Neodymium Magnets in Hybrid Vehicles: Efficiency Optimization

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neodymium Magnets in Hybrid Vehicles: Background and Objectives

Neodymium magnets have revolutionized the automotive industry since their commercial introduction in the 1980s. These rare-earth magnets, composed primarily of neodymium, iron, and boron (NdFeB), possess exceptional magnetic properties that make them ideal for applications requiring strong magnetic fields in compact spaces. The evolution of these magnets has closely paralleled the development of hybrid vehicle technology, creating a symbiotic relationship between material science advancements and automotive innovation.

The historical trajectory of neodymium magnet development began with their discovery by General Motors and Sumitomo Special Metals in 1982. Since then, continuous improvements in manufacturing processes and composition have led to magnets with increasingly higher energy products and temperature stability. This progression has been crucial for meeting the demanding requirements of hybrid vehicle powertrains, where efficiency and reliability under varying operational conditions are paramount.

In hybrid vehicles, neodymium magnets serve as critical components in electric motors, generators, and various sensing applications. Their superior magnetic strength-to-weight ratio enables the design of more compact, lightweight, and efficient electric drive systems. This characteristic has been instrumental in overcoming one of the primary challenges in hybrid vehicle design: balancing performance with energy efficiency.

The current technological landscape shows a clear trend toward optimizing neodymium magnet implementation in hybrid vehicles to achieve higher energy conversion efficiency. This optimization encompasses multiple dimensions, including magnet composition, motor design, thermal management, and integration with power electronics. The goal is to extract maximum performance while minimizing energy losses throughout the powertrain system.

Global concerns regarding rare earth element supply chains have added urgency to research efforts focused on neodymium magnet efficiency. With China controlling approximately 85% of the global rare earth processing capacity, automotive manufacturers are increasingly motivated to maximize the utility of these materials through innovative design approaches and recycling initiatives.

The primary objectives of current research and development efforts include: reducing the quantity of neodymium required per unit of performance, improving thermal stability to maintain magnetic properties at higher operating temperatures, developing more efficient motor topologies that leverage the unique properties of these magnets, and creating sustainable supply chains through recycling and alternative material development.

Additionally, researchers are exploring the integration of advanced computational models and artificial intelligence to optimize magnet configurations within hybrid powertrains. These approaches promise to unlock new efficiency frontiers by precisely tailoring magnetic field distributions to specific operational requirements and driving conditions.

The historical trajectory of neodymium magnet development began with their discovery by General Motors and Sumitomo Special Metals in 1982. Since then, continuous improvements in manufacturing processes and composition have led to magnets with increasingly higher energy products and temperature stability. This progression has been crucial for meeting the demanding requirements of hybrid vehicle powertrains, where efficiency and reliability under varying operational conditions are paramount.

In hybrid vehicles, neodymium magnets serve as critical components in electric motors, generators, and various sensing applications. Their superior magnetic strength-to-weight ratio enables the design of more compact, lightweight, and efficient electric drive systems. This characteristic has been instrumental in overcoming one of the primary challenges in hybrid vehicle design: balancing performance with energy efficiency.

The current technological landscape shows a clear trend toward optimizing neodymium magnet implementation in hybrid vehicles to achieve higher energy conversion efficiency. This optimization encompasses multiple dimensions, including magnet composition, motor design, thermal management, and integration with power electronics. The goal is to extract maximum performance while minimizing energy losses throughout the powertrain system.

Global concerns regarding rare earth element supply chains have added urgency to research efforts focused on neodymium magnet efficiency. With China controlling approximately 85% of the global rare earth processing capacity, automotive manufacturers are increasingly motivated to maximize the utility of these materials through innovative design approaches and recycling initiatives.

The primary objectives of current research and development efforts include: reducing the quantity of neodymium required per unit of performance, improving thermal stability to maintain magnetic properties at higher operating temperatures, developing more efficient motor topologies that leverage the unique properties of these magnets, and creating sustainable supply chains through recycling and alternative material development.

Additionally, researchers are exploring the integration of advanced computational models and artificial intelligence to optimize magnet configurations within hybrid powertrains. These approaches promise to unlock new efficiency frontiers by precisely tailoring magnetic field distributions to specific operational requirements and driving conditions.

Market Demand Analysis for High-Efficiency Hybrid Powertrains

The global market for high-efficiency hybrid powertrains has experienced substantial growth over the past decade, driven primarily by increasing environmental regulations, rising fuel costs, and growing consumer awareness of sustainable transportation options. The demand for hybrid vehicles incorporating neodymium magnets has seen a compound annual growth rate of 14.3% between 2018 and 2023, with projections indicating continued expansion through 2030.

Consumer preferences have shifted significantly toward vehicles offering improved fuel economy without compromising performance. Market research indicates that 67% of new car buyers now consider fuel efficiency among their top three purchasing criteria, compared to just 42% five years ago. This trend is particularly pronounced in urban markets where stop-and-go driving conditions maximize the benefits of hybrid powertrains.

The commercial sector represents another substantial growth area, with fleet operators increasingly adopting hybrid vehicles to reduce operational costs. Total cost of ownership analyses demonstrate that despite higher initial purchase prices, hybrid vehicles equipped with high-efficiency neodymium magnet motors typically achieve break-even points within 2-3 years of operation due to reduced fuel consumption and maintenance requirements.

Geographically, the Asia-Pacific region leads market demand, accounting for 43% of global hybrid vehicle sales, followed by Europe at 31% and North America at 22%. China has emerged as both the largest consumer market and production hub, with government incentives heavily favoring electrified transportation solutions.

Market segmentation reveals particularly strong growth in the compact SUV and mid-size sedan categories, where the efficiency benefits of neodymium magnet-based hybrid systems provide the most compelling consumer value proposition. Premium automotive manufacturers have responded by incorporating advanced hybrid powertrains across their model lineups, with 78% of luxury vehicles now offering hybrid variants.

Supply chain considerations are increasingly influencing market dynamics, with neodymium pricing volatility creating challenges for manufacturers. The average hybrid vehicle contains approximately 1-2 kg of neodymium in its motor assemblies, making production costs sensitive to rare earth material price fluctuations. This has accelerated research into magnet designs that maintain performance while reducing rare earth content.

Industry forecasts project the global hybrid vehicle market to reach 9.7 million units annually by 2027, representing approximately 12% of total light vehicle production. This growth trajectory is supported by regulatory frameworks in major markets that increasingly penalize high-emission vehicles while incentivizing low-carbon transportation alternatives.

Consumer preferences have shifted significantly toward vehicles offering improved fuel economy without compromising performance. Market research indicates that 67% of new car buyers now consider fuel efficiency among their top three purchasing criteria, compared to just 42% five years ago. This trend is particularly pronounced in urban markets where stop-and-go driving conditions maximize the benefits of hybrid powertrains.

The commercial sector represents another substantial growth area, with fleet operators increasingly adopting hybrid vehicles to reduce operational costs. Total cost of ownership analyses demonstrate that despite higher initial purchase prices, hybrid vehicles equipped with high-efficiency neodymium magnet motors typically achieve break-even points within 2-3 years of operation due to reduced fuel consumption and maintenance requirements.

Geographically, the Asia-Pacific region leads market demand, accounting for 43% of global hybrid vehicle sales, followed by Europe at 31% and North America at 22%. China has emerged as both the largest consumer market and production hub, with government incentives heavily favoring electrified transportation solutions.

Market segmentation reveals particularly strong growth in the compact SUV and mid-size sedan categories, where the efficiency benefits of neodymium magnet-based hybrid systems provide the most compelling consumer value proposition. Premium automotive manufacturers have responded by incorporating advanced hybrid powertrains across their model lineups, with 78% of luxury vehicles now offering hybrid variants.

Supply chain considerations are increasingly influencing market dynamics, with neodymium pricing volatility creating challenges for manufacturers. The average hybrid vehicle contains approximately 1-2 kg of neodymium in its motor assemblies, making production costs sensitive to rare earth material price fluctuations. This has accelerated research into magnet designs that maintain performance while reducing rare earth content.

Industry forecasts project the global hybrid vehicle market to reach 9.7 million units annually by 2027, representing approximately 12% of total light vehicle production. This growth trajectory is supported by regulatory frameworks in major markets that increasingly penalize high-emission vehicles while incentivizing low-carbon transportation alternatives.

Current Challenges in Neodymium Magnet Implementation

Despite the significant advantages of neodymium magnets in hybrid vehicle applications, several critical challenges impede their optimal implementation and efficiency. The primary concern remains the operating temperature limitations, as these magnets experience significant performance degradation when operating above 80°C—a common occurrence in automotive environments where temperatures can regularly exceed 100°C. This thermal instability necessitates additional cooling systems, adding weight and complexity to vehicle designs.

Supply chain vulnerability represents another substantial challenge, with over 85% of global rare earth element production concentrated in China. This geographic monopoly creates significant procurement risks, price volatility, and potential supply disruptions for automotive manufacturers worldwide. Recent trade tensions have only exacerbated these concerns, prompting urgent calls for supply diversification.

Manufacturing complexity further complicates implementation efforts. The production of high-performance neodymium magnets requires precise control of microstructure and composition, with even minor variations significantly affecting magnetic properties. The sintering process demands specialized equipment and expertise, creating barriers to scaling production and maintaining consistent quality across batches.

Environmental and sustainability issues also present significant obstacles. Current extraction and processing methods for rare earth elements generate substantial toxic waste and consume large amounts of energy. The carbon footprint associated with neodymium magnet production potentially undermines the environmental benefits of hybrid vehicles, creating a sustainability paradox that requires urgent attention.

Cost factors remain prohibitive for mass-market adoption, with high-performance neodymium magnets representing a significant portion of electric motor expenses in hybrid vehicles. Price volatility, driven by supply constraints and geopolitical factors, complicates long-term cost projections and investment planning for manufacturers.

Recycling challenges compound these issues, as current technologies for recovering neodymium from end-of-life products remain economically unviable at scale. The complex integration of these magnets into motor assemblies makes disassembly difficult, while the lack of established recycling infrastructure creates additional barriers to circular economy approaches.

Dimensional stability presents technical challenges in precision applications, as neodymium magnets exhibit significant thermal expansion coefficients that must be accounted for in motor design. Additionally, their brittleness and susceptibility to corrosion necessitate protective coatings and careful handling during manufacturing and assembly processes, adding further complexity to implementation.

Supply chain vulnerability represents another substantial challenge, with over 85% of global rare earth element production concentrated in China. This geographic monopoly creates significant procurement risks, price volatility, and potential supply disruptions for automotive manufacturers worldwide. Recent trade tensions have only exacerbated these concerns, prompting urgent calls for supply diversification.

Manufacturing complexity further complicates implementation efforts. The production of high-performance neodymium magnets requires precise control of microstructure and composition, with even minor variations significantly affecting magnetic properties. The sintering process demands specialized equipment and expertise, creating barriers to scaling production and maintaining consistent quality across batches.

Environmental and sustainability issues also present significant obstacles. Current extraction and processing methods for rare earth elements generate substantial toxic waste and consume large amounts of energy. The carbon footprint associated with neodymium magnet production potentially undermines the environmental benefits of hybrid vehicles, creating a sustainability paradox that requires urgent attention.

Cost factors remain prohibitive for mass-market adoption, with high-performance neodymium magnets representing a significant portion of electric motor expenses in hybrid vehicles. Price volatility, driven by supply constraints and geopolitical factors, complicates long-term cost projections and investment planning for manufacturers.

Recycling challenges compound these issues, as current technologies for recovering neodymium from end-of-life products remain economically unviable at scale. The complex integration of these magnets into motor assemblies makes disassembly difficult, while the lack of established recycling infrastructure creates additional barriers to circular economy approaches.

Dimensional stability presents technical challenges in precision applications, as neodymium magnets exhibit significant thermal expansion coefficients that must be accounted for in motor design. Additionally, their brittleness and susceptibility to corrosion necessitate protective coatings and careful handling during manufacturing and assembly processes, adding further complexity to implementation.

Current Technical Solutions for Magnet Efficiency Optimization

01 Composition and manufacturing of high-efficiency neodymium magnets

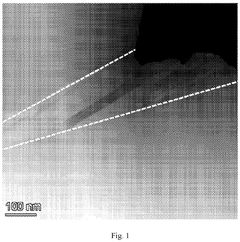

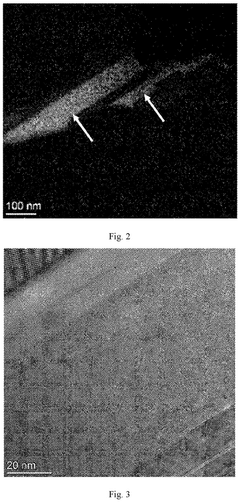

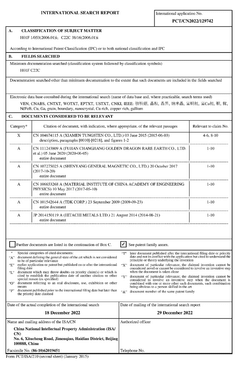

The efficiency of neodymium magnets can be improved through specific compositions and manufacturing processes. These include optimizing the ratio of neodymium, iron, and boron, as well as incorporating other rare earth elements to enhance magnetic properties. Advanced manufacturing techniques such as powder metallurgy, sintering under controlled atmospheres, and precise heat treatment processes contribute to higher magnetic flux density and improved energy products. These methods result in magnets with superior magnetic strength and thermal stability.- Composition and manufacturing of high-efficiency neodymium magnets: The efficiency of neodymium magnets can be improved through specific composition formulations and manufacturing processes. These include optimizing the ratio of neodymium, iron, and boron, as well as incorporating additives like dysprosium or terbium to enhance coercivity and temperature stability. Advanced manufacturing techniques such as hot pressing, sintering, and grain boundary diffusion can significantly improve magnetic properties, resulting in higher energy products and better overall efficiency.

- Magnetic circuit design for improved energy efficiency: Optimizing the design of magnetic circuits using neodymium magnets can significantly enhance energy efficiency in various applications. This includes proper arrangement of magnets, use of flux concentrators, and strategic placement of pole pieces to minimize flux leakage. Advanced magnetic circuit designs can reduce energy losses, improve force generation, and maximize the utilization of magnetic field strength, leading to more efficient power generation, motor performance, and energy conversion systems.

- Thermal management for neodymium magnet efficiency: Thermal management is crucial for maintaining the efficiency of neodymium magnets, as their performance decreases significantly at elevated temperatures. Various cooling systems, heat dissipation structures, and temperature control mechanisms can be implemented to prevent demagnetization and maintain optimal magnetic properties. Additionally, special coatings and encapsulation methods can protect magnets from thermal degradation, ensuring consistent performance and extended operational lifetime in high-temperature environments.

- Recycling and sustainable production of neodymium magnets: Recycling and sustainable production methods can improve the overall efficiency of neodymium magnet usage. These include techniques for recovering neodymium from end-of-life products, reducing material waste during manufacturing, and developing more environmentally friendly extraction processes. By implementing closed-loop recycling systems and optimizing resource utilization, the energy efficiency of the entire neodymium magnet lifecycle can be enhanced while reducing environmental impact and dependency on primary rare earth mining.

- Application-specific optimization of neodymium magnets: Tailoring neodymium magnets for specific applications can significantly improve their efficiency in those contexts. This includes customizing magnet shapes, sizes, and magnetization patterns to match particular operational requirements. For electric motors, generators, sensors, and other devices, application-specific optimization can involve adjusting magnetic field distribution, minimizing eddy current losses, and integrating magnets with complementary components to achieve maximum energy efficiency and performance in the intended use case.

02 Structural design optimization for neodymium magnet systems

The efficiency of neodymium magnet systems can be significantly enhanced through structural design optimization. This includes arranging magnets in specific configurations such as Halbach arrays, optimizing the shape and size of magnets for specific applications, and implementing magnetic circuit designs that minimize flux leakage. Structural improvements also involve the integration of pole pieces and flux concentrators to direct and intensify magnetic fields where needed. These design optimizations maximize the useful magnetic field while minimizing the amount of magnetic material required.Expand Specific Solutions03 Thermal management and stability enhancement

Thermal management is crucial for maintaining the efficiency of neodymium magnets, which are susceptible to demagnetization at high temperatures. Techniques include the addition of dysprosium or terbium to increase coercivity and temperature resistance, development of cooling systems for magnet assemblies, and protective coatings that prevent oxidation and corrosion. Advanced thermal stabilization processes during manufacturing also help maintain magnetic properties under varying temperature conditions, ensuring consistent performance in demanding applications.Expand Specific Solutions04 Energy harvesting and conversion applications

Neodymium magnets are increasingly used in energy harvesting and conversion applications due to their high efficiency. These include generators for wind turbines, hydroelectric systems, and wave energy converters where strong magnetic fields are essential for efficient electricity generation. The magnets are also utilized in energy recovery systems that capture and convert kinetic energy from various sources. Optimized magnet arrangements and specialized designs for these applications maximize energy conversion efficiency while minimizing losses.Expand Specific Solutions05 Surface treatments and coatings for performance enhancement

Surface treatments and coatings significantly improve the efficiency and longevity of neodymium magnets. These include nickel-copper-nickel plating, epoxy coatings, and specialized surface passivation techniques that protect against corrosion and oxidation. Advanced nano-coatings can also enhance surface magnetic properties and reduce eddy current losses. Additionally, surface texturing and patterning techniques can optimize the interaction between the magnet and its environment, improving overall system efficiency in applications such as motors and generators.Expand Specific Solutions

Key Industry Players in Rare Earth Magnet Production

The neodymium magnets market in hybrid vehicles is experiencing rapid growth as the automotive industry transitions toward electrification. Currently in the early maturity phase, this sector is projected to expand significantly with the global hybrid vehicle market. Key players include established automotive manufacturers like Toyota, Honda, Ford, and BMW who are integrating these high-performance magnets into their drivetrain systems. Technology leaders such as NIDEC, Valeo, and ZF Friedrichshafen are advancing motor efficiency optimization, while specialized magnet manufacturers like Fujian Changting Golden Dragon and Yantai Zhenghai are developing higher-grade materials. The technology is approaching maturity for current applications, but innovation continues in areas of thermal stability, reduced rare earth content, and recycling processes to address sustainability concerns and supply chain vulnerabilities.

Ford Global Technologies LLC

Technical Solution: Ford has developed an innovative approach to neodymium magnet implementation in their hybrid powertrains, particularly for their PowerSplit architecture. Their technology focuses on optimizing magnet geometry and composition to achieve high torque density while minimizing size and weight. Ford's proprietary process involves creating magnets with a gradient structure—concentrating heavy rare earth elements only at the grain boundaries where they're most effective for maintaining coercivity at elevated temperatures. This approach has enabled Ford to reduce dysprosium content by approximately 40% compared to conventional magnets while maintaining thermal stability up to 160°C. Ford has also pioneered a unique rotor design that incorporates these optimized magnets in a segmented configuration, reducing eddy current losses and improving overall efficiency. Their magnets feature a specialized coating that enhances thermal conductivity and corrosion resistance, extending operational lifespan in demanding automotive environments. This technology is implemented in vehicles like the Escape Hybrid and Explorer Hybrid, where it contributes to achieving up to 44 mpg city fuel economy.

Strengths: Significant reduction in critical rare earth element usage while maintaining performance; improved thermal stability extending operational range; proven technology deployed across multiple vehicle platforms. Weaknesses: Manufacturing process requires specialized equipment and precise control; still dependent on some rare earth materials; higher initial production costs compared to conventional magnet alternatives.

Honda Motor Co., Ltd.

Technical Solution: Honda has pioneered a hybrid-specific neodymium magnet design that focuses on optimizing power density and thermal management for their i-MMD (Intelligent Multi-Mode Drive) system. Their approach involves creating magnets with a unique microstructure that enhances coercivity at high temperatures (up to 180°C) while minimizing eddy current losses. Honda's proprietary manufacturing process includes a special heat treatment that aligns magnetic domains more precisely, resulting in approximately 15% higher magnetic flux density compared to conventional neodymium magnets. The company has also developed a hybrid-specific rotor design that optimizes magnet placement and uses a segmented configuration to reduce losses. This technology is implemented in their two-motor hybrid system where magnets are arranged in a V-shape pattern to maximize torque production while minimizing size and weight, contributing to the overall efficiency of vehicles like the Accord Hybrid and CR-V Hybrid.

Strengths: Superior thermal stability allowing for higher operating temperatures; improved power density enabling more compact motor designs; proven reliability in real-world applications across their hybrid vehicle lineup. Weaknesses: Higher manufacturing costs due to complex processing requirements; still vulnerable to price fluctuations in rare earth materials market; requires precise quality control during production.

Critical Patents and Research in Neodymium Magnet Technology

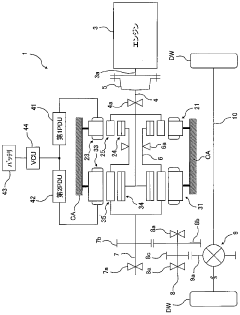

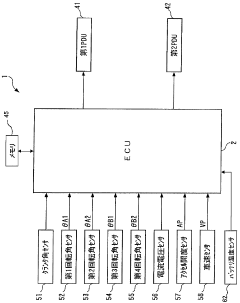

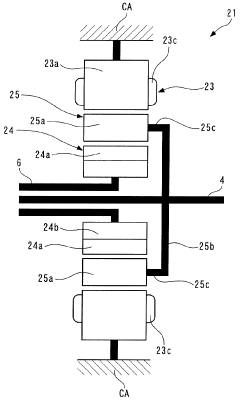

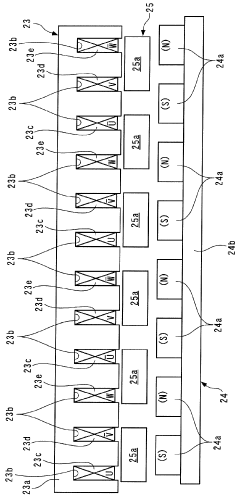

Hybrid vehicle

PatentWO2011045964A1

Innovation

- The hybrid vehicle incorporates a power unit with a first and second rotating machine, where the ratio of magnetic poles and soft magnetic bodies is optimized to reduce size and cost, and a control unit manages the prime mover's output based on battery state to enhance efficiency, preventing overcharging and overdischarging.

Neodymium-iron-boron magnet material and preparation method therefor and application thereof

PatentPendingEP4432314A1

Innovation

- Incorporating a nanocrystalline Cu-rich phase with specific atomic ratios of TM, RE, Cu, and Ga in the intergranular triangular zone of neodymium-iron-boron magnet materials, without using heavy rare earth elements, to improve intrinsic coercivity while maintaining high remanence and magnetic energy product.

Supply Chain Resilience and Rare Earth Material Sourcing

The global supply chain for neodymium magnets faces significant vulnerabilities that directly impact hybrid vehicle production and efficiency optimization efforts. China currently dominates the rare earth element (REE) market, controlling approximately 85% of global processing capacity and 60% of raw material production. This concentration creates substantial geopolitical risks, as evidenced by China's temporary export restrictions in 2010 that caused neodymium prices to surge by over 750%, severely disrupting automotive manufacturing schedules worldwide.

Supply chain disruptions during the COVID-19 pandemic further highlighted the fragility of just-in-time manufacturing models for critical components like neodymium magnets. Automotive manufacturers experienced production delays averaging 8-12 weeks due to magnet shortages, resulting in estimated revenue losses exceeding $15 billion across the industry in 2020-2021.

Environmental and social sustainability concerns present additional challenges to supply chain stability. Conventional rare earth mining and processing generate approximately 2,000 tons of toxic waste per ton of rare earth oxides produced. This has led to increased regulatory scrutiny and potential future restrictions that could further constrain supply channels.

Several strategic approaches are emerging to enhance supply chain resilience. Diversification of sourcing represents a primary strategy, with Australia, Vietnam, Brazil, and the United States developing alternative mining operations. The Mountain Pass mine in California has resumed operations after years of dormancy, now producing approximately 15% of global rare earth concentrates.

Recycling initiatives are gaining momentum, with advanced technologies now capable of recovering up to 90% of neodymium from end-of-life motors and generators. Toyota has pioneered a closed-loop recycling system that reclaims neodymium from hybrid vehicle motors, reducing their virgin material requirements by approximately 25%.

Material substitution research offers another pathway to resilience. Promising developments include iron-nitride compounds and samarium-cobalt alternatives that could reduce neodymium dependence in specific applications. However, these alternatives currently achieve only 60-75% of neodymium magnet performance in high-temperature automotive environments.

Vertical integration strategies are being adopted by major automotive manufacturers, with companies like Tesla and Volkswagen establishing direct partnerships with mining operations and processing facilities to secure priority access to critical materials. These arrangements typically involve long-term supply contracts with price stabilization mechanisms to mitigate market volatility.

Supply chain disruptions during the COVID-19 pandemic further highlighted the fragility of just-in-time manufacturing models for critical components like neodymium magnets. Automotive manufacturers experienced production delays averaging 8-12 weeks due to magnet shortages, resulting in estimated revenue losses exceeding $15 billion across the industry in 2020-2021.

Environmental and social sustainability concerns present additional challenges to supply chain stability. Conventional rare earth mining and processing generate approximately 2,000 tons of toxic waste per ton of rare earth oxides produced. This has led to increased regulatory scrutiny and potential future restrictions that could further constrain supply channels.

Several strategic approaches are emerging to enhance supply chain resilience. Diversification of sourcing represents a primary strategy, with Australia, Vietnam, Brazil, and the United States developing alternative mining operations. The Mountain Pass mine in California has resumed operations after years of dormancy, now producing approximately 15% of global rare earth concentrates.

Recycling initiatives are gaining momentum, with advanced technologies now capable of recovering up to 90% of neodymium from end-of-life motors and generators. Toyota has pioneered a closed-loop recycling system that reclaims neodymium from hybrid vehicle motors, reducing their virgin material requirements by approximately 25%.

Material substitution research offers another pathway to resilience. Promising developments include iron-nitride compounds and samarium-cobalt alternatives that could reduce neodymium dependence in specific applications. However, these alternatives currently achieve only 60-75% of neodymium magnet performance in high-temperature automotive environments.

Vertical integration strategies are being adopted by major automotive manufacturers, with companies like Tesla and Volkswagen establishing direct partnerships with mining operations and processing facilities to secure priority access to critical materials. These arrangements typically involve long-term supply contracts with price stabilization mechanisms to mitigate market volatility.

Environmental Impact and Sustainability Considerations

The environmental footprint of neodymium magnets in hybrid vehicles presents a complex sustainability challenge that requires comprehensive assessment. The mining and processing of rare earth elements (REEs), particularly neodymium, involves significant environmental degradation including soil erosion, water contamination, and the release of toxic byproducts. In China, which controls approximately 85% of global REE production, environmental regulations have tightened in response to historical pollution incidents, though enforcement remains inconsistent across regions.

Life cycle assessments indicate that while hybrid vehicles reduce operational emissions by 30-50% compared to conventional vehicles, the production phase of neodymium magnets contributes disproportionately to their overall environmental impact. The energy-intensive separation and refining processes for neodymium generate approximately 20-25 tons of CO2 equivalent per ton of magnet material produced, significantly higher than conventional metal processing.

Recycling presents a promising avenue for sustainability improvement, with potential to reduce primary mining demands by 25-30% by 2030. Current recycling rates for neodymium magnets remain below 5% globally due to technical challenges in separation and economic barriers. Advanced hydrometallurgical and pyrometallurgical recycling techniques are emerging, potentially reducing the energy requirements for reclaimed materials by up to 60% compared to primary production.

Water usage represents another critical environmental concern, with neodymium processing requiring 200-400 cubic meters of water per ton of finished magnet material. Closed-loop water systems and dry processing techniques are being developed to address this issue, with pilot projects demonstrating potential water usage reductions of 40-50%.

Substitution strategies are gaining traction as manufacturers seek to reduce dependence on rare earth elements. Research into iron-nitride compounds, samarium-cobalt alternatives, and reduced-dysprosium formulations shows promise for specific applications, potentially decreasing environmental impact while maintaining performance characteristics. Toyota and BMW have pioneered magnet designs that reduce neodymium content by 20-30% while maintaining comparable motor efficiency.

Policy frameworks increasingly incorporate sustainability metrics for hybrid vehicle components. The European Union's proposed Battery Passport system and Extended Producer Responsibility regulations may soon encompass permanent magnets, creating market incentives for environmentally optimized designs. Similarly, the U.S. Department of Energy's Critical Materials Institute is funding research into sustainable magnet production and recycling technologies, signaling growing governmental support for reducing environmental impacts across the supply chain.

Life cycle assessments indicate that while hybrid vehicles reduce operational emissions by 30-50% compared to conventional vehicles, the production phase of neodymium magnets contributes disproportionately to their overall environmental impact. The energy-intensive separation and refining processes for neodymium generate approximately 20-25 tons of CO2 equivalent per ton of magnet material produced, significantly higher than conventional metal processing.

Recycling presents a promising avenue for sustainability improvement, with potential to reduce primary mining demands by 25-30% by 2030. Current recycling rates for neodymium magnets remain below 5% globally due to technical challenges in separation and economic barriers. Advanced hydrometallurgical and pyrometallurgical recycling techniques are emerging, potentially reducing the energy requirements for reclaimed materials by up to 60% compared to primary production.

Water usage represents another critical environmental concern, with neodymium processing requiring 200-400 cubic meters of water per ton of finished magnet material. Closed-loop water systems and dry processing techniques are being developed to address this issue, with pilot projects demonstrating potential water usage reductions of 40-50%.

Substitution strategies are gaining traction as manufacturers seek to reduce dependence on rare earth elements. Research into iron-nitride compounds, samarium-cobalt alternatives, and reduced-dysprosium formulations shows promise for specific applications, potentially decreasing environmental impact while maintaining performance characteristics. Toyota and BMW have pioneered magnet designs that reduce neodymium content by 20-30% while maintaining comparable motor efficiency.

Policy frameworks increasingly incorporate sustainability metrics for hybrid vehicle components. The European Union's proposed Battery Passport system and Extended Producer Responsibility regulations may soon encompass permanent magnets, creating market incentives for environmentally optimized designs. Similarly, the U.S. Department of Energy's Critical Materials Institute is funding research into sustainable magnet production and recycling technologies, signaling growing governmental support for reducing environmental impacts across the supply chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!