Overcoming Supply Chain Constraints for Lithium Iron Phosphate Materials

AUG 7, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LFP Material Evolution

The evolution of Lithium Iron Phosphate (LFP) materials has been a significant journey in the field of energy storage technology. Initially developed in the 1990s, LFP cathodes have undergone substantial improvements in performance and manufacturing processes over the past three decades.

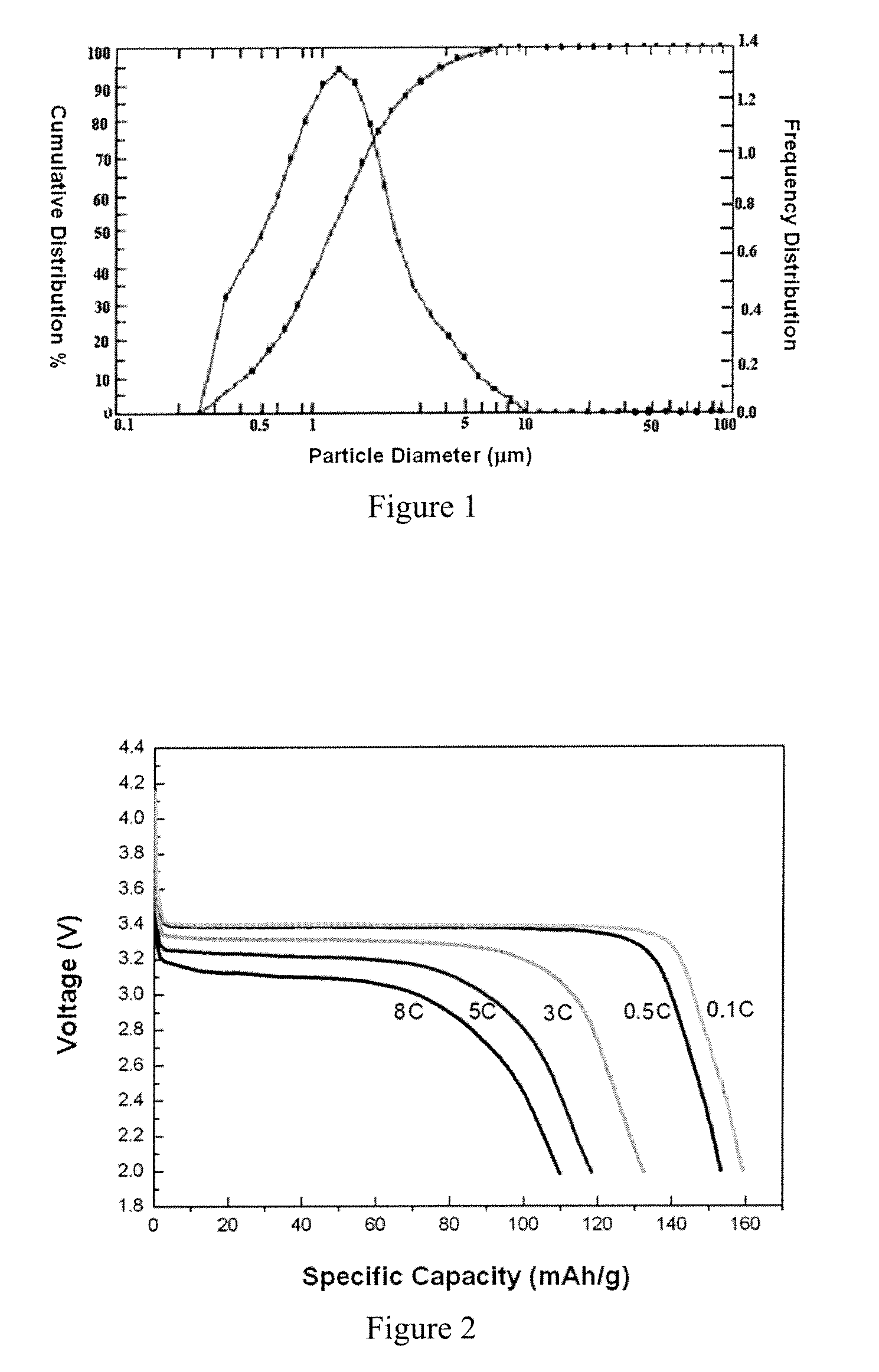

In the early stages, LFP materials faced challenges related to low electronic conductivity and limited energy density. Researchers focused on enhancing these properties through various methods, including carbon coating and particle size reduction. The introduction of nano-scale LFP particles in the early 2000s marked a crucial milestone, significantly improving the material's rate capability and overall performance.

As demand for electric vehicles (EVs) and renewable energy storage solutions grew, LFP technology experienced rapid advancement. The development of advanced synthesis methods, such as solid-state reactions and hydrothermal processes, led to more uniform particle size distribution and improved crystallinity. These advancements resulted in enhanced capacity retention and cycle life of LFP-based batteries.

The mid-2010s saw a shift towards optimizing LFP materials for high-volume production. Manufacturers focused on streamlining production processes and reducing costs while maintaining high quality. This period also witnessed the emergence of doped LFP materials, where small amounts of other elements were introduced to further enhance conductivity and stability.

Recent years have brought about innovations in LFP material design, including the development of hierarchical structures and core-shell architectures. These advancements have addressed some of the inherent limitations of LFP, such as its relatively low energy density compared to other cathode materials. Researchers have also explored the potential of LFP in solid-state batteries, opening new avenues for its application.

The evolution of LFP materials has been closely tied to advancements in battery management systems and cell design. Improved understanding of LFP's unique characteristics has led to the development of specialized charging protocols and thermal management strategies, further enhancing the overall performance and longevity of LFP-based energy storage systems.

As the demand for sustainable and cost-effective energy storage solutions continues to grow, LFP materials are poised for further evolution. Current research focuses on pushing the boundaries of energy density while maintaining the inherent safety and stability advantages of LFP. The integration of artificial intelligence and machine learning in material design and optimization processes is expected to accelerate the pace of innovation in this field.

In the early stages, LFP materials faced challenges related to low electronic conductivity and limited energy density. Researchers focused on enhancing these properties through various methods, including carbon coating and particle size reduction. The introduction of nano-scale LFP particles in the early 2000s marked a crucial milestone, significantly improving the material's rate capability and overall performance.

As demand for electric vehicles (EVs) and renewable energy storage solutions grew, LFP technology experienced rapid advancement. The development of advanced synthesis methods, such as solid-state reactions and hydrothermal processes, led to more uniform particle size distribution and improved crystallinity. These advancements resulted in enhanced capacity retention and cycle life of LFP-based batteries.

The mid-2010s saw a shift towards optimizing LFP materials for high-volume production. Manufacturers focused on streamlining production processes and reducing costs while maintaining high quality. This period also witnessed the emergence of doped LFP materials, where small amounts of other elements were introduced to further enhance conductivity and stability.

Recent years have brought about innovations in LFP material design, including the development of hierarchical structures and core-shell architectures. These advancements have addressed some of the inherent limitations of LFP, such as its relatively low energy density compared to other cathode materials. Researchers have also explored the potential of LFP in solid-state batteries, opening new avenues for its application.

The evolution of LFP materials has been closely tied to advancements in battery management systems and cell design. Improved understanding of LFP's unique characteristics has led to the development of specialized charging protocols and thermal management strategies, further enhancing the overall performance and longevity of LFP-based energy storage systems.

As the demand for sustainable and cost-effective energy storage solutions continues to grow, LFP materials are poised for further evolution. Current research focuses on pushing the boundaries of energy density while maintaining the inherent safety and stability advantages of LFP. The integration of artificial intelligence and machine learning in material design and optimization processes is expected to accelerate the pace of innovation in this field.

EV Battery Market Demand

The electric vehicle (EV) battery market has experienced unprecedented growth in recent years, driven by increasing global demand for sustainable transportation solutions. This surge in demand for EV batteries, particularly those utilizing Lithium Iron Phosphate (LFP) materials, has created significant challenges for the supply chain.

The global EV market has been expanding rapidly, with annual sales projected to reach 10 million units by 2025. This growth is primarily fueled by government initiatives promoting clean energy, consumer awareness of environmental issues, and advancements in battery technology. As a result, the demand for EV batteries is expected to grow at a compound annual growth rate (CAGR) of over 25% in the coming years.

LFP batteries have gained significant traction in the EV market due to their lower cost, improved safety features, and longer cycle life compared to other lithium-ion battery chemistries. Major automakers, including Tesla and Volkswagen, have announced plans to increase the use of LFP batteries in their electric vehicles, further driving demand for these materials.

The increasing adoption of LFP batteries has led to a surge in demand for key raw materials, particularly lithium, iron, and phosphate. This has put considerable strain on the existing supply chain, with manufacturers struggling to secure sufficient quantities of these materials to meet production targets.

The supply chain constraints for LFP materials are further exacerbated by geopolitical factors and regional concentration of resources. China, for instance, currently dominates the global LFP battery production, controlling a significant portion of the supply chain. This concentration has raised concerns about supply security and the need for diversification of sources.

To address these supply chain challenges, industry players are exploring various strategies. These include vertical integration of supply chains, development of alternative sourcing locations, and investments in recycling technologies to recover and reuse critical materials from end-of-life batteries.

The market demand for EV batteries, particularly those using LFP materials, is expected to continue its upward trajectory. However, the industry must overcome significant supply chain constraints to meet this growing demand. Addressing these challenges will require collaborative efforts from manufacturers, suppliers, and policymakers to ensure a sustainable and resilient supply chain for LFP materials in the EV battery market.

The global EV market has been expanding rapidly, with annual sales projected to reach 10 million units by 2025. This growth is primarily fueled by government initiatives promoting clean energy, consumer awareness of environmental issues, and advancements in battery technology. As a result, the demand for EV batteries is expected to grow at a compound annual growth rate (CAGR) of over 25% in the coming years.

LFP batteries have gained significant traction in the EV market due to their lower cost, improved safety features, and longer cycle life compared to other lithium-ion battery chemistries. Major automakers, including Tesla and Volkswagen, have announced plans to increase the use of LFP batteries in their electric vehicles, further driving demand for these materials.

The increasing adoption of LFP batteries has led to a surge in demand for key raw materials, particularly lithium, iron, and phosphate. This has put considerable strain on the existing supply chain, with manufacturers struggling to secure sufficient quantities of these materials to meet production targets.

The supply chain constraints for LFP materials are further exacerbated by geopolitical factors and regional concentration of resources. China, for instance, currently dominates the global LFP battery production, controlling a significant portion of the supply chain. This concentration has raised concerns about supply security and the need for diversification of sources.

To address these supply chain challenges, industry players are exploring various strategies. These include vertical integration of supply chains, development of alternative sourcing locations, and investments in recycling technologies to recover and reuse critical materials from end-of-life batteries.

The market demand for EV batteries, particularly those using LFP materials, is expected to continue its upward trajectory. However, the industry must overcome significant supply chain constraints to meet this growing demand. Addressing these challenges will require collaborative efforts from manufacturers, suppliers, and policymakers to ensure a sustainable and resilient supply chain for LFP materials in the EV battery market.

LFP Supply Chain Challenges

The lithium iron phosphate (LFP) battery industry faces significant supply chain challenges that have become increasingly prominent as demand for electric vehicles and energy storage systems continues to surge. One of the primary constraints is the limited availability of high-quality lithium iron phosphate materials, which are essential for LFP battery production. This scarcity is largely due to the concentration of raw material sources in a few geographical locations, particularly in China, which controls a substantial portion of the global LFP material supply.

The rapid expansion of the electric vehicle market has put unprecedented pressure on the LFP supply chain, leading to potential bottlenecks in production and delivery. Many battery manufacturers and automakers are struggling to secure stable and sufficient supplies of LFP materials, which can result in production delays and increased costs. This situation is exacerbated by the long lead times typically associated with establishing new LFP production facilities, which can take several years from planning to full-scale operation.

Another significant challenge is the volatility in raw material prices, particularly for lithium and iron ore. These price fluctuations can have a cascading effect throughout the supply chain, impacting the overall cost of LFP battery production and, ultimately, the end products. The unpredictability of material costs makes it difficult for manufacturers to plan and budget effectively, potentially hindering long-term investments in capacity expansion.

Quality control is also a critical issue in the LFP supply chain. Ensuring consistent high quality of LFP materials across different suppliers and batches is essential for maintaining battery performance and safety standards. However, the rapid scaling of production to meet growing demand can sometimes lead to compromises in quality control processes, posing risks to the reliability and safety of LFP batteries.

Furthermore, the LFP supply chain faces logistical challenges, including transportation bottlenecks and geopolitical tensions that can disrupt the flow of materials. The concentration of production in specific regions, coupled with global shipping constraints, can lead to delays and increased costs in getting LFP materials to battery manufacturers worldwide. This geographical imbalance in the supply chain also raises concerns about supply security and the need for diversification of sources.

Addressing these supply chain constraints requires a multi-faceted approach, including investments in new production capacities, development of alternative material sources, and improvements in recycling technologies to reduce reliance on primary raw materials. Collaboration between industry players, governments, and research institutions is crucial to overcome these challenges and ensure a sustainable and resilient LFP supply chain for the future of clean energy technologies.

The rapid expansion of the electric vehicle market has put unprecedented pressure on the LFP supply chain, leading to potential bottlenecks in production and delivery. Many battery manufacturers and automakers are struggling to secure stable and sufficient supplies of LFP materials, which can result in production delays and increased costs. This situation is exacerbated by the long lead times typically associated with establishing new LFP production facilities, which can take several years from planning to full-scale operation.

Another significant challenge is the volatility in raw material prices, particularly for lithium and iron ore. These price fluctuations can have a cascading effect throughout the supply chain, impacting the overall cost of LFP battery production and, ultimately, the end products. The unpredictability of material costs makes it difficult for manufacturers to plan and budget effectively, potentially hindering long-term investments in capacity expansion.

Quality control is also a critical issue in the LFP supply chain. Ensuring consistent high quality of LFP materials across different suppliers and batches is essential for maintaining battery performance and safety standards. However, the rapid scaling of production to meet growing demand can sometimes lead to compromises in quality control processes, posing risks to the reliability and safety of LFP batteries.

Furthermore, the LFP supply chain faces logistical challenges, including transportation bottlenecks and geopolitical tensions that can disrupt the flow of materials. The concentration of production in specific regions, coupled with global shipping constraints, can lead to delays and increased costs in getting LFP materials to battery manufacturers worldwide. This geographical imbalance in the supply chain also raises concerns about supply security and the need for diversification of sources.

Addressing these supply chain constraints requires a multi-faceted approach, including investments in new production capacities, development of alternative material sources, and improvements in recycling technologies to reduce reliance on primary raw materials. Collaboration between industry players, governments, and research institutions is crucial to overcome these challenges and ensure a sustainable and resilient LFP supply chain for the future of clean energy technologies.

Current LFP Production Methods

01 Raw material sourcing and processing

The supply chain for lithium iron phosphate (LFP) materials faces challenges in sourcing and processing raw materials. This includes the extraction and refinement of lithium, iron, and phosphate compounds. Innovations in mining techniques, purification processes, and sustainable sourcing strategies are being developed to address these constraints.- Raw material sourcing and processing: The supply chain for lithium iron phosphate (LFP) materials faces challenges in sourcing and processing raw materials. This includes the extraction and refinement of lithium, iron, and phosphate compounds. Innovations in mining techniques, purification processes, and sustainable sourcing strategies are being developed to address these constraints.

- Production capacity and scaling: Increasing demand for LFP batteries has led to production capacity constraints. Manufacturers are working on expanding facilities, optimizing production processes, and developing new manufacturing technologies to scale up LFP material production efficiently and meet market demands.

- Supply chain resilience and diversification: To mitigate supply chain risks, efforts are being made to diversify sourcing locations, develop alternative suppliers, and create more resilient supply networks. This includes exploring new geographical regions for raw material extraction and establishing strategic partnerships across the supply chain.

- Recycling and circular economy initiatives: Addressing supply constraints through recycling and reuse of LFP materials is gaining importance. Technologies and processes are being developed to efficiently recover and repurpose materials from end-of-life batteries, reducing dependence on primary raw material sources and improving sustainability.

- Material innovations and alternatives: Research is ongoing to develop new LFP material compositions, improve existing formulations, and explore alternative cathode materials. These innovations aim to enhance performance, reduce material requirements, and potentially alleviate supply chain pressures by offering more options for battery manufacturers.

02 Production capacity and scaling

Increasing demand for LFP batteries has led to production capacity constraints. Manufacturers are working on expanding facilities, optimizing production processes, and developing new manufacturing technologies to scale up LFP material production efficiently and meet market demands.Expand Specific Solutions03 Supply chain resilience and diversification

To mitigate supply chain risks, efforts are being made to diversify sourcing locations, develop alternative suppliers, and create more resilient supply networks. This includes exploring new geographical regions for raw material extraction and establishing strategic partnerships across the supply chain.Expand Specific Solutions04 Recycling and circular economy initiatives

Addressing supply constraints through recycling and reuse of LFP materials is gaining importance. Technologies and processes are being developed to efficiently recover and repurpose materials from end-of-life batteries, reducing dependence on primary raw material sources and improving sustainability.Expand Specific Solutions05 Material innovations and alternatives

Research is ongoing to develop new LFP material compositions, improve existing formulations, and explore alternative cathode materials. These innovations aim to enhance performance, reduce material requirements, and potentially alleviate supply chain pressures by diversifying material options for battery manufacturers.Expand Specific Solutions

Key LFP Suppliers Analysis

The lithium iron phosphate (LFP) materials market is in a growth phase, driven by increasing demand for electric vehicles and energy storage systems. The global market size is expanding rapidly, with projections indicating significant growth in the coming years. Technologically, LFP materials are relatively mature but still evolving, with companies like BYD, CATL (through subsidiaries like Guangdong Bangpu), and A123 Systems leading in production and innovation. Emerging players such as Nano One Materials and Svolt Energy are developing advanced manufacturing processes to improve performance and reduce costs. Research institutions like Zhejiang University and Tsinghua University are contributing to technological advancements. The industry faces challenges in scaling production and optimizing supply chains to meet growing demand, with companies like BASF and Johnson Matthey expanding their presence in this sector.

BASF Corp.

Technical Solution: BASF has developed a novel cathode active material (CAM) production process for lithium iron phosphate (LFP) batteries. This process combines all manufacturing steps into one continuous process, significantly reducing energy consumption, lowering investment costs, and decreasing waste[1]. The company has also introduced a high-performance LFP cathode active material with an innovative carbon-coating technology, enhancing the material's conductivity and power density[2]. BASF's approach includes the use of sustainable raw materials and recycled content in their LFP production, addressing supply chain constraints by reducing dependence on primary resources[3].

Strengths: Innovative production process, improved material performance, and focus on sustainability. Weaknesses: Potential high initial investment costs for new technology implementation and dependence on specific raw materials.

A123 Systems LLC

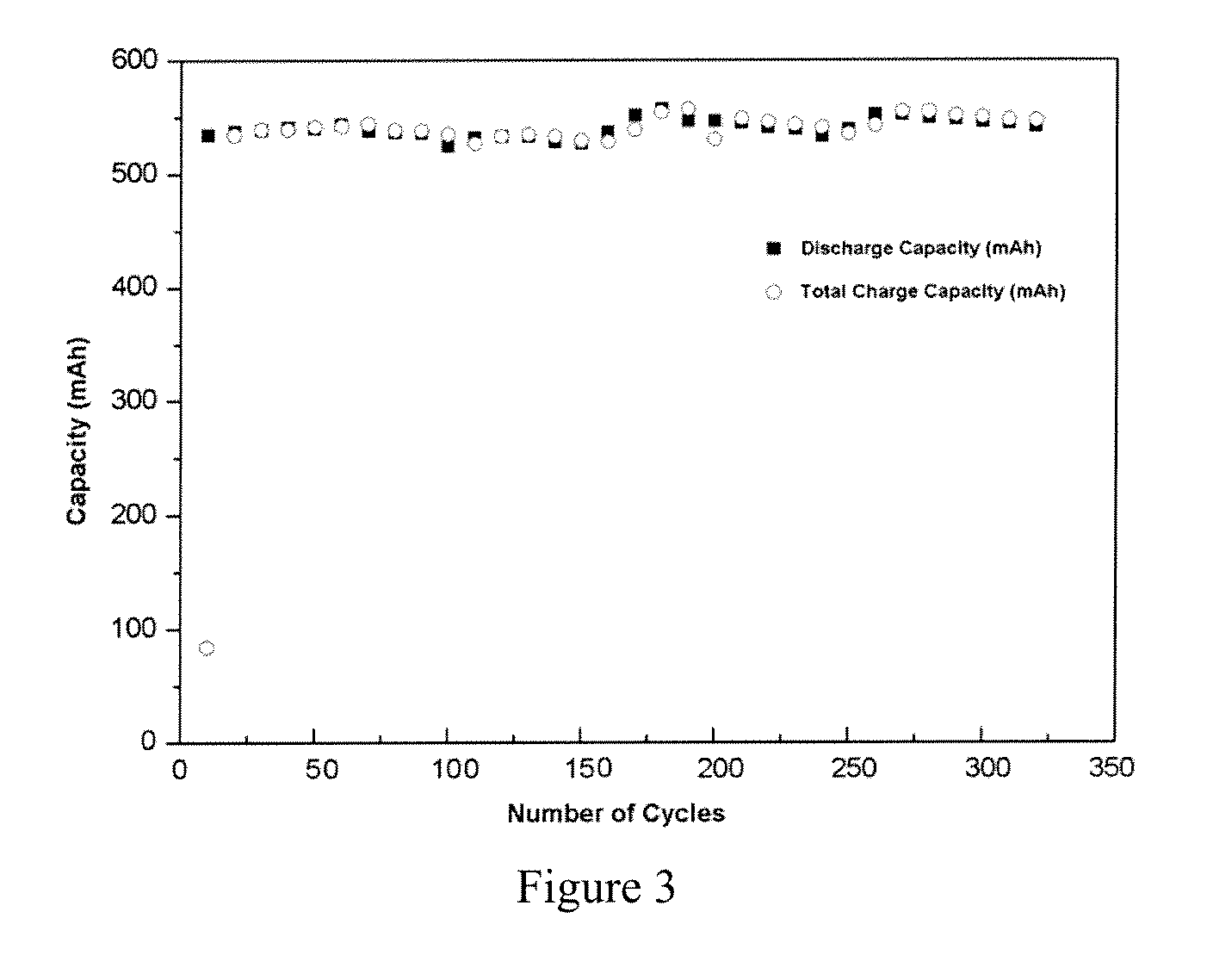

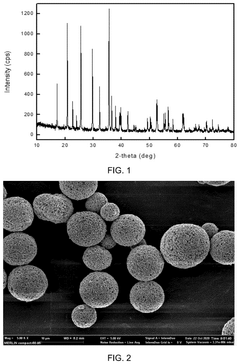

Technical Solution: A123 Systems has developed a proprietary Nanophosphate® LFP technology that offers improved power density and cycle life compared to conventional LFP materials[4]. Their approach involves precise control of particle size and morphology, resulting in enhanced lithium-ion transport and better overall battery performance. To address supply chain constraints, A123 has implemented a vertically integrated manufacturing process, controlling key aspects of production from raw materials to finished cells[5]. The company has also invested in advanced automation and quality control systems to optimize production efficiency and reduce reliance on manual labor[6].

Strengths: Proprietary technology with superior performance, vertical integration for supply chain control. Weaknesses: Potential higher production costs, limited flexibility in sourcing due to specialized materials.

LFP Material Innovations

Lithium iron phosphate having oxygen vacancy and doped in the position of fe and method of quick solid phase sintering for the same

PatentInactiveUS20100171071A1

Innovation

- A lithium iron phosphate material with oxygen vacancies and Fe doping, using a quick micro-wave solid phase sintering method, which improves electronic and ionic conductivity and reduces production costs and time, while maintaining the olivine structure for stable cycle performance.

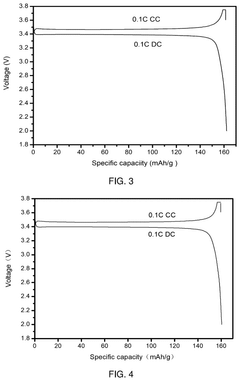

Lithium iron phosphate positive electrode material having a high tap density, method for preparing the same

PatentPendingUS20240391776A1

Innovation

- A method involving the use of anhydrous ferric phosphate with controlled grinding, spraying, and sintering processes, along with metal ion doping, to produce lithium iron phosphate with a high tap density and unique spherical morphology, compatible with ternary materials for enhanced performance.

Raw Material Sourcing Strategies

The sourcing of raw materials for lithium iron phosphate (LFP) batteries presents significant challenges in the current global supply chain. To overcome these constraints, companies are adopting diverse strategies to secure a stable and cost-effective supply of critical materials.

One key approach is vertical integration, where battery manufacturers are investing in or acquiring mining operations to gain direct control over raw material sources. This strategy helps reduce dependence on external suppliers and provides better visibility into the supply chain. Companies like CATL and BYD have made substantial investments in lithium mining projects to secure their supply of this crucial element.

Geographical diversification of sourcing is another important strategy. Traditionally, the LFP supply chain has been heavily concentrated in China. However, to mitigate geopolitical risks and reduce vulnerability to regional disruptions, companies are now exploring alternative sources in other countries. Australia, Chile, and Argentina are emerging as significant players in lithium production, while phosphate resources are being tapped in Morocco and the United States.

Long-term supply agreements with raw material producers are becoming increasingly common. These agreements provide stability in pricing and supply volumes, allowing battery manufacturers to plan their production more effectively. Some companies are even pre-paying for future deliveries to secure their supply and support the expansion of mining operations.

Recycling and circular economy initiatives are gaining traction as a means to reduce reliance on primary raw materials. Advanced recycling technologies are being developed to recover lithium, iron, and phosphorus from end-of-life batteries, creating a secondary source of these critical materials. This approach not only helps address supply constraints but also contributes to sustainability goals.

Research into alternative materials and battery chemistries is ongoing to reduce dependence on scarce or geopolitically sensitive resources. For instance, sodium-ion batteries are being explored as a potential alternative to lithium-ion batteries in certain applications, which could alleviate some of the pressure on lithium supply chains.

Lastly, companies are investing in supply chain digitalization and advanced analytics to improve forecasting, inventory management, and risk assessment. These technologies enable more agile responses to supply chain disruptions and help optimize raw material sourcing strategies.

One key approach is vertical integration, where battery manufacturers are investing in or acquiring mining operations to gain direct control over raw material sources. This strategy helps reduce dependence on external suppliers and provides better visibility into the supply chain. Companies like CATL and BYD have made substantial investments in lithium mining projects to secure their supply of this crucial element.

Geographical diversification of sourcing is another important strategy. Traditionally, the LFP supply chain has been heavily concentrated in China. However, to mitigate geopolitical risks and reduce vulnerability to regional disruptions, companies are now exploring alternative sources in other countries. Australia, Chile, and Argentina are emerging as significant players in lithium production, while phosphate resources are being tapped in Morocco and the United States.

Long-term supply agreements with raw material producers are becoming increasingly common. These agreements provide stability in pricing and supply volumes, allowing battery manufacturers to plan their production more effectively. Some companies are even pre-paying for future deliveries to secure their supply and support the expansion of mining operations.

Recycling and circular economy initiatives are gaining traction as a means to reduce reliance on primary raw materials. Advanced recycling technologies are being developed to recover lithium, iron, and phosphorus from end-of-life batteries, creating a secondary source of these critical materials. This approach not only helps address supply constraints but also contributes to sustainability goals.

Research into alternative materials and battery chemistries is ongoing to reduce dependence on scarce or geopolitically sensitive resources. For instance, sodium-ion batteries are being explored as a potential alternative to lithium-ion batteries in certain applications, which could alleviate some of the pressure on lithium supply chains.

Lastly, companies are investing in supply chain digitalization and advanced analytics to improve forecasting, inventory management, and risk assessment. These technologies enable more agile responses to supply chain disruptions and help optimize raw material sourcing strategies.

Recycling and Circular Economy

Recycling and circular economy principles are becoming increasingly crucial in addressing supply chain constraints for lithium iron phosphate (LFP) materials. As the demand for LFP batteries continues to grow, particularly in the electric vehicle and energy storage sectors, the need for sustainable and efficient resource management becomes paramount.

The recycling of LFP batteries presents both challenges and opportunities. Unlike traditional lithium-ion batteries, LFP batteries contain no cobalt or nickel, which are typically the primary drivers for recycling economics. However, the iron and phosphate components still hold significant value and can be recovered through advanced recycling processes.

Current recycling methods for LFP batteries include hydrometallurgical and pyrometallurgical processes. Hydrometallurgical techniques involve the use of aqueous solutions to selectively dissolve and recover materials, while pyrometallurgical methods use high-temperature treatments to separate and recover valuable components. Both approaches are being refined to improve efficiency and reduce environmental impact.

The circular economy approach extends beyond recycling to encompass the entire lifecycle of LFP materials. This includes designing batteries for easier disassembly and material recovery, as well as exploring second-life applications for batteries that no longer meet the requirements of their primary use but still retain significant capacity.

Implementing effective recycling and circular economy strategies can help alleviate supply chain pressures by reducing dependence on raw material extraction. This is particularly important for phosphate, a critical component of LFP batteries, as phosphate rock reserves are finite and geographically concentrated.

Several companies and research institutions are developing innovative technologies to improve LFP battery recycling. For instance, some are exploring direct recycling methods that aim to recover cathode materials in a form that can be directly reused in new batteries, minimizing the need for energy-intensive reprocessing.

The adoption of recycling and circular economy principles also aligns with broader sustainability goals and regulatory trends. Many jurisdictions are implementing or considering extended producer responsibility (EPR) policies for batteries, which place the onus on manufacturers to ensure proper end-of-life management of their products.

As the LFP battery market expands, establishing robust recycling infrastructure and circular economy practices will be essential for long-term sustainability and supply chain resilience. This will require collaboration across the value chain, from battery manufacturers and electric vehicle producers to recycling companies and policymakers.

The recycling of LFP batteries presents both challenges and opportunities. Unlike traditional lithium-ion batteries, LFP batteries contain no cobalt or nickel, which are typically the primary drivers for recycling economics. However, the iron and phosphate components still hold significant value and can be recovered through advanced recycling processes.

Current recycling methods for LFP batteries include hydrometallurgical and pyrometallurgical processes. Hydrometallurgical techniques involve the use of aqueous solutions to selectively dissolve and recover materials, while pyrometallurgical methods use high-temperature treatments to separate and recover valuable components. Both approaches are being refined to improve efficiency and reduce environmental impact.

The circular economy approach extends beyond recycling to encompass the entire lifecycle of LFP materials. This includes designing batteries for easier disassembly and material recovery, as well as exploring second-life applications for batteries that no longer meet the requirements of their primary use but still retain significant capacity.

Implementing effective recycling and circular economy strategies can help alleviate supply chain pressures by reducing dependence on raw material extraction. This is particularly important for phosphate, a critical component of LFP batteries, as phosphate rock reserves are finite and geographically concentrated.

Several companies and research institutions are developing innovative technologies to improve LFP battery recycling. For instance, some are exploring direct recycling methods that aim to recover cathode materials in a form that can be directly reused in new batteries, minimizing the need for energy-intensive reprocessing.

The adoption of recycling and circular economy principles also aligns with broader sustainability goals and regulatory trends. Many jurisdictions are implementing or considering extended producer responsibility (EPR) policies for batteries, which place the onus on manufacturers to ensure proper end-of-life management of their products.

As the LFP battery market expands, establishing robust recycling infrastructure and circular economy practices will be essential for long-term sustainability and supply chain resilience. This will require collaboration across the value chain, from battery manufacturers and electric vehicle producers to recycling companies and policymakers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!