Mini LED vs Thermionic Displays: Cost-Effectiveness Study

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Mini LED and Thermionic Display Evolution

The evolution of display technologies has witnessed significant advancements over the decades, with Mini LED and Thermionic displays representing two distinct technological approaches with varying development trajectories. Mini LED technology emerged as an enhancement to traditional LED backlighting systems around 2017-2018, when companies like TCL and Apple began serious research and development efforts to overcome limitations of conventional LCD displays.

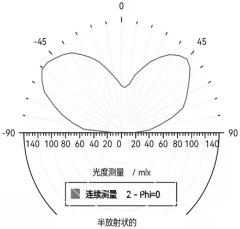

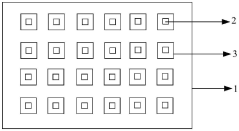

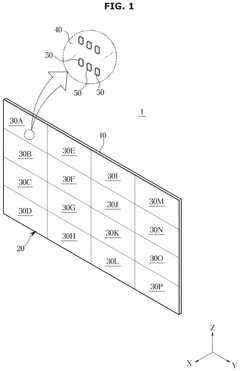

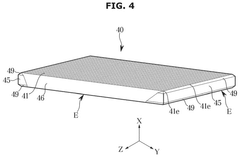

Mini LED displays utilize thousands of tiny LED chips (typically 0.1-0.2mm) arranged in precise arrays to create more dimming zones compared to traditional LED-backlit displays. This evolution was driven by the market demand for improved contrast ratios and deeper blacks while maintaining cost advantages over OLED technology. The development curve accelerated significantly between 2019-2021, with major breakthroughs in manufacturing processes that allowed for more efficient placement of these miniaturized components.

Thermionic displays, conversely, represent a more experimental technology with roots in vacuum tube electronics. These displays operate on the principle of thermionic emission, where heated cathodes emit electrons that can be directed to create images. The concept dates back to early cathode ray tube technology but has seen renewed interest as researchers explore novel applications of thermionic emission in modern display contexts.

The technological progression of Mini LED has followed a relatively predictable path, with incremental improvements in chip size reduction, optical efficiency, and manufacturing yield. Key milestones include the reduction of LED chip size below 100 micrometers, the development of transfer techniques for precise placement, and the implementation of advanced local dimming algorithms that maximize contrast performance.

Thermionic display technology has evolved more sporadically, with significant research occurring in specialized laboratories rather than mainstream consumer electronics companies. Recent developments have focused on creating more efficient electron emitters, reducing power consumption, and exploring novel materials that could enable thinner form factors.

The convergence point between these technologies lies in their pursuit of superior image quality with energy efficiency. Mini LED has progressed toward increasing dimming zone counts from hundreds to thousands, while thermionic research has focused on achieving comparable visual performance through fundamentally different physical mechanisms.

Looking forward, Mini LED technology appears positioned on a trajectory toward further miniaturization, potentially evolving toward Micro LED implementations. Thermionic displays, while currently less commercially viable, represent an alternative evolutionary path that could potentially leapfrog current technologies if certain technical hurdles regarding efficiency and manufacturing scalability can be overcome.

Mini LED displays utilize thousands of tiny LED chips (typically 0.1-0.2mm) arranged in precise arrays to create more dimming zones compared to traditional LED-backlit displays. This evolution was driven by the market demand for improved contrast ratios and deeper blacks while maintaining cost advantages over OLED technology. The development curve accelerated significantly between 2019-2021, with major breakthroughs in manufacturing processes that allowed for more efficient placement of these miniaturized components.

Thermionic displays, conversely, represent a more experimental technology with roots in vacuum tube electronics. These displays operate on the principle of thermionic emission, where heated cathodes emit electrons that can be directed to create images. The concept dates back to early cathode ray tube technology but has seen renewed interest as researchers explore novel applications of thermionic emission in modern display contexts.

The technological progression of Mini LED has followed a relatively predictable path, with incremental improvements in chip size reduction, optical efficiency, and manufacturing yield. Key milestones include the reduction of LED chip size below 100 micrometers, the development of transfer techniques for precise placement, and the implementation of advanced local dimming algorithms that maximize contrast performance.

Thermionic display technology has evolved more sporadically, with significant research occurring in specialized laboratories rather than mainstream consumer electronics companies. Recent developments have focused on creating more efficient electron emitters, reducing power consumption, and exploring novel materials that could enable thinner form factors.

The convergence point between these technologies lies in their pursuit of superior image quality with energy efficiency. Mini LED has progressed toward increasing dimming zone counts from hundreds to thousands, while thermionic research has focused on achieving comparable visual performance through fundamentally different physical mechanisms.

Looking forward, Mini LED technology appears positioned on a trajectory toward further miniaturization, potentially evolving toward Micro LED implementations. Thermionic displays, while currently less commercially viable, represent an alternative evolutionary path that could potentially leapfrog current technologies if certain technical hurdles regarding efficiency and manufacturing scalability can be overcome.

Market Demand Analysis for Advanced Display Technologies

The display technology market has witnessed significant growth in recent years, driven by increasing consumer demand for enhanced visual experiences across various devices. The global display market size was valued at approximately $148 billion in 2022 and is projected to reach $206 billion by 2028, growing at a CAGR of 5.7% during the forecast period. Within this expanding market, advanced display technologies like Mini LED and Thermionic displays are gaining substantial attention from manufacturers and consumers alike.

Consumer electronics represent the largest application segment for advanced display technologies, with smartphones, tablets, and televisions being the primary drivers. The premium television market has shown particular interest in Mini LED technology, with market penetration increasing from 3% in 2021 to an estimated 15% by 2025. This growth is primarily attributed to consumers' willingness to pay premium prices for superior visual experiences, including higher contrast ratios, better color accuracy, and improved energy efficiency.

Commercial applications for advanced display technologies are also expanding rapidly. The digital signage market, valued at $21.5 billion in 2022, is expected to grow at 11.2% CAGR through 2028, with Mini LED displays increasingly preferred for outdoor and high-brightness environments. Meanwhile, specialized sectors such as medical imaging, automotive displays, and aerospace applications are exploring Thermionic display technology for its potential advantages in extreme operating conditions.

Regional analysis reveals varying adoption patterns for advanced display technologies. Asia-Pacific dominates the manufacturing landscape, with China, Taiwan, and South Korea collectively accounting for over 70% of global production capacity. North America and Europe represent significant consumer markets, particularly for premium display products, with adoption rates growing at 18% and 15% annually, respectively.

Price sensitivity remains a critical factor influencing market demand. Current cost structures show Mini LED displays commanding a 30-40% premium over conventional LCD displays, while early Thermionic display prototypes indicate potentially higher manufacturing costs. However, consumer surveys suggest that 65% of premium device buyers are willing to pay up to 25% more for significantly improved display quality, indicating a viable market for these advanced technologies despite their higher costs.

The sustainability aspect is increasingly influencing purchasing decisions, with 48% of consumers in developed markets considering energy efficiency an important factor when selecting display devices. Mini LED technology offers 20-30% power consumption reduction compared to traditional LCD displays, aligning with this growing consumer preference for environmentally friendly products.

Consumer electronics represent the largest application segment for advanced display technologies, with smartphones, tablets, and televisions being the primary drivers. The premium television market has shown particular interest in Mini LED technology, with market penetration increasing from 3% in 2021 to an estimated 15% by 2025. This growth is primarily attributed to consumers' willingness to pay premium prices for superior visual experiences, including higher contrast ratios, better color accuracy, and improved energy efficiency.

Commercial applications for advanced display technologies are also expanding rapidly. The digital signage market, valued at $21.5 billion in 2022, is expected to grow at 11.2% CAGR through 2028, with Mini LED displays increasingly preferred for outdoor and high-brightness environments. Meanwhile, specialized sectors such as medical imaging, automotive displays, and aerospace applications are exploring Thermionic display technology for its potential advantages in extreme operating conditions.

Regional analysis reveals varying adoption patterns for advanced display technologies. Asia-Pacific dominates the manufacturing landscape, with China, Taiwan, and South Korea collectively accounting for over 70% of global production capacity. North America and Europe represent significant consumer markets, particularly for premium display products, with adoption rates growing at 18% and 15% annually, respectively.

Price sensitivity remains a critical factor influencing market demand. Current cost structures show Mini LED displays commanding a 30-40% premium over conventional LCD displays, while early Thermionic display prototypes indicate potentially higher manufacturing costs. However, consumer surveys suggest that 65% of premium device buyers are willing to pay up to 25% more for significantly improved display quality, indicating a viable market for these advanced technologies despite their higher costs.

The sustainability aspect is increasingly influencing purchasing decisions, with 48% of consumers in developed markets considering energy efficiency an important factor when selecting display devices. Mini LED technology offers 20-30% power consumption reduction compared to traditional LCD displays, aligning with this growing consumer preference for environmentally friendly products.

Technical Challenges and Current Limitations

Despite the promising advancements in both Mini LED and Thermionic Display technologies, several significant technical challenges and limitations currently impede their widespread adoption and cost-effective implementation. Mini LED technology faces manufacturing complexity issues that directly impact production costs. The precise placement of thousands of miniaturized LED chips requires sophisticated equipment and processes, with current yield rates remaining suboptimal. Each defective chip contributes to higher overall costs, creating a substantial barrier to price reduction.

Thermal management represents another critical challenge for Mini LED displays. The concentrated arrangement of numerous LED chips generates considerable heat, necessitating advanced cooling systems that add to both the manufacturing complexity and final product cost. Without effective thermal solutions, display performance and longevity suffer significantly.

For Thermionic Displays, the primary limitation centers on the vacuum-sealed environment required for electron emission. Maintaining perfect vacuum conditions during manufacturing and throughout the product lifecycle presents extraordinary technical difficulties. Any compromise in the vacuum integrity dramatically reduces display performance and reliability, necessitating costly quality control measures and specialized production facilities.

Material science constraints further complicate both technologies. Mini LED requires high-quality semiconductor materials with consistent properties, while Thermionic Displays depend on specialized cathode materials with precise electron emission characteristics. The availability and processing of these materials represent significant cost factors and potential supply chain vulnerabilities.

Energy efficiency remains problematic, particularly for Thermionic Displays which typically require higher operating voltages. This translates to increased power consumption and heat generation, necessitating additional cooling mechanisms that further elevate production costs and design complexity.

Scaling challenges affect both technologies differently. Mini LED faces diminishing returns when scaling to larger display sizes due to the exponential increase in the number of required LED chips and control circuits. Thermionic Displays encounter uniformity issues across larger surfaces, where maintaining consistent electron emission becomes increasingly difficult.

Reliability testing reveals that both technologies face longevity concerns under various operating conditions. Mini LED displays show brightness degradation over time, while Thermionic Displays may experience cathode deterioration and vacuum integrity issues. These reliability factors necessitate additional engineering solutions that impact the overall cost-effectiveness equation.

The manufacturing infrastructure for both technologies remains underdeveloped compared to established display technologies like conventional LCD. The specialized equipment required for mass production represents substantial capital investment barriers for manufacturers, limiting production capacity and maintaining higher unit costs until economies of scale can be achieved.

Thermal management represents another critical challenge for Mini LED displays. The concentrated arrangement of numerous LED chips generates considerable heat, necessitating advanced cooling systems that add to both the manufacturing complexity and final product cost. Without effective thermal solutions, display performance and longevity suffer significantly.

For Thermionic Displays, the primary limitation centers on the vacuum-sealed environment required for electron emission. Maintaining perfect vacuum conditions during manufacturing and throughout the product lifecycle presents extraordinary technical difficulties. Any compromise in the vacuum integrity dramatically reduces display performance and reliability, necessitating costly quality control measures and specialized production facilities.

Material science constraints further complicate both technologies. Mini LED requires high-quality semiconductor materials with consistent properties, while Thermionic Displays depend on specialized cathode materials with precise electron emission characteristics. The availability and processing of these materials represent significant cost factors and potential supply chain vulnerabilities.

Energy efficiency remains problematic, particularly for Thermionic Displays which typically require higher operating voltages. This translates to increased power consumption and heat generation, necessitating additional cooling mechanisms that further elevate production costs and design complexity.

Scaling challenges affect both technologies differently. Mini LED faces diminishing returns when scaling to larger display sizes due to the exponential increase in the number of required LED chips and control circuits. Thermionic Displays encounter uniformity issues across larger surfaces, where maintaining consistent electron emission becomes increasingly difficult.

Reliability testing reveals that both technologies face longevity concerns under various operating conditions. Mini LED displays show brightness degradation over time, while Thermionic Displays may experience cathode deterioration and vacuum integrity issues. These reliability factors necessitate additional engineering solutions that impact the overall cost-effectiveness equation.

The manufacturing infrastructure for both technologies remains underdeveloped compared to established display technologies like conventional LCD. The specialized equipment required for mass production represents substantial capital investment barriers for manufacturers, limiting production capacity and maintaining higher unit costs until economies of scale can be achieved.

Current Cost-Effectiveness Solutions

01 Mini LED display manufacturing cost optimization

Various manufacturing techniques and processes have been developed to optimize the cost-effectiveness of Mini LED displays. These include improved assembly methods, substrate materials selection, and automated production processes that reduce labor costs. The innovations focus on minimizing material waste, increasing production yield, and implementing efficient quality control systems to make Mini LED technology more commercially viable compared to traditional display technologies.- Manufacturing cost optimization for Mini LED displays: Various manufacturing techniques and processes have been developed to optimize the cost-effectiveness of Mini LED displays. These include improved assembly methods, substrate materials selection, and automated production processes that reduce labor costs. The innovations focus on minimizing material waste, increasing production yield, and streamlining the manufacturing workflow to make Mini LED technology more economically competitive against other display technologies.

- Energy efficiency comparison between display technologies: Research shows significant differences in energy consumption between Mini LED and thermionic display technologies. Mini LED displays generally offer better power efficiency due to their selective dimming capabilities and lower operating temperatures. This energy efficiency translates to lower operational costs over the lifetime of the display, making them more cost-effective in long-term applications despite potentially higher initial investment compared to some thermionic display variants.

- Integration of Mini LED in commercial applications: The commercial viability of Mini LED technology has been enhanced through innovative integration methods in various applications. These include specialized backlighting systems for consumer electronics, automotive displays, and large-format commercial signage. The adaptability of Mini LED technology to different form factors and environments has expanded its market potential, improving economies of scale and driving down costs through increased production volumes.

- Thermionic display cost reduction strategies: Several innovations focus on reducing the production and operational costs of thermionic displays. These include new electrode materials, improved vacuum sealing techniques, and more efficient electron emission mechanisms. The developments aim to address the traditionally high manufacturing costs associated with thermionic technology while maintaining or improving display performance characteristics such as brightness, contrast, and longevity.

- Hybrid display technologies for cost optimization: Hybrid approaches combining elements of Mini LED and other display technologies have been developed to optimize cost-effectiveness. These solutions leverage the strengths of multiple technologies to achieve better price-performance ratios. Examples include combining Mini LED backlighting with LCD panels, or integrating selective Mini LED zones with other lighting technologies to reduce component costs while maintaining high display quality in critical viewing areas.

02 Thermionic display cost reduction strategies

Cost reduction strategies for thermionic displays involve innovative electrode designs, improved emission materials, and simplified manufacturing processes. These displays utilize electron emission principles to create images with potentially lower power consumption than conventional technologies. Advancements in thermionic emission materials and structural designs help reduce production costs while maintaining display performance, making them potentially competitive with other display technologies in specific applications.Expand Specific Solutions03 Comparative cost-effectiveness analysis between display technologies

Comparative analyses between Mini LED, thermionic, and other display technologies evaluate factors such as production costs, energy efficiency, lifespan, and performance metrics. These analyses consider total cost of ownership including initial manufacturing expenses, operational costs, and maintenance requirements. The studies provide frameworks for determining which display technology offers the best value proposition for specific applications, considering both upfront investment and long-term operational expenses.Expand Specific Solutions04 Energy efficiency impact on display cost-effectiveness

Energy consumption significantly affects the overall cost-effectiveness of display technologies. Mini LED displays offer improved energy efficiency through precise local dimming and optimized backlighting systems, while thermionic displays may provide energy advantages in certain usage scenarios. Innovations in power management systems, low-power driving circuits, and energy-efficient materials contribute to reduced operational costs over the display lifetime, enhancing the long-term economic viability of these technologies.Expand Specific Solutions05 Modular design approaches for cost-effective display manufacturing

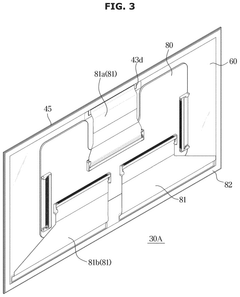

Modular design approaches enable more cost-effective manufacturing and maintenance of both Mini LED and thermionic displays. These designs feature standardized components that can be mass-produced separately and assembled efficiently, reducing production complexity and costs. Modular architectures also facilitate easier repairs and upgrades, extending product lifespan and improving the total cost of ownership. This approach allows manufacturers to scale production more efficiently and adapt to market demands with minimal retooling.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The Mini LED vs Thermionic Displays market is currently in a growth phase, with increasing adoption across consumer electronics and automotive sectors. The global market size is projected to reach significant scale as cost-effectiveness improves. Technologically, Mini LED is more mature, with major players like BOE Technology, Samsung Electronics, and TCL China Star Optoelectronics leading commercial deployment. Companies such as Jade Bird Display and Rayleigh Vision Intelligence are advancing MicroLED technologies, while traditional display manufacturers like Japan Display and HKC Corp are adapting their strategies. The competitive landscape shows Asian manufacturers dominating production capacity, with research institutions like Industrial Technology Research Institute providing technological foundations for next-generation display solutions.

BOE Technology Group Co., Ltd.

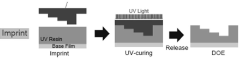

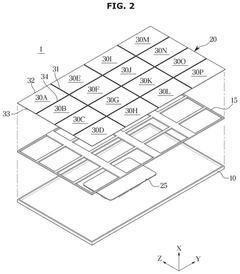

Technical Solution: BOE has developed a comprehensive Mini LED display solution that focuses on cost optimization through innovative manufacturing processes. Their approach utilizes chip-scale packaging technology that reduces the traditional LED packaging steps, decreasing production costs by approximately 25%. BOE's Mini LED displays feature active matrix driving technology with up to 1,000+ independent dimming zones and brightness capabilities exceeding 1,200 nits. For cost-effectiveness, BOE has implemented a "transfer printing" process that allows for mass placement of Mini LED chips with high precision and speed, significantly reducing assembly time and labor costs. Their displays utilize chips sized between 100-200 micrometers, striking a balance between performance and manufacturing complexity. BOE has also developed proprietary optical designs that improve light utilization efficiency, reducing the number of LEDs required while maintaining brightness performance, further contributing to cost reduction.

Strengths: Advanced transfer printing technology enables efficient mass production; integrated supply chain for key components; strong R&D capabilities in backplane technologies that complement Mini LED implementation. Weaknesses: Less experience in quantum dot color enhancement technologies compared to competitors; higher initial capital investment requirements for new production lines; challenges in ultra-fine pitch Mini LED manufacturing for smaller displays.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has pioneered cost-effective Mini LED solutions through their "Vidrian Mini-LED Technology" that integrates the backlight directly into a glass substrate. Their approach reduces the overall display thickness while improving optical performance. TCL's manufacturing process involves direct mounting of tens of thousands of Mini LEDs (typically sized between 50-200 micrometers) onto a TFT glass substrate, which enables more precise control over local dimming zones. Their cost optimization strategy includes developing standardized Mini LED modules that can be used across different display sizes, reducing development and manufacturing costs. TCL has also implemented an innovative "active matrix" driving method that reduces the number of driver ICs required, lowering component costs by approximately 15-20% compared to passive matrix approaches. Their displays typically feature 1000+ dimming zones with peak brightness exceeding 1500 nits.

Strengths: Standardized modular approach reduces manufacturing complexity; innovative glass substrate integration improves yield rates; established LCD manufacturing facilities can be adapted for Mini LED production. Weaknesses: Less vertical integration than competitors like Samsung, resulting in potential supply chain vulnerabilities; higher dependency on external Mini LED chip suppliers; thermal management challenges in ultra-thin display designs.

Core Patents and Technical Innovations

MiniLED structure capable of improving light emitting uniformity

PatentActiveCN220753466U

Innovation

- A rectangular ink frame is made on the substrate and connected to the LED light chip. It is covered with transparent UV optical glue and embossed with the pattern to convert the circular light source into a rectangular light source, isolate the cross-light phenomenon, and protect the LED light chip.

Display apparatus and method of manufacturing the same

PatentPendingUS20250120231A1

Innovation

- A display apparatus utilizing micro light-emitting diode (micro LED) panels, where inorganic light-emitting devices are mounted on a substrate and used as pixels, offering improved optical properties and manufacturing methods involving the formation of light-emitting layers, mask patterns, and reflective layers.

Supply Chain Analysis and Manufacturing Considerations

The supply chain for Mini LED and Thermionic display technologies presents distinct challenges and opportunities that significantly impact their cost-effectiveness. Mini LED production relies heavily on established semiconductor manufacturing infrastructure, benefiting from economies of scale already present in LED industries. The supply chain typically involves substrate manufacturers, LED chip producers, packaging companies, and module assemblers. Currently, Taiwan, Japan, and South Korea dominate the high-quality Mini LED component production, while China leads in volume manufacturing capabilities.

Manufacturing considerations for Mini LED displays include the critical transfer process, where thousands of tiny LED chips must be precisely positioned. This process requires specialized equipment and clean room environments, contributing significantly to capital expenditure. Yield rates in Mini LED production have improved from 70% to over 90% in recent years, though defects in the transfer process remain a cost factor. The technology benefits from incremental improvements in existing LED manufacturing processes rather than requiring entirely new production methods.

Thermionic displays, conversely, face more substantial supply chain challenges as an emerging technology. The manufacturing ecosystem is less developed, with fewer specialized suppliers and limited production capacity. Key materials include specialized cathode materials, vacuum-sealed glass components, and proprietary electronic drivers. The nascent nature of this supply chain results in higher component costs and potential supply bottlenecks that could impact mass production capabilities.

Production of thermionic displays requires significant investment in new manufacturing facilities and processes. The vacuum sealing process is particularly challenging, requiring specialized equipment and expertise. Current manufacturing yields for thermionic displays remain lower, typically in the 60-75% range, significantly impacting unit economics. However, the technology potentially requires fewer processing steps than Mini LED, which could eventually translate to cost advantages if production scales successfully.

Material sourcing presents different challenges for each technology. Mini LED relies on gallium nitride and sapphire substrates, materials with established supply chains but subject to market fluctuations. Thermionic displays require specialized cathode materials and high-vacuum components, which currently have more limited supplier networks. Both technologies face potential rare earth material constraints, though Mini LED's supply chain maturity provides better mitigation strategies.

Labor requirements also differ significantly. Mini LED manufacturing is increasingly automated but still requires skilled technicians for quality control and equipment maintenance. Thermionic display production currently demands more specialized engineering talent, contributing to higher labor costs in the short term. As production scales, both technologies will likely see decreasing labor costs per unit, though Mini LED has a head start in this optimization process.

Manufacturing considerations for Mini LED displays include the critical transfer process, where thousands of tiny LED chips must be precisely positioned. This process requires specialized equipment and clean room environments, contributing significantly to capital expenditure. Yield rates in Mini LED production have improved from 70% to over 90% in recent years, though defects in the transfer process remain a cost factor. The technology benefits from incremental improvements in existing LED manufacturing processes rather than requiring entirely new production methods.

Thermionic displays, conversely, face more substantial supply chain challenges as an emerging technology. The manufacturing ecosystem is less developed, with fewer specialized suppliers and limited production capacity. Key materials include specialized cathode materials, vacuum-sealed glass components, and proprietary electronic drivers. The nascent nature of this supply chain results in higher component costs and potential supply bottlenecks that could impact mass production capabilities.

Production of thermionic displays requires significant investment in new manufacturing facilities and processes. The vacuum sealing process is particularly challenging, requiring specialized equipment and expertise. Current manufacturing yields for thermionic displays remain lower, typically in the 60-75% range, significantly impacting unit economics. However, the technology potentially requires fewer processing steps than Mini LED, which could eventually translate to cost advantages if production scales successfully.

Material sourcing presents different challenges for each technology. Mini LED relies on gallium nitride and sapphire substrates, materials with established supply chains but subject to market fluctuations. Thermionic displays require specialized cathode materials and high-vacuum components, which currently have more limited supplier networks. Both technologies face potential rare earth material constraints, though Mini LED's supply chain maturity provides better mitigation strategies.

Labor requirements also differ significantly. Mini LED manufacturing is increasingly automated but still requires skilled technicians for quality control and equipment maintenance. Thermionic display production currently demands more specialized engineering talent, contributing to higher labor costs in the short term. As production scales, both technologies will likely see decreasing labor costs per unit, though Mini LED has a head start in this optimization process.

Environmental Impact and Sustainability Factors

The environmental impact of display technologies has become increasingly important as sustainability concerns rise across industries. Mini LED and thermionic display technologies present distinct environmental profiles throughout their lifecycle, from raw material extraction to end-of-life disposal.

Mini LED technology demonstrates several environmental advantages. Its manufacturing process requires significantly less energy compared to traditional LCD displays, resulting in a reduced carbon footprint during production. The technology's longer lifespan—typically 30,000 to 50,000 hours—translates to fewer replacements and consequently less electronic waste. Additionally, Mini LEDs contain minimal hazardous substances compared to other display technologies, with lower concentrations of heavy metals and absence of mercury.

However, Mini LED production does present sustainability challenges. The extraction of rare earth elements required for LED phosphors causes considerable environmental disruption, including soil degradation and water pollution. The manufacturing process also generates substantial electronic waste, particularly during the precision assembly of thousands of miniaturized LED chips.

Thermionic displays, while less common in current markets, offer their own environmental considerations. These displays typically consume more power during operation compared to Mini LED alternatives, resulting in higher lifetime carbon emissions in regions dependent on fossil fuel energy. However, their simpler construction may facilitate easier recycling and component recovery at end-of-life.

Both technologies face end-of-life management challenges. Current recycling infrastructure remains inadequate for efficiently processing advanced display components, with recovery rates for critical materials remaining suboptimal. This represents a significant sustainability gap as production volumes increase.

From a regulatory perspective, both technologies must navigate evolving environmental compliance frameworks. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives impose strict requirements on electronic displays. Similarly, energy efficiency standards like ENERGY STAR influence market viability, with Mini LED displays generally achieving better certification ratings due to their lower power consumption.

Forward-looking sustainability improvements for both technologies include developing closed-loop recycling systems, implementing design-for-disassembly principles, and researching alternative materials with reduced environmental impact. Manufacturers investing in these approaches may gain competitive advantages as environmental considerations increasingly influence procurement decisions across consumer and enterprise markets.

Mini LED technology demonstrates several environmental advantages. Its manufacturing process requires significantly less energy compared to traditional LCD displays, resulting in a reduced carbon footprint during production. The technology's longer lifespan—typically 30,000 to 50,000 hours—translates to fewer replacements and consequently less electronic waste. Additionally, Mini LEDs contain minimal hazardous substances compared to other display technologies, with lower concentrations of heavy metals and absence of mercury.

However, Mini LED production does present sustainability challenges. The extraction of rare earth elements required for LED phosphors causes considerable environmental disruption, including soil degradation and water pollution. The manufacturing process also generates substantial electronic waste, particularly during the precision assembly of thousands of miniaturized LED chips.

Thermionic displays, while less common in current markets, offer their own environmental considerations. These displays typically consume more power during operation compared to Mini LED alternatives, resulting in higher lifetime carbon emissions in regions dependent on fossil fuel energy. However, their simpler construction may facilitate easier recycling and component recovery at end-of-life.

Both technologies face end-of-life management challenges. Current recycling infrastructure remains inadequate for efficiently processing advanced display components, with recovery rates for critical materials remaining suboptimal. This represents a significant sustainability gap as production volumes increase.

From a regulatory perspective, both technologies must navigate evolving environmental compliance frameworks. The European Union's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives impose strict requirements on electronic displays. Similarly, energy efficiency standards like ENERGY STAR influence market viability, with Mini LED displays generally achieving better certification ratings due to their lower power consumption.

Forward-looking sustainability improvements for both technologies include developing closed-loop recycling systems, implementing design-for-disassembly principles, and researching alternative materials with reduced environmental impact. Manufacturers investing in these approaches may gain competitive advantages as environmental considerations increasingly influence procurement decisions across consumer and enterprise markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!