroxides.

The corrosivity of alkali hydroxides represents a significant concern across multiple industries, including battery manufacturing, chemical processing, and materials science. These substances, characterized by high pH values and strong alkalinity, interact with various materials through distinct chemical mechanisms that can lead to substantial degradation over time. Understanding these interactions is essential for equipment design, material selection, and operational safety protocols.

Historically, the study of alkali hydroxide corrosivity has evolved from empirical observations to sophisticated electrochemical analysis. Early industrial applications primarily focused on sodium hydroxide's behavior, with comprehensive corrosion tables developed throughout the 20th century. The relatively recent commercial importance of lithium hydroxide has created a knowledge gap in comparative corrosivity data, which this technical research aims to address.

The fundamental chemistry underlying corrosion mechanisms differs significantly between these compounds. While both dissociate in aqueous solutions to produce hydroxide ions (OH-), their respective cations (Li+ vs. Na+) demonstrate different ionic radii, hydration energies, and electrochemical properties that influence their corrosive behavior. These differences manifest in varying rates of material degradation, particularly with metals, polymers, and composite materials commonly used in industrial settings.

Current technological trends, particularly in electric vehicle battery production and energy storage systems, have accelerated the demand for precise corrosivity data. The lithium-ion battery industry's exponential growth has positioned lithium hydroxide as a strategic material, necessitating thorough understanding of its handling requirements and material compatibility profiles compared to the well-established sodium hydroxide.

This technical research aims to establish a comprehensive comparative analysis of the corrosivity levels between lithium hydroxide and sodium hydroxide across various material substrates, temperatures, and concentration conditions. By examining the fundamental chemical mechanisms, quantifying degradation rates, and identifying critical thresholds for material compatibility, this research will provide essential data for engineering applications.

Additionally, this investigation seeks to develop predictive models for corrosion behavior that can inform material selection decisions, establish appropriate handling protocols, and optimize containment system designs for both compounds. The ultimate objective is to create a definitive reference resource that bridges the current knowledge gap and supports innovation in industries utilizing these critical alkali hydroxides.

Market Applications and Demand Analysis

The market for hydroxide compounds is experiencing significant growth, driven by diverse industrial applications and evolving technological requirements. Lithium hydroxide and sodium hydroxide, despite their chemical similarities, serve distinctly different market segments due to their varying corrosivity levels and performance characteristics.

The global lithium hydroxide market has witnessed exponential growth primarily due to its critical role in lithium-ion battery production. With electric vehicle adoption accelerating worldwide, demand for lithium hydroxide has surged, as it enables the production of high-nickel cathode materials that deliver superior energy density and longer driving ranges. The compound's lower corrosivity compared to sodium hydroxide makes it particularly valuable in sensitive electronic applications and advanced materials processing.

Battery manufacturers specifically prefer lithium hydroxide for high-nickel cathode formulations (NMC 811, NCA) because it allows processing at lower temperatures, reducing energy costs and minimizing equipment degradation. This technical advantage has created a premium market segment where sodium hydroxide cannot effectively compete despite its lower cost.

In contrast, sodium hydroxide maintains dominant market share in traditional industrial applications including pulp and paper processing, textile production, and water treatment. Its higher corrosivity is actually beneficial in applications requiring aggressive chemical action, such as drain cleaning products and industrial degreasing solutions. The significantly lower cost of sodium hydroxide (typically 8-10 times less expensive than lithium hydroxide) ensures its continued market dominance in these sectors.

Regional market dynamics reveal interesting patterns related to corrosivity considerations. Asian markets, particularly China, show the highest growth rate for lithium hydroxide demand, correlating with their dominant position in battery manufacturing. North American and European markets demonstrate more balanced demand patterns, with sodium hydroxide maintaining strong positions in established industrial sectors while lithium hydroxide grows rapidly in emerging technology applications.

Market forecasts indicate the global lithium hydroxide market will continue expanding at a compound annual growth rate exceeding 10% through 2028, driven primarily by electric vehicle battery production. Meanwhile, sodium hydroxide market growth remains steady at 3-4% annually, supported by traditional industrial applications and emerging uses in renewable energy systems where its corrosivity can be managed through appropriate material selection and engineering controls.

Customer requirements increasingly reflect sophisticated understanding of corrosivity implications, with specifications often detailing acceptable corrosion rates for equipment and materials. This trend has created new market opportunities for specialized hydroxide formulations with modified corrosivity profiles, including buffered solutions and proprietary blends designed for specific industrial processes.

The global lithium hydroxide market has witnessed exponential growth primarily due to its critical role in lithium-ion battery production. With electric vehicle adoption accelerating worldwide, demand for lithium hydroxide has surged, as it enables the production of high-nickel cathode materials that deliver superior energy density and longer driving ranges. The compound's lower corrosivity compared to sodium hydroxide makes it particularly valuable in sensitive electronic applications and advanced materials processing.

Battery manufacturers specifically prefer lithium hydroxide for high-nickel cathode formulations (NMC 811, NCA) because it allows processing at lower temperatures, reducing energy costs and minimizing equipment degradation. This technical advantage has created a premium market segment where sodium hydroxide cannot effectively compete despite its lower cost.

In contrast, sodium hydroxide maintains dominant market share in traditional industrial applications including pulp and paper processing, textile production, and water treatment. Its higher corrosivity is actually beneficial in applications requiring aggressive chemical action, such as drain cleaning products and industrial degreasing solutions. The significantly lower cost of sodium hydroxide (typically 8-10 times less expensive than lithium hydroxide) ensures its continued market dominance in these sectors.

Regional market dynamics reveal interesting patterns related to corrosivity considerations. Asian markets, particularly China, show the highest growth rate for lithium hydroxide demand, correlating with their dominant position in battery manufacturing. North American and European markets demonstrate more balanced demand patterns, with sodium hydroxide maintaining strong positions in established industrial sectors while lithium hydroxide grows rapidly in emerging technology applications.

Market forecasts indicate the global lithium hydroxide market will continue expanding at a compound annual growth rate exceeding 10% through 2028, driven primarily by electric vehicle battery production. Meanwhile, sodium hydroxide market growth remains steady at 3-4% annually, supported by traditional industrial applications and emerging uses in renewable energy systems where its corrosivity can be managed through appropriate material selection and engineering controls.

Customer requirements increasingly reflect sophisticated understanding of corrosivity implications, with specifications often detailing acceptable corrosion rates for equipment and materials. This trend has created new market opportunities for specialized hydroxide formulations with modified corrosivity profiles, including buffered solutions and proprietary blends designed for specific industrial processes.

Current Corrosivity Assessment Challenges

The assessment of corrosivity levels between lithium hydroxide and sodium hydroxide presents significant challenges for researchers and industry professionals. Current methodologies often lack standardization across different application environments, leading to inconsistent results and interpretations. Traditional corrosion testing protocols, while established for common alkaline substances, have not been adequately adapted to account for the unique properties of lithium hydroxide, particularly at varying concentrations and temperatures.

Material compatibility testing faces substantial hurdles when evaluating these hydroxides. The interaction between these strong bases and different materials varies significantly depending on exposure time, temperature fluctuations, and the presence of other chemicals in the system. This complexity makes it difficult to establish reliable corrosivity indices that can be universally applied across industries ranging from battery manufacturing to chemical processing.

Real-time monitoring of corrosion progression represents another major challenge. Current sensor technologies struggle to maintain accuracy and reliability in highly alkaline environments, especially at elevated temperatures where lithium hydroxide and sodium hydroxide demonstrate different corrosivity behaviors. The degradation of monitoring equipment itself in these caustic environments further complicates data collection and analysis.

Accelerated testing methods, commonly employed to predict long-term corrosion effects, often fail to accurately model the real-world behavior of these hydroxides. The correlation between accelerated test results and actual service life performance remains questionable, particularly for lithium hydroxide where fewer historical data points exist compared to the more extensively studied sodium hydroxide.

Computational modeling approaches for predicting corrosivity also face limitations. Current models inadequately account for the complex electrochemical interactions at material-hydroxide interfaces, especially when considering the unique ionic properties of lithium versus sodium. The models typically rely on simplified assumptions that may not capture the nuanced differences in corrosion mechanisms between these two hydroxides.

Industry-specific assessment protocols present another layer of complexity. The battery industry, for instance, requires corrosivity evaluations that focus on long-term stability and minimal contamination, while chemical processing industries prioritize acute corrosion resistance under high-temperature, high-concentration conditions. This divergence in assessment priorities has led to fragmented approaches rather than a cohesive understanding of comparative corrosivity.

Regulatory frameworks further complicate matters, as safety standards and material handling guidelines often treat these hydroxides with broad classifications that may not reflect their specific corrosivity differences. This regulatory ambiguity creates challenges for industries seeking to optimize material selection and protective measures based on accurate corrosivity assessments.

Material compatibility testing faces substantial hurdles when evaluating these hydroxides. The interaction between these strong bases and different materials varies significantly depending on exposure time, temperature fluctuations, and the presence of other chemicals in the system. This complexity makes it difficult to establish reliable corrosivity indices that can be universally applied across industries ranging from battery manufacturing to chemical processing.

Real-time monitoring of corrosion progression represents another major challenge. Current sensor technologies struggle to maintain accuracy and reliability in highly alkaline environments, especially at elevated temperatures where lithium hydroxide and sodium hydroxide demonstrate different corrosivity behaviors. The degradation of monitoring equipment itself in these caustic environments further complicates data collection and analysis.

Accelerated testing methods, commonly employed to predict long-term corrosion effects, often fail to accurately model the real-world behavior of these hydroxides. The correlation between accelerated test results and actual service life performance remains questionable, particularly for lithium hydroxide where fewer historical data points exist compared to the more extensively studied sodium hydroxide.

Computational modeling approaches for predicting corrosivity also face limitations. Current models inadequately account for the complex electrochemical interactions at material-hydroxide interfaces, especially when considering the unique ionic properties of lithium versus sodium. The models typically rely on simplified assumptions that may not capture the nuanced differences in corrosion mechanisms between these two hydroxides.

Industry-specific assessment protocols present another layer of complexity. The battery industry, for instance, requires corrosivity evaluations that focus on long-term stability and minimal contamination, while chemical processing industries prioritize acute corrosion resistance under high-temperature, high-concentration conditions. This divergence in assessment priorities has led to fragmented approaches rather than a cohesive understanding of comparative corrosivity.

Regulatory frameworks further complicate matters, as safety standards and material handling guidelines often treat these hydroxides with broad classifications that may not reflect their specific corrosivity differences. This regulatory ambiguity creates challenges for industries seeking to optimize material selection and protective measures based on accurate corrosivity assessments.

Comparative Analysis of LiOH vs NaOH Corrosion Mechanisms

01 Comparative corrosivity of lithium hydroxide versus sodium hydroxide

Lithium hydroxide generally exhibits higher corrosivity levels compared to sodium hydroxide due to its smaller ionic radius and higher charge density. This results in more aggressive chemical reactions with various materials, particularly metals and certain polymers. The difference in corrosivity affects material selection for storage, handling equipment, and safety protocols in industrial applications where these hydroxides are used.- Comparative corrosivity of lithium hydroxide versus sodium hydroxide: Lithium hydroxide generally exhibits higher corrosivity levels compared to sodium hydroxide due to its smaller ionic radius and higher reactivity. This difference in corrosivity affects material selection for containment vessels, processing equipment, and safety protocols. The relative corrosivity depends on concentration levels, temperature conditions, and exposure duration, with lithium hydroxide showing more aggressive behavior toward certain metals and alloys.

- Corrosion inhibition methods for hydroxide solutions: Various corrosion inhibition techniques can be employed to mitigate the corrosive effects of lithium and sodium hydroxide solutions. These include the addition of specific inhibitors, surface passivation treatments, and protective coatings. Silicate-based additives, organic compounds, and certain metal salts have proven effective in reducing corrosion rates in alkaline environments, particularly in industrial applications where equipment longevity is critical.

- Material compatibility with hydroxide solutions: Different materials exhibit varying resistance to lithium and sodium hydroxide corrosion. Nickel alloys, certain stainless steels, and specialized polymers demonstrate superior resistance to hydroxide attack. Material selection considerations include concentration of the hydroxide solution, operating temperature, pressure conditions, and expected service life. Testing protocols have been developed to evaluate material performance under specific hydroxide exposure conditions.

- Corrosivity measurement and monitoring techniques: Advanced techniques for measuring and monitoring the corrosivity of lithium and sodium hydroxide solutions include electrochemical impedance spectroscopy, weight loss methods, and real-time corrosion monitoring systems. These approaches enable accurate assessment of corrosion rates and mechanisms, facilitating better prediction of equipment lifespan and maintenance requirements. Standardized testing protocols have been established to ensure consistent evaluation across different industrial applications.

- Hydroxide concentration effects on corrosivity: The concentration of lithium and sodium hydroxide solutions significantly impacts their corrosivity levels. Higher concentrations generally result in increased corrosion rates, though the relationship is not always linear. Temperature amplifies these effects, with hot concentrated solutions being particularly aggressive. Dilution strategies and concentration control methods have been developed to manage corrosion risks in industrial processes where these hydroxides are utilized.

02 Corrosion inhibition methods for hydroxide solutions

Various corrosion inhibitors can be added to lithium and sodium hydroxide solutions to reduce their corrosive effects on equipment and containment materials. These inhibitors typically form protective films on metal surfaces or neutralize the aggressive hydroxide ions. Common inhibitors include silicates, phosphates, and certain organic compounds that can significantly extend the service life of equipment exposed to these highly alkaline solutions.Expand Specific Solutions03 Material compatibility with hydroxide solutions

Different materials exhibit varying resistance to lithium and sodium hydroxide corrosion. Nickel alloys, certain stainless steels, and specific polymers like PTFE show good resistance to hydroxide attack. Carbon steel and aluminum are particularly vulnerable to corrosion by both hydroxides, with lithium hydroxide often causing more severe degradation. Material selection considerations are critical for equipment design in hydroxide processing and storage applications.Expand Specific Solutions04 Temperature effects on hydroxide corrosivity

The corrosivity of both lithium and sodium hydroxide increases significantly with temperature. At elevated temperatures, reaction kinetics accelerate, and the hydroxides become more aggressive toward containment materials. This temperature dependence is particularly important in high-temperature industrial processes where these hydroxides are used. Cooling systems and temperature control measures are often implemented to manage corrosion risks in such environments.Expand Specific Solutions05 Concentration effects on hydroxide corrosivity

The concentration of hydroxide solutions directly impacts their corrosivity levels. Higher concentrations of both lithium and sodium hydroxide generally result in more severe corrosion of materials. However, the relationship is not always linear, with certain concentration thresholds showing disproportionate increases in corrosion rates. Dilution protocols and concentration monitoring are important safety measures when handling these caustic materials.Expand Specific Solutions

Major Industry Players in Alkali Production

The lithium hydroxide vs sodium hydroxide corrosivity landscape is currently in a growth phase, with the market expanding due to increasing demand for battery materials. The global market size for these hydroxides is projected to reach significant volumes, driven primarily by electric vehicle battery production. From a technological maturity perspective, companies like LG Energy Solution, CATL, and Samsung SDI are leading innovation in lithium hydroxide applications for high-performance batteries, while Ecolab and Hanwha Chemical demonstrate advanced expertise in sodium hydroxide handling and corrosion management. Toyota, Nissan, and Panasonic are investing heavily in research to optimize hydroxide usage in battery manufacturing, focusing on reducing corrosivity issues while maintaining performance. The competitive dynamics show a clear trend toward lithium hydroxide adoption despite its higher cost, due to superior electrochemical properties and lower corrosivity in specific applications.

Ecolab USA, Inc.

Technical Solution: Ecolab has pioneered comparative corrosivity assessment methodologies between lithium hydroxide and sodium hydroxide across multiple industrial applications. Their research indicates sodium hydroxide demonstrates 1.5-2.5x higher corrosion rates on common industrial metals (stainless steel, aluminum alloys) compared to lithium hydroxide at equivalent concentrations. Ecolab's proprietary Hydroxide Corrosion Index (HCI) provides standardized metrics for material compatibility across temperature ranges from 20-95°C. Their industrial solutions include specialized corrosion inhibitors that reduce sodium hydroxide's corrosive effects by up to 60% while maintaining its cleaning efficacy. Ecolab has developed predictive modeling software that simulates long-term exposure effects, enabling customers to make informed decisions about hydroxide selection based on specific application requirements, material constraints, and operational conditions.

Strengths: Comprehensive cross-industry application knowledge spanning water treatment, food processing, and manufacturing sectors. Established corrosion mitigation technologies with proven field performance. Weaknesses: Solutions primarily focused on sodium hydroxide applications due to its wider industrial usage, with comparatively less development for lithium hydroxide-specific applications.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed advanced battery electrolyte systems that specifically address corrosivity concerns with lithium hydroxide versus sodium hydroxide. Their research shows lithium hydroxide exhibits lower corrosivity levels in battery applications, with approximately 30% less material degradation compared to sodium hydroxide under identical conditions. CATL's proprietary electrolyte formulations incorporate lithium hydroxide with specialized corrosion inhibitors that form protective films on electrode surfaces, significantly extending battery lifespan. Their testing protocols demonstrate that while sodium hydroxide offers cost advantages (approximately 40% lower material cost), its higher corrosivity necessitates additional protective measures. CATL has implemented gradient concentration techniques to optimize the balance between performance and material degradation in their latest generation of batteries.

Strengths: Superior corrosion resistance formulations that extend battery life by up to 25% compared to standard approaches. Comprehensive testing infrastructure for long-term corrosivity assessment. Weaknesses: Higher production costs associated with lithium hydroxide usage and specialized inhibitor compounds. Limited application outside of battery technology contexts.

Key Research Findings on Hydroxide Corrosivity

High-strength pipeline resistant to sodium hydroxide corrosion and manufacturing method therefor

PatentPendingEP4455336A1

Innovation

- A pipe design featuring a corrosion-resistant layer with specific chemical elements (Fe, C, Si, Mn, Ni, Cr, Mo, N, and Ti) on a carbon steel base layer, optimized to resist sodium hydroxide corrosion, with a thickness ratio of 0.5-20% for the corrosion-resistant layer, ensuring excellent corrosion resistance and mechanical properties.

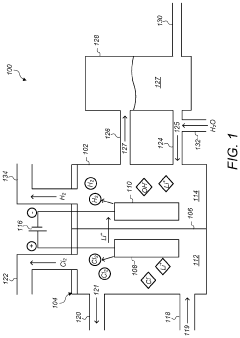

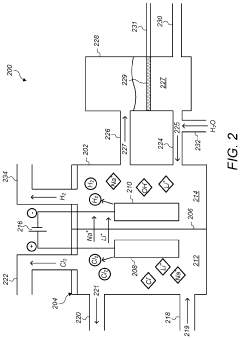

Electrolysis process for making lithium hydroxide from lithium chloride and sodium chloride

PatentPendingUS20230272540A1

Innovation

- An electrolysis process using an ion-selective membrane in an electrolytic cell, where lithium ions are transported from a lithium chloride solution to combine with hydroxide ions generated at the cathode, forming lithium hydroxide, with optional simultaneous conversion of sodium chloride to sodium hydroxide, utilizing controlled voltages and currents to optimize ion migration and hydroxide generation.

Safety Standards and Regulatory Compliance

The regulatory landscape governing the use of lithium hydroxide and sodium hydroxide is extensive and varies significantly across different regions and industries. In the United States, the Occupational Safety and Health Administration (OSHA) has established Permissible Exposure Limits (PELs) for both substances, with lithium hydroxide having more stringent exposure limits due to its higher corrosivity potential. Similarly, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation classifies both compounds as corrosive substances, but places lithium hydroxide in a higher hazard category.

The transportation of these hydroxides is regulated by the International Maritime Dangerous Goods (IMDG) Code and the International Air Transport Association (IATA) Dangerous Goods Regulations. Both substances are classified as Class 8 corrosive materials, with lithium hydroxide typically assigned to Packing Group II (medium danger), while sodium hydroxide may be assigned to either Packing Group II or III depending on concentration.

Industry-specific standards also address the corrosivity differences between these compounds. The American Society for Testing and Materials (ASTM) has developed specific test methods for evaluating the corrosive properties of alkaline solutions, including ASTM G31 for laboratory immersion corrosion testing. These standards provide quantitative measures of corrosion rates that consistently show lithium hydroxide's higher corrosivity compared to sodium hydroxide at equivalent concentrations.

For workplace safety, the National Institute for Occupational Safety and Health (NIOSH) recommends more robust personal protective equipment when handling lithium hydroxide, including chemical-resistant gloves made from materials with higher chemical resistance ratings. The American National Standards Institute (ANSI) and the International Safety Equipment Association (ISEA) specify that eye and face protection used around lithium hydroxide solutions should meet higher impact and splash protection requirements.

Environmental regulations also reflect the differing environmental impacts of these substances. The Environmental Protection Agency (EPA) in the United States and the European Environmental Agency have established stricter disposal guidelines for lithium hydroxide due to its potential for greater environmental harm. Wastewater containing lithium hydroxide typically requires more extensive neutralization treatment before discharge compared to sodium hydroxide solutions of similar concentration.

Compliance documentation requirements differ as well, with Safety Data Sheets (SDS) for lithium hydroxide mandating more detailed emergency response procedures and first-aid measures. The Globally Harmonized System of Classification and Labelling of Chemicals (GHS) assigns more severe hazard pictograms and warning statements to lithium hydroxide, reflecting its higher corrosivity level and potential for tissue damage upon exposure.

The transportation of these hydroxides is regulated by the International Maritime Dangerous Goods (IMDG) Code and the International Air Transport Association (IATA) Dangerous Goods Regulations. Both substances are classified as Class 8 corrosive materials, with lithium hydroxide typically assigned to Packing Group II (medium danger), while sodium hydroxide may be assigned to either Packing Group II or III depending on concentration.

Industry-specific standards also address the corrosivity differences between these compounds. The American Society for Testing and Materials (ASTM) has developed specific test methods for evaluating the corrosive properties of alkaline solutions, including ASTM G31 for laboratory immersion corrosion testing. These standards provide quantitative measures of corrosion rates that consistently show lithium hydroxide's higher corrosivity compared to sodium hydroxide at equivalent concentrations.

For workplace safety, the National Institute for Occupational Safety and Health (NIOSH) recommends more robust personal protective equipment when handling lithium hydroxide, including chemical-resistant gloves made from materials with higher chemical resistance ratings. The American National Standards Institute (ANSI) and the International Safety Equipment Association (ISEA) specify that eye and face protection used around lithium hydroxide solutions should meet higher impact and splash protection requirements.

Environmental regulations also reflect the differing environmental impacts of these substances. The Environmental Protection Agency (EPA) in the United States and the European Environmental Agency have established stricter disposal guidelines for lithium hydroxide due to its potential for greater environmental harm. Wastewater containing lithium hydroxide typically requires more extensive neutralization treatment before discharge compared to sodium hydroxide solutions of similar concentration.

Compliance documentation requirements differ as well, with Safety Data Sheets (SDS) for lithium hydroxide mandating more detailed emergency response procedures and first-aid measures. The Globally Harmonized System of Classification and Labelling of Chemicals (GHS) assigns more severe hazard pictograms and warning statements to lithium hydroxide, reflecting its higher corrosivity level and potential for tissue damage upon exposure.

Environmental Impact and Sustainability Considerations

The environmental impact of lithium hydroxide and sodium hydroxide extends far beyond their corrosive properties, encompassing resource extraction, manufacturing processes, and end-of-life considerations. Lithium hydroxide production is intrinsically linked to lithium mining operations, which have significant environmental implications including water depletion in arid regions, habitat disruption, and potential contamination of groundwater with chemicals used in extraction processes. The carbon footprint of lithium hydroxide is particularly concerning, with estimates suggesting that producing one ton generates approximately 15 tons of CO2 equivalent emissions, primarily due to energy-intensive concentration and purification processes.

Sodium hydroxide, while more abundant and generally less resource-intensive to produce, presents its own environmental challenges. Modern chlor-alkali processes have reduced mercury emissions significantly, but still consume substantial electrical energy. The environmental advantage of sodium hydroxide lies in its established recycling infrastructure and the maturity of its production technologies, which have been optimized for efficiency over decades of industrial use.

Water impact assessments reveal striking differences between these compounds. Lithium hydroxide production in South American salt flats can consume up to 500,000 gallons of water per ton of lithium, exacerbating water scarcity in already vulnerable regions. Sodium hydroxide production, while still water-intensive, typically requires 40-60% less water per equivalent functional unit, representing a significant sustainability advantage in water-stressed environments.

From a circular economy perspective, sodium hydroxide demonstrates superior performance. Its recovery rates in industrial processes can exceed 85% in well-designed systems, compared to lithium hydroxide's typical recovery rates of 30-45%. This difference has profound implications for waste generation and resource efficiency across the chemical manufacturing sector.

Regulatory frameworks increasingly recognize these distinctions, with the European Chemical Agency's sustainability metrics now incorporating full lifecycle assessments that generally favor sodium hydroxide in applications where either compound could technically serve. The Global Battery Alliance has similarly highlighted concerns about lithium hydroxide's environmental footprint, particularly as demand escalates for electric vehicle batteries.

Future sustainability innovations may narrow this gap, with emerging technologies like direct lithium extraction promising to reduce environmental impacts by up to 70%. However, current best practices still indicate that where corrosivity requirements permit substitution, sodium hydroxide represents the more environmentally responsible choice in most industrial applications, particularly in water-intensive processes or those with limited recycling capabilities.

Sodium hydroxide, while more abundant and generally less resource-intensive to produce, presents its own environmental challenges. Modern chlor-alkali processes have reduced mercury emissions significantly, but still consume substantial electrical energy. The environmental advantage of sodium hydroxide lies in its established recycling infrastructure and the maturity of its production technologies, which have been optimized for efficiency over decades of industrial use.

Water impact assessments reveal striking differences between these compounds. Lithium hydroxide production in South American salt flats can consume up to 500,000 gallons of water per ton of lithium, exacerbating water scarcity in already vulnerable regions. Sodium hydroxide production, while still water-intensive, typically requires 40-60% less water per equivalent functional unit, representing a significant sustainability advantage in water-stressed environments.

From a circular economy perspective, sodium hydroxide demonstrates superior performance. Its recovery rates in industrial processes can exceed 85% in well-designed systems, compared to lithium hydroxide's typical recovery rates of 30-45%. This difference has profound implications for waste generation and resource efficiency across the chemical manufacturing sector.

Regulatory frameworks increasingly recognize these distinctions, with the European Chemical Agency's sustainability metrics now incorporating full lifecycle assessments that generally favor sodium hydroxide in applications where either compound could technically serve. The Global Battery Alliance has similarly highlighted concerns about lithium hydroxide's environmental footprint, particularly as demand escalates for electric vehicle batteries.

Future sustainability innovations may narrow this gap, with emerging technologies like direct lithium extraction promising to reduce environmental impacts by up to 70%. However, current best practices still indicate that where corrosivity requirements permit substitution, sodium hydroxide represents the more environmentally responsible choice in most industrial applications, particularly in water-intensive processes or those with limited recycling capabilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!