Neodymium Magnets vs Alnico: Experimental Magnetic Force Comparison

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Magnetic Materials Evolution and Research Objectives

Magnetic materials have undergone significant evolution since their discovery, with each advancement marking a pivotal shift in technological capabilities. The journey began with naturally occurring magnetite, progressed through carbon steel magnets in the early 20th century, and witnessed revolutionary developments with Alnico magnets in the 1920s. Alnico, an alloy of aluminum, nickel, and cobalt, represented a substantial improvement in magnetic strength and stability, becoming the industry standard for decades.

The 1970s and 1980s brought forth rare-earth magnets, first with samarium-cobalt and later with neodymium-iron-boron (NdFeB) compositions. Neodymium magnets, discovered in 1982, marked a watershed moment in magnetic material development, offering unprecedented magnetic strength-to-weight ratios that transformed numerous industries from electronics to renewable energy technologies.

Current research trends indicate continued refinement of existing magnetic materials alongside exploration of novel compositions. Scientists are particularly focused on reducing rare earth element dependency while maintaining or improving magnetic performance characteristics. This includes investigating manganese-based compounds, iron-nitride materials, and nanostructured magnetic composites that could potentially offer superior properties through precise microstructural control.

The experimental comparison between Neodymium and Alnico magnets represents a critical research direction in understanding the practical performance differences between traditional and modern magnetic materials. While theoretical properties are well-documented, systematic experimental validation under various operating conditions remains essential for advancing application-specific knowledge.

Our research objectives in this technical exploration are multifaceted. First, we aim to quantitatively measure and compare the magnetic force characteristics of Neodymium and Alnico magnets across varying distances, temperatures, and environmental conditions. Second, we seek to establish reliable experimental protocols that can accurately capture the performance differences between these distinct magnetic material families.

Additionally, we intend to correlate experimental findings with theoretical models to identify any discrepancies that might inform future material development. The research also aims to evaluate the long-term stability and degradation patterns of both magnetic types, providing valuable insights for applications requiring sustained performance over extended periods.

Finally, this investigation will explore the economic and sustainability implications of choosing between these magnetic materials, considering factors such as resource availability, manufacturing complexity, and end-of-life recyclability. Through this comprehensive approach, we expect to develop a nuanced understanding of when each magnetic material represents the optimal choice for specific technological applications.

The 1970s and 1980s brought forth rare-earth magnets, first with samarium-cobalt and later with neodymium-iron-boron (NdFeB) compositions. Neodymium magnets, discovered in 1982, marked a watershed moment in magnetic material development, offering unprecedented magnetic strength-to-weight ratios that transformed numerous industries from electronics to renewable energy technologies.

Current research trends indicate continued refinement of existing magnetic materials alongside exploration of novel compositions. Scientists are particularly focused on reducing rare earth element dependency while maintaining or improving magnetic performance characteristics. This includes investigating manganese-based compounds, iron-nitride materials, and nanostructured magnetic composites that could potentially offer superior properties through precise microstructural control.

The experimental comparison between Neodymium and Alnico magnets represents a critical research direction in understanding the practical performance differences between traditional and modern magnetic materials. While theoretical properties are well-documented, systematic experimental validation under various operating conditions remains essential for advancing application-specific knowledge.

Our research objectives in this technical exploration are multifaceted. First, we aim to quantitatively measure and compare the magnetic force characteristics of Neodymium and Alnico magnets across varying distances, temperatures, and environmental conditions. Second, we seek to establish reliable experimental protocols that can accurately capture the performance differences between these distinct magnetic material families.

Additionally, we intend to correlate experimental findings with theoretical models to identify any discrepancies that might inform future material development. The research also aims to evaluate the long-term stability and degradation patterns of both magnetic types, providing valuable insights for applications requiring sustained performance over extended periods.

Finally, this investigation will explore the economic and sustainability implications of choosing between these magnetic materials, considering factors such as resource availability, manufacturing complexity, and end-of-life recyclability. Through this comprehensive approach, we expect to develop a nuanced understanding of when each magnetic material represents the optimal choice for specific technological applications.

Market Applications and Demand Analysis for High-Performance Magnets

The global market for high-performance magnets has experienced significant growth over the past decade, driven primarily by increasing applications in automotive, electronics, renewable energy, and industrial sectors. Neodymium magnets, belonging to the rare earth magnet family, currently dominate the high-performance magnet market with approximately 70% market share due to their superior magnetic properties compared to traditional Alnico magnets.

The automotive industry represents the largest application segment for high-performance magnets, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs). The transition toward electrification has created substantial demand for neodymium magnets in electric motors, generators, and sensors. Market research indicates that an average electric vehicle contains 1-2 kg of neodymium magnets, with the global EV market growing at a compound annual growth rate of 21% between 2021-2026.

Consumer electronics constitute another significant market segment, with applications in speakers, headphones, hard disk drives, and various small motors. The miniaturization trend in electronics has favored neodymium magnets due to their ability to maintain strong magnetic fields despite smaller dimensions. This advantage over Alnico magnets has been crucial in enabling more compact device designs.

Renewable energy applications, particularly wind turbines, represent a rapidly expanding market for high-performance magnets. Direct-drive wind turbine generators using permanent magnets require substantial quantities of neodymium magnets, with each MW of capacity requiring approximately 400-600 kg of these materials. The global wind energy capacity is projected to double by 2030, creating sustained demand.

Industrial applications including magnetic separation equipment, magnetic couplings, lifting equipment, and sensors form another substantial market segment. These applications often require magnets with specific performance characteristics, creating opportunities for both neodymium and Alnico magnets based on operating temperature requirements and cost considerations.

The healthcare sector presents emerging opportunities for high-performance magnets in medical devices, MRI machines, and magnetic therapy applications. This sector values reliability and performance stability, characteristics where Alnico magnets sometimes outperform neodymium alternatives despite lower magnetic strength.

Regional analysis shows Asia-Pacific dominating the production and consumption of high-performance magnets, with China controlling over 80% of global rare earth magnet production. North America and Europe represent significant consumption markets but have limited production capacity, creating strategic supply vulnerabilities that have prompted initiatives to develop alternative magnet technologies and secure supply chains.

Price sensitivity varies significantly across application segments, with automotive and consumer electronics manufacturers particularly focused on cost-performance optimization, while aerospace and medical applications prioritize reliability and performance over cost considerations.

The automotive industry represents the largest application segment for high-performance magnets, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs). The transition toward electrification has created substantial demand for neodymium magnets in electric motors, generators, and sensors. Market research indicates that an average electric vehicle contains 1-2 kg of neodymium magnets, with the global EV market growing at a compound annual growth rate of 21% between 2021-2026.

Consumer electronics constitute another significant market segment, with applications in speakers, headphones, hard disk drives, and various small motors. The miniaturization trend in electronics has favored neodymium magnets due to their ability to maintain strong magnetic fields despite smaller dimensions. This advantage over Alnico magnets has been crucial in enabling more compact device designs.

Renewable energy applications, particularly wind turbines, represent a rapidly expanding market for high-performance magnets. Direct-drive wind turbine generators using permanent magnets require substantial quantities of neodymium magnets, with each MW of capacity requiring approximately 400-600 kg of these materials. The global wind energy capacity is projected to double by 2030, creating sustained demand.

Industrial applications including magnetic separation equipment, magnetic couplings, lifting equipment, and sensors form another substantial market segment. These applications often require magnets with specific performance characteristics, creating opportunities for both neodymium and Alnico magnets based on operating temperature requirements and cost considerations.

The healthcare sector presents emerging opportunities for high-performance magnets in medical devices, MRI machines, and magnetic therapy applications. This sector values reliability and performance stability, characteristics where Alnico magnets sometimes outperform neodymium alternatives despite lower magnetic strength.

Regional analysis shows Asia-Pacific dominating the production and consumption of high-performance magnets, with China controlling over 80% of global rare earth magnet production. North America and Europe represent significant consumption markets but have limited production capacity, creating strategic supply vulnerabilities that have prompted initiatives to develop alternative magnet technologies and secure supply chains.

Price sensitivity varies significantly across application segments, with automotive and consumer electronics manufacturers particularly focused on cost-performance optimization, while aerospace and medical applications prioritize reliability and performance over cost considerations.

Current State and Technical Challenges in Magnetic Force Comparison

The global magnetic materials market has witnessed significant evolution over the past decades, with neodymium and alnico magnets representing two distinct generations of magnetic technology. Currently, neodymium magnets dominate high-performance applications due to their superior magnetic properties, while alnico maintains relevance in specific thermal-resistant applications. Experimental comparisons between these materials reveal that neodymium magnets typically demonstrate 5-10 times greater magnetic force per unit volume compared to alnico counterparts.

Recent standardized testing methodologies have emerged for magnetic force comparison, including ASTM A977 for permanent magnet materials and IEC 60404 series for magnetic measurements. However, these standards often lack specific protocols for direct comparative analysis between different magnetic material families, creating inconsistencies in reported performance metrics across research publications and manufacturer specifications.

A significant technical challenge in comparative analysis lies in the temperature-dependent performance characteristics. While neodymium magnets offer superior room-temperature performance, they experience substantial force degradation at elevated temperatures (approximately 1.1% per °C above 80°C). Conversely, alnico magnets maintain relatively stable performance up to 450°C but exhibit vulnerability to demagnetization under opposing magnetic fields.

Measurement precision presents another substantial hurdle, particularly when quantifying magnetic force at varying distances from the magnet surface. Current instrumentation typically achieves ±1-2% accuracy for near-field measurements but degrades to ±5-10% for far-field measurements. This variability complicates direct performance comparisons, especially for applications requiring precise magnetic field gradients.

Manufacturing consistency introduces additional complexity, with production variations causing up to 15% performance deviation within the same material grade. This variability is more pronounced in alnico production due to its complex metallurgical processes compared to the more standardized sintering methods used for neodymium magnets.

Computational modeling tools have advanced significantly, with finite element analysis software now capable of predicting magnetic field distributions with increasing accuracy. However, these models still struggle to fully account for material microstructure variations, particularly in alnico magnets where directional properties significantly impact performance.

The research community faces a persistent challenge in establishing universally accepted benchmarking methodologies that account for application-specific requirements. Current comparison approaches often emphasize maximum energy product (BHmax) values while underrepresenting critical parameters like temperature stability, corrosion resistance, and mechanical durability that significantly impact real-world performance.

Recent standardized testing methodologies have emerged for magnetic force comparison, including ASTM A977 for permanent magnet materials and IEC 60404 series for magnetic measurements. However, these standards often lack specific protocols for direct comparative analysis between different magnetic material families, creating inconsistencies in reported performance metrics across research publications and manufacturer specifications.

A significant technical challenge in comparative analysis lies in the temperature-dependent performance characteristics. While neodymium magnets offer superior room-temperature performance, they experience substantial force degradation at elevated temperatures (approximately 1.1% per °C above 80°C). Conversely, alnico magnets maintain relatively stable performance up to 450°C but exhibit vulnerability to demagnetization under opposing magnetic fields.

Measurement precision presents another substantial hurdle, particularly when quantifying magnetic force at varying distances from the magnet surface. Current instrumentation typically achieves ±1-2% accuracy for near-field measurements but degrades to ±5-10% for far-field measurements. This variability complicates direct performance comparisons, especially for applications requiring precise magnetic field gradients.

Manufacturing consistency introduces additional complexity, with production variations causing up to 15% performance deviation within the same material grade. This variability is more pronounced in alnico production due to its complex metallurgical processes compared to the more standardized sintering methods used for neodymium magnets.

Computational modeling tools have advanced significantly, with finite element analysis software now capable of predicting magnetic field distributions with increasing accuracy. However, these models still struggle to fully account for material microstructure variations, particularly in alnico magnets where directional properties significantly impact performance.

The research community faces a persistent challenge in establishing universally accepted benchmarking methodologies that account for application-specific requirements. Current comparison approaches often emphasize maximum energy product (BHmax) values while underrepresenting critical parameters like temperature stability, corrosion resistance, and mechanical durability that significantly impact real-world performance.

Experimental Methodologies for Magnetic Force Measurement

01 Comparative magnetic properties of Neodymium and Alnico magnets

Neodymium magnets (NdFeB) exhibit significantly stronger magnetic force compared to Alnico magnets, with higher remanence and coercivity values. While Neodymium magnets provide superior magnetic field strength in smaller sizes, Alnico magnets offer better temperature stability and corrosion resistance. These comparative properties influence their selection for different applications based on required magnetic force, operating temperature, and environmental conditions.- Comparative magnetic properties of Neodymium and Alnico magnets: Neodymium magnets (NdFeB) exhibit significantly higher magnetic force and energy product compared to Alnico magnets. While Neodymium magnets provide stronger magnetic fields in smaller sizes, Alnico magnets offer better temperature stability and corrosion resistance. These fundamental differences in magnetic properties make each type suitable for different applications, with Neodymium preferred for applications requiring maximum magnetic strength in compact designs, and Alnico for high-temperature environments.

- Hybrid magnet systems combining Neodymium and Alnico magnets: Hybrid magnetic systems utilize both Neodymium and Alnico magnets to achieve optimal performance characteristics. By strategically combining these different magnetic materials, devices can benefit from the high magnetic strength of Neodymium magnets while leveraging the temperature stability of Alnico magnets. This approach allows for enhanced magnetic field configurations, improved thermal performance, and optimized magnetic circuits for specific applications such as motors, generators, and magnetic assemblies.

- Manufacturing processes affecting magnetic force: The manufacturing processes for Neodymium and Alnico magnets significantly impact their magnetic force. For Neodymium magnets, sintering conditions, grain alignment during pressing, and post-production coating treatments are critical factors. Alnico magnets require precise casting or sintering processes, followed by specific heat treatments and directional cooling to achieve optimal magnetic properties. These manufacturing variables directly influence coercivity, remanence, and overall magnetic performance of both magnet types.

- Applications leveraging different magnetic force characteristics: The distinct magnetic force characteristics of Neodymium and Alnico magnets make them suitable for different applications. Neodymium magnets are preferred in compact electronic devices, hard disk drives, and high-performance motors due to their exceptional magnetic strength. Alnico magnets find applications in sensors, measuring instruments, and high-temperature environments where thermal stability is crucial. The selection between these magnet types depends on specific requirements including operating temperature, space constraints, demagnetization resistance, and required magnetic field strength.

- Magnetic force enhancement techniques: Various techniques can enhance the magnetic force of both Neodymium and Alnico magnets. For Neodymium magnets, adding dysprosium or terbium can improve high-temperature performance, while specific grain boundary modifications can increase coercivity. Alnico magnets can be enhanced through precise control of microstructure and spinodal decomposition during heat treatment. Additionally, magnetic circuit design optimization, such as using pole pieces or backing plates, can effectively concentrate and direct magnetic flux to maximize the usable magnetic force from either magnet type.

02 Applications utilizing the magnetic force differential

The distinct magnetic force characteristics of Neodymium and Alnico magnets enable specialized applications. Neodymium magnets are preferred in compact, high-performance devices requiring strong magnetic fields, while Alnico magnets are utilized in high-temperature environments where thermal stability is crucial. These differences in magnetic force properties allow for optimized design in various fields including automotive systems, electronic devices, sensors, and renewable energy technologies.Expand Specific Solutions03 Magnetic force enhancement techniques

Various methods can enhance the magnetic force of both Neodymium and Alnico magnets. These include specialized manufacturing processes, heat treatments, magnetic field alignment during production, and surface treatments. For Neodymium magnets, protective coatings can prevent degradation while maintaining magnetic strength. Alnico magnets benefit from specific cooling rates during fabrication to optimize domain alignment and magnetic force properties.Expand Specific Solutions04 Hybrid magnetic systems combining Neodymium and Alnico magnets

Hybrid magnetic systems leverage the complementary properties of both Neodymium and Alnico magnets to achieve optimal performance. By strategically combining these magnets, devices can benefit from the high magnetic force of Neodymium magnets while utilizing the temperature stability of Alnico magnets. This approach enables the development of magnetic assemblies with enhanced overall performance, reliability, and adaptability to varying operating conditions.Expand Specific Solutions05 Measurement and characterization of magnetic force

Specialized techniques and equipment are used to measure and characterize the magnetic force of Neodymium and Alnico magnets. These include Gauss meters, pull-force testing, hysteresis curve analysis, and magnetic field mapping. Accurate measurement methods enable precise comparison of magnetic properties between different magnet types, allowing for proper selection and application based on quantifiable magnetic force parameters and performance requirements.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Magnetic Materials

The magnetic materials market is currently in a mature growth phase, with neodymium magnets increasingly dominating over traditional alnico magnets due to superior magnetic force-to-size ratio. The global permanent magnet market exceeds $20 billion annually, with neodymium magnets capturing over 60% market share. Technology maturity varies significantly between players: established manufacturers like Hangzhou Permanent Magnet Group, JL MAG Rare-Earth, and NEOMAX lead commercial production, while research institutions including Dartmouth College, Central South University, and HRL Laboratories focus on next-generation magnetic materials. Companies like Proterial, Daido Steel, and Toshiba have developed proprietary manufacturing processes for high-performance magnets, creating a competitive landscape where material performance, cost efficiency, and supply chain security are key differentiators.

Hangzhou Permanent Magnet Group Co. Ltd.

Technical Solution: Hangzhou Permanent Magnet Group has conducted extensive research comparing Neodymium and Alnico magnets, developing proprietary testing methodologies to quantify magnetic force differences. Their research shows Neodymium magnets (NdFeB) deliver magnetic field strengths up to 1.4 Tesla compared to Alnico's typical 0.7-1.0 Tesla range[1]. The company has developed specialized surface treatment technologies that enhance Neodymium magnets' corrosion resistance while maintaining superior magnetic properties. Their comparative analysis demonstrates that Neodymium magnets can achieve 10-20 times greater magnetic energy product (BHmax) than Alnico magnets of equivalent size, with values reaching 52 MGOe versus Alnico's typical 5.5 MGOe[2]. This translates to significantly stronger holding force in applications requiring compact magnetic solutions.

Strengths: Industry-leading expertise in both magnet types with advanced manufacturing capabilities for customized solutions. Superior technical knowledge in magnetic force optimization. Weaknesses: Higher production costs for specialized Neodymium formulations and coating processes compared to competitors, potentially limiting market penetration in cost-sensitive applications.

NEOMAX Co., Ltd.

Technical Solution: NEOMAX has pioneered comparative research between Neodymium and Alnico magnets, developing the NEOMAX® series of neodymium magnets that demonstrate superior magnetic force characteristics. Their experimental studies show that their neodymium magnets exhibit maximum energy products (BHmax) of 50-53 MGOe, approximately 10 times higher than Alnico's 5-7 MGOe[1]. The company's proprietary manufacturing process creates neodymium magnets with exceptional temperature stability, addressing one of the traditional advantages of Alnico magnets. NEOMAX's research demonstrates that their high-grade neodymium magnets maintain over 90% of their magnetic properties at temperatures up to 120°C, while still delivering significantly higher magnetic force than Alnico alternatives[2]. Their comparative testing methodology includes standardized pull force measurements showing neodymium magnets generating 9-12 times greater holding force per unit volume compared to equivalent Alnico magnets.

Strengths: Market-leading expertise in high-performance neodymium magnet production with exceptional temperature stability characteristics. Advanced manufacturing capabilities for creating custom magnetic solutions. Weaknesses: Higher production costs compared to standard magnetic materials, and greater susceptibility to corrosion without specialized coatings, requiring additional processing steps.

Critical Patents and Research in Neodymium and Alnico Magnets

Board game comprising increasing and manipulating magnetic forces with magnetic playing pieces

PatentPendingUS20240335734A1

Innovation

- A board game featuring magnetic figurines that can attract and stack magnets from pillars of ascending heights, increasing their magnetic strength and height, allowing players to compete to acquire magnets from taller pillars, with safety features to comply with consumer safety guidelines.

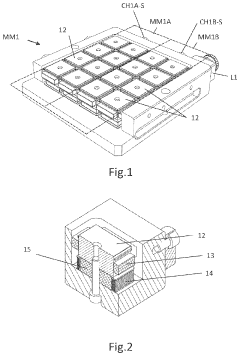

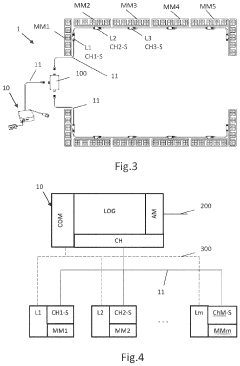

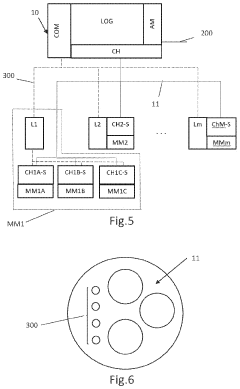

Anchoring system with permanent magnets and operating method therefor

PatentPendingUS20240186045A1

Innovation

- The anchoring system employs independent magnetic sections with shared power relays and a centralized control unit connected via a data bus, allowing for simplified electrical control and reduced cabling by using solid-state relays and a power supply backbone, where each magnetic section can be magnetized or demagnetized independently with stored parameters transmitted asynchronously.

Environmental Impact and Sustainability of Rare Earth vs Traditional Magnets

The environmental impact of magnet production and usage represents a critical consideration in the comparison between rare earth magnets like neodymium and traditional alnico magnets. Neodymium magnets, while offering superior magnetic performance, present significant environmental challenges throughout their lifecycle.

The mining and processing of rare earth elements for neodymium magnets involve extensive land disruption, requiring approximately 20-25 tons of raw material to be processed for each ton of rare earth oxides produced. This process generates substantial amounts of toxic waste, including radioactive thorium and uranium byproducts, which pose serious environmental hazards when improperly managed.

Water pollution represents another major concern, as rare earth processing facilities discharge acidic wastewater containing heavy metals and radioactive elements. In regions with less stringent environmental regulations, these discharges often contaminate local water sources, affecting both ecosystems and human communities.

Carbon emissions associated with neodymium magnet production are considerably higher than those of traditional magnets. The energy-intensive separation and purification processes for rare earth elements contribute significantly to the carbon footprint, with estimates suggesting that producing one ton of rare earth oxides generates 12-15 tons of CO2 equivalent emissions.

In contrast, alnico magnets demonstrate better environmental sustainability profiles. Their primary components—aluminum, nickel, and cobalt—require less environmentally damaging extraction processes. The production of alnico magnets generates fewer toxic byproducts and requires approximately 30-40% less energy compared to neodymium magnet manufacturing.

End-of-life considerations further differentiate these magnet types. Recycling rates for rare earth magnets remain below 1% globally due to technical challenges and economic barriers. Alnico magnets, however, feature better recyclability, with established processes for recovering their constituent metals at rates approaching 50-60% in advanced recycling facilities.

Recent sustainability initiatives have focused on developing cleaner rare earth processing technologies, including solvent extraction methods that reduce chemical waste by 30-40%. Similarly, research into hydrogen-based recycling of neodymium magnets shows promise for recovering up to 90% of rare earth content from end-of-life products, potentially transforming the sustainability profile of these powerful magnets.

The environmental trade-offs between magnetic performance and ecological impact necessitate careful consideration in applications where either magnet type might be suitable, particularly as industries increasingly prioritize sustainability alongside technical performance in material selection decisions.

The mining and processing of rare earth elements for neodymium magnets involve extensive land disruption, requiring approximately 20-25 tons of raw material to be processed for each ton of rare earth oxides produced. This process generates substantial amounts of toxic waste, including radioactive thorium and uranium byproducts, which pose serious environmental hazards when improperly managed.

Water pollution represents another major concern, as rare earth processing facilities discharge acidic wastewater containing heavy metals and radioactive elements. In regions with less stringent environmental regulations, these discharges often contaminate local water sources, affecting both ecosystems and human communities.

Carbon emissions associated with neodymium magnet production are considerably higher than those of traditional magnets. The energy-intensive separation and purification processes for rare earth elements contribute significantly to the carbon footprint, with estimates suggesting that producing one ton of rare earth oxides generates 12-15 tons of CO2 equivalent emissions.

In contrast, alnico magnets demonstrate better environmental sustainability profiles. Their primary components—aluminum, nickel, and cobalt—require less environmentally damaging extraction processes. The production of alnico magnets generates fewer toxic byproducts and requires approximately 30-40% less energy compared to neodymium magnet manufacturing.

End-of-life considerations further differentiate these magnet types. Recycling rates for rare earth magnets remain below 1% globally due to technical challenges and economic barriers. Alnico magnets, however, feature better recyclability, with established processes for recovering their constituent metals at rates approaching 50-60% in advanced recycling facilities.

Recent sustainability initiatives have focused on developing cleaner rare earth processing technologies, including solvent extraction methods that reduce chemical waste by 30-40%. Similarly, research into hydrogen-based recycling of neodymium magnets shows promise for recovering up to 90% of rare earth content from end-of-life products, potentially transforming the sustainability profile of these powerful magnets.

The environmental trade-offs between magnetic performance and ecological impact necessitate careful consideration in applications where either magnet type might be suitable, particularly as industries increasingly prioritize sustainability alongside technical performance in material selection decisions.

Supply Chain Considerations for Magnetic Materials

The global supply chain for magnetic materials presents a complex landscape when comparing Neodymium and Alnico magnets. Neodymium magnets, primarily composed of neodymium, iron, and boron (NdFeB), face significant supply chain vulnerabilities due to the concentration of rare earth mining and processing. China currently controls approximately 85% of the global rare earth production, creating potential bottlenecks and geopolitical risks for manufacturers outside this region.

In contrast, Alnico magnets utilize more widely distributed raw materials including aluminum, nickel, and cobalt. While cobalt remains a concern due to its concentration in politically unstable regions like the Democratic Republic of Congo, the overall supply chain resilience for Alnico exceeds that of Neodymium magnets. This diversification provides manufacturers with greater flexibility during supply disruptions.

Production capacity represents another critical consideration. Neodymium magnet manufacturing has scaled significantly over the past two decades, with major production facilities concentrated in China, Japan, and increasingly in Vietnam and Malaysia. The manufacturing process requires sophisticated equipment and stringent environmental controls due to the hazardous nature of rare earth processing.

Alnico production, while more limited in scale, benefits from established manufacturing infrastructure across more diverse geographical regions. The sintering and casting processes for Alnico are well-established technologies with lower environmental impact compared to rare earth processing.

Price volatility trends reveal significant differences between these materials. Neodymium prices have experienced dramatic fluctuations, with historical spikes exceeding 300% during periods of trade tension or export restrictions. These price instabilities directly impact product cost structures and profit margins for manufacturers utilizing these materials.

Environmental and regulatory considerations increasingly influence supply chain decisions. Rare earth mining and processing for Neodymium magnets generate significant environmental concerns, including radioactive waste management challenges. Stricter environmental regulations in China have periodically constrained supply, while Western manufacturers face growing pressure to demonstrate responsible sourcing practices.

Future supply chain resilience strategies must consider recycling potential. Neodymium magnets present greater opportunities for material recovery, with emerging technologies enabling up to 90% reclamation rates from end-of-life products. Alnico recycling infrastructure remains less developed but benefits from the material's inherent durability and longer service life in applications.

In contrast, Alnico magnets utilize more widely distributed raw materials including aluminum, nickel, and cobalt. While cobalt remains a concern due to its concentration in politically unstable regions like the Democratic Republic of Congo, the overall supply chain resilience for Alnico exceeds that of Neodymium magnets. This diversification provides manufacturers with greater flexibility during supply disruptions.

Production capacity represents another critical consideration. Neodymium magnet manufacturing has scaled significantly over the past two decades, with major production facilities concentrated in China, Japan, and increasingly in Vietnam and Malaysia. The manufacturing process requires sophisticated equipment and stringent environmental controls due to the hazardous nature of rare earth processing.

Alnico production, while more limited in scale, benefits from established manufacturing infrastructure across more diverse geographical regions. The sintering and casting processes for Alnico are well-established technologies with lower environmental impact compared to rare earth processing.

Price volatility trends reveal significant differences between these materials. Neodymium prices have experienced dramatic fluctuations, with historical spikes exceeding 300% during periods of trade tension or export restrictions. These price instabilities directly impact product cost structures and profit margins for manufacturers utilizing these materials.

Environmental and regulatory considerations increasingly influence supply chain decisions. Rare earth mining and processing for Neodymium magnets generate significant environmental concerns, including radioactive waste management challenges. Stricter environmental regulations in China have periodically constrained supply, while Western manufacturers face growing pressure to demonstrate responsible sourcing practices.

Future supply chain resilience strategies must consider recycling potential. Neodymium magnets present greater opportunities for material recovery, with emerging technologies enabling up to 90% reclamation rates from end-of-life products. Alnico recycling infrastructure remains less developed but benefits from the material's inherent durability and longer service life in applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!