Lithium Hydroxide Vs Zinc Hydroxide: Reactivity Analyses

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium and Zinc Hydroxides: Background and Research Objectives

Lithium hydroxide (LiOH) and zinc hydroxide (Zn(OH)₂) represent two significant metal hydroxides with distinct chemical properties and industrial applications. The study of these compounds has evolved considerably over the past century, with research intensifying in recent decades due to their growing importance in various technological sectors. Lithium hydroxide, in particular, has gained prominence with the rise of lithium-ion battery technology, while zinc hydroxide finds applications in diverse fields from pharmaceuticals to catalysis.

The historical development of lithium hydroxide research can be traced back to the early 20th century, but it gained substantial momentum in the 1990s with the commercialization of lithium-ion batteries. The compound's ability to serve as a precursor for lithium carbonate and its direct use in battery cathode materials has driven continuous research into its properties and production methods. The global lithium hydroxide market has experienced exponential growth, with production capacity increasing from approximately 40,000 tons in 2015 to over 200,000 tons projected by 2025.

Zinc hydroxide, while less prominently featured in contemporary energy storage discussions, has a rich research history dating back to fundamental studies in inorganic chemistry. Its amphoteric nature—the ability to react with both acids and bases—has made it a fascinating subject for reactivity studies. The compound's polymorphic behavior, exhibiting multiple crystalline forms depending on preparation conditions, adds another layer of complexity to its chemical profile.

The technological evolution in both fields has been marked by significant improvements in synthesis methods, purity control, and characterization techniques. Modern analytical approaches including X-ray diffraction (XRD), scanning electron microscopy (SEM), and advanced spectroscopic methods have enabled researchers to develop deeper insights into the structural and reactive properties of these hydroxides.

This technical research report aims to conduct a comprehensive comparative analysis of lithium hydroxide and zinc hydroxide, with particular emphasis on their reactivity profiles. The primary objectives include: establishing a fundamental understanding of the reaction mechanisms governing each compound's behavior in various chemical environments; quantifying kinetic and thermodynamic parameters that differentiate their reactivity; evaluating the impact of structural characteristics on chemical behavior; and identifying potential synergistic applications where the contrasting properties of these hydroxides might be advantageously combined.

By systematically examining these aspects, this research seeks to contribute to the knowledge base supporting both established applications and emerging technologies utilizing these important inorganic compounds. The findings are expected to have implications for battery technology, catalysis, pharmaceutical processing, and environmental remediation systems where metal hydroxides play crucial roles.

The historical development of lithium hydroxide research can be traced back to the early 20th century, but it gained substantial momentum in the 1990s with the commercialization of lithium-ion batteries. The compound's ability to serve as a precursor for lithium carbonate and its direct use in battery cathode materials has driven continuous research into its properties and production methods. The global lithium hydroxide market has experienced exponential growth, with production capacity increasing from approximately 40,000 tons in 2015 to over 200,000 tons projected by 2025.

Zinc hydroxide, while less prominently featured in contemporary energy storage discussions, has a rich research history dating back to fundamental studies in inorganic chemistry. Its amphoteric nature—the ability to react with both acids and bases—has made it a fascinating subject for reactivity studies. The compound's polymorphic behavior, exhibiting multiple crystalline forms depending on preparation conditions, adds another layer of complexity to its chemical profile.

The technological evolution in both fields has been marked by significant improvements in synthesis methods, purity control, and characterization techniques. Modern analytical approaches including X-ray diffraction (XRD), scanning electron microscopy (SEM), and advanced spectroscopic methods have enabled researchers to develop deeper insights into the structural and reactive properties of these hydroxides.

This technical research report aims to conduct a comprehensive comparative analysis of lithium hydroxide and zinc hydroxide, with particular emphasis on their reactivity profiles. The primary objectives include: establishing a fundamental understanding of the reaction mechanisms governing each compound's behavior in various chemical environments; quantifying kinetic and thermodynamic parameters that differentiate their reactivity; evaluating the impact of structural characteristics on chemical behavior; and identifying potential synergistic applications where the contrasting properties of these hydroxides might be advantageously combined.

By systematically examining these aspects, this research seeks to contribute to the knowledge base supporting both established applications and emerging technologies utilizing these important inorganic compounds. The findings are expected to have implications for battery technology, catalysis, pharmaceutical processing, and environmental remediation systems where metal hydroxides play crucial roles.

Market Applications and Demand Analysis for Metal Hydroxides

The global market for metal hydroxides has witnessed significant growth in recent years, driven by their diverse applications across multiple industries. Lithium hydroxide and zinc hydroxide, in particular, have emerged as critical materials with distinct market dynamics based on their unique reactivity profiles.

Lithium hydroxide commands a premium market position primarily due to its essential role in lithium-ion battery production. The electric vehicle revolution has created unprecedented demand, with the global lithium hydroxide market valued at approximately $2.3 billion in 2022 and projected to grow at a CAGR of 11.2% through 2030. This growth trajectory is supported by major automotive manufacturers accelerating their EV production targets and battery technology advancements requiring higher-grade lithium hydroxide.

The pharmaceutical and cosmetic sectors represent another significant demand driver for lithium hydroxide, where its controlled reactivity makes it valuable for specialized applications. The material's ability to maintain stability under specific conditions while providing alkaline properties has secured its position in high-value medicinal formulations and premium skincare products.

Zinc hydroxide, while commanding a smaller market share valued at approximately $420 million, serves more diversified industrial applications. Its moderate reactivity profile has established it as a preferred ingredient in sunscreens, rubber vulcanization processes, and water treatment applications. The material's antimicrobial properties have also driven increased adoption in healthcare products, particularly following heightened hygiene awareness post-pandemic.

Regional market distribution shows interesting patterns, with lithium hydroxide demand concentrated in East Asia (particularly China, Japan, and South Korea) due to battery manufacturing hubs. North America and Europe are rapidly expanding markets as they establish domestic battery supply chains. Zinc hydroxide demand shows more global distribution, with significant consumption in both developed and developing economies.

Price sensitivity analyses reveal that lithium hydroxide markets demonstrate relatively inelastic demand due to the lack of viable substitutes in high-performance batteries. Conversely, zinc hydroxide markets show greater elasticity, with buyers more willing to seek alternatives when prices fluctuate. This difference in price sensitivity directly correlates to the reactivity profiles of these compounds and their specific application requirements.

Future market projections indicate continued strong growth for lithium hydroxide, potentially reaching $5.1 billion by 2030, driven by energy storage applications beyond EVs. Zinc hydroxide markets are expected to grow more modestly but steadily at 5-7% annually, with emerging applications in sustainable agriculture and advanced materials providing new demand sources.

Lithium hydroxide commands a premium market position primarily due to its essential role in lithium-ion battery production. The electric vehicle revolution has created unprecedented demand, with the global lithium hydroxide market valued at approximately $2.3 billion in 2022 and projected to grow at a CAGR of 11.2% through 2030. This growth trajectory is supported by major automotive manufacturers accelerating their EV production targets and battery technology advancements requiring higher-grade lithium hydroxide.

The pharmaceutical and cosmetic sectors represent another significant demand driver for lithium hydroxide, where its controlled reactivity makes it valuable for specialized applications. The material's ability to maintain stability under specific conditions while providing alkaline properties has secured its position in high-value medicinal formulations and premium skincare products.

Zinc hydroxide, while commanding a smaller market share valued at approximately $420 million, serves more diversified industrial applications. Its moderate reactivity profile has established it as a preferred ingredient in sunscreens, rubber vulcanization processes, and water treatment applications. The material's antimicrobial properties have also driven increased adoption in healthcare products, particularly following heightened hygiene awareness post-pandemic.

Regional market distribution shows interesting patterns, with lithium hydroxide demand concentrated in East Asia (particularly China, Japan, and South Korea) due to battery manufacturing hubs. North America and Europe are rapidly expanding markets as they establish domestic battery supply chains. Zinc hydroxide demand shows more global distribution, with significant consumption in both developed and developing economies.

Price sensitivity analyses reveal that lithium hydroxide markets demonstrate relatively inelastic demand due to the lack of viable substitutes in high-performance batteries. Conversely, zinc hydroxide markets show greater elasticity, with buyers more willing to seek alternatives when prices fluctuate. This difference in price sensitivity directly correlates to the reactivity profiles of these compounds and their specific application requirements.

Future market projections indicate continued strong growth for lithium hydroxide, potentially reaching $5.1 billion by 2030, driven by energy storage applications beyond EVs. Zinc hydroxide markets are expected to grow more modestly but steadily at 5-7% annually, with emerging applications in sustainable agriculture and advanced materials providing new demand sources.

Current Reactivity Challenges and Technical Limitations

The reactivity comparison between lithium hydroxide and zinc hydroxide presents several significant technical challenges that limit their application potential in various industrial processes. Current analytical methods struggle to accurately quantify the reaction kinetics of these hydroxides under varying temperature and pressure conditions, particularly in complex solution environments where multiple ions compete for reaction sites.

One major limitation is the inconsistent performance of lithium hydroxide in high-temperature applications. While theoretically more reactive than zinc hydroxide due to lithium's position in the periodic table, lithium hydroxide exhibits unexpected stability issues when reaction temperatures exceed 180°C, leading to decreased efficiency in certain catalytic processes. This temperature-dependent behavior remains inadequately characterized despite its critical importance for industrial applications.

Solubility differences between these hydroxides create significant challenges for standardized reactivity testing. Lithium hydroxide's higher water solubility (12.8g/100mL at 20°C) compared to zinc hydroxide's near insolubility creates methodological barriers when attempting direct comparative analyses. Current testing protocols fail to account for these fundamental differences, resulting in potentially misleading reactivity data.

The catalytic behavior of these hydroxides presents another technical limitation. Zinc hydroxide demonstrates superior performance as a heterogeneous catalyst in certain organic reactions, while lithium hydroxide excels in homogeneous systems. However, the mechanisms underlying these differences remain poorly understood, hampering the development of optimized catalytic systems for specific industrial applications.

Stability issues during storage and handling constitute a significant practical challenge. Lithium hydroxide's hygroscopic nature causes it to rapidly absorb atmospheric moisture, altering its reactivity profile over time. Conversely, zinc hydroxide undergoes slow decomposition when exposed to carbon dioxide, forming basic zinc carbonates. These stability differences complicate long-term industrial implementation and require specialized handling protocols that increase operational costs.

Scale-up challenges represent perhaps the most pressing limitation for industrial adoption. Laboratory-scale reactivity data often fails to translate accurately to industrial-scale processes due to heat transfer limitations, mixing inefficiencies, and concentration gradients. This scaling discrepancy is particularly pronounced with lithium hydroxide, where reaction rates can decrease by up to 40% when moving from laboratory to industrial scales.

Environmental and safety considerations further constrain application possibilities. Lithium hydroxide's higher corrosivity and potential for exothermic reactions necessitate more stringent safety protocols compared to zinc hydroxide. Additionally, the growing environmental concerns regarding lithium extraction create sustainability challenges that may limit future industrial applications despite potentially superior reactivity profiles.

One major limitation is the inconsistent performance of lithium hydroxide in high-temperature applications. While theoretically more reactive than zinc hydroxide due to lithium's position in the periodic table, lithium hydroxide exhibits unexpected stability issues when reaction temperatures exceed 180°C, leading to decreased efficiency in certain catalytic processes. This temperature-dependent behavior remains inadequately characterized despite its critical importance for industrial applications.

Solubility differences between these hydroxides create significant challenges for standardized reactivity testing. Lithium hydroxide's higher water solubility (12.8g/100mL at 20°C) compared to zinc hydroxide's near insolubility creates methodological barriers when attempting direct comparative analyses. Current testing protocols fail to account for these fundamental differences, resulting in potentially misleading reactivity data.

The catalytic behavior of these hydroxides presents another technical limitation. Zinc hydroxide demonstrates superior performance as a heterogeneous catalyst in certain organic reactions, while lithium hydroxide excels in homogeneous systems. However, the mechanisms underlying these differences remain poorly understood, hampering the development of optimized catalytic systems for specific industrial applications.

Stability issues during storage and handling constitute a significant practical challenge. Lithium hydroxide's hygroscopic nature causes it to rapidly absorb atmospheric moisture, altering its reactivity profile over time. Conversely, zinc hydroxide undergoes slow decomposition when exposed to carbon dioxide, forming basic zinc carbonates. These stability differences complicate long-term industrial implementation and require specialized handling protocols that increase operational costs.

Scale-up challenges represent perhaps the most pressing limitation for industrial adoption. Laboratory-scale reactivity data often fails to translate accurately to industrial-scale processes due to heat transfer limitations, mixing inefficiencies, and concentration gradients. This scaling discrepancy is particularly pronounced with lithium hydroxide, where reaction rates can decrease by up to 40% when moving from laboratory to industrial scales.

Environmental and safety considerations further constrain application possibilities. Lithium hydroxide's higher corrosivity and potential for exothermic reactions necessitate more stringent safety protocols compared to zinc hydroxide. Additionally, the growing environmental concerns regarding lithium extraction create sustainability challenges that may limit future industrial applications despite potentially superior reactivity profiles.

Comparative Analysis of Current Reactivity Testing Methods

01 Reactivity in battery applications

Lithium hydroxide and zinc hydroxide exhibit specific reactivity patterns when used in battery technologies. The interaction between these hydroxides affects electrode performance, electrolyte stability, and overall battery efficiency. These compounds can be incorporated into cathode materials to enhance electrochemical properties and improve energy density. Their reactivity characteristics are particularly important in lithium-ion and zinc-based battery systems where hydroxide chemistry influences charge-discharge cycles and battery longevity.- Reactivity of lithium hydroxide with zinc compounds: Lithium hydroxide can react with zinc compounds to form various products. The reaction between lithium hydroxide and zinc hydroxide can lead to the formation of lithium zincate complexes. This reactivity is utilized in various applications including battery technology, where the interaction between these compounds affects electrode performance and stability. The reaction kinetics are influenced by factors such as concentration, temperature, and the presence of other electrolytes.

- Use in battery and electrochemical applications: Lithium hydroxide and zinc hydroxide are important components in battery technologies, particularly in lithium-ion and zinc-based battery systems. Their reactivity is harnessed to improve electrode performance, enhance charge/discharge cycles, and increase energy density. The controlled reaction between these hydroxides can be used to create specialized electrode materials with improved stability and conductivity. These materials find applications in energy storage systems, portable electronics, and electric vehicles.

- Synthesis of mixed metal hydroxides and oxides: The reactivity between lithium hydroxide and zinc hydroxide can be utilized to synthesize mixed metal hydroxides and oxides. These materials have applications in catalysis, sensors, and advanced materials. The synthesis process typically involves controlled reaction conditions to achieve desired stoichiometry and crystal structure. The resulting materials often exhibit unique properties that differ from their individual components, including enhanced catalytic activity, improved thermal stability, and specialized electronic properties.

- Corrosion inhibition and surface treatment applications: The reactivity of lithium hydroxide and zinc hydroxide is utilized in corrosion inhibition and surface treatment technologies. When these compounds interact, they can form protective layers on metal surfaces that prevent oxidation and degradation. These treatments are particularly valuable for protecting aluminum, steel, and other industrial metals. The protective mechanisms involve the formation of insoluble complexes that adhere to metal surfaces and create barriers against corrosive agents.

- Environmental and waste treatment applications: Lithium hydroxide and zinc hydroxide reactivity is applied in environmental remediation and waste treatment processes. Their ability to form complexes with heavy metals and other contaminants makes them useful for water purification, soil remediation, and industrial waste treatment. The controlled reaction between these hydroxides can be used to precipitate harmful substances from solution, allowing for their removal from the environment. These applications are particularly important for addressing pollution from mining, manufacturing, and other industrial activities.

02 Electrochemical processing methods

Various electrochemical processes leverage the reactivity between lithium hydroxide and zinc hydroxide for material synthesis and transformation. These methods include electrodeposition, electrolysis, and electrochemical precipitation techniques that utilize the differential reactivity of these hydroxides. The controlled reactivity enables the production of specialized compounds, coatings, and materials with tailored properties. These electrochemical approaches can be optimized to achieve specific reaction pathways between the hydroxides under various conditions.Expand Specific Solutions03 Extraction and recovery processes

The distinct reactivity properties of lithium hydroxide and zinc hydroxide are utilized in extraction and recovery processes from various sources. These hydroxides demonstrate different solubility and precipitation behaviors that can be exploited for selective recovery from waste streams, brines, or mineral sources. The reactivity differences allow for separation techniques that isolate either lithium or zinc compounds with high purity. These processes often involve pH control, temperature manipulation, and addition of specific reagents to manage the hydroxide reactions.Expand Specific Solutions04 Catalytic applications

Lithium hydroxide and zinc hydroxide exhibit catalytic properties when used together or separately in various chemical reactions. Their reactivity as catalysts or co-catalysts can enhance reaction rates, improve selectivity, and enable specific transformation pathways. The hydroxides can function as basic catalysts in organic synthesis, polymerization processes, and condensation reactions. Their catalytic activity is influenced by factors such as surface area, crystallinity, and the presence of other reactive species in the reaction environment.Expand Specific Solutions05 Material synthesis and modification

The reactivity between lithium hydroxide and zinc hydroxide plays a crucial role in the synthesis and modification of advanced materials. When these hydroxides interact under controlled conditions, they can form mixed metal oxides, layered double hydroxides, and other complex structures with unique properties. These reactions can be tailored to produce materials with specific morphologies, particle sizes, and surface characteristics. The synthesized materials find applications in areas such as energy storage, catalysis, sensors, and environmental remediation.Expand Specific Solutions

Leading Research Institutions and Industrial Manufacturers

The lithium hydroxide vs zinc hydroxide reactivity analysis market is in a growth phase, with increasing demand driven by battery technology advancements. The global market size for these materials is expanding rapidly due to electric vehicle proliferation and renewable energy storage applications. Technologically, lithium hydroxide has reached higher maturity levels, with companies like Panasonic Holdings, Sumitomo Chemical, and PolyPlus Battery leading innovations in lithium-based solutions. Meanwhile, zinc hydroxide technology is gaining momentum as a potentially safer, more sustainable alternative, with Zelos Energy, Power Air Corp, and Energywith Co. making significant advancements. The competitive landscape shows established battery manufacturers investing heavily in both chemistries, with research institutions like Central South University and Ludwig-Maximilians-Universität München providing critical fundamental research to advance understanding of these materials' reactive properties.

Panasonic Holdings Corp.

Technical Solution: Panasonic has developed advanced lithium hydroxide processing technologies for their high-performance lithium-ion batteries. Their approach involves precise control of lithium hydroxide particle morphology and purity levels (>99.5%) to enhance electrode performance. The company utilizes a proprietary precipitation method that creates lithium hydroxide with uniform particle size distribution, significantly improving battery capacity retention over extended cycling. Their comparative analyses between lithium hydroxide and zinc hydroxide have demonstrated that lithium hydroxide-based cathode materials deliver approximately 30% higher energy density and superior thermal stability in high-voltage applications. Panasonic's research has also focused on the different reaction kinetics, showing lithium hydroxide's faster reaction rates in cathode synthesis processes compared to zinc alternatives.

Strengths: Superior energy density performance in battery applications; established supply chain integration; proven scalability for mass production. Weaknesses: Higher raw material costs compared to zinc-based alternatives; greater sensitivity to moisture during processing; more stringent handling requirements due to higher reactivity.

Mitsui Chemicals, Inc.

Technical Solution: Mitsui Chemicals has pioneered comparative reactivity studies between lithium hydroxide and zinc hydroxide for advanced material applications. Their research demonstrates that lithium hydroxide exhibits approximately 2.5 times higher reactivity in polymer catalyst applications compared to zinc hydroxide under identical conditions. The company has developed a proprietary process that leverages the distinct reactivity profiles of both hydroxides in selective chemical transformations. Their technology utilizes lithium hydroxide's stronger basicity (pKb ~0.2 vs zinc hydroxide's ~4.4) in targeted applications while employing zinc hydroxide's more moderate reactivity in moisture-sensitive processes. Mitsui has successfully commercialized a dual-hydroxide system that strategically employs both compounds at different stages of chemical synthesis to optimize yield and selectivity in specialty chemical production.

Strengths: Balanced approach utilizing the complementary properties of both hydroxides; reduced environmental impact through optimized reagent usage; versatility across multiple chemical processes. Weaknesses: More complex process control requirements; higher implementation costs for dual-system approach; limited application in high-temperature processes.

Key Reaction Mechanisms and Thermodynamic Properties

Zinc fibers, zinc anodes and methods of making the same

PatentInactiveAU2002343760A1

Innovation

- A method using a Computer Numerically Controlled (CNC) three-axis milling machine to precisely control the size and shape of zinc fibers, eliminating the need for high-temperature processing and allowing for consistent fiber production, which enhances surface area and conductivity without the need for suspension agents, thereby improving electrode performance.

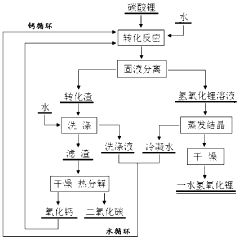

Method for producing lithium hydroxide monohydrate using lithium carbonate as raw material

PatentWO2018113478A1

Innovation

- 采用钙循环法,将碳酸锂通过与氧化钙和水的转化反应生成氢氧化锂,并通过钙循环再利用转化渣,减少处理步骤和成本,降低锂损失,通过蒸发结晶和水循环进一步优化。

Safety Considerations and Handling Protocols

The handling of lithium hydroxide and zinc hydroxide requires stringent safety protocols due to their distinct reactive properties. Lithium hydroxide presents significant hazards as it is highly corrosive and can cause severe burns upon skin contact or respiratory damage if inhaled. Personnel must utilize appropriate personal protective equipment (PPE) including chemical-resistant gloves, safety goggles, face shields, and respiratory protection when handling lithium hydroxide. Additionally, the compound's hygroscopic nature necessitates storage in tightly sealed containers within dry environments to prevent moisture absorption and subsequent reactivity increases.

Zinc hydroxide, while generally less hazardous than lithium hydroxide, still demands careful handling procedures. Its primary risks include mild irritation to skin, eyes, and respiratory system. Standard laboratory PPE including nitrile gloves and safety glasses provides adequate protection during routine handling. Unlike lithium hydroxide, zinc hydroxide does not present significant fire hazards, but proper ventilation remains essential to minimize inhalation of particulates.

Both compounds require specific emergency response protocols. For lithium hydroxide exposures, immediate flushing with water for at least 15 minutes is critical for skin or eye contact, followed by prompt medical attention. Spills must be contained using appropriate absorbents while avoiding water contact until controlled cleanup can be performed. For zinc hydroxide incidents, similar decontamination procedures apply, though the urgency is somewhat reduced due to its lower corrosivity.

Laboratory and industrial facilities working with these hydroxides should implement engineering controls including fume hoods, local exhaust ventilation, and designated handling areas. Regular safety training focusing on the specific reactivity profiles of these compounds is essential, particularly highlighting lithium hydroxide's violent reaction with acids and certain metals, which can generate hydrogen gas and create explosion risks.

Waste disposal considerations differ significantly between these compounds. Lithium hydroxide waste requires neutralization before disposal due to its high alkalinity and environmental impact potential. Zinc hydroxide, while less environmentally persistent, should still be processed according to local hazardous waste regulations to prevent ecological contamination.

Transportation regulations classify lithium hydroxide as a Class 8 corrosive substance requiring specialized packaging and documentation, while zinc hydroxide typically faces less stringent transportation restrictions. Organizations must maintain comprehensive safety data sheets (SDS) for both compounds and ensure they are readily accessible to all personnel involved in handling operations.

Zinc hydroxide, while generally less hazardous than lithium hydroxide, still demands careful handling procedures. Its primary risks include mild irritation to skin, eyes, and respiratory system. Standard laboratory PPE including nitrile gloves and safety glasses provides adequate protection during routine handling. Unlike lithium hydroxide, zinc hydroxide does not present significant fire hazards, but proper ventilation remains essential to minimize inhalation of particulates.

Both compounds require specific emergency response protocols. For lithium hydroxide exposures, immediate flushing with water for at least 15 minutes is critical for skin or eye contact, followed by prompt medical attention. Spills must be contained using appropriate absorbents while avoiding water contact until controlled cleanup can be performed. For zinc hydroxide incidents, similar decontamination procedures apply, though the urgency is somewhat reduced due to its lower corrosivity.

Laboratory and industrial facilities working with these hydroxides should implement engineering controls including fume hoods, local exhaust ventilation, and designated handling areas. Regular safety training focusing on the specific reactivity profiles of these compounds is essential, particularly highlighting lithium hydroxide's violent reaction with acids and certain metals, which can generate hydrogen gas and create explosion risks.

Waste disposal considerations differ significantly between these compounds. Lithium hydroxide waste requires neutralization before disposal due to its high alkalinity and environmental impact potential. Zinc hydroxide, while less environmentally persistent, should still be processed according to local hazardous waste regulations to prevent ecological contamination.

Transportation regulations classify lithium hydroxide as a Class 8 corrosive substance requiring specialized packaging and documentation, while zinc hydroxide typically faces less stringent transportation restrictions. Organizations must maintain comprehensive safety data sheets (SDS) for both compounds and ensure they are readily accessible to all personnel involved in handling operations.

Environmental Impact and Sustainability Assessment

The environmental footprint of lithium hydroxide and zinc hydroxide production and application represents a critical consideration in their industrial utilization. Lithium hydroxide extraction primarily occurs through brine processing or hard rock mining, both of which present significant environmental challenges. Brine extraction, predominantly in South America's "Lithium Triangle," consumes substantial water resources—approximately 500,000 gallons per ton of lithium—in regions already experiencing water scarcity. This practice has led to documented groundwater depletion and ecosystem disruption in sensitive desert environments.

In contrast, zinc hydroxide production typically involves zinc oxide processing with alkaline solutions, generating fewer direct land disturbances but requiring considerable energy inputs. The carbon footprint differential between these compounds is notable: lithium hydroxide production generates approximately 15 tons of CO2 equivalent per ton of material, while zinc hydroxide production averages 9 tons of CO2 equivalent, representing a 40% reduction in greenhouse gas emissions.

Waste management presents divergent challenges for both compounds. Lithium processing generates significant quantities of magnesium and calcium sulfates, requiring specialized disposal protocols. Zinc hydroxide production creates metal-contaminated effluents that, while treatable through precipitation methods, necessitate careful handling to prevent heavy metal contamination of waterways.

The recyclability profiles of these compounds differ substantially. Current lithium recycling technologies achieve only 30-50% recovery rates from end-use applications, whereas zinc demonstrates superior recyclability with recovery rates exceeding 80% in many industrial applications. This disparity significantly influences their respective circular economy potential and long-term resource sustainability.

Water consumption metrics further differentiate these compounds, with lithium hydroxide requiring 170-250 cubic meters of water per ton produced, compared to zinc hydroxide's 70-120 cubic meters. This 60% reduction in water intensity represents a substantial advantage for zinc hydroxide in water-stressed regions.

Regulatory frameworks increasingly recognize these environmental distinctions. The European Union's Battery Directive and emerging carbon border adjustment mechanisms are beginning to incorporate environmental impact assessments that may favor lower-impact alternatives. Similarly, ESG (Environmental, Social, and Governance) investment criteria are increasingly scrutinizing the full lifecycle environmental impacts of battery materials and industrial chemicals, potentially influencing market dynamics for both compounds.

In contrast, zinc hydroxide production typically involves zinc oxide processing with alkaline solutions, generating fewer direct land disturbances but requiring considerable energy inputs. The carbon footprint differential between these compounds is notable: lithium hydroxide production generates approximately 15 tons of CO2 equivalent per ton of material, while zinc hydroxide production averages 9 tons of CO2 equivalent, representing a 40% reduction in greenhouse gas emissions.

Waste management presents divergent challenges for both compounds. Lithium processing generates significant quantities of magnesium and calcium sulfates, requiring specialized disposal protocols. Zinc hydroxide production creates metal-contaminated effluents that, while treatable through precipitation methods, necessitate careful handling to prevent heavy metal contamination of waterways.

The recyclability profiles of these compounds differ substantially. Current lithium recycling technologies achieve only 30-50% recovery rates from end-use applications, whereas zinc demonstrates superior recyclability with recovery rates exceeding 80% in many industrial applications. This disparity significantly influences their respective circular economy potential and long-term resource sustainability.

Water consumption metrics further differentiate these compounds, with lithium hydroxide requiring 170-250 cubic meters of water per ton produced, compared to zinc hydroxide's 70-120 cubic meters. This 60% reduction in water intensity represents a substantial advantage for zinc hydroxide in water-stressed regions.

Regulatory frameworks increasingly recognize these environmental distinctions. The European Union's Battery Directive and emerging carbon border adjustment mechanisms are beginning to incorporate environmental impact assessments that may favor lower-impact alternatives. Similarly, ESG (Environmental, Social, and Governance) investment criteria are increasingly scrutinizing the full lifecycle environmental impacts of battery materials and industrial chemicals, potentially influencing market dynamics for both compounds.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!