Optimizing Mini LED Backlight for HDR Content

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Mini LED Backlight Technology Evolution and Objectives

Mini LED backlight technology represents a significant advancement in display technology, bridging the gap between traditional LED backlighting and the more advanced micro LED displays. The evolution of this technology can be traced back to the early 2010s when manufacturers began exploring ways to enhance LCD display performance through improved backlighting solutions. Traditional LED-backlit displays utilized a limited number of LEDs, resulting in challenges with local dimming precision and contrast ratios.

The technological progression accelerated around 2017-2018 when companies like TCL and Samsung began introducing early commercial applications of Mini LED technology. This evolution was driven by the increasing demand for High Dynamic Range (HDR) content, which requires displays capable of producing both deep blacks and bright highlights simultaneously – a capability that conventional LCD displays with standard LED backlighting struggled to achieve.

Mini LED technology is characterized by significantly smaller LED chips, typically measuring between 50-200 micrometers, compared to traditional LEDs which measure 300+ micrometers. This miniaturization allows for thousands rather than hundreds of LEDs to be packed into the same display area, creating many more dimming zones and substantially improving local dimming capabilities.

The primary objective of Mini LED backlight technology in the context of HDR content optimization is to achieve OLED-comparable contrast ratios while maintaining the brightness advantages of LED technology. Specifically, this involves developing systems capable of precise local dimming to minimize blooming effects (light leakage around bright objects on dark backgrounds) while delivering peak brightness levels exceeding 1,000 nits for true HDR performance.

Secondary objectives include improving energy efficiency, as more precise backlighting can reduce power consumption by illuminating only necessary areas of the screen. Additionally, manufacturers aim to reduce production costs through improved manufacturing processes and supply chain optimizations, making premium display performance more accessible to mainstream consumers.

Current technological trends point toward further miniaturization of LED chips, with research focused on reducing chip size while maintaining or improving luminous efficiency. Parallel development efforts are targeting advanced algorithms for backlight control, utilizing machine learning to optimize dimming patterns based on content analysis in real-time.

The ultimate goal for Mini LED technology is to approach the pixel-level precision of self-emissive displays like OLED while retaining LED advantages in brightness, longevity, and resistance to burn-in – essentially creating the ideal display technology for HDR content consumption across various device categories from premium televisions to professional monitors and mobile devices.

The technological progression accelerated around 2017-2018 when companies like TCL and Samsung began introducing early commercial applications of Mini LED technology. This evolution was driven by the increasing demand for High Dynamic Range (HDR) content, which requires displays capable of producing both deep blacks and bright highlights simultaneously – a capability that conventional LCD displays with standard LED backlighting struggled to achieve.

Mini LED technology is characterized by significantly smaller LED chips, typically measuring between 50-200 micrometers, compared to traditional LEDs which measure 300+ micrometers. This miniaturization allows for thousands rather than hundreds of LEDs to be packed into the same display area, creating many more dimming zones and substantially improving local dimming capabilities.

The primary objective of Mini LED backlight technology in the context of HDR content optimization is to achieve OLED-comparable contrast ratios while maintaining the brightness advantages of LED technology. Specifically, this involves developing systems capable of precise local dimming to minimize blooming effects (light leakage around bright objects on dark backgrounds) while delivering peak brightness levels exceeding 1,000 nits for true HDR performance.

Secondary objectives include improving energy efficiency, as more precise backlighting can reduce power consumption by illuminating only necessary areas of the screen. Additionally, manufacturers aim to reduce production costs through improved manufacturing processes and supply chain optimizations, making premium display performance more accessible to mainstream consumers.

Current technological trends point toward further miniaturization of LED chips, with research focused on reducing chip size while maintaining or improving luminous efficiency. Parallel development efforts are targeting advanced algorithms for backlight control, utilizing machine learning to optimize dimming patterns based on content analysis in real-time.

The ultimate goal for Mini LED technology is to approach the pixel-level precision of self-emissive displays like OLED while retaining LED advantages in brightness, longevity, and resistance to burn-in – essentially creating the ideal display technology for HDR content consumption across various device categories from premium televisions to professional monitors and mobile devices.

HDR Content Market Demand Analysis

The HDR content market has experienced substantial growth in recent years, driven by increasing consumer demand for more immersive and realistic visual experiences. As display technologies advance, particularly with the introduction of Mini LED backlight solutions, the market for HDR content continues to expand across multiple sectors including streaming platforms, gaming, cinematography, and professional content creation.

Consumer streaming platforms have emerged as primary drivers of HDR content demand, with major services like Netflix, Amazon Prime, Disney+, and Apple TV+ significantly expanding their HDR libraries. Market research indicates that subscribers are increasingly selecting platforms based on HDR content availability, with premium HDR content driving subscription growth rates 15% higher than standard content offerings.

The gaming industry represents another substantial market segment for HDR content, with next-generation consoles and high-end PC gaming systems now supporting various HDR standards. Gaming enthusiasts demonstrate strong willingness to invest in display technologies that maximize HDR capabilities, creating a symbiotic relationship between content and hardware development. The gaming peripheral market has responded with specialized monitors optimized for HDR content, growing at 24% annually since 2020.

Professional content creation sectors including film production, photography, and digital art have embraced HDR workflows, necessitating display solutions that accurately represent HDR content during the creation process. This professional segment, though smaller in volume than consumer markets, drives technical innovation and establishes quality benchmarks that eventually influence consumer expectations.

Market analysis reveals regional variations in HDR content adoption, with North America and East Asia leading consumption rates. European markets show strong growth potential as HDR-capable devices become more accessible. Emerging markets demonstrate increasing interest as smartphone manufacturers incorporate HDR display capabilities into mid-range devices.

Consumer research indicates that brightness capabilities, contrast ratios, and color accuracy rank as the most valued aspects of HDR display performance. Mini LED backlight technology directly addresses these priorities by enabling precise local dimming, higher peak brightness, and improved contrast compared to conventional LED solutions. This alignment between consumer preferences and Mini LED capabilities suggests strong market receptivity.

Industry forecasts project the global HDR content market to maintain double-digit growth through 2028, with particularly strong expansion in interactive content categories including gaming and virtual reality applications. As content creators increasingly adopt HDR as a standard production format rather than a premium option, the demand for display technologies capable of faithfully reproducing this content will continue to accelerate across all market segments.

Consumer streaming platforms have emerged as primary drivers of HDR content demand, with major services like Netflix, Amazon Prime, Disney+, and Apple TV+ significantly expanding their HDR libraries. Market research indicates that subscribers are increasingly selecting platforms based on HDR content availability, with premium HDR content driving subscription growth rates 15% higher than standard content offerings.

The gaming industry represents another substantial market segment for HDR content, with next-generation consoles and high-end PC gaming systems now supporting various HDR standards. Gaming enthusiasts demonstrate strong willingness to invest in display technologies that maximize HDR capabilities, creating a symbiotic relationship between content and hardware development. The gaming peripheral market has responded with specialized monitors optimized for HDR content, growing at 24% annually since 2020.

Professional content creation sectors including film production, photography, and digital art have embraced HDR workflows, necessitating display solutions that accurately represent HDR content during the creation process. This professional segment, though smaller in volume than consumer markets, drives technical innovation and establishes quality benchmarks that eventually influence consumer expectations.

Market analysis reveals regional variations in HDR content adoption, with North America and East Asia leading consumption rates. European markets show strong growth potential as HDR-capable devices become more accessible. Emerging markets demonstrate increasing interest as smartphone manufacturers incorporate HDR display capabilities into mid-range devices.

Consumer research indicates that brightness capabilities, contrast ratios, and color accuracy rank as the most valued aspects of HDR display performance. Mini LED backlight technology directly addresses these priorities by enabling precise local dimming, higher peak brightness, and improved contrast compared to conventional LED solutions. This alignment between consumer preferences and Mini LED capabilities suggests strong market receptivity.

Industry forecasts project the global HDR content market to maintain double-digit growth through 2028, with particularly strong expansion in interactive content categories including gaming and virtual reality applications. As content creators increasingly adopt HDR as a standard production format rather than a premium option, the demand for display technologies capable of faithfully reproducing this content will continue to accelerate across all market segments.

Mini LED Backlight Technical Challenges and Global Development Status

Mini LED backlight technology represents a significant advancement in display technology, positioned between traditional LED backlighting and micro LED displays. The global development of this technology has been accelerating since 2018, with major display manufacturers in Asia leading the charge. Companies from Taiwan, South Korea, Japan, and China have established strong positions in the Mini LED supply chain, with Taiwan particularly dominant in chip manufacturing and packaging.

The technical landscape presents several significant challenges that currently limit the optimization of Mini LED backlights for HDR content. The primary challenge involves achieving precise local dimming control with minimal blooming effects. Current Mini LED arrays typically feature thousands of dimming zones, but this remains insufficient for perfectly matching the pixel-level precision required by HDR content, resulting in halo effects around bright objects on dark backgrounds.

Thermal management represents another critical challenge, as the dense arrangement of Mini LEDs generates considerable heat during operation. This thermal load can affect color consistency, reduce component lifespan, and impact energy efficiency. Current cooling solutions add complexity and cost to display designs, particularly in thin form factor devices.

Manufacturing yield issues persist across the industry, with defect rates in Mini LED production remaining higher than desired. The miniaturization process introduces complexities in handling, placement accuracy, and electrical connections. These manufacturing challenges directly impact production costs and market adoption rates.

Power efficiency optimization presents ongoing difficulties, particularly for portable devices. While Mini LED backlights offer improved efficiency compared to conventional LED solutions, the power requirements for driving thousands of independent dimming zones remain substantial, especially when displaying HDR content with high brightness requirements.

Uniformity control across the display surface represents another technical hurdle. Ensuring consistent brightness and color performance across all dimming zones requires sophisticated compensation algorithms and precise manufacturing tolerances. Even minor variations become noticeable in HDR content where contrast ratios are dramatically expanded.

The cost structure remains challenging for mass-market adoption, with Mini LED backlights adding significant premium to display components. The complex driving circuits, increased number of LEDs, and sophisticated control systems contribute to higher manufacturing costs compared to conventional backlighting solutions.

Geographically, Asia dominates the Mini LED development landscape, with Taiwan leading in chip manufacturing, South Korea and Japan focusing on advanced control systems, and China rapidly expanding production capacity. North American companies primarily contribute through intellectual property and design innovations rather than manufacturing scale.

The technical landscape presents several significant challenges that currently limit the optimization of Mini LED backlights for HDR content. The primary challenge involves achieving precise local dimming control with minimal blooming effects. Current Mini LED arrays typically feature thousands of dimming zones, but this remains insufficient for perfectly matching the pixel-level precision required by HDR content, resulting in halo effects around bright objects on dark backgrounds.

Thermal management represents another critical challenge, as the dense arrangement of Mini LEDs generates considerable heat during operation. This thermal load can affect color consistency, reduce component lifespan, and impact energy efficiency. Current cooling solutions add complexity and cost to display designs, particularly in thin form factor devices.

Manufacturing yield issues persist across the industry, with defect rates in Mini LED production remaining higher than desired. The miniaturization process introduces complexities in handling, placement accuracy, and electrical connections. These manufacturing challenges directly impact production costs and market adoption rates.

Power efficiency optimization presents ongoing difficulties, particularly for portable devices. While Mini LED backlights offer improved efficiency compared to conventional LED solutions, the power requirements for driving thousands of independent dimming zones remain substantial, especially when displaying HDR content with high brightness requirements.

Uniformity control across the display surface represents another technical hurdle. Ensuring consistent brightness and color performance across all dimming zones requires sophisticated compensation algorithms and precise manufacturing tolerances. Even minor variations become noticeable in HDR content where contrast ratios are dramatically expanded.

The cost structure remains challenging for mass-market adoption, with Mini LED backlights adding significant premium to display components. The complex driving circuits, increased number of LEDs, and sophisticated control systems contribute to higher manufacturing costs compared to conventional backlighting solutions.

Geographically, Asia dominates the Mini LED development landscape, with Taiwan leading in chip manufacturing, South Korea and Japan focusing on advanced control systems, and China rapidly expanding production capacity. North American companies primarily contribute through intellectual property and design innovations rather than manufacturing scale.

Current Mini LED Local Dimming Solutions for HDR

01 LED Arrangement and Distribution Optimization

Optimizing the arrangement and distribution of mini LEDs in backlight modules to achieve uniform brightness and reduce hot spots. This includes strategic placement of LEDs, adjusting the density of LED arrays, and implementing specific patterns to enhance light distribution across the display panel. These techniques improve overall luminance uniformity while potentially reducing the total number of LEDs required.- LED arrangement and distribution optimization: Optimizing the arrangement and distribution of mini LEDs in backlight modules to achieve uniform illumination and reduce optical artifacts. This includes strategic placement patterns, density optimization, and zonal distribution to enhance brightness uniformity while minimizing the number of LEDs required. These arrangements help eliminate hotspots and dark areas, improving overall display quality and energy efficiency.

- Thermal management solutions: Implementation of advanced thermal management techniques to address heat dissipation challenges in mini LED backlight systems. These solutions include specialized heat sinks, thermal interface materials, and cooling structures designed to maintain optimal operating temperatures. Effective thermal management extends the lifespan of mini LEDs, ensures consistent brightness output, and prevents performance degradation due to overheating.

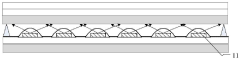

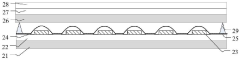

- Optical film and light guide enhancements: Development of specialized optical films and light guide plates to improve light extraction and distribution from mini LED backlights. These components include diffusers, reflectors, and prism films that work together to enhance brightness, viewing angles, and color uniformity. Advanced optical designs help reduce light loss, improve energy efficiency, and achieve more uniform illumination across the display surface.

- Local dimming control systems: Implementation of sophisticated local dimming control systems that enable precise control of mini LED zones to enhance contrast ratio and reduce power consumption. These systems include advanced algorithms for dynamic backlight adjustment based on image content, driver circuits for individual or grouped LED control, and timing controllers that synchronize backlight operation with display refresh rates to minimize motion blur and improve HDR performance.

- Manufacturing and assembly techniques: Innovative manufacturing and assembly methods to improve production efficiency and quality of mini LED backlight modules. These techniques include automated placement systems for precise LED positioning, novel substrate materials and designs that enhance electrical and thermal performance, and modular assembly approaches that facilitate repairs and upgrades. Advanced manufacturing processes help reduce costs while improving reliability and consistency of mini LED backlight systems.

02 Thermal Management Solutions

Implementation of advanced thermal management techniques to address heat dissipation challenges in mini LED backlight systems. These solutions include specialized heat sinks, thermal interface materials, and cooling structures designed to maintain optimal operating temperatures. Effective thermal management extends the lifespan of mini LEDs, ensures consistent brightness output, and prevents performance degradation over time.Expand Specific Solutions03 Light Guide and Optical Film Enhancements

Development of improved light guide plates and optical films specifically designed for mini LED backlights. These components help to diffuse light more effectively, reduce optical interference, and enhance brightness uniformity. Advanced optical designs include specialized microstructures, reflective patterns, and multi-layer film configurations that optimize light extraction and distribution from mini LED sources.Expand Specific Solutions04 Local Dimming Control Algorithms

Advanced control algorithms for local dimming that optimize the performance of mini LED backlight zones. These algorithms dynamically adjust the brightness of individual mini LED zones based on image content to enhance contrast ratio, reduce blooming effects, and improve energy efficiency. The control systems include sophisticated image processing techniques to determine optimal dimming patterns and transitions between zones.Expand Specific Solutions05 Manufacturing and Assembly Process Improvements

Innovations in manufacturing and assembly processes for mini LED backlight modules to improve production efficiency and reduce costs. These include automated placement technologies, novel bonding methods, and integrated testing procedures. Process improvements focus on achieving higher precision in LED positioning, better electrical connections, and more reliable overall assembly, resulting in higher quality backlight units with fewer defects.Expand Specific Solutions

Key Industry Players in Mini LED Backlight Ecosystem

The Mini LED backlight technology for HDR content optimization is in a growth phase, with the market expanding rapidly due to increasing demand for premium display experiences. The global market size is projected to grow significantly as Mini LED technology bridges the gap between traditional LED and OLED displays. Technologically, the field is advancing toward maturity with key players demonstrating varied capabilities. BOE Technology, TCL China Star Optoelectronics, and Samsung Electronics lead with advanced manufacturing capabilities and significant R&D investments. Chinese manufacturers like Hisense, Skyworth, and Konka are rapidly closing the technology gap, while Huawei and Sharp contribute innovations in integration and application. The competitive landscape shows regional clusters of expertise forming in China, Japan, and South Korea.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive Mini LED backlight solution specifically optimized for HDR content rendering. Their approach utilizes ultra-small LED chips (75-150 micrometers) arranged in precisely controlled local dimming zones, with premium models featuring over 1,000 independent zones. BOE's implementation incorporates advanced driver ICs that enable 14-bit grayscale precision, allowing for 16,384 brightness levels per zone. For HDR optimization, BOE employs a dual-layer control system: hardware-level zone mapping combined with content-adaptive software algorithms that analyze incoming HDR metadata to dynamically adjust backlight patterns. Their proprietary "Active HDR Enhancement" technology uses scene recognition to identify content types and apply optimized dimming curves, particularly enhancing specular highlights while maintaining energy efficiency. BOE's solution also addresses thermal management challenges through specialized heat dissipation structures that maintain consistent performance during extended HDR content playback.

Strengths: Exceptional zone-specific brightness control with minimal light leakage; sophisticated content-adaptive algorithms optimize power consumption while maintaining visual quality; scalable architecture allows implementation across various display sizes. Weaknesses: Complex manufacturing process increases production costs; requires substantial processing power for real-time content analysis; zone transition artifacts can still occur with rapidly changing content.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed a sophisticated Mini LED backlight solution marketed as "OD Zero" (Optical Distance Zero) technology specifically designed for optimizing HDR content display. Their approach utilizes ultra-small LED chips (under 150 micrometers) arranged in thousands of independently controlled dimming zones with minimal distance between the backlight layer and the LCD panel. TCL CSOT's implementation features advanced driver ICs supporting 12-bit dimming precision (4,096 brightness levels) per zone, enabling fine-grained control of luminance. For HDR content optimization, their solution employs a proprietary "HDR Premium Engine" that analyzes incoming video signals to identify content characteristics and dynamically adjust local dimming patterns. The system implements sophisticated algorithms for handling challenging HDR scenarios, particularly addressing the "halo effect" around bright objects through predictive light spread modeling and compensation. Their technology also incorporates specialized thermal management solutions that maintain consistent brightness levels during extended HDR content playback, preventing performance degradation from thermal throttling that commonly affects high-brightness display scenarios.

Strengths: Extremely thin backlight design enables slimmer display profiles while maintaining excellent HDR performance; high zone count provides superior contrast with minimal blooming artifacts; advanced thermal management ensures consistent performance during extended HDR content viewing. Weaknesses: Premium manufacturing techniques result in higher production costs; complex driving circuitry requires sophisticated control systems; higher power consumption compared to standard LED backlighting solutions.

Critical Patents and Innovations in Mini LED Backlight Control

Patent

Innovation

- Dynamic backlight control algorithm that optimizes Mini LED zones based on HDR content analysis, reducing halo effects while maintaining high contrast ratios.

- Adaptive local dimming technique that considers both spatial and temporal information from HDR content to minimize blooming artifacts around bright objects on dark backgrounds.

- Energy-efficient backlight management system that selectively boosts brightness only in required zones while maintaining overall power consumption within acceptable limits.

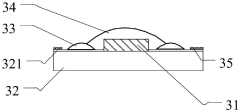

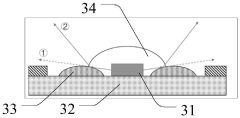

Mini LED box dam structure and manufacturing method thereof

PatentPendingCN118173549A

Innovation

- Using Mini LED dam structure, the dam structure is formed by dotting the target material around the LED chip, and encapsulating silica gel is set inside the dam structure to form a transparent package, which functions as a dam and lens to improve contrast and brightness.

Power Efficiency and Thermal Management Considerations

Power efficiency and thermal management represent critical challenges in Mini LED backlight systems for HDR content, particularly as these displays push brightness levels to unprecedented heights. The power consumption of Mini LED backlights increases substantially when displaying HDR content that requires high peak brightness, often reaching 2-3 times the power draw of standard content. This power demand creates a complex engineering challenge that balances visual performance against energy efficiency and heat generation.

The thermal characteristics of Mini LED arrays present unique management challenges. When operating at peak brightness for HDR highlights, localized heating occurs in specific zones of the backlight, creating thermal gradients across the display panel. These temperature variations can lead to inconsistent light output, color shift, and accelerated LED degradation if not properly managed. Advanced thermal simulation models have become essential tools for predicting hotspots and optimizing heat dissipation pathways during the design phase.

Manufacturers have developed several innovative approaches to address these challenges. Dynamic power allocation algorithms intelligently distribute power resources based on content analysis, allocating maximum power only to zones requiring peak brightness while maintaining lower power states elsewhere. This approach has demonstrated power savings of 15-30% compared to static power allocation methods, without compromising perceived image quality.

Thermal management solutions have evolved significantly, incorporating multi-layer heat dissipation structures with graphite sheets, vapor chambers, and micro-channel cooling systems. These solutions effectively transfer heat away from LED clusters to larger dissipation surfaces. The latest designs implement active thermal monitoring with embedded temperature sensors that provide real-time feedback to the power management system, enabling dynamic thermal throttling when necessary to prevent overheating.

Energy-efficient driver ICs represent another frontier in optimization efforts. Advanced driver architectures with improved switching efficiency and reduced standby power have emerged, offering up to 20% better power conversion efficiency compared to previous generations. These drivers implement sophisticated current regulation techniques that maintain consistent LED performance while minimizing power losses.

The industry is increasingly adopting adaptive refresh rate technologies that synchronize backlight operation with content requirements. By reducing backlight power during low-brightness scenes or static content, these systems achieve significant energy savings during typical viewing scenarios. Combined with ambient light sensing and automatic brightness adjustment, these approaches further optimize power consumption based on viewing environments.

Future developments are focusing on AI-driven power management systems that learn from content patterns and user preferences to create highly optimized power profiles. These systems promise to deliver the ideal balance between visual impact and energy efficiency, potentially reducing overall power consumption by an additional 25% while maintaining the spectacular visual experience that makes HDR content compelling.

The thermal characteristics of Mini LED arrays present unique management challenges. When operating at peak brightness for HDR highlights, localized heating occurs in specific zones of the backlight, creating thermal gradients across the display panel. These temperature variations can lead to inconsistent light output, color shift, and accelerated LED degradation if not properly managed. Advanced thermal simulation models have become essential tools for predicting hotspots and optimizing heat dissipation pathways during the design phase.

Manufacturers have developed several innovative approaches to address these challenges. Dynamic power allocation algorithms intelligently distribute power resources based on content analysis, allocating maximum power only to zones requiring peak brightness while maintaining lower power states elsewhere. This approach has demonstrated power savings of 15-30% compared to static power allocation methods, without compromising perceived image quality.

Thermal management solutions have evolved significantly, incorporating multi-layer heat dissipation structures with graphite sheets, vapor chambers, and micro-channel cooling systems. These solutions effectively transfer heat away from LED clusters to larger dissipation surfaces. The latest designs implement active thermal monitoring with embedded temperature sensors that provide real-time feedback to the power management system, enabling dynamic thermal throttling when necessary to prevent overheating.

Energy-efficient driver ICs represent another frontier in optimization efforts. Advanced driver architectures with improved switching efficiency and reduced standby power have emerged, offering up to 20% better power conversion efficiency compared to previous generations. These drivers implement sophisticated current regulation techniques that maintain consistent LED performance while minimizing power losses.

The industry is increasingly adopting adaptive refresh rate technologies that synchronize backlight operation with content requirements. By reducing backlight power during low-brightness scenes or static content, these systems achieve significant energy savings during typical viewing scenarios. Combined with ambient light sensing and automatic brightness adjustment, these approaches further optimize power consumption based on viewing environments.

Future developments are focusing on AI-driven power management systems that learn from content patterns and user preferences to create highly optimized power profiles. These systems promise to deliver the ideal balance between visual impact and energy efficiency, potentially reducing overall power consumption by an additional 25% while maintaining the spectacular visual experience that makes HDR content compelling.

Cost-Performance Analysis and Manufacturing Scalability

The cost-performance ratio of Mini LED backlight technology represents a critical factor in its market adoption for HDR displays. Current manufacturing costs remain significantly higher than traditional LCD backlighting solutions, with premium Mini LED displays commanding 30-40% price increases over conventional alternatives. This cost differential stems primarily from the complex manufacturing processes required for precise placement of thousands of miniaturized LED chips and the sophisticated driving circuits needed to control local dimming zones.

Material costs constitute approximately 60% of the total manufacturing expense, with the Mini LED chips themselves representing the largest component. The driving IC and thermal management systems account for another 25% of costs, while assembly and quality control processes make up the remainder. Industry analysts project that economies of scale could reduce these costs by 15-20% annually over the next three years as production volumes increase.

Performance metrics must be evaluated against these cost considerations. Mini LED backlights deliver contrast ratios approaching 1,000,000:1 and peak brightness exceeding 1,500 nits, significantly outperforming conventional LCD displays. The technology enables more precise HDR content rendering with minimal blooming effects compared to standard local dimming solutions. These performance advantages justify premium pricing in high-end consumer and professional display markets.

Manufacturing scalability presents both challenges and opportunities. Current production capacity limitations stem from the precision equipment required for Mini LED placement and the specialized testing procedures needed to ensure uniform performance across thousands of light sources. Leading display manufacturers have invested heavily in automated production lines capable of handling the miniaturized components with the necessary precision.

Yield rates remain a significant concern, with current industry averages hovering between 70-80% for high-density Mini LED arrays. Each 1% improvement in yield translates to approximately 0.8-1.2% reduction in final product cost. Advanced optical inspection systems and machine learning algorithms for defect detection are being deployed to improve these metrics.

Regional manufacturing capabilities vary significantly, with East Asian producers—particularly in Taiwan, South Korea, and China—dominating the supply chain. Recent investments in Mini LED production facilities suggest annual capacity growth of 35-40% through 2025, which should alleviate supply constraints and drive further cost reductions through increased competition and manufacturing efficiency.

Material costs constitute approximately 60% of the total manufacturing expense, with the Mini LED chips themselves representing the largest component. The driving IC and thermal management systems account for another 25% of costs, while assembly and quality control processes make up the remainder. Industry analysts project that economies of scale could reduce these costs by 15-20% annually over the next three years as production volumes increase.

Performance metrics must be evaluated against these cost considerations. Mini LED backlights deliver contrast ratios approaching 1,000,000:1 and peak brightness exceeding 1,500 nits, significantly outperforming conventional LCD displays. The technology enables more precise HDR content rendering with minimal blooming effects compared to standard local dimming solutions. These performance advantages justify premium pricing in high-end consumer and professional display markets.

Manufacturing scalability presents both challenges and opportunities. Current production capacity limitations stem from the precision equipment required for Mini LED placement and the specialized testing procedures needed to ensure uniform performance across thousands of light sources. Leading display manufacturers have invested heavily in automated production lines capable of handling the miniaturized components with the necessary precision.

Yield rates remain a significant concern, with current industry averages hovering between 70-80% for high-density Mini LED arrays. Each 1% improvement in yield translates to approximately 0.8-1.2% reduction in final product cost. Advanced optical inspection systems and machine learning algorithms for defect detection are being deployed to improve these metrics.

Regional manufacturing capabilities vary significantly, with East Asian producers—particularly in Taiwan, South Korea, and China—dominating the supply chain. Recent investments in Mini LED production facilities suggest annual capacity growth of 35-40% through 2025, which should alleviate supply constraints and drive further cost reductions through increased competition and manufacturing efficiency.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!