Mini LED vs Hybrid Display: Market Relevance Test

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Mini LED and Hybrid Display Technology Evolution

The evolution of display technologies has witnessed significant advancements over the past decade, with Mini LED and Hybrid Display technologies emerging as pivotal innovations in the visual interface landscape. Mini LED technology, first conceptualized in the early 2010s, represents an enhancement of traditional LED backlighting by utilizing significantly smaller diodes measuring between 50-200 micrometers, compared to conventional LEDs at 300+ micrometers.

The developmental trajectory of Mini LED began with its introduction as a premium backlighting solution for LCD panels around 2018, when manufacturers like TCL and Samsung first commercialized the technology. By 2020, the technology had matured sufficiently to enable mass production, leading to wider adoption in high-end televisions and professional monitors. The evolution continued with the integration of Mini LED backlighting in portable devices, marking a significant milestone when Apple incorporated the technology in iPad Pro (2021) and MacBook Pro models.

Parallel to Mini LED development, Hybrid Display technology has evolved as a convergent solution combining elements of multiple display technologies. The concept emerged around 2015, initially focusing on combining OLED and quantum dot technologies. By 2018, research expanded to incorporate Mini LED backlighting with quantum dot color conversion layers, creating what the industry termed "QLED with Mini LED" displays.

A critical evolutionary milestone occurred in 2019-2020 when manufacturers began developing dual-layer displays that could switch between transmissive and emissive modes, effectively creating true hybrid functionality. This approach allowed displays to leverage the high brightness capabilities of LED/LCD technology while simultaneously benefiting from the perfect blacks and power efficiency of OLED in appropriate content scenarios.

The technological progression has been characterized by continuous improvements in local dimming zones, with early Mini LED implementations featuring hundreds of zones evolving to current premium models with thousands of independently controlled dimming zones. Similarly, hybrid solutions have evolved from simple dual-technology implementations to sophisticated systems with advanced algorithms that dynamically determine optimal display modes based on content requirements.

Manufacturing processes have simultaneously evolved, with early Mini LED production facing yield challenges and high costs due to the precision required for placement of thousands of miniaturized diodes. Recent advancements in mass transfer techniques and automated production lines have significantly reduced these barriers, contributing to broader market adoption and decreasing price premiums.

The convergence point in this evolution appears to be emerging in 2023-2024, as manufacturers explore micro-LED technology as the ultimate display solution, potentially rendering the distinction between backlighting and self-emissive technologies obsolete. This represents the natural progression of both Mini LED and Hybrid Display technologies toward a unified future display paradigm.

The developmental trajectory of Mini LED began with its introduction as a premium backlighting solution for LCD panels around 2018, when manufacturers like TCL and Samsung first commercialized the technology. By 2020, the technology had matured sufficiently to enable mass production, leading to wider adoption in high-end televisions and professional monitors. The evolution continued with the integration of Mini LED backlighting in portable devices, marking a significant milestone when Apple incorporated the technology in iPad Pro (2021) and MacBook Pro models.

Parallel to Mini LED development, Hybrid Display technology has evolved as a convergent solution combining elements of multiple display technologies. The concept emerged around 2015, initially focusing on combining OLED and quantum dot technologies. By 2018, research expanded to incorporate Mini LED backlighting with quantum dot color conversion layers, creating what the industry termed "QLED with Mini LED" displays.

A critical evolutionary milestone occurred in 2019-2020 when manufacturers began developing dual-layer displays that could switch between transmissive and emissive modes, effectively creating true hybrid functionality. This approach allowed displays to leverage the high brightness capabilities of LED/LCD technology while simultaneously benefiting from the perfect blacks and power efficiency of OLED in appropriate content scenarios.

The technological progression has been characterized by continuous improvements in local dimming zones, with early Mini LED implementations featuring hundreds of zones evolving to current premium models with thousands of independently controlled dimming zones. Similarly, hybrid solutions have evolved from simple dual-technology implementations to sophisticated systems with advanced algorithms that dynamically determine optimal display modes based on content requirements.

Manufacturing processes have simultaneously evolved, with early Mini LED production facing yield challenges and high costs due to the precision required for placement of thousands of miniaturized diodes. Recent advancements in mass transfer techniques and automated production lines have significantly reduced these barriers, contributing to broader market adoption and decreasing price premiums.

The convergence point in this evolution appears to be emerging in 2023-2024, as manufacturers explore micro-LED technology as the ultimate display solution, potentially rendering the distinction between backlighting and self-emissive technologies obsolete. This represents the natural progression of both Mini LED and Hybrid Display technologies toward a unified future display paradigm.

Market Demand Analysis for Advanced Display Technologies

The display technology market is witnessing a significant shift towards advanced solutions that offer superior visual experiences while maintaining energy efficiency. Current market analysis indicates robust growth in the advanced display sector, with the global market valued at approximately 143 billion USD in 2022 and projected to reach 206 billion USD by 2027, representing a compound annual growth rate of 7.5%. This growth is primarily driven by increasing consumer demand for higher resolution, better contrast ratios, and more vibrant color reproduction in various devices.

Mini LED technology has gained substantial traction in premium television and high-end monitor segments, where consumers demonstrate willingness to pay premium prices for enhanced visual quality. Market research reveals that Mini LED shipments increased by 85% in 2022, with particularly strong adoption in gaming monitors and professional displays where precise backlighting control delivers competitive advantages.

Hybrid display technologies, combining elements of different display solutions, are emerging as a promising segment addressing the limitations of individual technologies. Consumer electronics manufacturers report growing interest in hybrid solutions that balance performance characteristics with production costs. The flexibility of hybrid approaches allows manufacturers to target specific market segments with optimized price-performance ratios.

Regional analysis shows differentiated demand patterns, with North American and European markets prioritizing quality and performance, while Asian markets demonstrate greater price sensitivity but rapidly increasing quality expectations. This regional variation creates opportunities for tiered product strategies utilizing different display technologies across price points.

Industry surveys indicate that consumers increasingly consider display quality as a primary purchase factor for devices like smartphones (68%), televisions (82%), and laptops (57%). This represents a significant shift from five years ago when price and brand were dominant decision factors. The growing consumer awareness of display specifications has created market pressure for continuous innovation.

Commercial applications represent another substantial growth vector, with digital signage, automotive displays, and medical imaging driving demand for specialized display solutions. These sectors require customized performance characteristics that often align with the strengths of either Mini LED or hybrid technologies, depending on specific use cases.

Supply chain analysis reveals that manufacturers are investing heavily in production capacity for advanced display technologies, with particular emphasis on addressing yield challenges that have historically limited adoption. Recent manufacturing innovations have reduced production costs by approximately 30% over the past three years, accelerating market penetration of these technologies.

Mini LED technology has gained substantial traction in premium television and high-end monitor segments, where consumers demonstrate willingness to pay premium prices for enhanced visual quality. Market research reveals that Mini LED shipments increased by 85% in 2022, with particularly strong adoption in gaming monitors and professional displays where precise backlighting control delivers competitive advantages.

Hybrid display technologies, combining elements of different display solutions, are emerging as a promising segment addressing the limitations of individual technologies. Consumer electronics manufacturers report growing interest in hybrid solutions that balance performance characteristics with production costs. The flexibility of hybrid approaches allows manufacturers to target specific market segments with optimized price-performance ratios.

Regional analysis shows differentiated demand patterns, with North American and European markets prioritizing quality and performance, while Asian markets demonstrate greater price sensitivity but rapidly increasing quality expectations. This regional variation creates opportunities for tiered product strategies utilizing different display technologies across price points.

Industry surveys indicate that consumers increasingly consider display quality as a primary purchase factor for devices like smartphones (68%), televisions (82%), and laptops (57%). This represents a significant shift from five years ago when price and brand were dominant decision factors. The growing consumer awareness of display specifications has created market pressure for continuous innovation.

Commercial applications represent another substantial growth vector, with digital signage, automotive displays, and medical imaging driving demand for specialized display solutions. These sectors require customized performance characteristics that often align with the strengths of either Mini LED or hybrid technologies, depending on specific use cases.

Supply chain analysis reveals that manufacturers are investing heavily in production capacity for advanced display technologies, with particular emphasis on addressing yield challenges that have historically limited adoption. Recent manufacturing innovations have reduced production costs by approximately 30% over the past three years, accelerating market penetration of these technologies.

Technical Challenges and Limitations in Display Technologies

Despite significant advancements in display technologies, both Mini LED and Hybrid Display solutions face substantial technical challenges that impact their market adoption. Mini LED technology struggles with manufacturing complexity due to the precise placement requirements of thousands of tiny LED chips. The production yield rates remain suboptimal, with defect rates higher than established technologies, directly affecting production costs and scalability.

Thermal management presents another critical limitation for Mini LED displays. The dense arrangement of LEDs generates considerable heat during operation, requiring sophisticated thermal dissipation systems. Without adequate cooling, these displays risk shortened lifespans and performance degradation, particularly in compact device designs where space for cooling systems is limited.

For Hybrid Display technology, which typically combines OLED and quantum dot elements, material stability remains a persistent challenge. The organic components in OLED layers are susceptible to degradation when exposed to oxygen and moisture, leading to reduced display longevity and potential color shifting over time. This vulnerability necessitates complex encapsulation techniques that add to manufacturing complexity and cost.

Color consistency across the display surface represents a significant technical hurdle for both technologies. Mini LED backlight systems struggle with achieving uniform brightness across the entire panel, often resulting in visible "blooming" effects where bright objects on dark backgrounds create halos. Hybrid Displays face challenges in maintaining consistent color reproduction between different display elements, particularly at varying brightness levels.

Power efficiency continues to be problematic, especially for portable devices. While Mini LED offers improved efficiency compared to conventional LCD technology, it still consumes significantly more power than OLED solutions in displaying dark content. Hybrid Displays aim to balance these concerns but often require sophisticated power management systems that add complexity to device design.

Resolution limitations affect both technologies differently. Mini LED backlighting improves contrast but doesn't inherently enhance pixel density, requiring additional panel technologies to achieve ultra-high resolutions. Meanwhile, Hybrid Displays face challenges in maintaining consistent pixel structures across different display elements, potentially creating visible artifacts at certain viewing angles.

Supply chain constraints further complicate advancement, with both technologies requiring specialized materials and manufacturing equipment. The limited number of suppliers capable of producing key components creates bottlenecks in production scaling and increases vulnerability to market disruptions, directly impacting manufacturers' ability to meet market demand consistently.

Thermal management presents another critical limitation for Mini LED displays. The dense arrangement of LEDs generates considerable heat during operation, requiring sophisticated thermal dissipation systems. Without adequate cooling, these displays risk shortened lifespans and performance degradation, particularly in compact device designs where space for cooling systems is limited.

For Hybrid Display technology, which typically combines OLED and quantum dot elements, material stability remains a persistent challenge. The organic components in OLED layers are susceptible to degradation when exposed to oxygen and moisture, leading to reduced display longevity and potential color shifting over time. This vulnerability necessitates complex encapsulation techniques that add to manufacturing complexity and cost.

Color consistency across the display surface represents a significant technical hurdle for both technologies. Mini LED backlight systems struggle with achieving uniform brightness across the entire panel, often resulting in visible "blooming" effects where bright objects on dark backgrounds create halos. Hybrid Displays face challenges in maintaining consistent color reproduction between different display elements, particularly at varying brightness levels.

Power efficiency continues to be problematic, especially for portable devices. While Mini LED offers improved efficiency compared to conventional LCD technology, it still consumes significantly more power than OLED solutions in displaying dark content. Hybrid Displays aim to balance these concerns but often require sophisticated power management systems that add complexity to device design.

Resolution limitations affect both technologies differently. Mini LED backlighting improves contrast but doesn't inherently enhance pixel density, requiring additional panel technologies to achieve ultra-high resolutions. Meanwhile, Hybrid Displays face challenges in maintaining consistent pixel structures across different display elements, potentially creating visible artifacts at certain viewing angles.

Supply chain constraints further complicate advancement, with both technologies requiring specialized materials and manufacturing equipment. The limited number of suppliers capable of producing key components creates bottlenecks in production scaling and increases vulnerability to market disruptions, directly impacting manufacturers' ability to meet market demand consistently.

Current Technical Solutions and Implementation Approaches

01 Mini LED backlight technology advancements

Mini LED technology offers significant improvements in display performance through enhanced backlighting systems. These advancements include higher contrast ratios, improved brightness, and more precise local dimming capabilities compared to traditional LED displays. The technology utilizes thousands of tiny LED chips arranged in multiple dimming zones, allowing for better control of light distribution and reduced blooming effects. These improvements make Mini LED displays particularly suitable for high-end consumer electronics and professional applications requiring superior visual performance.- Mini LED display technology advancements: Mini LED technology represents a significant advancement in display technology, offering improved brightness, contrast ratio, and energy efficiency compared to traditional LED displays. These displays use smaller LED chips arranged in arrays to provide more precise local dimming zones, resulting in better image quality and HDR performance. The technology serves as a bridge between conventional LED and more advanced micro LED displays, making it increasingly relevant in premium consumer electronics markets.

- Hybrid display integration solutions: Hybrid display technologies combine different display types to leverage the advantages of each, such as integrating OLED with Mini LED or LCD with quantum dot technology. These hybrid approaches aim to overcome limitations of individual technologies while maximizing performance characteristics like color accuracy, power efficiency, and lifespan. The integration often involves specialized backlight systems, optical films, and control algorithms to ensure seamless operation across different display components.

- Market applications and consumer electronics implementation: Mini LED and hybrid display technologies are finding increasing market relevance across various consumer electronics segments, particularly in high-end televisions, premium monitors, tablets, and laptops. These technologies enable manufacturers to offer thinner devices with superior visual performance, meeting growing consumer demand for immersive viewing experiences. The commercial adoption is accelerating as production costs decrease and manufacturing processes become more efficient, expanding from luxury segments into mainstream consumer products.

- Technical design and manufacturing innovations: Innovations in the design and manufacturing of Mini LED and hybrid displays focus on addressing challenges such as thermal management, uniformity control, and yield improvement. Advanced packaging techniques, automated assembly methods, and novel substrate materials are being developed to enhance production efficiency and reduce costs. These innovations include specialized circuit designs for driving Mini LEDs, optical structures for light distribution optimization, and integration frameworks that simplify the manufacturing process while improving display performance.

- Energy efficiency and environmental considerations: Mini LED and hybrid display technologies offer significant improvements in energy efficiency compared to conventional display technologies. These advancements include optimized power management systems, selective dimming capabilities, and more efficient light utilization. The reduced power consumption not only extends battery life in portable devices but also aligns with global sustainability initiatives. Additionally, some manufacturing innovations focus on reducing the use of rare or environmentally problematic materials, making these display technologies more environmentally friendly.

02 Hybrid display integration solutions

Hybrid display technologies combine different display technologies to leverage the advantages of each while minimizing their limitations. These solutions typically integrate Mini LED backlighting with other display types such as LCD or OLED to achieve optimal performance characteristics. The hybrid approach allows manufacturers to create displays with enhanced color accuracy, improved energy efficiency, and extended lifespan. Integration solutions also address technical challenges such as heat management, uniform light distribution, and manufacturing complexity to deliver commercially viable products.Expand Specific Solutions03 Market applications and consumer electronics implementation

Mini LED and hybrid display technologies are finding widespread applications across various consumer electronics segments. These technologies are being implemented in premium televisions, high-end monitors, tablets, laptops, and automotive displays. The market relevance is driven by consumer demand for improved visual experiences, thinner device profiles, and energy efficiency. Manufacturers are developing specialized implementations for different market segments, with particular focus on gaming displays, professional content creation monitors, and premium home entertainment systems where the visual performance advantages justify the higher cost.Expand Specific Solutions04 Manufacturing processes and cost optimization

Innovations in manufacturing processes for Mini LED and hybrid displays focus on improving production efficiency and reducing costs to increase market adoption. These advancements include automated assembly techniques, improved substrate materials, enhanced chip transfer methods, and optimized circuit designs. Cost optimization strategies involve reducing the number of LED chips while maintaining performance, developing more efficient driver ICs, and creating standardized manufacturing processes. These improvements aim to make Mini LED technology more accessible across different price segments while maintaining the key performance advantages.Expand Specific Solutions05 Display performance enhancement technologies

Various technologies are being developed to enhance the performance of Mini LED and hybrid displays beyond basic implementation. These include advanced optical films to improve light distribution, specialized quantum dot layers for color enhancement, sophisticated local dimming algorithms, and thermal management solutions. Additional enhancements focus on reducing motion blur, improving viewing angles, and optimizing power consumption. These technologies collectively contribute to creating displays with superior visual quality, addressing specific performance limitations, and differentiating products in competitive market segments.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The Mini LED vs Hybrid Display market is currently in a growth phase, with increasing adoption across consumer electronics and commercial applications. The market size is expanding rapidly, projected to reach significant value as major players like BOE Technology Group, TCL China Star Optoelectronics, and Hisense Visual Technology intensify their R&D investments. Technologically, Mini LED is more mature with established manufacturing processes, while hybrid display technologies are still evolving. Companies like BOE Mled Technology and Jade Bird Display are advancing Mini LED innovations, while established players such as LG Electronics and Ricoh are exploring hybrid solutions. Chinese manufacturers dominate the competitive landscape, with significant contributions from BOE, TCL, and HKC Corp in advancing both technologies toward commercial viability and cost-effectiveness.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced Mini LED backlight technology featuring ultra-thin direct-type backlight modules with thousands of individually controlled dimming zones. Their solution achieves high contrast ratios exceeding 1,000,000:1 and peak brightness levels of 1,500-2,000 nits. BOE's Mini LED displays utilize chips sized between 100-200 micrometers with precise transfer technology ensuring 99.99% yield rates. For hybrid display solutions, BOE has pioneered "Active Matrix Mini LED" (AM Mini LED) technology that combines TFT backplanes with Mini LED elements to create self-emissive zones while maintaining LCD panels for color reproduction. This approach bridges the gap between traditional LCD and OLED technologies, offering improved HDR performance with significantly reduced blooming effects compared to conventional local dimming solutions.

Strengths: Industry-leading local dimming zone count (up to 5,000+ zones in premium models), superior production capacity with multiple dedicated Mini LED manufacturing lines, and established supply chain integration. Weaknesses: Higher production costs compared to conventional displays, thermal management challenges in ultra-thin designs, and competition from their own OLED division potentially creating internal market cannibalization.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed a comprehensive Mini LED display solution branded as "Vidrian Mini LED Technology" that integrates semiconductor-grade Mini LEDs directly onto a glass substrate powered by their proprietary active-matrix driving technology. Their displays feature up to 25,000 individual Mini LED light sources and over 1,000 control zones, achieving peak brightness of 2,500 nits with precise local dimming capabilities. TCL's hybrid display approach combines quantum dot color enhancement layer with Mini LED backlighting, resulting in their "QLED Pro" technology that delivers 100% DCI-P3 color gamut coverage. Their latest generation incorporates dual-layer LCD technology (branded as "H-DNR") working in conjunction with Mini LED backlighting to achieve contrast ratios approaching OLED levels while maintaining higher brightness and eliminating burn-in concerns. TCL CSOT has also pioneered cost-reduction manufacturing techniques including glass substrate direct printing that reduces production steps by 30-40% compared to traditional PCB-based Mini LED implementations.

Strengths: Vertical integration from panel manufacturing to end products allows for optimized design and cost control; proprietary glass substrate direct printing technology reduces manufacturing complexity; strong consumer market presence through TCL branded products provides immediate commercialization channels. Weaknesses: Higher initial investment costs compared to conventional display technologies; challenges in achieving uniform brightness across large panel sizes; limited production capacity compared to industry giants like Samsung and LG.

Core Patents and Innovations in Display Technologies

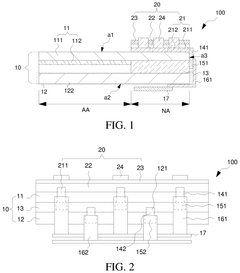

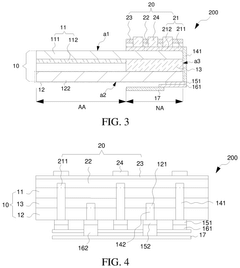

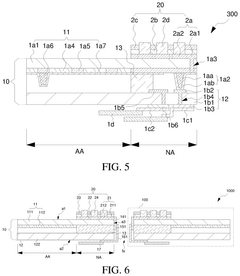

Hybrid panel and spliced panel

PatentPendingUS20240413283A1

Innovation

- A hybrid panel is designed with an LED substrate in the non-display region, increasing the display area and reducing the pitch between adjacent display regions by thinning the LED substrate and using side or back surface bonding techniques to minimize bezel width.

Mini light emitting diode (LED) backlight and method of manufacturing same

PatentActiveUS20200341333A1

Innovation

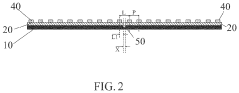

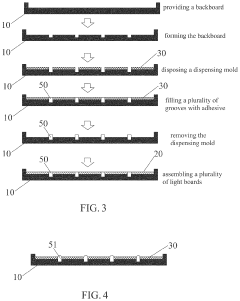

- A mini LED backlight design featuring a backboard with grooves corresponding to seams between light boards, filled with cured adhesive, where the groove width (X) is set such that X<P−2L1, ensuring uniform reflectivity and assembly accuracy, and the adhesive is flush or slightly protruding to enhance light uniformity.

Supply Chain Analysis and Manufacturing Considerations

The supply chain for Mini LED and Hybrid Display technologies represents a complex ecosystem with distinct manufacturing requirements and challenges. Mini LED production relies heavily on specialized equipment for precise LED chip placement, with key components sourced primarily from East Asian manufacturers. Taiwan, Japan, and South Korea dominate the high-precision chip manufacturing segment, while mainland China has rapidly expanded its capacity for assembly and packaging operations.

Manufacturing considerations for Mini LED displays include the critical challenge of yield management. With thousands of miniaturized LEDs in a single display, even small defect rates can significantly impact production costs. Industry leaders have invested substantially in automated optical inspection systems and AI-driven quality control processes to address this challenge, resulting in gradual yield improvements from approximately 70% in early production to over 90% in advanced facilities.

Hybrid Display technology presents a different set of supply chain dynamics, combining elements from both OLED and LCD/Mini LED manufacturing processes. This creates potential for supply chain diversification but also introduces complexity in component sourcing and integration. The specialized materials required for hybrid solutions, particularly advanced color conversion layers and optical bonding materials, currently face limited supplier options, creating potential bottlenecks.

Energy consumption during manufacturing represents another significant consideration. Mini LED production typically requires 30-40% more energy than conventional LCD manufacturing due to the additional processing steps. Hybrid Display approaches may offer efficiency advantages through streamlined production processes that eliminate certain energy-intensive steps, though this varies significantly based on the specific hybrid technology implementation.

Regional manufacturing capabilities also influence market adoption trajectories. While East Asia maintains dominance in display manufacturing infrastructure, recent geopolitical tensions have accelerated efforts to diversify supply chains. Several major brands have initiated programs to establish secondary manufacturing capabilities in Southeast Asia and Eastern Europe, though these facilities primarily focus on final assembly rather than core component production.

Labor requirements differ substantially between technologies. Mini LED manufacturing demands highly skilled technicians for precision equipment operation, while certain hybrid approaches may leverage existing LCD manufacturing workforce skills. This distinction influences both production costs and regional manufacturing viability, with implications for market pricing strategies and competitive positioning.

Manufacturing considerations for Mini LED displays include the critical challenge of yield management. With thousands of miniaturized LEDs in a single display, even small defect rates can significantly impact production costs. Industry leaders have invested substantially in automated optical inspection systems and AI-driven quality control processes to address this challenge, resulting in gradual yield improvements from approximately 70% in early production to over 90% in advanced facilities.

Hybrid Display technology presents a different set of supply chain dynamics, combining elements from both OLED and LCD/Mini LED manufacturing processes. This creates potential for supply chain diversification but also introduces complexity in component sourcing and integration. The specialized materials required for hybrid solutions, particularly advanced color conversion layers and optical bonding materials, currently face limited supplier options, creating potential bottlenecks.

Energy consumption during manufacturing represents another significant consideration. Mini LED production typically requires 30-40% more energy than conventional LCD manufacturing due to the additional processing steps. Hybrid Display approaches may offer efficiency advantages through streamlined production processes that eliminate certain energy-intensive steps, though this varies significantly based on the specific hybrid technology implementation.

Regional manufacturing capabilities also influence market adoption trajectories. While East Asia maintains dominance in display manufacturing infrastructure, recent geopolitical tensions have accelerated efforts to diversify supply chains. Several major brands have initiated programs to establish secondary manufacturing capabilities in Southeast Asia and Eastern Europe, though these facilities primarily focus on final assembly rather than core component production.

Labor requirements differ substantially between technologies. Mini LED manufacturing demands highly skilled technicians for precision equipment operation, while certain hybrid approaches may leverage existing LCD manufacturing workforce skills. This distinction influences both production costs and regional manufacturing viability, with implications for market pricing strategies and competitive positioning.

Energy Efficiency and Sustainability Factors

Energy efficiency has emerged as a critical factor in display technology evaluation, with Mini LED and Hybrid Display technologies presenting distinct sustainability profiles. Mini LED displays demonstrate significant energy efficiency advantages over traditional LCD panels, consuming approximately 30% less power while delivering superior brightness levels. This efficiency stems from Mini LED's precise local dimming capabilities, which allow for selective illumination of screen areas rather than maintaining uniform backlighting across the entire display.

When comparing Mini LED to Hybrid Display technologies, the energy consumption patterns reveal interesting distinctions. Hybrid Displays, which typically combine elements of LCD and OLED or other display technologies, often achieve moderate energy savings in mixed-content scenarios. However, Mini LED generally maintains superior efficiency when displaying bright content with high dynamic range requirements.

Manufacturing sustainability represents another crucial dimension in the comparative analysis. Mini LED production processes have been optimized over recent years, reducing waste materials by approximately 15-20% compared to first-generation implementations. The semiconductor materials used in Mini LED production, while requiring energy-intensive manufacturing, offer longer operational lifespans that partially offset initial environmental impacts.

Hybrid Display technologies present a mixed sustainability profile, with some configurations utilizing fewer rare earth elements but potentially requiring more complex assembly processes. Recent industry data indicates that the carbon footprint of Hybrid Display manufacturing has decreased by approximately 22% since 2019, though this varies significantly between manufacturers and specific technological implementations.

End-of-life considerations further differentiate these technologies. Mini LED components contain valuable recoverable materials, with recycling efficiency rates reaching 70-85% in advanced facilities. The modular nature of some Mini LED designs also facilitates easier component replacement, potentially extending product lifespans by 30-40% compared to displays requiring complete replacement upon partial failure.

Regulatory frameworks increasingly influence market adoption, with the EU's Energy Efficiency Index and similar global standards favoring technologies with lower power consumption profiles. Corporate sustainability initiatives among major technology companies have similarly prioritized energy-efficient display technologies, with several major manufacturers committing to carbon-neutral production processes by 2030.

The total cost of ownership calculations, incorporating both initial purchase price and operational energy costs over a standard five-year usage period, typically favor Mini LED technology for high-brightness commercial applications, while Hybrid Displays may offer advantages in consumer devices with variable usage patterns.

When comparing Mini LED to Hybrid Display technologies, the energy consumption patterns reveal interesting distinctions. Hybrid Displays, which typically combine elements of LCD and OLED or other display technologies, often achieve moderate energy savings in mixed-content scenarios. However, Mini LED generally maintains superior efficiency when displaying bright content with high dynamic range requirements.

Manufacturing sustainability represents another crucial dimension in the comparative analysis. Mini LED production processes have been optimized over recent years, reducing waste materials by approximately 15-20% compared to first-generation implementations. The semiconductor materials used in Mini LED production, while requiring energy-intensive manufacturing, offer longer operational lifespans that partially offset initial environmental impacts.

Hybrid Display technologies present a mixed sustainability profile, with some configurations utilizing fewer rare earth elements but potentially requiring more complex assembly processes. Recent industry data indicates that the carbon footprint of Hybrid Display manufacturing has decreased by approximately 22% since 2019, though this varies significantly between manufacturers and specific technological implementations.

End-of-life considerations further differentiate these technologies. Mini LED components contain valuable recoverable materials, with recycling efficiency rates reaching 70-85% in advanced facilities. The modular nature of some Mini LED designs also facilitates easier component replacement, potentially extending product lifespans by 30-40% compared to displays requiring complete replacement upon partial failure.

Regulatory frameworks increasingly influence market adoption, with the EU's Energy Efficiency Index and similar global standards favoring technologies with lower power consumption profiles. Corporate sustainability initiatives among major technology companies have similarly prioritized energy-efficient display technologies, with several major manufacturers committing to carbon-neutral production processes by 2030.

The total cost of ownership calculations, incorporating both initial purchase price and operational energy costs over a standard five-year usage period, typically favor Mini LED technology for high-brightness commercial applications, while Hybrid Displays may offer advantages in consumer devices with variable usage patterns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!